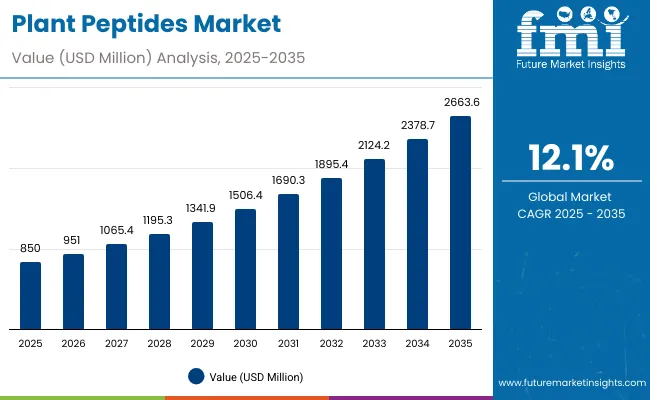

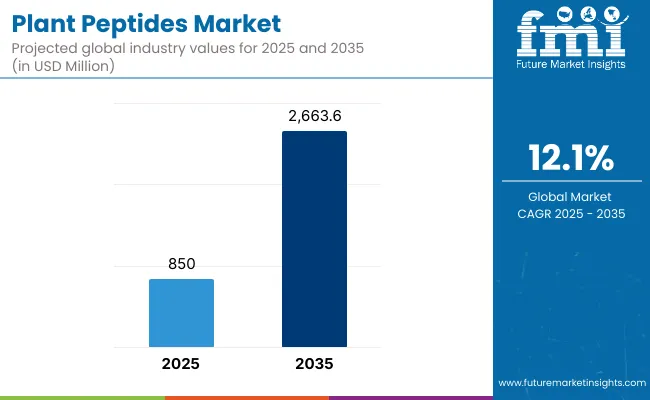

The Plant Peptides Market is projected to be valued at USD 850.0 million in 2025 and is anticipated to reach USD 2,663.6 million by 2035, representing an expansion of USD 1,813.6 million over the decade. This transformation reflects a 193% growth during the forecast horizon, supported by a strong CAGR of 12.1%, resulting in a market size that more than triples between 2025 and 2035.

Plant Peptides Market Key Takeaways

| Metric | Value |

|---|---|

| Plant Peptides Estimated Value in (2025E) | USD 850.0 million |

| Plant Peptides Forecast Value in (2035F) | USD 2,663.6 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

During the first half of the decade, from 2025 to 2030, the market is expected to increase from USD 850.0 million to nearly USD 1,506.4 million, generating an incremental gain of USD 656.4 million. This phase is anticipated to witness steady traction across nutritional and cosmetic formulations, with enhanced demand for high-purity peptide powders and encapsulated formats that address targeted health and beauty needs. Adoption is expected to be reinforced by consumer alignment with natural, bioactive solutions and by expanded integration of plant peptides into performance-driven functional foods and supplements.

The second half of the forecast period, spanning 2030 to 2035, is projected to contribute USD 1,157.2 million, equal to 64% of the decade’s incremental value. Market expansion in this phase will be accelerated by large-scale adoption in therapeutic and pharmaceutical-grade applications, where clinical validation and regulatory backing are expected to play defining roles. By 2035, advanced controlled-release delivery systems and bioefficacy-driven product innovation are anticipated to reposition plant peptides as critical ingredients across health, wellness, and cosmeceutical industries, ensuring sustained growth momentum.

From 2020 to 2024, the Plant Peptides Market expanded steadily, as hydrolyzed proteins and bioactive fractions were increasingly adopted in nutraceuticals and cosmetics. Growth was supported by rising consumer preference for clean-label, sustainable, and clinically validated bioactive solutions. During this period, large multinational suppliers such as Roquette, Kerry, and Ingredion dominated, holding nearly 50% of global revenues through broad portfolios and supply chain scale. Mid-sized innovators like Burcon and Axiom Foods reinforced competition by developing differentiated peptide fractions, while specialty players such as Symrise and Givaudan accelerated cosmetic-grade peptide innovation.

By 2025, the market is expected to reach USD 850 million, with further expansion driven by therapeutic-grade applications, advanced encapsulation formats, and bioefficacy-led differentiation. The competitive advantage is shifting away from commodity protein supply toward clinically supported peptide ecosystems, sustainability credentials, and integrated partnerships across food, pharma, and personal care value chains.

The growth of the plant peptides market is being driven by rising global preference for natural, sustainable, and multifunctional ingredients. Increasing demand for clean-label nutrition has been combined with a shift toward bioactive compounds that deliver both functional and therapeutic benefits. Nutraceuticals and dietary supplements have been reinforced as major growth channels, as plant peptides are being positioned as targeted solutions for immunity, metabolic health, and cognitive support.

Expansion has also been supported by rapid advances in extraction and formulation technologies, which have enabled improved stability, purity, and bioavailability of peptide-based ingredients. In the cosmetics and personal care industry, plant peptides are being adopted as alternatives to synthetic actives due to their proven anti-aging, moisturizing, and barrier-protection properties. Pharmaceuticals are projected to accelerate usage as clinical validation increases for therapeutic peptides derived from plant sources.

A further boost is being provided by the growing role of contract manufacturers and B2B ingredient suppliers, ensuring scalability and consistent quality for global brands. Regional demand in Asia-Pacific and Latin America is being amplified by rising health-conscious populations and increasing investment in functional foods. As innovation in encapsulated and controlled-release forms advances, wider adoption across industries is expected to define the next phase of market growth.

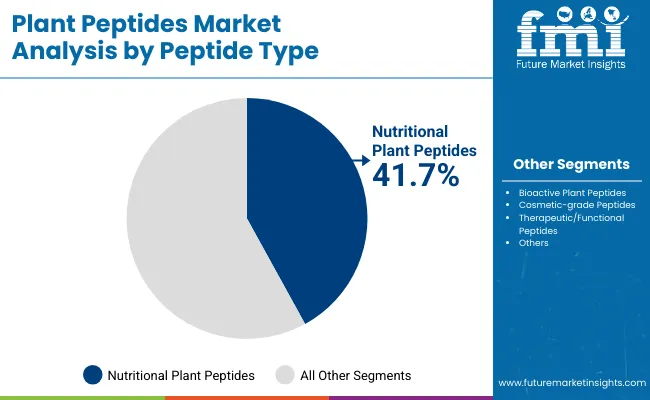

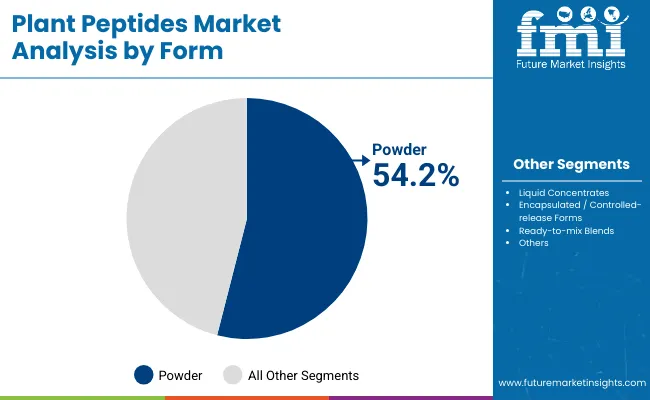

The plant peptides market has been segmented by Source, Peptide Type, Form, End-Use Application, and Distribution Channel reflecting the key dimensions shaping future adoption. Sources include soy, pea, rice, wheat, oat, corn, potato, legumes, algae/microalgae, and hemp, highlighting the diversity of plant-derived inputs fueling innovation. Peptide type segmentation covers nutritional peptides, bioactive peptides, cosmetic-grade peptides, and therapeutic/functional peptides, each serving distinct application areas. Form-based classification encompasses powders, liquid concentrates, encapsulated or controlled-release forms, and ready-to-mix blends, showcasing the evolving delivery systems enhancing usability across industries. Collectively, these segments illustrate how plant peptides are positioned to address cross-sectoral needs in food and beverages, nutraceuticals, cosmetics, pharmaceuticals, and animal nutrition. Regional adoption patterns

| Peptide Type Segment | Market Value Share, 2025 |

|---|---|

| Nutritional plant peptides | 41.7% |

| Bioactive plant peptides | 26.9% |

Nutritional plant peptides are anticipated to hold 41.7% of global revenues in 2025, reflecting their foundational role in functional foods and dietary supplements. Their adoption has been reinforced by growing consumer awareness of protein quality, digestibility, and amino acid balance. Nutritional peptides are projected to maintain steady dominance due to their adaptability in both mass-market and premium wellness products. Bioactive peptides, however, are expected to gain momentum as clinical evidence strengthens, driving therapeutic and preventive health applications. Cosmetic-grade peptides will continue to capture consumer attention for anti-aging and skin-health claims, but nutritional peptides will remain the largest contributor, supported by their scalability, affordability, and compatibility with mainstream product portfolios worldwide.

| Form | 2025 Share% |

|---|---|

| Powder | 54.2% |

| Liquid concentrates | 17.8% |

| Encapsulated / controlled-release forms | 14.2% |

Powder formulations are forecast to account for 54.2% of revenues in 2025, reinforcing their role as the most versatile and widely adopted format. Demand has been driven by ease of integration into diverse applications including beverages, supplements, bakery, and sports nutrition. Their stability, transportability, and cost-effectiveness ensure consistent preference by manufacturers. Growth has also been aided by advances in microfiltration and spray-drying technologies, which enhance purity and solubility. Liquid concentrates and encapsulated formats are expected to record faster growth rates, driven by consumer demand for convenience and targeted delivery. However, powder formulations are projected to retain leadership throughout the decade, owing to their scalability and dominant role in global plant peptide supply chains.

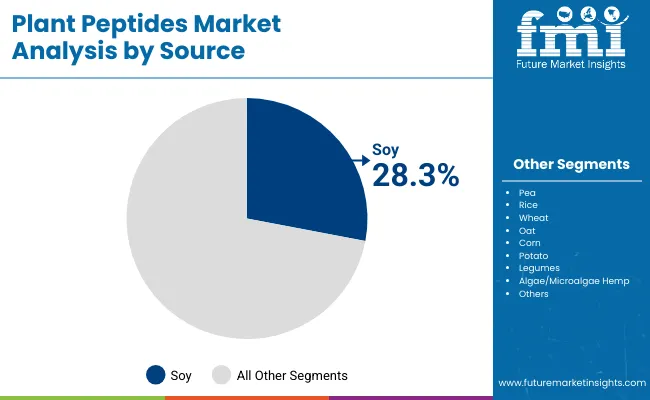

| Source | 2025 Share% |

|---|---|

| Soy | 28.3% |

| Pea | 18.4% |

| Rice | 13.2% |

Soy is projected to contribute 28.3% of plant peptides revenue in 2025, maintaining its lead as the dominant source category. Growth has been reinforced by soy’s established infrastructure, cost efficiency, and well-documented nutritional profile, which ensure broad adoption in food, beverage, and nutraceutical formulations. While pea and rice proteins are steadily gaining ground, soy remains a scalable and trusted foundation for industrial peptide extraction. Expansion of non-GMO and identity-preserved soy supply chains is expected to strengthen its relevance in premium markets. In parallel, growth from legumes, algae, and hemp is forecast to accelerate, but soy’s entrenched role across geographies positions it as the primary driver of overall market stability through 2035.

Rising formulation costs, regulatory uncertainties, and supply-chain volatility have challenged plant peptide adoption, even as demand grows in nutraceuticals, cosmetics, and pharmaceuticals. Broader consumer alignment with sustainable, functional, and clinically supported ingredients is driving acceptance, while technological advances in extraction and delivery systems are reshaping growth opportunities across health, beauty, and functional food applications.

Growing Demand for Functional and Therapeutic Nutrition

The expansion of functional nutrition has been reinforced by the increasing need for clinically supported, plant-derived ingredients. Plant peptides are being adopted in supplements and fortified foods as they deliver targeted health benefits such as cardiovascular support, metabolic regulation, and muscle recovery. This growth has been supported by rising consumer preference for preventive health solutions and by expanding nutraceutical product portfolios. As bioavailability and delivery mechanisms improve, functional nutrition is projected to remain a leading driver of long-term market penetration.

High Production and Processing Costs

The cost of producing high-purity plant peptides has been constrained by complex extraction, purification, and stabilization processes. Investment in advanced enzymatic hydrolysis, fermentation, and encapsulation technologies has been required, yet cost pressures remain significant, particularly for therapeutic and cosmetic applications. Limited scalability and infrastructure challenges in emerging economies have further restrained affordability. Unless production economics improve, premium pricing is expected to limit accessibility for mass-market applications.

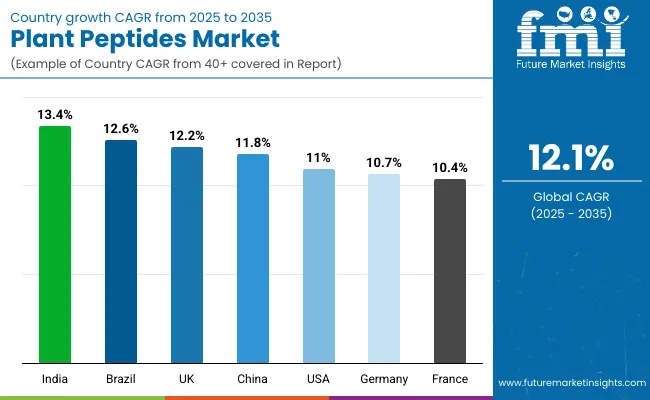

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 11.8% |

| India | 13.4% |

| Germany | 10.7% |

| France | 10.4% |

| UK | 12.2% |

| USA | 11.0% |

| Brazil | 12.6% |

The global plant peptides market has been characterized by clear country-level disparities in adoption, shaped by consumer demand shifts, technological readiness, and regulatory frameworks. Asia-Pacific has been positioned as the fastest-growing region, with China advancing at a CAGR of 11.8% and India at 13.4%, reflecting rapid investments in nutraceuticals, functional foods, and pharmaceutical-grade ingredients. China’s ecosystem has been reinforced by strong raw material availability and expanding clinical validation pipelines, which are expected to strengthen its leadership in bioactive peptide development. India’s trajectory has been accelerated by a rising middle-class consumer base and expanding supplement consumption, supported by contract manufacturing capabilities that enhance export potential.

In Europe, Germany (10.7% CAGR), France (10.4% CAGR), and the UK (12.2% CAGR) are projected to sustain strong momentum, underpinned by regulatory emphasis on clean-label formulations and stringent standards for cosmetic and nutraceutical safety. The UK is expected to outpace its European peers, driven by high consumer alignment with plant-based wellness trends.

North America is expected to record steady growth, with the USA expanding at 11.0% CAGR, anchored by established nutraceutical and personal care industries. Meanwhile, Latin America, led by Brazil at 12.6% CAGR, is anticipated to emerge as a high-potential market, supported by increasing consumer preference for plant-based solutions and rising regional manufacturing capacity.

| Year | USA Plant Peptides Market (USD Million) |

|---|---|

| 2025 | 187.7 |

| 2026 | 208.7 |

| 2027 | 230.6 |

| 2028 | 255.8 |

| 2029 | 284.0 |

| 2030 | 313.5 |

| 2031 | 349.2 |

| 2032 | 387.9 |

| 2033 | 431.2 |

| 2034 | 481.1 |

| 2035 | 533.4 |

The plant peptides market in the United States is projected to expand from USD 187.7 million in 2025 to USD 533.4 million by 2035, reflecting a CAGR of 11.0%. Growth has been reinforced by rising adoption of bioactive and nutritional peptides in functional foods, nutraceuticals, and pharmaceutical formulations. Demand has also been supported by the rapid integration of peptides into skincare, anti-aging solutions, and cosmeceuticals, where clinical validation and consumer preference for natural actives are driving accelerated uptake.

Pharmaceutical applications are anticipated to play an increasingly important role, supported by ongoing R&D for therapeutic peptides targeting chronic diseases and metabolic health. Contract manufacturing partnerships and ingredient distributors are expected to enhance accessibility for both established and emerging USA brands. Market expansion has further been supported by consumer alignment with plant-based, clean-label products and regulatory acceptance of natural bioactives.

The plant peptides market in the United Kingdom is projected to expand at a CAGR of 12.2%, supported by rising demand for nutraceuticals, functional foods, and cosmetic-grade actives. Market growth has been reinforced by strong consumer alignment with clean-label wellness solutions and high adoption of sustainable, plant-based ingredients across food and beauty industries. Regulatory emphasis on ingredient transparency and product safety has created favorable conditions for accelerated penetration. Innovation in encapsulated formats is expected to drive premium positioning, especially in dietary supplements and anti-aging skincare.

The plant peptides market in China is forecast to grow at a CAGR of 11.8%, anchored by strong demand across functional nutrition, pharmaceuticals, and personal care sectors. Growth has been reinforced by large-scale supply availability of soy, pea, and rice proteins, which provide a robust base for peptide extraction. Government-backed initiatives supporting biotechnology innovation and clinical validation are further boosting adoption. As local consumers shift toward preventive health solutions, demand for bioactive peptides is expected to accelerate in both domestic and export markets.

The plant peptides market in India is anticipated to achieve the fastest growth globally, at a CAGR of 13.4%, reaching strong adoption across nutraceuticals, dietary supplements, and functional food segments. Rising disposable incomes, urbanization, and health-conscious consumer behavior are expected to be major enablers. Market expansion has also been supported by India’s robust contract manufacturing sector, which enhances cost competitiveness and supports export-oriented supply chains. Increasing domestic investments in R&D and clinical validation of bioactive peptides are projected to further stimulate demand.

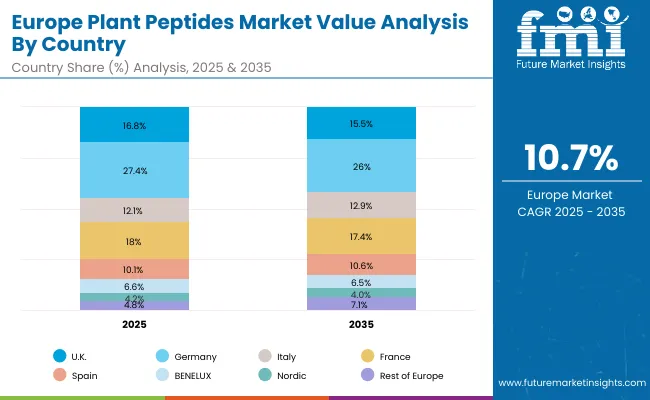

| Country | 2025 |

|---|---|

| UK | 16.8% |

| Germany | 27.4% |

| Italy | 12.1% |

| France | 18.0% |

| Spain | 10.1% |

| BENELUX | 6.6% |

| Nordic | 4.2% |

| Rest of Europe | 4.8% |

| Country | 2035 |

|---|---|

| UK | 15.5% |

| Germany | 26.0% |

| Italy | 12.9% |

| France | 17.4% |

| Spain | 10.6% |

| BENELUX | 6.5% |

| Nordic | 4.0% |

| Rest of Europe | 7.1% |

The plant peptides market in Germany is projected to record steady expansion at a CAGR of 10.7%, underpinned by the country’s strong nutraceutical, pharmaceutical, and cosmetics industries. Growth has been reinforced by stringent regulatory standards emphasizing product safety and efficacy, which elevate demand for clinically validated plant-based peptides. Rising popularity of anti-aging formulations, combined with innovation in controlled-release forms, is expected to support long-term adoption. Germany’s position as a European manufacturing hub further strengthens supply chain integration for B2B distribution.

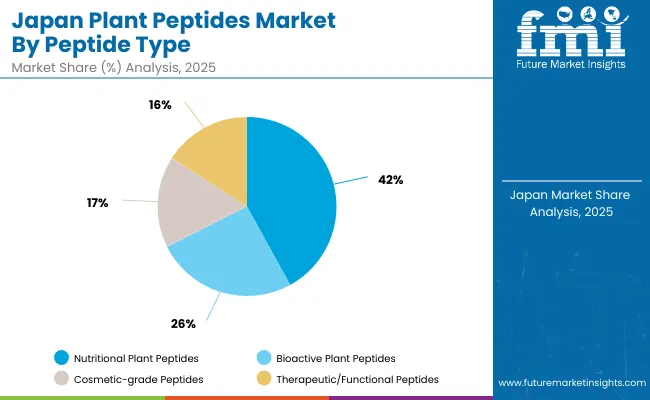

| Peptide Type | Market Value Share, 2025 |

|---|---|

| Nutritional plant peptides | 42.0% |

| Bioactive plant peptides | 25.6% |

| Cosmetic-grade peptides | 16.5% |

| Therapeutic/functional peptides | 15.9% |

The Plant Peptides Market in Japan is projected at USD 55.2 million in 2025. Nutritional plant peptides contribute 42.0%, while bioactive peptides hold 25.6%, which highlights a strong concentration toward health and wellness-driven applications. This dominance is being reinforced by Japan’s deeply established nutraceutical and functional food industries, where clinically validated and clean-label solutions are prioritized.

Cosmetic-grade peptides, at 16.5%, are expected to accelerate adoption, reflecting Japan’s strong beauty and personal care culture that emphasizes natural anti-aging and skin-health ingredients. Therapeutic/functional peptides, at 15.9%, are projected to record the fastest CAGR of 12.6%, supported by Japan’s focus on advanced pharmaceutical research and functional medicine. This transition signals a gradual shift from traditional nutritional applications toward therapeutic-grade innovations.

Rising consumer preference for longevity, preventive healthcare, and natural beauty solutions will reinforce market expansion. Integration of encapsulated and controlled-release technologies is expected to enhance product efficacy, while regulatory support for nutraceuticals and functional cosmetics strengthens adoption.

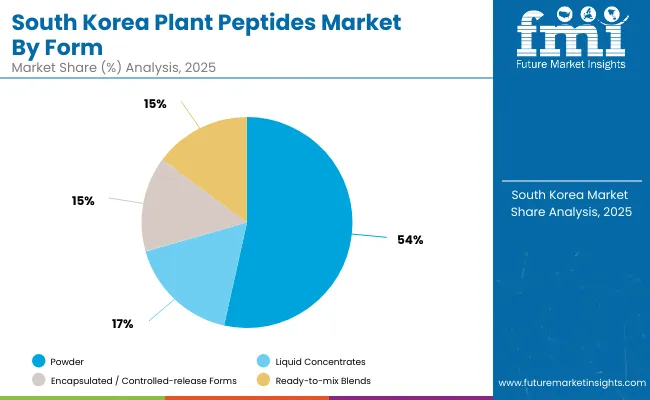

| Form | Market Value Share, 2025 |

|---|---|

| Powder | 53.5% |

| Liquid concentrates | 17.1% |

| Encapsulated / controlled-release forms | 14.6% |

| Ready-to-mix blends | 14.8% |

The Plant Peptides Market in South Korea is projected at USD 34.5 million in 2025. Powder formulations contribute 53.5%, holding the dominant position due to their versatility, ease of integration, and widespread use in functional foods, sports nutrition, and dietary supplements. While powders lead, future adoption is expected to diversify toward advanced delivery systems.

Liquid concentrates, with a 17.1% share, are projected to gain momentum as consumer demand for convenience-driven wellness products strengthens. Encapsulated and controlled-release forms, at 14.6%, are expected to expand significantly at a CAGR of 12.8%, supported by South Korea’s strong innovation pipeline in pharmaceutical and nutraceutical R&D. Ready-to-mix blends, accounting for 14.8%, are forecast to record the fastest growth at 13.3%, reflecting strong alignment with South Korea’s lifestyle-driven health culture and rapid uptake of personalized nutrition formats.

Market growth will be reinforced by South Korea’s advanced biotechnology sector, government support for functional food exports, and strong consumer inclination toward high-quality, science-backed wellness products.

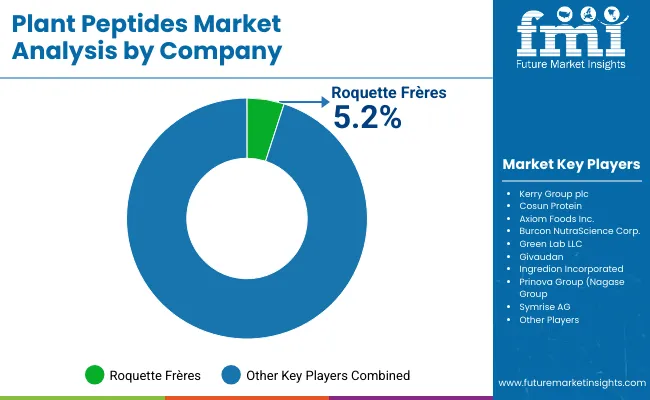

| Company | Global Value Share 2025 |

|---|---|

| Roquette Frères | 5.2% |

| Others | 94.8% |

The Plant Peptides Market is moderately fragmented, with multinational ingredient leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Global players such as Roquette Frères, Kerry Group plc, and Ingredion Incorporated hold significant market share, supported by their extensive portfolios in plant-based proteins and peptides. Their strategies are being reinforced by investments in bioactive research, large-scale production capabilities, and collaborations with nutraceutical and cosmetic companies. Increasing focus has been placed on sustainability certifications, clinical validation, and advanced formulation delivery systems.

Mid-sized innovators including Burcon NutraScience Corp., Cosun Protein, and Axiom Foods Inc. are catering to demand for differentiated peptide offerings across functional foods, dietary supplements, and specialty nutrition. These companies are enhancing competitiveness by emphasizing cost-effective hydrolysis technologies, application-specific customization, and partnerships with contract manufacturers.

Specialized providers such as Green Lab LLC, Prinova Group (Nagase Group), and Symrise AG are carving out positions through niche applications in cosmeceuticals, personal care, and therapeutic formulations. Their strengths are being reinforced by agility in product innovation and targeted regional expansion strategies.

Competitive differentiation is shifting from commodity protein bases to high-value peptide ecosystems that integrate controlled-release technologies, science-backed efficacy claims, and B2B ingredient-brand partnerships.

Key Developments in Plant PeptidesMarket

| Item | Value |

|---|---|

| Quantitative Units | USD 850.0 million |

| Peptide Type | Nutritional plant peptides, Bioactive plant peptides, Cosmetic-grade peptides, Therapeutic/functional peptides |

| Source | Soy, Pea, Rice, Wheat, Oat, Corn, Potato, Legumes (lentils, chickpeas, fava beans, etc.), Algae/Microalgae, Hemp |

| Form | Powder, Liquid concentrates, Encapsulated / Controlled-release forms, Ready-to-mix blends |

| End-Use Application | Food & Beverages Industry, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care, Pharmaceuticals, Animal Nutrition |

| Distribution Channel | B2B Ingredient Suppliers, Contract Manufacturers (CMOs), Ingredient Distributors & Traders, Cosmetic Formulation Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Roquette Frères, Kerry Group plc, Cosun Protein, Axiom Foods Inc., Burcon NutraScience Corp., Green Lab LLC, Givaudan, Ingredion Incorporated, Prinova Group (Nagase Group), and Symrise AG |

| Additional Attributes | Market revenues segmented by source, peptide type, form, and end-use; rising demand for bioactive and cosmetic-grade peptides; expansion of functional food and nutraceutical applications; increasing role of contract manufacturing and B2B supply; sustainability and clean-label certifications shaping competitiveness; innovations in controlled-release formats and encapsulation technologies; regional growth led by Asia-Pacific and Latin America; clinical validation and R&D driving therapeutic peptide adoption. |

The global Plant Peptides is estimated to be valued at USD 850.0 million in 2025.

The market size for the Plant Peptides is projected to reach USD 2,663.6 million by 2035.

The Plant Peptides is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key peptide types in the plant peptides Market include nutritional plant peptides, bioactive plant peptides, cosmetic-grade peptides, and therapeutic/functional peptide.

In terms of source, the Soy segment is projected to command the largest share at 28.3% of the plant peptides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA