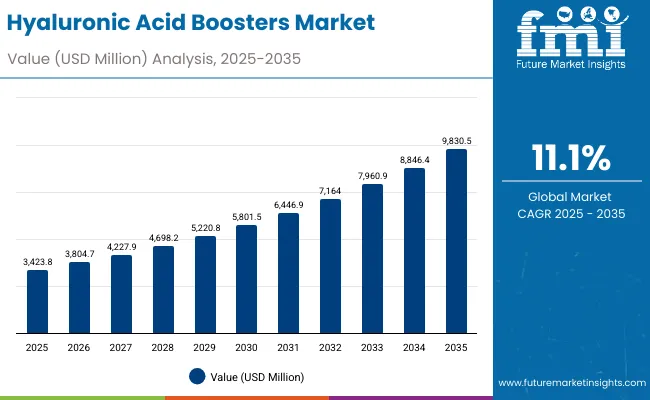

The Hyaluronic Acid Boosters Market is expected to record a valuation of USD 3,423.8 million in 2025 and USD 9,830.5 million in 2035, with an increase of USD 6,406.7 million, which equals a growth of 187% over the decade. The overall expansion represents a CAGR of 11.1% and a nearly threefold increase in market size.

Hyaluronic Acid Boosters Market Key Takeaways

| Metric | Value |

|---|---|

| Hyaluronic Acid Boosters Market Estimated Value in (2025E) | USD 3,423.8 million |

| Hyaluronic Acid Boosters Market Forecast Value in (2035F) | USD 9,830.5 million |

| Forecast CAGR (2025 to 2035) | 11.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,423.8 million to USD 5,801.5 million, adding USD 2,377.7 million, which accounts for 37% of the total decade growth. This phase records steady adoption in hydration-focused boosters, dermatologist-tested serums, and repair-oriented formulations, driven by strong consumer demand for clinical efficacy. Serum-based boosters dominate this period as they cater to over 52% of global sales, supported by ease of application and fast absorption rates.

The second half from 2030 to 2035 contributes USD 4,029.0 million, equal to 63% of total growth, as the market jumps from USD 5,801.5 million to USD 9,830.5 million. This acceleration is powered by widespread deployment of multifunctional boosters (hydration + wrinkle-reduction), clean-label and vegan-certified claims, and adoption of dermatologist-tested formulations in Asia-Pacific. Mask-based boosters and capsule innovations gain traction in late-period adoption, while premium positioning drives the clinical-grade category. E-commerce-led expansion, coupled with pharmacy-driven endorsements, adds recurring revenue, increasing the channel share of digital platforms beyond 40% in total value.

From 2020 to 2024, the Hyaluronic Acid Boosters Market expanded steadily, reflecting hardware-like adoption dynamics but centered on hydration-led skincare. During this period, the competitive landscape was dominated by multinational cosmetic companies controlling nearly 70% of global revenue, with leaders such as L’Oréal, La Roche-Posay, and Neutrogena focusing on dermatologist-tested serums and clean-label skincare innovations. Competitive differentiation relied on clinical validation, skin compatibility, and affordability, while niche premium players like SkinCeuticals and Drunk Elephant built loyalty in the clinical-grade and vegan-certified space. Service-based beauty platforms had limited traction, contributing less than 10% of the market through e-commerce subscription boxes.

Demand for hyaluronic acid boosters will expand to USD 3,423.8 million in 2025, and the revenue mix will shift as vegan, clean-label, and dermatologist-tested claims grow to over 50% share. Traditional skincare leaders face rising competition from digital-first players offering dermatologist-backed e-commerce channels, subscription-based skincare kits, and personalized formulations. Major brands are pivoting to hybrid models, integrating clinical validation with sustainable sourcing to retain relevance. Emerging entrants specializing in capsule-based delivery, biotech-derived hyaluronic acid, and AI-driven skincare personalization are gaining share. The competitive advantage is moving away from mass affordability alone to a broader ecosystem of science-backed efficacy, digital presence, and recurring customer engagement.

Advances in skincare formulation have enhanced penetration, moisture retention, and wrinkle reduction, allowing for more efficient treatment across diverse consumer segments. Serum formats have gained popularity due to their suitability for daily hydration and rapid absorption. The rise of dermatologist-tested claims has contributed to strong consumer trust, enhancing demand across both developed and emerging economies. Industries such as beauty retail, pharmaceuticals, and clinical skincare are driving adoption of boosters that can integrate seamlessly into dermatological routines.

Expansion of anti-aging, repair-oriented, and multifunctional booster applications has fueled market growth. Innovations in clean-label serums, vegan masks, and capsule-based boosters are expected to open new consumer segments. Segment growth is expected to be led by hydration, serum-based delivery systems, and dermatologist-tested claims due to their efficacy, adaptability, and higher trust value.

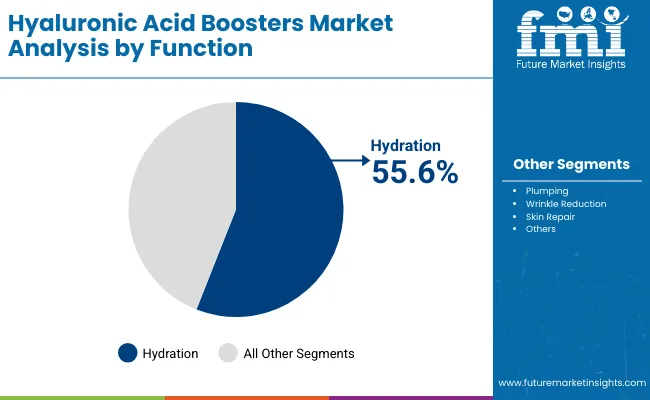

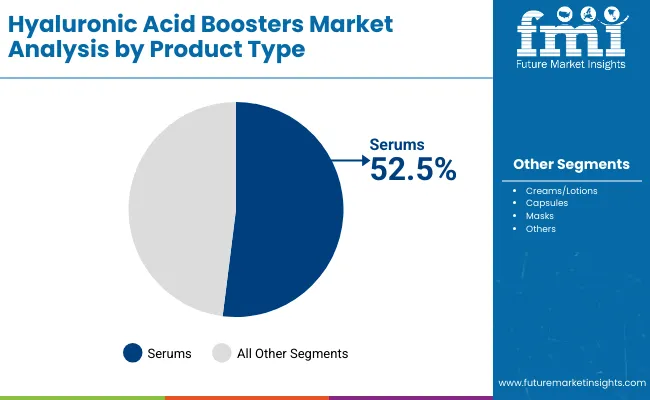

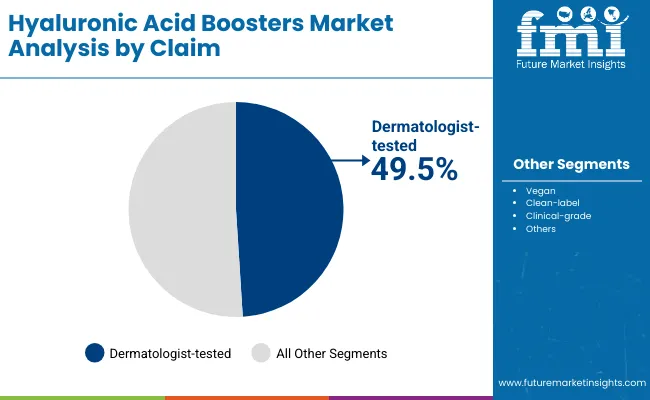

The market is segmented by function, product type, channel, claim, and region. Functions include hydration, plumping, wrinkle reduction, and skin repair, highlighting the core consumer needs driving adoption. Product type segmentation covers serums, creams/lotions, capsules, and masks catering to different skincare preferences. Channel segmentation spans e-commerce, pharmacies, mass retail, and specialty retail, reflecting both digital and offline pathways. By claim, the market covers vegan, clean-label, clinical-grade, and dermatologist-tested categories. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Function | Value Share% 2025 |

|---|---|

| Hydration | 55.6% |

| Others | 44.4% |

The hydration segment is projected to contribute 55.6% of the Hyaluronic Acid Boosters Market revenue in 2025, maintaining its lead as the dominant function category. This dominance is driven by consumer reliance on hyaluronic acid’s core property of deep moisture retention and skin elasticity restoration. Hydration-focused boosters are prioritized by users seeking reliable, daily-use solutions that deliver consistent results across climates.

The segment’s growth is also supported by the development of multi-layer hydration serums and biotech-enhanced formulations that enhance absorption. As anti-aging and repair functions become increasingly integrated into hydration products, this segment is expected to retain its position as the backbone of hyaluronic acid-based skincare.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 52.5% |

| Others | 47.5% |

The serum segment is forecasted to hold 52.5% of the market share in 2025, led by its application in hydration and anti-aging care. Serums are favored for their lightweight texture, high concentration, and faster absorption, making them ideal for layering within skincare routines.

Their compact packaging and positioning as dermatologist-recommended products have facilitated widespread adoption across pharmacies and e-commerce platforms. The segment’s growth is bolstered by personalized formulations and biotech-derived hyaluronic acid variants that improve efficacy. As consumers increasingly require multi-functional solutions, serums are expected to continue their dominance in the market.

| Claim | Value Share% 2025 |

|---|---|

| Dermatologist-tested | 49.5% |

| Others | 50.5% |

The dermatologist-tested segment is projected to account for 49.5% of the Hyaluronic Acid Boosters Market revenue in 2025, establishing it as the leading claim category. This claim is preferred due to its alignment with rising consumer emphasis on clinical validation and safety across sensitive skin types.

Its suitability across all major product types and strong endorsement from pharmacy channels have made it highly popular in developed markets such as the USA, Germany, and Japan. With emerging markets like China and India also moving toward clinical-grade and dermatologist-approved skincare, this category is expected to retain its leadership position throughout the decade.

Surge in Hydration-Centric Formulations as Primary Consumer Need

Hydration accounts for 55.6% of global function share in 2025, equivalent to USD 1.88 billion, making it the single largest driver of demand. This dominance is rooted in the unique molecular property of hyaluronic acid to hold up to 1,000 times its weight in water, which is now widely marketed in serums (52.5% share in 2025). Across the USA and China, hydration-backed serums are positioned as both preventive and corrective skincare, expanding their adoption among consumers aged 20-35 as an early anti-aging measure. The high penetration of dermatologist-tested hydration boosters in the USA and clinical-grade claims in Japan illustrates how hydration has shifted from being a basic skincare function to a premium, medically validated offering. This targeted demand ensures hydration will remain the market’s structural growth engine through 2035.

Asia-Pacific Growth Momentum, Led by China and India

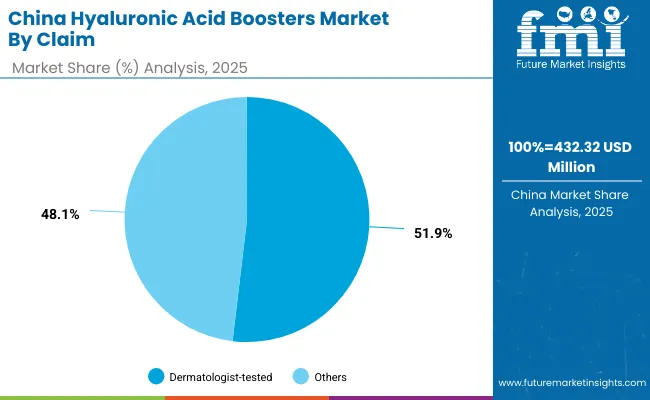

China and India show CAGRs above 22% (22.2% and 22.4% respectively), significantly outpacing the global average of 11.1%. In China, dermatologist-tested claims alone represent 51.9% of sales in 2025 (USD 225 million), reflecting rising trust in clinically endorsed beauty products. In India, capsule-based and mask-based boosters are creating new premium niches, particularly in urban markets where disposable income and digital adoption are accelerating. These growth patterns are not only regional but reshape the global landscape: by 2035, China’s share rises from 12.6% to 14.1%, narrowing the gap with the USA This momentum makes Asia-Pacific a critical driver, as global brands prioritize product launches, localized clean-label claims, and e-commerce-heavy distribution strategies across these markets.

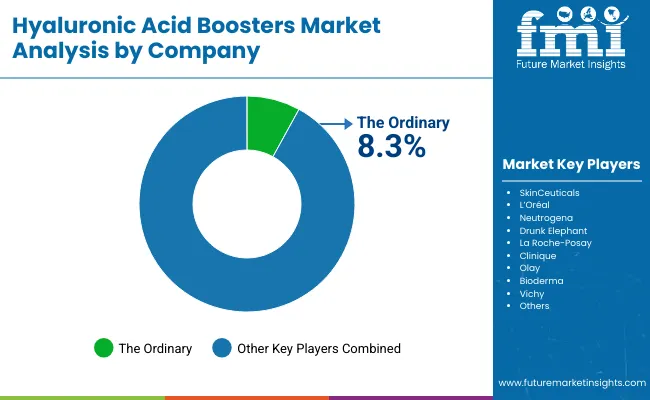

High Competitive Fragmentation Reducing Brand Loyalty

The competitive landscape is extremely fragmented, with The Ordinary holding just 8.3% share in 2025 and the remaining 91.7% split among dozens of brands. While this fragmentation signals market opportunity, it also results in low brand loyalty and frequent consumer switching. Affordable players such as The Ordinary and Neutrogena compete directly against premium labels like SkinCeuticals and Drunk Elephant, with similar hydration or repair claims, diluting differentiation. As consumers shift between brands in search of novelty or affordability, even established players face pricing pressure and shorter product lifecycles. This restraint is especially acute in e-commerce-driven markets, where price comparison and influencer-driven promotions intensify churn.

Regulatory and Claim Validation Challenges

With the rise of vegan, clean-label, and clinical-grade claims, regulatory scrutiny is intensifying, particularly in Europe and Japan. Inconsistent claim validation standards across countries create a fragmented regulatory burden for global players. For instance, dermatologist-tested positioning is highly effective in China (51.9% share) but requires localized testing under CFDA guidelines, raising compliance costs. Meanwhile, clean-label certifications in Europe and vegan approvals in the UK demand separate processes, slowing product rollout cycles. These hurdles restrain multinational scalability and limit smaller entrants who cannot absorb the higher compliance costs, creating market inefficiencies despite rising consumer demand.

Premiumization Through Clinical-Grade and Dermatologist-Tested Claims

By 2025, dermatologist-tested boosters represent 49.5% of global revenue (USD 1.68 billion), highlighting clinical validation as a cornerstone of trust. This trend is expanding further as clinical-grade formulations emerge in premium categories, particularly in the USA and Japan, where consumers are shifting from mass hydration serums to boosters promising measurable wrinkle reduction and skin repair outcomes. The clinical positioning transforms boosters from a cosmetic purchase to a quasi-medical decision, fostering adoption through pharmacies and dermatology clinics. This trend is expected to accelerate as consumers increasingly demand scientific proof, clinical trial backing, and transparency in ingredient sourcing, leading brands like La Roche-Posay and SkinCeuticals to intensify R&D-backed marketing.

E-Commerce and Digital-First Distribution as Growth Accelerators

E-commerce channels are rapidly outpacing traditional retail, with China and India leading adoption through platforms like Tmall, Nykaa, and Amazon Beauty. Younger demographics in these markets rely on social commerce and influencer-led campaigns for brand discovery, boosting clean-label and vegan products. Subscription-based delivery models, bundling boosters with complementary skincare routines, are reshaping purchase cycles by driving recurring revenue streams. The trend is not only about channel shift but also about digital integration of personalization AI-driven skin diagnostics and AR-based product try-ons are increasingly bundled with online sales. This places digital-first brands and mass players with strong e-commerce footprints in a favorable position, while specialty retail and mass retail channels risk stagnation.

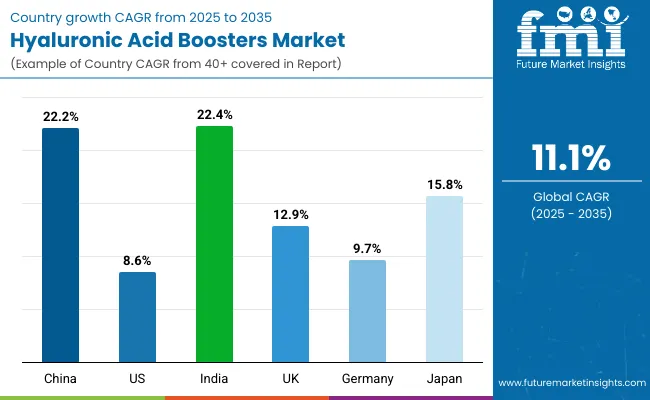

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 8.6% |

| India | 22.4% |

| UK | 12.9% |

| Germany | 9.7% |

| Japan | 15.8% |

The Hyaluronic Acid Boosters Market demonstrates highly uneven growth rates across major countries, highlighting clear regional demand patterns. China (22.2% CAGR) and India (22.4% CAGR) emerge as the fastest-growing markets, driven by youthful demographics, rising disposable incomes, and rapid e-commerce penetration. Both countries are witnessing a surge in demand for dermatologist-tested and clean-label boosters, with younger consumers increasingly adopting hydration and repair-oriented serums as part of preventive skincare.

Multinational brands are prioritizing these markets with localized product lines and aggressive digital campaigns, as evidenced by China’s growing global share from 12.6% in 2025 to 14.1% by 2035. India’s momentum, while from a smaller base, reflects untapped urban demand, capsule and mask innovations, and heightened consumer education around clinical-grade skincare.

In contrast, developed markets such as the USA (8.6%), Germany (9.7%), and the UK (12.9%) are expanding at slower but steady rates, emphasizing product differentiation and clinical validation. The USA remains the single largest market in absolute value, but its share is projected to decline slightly as Asia-Pacific accelerates. Germany and the UK are influenced by strong regulatory frameworks that favor vegan and clean-label claims, pushing brands to emphasize transparency and sustainability in formulation. Japan (15.8% CAGR) occupies a unique middle ground, combining a premium anti-aging focus with advanced clinical-grade positioning, reinforcing its role as a high-value growth contributor. Together, these trends show that while North America and Europe will provide stability, Asia-Pacific will be the epicenter of market acceleration through 2035.

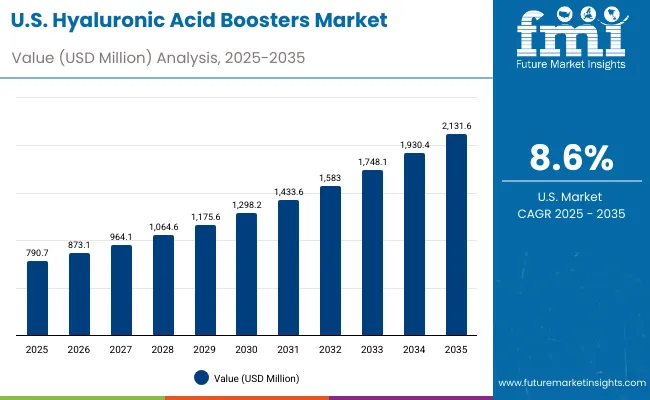

| Year | USA Hyaluronic Acid Boosters Market (USD Million) |

|---|---|

| 2025 | 790.7 |

| 2026 | 873.1 |

| 2027 | 964.1 |

| 2028 | 1,064.6 |

| 2029 | 1,175.6 |

| 2030 | 1,298.2 |

| 2031 | 1,433.6 |

| 2032 | 1,583.0 |

| 2033 | 1,748.1 |

| 2034 | 1,930.4 |

| 2035 | 2,131.6 |

The Hyaluronic Acid Boosters Market in the United States is projected to grow at a CAGR of 8.6%, supported by strong demand for hydration and anti-aging formulations. Reverse engineering equivalents in beauty hydration-led boosters dominate, accounting for 58.6% of function share in 2025 (USD 463 million). Pharmacies and dermatology clinics remain key distribution hubs, as USA consumers emphasize dermatologist-tested claims, which continue to hold the highest trust levels. Digital adoption through subscription models and bundled serums with other anti-aging creams is further fueling market penetration.

The Hyaluronic Acid Boosters Market in the United Kingdom is expected to grow at a CAGR of 12.9%, supported by demand for vegan and clean-label claims. Motorsport engineering equivalents are mirrored here by premium cosmetic labs, where clean formulations drive consumer interest. British museums and institutions have extended the heritage theme into skincare, with heritage-inspired branding enhancing product resonance. In retail, hyaluronic acid boosters are increasingly bundled into AR-based skin diagnostics for personalized recommendations on digital beauty platforms. Regulatory frameworks emphasizing sustainability and clean labeling are further accelerating adoption.

India is witnessing rapid growth in the Hyaluronic Acid Boosters Market, forecast to expand at a CAGR of 22.4% through 2035, one of the highest globally. Adoption is extending beyond metropolitan areas into tier-2 and tier-3 cities, supported by affordable launches and digital retail penetration. Capsule-based boosters and sheet masks are rising in popularity, especially among millennials seeking convenience formats. Educational campaigns by dermatologists and beauty influencers are creating awareness around preventive hydration and repair regimens. Government interest in promoting domestic cosmetic manufacturing is indirectly boosting availability and affordability.

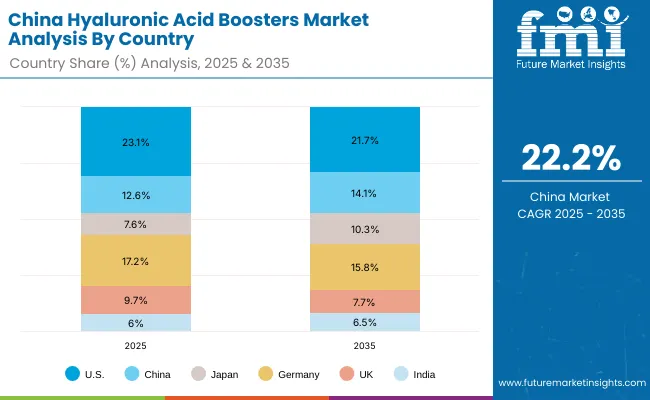

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.1% |

| China | 12.6% |

| Japan | 7.6% |

| Germany | 17.2% |

| UK | 9.7% |

| India | 6.0% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.7% |

| China | 14.1% |

| Japan | 10.3% |

| Germany | 15.8% |

| UK | 7.7% |

| India | 6.5% |

The Hyaluronic Acid Boosters Market in China is expected to grow at a CAGR of 22.2%, the strongest among leading economies. This momentum is driven by younger consumers adopting hydration serums early, combined with dermatologist-tested boosters which account for 51.9% of market value in 2025 (USD 225 million). Domestic beauty tech firms are aggressively innovating with affordable vegan and clean-label serums, intensifying price competition. Municipal promotion of biotech and clean beauty clusters is further enabling scalability. Cross-sector digitization such as app-based skin diagnostics and influencer-driven e-commerce remains a core growth lever.

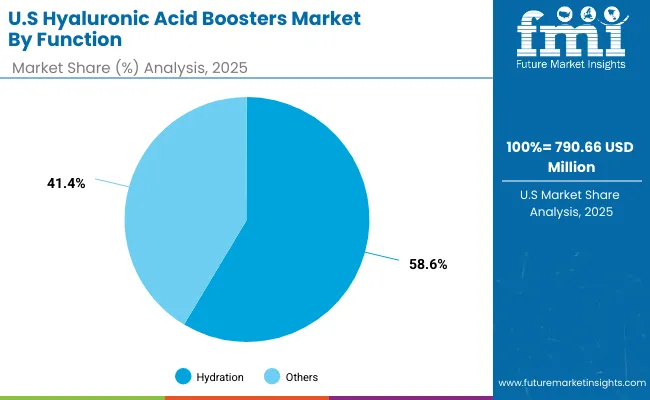

| USA by Function | Value Share% 2025 |

|---|---|

| Hydration | 58.6% |

| Others | 41.4% |

The Hyaluronic Acid Boosters Market in the United States is valued at USD 790.66 million in 2025, with hydration leading at 58.6% (USD 463 million). The dominance of hydration boosters stems from the USA consumer base’s demand for clinically validated, daily-use skincare routines. Dermatologist-tested serums are widely prescribed in pharmacies and skin clinics, reinforcing trust-driven adoption. The USA market is also characterized by integration of boosters into anti-aging regimens, where serums are combined with creams and repair-focused formulations for a multi-functional skincare approach.

This structural advantage positions hydration-based boosters as indispensable in the American skincare portfolio, providing both preventive and corrective value. Wrinkle-reduction and skin-repair boosters are steadily rising, targeting the 35+ demographic through premium clinical-grade offerings. As subscription beauty boxes, e-commerce bundles, and pharmacy endorsements expand, booster penetration will strengthen. By 2035, the USA is forecast to reach USD 2.13 billion, despite its slower CAGR of 8.6% compared to Asia-Pacific markets.

| China by Claim | Value Share% 2025 |

|---|---|

| Dermatologist-tested | 51.9% |

| Others | 48.1% |

The Hyaluronic Acid Boosters Market in China is valued at USD 432.32 million in 2025, with dermatologist-tested boosters leading at 51.9% (USD 225 million). The preference for clinically validated products is amplified by the influence of K-beauty and growing consumer trust in scientific efficacy. Younger demographics are adopting hydration serums as early as their early 20s, creating a broad preventive skincare base. Domestic brands are capitalizing on this with affordable clean-label and vegan-certified boosters, driving mass adoption.

This early adoption advantage positions China as a high-growth hub, expanding at a CAGR of 22.2% through 2035, outpacing mature markets like the USA Affordable booster innovations and influencer-driven e-commerce platforms like Tmall and Douyin are accelerating penetration across both urban and suburban markets. By 2035, China’s share is projected to rise from 12.6% to 14.1%, reflecting its pivotal role in global demand expansion.

The Hyaluronic Acid Boosters Market is moderately fragmented, with mass-market leaders, premium dermatology-backed brands, and niche-focused innovators competing across diverse application areas. Global giants such as L’Oréal, Neutrogena, and La Roche-Posay command significant share, driven by dermatologist-tested positioning, clinical trials, and strong pharmacy penetration. Their strategies emphasize multifunctional boosters, AI-driven personalization, and subscription beauty bundles, aligning with the trend toward digital-first skincare ecosystems. Established mid-tier players, including SkinCeuticals, Clinique, and Drunk Elephant, focus on clinical-grade and vegan positioning. Their growth comes from strong credibility among dermatologists and targeted appeal to high-income millennial and Gen Z consumers.

These brands are expanding aggressively into e-commerce and premium retail, leveraging influencer collaborations and biotech-driven innovation. Specialized niche players such as Bioderma, Vichy, and Olay cater to specific segments like sensitive skin, hydration-first care, or anti-aging repair. Their strength lies in regional adaptability Bioderma in Europe, Vichy in pharmacy-led France, and Olay in mass-affordable USA and Asian channels. Competitive differentiation is shifting away from simple hydration efficacy toward integrated strategies involving clean-label sourcing, dermatologist validation, subscription models, and AI-powered skin diagnostics. Players that combine affordability with scientific credibility and digital presence are expected to gain the most traction by 2035.

Key Developments in Hyaluronic Acid Boosters Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,423.8 million |

| Function | Hydration; Plumping; Wrinkle Reduction; Skin Repair |

| Product Type | Serums; Creams/Lotions; Capsules; Masks |

| Channel | E-commerce; Pharmacies; Mass Retail; Specialty Retail |

| Type | Vegan; Clean-label; Clinical-grade; Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary; SkinCeuticals; L’Oréal; Neutrogena; Drunk Elephant; La Roche- Posay; Clinique; Olay; Bioderma; Vichy |

| Additional Attributes | Dollar sales by function and product type; adoption trends in hydration, repair, and wrinkle-reduction; rising demand for dermatologist-tested, vegan, and clean-label claims; channel performance across e-commerce and pharmacies; software-like subscription bundles and personalization in digital beauty; regional shifts driven by China/India high CAGR; innovations in multi-weight and cross-linked HA, biotech-derived HA, encapsulation and serum delivery systems; price-point tiering (mass, masstige, premium); regulatory/claim validation dynamics across USA, EU, China; competitive share tracking with fragmentation analysis. |

The Hyaluronic Acid Boosters Market is estimated to be valued at USD 3,423.8 million in 2025.

The market size for the Hyaluronic Acid Boosters Market is projected to reach USD 9,830.5 million by 2035.

The Hyaluronic Acid Boosters Market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types are Serums, Creams/Lotions, Capsules, and Masks.

While “range” is not applicable, by function, Hydration leads with 55.6% share in 2025, and by product type, Serums command 52.5% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hyaluronic Viscosupplementation Market Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Products Market Insights - Demand, Growth & Forecast 2025 to 2035

Hyaluronic Acid Supplement Market Product, Type, Application, Distribution Channel and Others Through 2035

Hyaluronic Acid Personal Care Products Market Overview - Growth & Forecast 2025 to 2035

Hyaluronic Acid Market Growth – Trends & Forecast 2024-2034

Non-Hyaluronic Acid Dermal Filler Market Size and Share Forecast Outlook 2025 to 2035

USA Hyaluronic Acid Products Market Insights – Growth, Demand & Forecast 2025-2035

Knee Hyaluronic Acid Injections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Brazil Hyaluronic Acid Products Market Outlook – Share, Growth & Forecast 2025-2035

Germany Hyaluronic Acid Products Market Trends – Size, Share & Growth 2025-2035

South Korea Hyaluronic Acid Products Market Growth – Trends, Demand & Innovations 2025-2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA