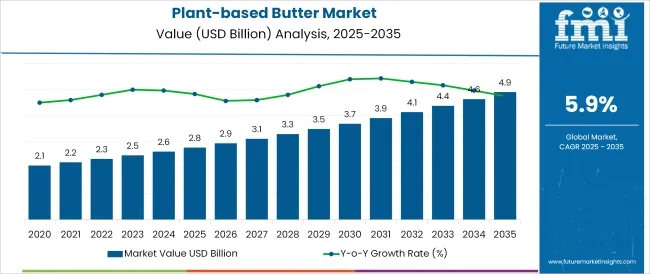

The Plant-based Butter Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The plant-based butter market is progressing steadily as shifting consumer preferences, heightened awareness of health benefits, and sustainability concerns drive adoption. The growing inclination toward dairy alternatives is being fueled by rising lactose intolerance rates, ethical considerations regarding animal welfare, and increasing alignment with plant-forward diets.

Brands are focusing on clean-label formulations, diversified flavors, and enhanced nutritional profiles to meet evolving consumer expectations, strengthening their competitive positions. Regulatory support for plant-based food innovation and the proliferation of retail shelf space for vegan products are expected to sustain momentum.

Further growth opportunities are being created through collaborations with foodservice operators, investments in supply chain efficiency, and expanding availability in emerging markets. These dynamics are paving the way for consistent growth and deeper market penetration over the coming years.

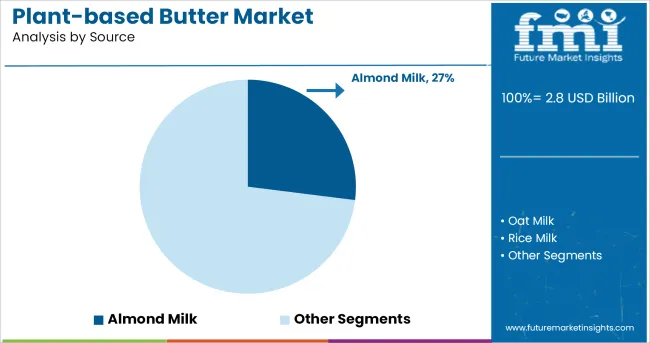

The market is segmented by Source and Distribution Channel and region. By Source, the market is divided into Almond Milk, Oat Milk, Rice Milk, Corn Milk, Soy Milk, Pea Milk, Coconut Milk, Cashew Milk, Flax Milk, Hemp Milk, and Others.

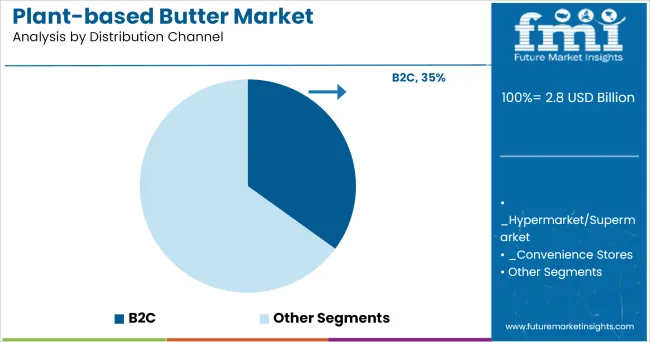

In terms of Distribution Channel, the market is classified into B2C, Hypermarket/Supermarket, Convenience Stores, Specialty Stores, Mom and Pop Stores, Discount Stores, Food & Drink Specialty Stores, Independent Small Groceries, Online Retail, Others, B2B, Hotels, Restaurants, and Cafes.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by source, almond milk-based plant butter is projected to hold 27.0% of the total market revenue in 2025, maintaining its position as the leading source segment. This leadership is attributed to almond milk’s mild flavor profile, consumer familiarity, and strong association with health conscious and premium plant-based products.

Its compatibility with a wide range of culinary applications and its perceived nutritional advantages have encouraged manufacturers to prioritize almond-based formulations. The segment’s appeal has been reinforced by innovations in texture and stability, enabling products to closely mimic the mouthfeel of traditional dairy butter.

Efficient supply chains for almonds and established consumer trust in almond-derived products have further solidified this segment’s dominance within the source category.

When segmented by distribution channel, the B2C segment is expected to account for 35.0% of the plant-based butter market revenue in 2025, establishing itself as the largest channel. This prominence has been supported by the rise of health conscious and ethically motivated consumers actively seeking plant-based options in retail and online marketplaces.

Increased product visibility in supermarkets, specialty stores, and direct to consumer platforms has accelerated adoption rates. Brands have focused on developing attractive packaging, competitive pricing, and marketing campaigns that resonate with individual consumers’ lifestyle choices.

The B2C segment’s leadership has also been reinforced by the growth of e-commerce, which has expanded access and convenience for consumers exploring dairy-free alternatives. The ability to build brand loyalty and engage consumers directly through promotions and feedback mechanisms has cemented B2C as the preferred and most impactful distribution channel.

In the recent past between 2020 and 2020, the plant-based butter market has grown steadily. According to FMI report, during this period dairy volumes slumped by around 300 million gallons. On the other hand, the consumption of plant-based alternatives went up by around 2.1 million gallons. This trend has continued post 2020 and is likely to rise through 2035.

The market will witness steady growth post 2024 to reach an estimated USD 4.9 Billion valuation by the end of 2035. North America, led by the United States will have a major role to play in future growth.According to the Good Food Institute, dollar sales of plant-based foods have increased by 29% in the past 2 years, creating a favorable environment for plant-based butter sales.

While plant-based butter products are largely aimed towards vegans and vegetarians, flexitarians are rapidly emerging as a major consumer group.

According to the Food Industry Association, around a third of all households hold at least one vegan, vegetarian, flexitarian, or pescatarian. However, only 5% of households adhere strictly to animal-free diets.

The Food Industry Association report states that more than 10% of all Gen Z, Gen X, and millennial consumers adhere to a flexitarian diet. On the other hand, only around 5% of older boomer demographics are flexitarians.

Consequently, with the increased interest in plant-based food products, plant-based alternatives have risen by more than 19% between 2020 and 2020. This trend is projected to aid growth in the market through the forecast period.

As per Virginia-based FMI Foundation, a non-profit organization on nutrition, health, and food, 40% of the American population has increased cooking activities. Restrictions on the food service sector has made home cooking a viable option, creating opportunities for plant-based butter sales.

According to the United States Census Bureau, nearly 50% of households have reported a loss income during the pandemic. As per the European Commission disposable income levels have dropped by over 700 euros in 2024.

Consequently, home cooking is becoming more popular as an option for savings. This will create potential revenue generation opportunities during this period.

Consumption of conventional butter has widely been associated with obesity, heart disease and other ailments. As per a report by Switch4Good, a health awareness non-profit organization, a tablespoon of butter accounts for more than 30% of the daily recommended saturated fat in a 2000 calorie diet.

Also, a 2020 study by the United States Department of Health and Human Services has stated that high fat diets can also result in alternation of red blood cells, and immunity cells aside from heart disease. This will create opportunities for clean label, organic plant-based butter alternatives, which are characterized by lower fat levels.

The global market for plant-based butter is steadily becoming mainstream, as supply chains are more resilient in comparison to that of industrial animal agriculture. However, participants in the industry are likely to face challenges that affect the potential for growth through the forecast period.

For instance, the costs of producing conventional plant-based butter and the resultant pricing is expected to be higher than that of conventional butter alternatives. This will limit adoption rates for the foreseeable future.

Also, the plant-based butter industry is largely reliant on the yields of vegetable and nuts. The fluctuation of yields and prices of these raw materials owing to environmental factors is also a challenge to market players in the industry.

North America is a major market for plant-based butter products and is projected to account for more than 35% of the global market share by the end of the forecast period in 2035. The United States holds the lead with a valuation of approximately USD 200 million.

According to a report by the Good Food Institute, the sales of plant-based butter in the United States has jumped by 15% between 2020 and 2020.

A study by Cornell University has also found that more than 10% of the overall American population is lactose intolerant. This factor will also support the adoption of plant-based butter in North America through the forecast period.

According to the Vegan Society, the number of vegans has gone up four times between 2014 and 2020. Also, in 2020 UK launched the highest number of vegan products in comparison to any other nation. Also, the UK's sales and consumption of vegan butter, milk, margarine, cheese, and ready meals have become the highest in Europe.

The Vegan Society has also stated that the UK plant-based milk sector was worth more than 2.1 million in 2020, accounting for more than 15% of the overall European market share. This figure is projected to more than double with a CAGR of close to 14% through 2025.

This is likely to create a highly favorable environment for the expansion of plant-based butter producers in the country.

According to FarmingUK, dairy farmers in the UK were hit by a 50 percent slump in profits from milk sales between 2020 to 2020, with a quarter of Brits now opting for plant-based dairy products, including butter.

As per the Journal of Food Science and Technology, dairy-free products reflected a growth rate of less than 1% between late 2020 and early 2024.

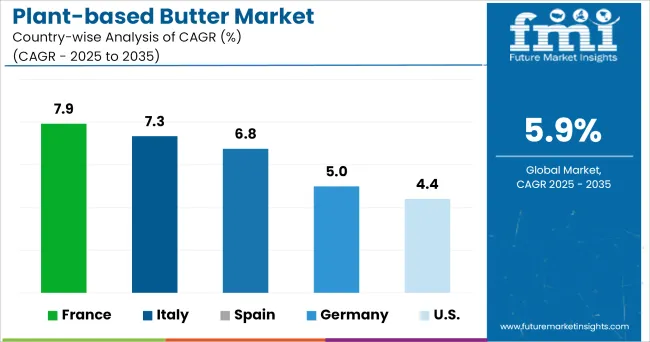

As per the Association Végétarienne de France, plant-based dairy products are most commonly consumed in the UK and Belgium, with France being among the lowest at around 40%, attributed to general consumer preference for conventional milk-based options.

However, France has been facing a crisis in terms of conventional butter stocks. 30% of demand for butter in French supermarkets was not met in October 2024. Also, butter prices have tripled between 2020 and 2024 reaching a valuation of 7,000 euros per ton. According to the FNPL milk-producers federation, the issue can be largely attributed to a price war occurring among French retailers.

This is a key factor that is likely to generate opportunities for growth in the plant-based butter sector in the near term. According to Mercy for Animals, a 17% annual growth of plant-based products is expected between 2020 and 2024 in France, creating a favorable atmosphere for the industry.

As per a USDA report, 15 percent of all new vegan food and beverage product launches for 2020-18 took place in Germany. As per Proveg International the country is home to around 1.3 million vegans, and approximately 8 million vegetarians.

The USDA report has also stated that around 70% of German households would like to see a larger variety of vegetarian products in supermarkets, with close to two-thirds purchasing vegan and vegetarian products intentionally.

Further, the projected growth of dairy alternatives product sales between 2020 to 2025 is expected to be more than 7% CAGR, and plant-based milk accounted for 15 percent of the overall milk sales in 2020. According to a study by Veganz, 30% of Germany’s population is flexitarian. These factors are likely to generate favorable conditions for long-term growth of the plant-based butter industry in Germany.

As per a report by the Irish Food Board, lactose-free products are gaining ground in Spain with close to 35% of the country’s population suffering from lactose intolerance, which is among the highest numbers in European countries.

Further, a report from the USDA has stated that retail sales of free-from products in Spain reached a value of USD 2.1 billion in 2020, which was a 12% increase over the previous year. Also, the free-from dairy retail value sales went up by 17% in 2020. The Green Revolution has stated that food stores and restaurants catering to vegans and vegetarians has doubled between 2020 and 2020.

According to WhiteWave Foods, Spain has emerged as a key market for non-dairy alternatives, with soy-milk being the primary source, while almond and oats reflecting stronger growth. Also, 2% of the country’s population is vegan or vegetarian, while flexitarians account for 8%. This bodes well for the future of the country’s plant-based butter industry.

According to the Vegan Society, close to 50% of all Italian consumers have stated an interest in lowering meat intakes, with close a quarter pushing to increase consumption of vegetarian processed foods in daily diets. Also, Vegan Society has also indicated that Italy has the fastest growing population of animal-free consumers.

A report by the European Data Journalism Network, the population of Italian vegans, albeit small at 3%, nearly doubled between 2020 and 2020. Also, a report by the National Library of Medicine Northern and Southern Italy populations reflect 52% and 41% lactose malabsorption cases, while central Italy accounts for only 19%.

These trends are likely to have significant influence on the prospects of plant-based butter purchases in the country.

According to the Good Food Institute, the growth of plant-based product sales has surpassed that of animal-based products in China in terms of dairy and meat products.

As per Health Ingredients China, Asian consumers, of which the Chinese comprise a large percentage, are prioritizing healthy food choices, with approximately 90% of Asians being lactose intolerant.

Also, the adoption of vegan labeling on food packaging has increased by more than 400% between 2020 and 2020. Health Ingredients China has also stated that between 2020 and 2020, the sales of plant-based milk rose in the country by 17%. According to the Xinhua News Agency, the Chinese vegan population has surpassed 50 million individuals.

Also, the Chinese government has set up standards for plant-based dairy including the GB/T 10789-2020 General Standard for Beverages which provides details on the different standards used in different plant milks: GB/T 31325-2014 for walnut milk, QB/T 2439 for peanut milk, and GB/T 30885-2014 among others.

These factors are likely to aid China as a high potential market for plant-based market in the near future.

According to the Census data from the government of India, around 30% of the country’s population is either vegan or vegetarian. On the other hand, a substantial percentage of this demographic is lacto-vegetarian, with the consumption of milk products. These trends are likely to influence the sales of plant-based butter products.

Some of the prominent brands in India offering plant-based butters include Dakini Health Foods, i2Cook, and JUS’ AMAZIN Seed who have launched sesame, sunflower, peanut, cashew, and almond-based butter offerings.

While higher levels of health awareness among the Indian population will prove beneficial, the higher costs of vegan products in the country are likely to hold back growth of the plan based butter industry in the near term.

Plant-based butter can be sourced from oat milk, rice milk, corn milk, soy milk, pea milk, almond milk, coconut milk, cashew milk, flax milk, and hemp milk. Of these soy milk will account for major market share, holding more than 40% of the overall market share in 2024.

Easy access to soy raw materials and significant cultivation efforts around the world result in low costs and prices, which is a key factor likely to drive demand throughout the assessment period. Almond milk is also witnessing strong growth, supported by a favorable flavor profile and higher consumer preference.

Prominent distribution channels for the market are B2B and B2C. B2B distribution can be further segmented into hotels, restaurants, and cafes.

B2C distribution can be divided into hypermarket/supermarket, convenience stores, mom and pop stores, discount stores, food & drink specialty stores, independent small groceries, and online retail. Online retail is expected to be a fast-growing segment with a significant market share.

Online retail has been gaining ground in the food and beverage industry, with advantages in terms of consumer engagement, with minimal costs.

The global plant-based butter industry is competitive and fragmented in nature, with the numerous small scale players operating in the industry. Top players are increasingly investing in product launch and geographical expansion strategies to consolidate their position in the market.

In December 2024, Nestle announced the launch of Harvest Gourmet range of vegan foods including butter among others for consumers in China. The products will be manufactured at a new facility in the Tianjin province.

Kite Hill Launched its Plant-based Butter Alternative in the summer of 2024, which is produced with almond milk, and oils from sunflower, olives, and coconut, for consumers in the United States.

Further, ForA has launched a plant-based butter, with key ingredients of the original recipe being coconut oil, coconut cream, sunflower oil, aquafaba, and cocoa butter. The product is largely aimed towards bakery applications.

Future Market Insights has also studied the following plant-based butter manufacturers in its detailed study:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2020 |

| Market Analysis | USD Million for Value, Million Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa; and Asia Pacific |

| Key Countries Covered | USA, Canada, Mexico, Greater China, Japan, India, South Korea, Australia, and New Zealand |

| Key Segments Covered | Source, Distribution Channel, and Region |

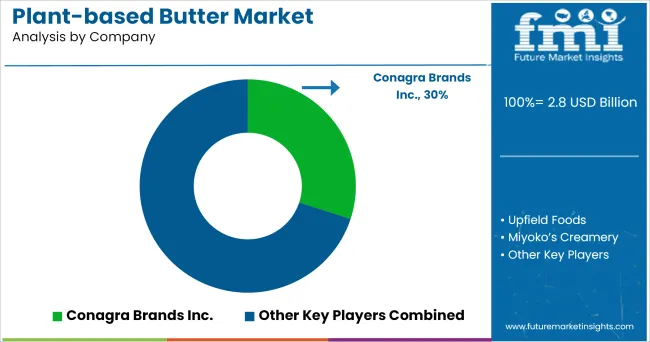

| Key Companies Profiled | Conagra Brands Inc.; Upfield Foods; Miyoko’s Creamery; Wayfare Food; Prosperity Organic Food Inc.; Lyrical Foods Inc.; Califia Farms; Premier Organics; Naturli Foods; Ekogram-the real food; Wildfriend Foods; The J.M. Smuker Co.; The Leaviet Corp.; Milkadamia; Chobani LLC; Carley’s Organic; Pintola; Alpino Health Foods; Vegan Way; Dhatu Organics; Kitchen Garden; Naturally Organic; Daisya Fine Food; and Ceres Organics |

| Report Coverage | Market Overview, Key Market Trends, Demand Analysis, Market Background, Segmental Analysis, Regional Profiling, Market Structure Analysis and Competition Analysis |

| Customization & Pricing | Available upon Request |

The global plant-based butter market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the plant-based butter market is projected to reach USD 4.9 billion by 2035.

The plant-based butter market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in plant-based butter market are almond milk, oat milk, rice milk, corn milk, soy milk, pea milk, coconut milk, cashew milk, flax milk, hemp milk and others.

In terms of distribution channel, b2c segment to command 35.0% share in the plant-based butter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Butter Flavor Market Trends – Food & Beverage Innovation 2025 to 2035

Butter Powder Market Growth – Applications & Demand 2025 to 2035

Analysis and Growth Projections for Butter and Margarine Business

Competitive Breakdown of Buttermilk Powder Providers

Butter Concentrate Market

Nut Butters Market Insights - Premium Spreads & Consumer Trends 2025 to 2035

Dry Buttermilk Market

Shea Butter Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Aloe Butter Market

Kokum Butter Market Analysis by Application, End Use, and Region through 2035

Vegan Butter Market Insights - Dairy-Free Alternatives & Industry Growth 2025 to 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Lactic Butter Market Analysis - Size, Share & Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA