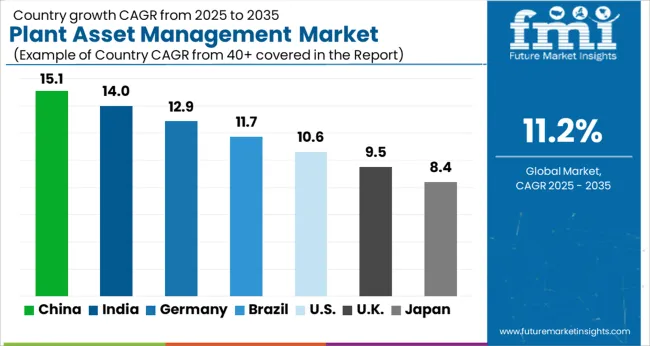

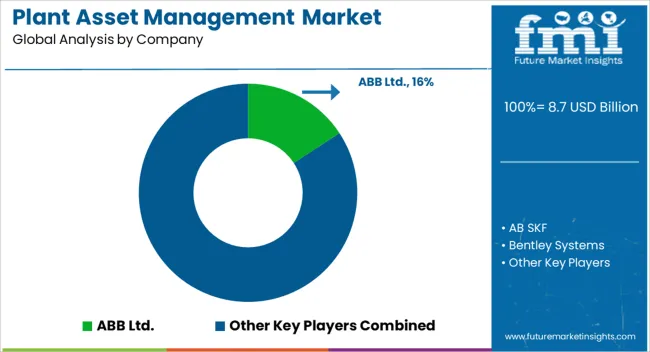

The Plant Asset Management Market is estimated to be valued at USD 8.7 billion in 2025 and is projected to reach USD 25.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| Plant Asset Management Market Estimated Value in (2025 E) | USD 8.7 billion |

| Plant Asset Management Market Forecast Value in (2035 F) | USD 25.2 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The plant asset management market is experiencing sustained growth as industries prioritize predictive maintenance, cost optimization, and improved equipment efficiency. Rising demand for digital transformation across asset intensive sectors is driving the adoption of advanced solutions that enhance visibility, minimize downtime, and extend asset life cycles.

Integration with IoT, AI, and data analytics has enabled real time monitoring and informed decision making, strengthening reliability and operational safety. Increasing investment in Industry 4.0 initiatives and regulatory requirements for plant safety are further boosting deployment.

As enterprises focus on lowering maintenance costs while maximizing productivity, the adoption of plant asset management systems is expected to accelerate, positioning the market for long term growth.

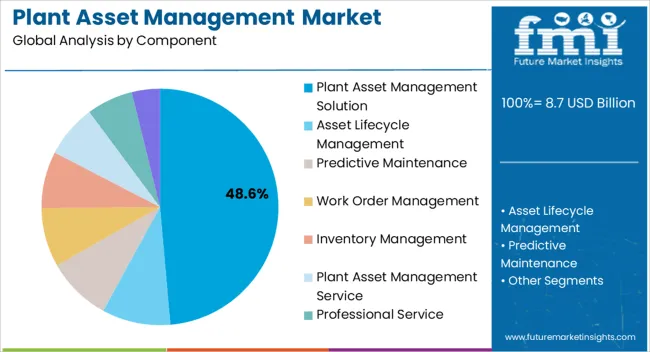

The plant asset management solution component segment is anticipated to represent 48.60% of the total market revenue by 2025 within the component category, making it the leading segment. Growth is supported by its ability to provide centralized asset visibility, streamline maintenance workflows, and improve return on assets.

The solution enables predictive maintenance strategies, reducing unexpected downtime and optimizing spare parts usage. Adoption has been reinforced by its capability to integrate with enterprise resource planning and manufacturing execution systems, further improving decision making efficiency.

As industries seek to modernize asset management practices, this component segment has become central to achieving reliability and cost effectiveness.

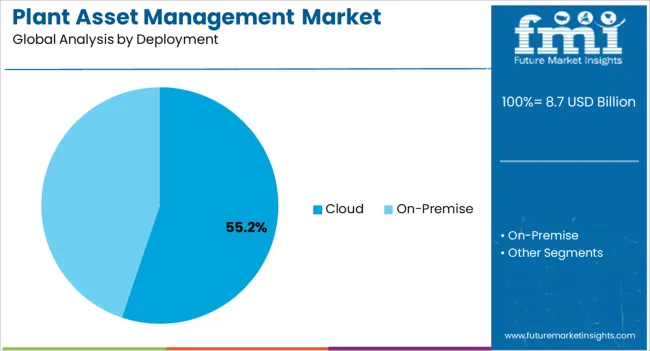

The cloud deployment segment is expected to account for 55.20% of the total market revenue by 2025, positioning it as the dominant deployment model. Its growth is being driven by advantages such as scalability, reduced upfront infrastructure costs, and easier integration with advanced analytics platforms.

Cloud based plant asset management allows for remote monitoring, enabling enterprises to oversee geographically distributed plants with efficiency. The flexibility of subscription models and faster software updates has further encouraged adoption.

Rising demand for real time insights and secure data storage has also reinforced reliance on cloud deployment, making it the preferred choice over traditional on premise systems.

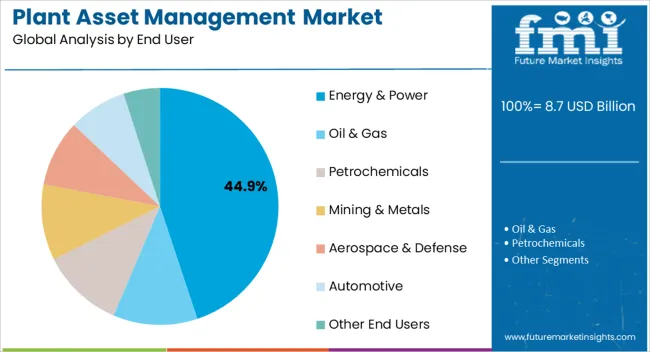

The energy and power segment is projected to contribute 44.90% of the overall market revenue by 2025 within the end user category, making it the leading sector. This dominance is attributed to the need for continuous operation of critical assets, high regulatory compliance requirements, and the financial impact of equipment downtime.

Asset reliability is particularly crucial in this industry where operational disruptions can significantly affect energy supply and safety. Implementation of plant asset management in power generation and distribution facilities has helped optimize maintenance schedules and improve operational efficiency.

As energy companies increasingly adopt digital technologies to manage aging infrastructure and renewable integration, the segment continues to lead in plant asset management adoption.

Increasing Adoption of Cloud-based Technologies to Boost the Market

The plant asset management strategy calls for several measuring methods to safeguard and forecast the health of plant assets. It gives valuable information regarding the condition of support throughout their life cycle. This data is utilized to optimize plant operations and maintenance, boost production capacity, and adopt predictive maintenance and operational plans.

Furthermore, the increasing adoption of lean manufacturing practices by several organizations, increased emphasis on providing cloud-based PAM solutions to meet customer demands, rising demand for asset management software that can identify potential failures to avoid future losses, and growing need for real-time data analytics are the major factors driving the market growth.

Automotive Industry to Create an Abundance of Investment Opportunities

The automobile sector is increasingly reliant on digital technology. Massive capital investments by market participants in undeveloped areas in emerging nations are also driving the rise of the automobile sector.

Technological advancements such as electric and gas-powered vehicles cause infrastructure changes in the automotive industry; additionally, new machines and equipment have replaced the need for human operators for most of the critical processes in the automotive industry for precise accuracy, which accelerates the demand for PAM solutions for automation assets used in automobile manufacturing plants.

The absence of Trained Professionals may impede the Market's Growth.

A shortage of trained workers is hampering the market's expansion. The World Economic Forum (WEF) stated in its study titled 'The Future of Jobs 2020' that around 54% of the global workforce must be re-skilled or up-skilled to work in disruptive and digital technologies producing the virtual world. Because of a lack of technical understanding, operators are less accepting.

| Attributes | Details |

|---|---|

| Market CAGR (2025 to 2035) | 11.7% |

| Market Valuation (2025) | USD 7.0 billion |

| Market Valuation (2035) | USD 21.4 billion |

During the historical period from 2020-2025, the market grew at a CAGR of 9.6%. The market secured a valuation of USD 5.1 billion in 2020 and USD 8.7 billion in 2025.

The implementation of lean manufacturing processes is driving the market. Companies that apply lean manufacturing concepts should consider an asset management system to increase dependability while lowering maintenance and operational costs across various asset classes.

Furthermore, process facilities in the oil and gas sector are complicated, with expensive and crucial production equipment. As the plant's health and performance deteriorate over time owing to wear from various sources, production, and related expenses suffer.

Asset management solutions seek to mitigate this impact by systematic equipment condition monitoring, the avoidance of unscheduled production downtime, and the reduction of operating expenditures through better maintenance planning. All these factors grow at a CAGR of 11.7% over the assessment period from 2025 to 2035.

Oil & Gas Industry helps the Market to Gain Huge Traction

By end-user, the global Plant Asset Management market can be segmented into energy & power, oil & gas, petrochemical, mining & metal, aerospace & defense, and automotive.

Process facilities in the oil and gas sector are very complicated, with expensive and crucial production equipment. As the plant's health and performance deteriorate over time owing to wear from various sources, production, and related expenses suffer.

Asset management solutions seek to mitigate this impact by systematic equipment condition monitoring, the avoidance of unscheduled production downtime, and the reduction of operating expenditures through better maintenance planning.

Automation Assets Exhibit Rapid Growth in the PAM Market during the Forecast Period

The global market can be segmented by asset type into production and automation assets. During the forecast period, the market for automation assets is predicted to grow fastest—the increased use of automation technology to boost production capacity in the process industries.

However, other types of automation systems, such as programmable logic controllers (PLCs) and distributed control systems (DCSs), find applications in discrete sectors, fueling the need for PAM solutions for effective automation asset management.

| Countries | Forecast CAGR Between 2025 to 2035 |

|---|---|

| China | 10.5% |

| India | 14.5% |

| United Kingdom | 9.2% |

Availability of Sophisticated IT infrastructure and supporting government actions to promote market growth.

The analysis shows the United States is likely to be a profitable Plant Asset Management market during the forecast period. The United States plant asset management industry is estimated to skyrocket at a CAGR of 10.6%, driven by the region's advanced factory solutions. The United States is estimated to capture 15.8% of the global market by 2035.

The fast adoption of IoT/IIoT across various industries, including manufacturing, automotive, and healthcare, can be attributed to increased internet penetration, the availability of low-cost IoT sensors, and the proliferation of smart-linked devices. The availability of sophisticated IT infrastructure and supporting government actions to promote the region's transition to Industry 4.0 is estimated to fuel the market's growth.

Low Labor Costs and Availability of Trained Workers

China is predicted to be the fastest-growing market during the forecast period. As per the estimations, China's aerospace and military sector is expected to grow by roughly 15% due to rising investments in sophisticated technology in the aerospace and defense sector. China is securing a CAGR of 10.5% in the global market by 2035.

Manufacturing cost control is becoming a top focus for aerospace companies, prompting them to invest in asset management technology. With sophisticated technologies like predictive maintenance and AI, the aircraft industry is deploying PAM solutions to minimize operating expenses.

Analysis reveals that PAM solutions are widely used throughout China due to the increasing industrial industry. Because of the low labor costs and availability of trained workers, major firms from various sectors have relocated their manufacturing units to China. These industrial facilities are utilizing asset management solutions to enhance overall manufacturing processes, which is projected to boost the growth of the PAM market in the area.

FMI highlights top Asset Management startups in the market. These startups are pioneering in several ways inside the Plant Asset Management business and worldwide. They are all outstanding startups worth following. A few of these startups are mentioned below:

Neer: NEER was founded by Elango Thevar in 2024. It is a cloud-based Machine Learning Platform that assists communities in optimizing current water infrastructure and developing an efficient system. It's a tool for everyone, from engineers managing highly complex systems to communities beginning to create new infrastructure.

Fincovi: Fincovi was founded by Ray O Neill, Damian Malone, and Jayesh Shah in 2020. It is located in Athlone, Westmeath, Ireland. It is a renewable energy-focused technology-enabled back and middle office solution provider.

The market is highly fragmented by the number of key players globally. The key players play a vital role in developing innovative and advanced products by investing a considerable amount in research and development activities. These key players drive the market by adopting marketing tactics such as mergers, collaborations, product launches, and agreements.

Other Essential Players in the Global Market are:

Recent key developments among players are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, United Kingdom, Japan, India, China, Australia, Germany |

| Key Segments Covered | Type, Application, Region |

| Key Companies Profiled | ABB Ltd.; AB SKF; Bentley Systems; CGI Group, Inc.; Dassault Systèmes; Emerson; Endress+Hauser Management AG; General Electrical; Hitachi; Honeywell; IBM Corporation; IFS AB; Ing. Punzenberger COPA-DATA GmbH; Maxwell Technologies Inc; Oracle Corporation; Ramco Systems Ltd.; Rockwell Automation; SAP SE; Siemens; Schneider Electric SA; Yokogawa Electric Corporation |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global plant asset management market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the plant asset management market is projected to reach USD 25.2 billion by 2035.

The plant asset management market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in plant asset management market are plant asset management solution, asset lifecycle management, predictive maintenance, work order management, inventory management, plant asset management service, professional service and managed service.

In terms of deployment, cloud segment to command 55.2% share in the plant asset management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA