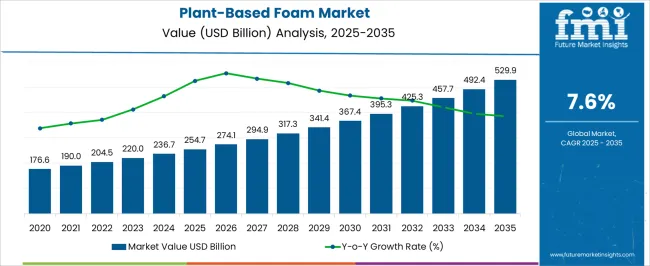

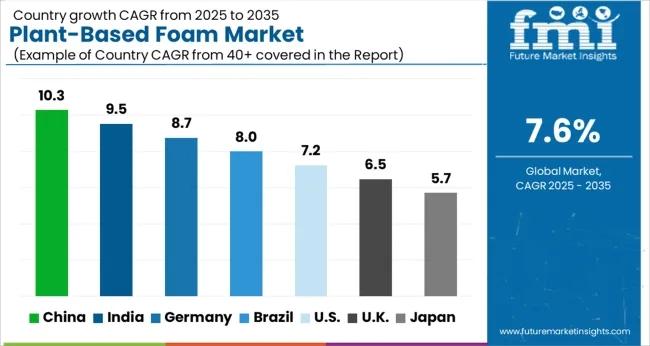

The Plant-Based Foam Market is estimated to be valued at USD 254.7 billion in 2025 and is projected to reach USD 529.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Plant-Based Foam Market Estimated Value in (2025 E) | USD 254.7 billion |

| Plant-Based Foam Market Forecast Value in (2035 F) | USD 529.9 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The plant based foam market is experiencing accelerated adoption driven by rising environmental concerns, regulatory push against petroleum based plastics, and consumer preference for sustainable alternatives. The market has gained momentum due to technological advancements in bio based polymers, which are enhancing foam durability, thermal resistance, and cost competitiveness.

Brands are actively investing in bio derived materials as part of their sustainability commitments, while industries such as packaging, automotive, and furniture are increasingly shifting toward eco friendly foam to reduce carbon footprints. Government initiatives supporting renewable resources and bans on single use plastics are further amplifying demand.

The outlook for the sector remains positive as plant based foams align with circular economy principles, offering both performance benefits and ecological advantages across multiple end use industries.

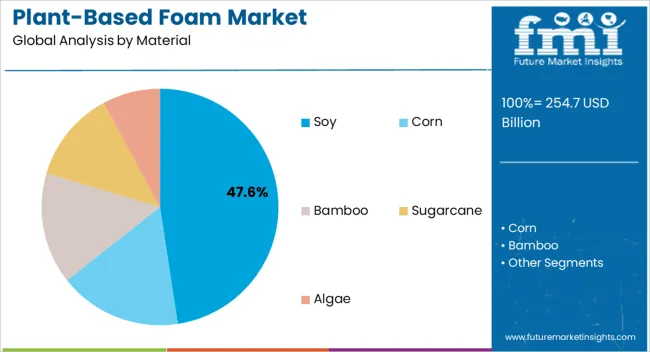

The soy material segment is projected to account for 47.60% of total market revenue by 2025 within the material category, making it the most significant contributor. Growth in this segment is being fueled by increasing agricultural utilization for bio based chemical production and the ability of soy derived foams to offer both performance and sustainability benefits.

The abundance of soy as a renewable feedstock, coupled with advances in processing technologies, has supported cost efficiency and large scale production.

Additionally, soy based foams are increasingly being preferred for their reduced environmental impact compared to conventional petrochemical alternatives, reinforcing their dominance in the material category.

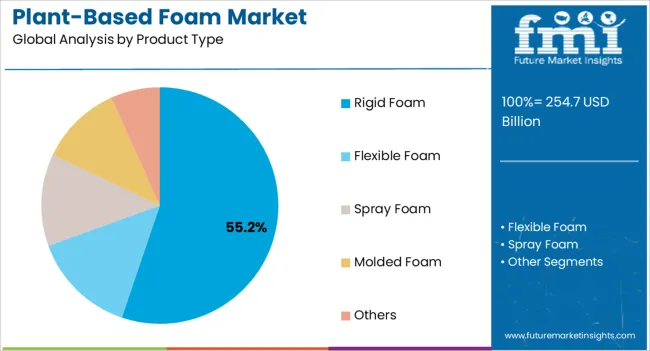

The rigid foam segment is expected to represent 55.20% of market revenue by 2025 within the product type category, establishing it as the leading segment. This growth is supported by its widespread application in structural, protective, and insulation uses where strength and durability are paramount.

The segment’s adoption has been strengthened by its compatibility with packaging and automotive sectors that demand lightweight yet resilient materials. Its superior resistance to compression and ability to retain shape have made it a preferred option in both industrial and consumer applications.

The ongoing push for sustainable rigid packaging formats has further reinforced the leadership of this segment.

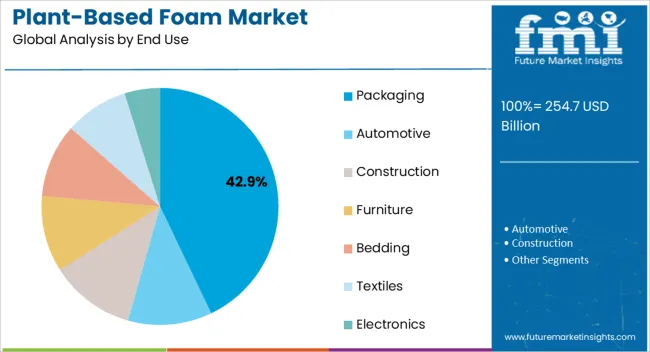

The packaging end use segment is projected to contribute 42.90% of total revenue by 2025, positioning it as the dominant application. Rising consumer awareness of eco friendly packaging and increasing regulations against single use plastics are driving this trend.

Plant based foam is being widely adopted for protective and cushioning applications in e commerce, food delivery, and retail packaging. The lightweight, recyclable, and biodegradable properties of plant based foam are enabling cost effective logistics and aligning with brand sustainability targets.

As demand for sustainable packaging accelerates globally, this segment continues to lead adoption, strengthening its role as the largest end use category in the market.

Historical Analysis: Looking at the past, we can observe the market's evolution and trends. Initially, plant-based foam faced limited adoption due to challenges such as high production costs and limited awareness. However, as sustainability became a significant concern, consumer preferences shifted toward eco-friendly materials. This led to increased demand for plant-based foam in various industries, including packaging, automotive, and construction.

Market players invested in research and development, improving the quality, performance, and cost-effectiveness of plant-based foam. Regulatory support also played a role, with governments implementing policies to promote sustainable materials. As a result, the market witnessed steady growth, with an expanding customer base and a broad range of applications.

Future Prediction: Looking ahead, the future of the plant-based foam market appears promising. Several factors contribute to this positive outlook. Firstly, growing environmental consciousness among consumers continues to drive demand for sustainable alternatives. As awareness about the harmful effects of traditional foam increases, many industries are expected to adopt plant-based foam as a green option.

Advancements in manufacturing technologies and economies of scale are likely to reduce production costs, making plant-based foam competitive with traditional foam. Cost reduction, coupled with the expanding market, is anticipated to drive further adoption and market growth.

Ongoing research and innovation efforts are anticipated to enhance the performance and properties of plant-based foam, opening up new opportunities in niche applications.

Plant-based foam market is predicted to expand at a healthy CAGR of 7.6% from 2025 to 2035, with the global market expected to close in on a valuation of USD 529.9.0 million by 2035.

Soy-based foam segment captured a 40% market share in 2025 due to its renewable and sustainable nature. It is derived from soybean oil, which is a natural and abundant resource. Soy-based foam offers several advantages such as excellent cushioning properties, durability, and resistance to deformation. It is commonly used in the production of mattresses, furniture, automotive seating, and insulation materials.

The utilization of soy-based foam aligns with the growing demand for eco-friendly alternatives to traditional foam materials, as it reduces dependence on petroleum-based products and helps mitigate environmental impacts.

Plant-based foam is widely used in various packaging applications, including the packaging of electronics, fragile goods, food and beverages, healthcare products, and other consumer goods. The packaging industry recognizes the need for sustainable and eco-friendly materials to meet the growing demand for environmentally conscious packaging solutions. Plant-based foam provides a renewable and biodegradable alternative to traditional foam materials, aligning with the industry's sustainability goals.

It finds extensive application in various industries, including furniture, bedding, automotive, and packaging. Flexible foam provides excellent support, comfort, and durability, making it ideal for mattresses, cushions, seating, and upholstery. Its ability to conform to different shapes and sizes makes it a preferred choice for customized applications.

The utilization of flexible foam in the plant-based foam market continues to grow as the demand for sustainable and eco-friendly alternatives to traditional foam increases. Its dominance in the market reflects its widespread adoption across industries and its contribution to an environmentally conscious approach to foam materials.

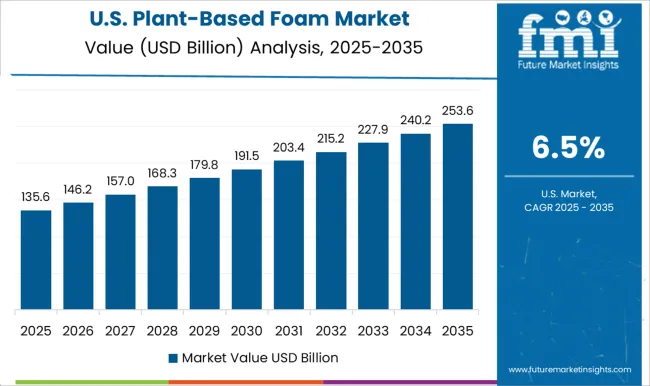

The region's strong presence can be attributed to several factors. Firstly, North America is characterized by a high level of consumer awareness and demand for sustainable and eco-friendly products. Consequently, this factor has driven the adoption of plant-based foam materials. Secondly, the region has well-established industries such as packaging, automotive, furniture, and bedding, which are key users of plant-based foam. Additionally, North America has seen the implementation of supportive regulations and initiatives promoting sustainability, further propelling market growth.

The presence of advanced manufacturing capabilities, research and development facilities, and a robust distribution network also contribute to the region's market share. North America is expected to continue its significant contribution to the plant-based foam market due to the factors such as:

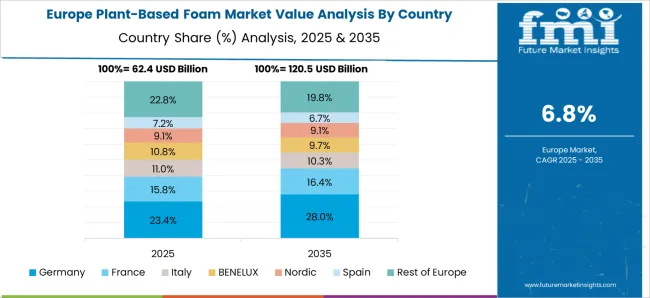

Europe is one of the leading regions for the plant-based foam market. The market growth in this region is driven by important factors including:

The presence of key automotive and packaging industries in the region is also contributing to the growth of the plant-based foam market. The market share of Europe in the global plant-based foam market is expected to continue to grow due to:

Asia Pacific region is expected to have a significant share in the plant-based foam market due to the increasing demand for eco-friendly and sustainable products in countries like China, India, Japan, and South Korea. The rising awareness regarding the environmental impact of conventional foam products and government initiatives to promote the use of bio-based products are driving the growth of the plant-based foam market in this region.

The increasing use of plant-based foam in the packaging, automotive, and construction industries is expected to fuel market growth in Asia Pacific region.

Partnerships can help expand market reach, access new technologies, and leverage combined expertise for mutual growth.

By adopting these strategies, manufacturers and service providers can position themselves for growth and capitalize on the increasing demand for plant-based foam products in the market.

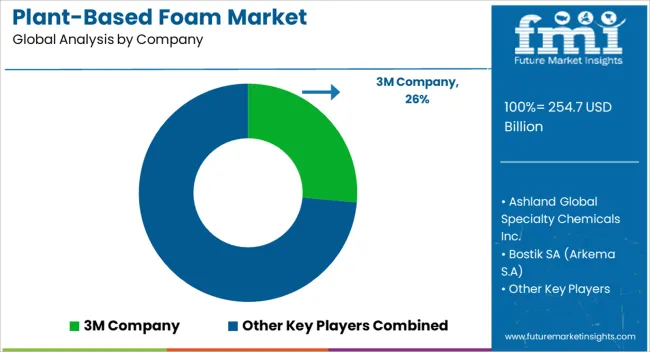

Key players are actively involved in research and development activities, partnerships, and strategic initiatives to strengthen their market position. The market is dynamic, with continuous advancements in technology and increasing consumer demand for eco-friendly alternatives, driving competition and fostering innovation in the plant-based foam market.

Some of the Key Players Operating in the Plant-based Foam Market Include:

3M Company, Ashland Global Specialty Chemicals Inc., Bostik SA (Arkema S. A), Coim Group, DIC Corporation, Dow Inc., DuPont de Nemours Inc., Evonik Industries AG, Flint Group, H.B. Fuller Company, Henkel AG & Co. KGaA, L.D. Davis Industries Inc., Sika AG, and Vimasco Corporation.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.6% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | Material, Product, End-use Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | 3M Company; Ashland Global Specialty Chemicals Inc.; Bostik SA (Arkema S.A); Coim Group; DIC Corporation; Dow Inc.; DuPont de Nemours Inc.; Evonik Industries AG; Flint Group; H.B. Fuller Company; Henkel AG & Co. KGaA; L.D. Davis Industries Inc.; Sika AG; and Vimasco Corporation. |

| Customization & Pricing | Available upon Request |

The global plant-based foam market is estimated to be valued at USD 254.7 billion in 2025.

The market size for the plant-based foam market is projected to reach USD 529.9 billion by 2035.

The plant-based foam market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in plant-based foam market are soy, corn, bamboo, sugarcane and algae.

In terms of product type, rigid foam segment to command 55.2% share in the plant-based foam market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA