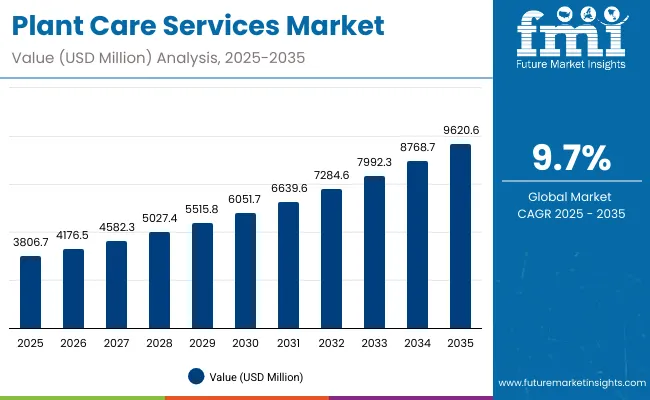

The plant care services market is expected to record a valuation of USD 3,806.7 million in 2025 and USD 9,620.6 million in 2035, with an increase of USD 5,813.9 million, which equals a growth of 153% over the decade. The overall expansion represents a CAGR of 9.7% and a 2.5X increase in market size.

During the first five-year period from 2025 to 2030, the market increases from USD 3,806.7 million to USD 6,051.7 million, adding USD 2,245 million, which accounts for 39% of the total decade growth. This phase records steady adoption of on-site services for residential and commercial offices, as well as greater uptake of subscription-based plant care kits among urban households seeking convenience.

The second half from 2030 to 2035 contributes USD 3,569 million, equal to 61% of total growth, as the market jumps from USD 6,051.7 million to USD 9,620.6 million. This acceleration is powered by widespread digitization of plant care through IoT-enabled monitoring, AI-driven pest detection, and remote advisory models. Subscription deliveries and app-based plant care expand rapidly, while commercial offices and hospitality sectors increasingly adopt professional maintenance programs. By 2035, digital and subscription-led models account for a much larger share of the total value.

From 2020 to 2024, the plant care services market steadily expanded, driven by rising urban greenery initiatives and demand for managed indoor plant services. During this period, on-site visits dominated revenues, accounting for nearly two-thirds of total value, with service leaders such as Ambius, Rentokil Initial, and Bloomscape scaling operations through commercial contracts. Competitive differentiation relied on reliability, customized care packages, and sustainable practices, while DIY subscription kits remained a niche with less than 10% penetration.

Demand will further expand to USD 3,806.7 million in 2025, and the revenue mix is expected to shift as subscription deliveries and remote advisory models grow to capture a larger share. Traditional service leaders face rising competition from digital-first plant care platforms offering app-based monitoring, IoT-enabled soil and water sensors, and subscription-based wellness programs. Leading providers are pivoting to hybrid models, combining physical plant services with AI-driven disease detection and remote advisory ecosystems. The competitive advantage is moving away from physical service scale alone toward ecosystem strength, tech-integration, and recurring subscription revenues.

Facility managers evaluate plant care service specifications based on maintenance frequency, plant selection expertise, and integrated pest management capabilities when establishing interior landscaping programs for office buildings, healthcare facilities, and retail environments. Service selection involves analyzing horticultural knowledge, replacement guarantees, and seasonal rotation programs while considering water management systems, lighting requirements, and allergen considerations necessary for maintaining healthy plant environments throughout commercial spaces.

Plant Care Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 3,806.7 million |

| Market Forecast Value in (2035F) | USD 9,620.6 million |

| Forecast CAGR (2025 to 2035) | 9.7% |

The market expansion is indicative to the increasing adoption of plant care services in commercial office spaces. Employers are investing in greenery as part of sustainability goals, ESG reporting, and workplace wellness programs. Studies link indoor plants to higher productivity, reduced stress, and improved air quality, making them a preferred investment in corporate environments. Service providers are offering customized maintenance contracts, IoT-based plant monitoring, and seasonal plant rotations, which appeal to enterprises seeking consistent care. This structural demand ensures recurring, high-value contracts driving market growth.

Urban millennials are increasingly adopting subscription-based plant care kits that deliver DIY solutions with fertilizers, soil boosters, and remote advisory support through mobile apps. This shift is fueled by limited time, smaller living spaces, and rising interest in home aesthetics and indoor greenery. These kits not only simplify care but also integrate AI-driven reminders, pest detection advice, and seasonal customization. The digital-first, experience-driven model aligns with consumer preferences for personalization and convenience, expanding revenue beyond traditional on-site services into scalable, tech-enabled ecosystems.

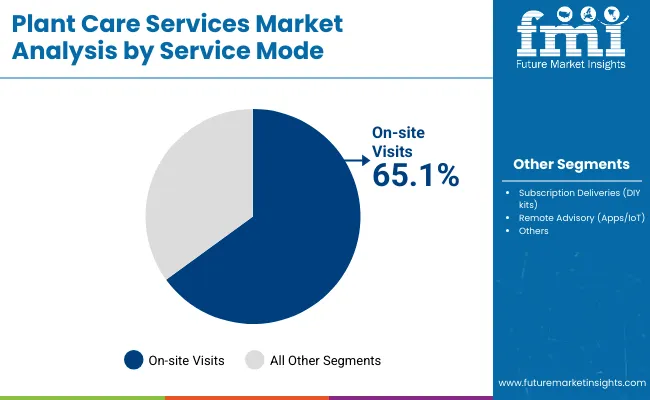

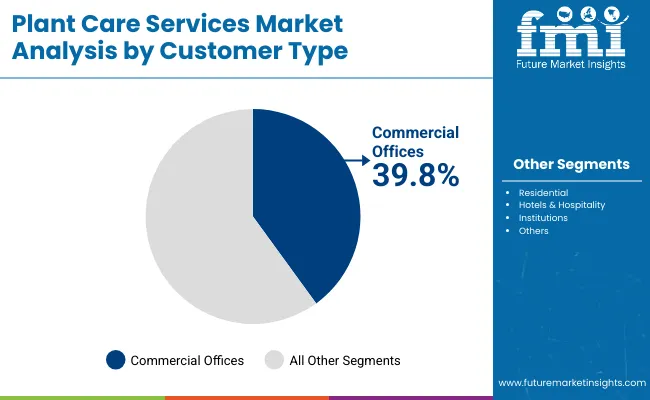

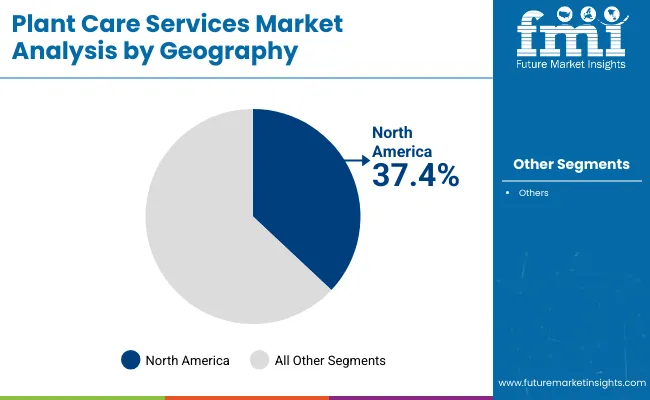

The Plant Care Services Market is segmented by service type, customer type, service mode, and region, reflecting its diverse structure and evolving demand. Service types include plant watering & feeding, pest/disease management, repotting & soil services, landscaping & aesthetic care, and subscription plant care kits, addressing both essential and lifestyle-driven needs. Customer types span residential, commercial offices, hotels & hospitality, and institutions, highlighting wide applicability across households and businesses. Service modes consist of on-site visits, subscription deliveries (DIY kits), and remote advisory through apps and IoT devices, with traditional in-person care being supplemented by digital-first solutions. Regionally, the market scope extends across North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with growth driven by urban greenery initiatives, wellness-focused workplaces, and the rising popularity of indoor plants among younger consumers.

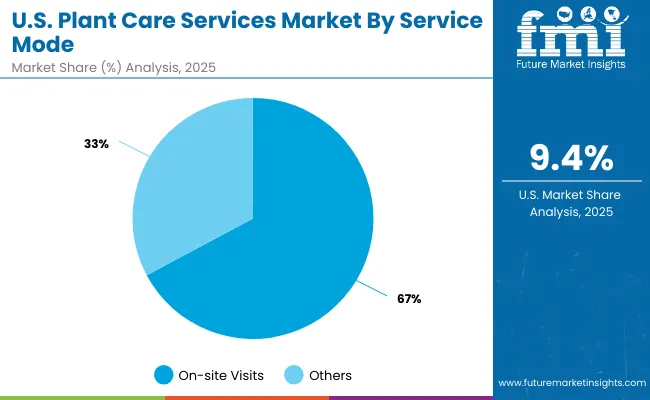

| Service Mode | Value Share% 2025 |

|---|---|

| On-site visits | 65.1% |

| Others | 34.9% |

The on-site visits segment is projected to contribute the largest share of the Plant Care Services Market revenue in 2025, maintaining its dominance as the preferred service mode. This leadership is driven by strong demand across residential households, commercial offices, and hospitality spaces where clients require hands-on, professional maintenance to ensure plant health and aesthetic appeal. On-site visits provide reliability, tailored solutions, and consistent quality, which are particularly valued by businesses integrating greenery into workplace wellness and ESG programs.

The segment’s growth is further supported by expanding corporate contracts, premium urban households, and institutions such as schools and hospitals seeking professional care. While digital solutions and subscription kits are growing, on-site visits remain the backbone of plant care services, offering personalized expertise that cannot be fully replicated by remote or DIY alternatives.

| Customer Type | Value Share% 2025 |

|---|---|

| Commercial offices | 39.8% |

| Others | 60.2% |

The commercial offices segment is forecasted to hold a significant share of the Plant Care Services Market in 2025, driven by rising demand for sustainable workplace environments and wellness-focused initiatives. Offices increasingly adopt professional plant care to improve air quality, enhance aesthetics, and support employee wellbeing, with green certifications (such as LEED and WELL) reinforcing this trend. Corporate sustainability programs also integrate greenery as part of ESG commitments, creating recurring demand for specialized plant care contracts.

The segment’s growth is further supported by large-scale urban office complexes, co-working spaces, and hybrid work environments where companies seek to foster healthier, more attractive workspaces. Service providers are responding with customized care packages, IoT-enabled monitoring, and seasonal plant rotation programs, ensuring long-term engagement. As businesses increasingly link indoor greenery to productivity and corporate image, commercial offices are expected to remain one of the most lucrative customer groups in the Plant Care Services Market.

| Geography | Value Share% 2025 |

|---|---|

| North America | 37.4% |

| Others | 62.6% |

he North American region is projected to account for the largest share of the Plant Care Services Market in 2025, establishing it as the leading geography. This dominance is supported by the region’s strong adoption of professional plant care in residential, commercial, and hospitality spaces, alongside growing emphasis on sustainability certifications and workplace wellness programs. With rising corporate demand for biophilic design, office greenery, and ESG compliance, plant care services have become an essential component of business and residential urban living.

The region’s growth is further strengthened by high penetration of subscription-based plant care kits among millennials and urban households, as well as advanced digital platforms integrating IoT-enabled plant monitoring and advisory services. Service providers in North America also lead in offering premium, customized solutions for hotels, institutions, and luxury residences. Given its mature service ecosystem and emphasis on lifestyle-driven greenery, North America is expected to maintain its leading role in the Plant Care Services Market throughout the forecast period.

Corporate ESG and Workplace Wellness Initiatives

A major driver for the Plant Care Services Market is the surge in corporate sustainability and wellness programs. Offices are increasingly integrating indoor greenery to align with LEED and WELL certifications and ESG goals. Studies show plants improve productivity, reduce stress, and enhance indoor air quality, making professional plant care indispensable for modern workspaces. Service providers offering long-term contracts, IoT-based plant health monitoring, and customized care packages are seeing strong demand from large corporates, ensuring recurring revenue streams and steady market expansion.

Subscription Plant Care Kits for Urban Households

Urbanization and the popularity of apartment living are driving demand for subscription-based plant care kits. These kits offer fertilizers, soil boosters, seasonal plant food, and app-based reminders, meeting the needs of time-constrained urban millennials. Growing interest in aesthetic indoor greenery and Instagram-driven lifestyle trends amplifies adoption. Providers are integrating AI-driven advisory features, pest detection tips, and IoT sensor compatibility, creating convenience and personalization. This shift expands the market beyond traditional on-site services, opening a scalable, digital-first revenue model with strong consumer loyalty.

High Service Costs and Limited Scalability

The cost-intensive nature of personalized on-site plant care remains a key restraint. Professional maintenance requires skilled labor, frequent visits, and customized solutions, making services relatively expensive for small households and SMEs. Additionally, the reliance on manual service models limits scalability compared to subscription kits or app-based advisory systems. In price-sensitive regions, consumers often resort to DIY care, reducing market penetration. This cost barrier restricts adoption among lower-income groups and smaller businesses, slowing overall expansion despite growing awareness of plant care benefits.

Integration of IoT and AI into Plant Care Services

A defining trend is the integration of IoT sensors and AI-driven advisory platforms in plant care. Smart soil sensors now monitor moisture, nutrients, and light exposure, sending data to mobile apps that provide real-time recommendations. AI enhances this ecosystem by offering automated pest and disease detection with predictive alerts. Service providers are combining these technologies with subscription care models to deliver hybrid offerings blending professional visits with digital monitoring. This convergence is transforming plant care into a tech-enabled, scalable service model.

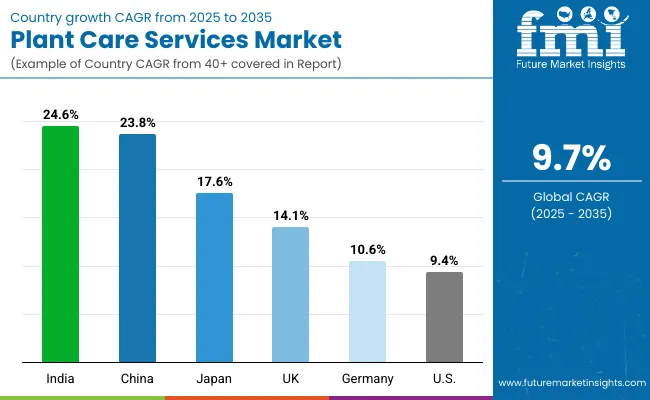

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 23.8% |

| USA | 9.4% |

| India | 24.6% |

| UK | 14.1% |

| Germany | 10.6% |

| Japan | 17.6% |

The global Plant Care Services Market shows significant regional disparities, shaped by urbanization, workplace wellness programs, and adoption of subscription-based care models. Asia-Pacific is the fastest-growing region, led by China (23.8% CAGR) and India (24.6% CAGR). China’s growth is supported by urban lifestyle changes, municipal greenery initiatives, and strong adoption of plant care apps and subscription kits. India demonstrates a similar trajectory, driven by rising awareness in tier-2 cities, cost-effective service launches, and growing demand from commercial offices and institutions.

Europe maintains steady momentum, with Germany (10.6% CAGR) and the UK (14.1% CAGR) benefiting from a strong culture of indoor gardening, biophilic design adoption in offices, and government-backed sustainability programs. Japan (17.6% CAGR) shows robust expansion fueled by technological integration, where IoT-enabled plant monitoring and AI-driven wellness programs are becoming mainstream.

North America remains a mature market, with the USA (9.4% CAGR) growing at a slower pace due to saturation but continuing to benefit from large-scale corporate contracts and premium residential services. Growth in the region is increasingly shaped by digital-first models such as IoT-based monitoring, app-based advisory, and hybrid subscription bundles rather than traditional services alone.

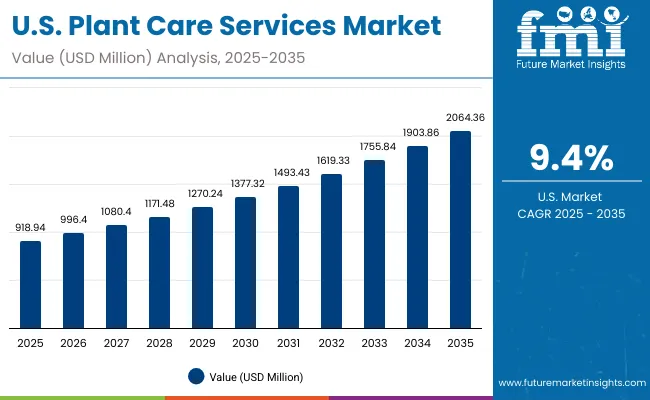

| Year | USA Plant Care Services Market (USD Million) |

|---|---|

| 2025 | 918.94 |

| 2026 | 996.40 |

| 2027 | 1080.40 |

| 2028 | 1171.48 |

| 2029 | 1270.24 |

| 2030 | 1377.32 |

| 2031 | 1493.43 |

| 2032 | 1619.33 |

| 2033 | 1755.84 |

| 2034 | 1903.86 |

| 2035 | 2064.36 |

The Plant Care Services Market in the United States is projected to grow at a CAGR of 9.4% between 2025 and 2035, fueled by rising adoption of greenery in corporate offices, hotels, and premium residential spaces. Growth is anchored by large-scale commercial contracts where sustainability and wellness programs drive demand for long-term plant care partnerships. Additionally, the expansion of subscription deliveries and IoT-enabled monitoring solutions is reshaping service delivery, making care more data-driven and scalable.

Adoption is also rising in hospitality and institutional spaces, where interior landscaping is central to branding and customer experience. Service providers are bundling on-site visits with remote advisory apps to enhance efficiency and reduce service costs. This hybrid model appeals to both households and businesses. As wellness-driven spaces become a priority in urban planning, the USA market is expected to see continuous growth.

The Plant Care Services Market in the United Kingdom is expected to grow at a CAGR of 14.1% through 2035, driven by a combination of workplace wellness initiatives, hospitality sector investments, and a strong culture of home gardening. Corporate offices and co-working spaces are increasingly adopting professional plant care to align with sustainability certifications and employee wellbeing programs, creating recurring demand for on-site services. The UK’s hospitality and retail sectors are also integrating indoor greenery and landscaping as part of customer experience strategies, fueling steady adoption.

Public institutions and heritage sites further contribute to market growth by incorporating greenery into restoration and preservation projects, with plants being used for both aesthetic enhancement and environmental balance. Subscription-based plant care kits are gaining popularity among urban households, particularly in London and other metropolitan areas where lifestyle-driven demand for indoor greenery is high. Government-backed urban greening initiatives and public-private collaborations continue to strengthen market opportunities, creating a balanced growth environment across residential, commercial, and institutional segments.

The Plant Care Services Market in India is forecast to expand at a CAGR of 24.6% through 2035, making it one of the fastest-growing globally. A sharp increase in adoption is being driven by tier-2 and tier-3 cities, where affordable service packages and subscription kits are gaining traction among middle-class households and MSMEs. Corporate offices are increasingly investing in professional greenery management as part of sustainability mandates and employee wellness programs, while institutions and co-working spaces are adopting on-site contracts.

Educational institutes and vocational training centers are also contributing by integrating horticulture and IoT-enabled plant monitoring into their digital learning modules, creating long-term demand for professional services. Public infrastructure projects are embracing greenery in urban landscaping and smart city programs, fueling steady institutional adoption. India’s youthful population and rising disposable income are further driving lifestyle-driven demand for indoor and balcony plant cae.

The Plant Care Services Market in China is expected to grow at a CAGR of 23.8% between 2025 and 2035, the highest among leading economies. This growth is fueled by strong government support for urban greening, cultural heritage preservation, and smart city initiatives that integrate plant care into public spaces and community design. Rising disposable incomes and lifestyle changes are driving subscription-based plant care kits in urban households, while commercial complexes and hospitality chains are contracting large-scale professional services.

Municipal governments are actively encouraging plant care adoption in public parks, offices, and educational institutions, creating consistent long-term demand. Domestic players are expanding aggressively with affordable service packages and app-based advisory platforms, making care accessible to both households and businesses. The presence of tech-driven solutions, including IoT-enabled plant monitoring and AI-based care recommendations, is accelerating market penetration across demographics.

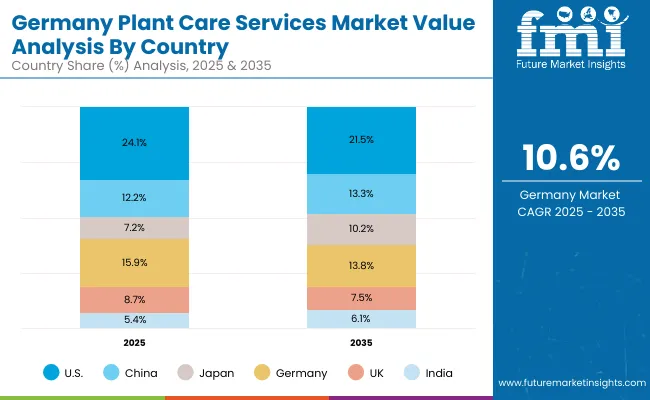

| Countries | 2025 Share (%) |

|---|---|

| USA | 24.1% |

| China | 12.2% |

| Japan | 7.2% |

| Germany | 15.9% |

| UK | 8.7% |

| India | 5.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.5% |

| China | 13.3% |

| Japan | 10.2% |

| Germany | 13.8% |

| UK | 7.5% |

| India | 6.1% |

The Plant Care Services Market in Germany is projected to grow at a CAGR of 10.6% from 2025 to 2035, supported by its strong focus on sustainability, workplace wellness, and urban greening initiatives. German corporations are increasingly contracting professional plant care providers as part of their ESG strategies and EU sustainability compliance frameworks, creating stable recurring revenue. Urban municipalities are integrating greenery into public infrastructure, transportation hubs, and educational institutions, boosting demand for both on-site visits and subscription-based solutions.

The hospitality and healthcare sectors are also key adopters, with hotels, hospitals, and clinics prioritizing indoor plant management for patient wellbeing and guest experience. Additionally, Germany’s strong gardening culture translates into household adoption of subscription-based DIY care kits, especially in metropolitan areas like Berlin, Hamburg, and Munich. With rising emphasis on energy-efficient, green-certified buildings, plant care is becoming a standard feature of modern construction and design projects, further strengthening the market outlook.

| USA by Service Mode | Value Share% 2025 |

|---|---|

| On-site visits | 67.2% |

| Others | 32.8% |

The Plant Care Services Market in the United States is projected to expand at a CAGR of 9.4% between 2025 and 2035. On-site visits dominate at 67.2% of service share in 2025, reflecting the preference of corporate offices, hospitals, and hospitality establishments for reliable, professional plant care contracts. Growth is also being reinforced by large-scale adoption in co-working spaces and premium residential complexes, where greenery is tied to wellness and sustainability branding.

The USA market is maturing but shifting toward hybrid models combining on-site visits with digital advisory and IoT-enabled plant monitoring for cost efficiency. Subscription deliveries of DIY plant care kits are increasingly popular in urban households, while the commercial segment drives recurring revenue through long-term contracts. With ESG reporting and wellness certifications rising, plant care is becoming an integral part of workplace and institutional environments.

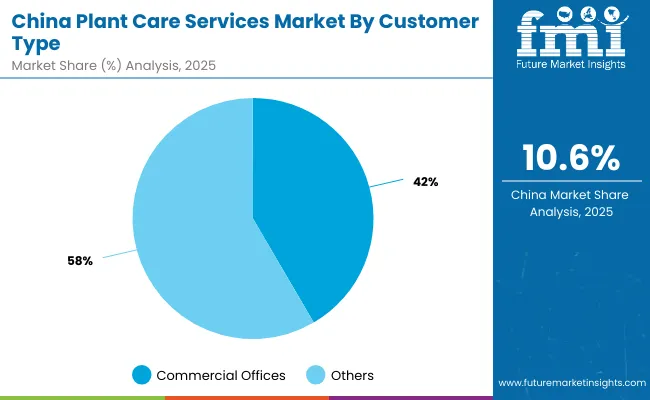

| China by Customer Type | Value Share% 2025 |

|---|---|

| Commercial offices | 41.6% |

| Others | 58.4% |

The Plant Care Services Market in China is forecast to grow at a CAGR of 23.8%, driven by rapid urbanization, smart city programs, and lifestyle shifts toward indoor greenery. In 2025, commercial offices account for 41.6% of demand, reflecting the trend of integrating biophilic design into workspaces to enhance productivity and air quality. Demand is further boosted by hospitality, malls, and public institutions adopting large-scale indoor landscaping.

Households are another fast-growing segment, supported by subscription-based plant care kits that cater to China’s digital-first consumer base. Domestic providers are leveraging mobile apps, AI-driven advisory, and affordable packages, enabling mass adoption across income groups. Municipal initiatives that mandate green public spaces and urban forestry are creating strong institutional opportunities, ensuring balanced demand from both households and commercial sectors.

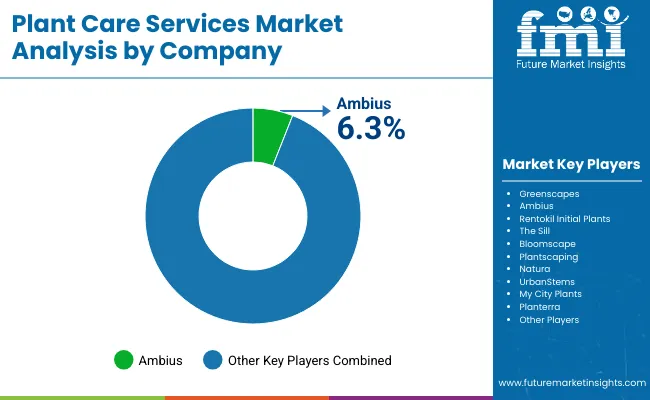

The plant care services market is increasingly competitive, driven by rising consumer interest in indoor greenery, corporate wellness initiatives, and sustainable urban landscaping. Greenscapes, Ambius, and Rentokil Initial Plants are among the leading players, offering comprehensive plant care, maintenance, and design services for commercial, hospitality, and residential clients. Their strengths lie in large-scale plant installations, biophilic design expertise, and ongoing maintenance programs that enhance indoor air quality and aesthetic appeal.

The Sill Inc. and Bloomscape Inc. have redefined the market through e-commerce-based plant delivery and remote plant care support, catering to tech-savvy urban consumers. Their business models integrate digital platforms for customer engagement, offering personalized care guidance and subscription-based maintenance services.

Plantscaping & Blooms, Natura, and Planterra Corporation specialize in sustainable and eco-friendly landscaping, integrating smart irrigation systems, green walls, and live plant installations in corporate and retail environments. These companies focus on wellness-oriented design that aligns with ESG goals and LEED-certified building standards.

UrbanStems Inc. and My City Plants strengthen market diversity through innovative online retail models and at-home plant care support. As urbanization and environmental awareness rise, competition centers on sustainability, digital service delivery, and customization to enhance both aesthetic and ecological value.

| Item | Value |

|---|---|

| Quantitative Units | USD 3,806.7 Million |

| Service Type | Plant watering & feeding, Pest/disease management, Repotting & soil services, Landscaping & aesthetic care, Subscription plant care kits |

| Customer Type | Residential, Commercial offices, Hotels & hospitality, Institutions |

| Service Mode | On-site visits, Subscription deliveries (DIY kits), Remote advisory (apps/ IoT) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Greenscapes, Ambius, Rentokil Initial Plants, The Sill Inc., Bloomscape Inc., Plantscaping & Blooms, Natura, UrbanStems Inc., My City Plants, Planterra Corporation |

| Additional Attributes | Dollar sales by service type and customer category, adoption trends in subscription plant care kits and IoT -enabled monitoring, rising demand for on-site visits and DIY care kits, sector-specific growth in residential, commercial offices, and hospitality, revenue segmentation between physical services and remote advisory platforms, integration with smart home IoT, AR/VR plant health visualization, and AI-driven predictive care, regional growth patterns shaped by urban greening initiatives and corporate wellness programs, and innovations in app-based remote advisory, automated irrigation systems, and eco-friendly pest/disease management methods. |

The global Plant Care Services Market is estimated to be valued at USD 3,806.7 million in 2025.

The market size for the Plant Care Services Market is projected to reach USD 9,620.6 million by 2035.

The Plant Care Services Market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key service types in the Plant Care Services Market are Plant watering & feeding, Pest/disease management, Repotting & soil services, Landscaping & aesthetic care, and Subscription plant care kits.

In terms of service mode, On-site visits are projected to command a 65.1% share in the Plant Care Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

Geriatric Care Services Market Size and Share Forecast Outlook 2025 to 2035

Canada Home Care Services Market Analysis – Size, Share & Trends 2025-2035

Germany Home Care Services Market Insights – Size, Trends & Forecast 2025-2035

Senior In-Home Care Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA