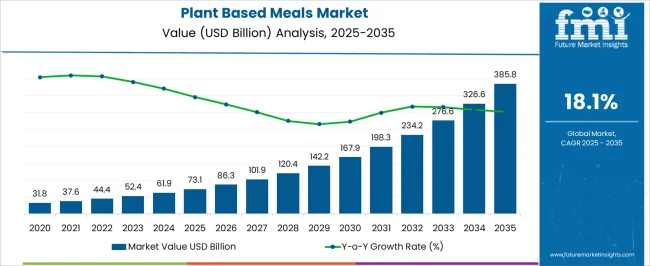

The plant-based meals market is estimated to reach 73.1 billion dollars in 2025, reaching USD 385.8 billion, growing at a CAGR of 18.1%. During the early adoption phase from 2020 to 2024, demand was primarily driven by niche consumers, specialty restaurants, and premium retail channels experimenting with alternative protein and plant-based options. Entering the scaling phase in 2025, adoption broadens across mainstream retail, quick-service restaurants, and food delivery platforms.

Production capacity expands, distribution networks strengthen, and repeat purchases increase. Rising consumer interest in convenient, nutritious meal solutions drives steady revenue growth and wider market penetration. From 2030 to 2035, the market is projected to reach 385.8 billion dollars, maintaining a CAGR of 18.1%. The consolidation phase is characterized by leading manufacturers expanding global presence through strategic partnerships, private-label agreements, and streamlined supply chains. Smaller players either specialize in niche offerings or exit. Market adoption stabilizes as most potential consumers are engaged. Companies focus on operational efficiency, product variety, and cost optimization. By 2035, the market will demonstrate mature competitive dynamics, predictable growth, and standardized offerings, creating a well-established and structured industry landscape.

| Metric | Value |

|---|---|

| Plant Based Meals Market Estimated Value in (2025 E) | USD 73.1 billion |

| Plant Based Meals Market Forecast Value in (2035 F) | USD 385.8 billion |

| Forecast CAGR (2025 to 2035) | 18.1% |

The plant based meals market is driven by diverse consumer and commercial segments, each contributing to overall growth. Retail Packaged Meals lead the market with approximately 35%, reflecting rising adoption of ready-to-eat and frozen plant-based products in supermarkets and convenience stores. Quick-Service Restaurants (QSRs) account for 20%, as major chains expand plant-based menu options to meet growing consumer demand. Food Delivery and Meal Kits contribute 15%, driven by online platforms and subscription-based services offering convenient alternatives. Casual Dining Restaurants hold around 10%, incorporating plant-based meals to attract health-conscious and flexitarian diners.

Corporate Cafeterias and Institutional Catering represent 8%, serving employees, students, and patients seeking diverse protein options. Specialty Health and Wellness Outlets account for 5%, focusing on premium or functional plant-based meals. Hotels and Hospitality contribute 4%, offering plant-based options to meet varied guest preferences.

Events and Catering Services make up 2%, delivering alternative meal solutions for conferences and gatherings. Smaller segments, including Export Markets and Research/Innovation Kitchens, represent 1%, supporting global expansion and product experimentation.

The plant based meals market is experiencing robust growth driven by rising health consciousness, environmental sustainability concerns, and increasing adoption of plant forward diets. Consumer demand for dairy alternatives, meat substitutes, and plant derived ready meals is being reinforced by innovation in taste, texture, and nutritional profiles that closely replicate conventional animal based products.

Regulatory support, corporate sustainability goals, and expanding product availability across retail formats are accelerating adoption. Advances in food processing technologies, clean label formulations, and fortified plant protein blends are enhancing the market’s appeal across diverse consumer groups.

With shifting dietary preferences, growing vegan populations, and heightened awareness of the environmental impact of food choices, the market outlook remains highly positive, particularly as brands leverage marketing strategies focused on wellness, ethical sourcing, and reduced carbon footprints.

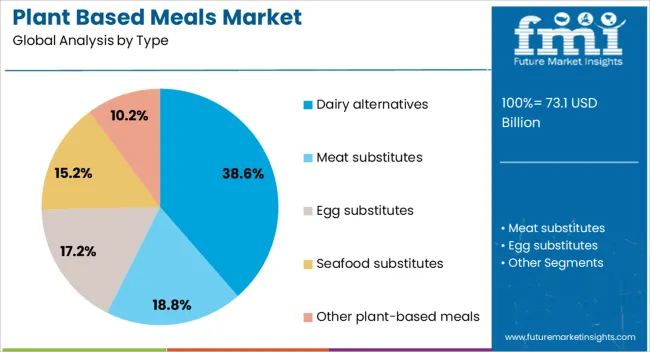

The plant based meals market is segmented by type, distribution channel, end user, and geographic regions. By type, plant based meals market is divided into Dairy alternatives, Meat substitutes, Egg substitutes, Seafood substitutes, and Other plant-based meals.

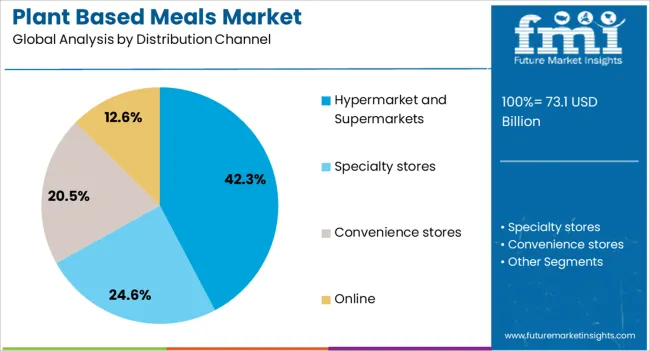

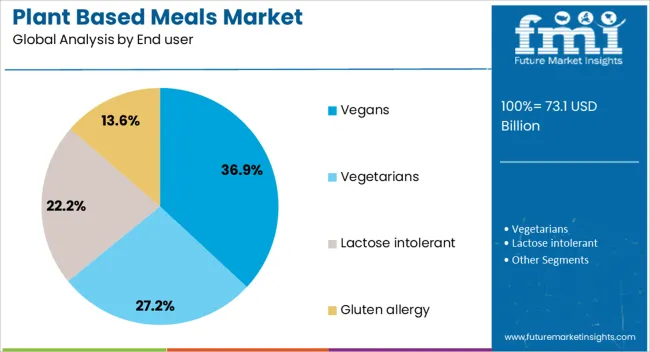

In terms of distribution channel, plant based meals market is classified into Hypermarket and Supermarkets, Specialty stores, Convenience stores, and Online. Based on end user, plant based meals market is segmented into Vegans, Vegetarians, Lactose intolerant, and Gluten allergy. Regionally, the plant based meals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dairy alternatives segment is projected to hold 38.60% of total market revenue by 2025 within the type category, making it the leading segment. Growth is being driven by rising lactose intolerance rates, increased awareness of dairy related allergens, and growing ethical and environmental considerations among consumers.

Innovations in plant based milks, yogurts, and cheeses with improved sensory profiles have boosted mainstream acceptance. The segment’s expansion is also supported by fortified offerings that match or exceed the nutritional value of dairy, alongside a variety of flavors and functional benefits.

The combination of health, sustainability, and product innovation continues to position dairy alternatives as the most dominant type in the plant based meals market.

The hypermarket and supermarkets segment accounts for 42.30% of total market revenue in 2025, establishing itself as the leading distribution channel. This dominance is supported by the wide product availability, in store promotions, and consumer trust in established retail formats.

These outlets offer extensive shelf space for plant based products, allowing brands to showcase variety and innovation. The convenience of one stop shopping, coupled with rising footfall in physical retail, has further boosted sales.

Retailer partnerships with plant based brands for exclusive launches and in store sampling programs have also played a key role in driving consumer trial and repeat purchases.

The vegans segment is expected to represent 36.90% of the market revenue by 2025 within the end user category, making it the largest consumer group. This growth is attributed to the global increase in vegan populations, fueled by ethical, environmental, and health related motivations.

The availability of diverse plant based meal options across both fresh and packaged categories has facilitated broader adoption. Additionally, social media influence and advocacy campaigns have amplified awareness about veganism, further driving demand.

With brands tailoring their offerings specifically for vegan consumers and ensuring product transparency, this end user segment continues to lead in shaping trends and preferences in the plant based meals market.

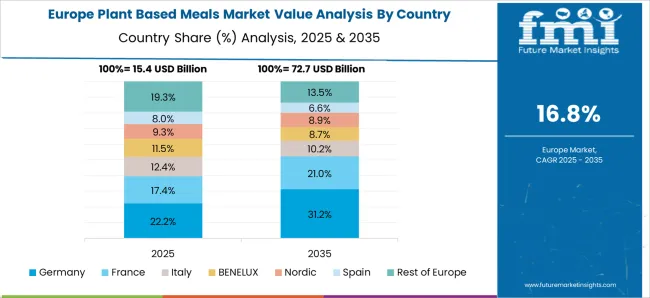

The plant-based meals market is growing rapidly due to rising health consciousness, environmental awareness, and demand for protein-rich alternatives. North America and Europe lead with premium, ready-to-eat meals, frozen products, and restaurant offerings targeting flexitarians and vegans. Asia-Pacific shows strong growth driven by urbanization, changing dietary patterns, and expanding foodservice infrastructure. Manufacturers differentiate through nutritional enrichment, flavor innovation, and convenient packaging. Regional variations in consumer preferences, culinary traditions, and regulatory frameworks strongly influence adoption, market penetration, and competitive positioning globally.

Rising awareness of health benefits, protein intake, and balanced nutrition is a major driver for plant-based meals. North America and Europe focus on meals fortified with vitamins, minerals, and plant proteins to meet dietary needs of health-conscious consumers. Asia-Pacific markets witness growing adoption among urban populations seeking low-cholesterol and low-fat alternatives in daily diets. Differences in nutritional priorities, awareness levels, and dietary habits influence product formulation, labeling, and consumption frequency. Leading manufacturers invest in high-protein, fortified meals with clean-label claims, while regional players offer traditional plant-based meals adapted for affordability. Health and nutrition contrasts shape adoption, product development, and market competitiveness globally.

Convenience and meal-ready solutions are driving plant-based meal adoption. North America and Europe emphasize frozen, ready-to-eat, and heat-and-serve formats for busy consumers, retail chains, and institutional foodservice. Asia-Pacific markets focus on packaged, shelf-stable options suitable for urban and semi-urban populations with limited preparation time. Differences in format preferences, storage conditions, and consumption habits affect market acceptance, distribution strategy, and sales growth. Leading suppliers provide microwavable, pre-portioned meals with long shelf life and attractive packaging, while regional manufacturers deliver simple, locally flavored, ready-to-cook options. Convenience and format contrasts drive adoption, consumer satisfaction, and competitiveness in the global plant-based meals market.

Flavor innovation and culinary appeal are key factors in consumer acceptance of plant-based meals. North America and Europe emphasize diverse international cuisines, meat-alternative textures, and gourmet formulations to attract flexitarian and vegan consumers. Asia-Pacific markets focus on traditional flavors and regional recipes adapted with plant-based ingredients to meet local taste preferences. Differences in flavor profiles, ingredient sourcing, and recipe development affect consumer satisfaction, repeat purchase, and market penetration. Leading manufacturers invest in taste optimization, texture replication, and international flavors, while regional players focus on cost-effective, culturally relevant meals. Culinary innovation contrasts shape adoption, brand differentiation, and competitiveness globally.

Sustainability, ethical sourcing, and environmental impact strongly influence consumer adoption. North America and Europe prioritize plant-based meals from certified, traceable sources emphasizing carbon footprint reduction and eco-friendly packaging. Asia-Pacific markets show growing awareness, with demand for responsibly sourced ingredients, though affordability remains key. Differences in sustainability priorities, certification availability, and consumer perception influence marketing strategies, pricing, and adoption. Leading suppliers highlight transparent sourcing, recyclable packaging, and environmental certifications, while regional players provide practical, cost-conscious alternatives. Sustainability and sourcing contrasts shape adoption, brand credibility, and competitive positioning in the global plant-based meals market.

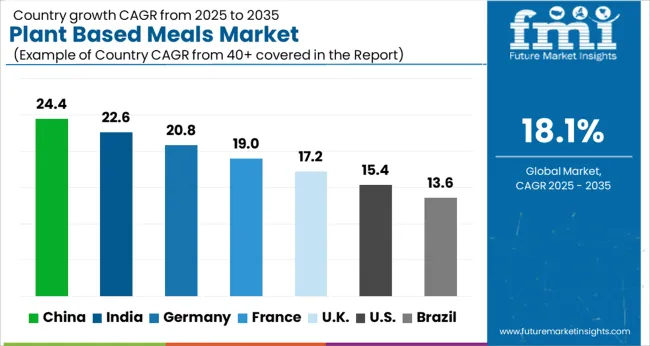

| Country | CAGR |

|---|---|

| China | 24.4% |

| India | 22.6% |

| Germany | 20.8% |

| France | 19.0% |

| UK | 17.2% |

| USA | 15.4% |

| Brazil | 13.6% |

The global plant-based meals market is projected to grow at an 18.1% CAGR through 2035, driven by demand in retail, foodservice, and health-focused consumer segments. Among BRICS nations, China led with 24.4% growth as large-scale production and distribution networks were established and adherence to food safety standards was enforced, while India at 22.6% growth expanded manufacturing and supply chains to serve rising regional consumption. In the OECD region, Germany at 20.8% sustained output under stringent regulatory frameworks, while the United Kingdom at 17.2% operated mid-scale production units for commercial and retail channels. The USA, growing at 15.4%, supported steady demand across retail and foodservice applications, complying with federal and state-level quality and safety regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The plant based meals market in China is projected to grow at a CAGR of 24.4% due to increasing consumer preference for health conscious and protein rich alternatives. Adoption is being driven by ready-to-eat plant based meals that provide convenience, nutritional benefits, and variety for households and food service providers. Manufacturers are being encouraged to supply high quality, safe, and flavorful products. Distribution through supermarkets, online grocery platforms, and food service chains is being strengthened. Research into product innovation, taste improvement, and packaging solutions is being conducted. Growing awareness of healthy diets, urban population demand, and expanding food retail networks are considered key factors supporting the plant based meals market in China.

The plant based meals market in India is expected to grow at a CAGR of 22.6%, driven by rising health awareness and demand for convenient protein rich alternatives. Adoption is being strengthened by ready-to-eat and frozen plant based meals that offer balanced nutrition and longer shelf life. Manufacturers are being encouraged to provide affordable, safe, and flavorful products. Distribution through supermarkets, health stores, and online food platforms is being expanded. Promotional campaigns and awareness programs are being conducted to educate consumers about plant based diets. Increasing urban population, health and wellness trends, and expansion of modern retail are recognized as primary drivers of the plant based meals market in India.

Germany is experiencing growth in the plant based meals market at a CAGR of 20.8%, supported by strong consumer preference for sustainable and nutritious food alternatives. Adoption is being strengthened by ready-to-eat plant based meals that provide convenience, taste consistency, and high protein content. Manufacturers are being encouraged to supply high quality, innovative, and safe products. Distribution through retail chains, supermarkets, and online grocery platforms is being maintained. Research in product development, flavor enhancement, and packaging innovations is being conducted. Health awareness, growth in vegetarian and vegan diets, and increased availability in retail are considered key growth drivers for the plant based meals market in Germany.

The plant based meals market in the United Kingdom is expected to grow at a CAGR of 17.2% due to rising consumer interest in convenient, healthy, and protein rich meal options. Adoption is being emphasized for ready-to-eat plant based meals that reduce cooking time while providing balanced nutrition. Manufacturers are being encouraged to provide safe, high quality, and flavorful products. Distribution through supermarkets, online retailers, and food service channels is being strengthened. Awareness programs and promotional campaigns are being conducted to increase consumer adoption. Expanding urban households, health conscious consumer demand, and growth of modern retail chains are recognized as key contributors to the plant based meals market in the United Kingdom.

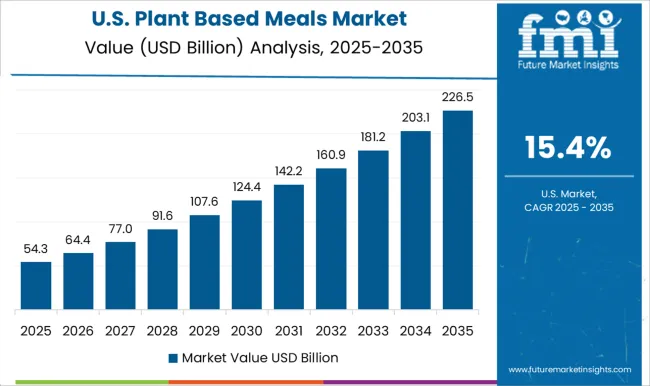

The plant based meals market in the United States is projected to grow at a CAGR of 15.4%, supported by increasing health awareness and consumer preference for protein rich, convenient alternatives. Adoption is being strengthened by frozen, ready-to-eat, and shelf stable plant based meals that provide balanced nutrition and variety. Manufacturers are being encouraged to supply safe, flavorful, and high quality products. Distribution through supermarkets, online grocery platforms, and food service providers is being maintained. Research in product innovation, improved taste, and sustainable packaging is being conducted. Rising consumer demand for healthy diets, expansion of retail networks, and growth in plant based eating trends are considered key factors driving growth of the plant based meals market in the United States.

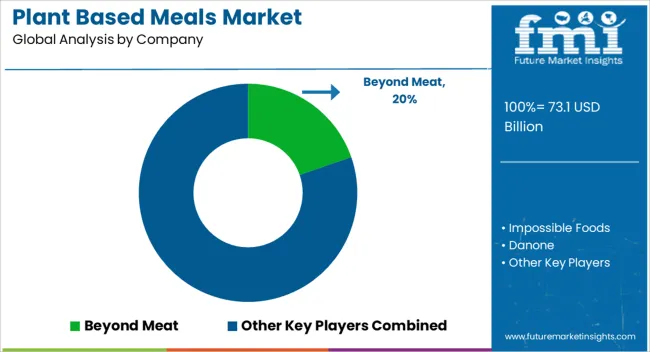

The plant-based meals market has experienced substantial growth as consumers increasingly shift toward healthier, sustainable, and environmentally friendly dietary choices. Key suppliers, including Beyond Meat, Impossible Foods, Danone, Unilever, Kellogg, The Hain Celestial Group, Campbell Soup, Archer Daniels Midland (ADM), Cargill, SunOpta, The Vegetarian Butcher, and Sweet Earth, have established themselves as prominent players by offering innovative, nutritious, and convenient meal options. These companies cater to a diverse audience, including health-conscious consumers, vegetarians, vegans, and flexitarians, driving the mainstream adoption of plant-based proteins and meal alternatives. Innovation and product diversification remain central to the strategies employed by these leading suppliers.

Beyond Meat and Impossible Foods, for instance, focus on replicating the taste and texture of traditional meat using plant proteins, while Danone, Unilever, and Kellogg's are expanding their product portfolios to include ready-to-eat meals, snacks, and dairy alternatives. Companies such as Archer Daniels Midland (ADM) and Cargill play a critical role in providing high-quality plant-based ingredients, supporting both branded products and private-label offerings. Sustainability initiatives, including the use of non-GMO ingredients, eco-friendly packaging, and low-carbon production processes, further strengthen the market presence of these suppliers and appeal to environmentally conscious consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 73.1 Billion |

| Type | Dairy alternatives, Meat substitutes, Egg substitutes, Seafood substitutes, and Other plant-based meals |

| Distribution Channel | Hypermarket and Supermarkets, Specialty stores, Convenience stores, and Online |

| End user | Vegans, Vegetarians, Lactose intolerant, and Gluten allergy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Beyond Meat, Impossible Foods, Danone, Unilever, Kellogg, The Hain Celestial Group, Campbell Soup, Archer Daniels Midland (ADM), Cargill, SunOpta, The Vegetarian Butcher, and Sweet Earth |

| Additional Attributes | Dollar sales vary by product type, including ready-to-eat meals, frozen meals, and meal kits; by source, spanning soy, pea, wheat, and other plant proteins; by application, such as retail, foodservice, and home delivery; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising veganism, health-conscious eating, and demand for sustainable protein alternatives. |

The global plant based meals market is estimated to be valued at USD 73.1 billion in 2025.

The market size for the plant based meals market is projected to reach USD 385.8 billion by 2035.

The plant based meals market is expected to grow at a 18.1% CAGR between 2025 and 2035.

The key product types in plant based meals market are dairy alternatives, meat substitutes, egg substitutes, seafood substitutes and other plant-based meals.

In terms of distribution channel, hypermarket and supermarkets segment to command 42.3% share in the plant based meals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sales of Plant‑based Ready Meals in US Analysis - Size, Share & Forecast 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Care Services Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Plant Milk Market Size and Share Forecast Outlook 2025 to 2035

Plant Growth Regulators Market Size and Share Forecast Outlook 2025 to 2035

Plant Activators Market Size and Share Forecast Outlook 2025 to 2035

Plant Phenotyping Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA