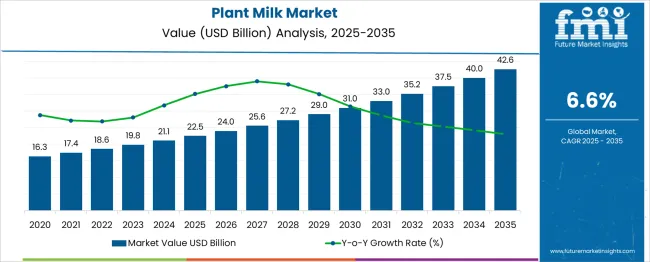

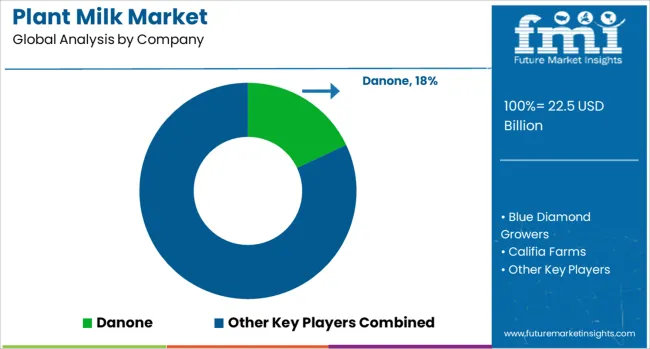

The Plant Milk Market is estimated to be valued at USD 22.5 billion in 2025 and is projected to reach USD 42.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. This reflects a growth multiplier of 1.89x, supported by a CAGR of 6.6%, driven by rising demand for lactose-free alternatives, increasing adoption of plant-based diets, and strong penetration in foodservice channels. During the first five-year phase (2025–2030), the market is expected to reach around USD 31.0 billion, adding USD 8.5 billion, which accounts for 42.3% of the total incremental growth, fueled by the popularity of almond, oat, and soy-based milk products. The second half (2030–2035) contributes USD 11.6 billion, representing 57.7% of incremental growth, reflecting accelerated adoption as product innovation, fortified nutrition profiles, and enhanced flavor options expand consumer appeal. Annual increments will rise from USD 1.5 billion in early years to nearly USD 2.5 billion by the end of the forecast period, indicating consistent momentum. Manufacturers investing in clean-label formulations, advanced processing technologies, and strategic distribution partnerships will capture the largest share of this USD 20.1 billion growth opportunity, particularly in emerging markets where plant-based alternatives are rapidly gaining mainstream acceptance.

| Metric | Value |

|---|---|

| Plant Milk Market Estimated Value in (2025 E) | USD 22.5 billion |

| Plant Milk Market Forecast Value in (2035 F) | USD 42.6 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The plant milk market commands a strong share within the growing plant-based ecosystem. In the Dairy Alternatives Market, it accounts for approximately 60%, as plant milk is the most widely consumed non-dairy product globally. Within the Plant-Based Food and Beverages Market, its share is about 25%, supported by increasing demand for vegan and lactose-free options. In the Functional Beverages Market, it represents nearly 8%, as fortified plant milks enriched with vitamins, minerals, and protein contribute to health-focused beverage trends. For the Non-Dairy Beverage Market, plant milk holds close to 70%, dominating over other categories like plant-based creamers and yogurts. Within the Health and Wellness Food Products Market, its share is approximately 6%, given its strong alignment with nutrition-focused consumer preferences. Growth is driven by rising lactose intolerance cases, lifestyle-driven dietary shifts, and increasing awareness of plant-based nutrition benefits. Oat, almond, soy, and coconut milk lead product innovation, while manufacturers are incorporating added protein and functional ingredients to enhance appeal. E-commerce and ready-to-drink packaging formats are accelerating accessibility, while cafes and foodservice channels further boost demand. With expanding product portfolios and broader consumer acceptance, plant milk continues to solidify its position as the leading non-dairy beverage category globally.

The plant milk market is gaining significant momentum, supported by shifting consumer dietary preferences, heightened lactose intolerance awareness, and a growing inclination toward plant-based nutrition. Regulatory and scientific backing for non-dairy alternatives, coupled with marketing campaigns focused on wellness and environmental impact, are influencing broader acceptance across demographics.

The reduction in dairy consumption and expansion of vegan lifestyles, especially among millennials and Gen Z consumers, have positioned plant milk as a mainstream product. Further, rapid innovation in taste, texture, and nutritional content is making plant-based milk competitive with traditional dairy.

Leading food and beverage manufacturers are increasing investment in plant milk R&D, private-label offerings, and cold-chain distribution, enabling market scalability. This positive outlook is being reinforced by institutional commitments to sustainability and food security.

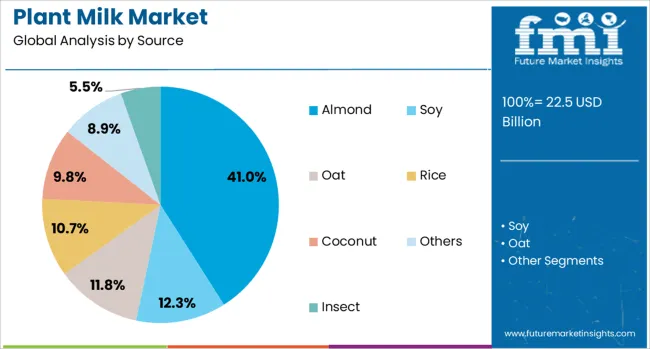

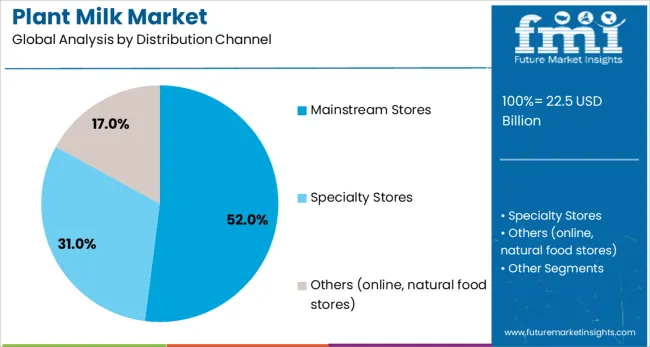

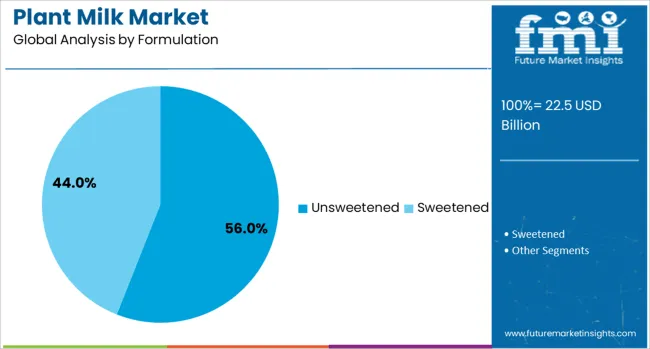

The plant milk market is segmented by source, distribution channel, formulation, and packaging, and geographic regions. The plant milk market is divided by source into Almond, Soy, Oat, Rice, Coconut, Others, and Insect. In terms of distribution channels, the plant milk market is classified into Mainstream Stores, Specialty Stores, and Others (online, natural food stores). The formulation of the plant milk market is segmented into Unsweetened and Sweetened. The packaging of the plant milk market is segmented into Carton packaging, Bottles, and Pouches. Regionally, the plant milk industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Almond-based plant milk is projected to account for 41.0% of the overall market revenue in 2025, emerging as the leading source segment. This growth is being driven by its wide consumer familiarity, mild flavor profile, and established availability across retail formats.

Almond milk’s perceived health benefits such as low calorie content and absence of saturated fats—have enhanced its appeal among calorie-conscious consumers. Significant marketing efforts have positioned almond milk as a staple in plant-based households, supported by recipes and endorsements by health influencers.

Additionally, increased agricultural output and processing efficiency in almond-producing regions have allowed for cost-effective mass production. Its strong presence in both shelf-stable and chilled variants further supports its leadership.

Mainstream stores are expected to hold 52.0% share of total distribution in the plant milk market by 2025, making them the dominant retail channel. This share is attributed to the expanding shelf space for dairy alternatives in conventional supermarkets, hypermarkets, and national retail chains.

Strategic alliances between plant milk producers and large-format retailers have ensured broader visibility and greater promotional reach. The convenience of availability, competitive pricing through private labels, and ability to support volume sales are factors that have enhanced market penetration through mainstream stores.

Improved in-store education, sampling initiatives, and digital shelf labeling have further encouraged consumer trial and conversion.

Unsweetened plant milk is forecast to capture 56.0% of total revenue share in the market by 2025, emerging as the leading formulation type. This dominance is supported by rising consumer demand for clean-label, low-sugar beverage options, especially among diabetic and health-focused individuals.

Regulatory pressures around sugar content and mandatory front-of-pack labeling have also contributed to the preference for unsweetened formulations. Brands have increasingly invested in improving taste and consistency of unsweetened varieties to minimize the taste gap with sweetened versions.

As dietary habits shift toward reduced carbohydrate intake and label transparency, unsweetened plant milk is expected to continue leading innovation and consumer adoption in the category.

The plant milk market is growing rapidly due to increased consumer preference for dairy alternatives and the expansion of retail and online distribution channels. Growth in 2024 and 2025 was supported by rising product innovations in almond, oat, and soy-based formulations. Opportunities are emerging in fortified blends, flavored variants, and single-serve packaging formats. Key trends include barista-friendly options, protein-rich plant milk, and extended shelf-life products for convenience. However, restraints such as higher production costs, fluctuating raw material availability, and inconsistent taste profiles across brands continue to pose challenges for manufacturers globally.

The primary growth driver is the shift toward plant-based alternatives driven by consumer preference for lactose-free beverages. In 2024 and 2025, almond and oat milk segments recorded significant sales growth in North America and Europe, supported by cafés and quick-service restaurants offering plant milk options. E-commerce platforms enhanced accessibility through subscription models for household delivery. Additionally, increased use of plant milk in smoothies and ready-to-drink beverages expanded application scope. These factors confirm that evolving dietary preferences and versatile product applications will remain major contributors to market expansion.

Significant opportunities exist in nutritional enrichment and convenience-focused formats. In 2025, fortified plant milk with added calcium, vitamins, and protein gained traction among consumers seeking functional benefits comparable to dairy. Single-serve packaging formats, particularly for oat and soy-based drinks, became popular in urban markets due to portability and portion control. Brands investing in flavored variants such as vanilla, chocolate, and matcha tapped into premium demand segments. These developments suggest that companies prioritizing value-added formulations and packaging innovation are likely to capture strong market share in competitive retail environments.

Emerging trends include the introduction of barista-specific formulations and protein-rich plant-based milk products. In 2024, oat milk designed for foaming consistency dominated café menus, replacing traditional dairy in specialty coffee beverages. High-protein variants made from peas and soy were introduced to attract fitness-conscious consumers seeking functional beverages. Long-shelf-life UHT packaging formats gained popularity for e-commerce distribution and rural markets. These innovations reflect a clear consumer inclination toward performance-focused, premium-quality options, highlighting the market’s transition toward specialized and value-driven product categories across retail and foodservice channels.

Market restraints are shaped by elevated production costs, raw material sourcing challenges, and taste inconsistencies. In 2024 and 2025, fluctuations in almond and oat prices impacted profit margins for manufacturers, while supply chain disruptions delayed product availability in emerging markets. Limited processing infrastructure for alternative milk production further constrained scalability in certain regions. Additionally, variations in flavor and texture among different plant milk types created barriers to mainstream acceptance. These challenges emphasize the importance of localized sourcing strategies, processing innovations, and sensory optimization to ensure long-term market competitiveness.

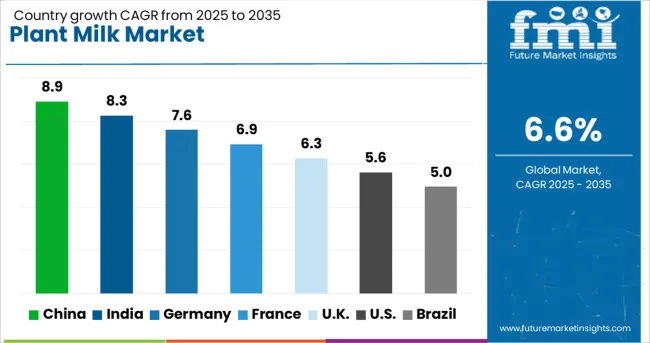

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global plant milk market is projected to grow at 6.6% CAGR during 2025–2035. China leads at 8.9% CAGR, driven by strong consumer preference for dairy alternatives and urban health trends. India follows at 8.3%, supported by increasing lactose intolerance awareness and growth in premium plant-based beverages. Germany records 7.6% CAGR, reflecting high penetration of oat, soy, and almond milk in retail and foodservice. The United Kingdom grows at 6.3%, while the United States posts 5.6%, reflecting mature market conditions focusing on premium and functional variants. Asia-Pacific dominates growth due to cost-effective production and consumer health awareness, while Western markets prioritize fortified, sustainable, and clean-label products.

The plant milk market in China is projected to grow at 8.9% CAGR, supported by rising consumer demand for lactose-free and vegan-friendly beverages. Soy milk remains dominant, but almond, oat, and coconut milk are witnessing rapid growth in urban centers. E-commerce platforms play a major role in distribution, offering a wide range of premium and flavored variants. Manufacturers integrate plant milk into functional beverage categories enriched with calcium, vitamins, and probiotics. Government health campaigns promoting low-cholesterol diets further enhance market penetration.

The plant milk market in India is forecasted to grow at 8.3% CAGR, driven by health-conscious consumers seeking dairy alternatives due to lactose intolerance and lifestyle changes. Almond and soy milk dominate the market, while oat and coconut milk gain traction in premium segments. Online grocery platforms and quick-commerce services enhance accessibility in metropolitan areas. Brands focus on cost-effective fortified plant milk options targeting middle-income consumers. Product diversification in flavored and barista blends caters to cafés and urban foodservice chains.

The plant milk market in Germany is expected to grow at 7.6% CAGR, fueled by strong vegan culture and sustainability-focused consumer preferences. Oat milk leads the segment, driven by its popularity in coffee-based beverages and low environmental footprint. Premium fortified products enriched with proteins, vitamins, and minerals dominate supermarket shelves. Innovations in packaging with recyclable materials and biodegradable cartons align with EU green policies. Partnerships between foodservice chains and plant milk producers further accelerate market penetration across cafés and quick-service restaurants.

The plant milk market in the United Kingdom is projected to grow at 6.3% CAGR, supported by consumer preference for dairy-free diets and government initiatives promoting healthier eating habits. Almond, oat, and coconut milk dominate product launches in both retail and foodservice sectors. Brands innovate with protein-rich and calcium-fortified formulations targeting fitness-conscious consumers. Sustainability trends encourage adoption of plant milk packaged in recyclable cartons and PET bottles. E-commerce platforms and direct-to-consumer models boost accessibility for premium and niche plant-based beverages.

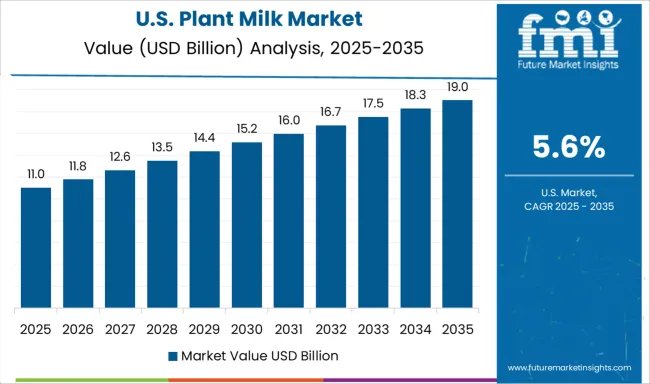

The plant milk market in the United States is projected to grow at 5.6% CAGR, reflecting mature demand with steady innovation in functional and premium offerings. Almond milk dominates, while oat milk sees strong adoption due to its neutral taste and sustainability appeal. Manufacturers introduce plant milk blends with added proteins, probiotics, and clean-label claims to maintain competitive advantage. Demand for barista-specific products strengthens partnerships with coffeehouse chains. Retailers expand shelf space for flavored and unsweetened variants, while e-commerce platforms support bulk purchases and subscription models.

The plant milk market is dominated by Danone, which leads through its strong portfolio of dairy alternatives under brands like Alpro and Silk, supported by extensive distribution networks and product diversification across almond, soy, oat, and coconut milk variants. Danone’s dominance is reinforced by strategic investments in R&D for improved taste and nutritional profiles, catering to consumer demand for lactose-free and plant-based options. Key players such as Nestlé, Oatly AB, Blue Diamond Growers, SunOpta Inc., and The Hain Celestial Group hold significant shares by offering fortified beverages with enhanced protein content, clean-label formulations, and innovative flavors. These companies focus on expanding global reach through retail and foodservice channels while ensuring compliance with regional nutritional standards. Emerging players including Califia Farms, Elmhurst 1925, Mooala, Pacific Foods, Plenish, Ripple Foods, and WhiteWave Foods are strengthening their positions by emphasizing non-GMO ingredients, sustainable sourcing, and premium functional attributes like added calcium and vitamins. Many of these brands leverage e-commerce platforms and niche marketing strategies to attract health-conscious and vegan consumers. Market growth is being driven by the rising popularity of plant-based diets, increasing lactose intolerance awareness, and growing adoption of alternatives in coffee chains and household consumption. Continuous innovation in shelf-stable packaging, protein-rich formulations, and barista-friendly blends is expected to shape competitive dynamics and fuel further expansion in global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.5 Billion |

| Source | Almond, Soy, Oat, Rice, Coconut, Others, and Insect |

| Distribution Channel | Mainstream Stores, Specialty Stores, and Others (online, natural food stores) |

| Formulation | Unsweetened and Sweetened |

| Packaging | Carton packaging, Bottles, and Pouches |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Danone, Blue Diamond Growers, Califia Farms, Elmhurst 1925, Mooala, Nestlé, Oatly AB, Pacific Foods, Plenish, Ripple Foods, SunOpta Inc., The Hain Celestial Group, and WhiteWave Foods |

| Additional Attributes | Dollar sales segmented by plant milk type (soy, almond, oat, rice, pea) and channel (retail, online, foodservice). North America leads adoption; Asia-Pacific posts fastest CAGR. Buyers demand protein-enriched, allergen-safe, barista-ready options. Innovations include flavored and fortified variants, eco-friendly packaging, and carbon-neutral sourcing aligned with clean-label and regulatory compliance. |

The global plant milk market is estimated to be valued at USD 22.5 billion in 2025.

The market size for the plant milk market is projected to reach USD 42.6 billion by 2035.

The plant milk market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in plant milk market are almond, soy, oat, rice, coconut, others and insect.

In terms of distribution channel, mainstream stores segment to command 52.0% share in the plant milk market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA