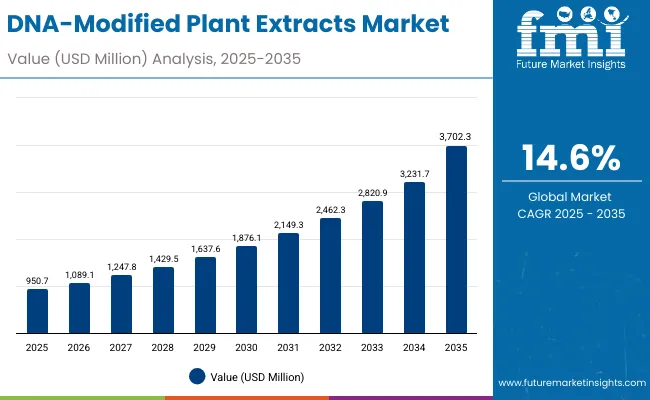

In 2025, the DNA-Modified Plant Extracts Market has been valued at USD 950.7 Million and is anticipated to reach USD 3,702.3 Million by 2035.The rise of USD 2,751.6 Million over the decade reflects an overall expansion of nearly 290%, translating into a strong CAGR of 14.6%.This rapid progression is expected to be underpinned by scientific advances in genetic engineering and increasing consumer demand for high-performance natural actives.

DNA-Modified Plant Extracts Market Key Takeaways

| Metric | Value |

|---|---|

| DNA-Modified Plant Extracts Market Estimated Value in (2025E) | USD 950.7 million |

| DNA-Modified Plant Extracts Market Forecast Value in (2035F) | USD 3,702.3 million |

| Forecast CAGR (2025 to 2035) | 14.60% |

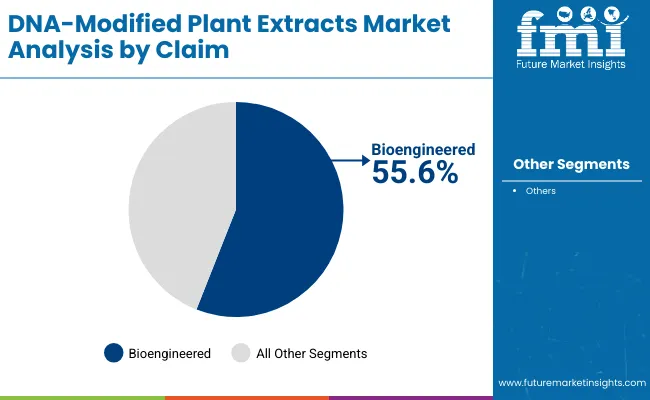

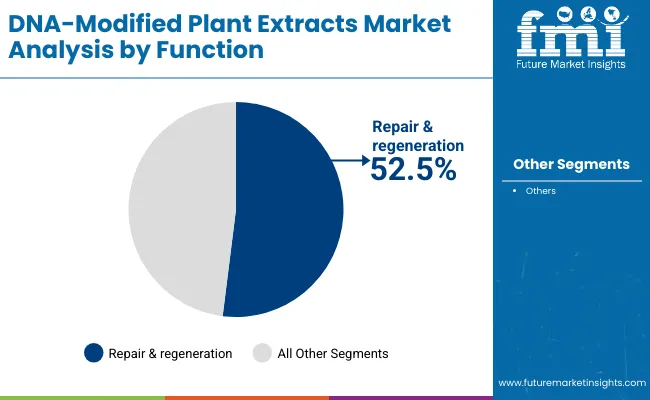

During the first five years, from 2025 to 2030, revenues are forecast to advance from USD 950.7 Million to USD 1,876.1 Million, adding USD 925.4 Million and accounting for 34% of the entire decade’s growth. This stage is expected to represent the formative period of adoption, when bioengineered claims command a 55.6% market share and "repair & regeneration" emerges as the most influential functional category with 52.5% share. Strong uptake is projected in North America and Europe, where robust regulatory frameworks are likely to encourage early adoption.

From 2030 to 2035, the market is expected to accelerate further, adding USD 1,826.2 Million and contributing 66% of the total decade expansion. As the market climbs from USD 1,876.1 Million to USD 3,702.3 Million, Asia Pacific particularly China and India is projected to lead the growth trajectory with CAGRs of 19.8% and 22.7% respectively. Consumer acceptance of bioengineered formulations is expected to rise steadily, with transparent labeling and clinically validated outcomes playing critical roles in sustaining long-term momentum.

This outlook reflects a shift from niche scientific innovation toward mainstream adoption, signaling a decade of strong and sustained market expansion.

From 2025 to 2030, the market is expected to nearly double, rising from USD 950.7 Million to USD 1,876.1 Million, powered by increasing adoption of bioengineered solutions and strong demand for repair & regeneration functions. By 2035, the market is projected to quadruple, reaching USD 3,702.3 Million, with Asia Pacific driving acceleration. Competitive strength is expected to shift from broad natural actives to engineered, traceable, and clinically validated formulations, enabling higher differentiation and sustained pricing power.

The growth of the DNA-Modified Plant Extracts Market is being propelled by the convergence of biotechnology innovation and rising consumer expectations for effective, sustainable, and traceable ingredients. Advances in genetic engineering have enabled precise modifications that enhance bioavailability and potency, creating new benchmarks for efficacy within personal care and therapeutic formulations. The preference for bioengineered claims, holding 55.6% share in 2025, highlights the importance of scientifically validated solutions that deliver measurable outcomes.

Increasing focus on repair and regeneration functions, which command 52.5% market share, reflects consumer demand for visible and long-lasting skin benefits. Asia Pacific, led by China and India, is anticipated to accelerate adoption through supportive regulatory clarity and strong digital penetration, positioning the region as a global growth hub. Moreover, partnerships between ingredient innovators and premium skincare brands are expected to expand product pipelines and accelerate commercialization, ensuring the market sustains its double-digit growth trajectory through 2035.

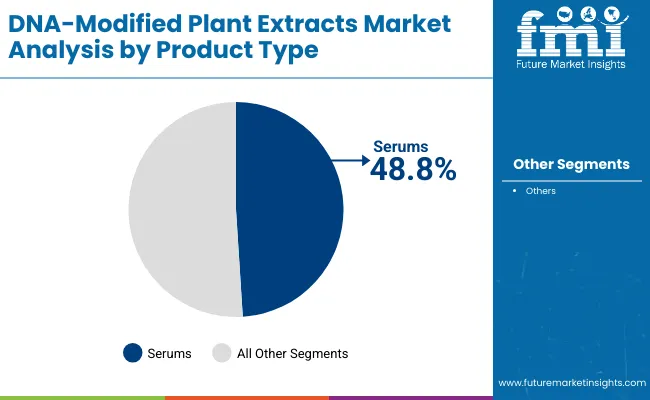

The DNA-Modified Plant Extracts Market has been segmented by Claim, Function, and Product Type, reflecting the diversity of innovation and consumer demand within the sector. Each category highlights how engineered approaches are reshaping value capture across applications. Claims demonstrate the rising significance of bioengineered solutions supported by data-driven efficacy. Functions illustrate the alignment of product benefits with consumer expectations for repair and regenerative outcomes.

Product type segmentation reveals how specific formats such as serums are emerging as delivery leaders, catering to premium positioning and targeted applications. This structured segmentation provides a comprehensive understanding of the evolving landscape and reveals where the strongest value creation is expected across the forecast horizon, enabling stakeholders to prioritize strategies effectively.

| Segment | Market Value Share, 2025 |

|---|---|

| Bioengineered | 55.6% |

| Others | 44.4% |

Bioengineered claims are projected to lead the DNA-Modified Plant Extracts Market in 2025 with a 55.6% share valued at USD 528.3 Million. This dominance is expected to be driven by growing preference for traceable, scientifically validated ingredients that ensure consistent efficacy and safety. Regulatory frameworks are anticipated to further encourage transparency, which will amplify trust in engineered solutions. While "Others" still contribute 44.4% of the market, their positioning is expected to be challenged by the stronger performance of bioengineered offerings as clinical-grade results become a primary differentiator. With increasing consumer awareness, the share of bioengineered claims is likely to expand further, reinforcing their role as the backbone of the category.

| Segment | Market Value Share, 2025 |

|---|---|

| Repair & regeneration | 52.5% |

| Others | 47.5% |

Repair and regeneration is expected to hold a dominant 52.5% share in 2025, valued at USD 498.9 Million. This segment’s leadership is being shaped by rising consumer demand for products that deliver visible improvements in skin recovery, barrier strength, and overall resilience. As wellness-focused consumers prioritize regenerative benefits, innovation in biomimetic pathways and clinical validation is projected to accelerate growth. While "Others" account for 47.5% share, their presence reflects broader market diversity, yet the regenerative focus is anticipated to remain superior due to clear differentiation in outcomes. As regulatory and clinical data availability increases, repair and regeneration is likely to retain its dominance, positioning itself as the most valuable function category for the coming decade.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 48.8% |

| Others | 51.2% |

Serums are projected to secure a 48.8% share in 2025, translating into USD 460.6 Million in value. This segment’s strength is expected to stem from its compatibility with high-potency, precision-targeted formulations, making it the preferred choice for DNA-modified extracts. As consumers seek premium solutions offering quick absorption and visible results, serums are anticipated to serve as a strategic delivery format. Although "Others" collectively hold 51.2% share, their broader composition dilutes focus, enabling serums to capture higher value per unit. Innovation in texture, stability, and encapsulation technologies is projected to further elevate serum performance, supporting their trajectory as a core growth driver within the product type category by 2035.

The DNA-Modified Plant Extracts Market is shaped by evolving consumer expectations and rapid advances in biotechnology, yet the trajectory is tempered by regulatory intricacies, infrastructure gaps, and shifting definitions of natural authenticity across global regions, creating a complex growth landscape.

Integration of Precision Genomics into Ingredient Pipelines

Market expansion is expected to be accelerated by the integration of precision genomics, where CRISPR-edited botanicals and engineered actives are designed to mimic cellular pathways with unprecedented accuracy. Unlike conventional extracts, these innovations allow for scalable replication of bioactive properties without agricultural volatility. This dynamic is anticipated to transform supply reliability, enabling brands to demonstrate consistent efficacy backed by genomic traceability. As competitive positioning becomes increasingly dependent on data-backed differentiation, adoption of DNA-modified inputs is projected to deliver both functional superiority and reputational resilience, creating a powerful driver of long-term growth.

Fragmented Standards for Claim Validation

Growth prospects are likely to face challenges from fragmented global standards governing bioengineered labeling and efficacy claims. Inconsistent definitions of "bioengineered" or "clean-label" across jurisdictions complicate cross-border launches and elevate compliance costs. This ambiguity not only limits scalability but also increases the risk of consumer mistrust when marketing language diverges from regulatory expectations. Companies are projected to navigate these pressures by investing in harmonized certification frameworks and multi-market validation studies, yet near-term friction is expected to persist. As a result, expansion potential could be partially constrained until global consensus or widely accepted third-party benchmarks emerge.

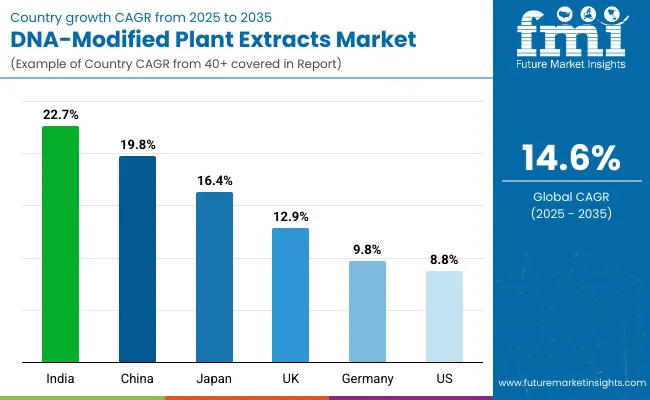

| Countries | CAGR |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

The global DNA-Modified Plant Extracts Market is expected to expand unevenly across countries, shaped by regulatory readiness, consumer openness to bioengineered products, and the scale of domestic biotech ecosystems. India is projected to lead with a CAGR of 22.7% from 2025 to 2035, supported by rapid adoption of advanced agricultural biotechnology, favorable policies promoting innovation, and rising demand for functional skincare within its expanding middle class. China follows closely with 19.8% CAGR, where strong government-backed investments in biotech R&D and rising consumer acceptance of engineered actives are anticipated to transform the market into a high-value growth hub.

Japan, with 16.4% CAGR, is expected to sustain momentum through premium positioning and integration of DNA-modified actives into advanced cosmeceutical formulations. The UK, at 12.9%, and Germany, at 9.8%, are forecast to remain central to Europe’s trajectory, driven by stringent safety standards and increasing demand for clinically validated, sustainable actives. Meanwhile, the USA shows a comparatively moderate CAGR of 8.8%, reflecting its market maturity but also highlighting opportunities in clinical-grade product positioning and collaborations between biotech firms and established cosmetic brands.

This country-level outlook underscores how Asia-Pacific is expected to outperform, while Europe and North America maintain steady but differentiated adoption pathways.

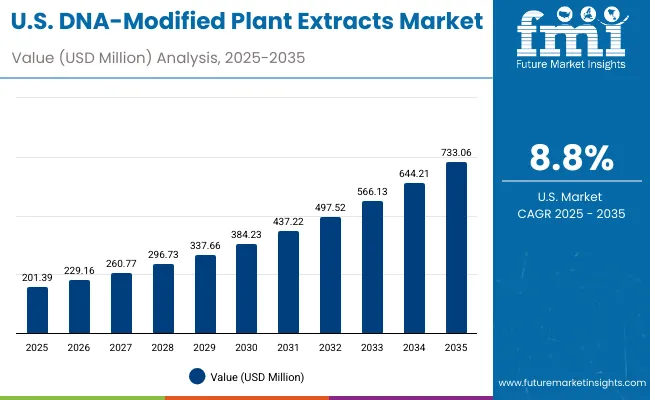

| Year | USA DNA-Modified Plant Extracts Market (USD Million) |

|---|---|

| 2025 | 201.39 |

| 2026 | 229.16 |

| 2027 | 260.77 |

| 2028 | 296.73 |

| 2029 | 337.66 |

| 2030 | 384.23 |

| 2031 | 437.22 |

| 2032 | 497.52 |

| 2033 | 566.13 |

| 2034 | 644.21 |

| 2035 | 733.06 |

The DNA-Modified Plant Extracts Market in the United States is projected to expand at a CAGR of 13.8% from 2025 to 2035, supported by advanced biotech research, regulatory clarity, and consumer inclination toward validated natural actives. Market size is anticipated to grow from USD 201.39 Million in 2025 to USD 733.06 Million by 2035.

Premium skincare and therapeutic categories are expected to anchor growth, with bioengineered claims gaining dominance due to stronger efficacy validation and transparent labeling requirements. Further expansion is anticipated in healthcare applications, where DNA-modified extracts will increasingly be integrated into clinical-grade formulations.

The DNA-Modified Plant Extracts Market in the UK is forecast to expand at a CAGR of 12.9% between 2025 and 2035, supported by a regulatory environment that prioritizes product safety and sustainability. Market adoption is expected to be fueled by demand for bioengineered claims as consumers increasingly seek clinically validated and environmentally responsible products. Transparent labeling practices and traceability standards are projected to shape consumer trust, ensuring stronger uptake of DNA-modified formulations. The UK’s advanced skincare and pharmaceutical sectors are likely to serve as early adopters, integrating next-generation actives into premium offerings.

The DNA-Modified Plant Extracts Market in India is projected to grow at a CAGR of 22.7% from 2025 to 2035, making it the fastest-growing country market globally. This acceleration is anticipated to be driven by rising demand for functional skincare in a rapidly expanding middle-class population and supportive government initiatives promoting biotech innovation. The integration of DNA-modified extracts into herbal and ayurvedic-inspired formulations is expected to create a unique hybrid positioning, resonating strongly with local preferences. Expanding R&D investment and a growing ecosystem of biotech startups are likely to further enhance the pace of adoption.

The DNA-Modified Plant Extracts Market in China is expected to grow at a CAGR of 19.8% between 2025 and 2035, driven by government-backed biotech investments and strong digital-first adoption in skincare and wellness markets. Consumer confidence in engineered actives is projected to rise due to transparent labeling regulations and high awareness of clinical efficacy. The country’s large manufacturing base is expected to enable cost-efficient scaling of DNA-modified actives, positioning China as both a key consumer and global supplier. Domestic brands are likely to leverage DNA-modified inputs to differentiate portfolios and capture premium urban segments.

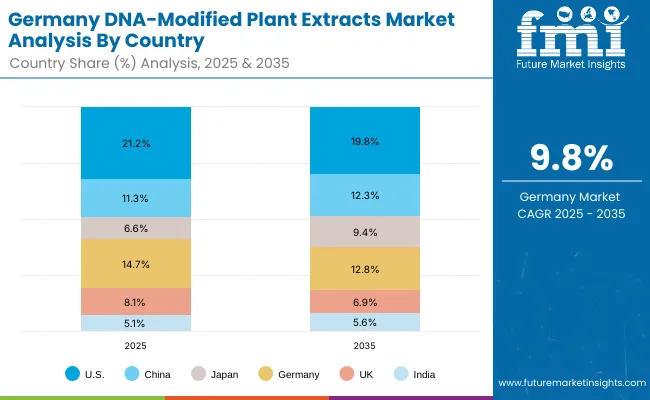

| Countries | 2025 |

|---|---|

| USA | 21.2% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 8.1% |

| India | 5.1% |

| Countries | 2035 |

|---|---|

| USA | 19.8% |

| China | 12.3% |

| Japan | 9.4% |

| Germany | 12.8% |

| UK | 6.9% |

| India | 5.6% |

The DNA-Modified Plant Extracts Market in Germany is projected to record a CAGR of 9.8% from 2025 to 2035, supported by Europe’s strict compliance standards and consumer focus on clinically validated sustainability solutions. The German market is expected to favor DNA-modified extracts with proven efficacy and reduced environmental impact, aligning with the country’s strong sustainability culture. Pharmaceutical and cosmeceutical players are projected to integrate engineered actives into clinical-grade products, enhancing credibility and adoption. Partnerships between biotech innovators and established European brands are anticipated to accelerate market entry and expand product pipelines.

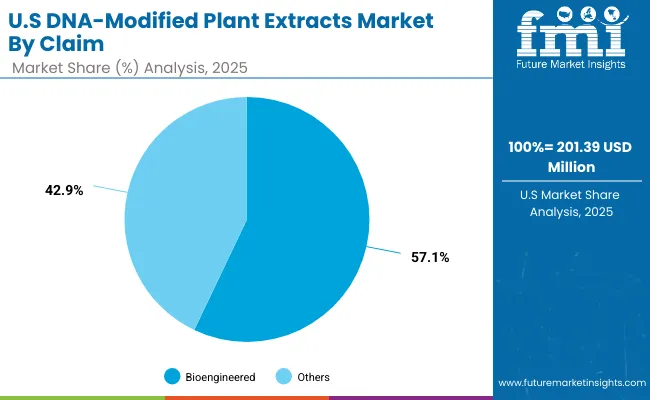

| Segment | Market Value Share, 2025 |

|---|---|

| Bioengineered | 57.1% |

| Others | 42.9% |

The DNA-Modified Plant Extracts Market in the United States is projected at USD 201.39 Million in 2025. Bioengineered claims contribute 57.1%, while others account for 42.9%, highlighting the country’s preference for scientifically validated and clinically substantiated formulations. This dominance of bioengineered inputs reflects the importance of data-driven efficacy in an advanced regulatory environment where transparency and traceability are prioritized. The segment’s strength is expected to be reinforced by consumer demand for premium, high-performance skincare and therapeutic solutions that demonstrate measurable outcomes.

The competitive dynamic is anticipated to be reshaped by collaborations between biotech developers and established cosmetic brands, ensuring robust commercialization pipelines. Growing integration of DNA-modified actives into clinical-grade formulations is likely to strengthen long-term value creation.

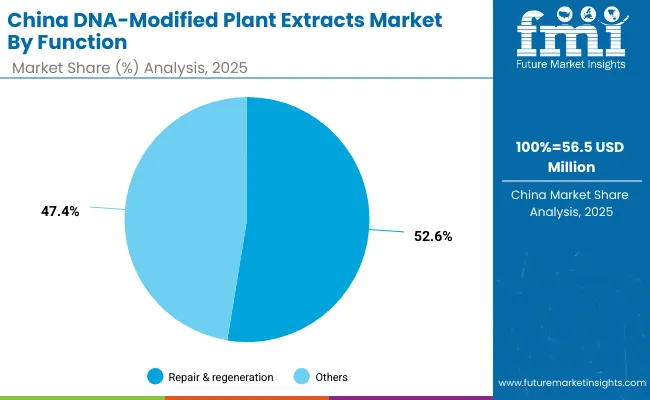

| Segment | Market Value Share, 2025 |

|---|---|

| Repair & regeneration | 52.6% |

| Others | 47.4% |

The DNA-Modified Plant Extracts Market in China is projected to record significant momentum, with repair & regeneration functions leading at 52.6% share in 2025, equal to USD 56.5 Million. This functional dominance highlights the market’s alignment with consumer demand for visible improvements in skin repair, resilience, and barrier strength. The emphasis on repair-driven benefits is expected to be reinforced by the country’s fast-expanding premium skincare sector, where performance validation and clinical outcomes are prioritized.

The adoption of DNA-modified extracts in China is likely to accelerate under supportive government policies, increased biotech funding, and rising consumer openness to scientifically engineered actives. Domestic players are projected to integrate repair-centric DNA-modified actives into new formulations, expanding differentiation across mid-tier and premium categories.

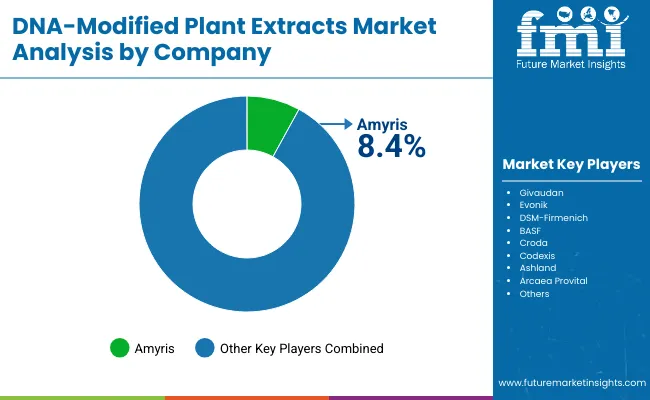

The DNA-Modified Plant Extracts Market is moderately fragmented, with a mix of global biotechnology pioneers, established ingredient suppliers, and emerging innovators competing across personal care, nutraceuticals, and pharmaceutical applications. Amyris holds the largest identified share in 2025 at 8.4%, positioning it as a leading player globally. The remainder of the market, representing 91.6%, is distributed among other players such as Givaudan, Evonik, DSM-Firmenich, BASF, Croda, Codexis, Ashland, Arcaea, and Provital. This fragmentation indicates a high degree of competition where differentiation is expected to depend less on scale and more on proprietary biotechnology, clinical validation, and sustainability positioning.

Amyris’ leadership is attributed to its deep expertise in synthetic biology and fermentation platforms, enabling consistent production of DNA-modified actives at scale. Other companies are expected to strengthen their positions by integrating genomics-driven pipelines with advanced delivery systems and clean-label branding. Mid-sized and emerging players are likely to focus on niche opportunities such as vegan claims, clinical-grade positioning, and functional specialization like repair and regeneration.

Competitive differentiation is projected to shift toward ecosystem building, where partnerships with premium skincare and wellness brands, coupled with data-driven efficacy validation, become decisive. Subscription models for ingredient access, digital twins for product testing, and transparent sourcing frameworks are anticipated to shape the next wave of leadership.

Key Developments in DNA-Modified Plant Extracts Market

| Item | Value |

|---|---|

| Quantitative Units | USD 950.7 Million (2025E) → USD 3,702.3 Million (2035F) |

| Claim | Bioengineered (55.6%, USD 528.3 Million in 2025), Others (44.4%, USD 422.53 Million in 2025) |

| Function | Repair & Regeneration (52.5%, USD 498.9 Million in 2025), Others (47.5%, USD 451.34 Million in 2025) |

| Product Type | Serums (48.8%, USD 460.6 Million in 2025), Others (51.2%, USD 486.3 Million in 2025) |

| Distribution Channel | E-commerce, Premium Retail, Pharmacies, Dermatology Clinics |

| End-use Applications | Skincare & Cosmetics, Dermatology Clinics, Nutraceuticals, Clinical-grade Therapeutics, Personal Wellness Products |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amyris, Givaudan, Evonik, DSM-Firmenich, BASF, Croda, Codexis, Ashland, Arcaea, Provital |

| Additional Attributes | Dollar sales by claim, function, and product type; adoption trends in bioengineered and clinical-grade claims; rising consumer preference for repair & regeneration; expansion in APAC markets with high CAGR (India 22.7%, China 19.8%); ecosystem strategies through biotech-brand partnerships; increasing role of clinical validation, transparent labeling, and sustainability narratives. |

The global DNA-Modified Plant Extracts Market is estimated to be valued at USD 950.7 million in 2025.

The market size for the DNA-Modified Plant Extracts Market is projected to reach USD 3,702.3 million by 2035.

The DNA-Modified Plant Extracts Market is expected to grow at a CAGR of 14.6% between 2025 and 2035.

The key product types in the DNA-Modified Plant Extracts Market are serums and others, with serums accounting for 48.8% share in 2025.

In terms of function, the repair & regeneration segment is projected to command a 52.5% share of the DNA-Modified Plant Extracts Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA