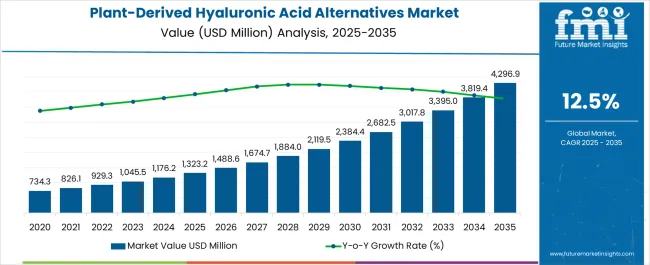

The global plant-derived hyaluronic acid alternatives market is projected to grow from USD 1,323.2 million in 2025 to approximately USD 4,296.9 million by 2035, recording an absolute increase of USD 2,990.6 million over the forecast period. This translates into a total growth of 228.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.5% between 2025 and 2035.

The overall market size is expected to grow by nearly 3.3X during the same period, supported by the rising consumer demand for natural and sustainable beauty ingredients and increasing awareness of the benefits of plant-based alternatives to traditional hyaluronic acid.

Between 2025 and 2030, the plant-derived hyaluronic acid alternatives market is projected to expand from USD 1,323.2 million to USD 2,385.7 million, resulting in a value increase of USD 1,074.8 million, which represents 35.9% of the total forecast growth for the decade. This phase of growth will be shaped by increasing consumer preference for natural and sustainable beauty products, growing awareness of environmental sustainability in cosmetics manufacturing, and rising demand for clean-label beauty formulations. Ingredient suppliers are expanding their plant-based portfolios to address the growing complexity of natural cosmetic formulations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,323.2 million |

| Forecast Value in (2035F) | USD 4,296.9 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

From 2030 to 2035, the market is forecast to grow from USD 2,385.7 million to USD 4,296.9 million, adding another USD 1,915.8 million, which constitutes 64.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of biotechnology-based production methods, integration of advanced extraction technologies, and development of standardized quality protocols across different plant-derived sources. The growing adoption of vegan and clean-label cosmetic products will drive demand for more sophisticated plant-derived alternatives and specialized extraction expertise.

Between 2020 and 2025, the plant-derived hyaluronic acid alternatives market experienced rapid expansion, driven by increasing consumer awareness of synthetic ingredient concerns and growing demand for sustainable beauty solutions. The market developed as cosmetic manufacturers recognized the need for natural alternatives that could deliver comparable hydration and anti-aging benefits to traditional hyaluronic acid. Regulatory bodies and certification organizations began establishing standards for natural and organic cosmetic ingredients, emphasizing the importance of plant-derived sourcing and sustainable production methods.

Market expansion is being supported by the rapid shift toward natural and sustainable beauty products worldwide and the corresponding need for effective plant-based alternatives to synthetic ingredients. Modern consumers are increasingly conscious of ingredient transparency and environmental impact, seeking products that combine efficacy with sustainability credentials. The growing awareness of potential skin sensitivities and long-term effects of synthetic ingredients is driving demand for gentler, plant-derived alternatives that provide comparable hydration and anti-aging benefits.

The rising popularity of clean beauty and wellness trends is creating significant market opportunities for plant-derived hyaluronic acid alternatives across diverse cosmetic applications. Social media influence and beauty education are increasing consumer knowledge about ingredient benefits and driving demand for products with recognizable, natural ingredient lists. Regulatory support for natural cosmetics and sustainability initiatives are establishing favorable conditions for plant-derived ingredient adoption and market growth.

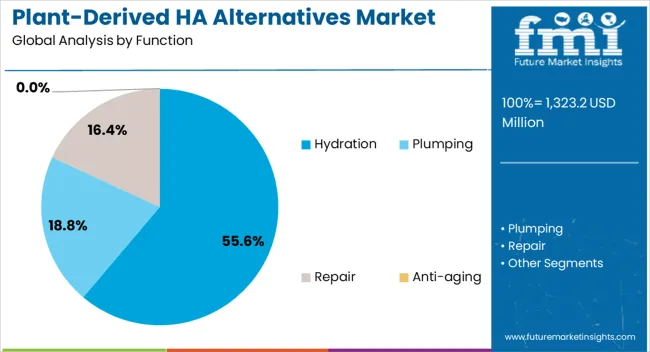

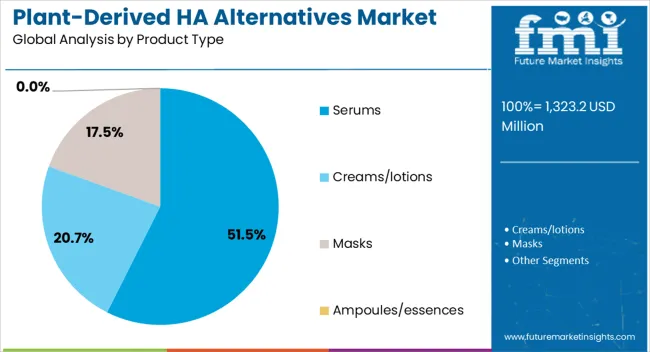

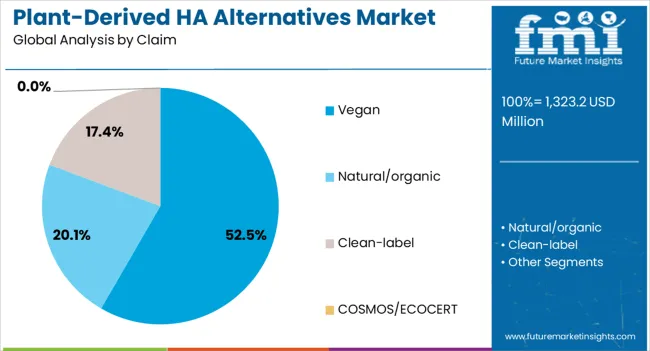

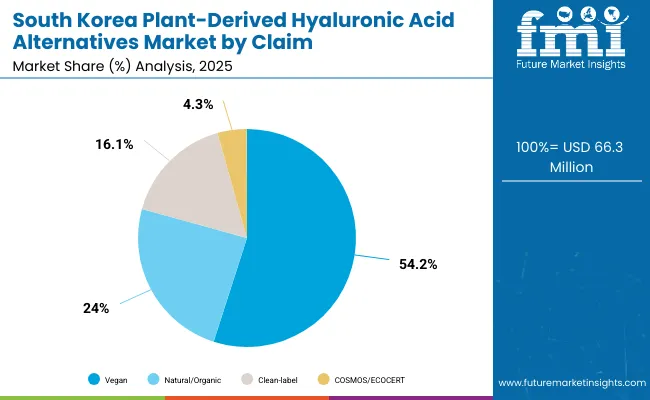

The market is segmented by source, function, product type, claim, channel, and region. By source, the market is divided into polyglutamic acid (natto), tremella mushroom polysaccharides, cassia angustifolia (botanical HA), and beta-glucans. Based on function, the market is categorized into hydration, plumping, repair, and anti-aging. In terms of product type, the market is segmented into serums, creams/lotions, masks, and ampoules/essences. By claim, the market is classified into vegan, natural/organic, clean-label, and COSMOS/ECOCERT certified. By channel, the market includes e-commerce, pharmacies, specialty beauty retail, and mass retail. Regionally, the market is divided into major countries including China, USA, India, UK, Germany, and Japan.

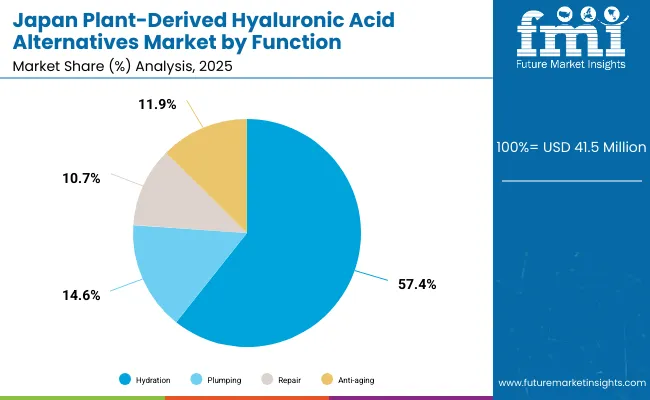

The hydration function is projected to represent 55.6% of the plant-derived hyaluronic acid alternatives market in 2025, reaffirming hydration as the cornerstone of modern skincare. Consumers increasingly recognize that moisture balance and skin barrier support are essential for achieving healthy, youthful-looking skin. Plant-derived hyaluronic acid alternatives, sourced from botanicals such as tremella mushroom, cassia seed, and aloe vera, deliver comparable or superior water-retention capacity to conventional hyaluronic acid while reducing irritation risks sometimes associated with synthetic variants.

The segment benefits from rising demand for “skinimalist” routines, where hydration-focused products serve as multipurpose essentials for all skin types. Growing consumer education through dermatologists, influencers, and beauty communities further emphasizes hydration’s importance in both preventive and corrective skincare. This positions plant-derived alternatives as gentle yet effective solutions, driving their adoption in both mainstream and premium formulations and ensuring hydration remains the leading functional driver in the category.

Serums are forecasted to account for 51.5% of demand in the plant-derived hyaluronic acid alternatives market in 2025, underscoring their role as the preferred delivery format for concentrated skincare actives. Consumers value serums for their lightweight textures, fast absorption, and ability to deliver high doses of plant-based humectants directly into the skin. This makes serums an ideal showcase for the efficacy of advanced natural alternatives to hyaluronic acid. Premium pricing opportunities are strong in this category, as buyers increasingly associate serums with innovation and science-backed performance.

Brands are responding with formulations that combine plant-derived hydration boosters with complementary actives like peptides or antioxidants, amplifying consumer appeal. The popularity of multi-step routines, particularly in Asia and among global skincare enthusiasts, further supports serum adoption. As a result, serums remain the anchor product type driving both growth and consumer trust in plant-derived hydration solutions.

The vegan claim is projected to represent 52.5% of the plant-derived hyaluronic acid alternatives market in 2025, highlighting the convergence of efficacy, ethics, and sustainability in beauty. With growing consumer demand for cruelty-free and eco-conscious products, vegan skincare has evolved from a niche positioning to a mainstream expectation. Plant-derived hyaluronic acid alternatives naturally support vegan credentials while delivering proven hydration and barrier-repair benefits, making them a strategic choice for brands targeting conscious consumers.

Certification programs and transparent ingredient sourcing further reinforce credibility, boosting consumer trust and loyalty. Vegan claims also allow brands to achieve premium price positioning, as buyers increasingly equate ethical values with higher quality and social responsibility. As younger demographics and environmentally aware shoppers expand their influence, vegan-labeled plant-derived hydration products will remain a dominant force, shaping the ethical and functional landscape of the market.

The plant-derived hyaluronic acid alternatives market is advancing rapidly due to increasing consumer preference for natural ingredients and growing environmental consciousness in beauty purchasing decisions. However, the market faces challenges including higher raw material costs, need for extensive efficacy validation, and varying quality standards across different plant sources. Standardization efforts and certification programs continue to influence ingredient acceptance and market development patterns.

The growing implementation of biotechnology and fermentation processes is enabling scalable production of plant-derived hyaluronic acid alternatives with consistent quality and purity profiles. Advanced extraction and purification technologies are improving ingredient yield and reducing environmental impact compared to traditional chemical synthesis methods. These production advances are making plant-derived alternatives more cost-effective and commercially viable for mainstream cosmetic applications.

Modern ingredient suppliers are incorporating comprehensive sustainability certifications and transparent supply chain documentation that support brand positioning and consumer trust. Integration of carbon footprint analysis and biodegradability testing enables more precise environmental impact assessment and marketing communications. Advanced certifications also support regulatory compliance and facilitate market access in regions with strict natural cosmetic regulations.

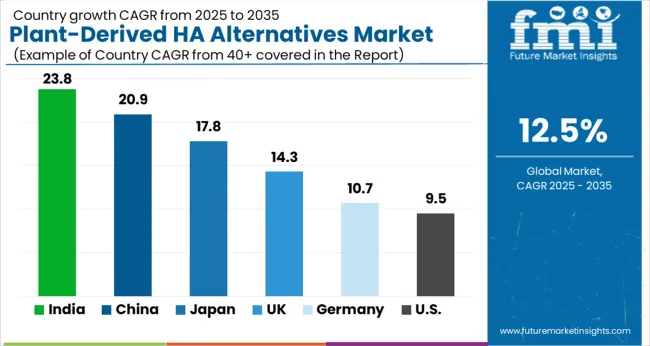

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 23.8% |

| China | 20.9% |

| Japan | 17.8% |

| UK | 14.3% |

| Germany | 10.7% |

| USA | 9.5% |

The plant-derived hyaluronic acid alternatives market is growing rapidly worldwide, with India leading at a 23.8% CAGR through 2035, driven by expanding domestic cosmetics production, growing consumer awareness of natural ingredients, and increasing export opportunities for ayurvedic and traditional plant-based formulations.

China follows at 20.9%, supported by massive cosmetics market growth, government support for natural ingredient development, and strong manufacturing capabilities. Japan records 17.8%, emphasizing innovation in biotechnology production methods and premium natural skincare formulations. The UK shows 14.3% growth, focusing on clean beauty trends and sustainable ingredient sourcing. Germany grows at 10.7%, leveraging advanced extraction technologies and strict quality standards. The USA demonstrates 9.5% growth, driven by mature clean beauty market and established distribution networks. The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from plant-derived hyaluronic acid alternatives in India is projected to exhibit the highest growth rate with a CAGR of 23.8% through 2035, driven by the integration of traditional Ayurvedic ingredient knowledge with modern cosmetic science and increasing global recognition of Indian botanical expertise. The country's diverse plant biodiversity and established extraction capabilities are creating significant opportunities for innovative ingredient development. Major ingredient suppliers and cosmetic manufacturers are establishing comprehensive research and production facilities to support growing domestic and international demand.

Revenue from plant-derived hyaluronic acid alternatives in China is expanding at a CAGR of 20.9%, supported by rapidly growing domestic cosmetics consumption, advanced biotechnology capabilities, and strong government support for sustainable ingredient development. The country's established manufacturing infrastructure and increasing consumer preference for natural beauty products are driving demand for innovative plant-derived alternatives. Domestic brands and international companies are investing significantly in research and production capabilities to serve the expanding market.

Demand for plant-derived hyaluronic acid alternatives in Japan is projected to grow at a CAGR of 17.8%, supported by the country's emphasis on skincare innovation, advanced biotechnology capabilities, and consumer preference for high-quality natural ingredients. Japanese cosmetic companies are investing heavily in research and development of novel plant-derived alternatives that meet strict quality and efficacy standards. The market is characterized by focus on premium positioning, advanced formulation technologies, and comprehensive clinical validation.

Demand for plant-derived hyaluronic acid alternatives in the UK is expanding at a CAGR of 14.3%, driven by strong clean beauty trends, increasing environmental consciousness, and established natural cosmetics market infrastructure. British consumers demonstrate high willingness to pay premium prices for sustainable, ethically sourced ingredients with proven efficacy. The market benefits from comprehensive regulatory support for natural cosmetics and well-developed distribution channels for premium natural beauty products.

Demand for plant-derived hyaluronic acid alternatives in Germany is growing at a CAGR of 10.7%, driven by the country's emphasis on ingredient quality, advanced extraction technologies, and stringent regulatory standards for natural cosmetics. German ingredient suppliers and cosmetic manufacturers are implementing comprehensive quality control systems that ensure consistent performance and safety of plant-derived alternatives. The market is characterized by focus on technical innovation, sustainable sourcing, and compliance with strict European natural cosmetic regulations.

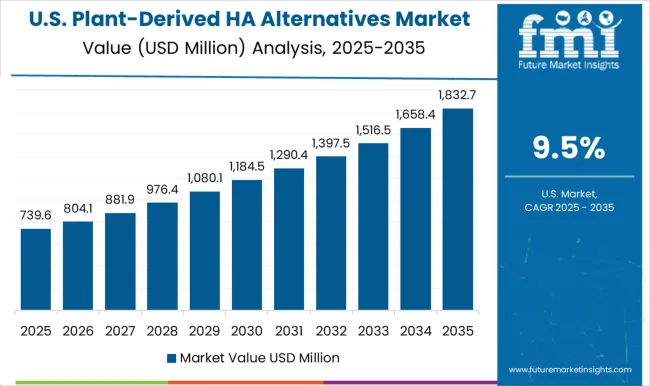

Demand for plant-derived hyaluronic acid alternatives in the USA is expanding at a CAGR of 9.5%, supported by mature clean beauty market infrastructure, established consumer awareness of natural ingredients, and comprehensive retail distribution networks. American consumers demonstrate strong preference for transparent ingredient labeling and scientifically validated natural alternatives. The market benefits from established regulatory frameworks and well-developed supply chains for natural cosmetic ingredients.

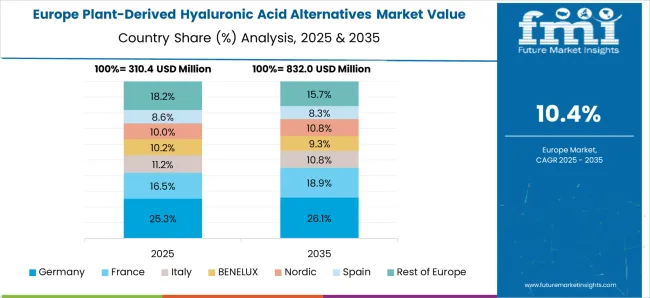

The plant-derived hyaluronic acid alternatives market in Europe demonstrates advanced development across key economies with Germany establishing leadership through its precision biotechnology capabilities and sustainable ingredient innovation, supported by companies like CLR Berlin, DSM-Firmenich, and Ashland pioneering cutting-edge plant-based hydration technologies that offer comparable or superior performance to traditional hyaluronic acid while meeting clean beauty demands.

France represents a significant market driven by its luxury cosmetics heritage and expertise in botanical extraction, with companies like Givaudan Active Beauty, Seppic, and Solabia developing sophisticated plant-derived moisture retention systems that combine French botanical artistry with advanced molecular science for premium skincare applications.

Switzerland contributes through companies like Mibelle Biochemistry creating innovative plant-based alternatives using advanced biotechnology and sustainable sourcing practices. The UK shows considerable growth through its embrace of natural and sustainable beauty trends, while Italy and Spain exhibit expanding interest in eco-friendly hydration solutions. BENELUX countries contribute through their focus on sustainable innovation, while Eastern Europe and Nordic regions display emerging potential, driven by growing environmental consciousness and increasing demand for plant-based cosmetic ingredients.

South Korea represents an emerging innovation center for plant-derived hyaluronic acid alternatives, positioning as a growing global market with environmentally conscious consumers increasingly embracing sustainable beauty solutions and plant-based skincare technologies. Companies like Provital and Rahn contribute through their botanical expertise, supporting the development of advanced plant-derived hydration systems that align with K-beauty principles of gentle effectiveness and skin barrier enhancement.

The market benefits from extensive research capabilities in fermentation technology and botanical processing, creating natural advantages for developing innovative plant-based moisture retention systems. Strong domestic biotechnology infrastructure and cosmetics manufacturing capabilities support both local development and significant export opportunities.

The integration of plant-derived alternatives with Korean expertise in fermented ingredients and bioprocessing, combined with consumer sophistication in understanding sustainable ingredient benefits and long-term skin health approaches, positions the market as both an important consumer base and emerging innovation catalyst for plant-derived hyaluronic acid alternatives in global clean beauty and sustainable cosmetics industries worldwide.

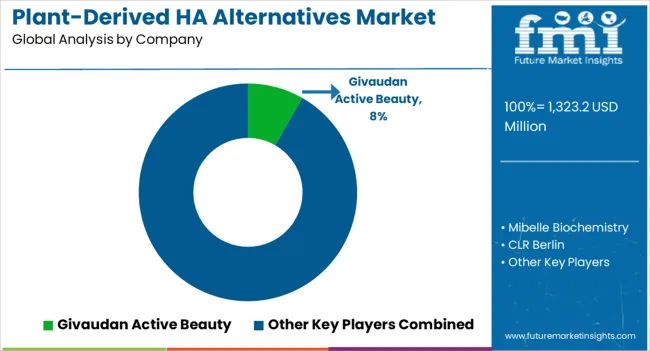

The plant-derived hyaluronic acid alternatives market is defined by competition among specialized ingredient suppliers, biotechnology companies, and established cosmetic raw material manufacturers. Companies are investing in advanced extraction technologies, sustainable sourcing practices, clinical validation studies, and strategic partnerships to deliver effective, reliable, and environmentally responsible alternative ingredients. Innovation leadership, quality assurance, and market education are central to strengthening product portfolios and market presence.

Givaudan Active Beauty holds an 8.3% global market share in 2025, leading with comprehensive natural ingredient portfolios and advanced extraction capabilities. The company focuses on sustainable sourcing, scientific validation, and technical support for cosmetic manufacturers seeking plant-derived alternatives. Other key players including Mibelle Biochemistry, CLR Berlin, Ashland, and Seppic compete through specialized ingredient innovation, quality excellence, and application expertise.

Solabia, Provital, Rahn, DSM-Firmenich, and INOLEX offer specialized plant-derived alternatives with focus on efficacy validation, sustainable production, and comprehensive technical support across global markets. These companies emphasize research and development, regulatory compliance, and customer education to support market adoption of innovative plant-derived ingredients.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,323.2 million |

| Source | Polyglutamic acid (natto), Tremella mushroom polysaccharides, Cassia angustifolia (botanical HA), Beta-glucans |

| Function | Hydration, Plumping, Repair, Anti-aging |

| Product Type | Serums, Creams/lotions, Masks, Ampoules/essences |

| Claim | Vegan, Natural/organic, Clean-label, COSMOS/ECOCERT |

| Channel | E-commerce, Pharmacies, Specialty beauty retail, Mass retail |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, United States, India, United Kingdom, Germany, Japan and 40+ countries |

| Key Companies Profiled | Givaudan Active Beauty, Mibelle Biochemistry, CLR Berlin, Ashland, Seppic, Solabia, Provital, Rahn, DSM-Firmenich, and INOLEX |

| Additional Attributes | Dollar sales by botanical source and molecular weight, regional demand trends, competitive landscape, buyer preferences for vegan versus biofermented options, integration with clean-label/hydration positioning, innovations in green extraction, biopolymer engineering, and sustainable cultivation practices |

The global plant-derived hyaluronic acid alternatives market is estimated to be valued at USD 1,323.2 million in 2025.

The market size for the plant-derived hyaluronic acid alternatives market is projected to reach USD 4,296.9 million by 2035.

The plant-derived hyaluronic acid alternatives market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in plant-derived hyaluronic acid alternatives market are hydration, plumping, repair and anti-aging.

In terms of claim, vegan segment to command 52.5% share in the plant-derived hyaluronic acid alternatives market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA