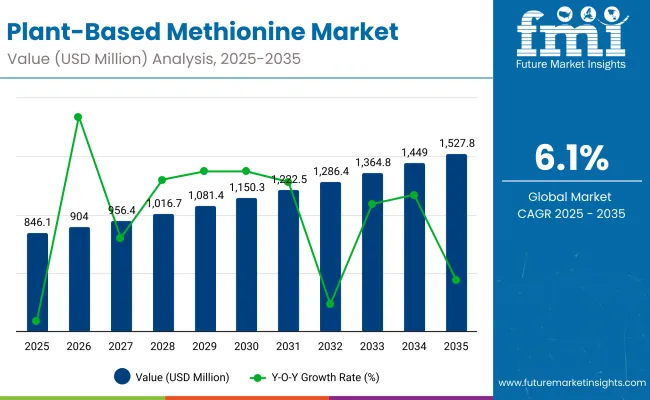

The Plant-Based Methionine Market is expected to record a valuation of USD 0.85 billion in 2025 and USD 1.53 billion in 2035, with an increase of USD 0.68 billion, which equals a growth of ~80.6% over the decade. The overall expansion represents a 6.1% CAGR and nearly a 2X increase in market size.

Plant-based methionine Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 0.85 billion |

| Market Forecast Value in (2035F) | USD 1.53 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

During the first five-year period from 2025 to 2030, the market rises from USD 0.85 billion to USD 1.15 billion, adding USD 0.30 billion, which accounts for 45% of the total decade growth. This phase records steady adoption in poultry feed, ruminant feed, and aquaculture feed, driven by the need for enhanced animal productivity and sustainable protein supply. Soy-derived methionine dominates this period as it caters to over a quarter of global applications, supported by established fermentation processes and cost efficiencies.

The second half from 2030 to 2035 contributes USD 0.38 billion, equal to 55% of total growth, as the market jumps from USD 1.15 billion to USD 1.53 billion. This acceleration is powered by the widespread deployment of algae- and legume-derived methionine, supported by biotechnology breakthroughs and demand for non-GMO alternatives. Algae-derived methionine, with the fastest CAGR of 8.3%, becomes a critical innovation driver. Increased uptake in Europe and Asia-Pacific, alongside precision livestock management, further amplifies the expansion.

From 2020 to 2024, the Plant-Based Methionine Market expanded steadily, rising from a niche valuation below USD 0.70 billion to USD 0.85 billion in 2025, largely driven by fermentation-based production platforms. During this period, the competitive landscape was dominated by established feed additive manufacturers, who collectively controlled nearly 70-75% of global revenue. Leaders such as CJ CheilJedang, Evonik, Adisseo, and Novus International focused on scaling precision fermentation and enzymatic conversion technologies, particularly for poultry and ruminant feed applications. Competitive differentiation relied heavily on cost efficiency, consistent amino acid yield, and integration into compound feed formulations, while smaller innovators struggled to compete on economies of scale. Service-based offerings, such as nutritional formulation support and digital feed optimization tools, contributed less than 10% of the overall market value.

By 2025, demand for plant-based methionine is projected to reach USD 0.85 billion, and the revenue mix is shifting toward specialty applications and functional nutrition segments. Traditional leaders face mounting competition from biotech-driven entrants such as METEX NØØVISTAGO, GreenLab Mexico, and Prinova, who are leveraging synthetic biology, fermentation optimization, and algae-derived production to expand product portfolios. Major incumbents are pivoting to hybrid business models, integrating feed analytics, sustainability scoring, and traceability solutions to maintain relevance in a changing market. Emerging players specializing in non-GMO legume-based methionine, algae-sourced formulations, and digital integration platforms are gaining traction. Competitive advantage is moving away from volume-driven methionine supply alone to ecosystem strength, biotechnology leadership, and recurring partnerships with feed manufacturers.

Advances in fermentation and enzymatic conversion technologies have enhanced the yield, purity, and cost-efficiency of plant-based methionine, making it a viable alternative to synthetic counterparts. Soy- and corn-derived methionine remain the backbone of production, while legume- and algae-derived methionine are gaining traction due to their sustainability profile and ability to integrate into non-GMO and specialty feed markets. As feed manufacturers demand precise amino acid balancing, plant-derived methionine offers a cleaner, eco-friendly pathway that aligns with both regulatory frameworks and consumer-driven sustainability preferences.

The expansion of poultry, aquaculture, and ruminant feed industries has further fueled market growth, as methionine is indispensable for protein synthesis, feather development, milk yield, and immunity support. Functional attributes such as antioxidant and reproductive health benefits are creating new application opportunities beyond basic growth promotion. Segment growth is expected to be led by L-Methionine formulations, poultry feed applications, and fermentation-derived production methods, owing to their scalability and adaptability to diverse feed systems.

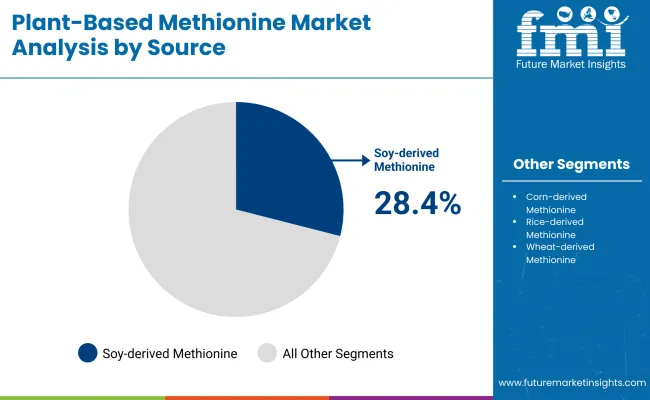

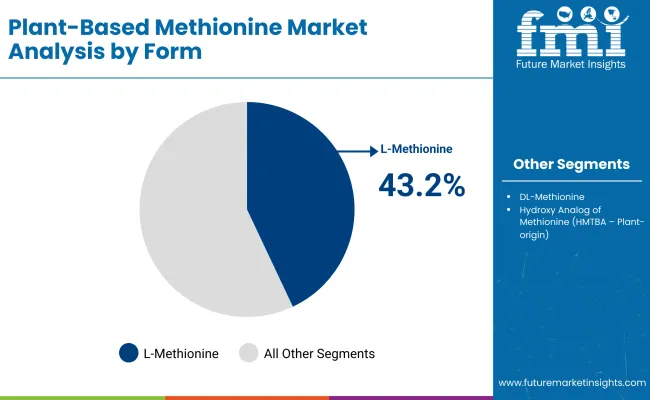

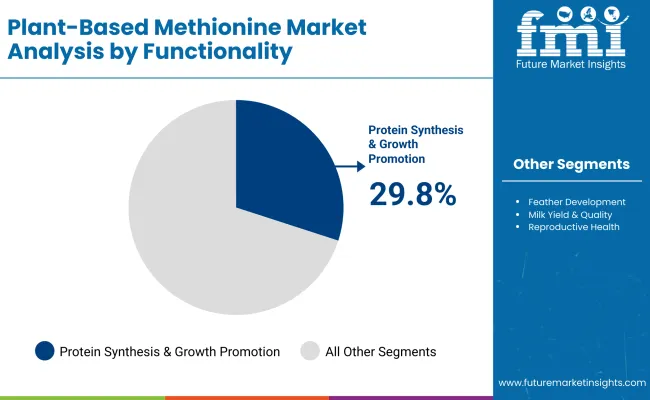

The Plant-Based Methionine Market is segmented by source, form, functionality, application, end-use feed type, production method, sales channel, and region. By source, it includes soy, corn, rice, wheat, potato, legume, and algae-derived methionine, offering varied nutritional and sustainability benefits. In form, the market is divided into L-Methionine, DL-Methionine (plant-origin), and HMTBA, with L-Methionine leading. Functionality spans protein synthesis, feather development, milk yield, reproductive health, immunity, and antioxidant roles, underscoring methionine’s broad impact on animal health. Applications cover poultry, swine, ruminant, aquaculture, and pet food. End-use feed types include compound feed, premixes, and supplements, while production methods range from fermentation and enzymatic conversion to protein hydrolysate extraction. Sales occur directly, through distributors, and via online B2B platforms. Regionally, adoption is strong in North America and Europe, with Asia-Pacific, led by China and India, showing the fastest growth.

| Source Segment | Market Value Share, 2025 |

|---|---|

| Soy-derived Methionine | 28.40% |

| Corn-derived Methionine | 18.70% |

| Rice-derived Methionine | 11.20% |

| Wheat-derived Methionine | 9.80% |

| Potato-derived Methionine | 6.90% |

| Legume-derived Methionine | 15.60% |

| Algae-derived Methionine | 9.40% |

Soy-derived methionine held 28.4% of the market share in 2025, making it the dominant source of plant-based methionine. Its leadership is driven by established fermentation platforms, cost-effectiveness, and widespread adoption in poultry and ruminant feed. Corn-derived methionine accounts for 18.7%, while rice-derived contributes 11.2%, both reflecting strong scalability in feed applications. Emerging categories such as legume-derived methionine (15.6%) and algae-derived methionine (9.4%) are gaining momentum, supported by sustainability initiatives and biotechnology-driven innovations. Algae-derived, in particular, is projected to grow at the fastest CAGR of 8.3%, making it a future growth driver. The source segment highlights a balance between traditional large-volume feed ingredients (soy, corn) and innovation-driven alternatives (algae, legumes).

| Form Segment | Market Value Share, 2025 |

|---|---|

| L-Methionine | 43.20% |

| DL-Methionine (Plant-origin) | 38.10% |

| Hydroxy Analog of Methionine (HMTBA - Plant-origin) | 18.70% |

L-Methionine dominates the form segment with 43.2% share in 2025, supported by its critical role in protein synthesis, improved digestibility, and extensive application in poultry and ruminant feed. DL-Methionine (38.1%) follows closely, offering a cost-efficient solution for diverse feed applications, while the Hydroxy Analog of Methionine (HMTBA) holds 18.7% and shows a higher growth potential with a CAGR of 6.9%. This segment reflects the growing preference for precision amino acid supplementation, with L-Methionine expected to retain leadership due to its superior bioavailability. The rising demand for HMTBA underscores the industry’s shift toward advanced, performance-enhancing methionine formulations that cater to specialized nutritional needs.

| Functionality Segment | Market Value Share, 2025 |

|---|---|

| Protein Synthesis & Growth Promotion | 29.80% |

| Feather Development (Poultry) | 17.50% |

| Milk Yield & Quality (Ruminants) | 16.40% |

| Reproductive Health | 12.30% |

| Immunity Support | 14.60% |

| Antioxidant Function | 9.40% |

Protein synthesis and growth promotion account for 29.8% of the market share in 2025, making it the leading functionality for plant-based methionine. Its dominance is attributed to the central role methionine plays in muscle development and productivity enhancement across livestock species. Feather development in poultry contributes 17.5%, while milk yield and quality improvement in ruminants holds 16.4%, reflecting critical roles in poultry and dairy industries. Other functions, including reproductive health (12.3%), immunity support (14.6%), and antioxidant function (9.4%), are expanding steadily, with antioxidant function recording the fastest growth at a CAGR of 7.0%. This highlights methionine’s evolution beyond core growth promotion into functional health and wellness applications, particularly in enhancing immunity and stress resilience in animals.

Sustainability-Driven Industry Adoption and Feed Integration

The Plant-Based Methionine Market is gaining traction across livestock industries, particularly in poultry, aquaculture, and ruminant nutrition, where amino acid balance is critical for productivity and health. Producers are increasingly adopting soy- and corn-derived methionine due to scalability, while legume- and algae-derived alternatives are rising as sustainable solutions. Integration into compound feed, premixes, and supplements ensures broad market uptake. Plant-based methionine also aligns with global regulatory pushes to reduce synthetic additives, enabling cleaner labels and eco-friendly feed formulations. Functionally, its role in protein synthesis, feather growth, milk yield, immunity, and antioxidant defense underscores its indispensability in modern feed strategies. As pet food and specialty feed applications grow, demand for plant-based sources is expanding beyond traditional livestock.

Cost Constraints and Complexity in Production Utilization

While adoption is rising, plant-based methionine faces significant cost barriers. Fermentation and enzymatic conversion processes require advanced infrastructure, continuous R&D, and high-quality substrates, driving up production costs relative to synthetic methionine. Limited economies of scale further restrict smaller innovators from competing with large incumbents. Feed manufacturers in price-sensitive regions face challenges integrating higher-cost plant-based methionine, especially where conventional alternatives remain cheaper. Additionally, ensuring consistent amino acid yield, bioavailability, and stability across feed types adds technical complexity. The fragmented supply chain, reliance on specific feedstocks (soy, legumes, algae), and compliance with non-GMO and organic certifications raise both capital and operational burdens, slowing wider adoption among mid- and small-scale feed players.

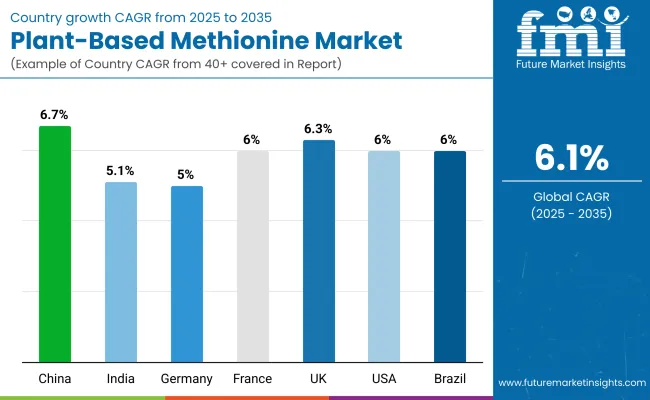

| Countries | CAGR |

|---|---|

| China | 6.72% |

| India | 5.14% |

| Germany | 5.04% |

| France | 6.01% |

| UK | 6.31% |

| USA | 6.50% |

| Brazil | 6.08% |

The Plant-Based Methionine Market shows regional disparities shaped by livestock intensity, sustainability mandates, and feed modernization. Asia-Pacific is the fastest-growing region, led by China (6.7% CAGR) with strong poultry and aquaculture demand, and India (5.1% CAGR) supported by dairy and poultry expansion. Europe maintains a robust profile, driven by Germany (5.0%), France (6.0%), and the UK (6.3%), reflecting stringent animal welfare rules and non-GMO feed preferences. North America grows steadily at 6.5% CAGR in the USA, with emphasis on organic and sustainable feed. Latin America, led by Brazil (6.1%), benefits from poultry exports, while MEA (3% share) shows gradual adoption through government livestock programs. Collectively, Asia-Pacific and Europe emerge as key growth engines, while North America remains a stable, innovation-driven market.

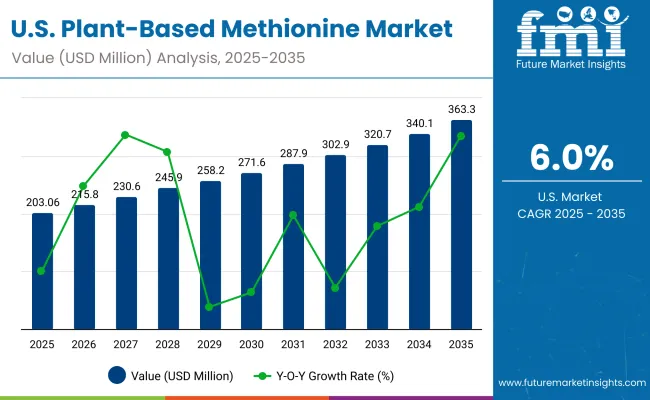

| Year | USA Plant-Based Methionine Market (USD Million) |

|---|---|

| 2025 | 203.06 |

| 2026 | 215.8 |

| 2027 | 230.6 |

| 2028 | 245.9 |

| 2029 | 258.2 |

| 2030 | 271.6 |

| 2031 | 287.9 |

| 2032 | 302.9 |

| 2033 | 320.7 |

| 2034 | 340.1 |

| 2035 | 363.3 |

The Plant-Based Methionine Market in the United States is projected to grow at a CAGR of 6.5%, supported by strong demand from poultry, dairy, and pet food industries. Growth is led by large-scale poultry production and rising consumer preference for sustainable, plant-origin amino acids. The USA feed industry is increasingly integrating fermentation-derived L-Methionine into compound feed and premixes to enhance animal productivity while meeting regulatory and clean-label standards. Pet food manufacturers are also driving adoption, leveraging methionine’s roles in immunity support, reproductive health, and antioxidant benefits to differentiate premium formulations. Precision livestock management and sustainability certifications further support uptake across the USA market.

The Plant-Based Methionine Market in the United Kingdom is projected to grow at a CAGR of 6.3%, driven by rising adoption in poultry, dairy, and premium pet food segments. Poultry producers are accelerating the use of L-Methionine to improve feed efficiency and enhance feather development in line with welfare and performance standards. The dairy sector is increasingly integrating plant-origin methionine into ruminant feed to improve milk yield and reproductive health. At the same time, the UK’s growing pet food industry, which emphasizes natural and functional ingredients, is expanding opportunities for algae- and legume-derived methionine. Government sustainability mandates and public-private nutrition initiatives are further supporting broader adoption across feed applications.

The Plant-Based Methionine Market in India is forecast to expand at a CAGR of 5.1% through 2035, driven by the rapid growth of poultry and dairy sectors. Adoption is spreading from major production hubs to tier-2 and tier-3 cities, supported by cost reductions in fermentation-derived methionine and greater awareness among feed manufacturers. Poultry feed suppliers are integrating soy- and corn-based methionine to enhance growth efficiency, while the dairy sector is adopting methionine to improve milk yield and reproductive health in ruminants. Educational and vocational programs are also beginning to introduce sustainable feed formulation training, further raising awareness of plant-based amino acid applications.

The Plant-Based Methionine Market in China is projected to grow at a CAGR of 6.7%, the highest among leading economies, supported by the country’s dominant poultry, aquaculture, and swine industries. Growth is fueled by smart feed factory rollouts, government nutrition mandates, and innovation by local biotech firms. Demand for methionine is rising in automated feed production lines for both industrial poultry and aquaculture farms. Municipal programs are also encouraging sustainable feed formulations to align with national food security goals. Affordable production by domestic players, coupled with increasing adoption in pet food, specialty feed, and functional health formulations, is making plant-based methionine more widely accessible across China’s feed industry.

| Countries | 2025 |

|---|---|

| UK | 18.10% |

| Germany | 20.81% |

| Italy | 10.34% |

| France | 13.45% |

| Spain | 10.48% |

| BNELUX | 6.64% |

| Nordic | 5.29% |

| Rest of Europe | 15% |

| Countries | 2035 |

|---|---|

| UK | 20.77% |

| Germany | 20.61% |

| Italy | 11.10% |

| France | 12.97% |

| Spain | 10.39% |

| BNELUX | 5.31% |

| Nordic | 5.46% |

| Rest of Europe | 13% |

The Plant-Based Methionine Market in Germany is projected to grow at a CAGR of 5.0%, underpinned by the country’s leadership in precision livestock farming and advanced feed technologies. German feed manufacturers are integrating fermentation-derived L-Methionine into poultry and ruminant feed to comply with strict EU sustainability and animal welfare standards. The dairy sector is increasingly adopting methionine to improve milk yield and reproductive health, while poultry producers are focusing on enhanced feather development and feed efficiency. Germany’s strong compliance culture and commitment to non-GMO formulations are accelerating demand for legume- and algae-derived methionine, particularly in premium feed and pet food applications.

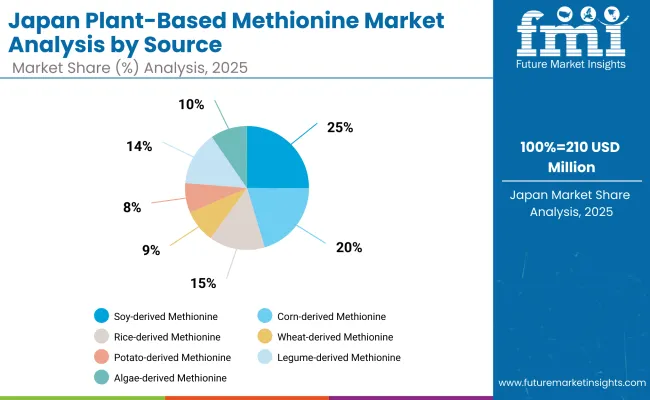

| Source Segment | Market Value Share, 2025 |

|---|---|

| Soy-derived Methionine | 25.10% |

| Corn-derived Methionine | 20.30% |

| Rice-derived Methionine | 14.60% |

| Wheat-derived Methionine | 8.50% |

| Potato-derived Methionine | 7.80% |

| Legume-derived Methionine | 14.10% |

| Algae-derived Methionine | 9.60% |

The Plant-Based Methionine Market in Japan is projected at USD 0.21 billion in 2025, with soy-derived methionine holding 25.1% share, followed by corn-derived at 20.3% and legumes at 14.1%. The country shows a balanced adoption of multiple sources, with algae-derived methionine recording the fastest growth at 7.5% CAGR. This reflects Japan’s strong focus on biotechnology-driven nutrition and its commitment to functional, sustainable feed additives. Demand is being driven by the poultry and aquaculture industries, alongside a rising emphasis on pet nutrition formulations. The integration of plant-origin methionine into premium feed is supported by regulatory encouragement of non-GMO and sustainable protein sources, aligning with Japan’s broader food security and animal welfare policies.

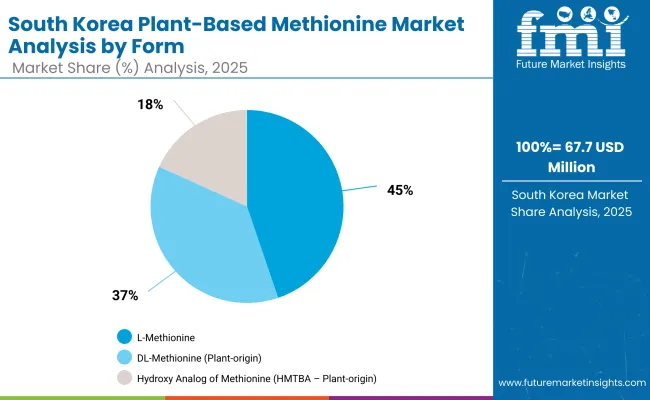

| Form Segment | Market Value Share, 2025 |

|---|---|

| L-Methionine | 44.80% |

| DL-Methionine (Plant-origin) | 37.00% |

| Hydroxy Analog of Methionine (HMTBA - Plant-origin) | 18.20% |

The Plant-Based Methionine Market in South Korea is valued at USD 67.7 million in 2025 and is projected to reach around USD 122.2 million by 2035. By form, L-Methionine holds 44.8% share in 2025 at a CAGR of 6.2%, DL-Methionine accounts for 37.0% at 6.0% CAGR, and Hydroxy Analog of Methionine (HMTBA) represents 18.2% at the fastest CAGR of 6.5%. This reflects South Korea’s advanced feed industry, where poultry and swine remain dominant users of amino acid supplementation. L-Methionine continues as the most widely adopted form due to digestibility benefits, while DL-Methionine remains a cost-effective option. HMTBA is the fastest-growing segment, favored for its enhanced bioavailability and alignment with precision nutrition practices. Rising demand in aquaculture and premium pet food further supports the expansion of plant-based methionine across the South Korean market.

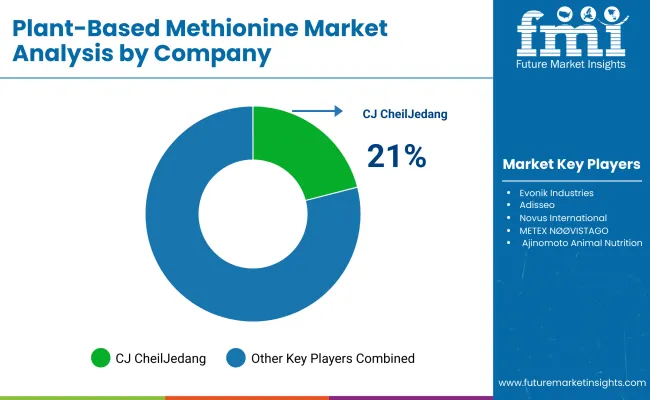

The Plant-Based Methionine Market is moderately fragmented, with global feed additive leaders, mid-sized innovators, and specialized biotech firms competing across animal nutrition applications. Global leaders such as CJ CheilJedang, Evonik, and Adisseo hold significant market share, driven by strong fermentation platforms, large-scale production capacity, and integration into poultry and ruminant feed supply chains. Their strategies increasingly emphasize sustainability-driven methionine production, fermentation optimization, and partnerships with global feed manufacturers to secure volume growth.

Established mid-sized players, including Novus International, METEX NØØVISTAGO, and Ajinomoto Animal Nutrition, cater to the demand for innovative solutions such as HMTBA formulations, enzymatic conversion, and legume-derived methionine. These companies are accelerating adoption by positioning plant-based methionine as a performance enhancer in poultry, dairy, and aquaculture feed, while expanding presence in emerging markets with lower-cost alternatives.

Specialized innovators, such as GreenLab Mexico, Prinova Group, and Meihua Holdings, are focused on algae-based methionine, non-GMO legume-derived solutions, and biotechnology-driven production. Their strength lies in customization, sustainability positioning, and regional adaptability, rather than global scale.

Competitive differentiation is shifting away from synthetic methionine and volume-driven models toward ecosystem strength, biotech innovation, and recurring partnerships with feed and pet food manufacturers. As regulatory and consumer pressures for sustainable and functional feed additives intensify, the ability to deliver high-purity, plant-origin methionine with functional health benefits will define long-term competitive advantage.

Key Developments in the Plant-Based Methionine Market

| Item | Value |

|---|---|

| Quantitative Units | USD 0.85 billion |

| Source | Soy-derived, Corn-derived, Rice-derived, Wheat-derived, Potato-derived, Legume-derived (pea, lentil), and Algae-derived Methionine |

| Form | L-Methionine, DL-Methionine (Plant-origin), Hydroxy Analog of Methionine (HMTBA - Plant-origin) |

| Functionality | Protein synthesis & growth promotion, Feather development (poultry), Milk yield & quality (ruminants), Reproductive health, Immunity support, Antioxidant function |

| Application | Poultry feed, Swine feed, Ruminant feed, Aquaculture feed, Pet food |

| End-use Feed Type | Compound feed, Premixes, Supplements |

| Production Method | Fermentation-derived (plant substrate), Enzymatic conversion, Extraction & purification from plant protein hydrolysates |

| Sales Channels | Direct to feed manufacturers, Distributors & agents, Online B2B platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CJ CheilJedang, Evonik Industries, Adisseo (BlueStar Adisseo), Novus International, METEX NØØVISTAGO, Ajinomoto Animal Nutrition, GreenLab Mexico, Prinova Group, Meihua Holdings Group |

| Additional Attributes | Dollar sales by source, form, and application; adoption trends in poultry, dairy, aquaculture, and pet food; functional benefits in immunity and reproductive health; biotechnology-led algae & legume methionine growth; regulatory drivers in Europe; sustainability-linked premium feed demand; and innovations in fermentation & enzymatic production. |

The global Plant-Based Methionine Market is estimated to be valued at USD 0.85 billion in 2025.

The market size for the Plant-Based Methionine Market is projected to reach USD 1.53 billion by 2035.

The Plant-Based Methionine Market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are L-Methionine, DL-Methionine (plant-origin), and Hydroxy Analog of Methionine (HMTBA).

In terms of source, Soy-derived methionine will command 28.4% share in 2025, while Algae-derived methionine will grow fastest at 8.3% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methionine Market Growth - Trends & Forecast through 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA