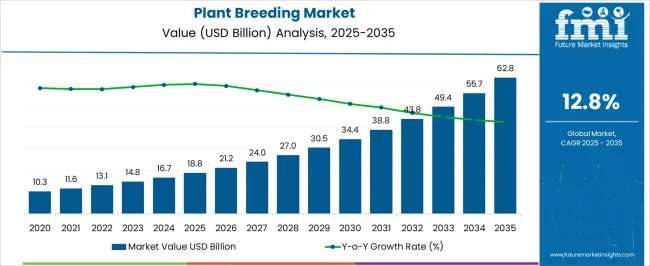

The plant breeding market is projected to grow from USD 18.8 billion in 2025 to USD 62.8 billion in 2035, reflecting a CAGR of 12.8%. This represents an absolute dollar opportunity of USD 44.0 billion over the decade. The market is expected to expand rapidly, reaching USD 21.2 billion in 2026, USD 27.0 billion in 2029, USD 34.4 billion in 2031, and USD 55.7 billion in 2034. The robust growth trajectory highlights increasing demand for improved crop varieties and high-yield solutions, offering stakeholders significant opportunities to capture incremental revenue and strengthen their market presence across the forecast period.

From an absolute dollar perspective, annual incremental growth starts at approximately USD 2.4–2.5 billion in the early years and accelerates to over USD 7 billion in the later stages, culminating in USD 44.0 billion by 2035. Intermediate benchmarks, such as USD 16.7 billion in 2025, USD 30.5 billion in 2030, and USD 49.4 billion in 2033, illustrate major inflection points along the growth path.

| Metric | Value |

|---|---|

| Plant Breeding Market Estimated Value in (2025 E) | USD 18.8 billion |

| Plant Breeding Market Forecast Value in (2035 F) | USD 62.8 billion |

| Forecast CAGR (2025 to 2035) | 12.8% |

Continuing with the plant breeding market, a breakpoint analysis highlights key phases of accelerated growth. Between 2025 and 2027, the market rises from USD 18.8 billion to USD 21.2 billion, marking the early growth phase where moderate adoption and initial investments drive incremental gains. Another critical breakpoint occurs around 2029–2031, as the market grows from USD 27.0 billion to USD 34.4 billion, reflecting a period of faster expansion and higher absolute dollar growth. These stages are pivotal for manufacturers and investors to align production, optimize supply chains, and capture revenue during periods of increasing demand. The final major breakpoint is observed between 2033 and 2035, when the market surges from USD 49.4 billion to USD 62.8 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 30.5 billion to USD 43.8 billion, acting as bridging periods that sustain momentum. Identifying these breakpoints enables stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential.

The market is experiencing robust growth driven by the increasing need for improved crop yields and sustainable agricultural practices. Current trends emphasize the integration of advanced breeding techniques that enhance crop resilience against climate change, pests, and diseases.

Investment in genetic research and biotechnology is facilitating the development of varieties that meet the growing global food demand. The future outlook is shaped by the expanding adoption of precision agriculture, government initiatives promoting food security, and the rising awareness among farmers about high-performing crop varieties.

The market is also benefiting from innovations that reduce breeding cycles and improve genetic gain. With the agricultural sector under continuous pressure to balance productivity with environmental impact, plant breeding remains a critical area for innovation, enabling the development of crops tailored to diverse agro-ecological zones and evolving consumer preferences.

The plant breeding market is segmented by type, trait, application, cereals & grains sub, oilseeds & pulses sub, fruits & vegetables sub, others, and geographic regions. By type, plant breeding market is divided into Traditional Breeding and Biotechnological Breeding. In terms of trait, plant breeding market is classified into Herbicide Tolerance, Disease Resistance, Insect Resistance, Yield Improvement, and Others.

Based on application, plant breeding market is segmented into Cereals & Grains, Maize (Corn), Wheat, Rice, Barley, and Others. By cereals & grains sub, plant breeding market is segmented into Maize (Corn), Wheat, Rice, Barley, Others, Oilseeds & Pulses, Fruits & Vegetables, and Others. By oilseeds & pulses sub, plant breeding market is segmented into Soybean, Canola, Sunflower, Peas, Lentils, and Others.

By fruits & vegetables sub, plant breeding market is segmented into Tomato, Potato, Lettuce, Cabbage, Strawberry, and Others. By others, plant breeding market is segmented into Turf & Ornamentals and Forage Crops. Regionally, the plant breeding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

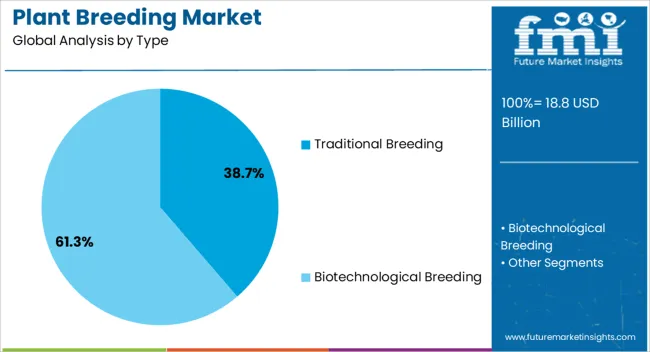

The Traditional Breeding segment is projected to hold 38.7% of the Plant Breeding market revenue share in 2025, making it the leading type. This prominence is attributed to its long-established methodologies that have been optimized over decades to deliver reliable improvements in crop traits.

Traditional breeding is favored due to its cost-effectiveness and broad acceptance among regulatory bodies and farmers. Its adaptability to various crops and environments has ensured continued relevance even as modern biotechnologies advance.

The segment benefits from strong institutional knowledge and infrastructure, facilitating large-scale breeding programs worldwide. Additionally, traditional breeding methods provide foundational germplasm that supports the integration of newer techniques, thereby reinforcing its critical role in the breeding landscape.

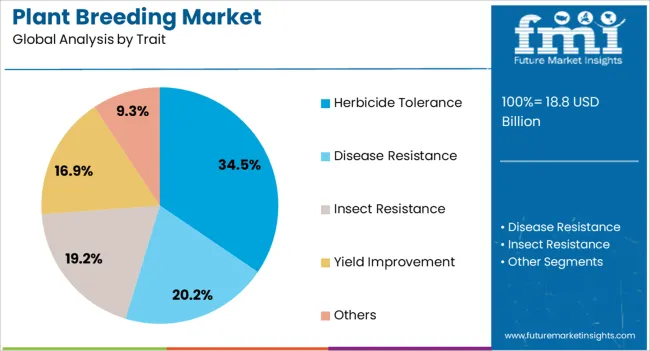

The Herbicide Tolerance trait segment is expected to account for 34.5% of the market revenue share in 2025, reflecting its significant role in plant breeding advancements. This segment’s growth is driven by the demand for crop varieties that enable efficient weed management, reducing labor and chemical usage while maintaining yield stability.

The widespread adoption of herbicide-tolerant crops allows farmers to apply selective herbicides without damaging the crop, improving field productivity and operational efficiency. Regulatory frameworks that support the use of such traits and the increasing emphasis on sustainable agricultural practices have further propelled this segment.

As herbicide resistance in weeds becomes a global challenge, the development of improved herbicide-tolerant varieties remains essential for effective crop management.

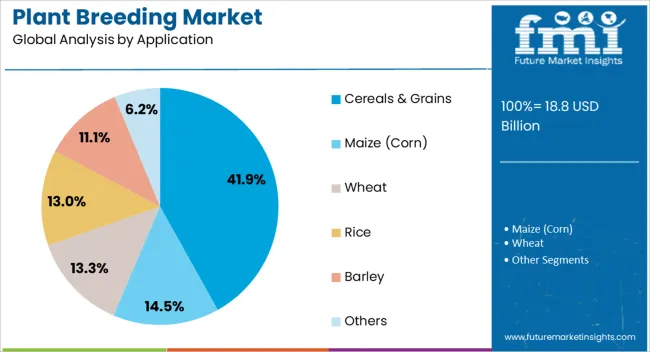

The Cereals and Grains application segment holds 41.9% of the Plant Breeding market revenue in 2025, establishing it as the largest application area. This dominance is owed to the high global demand for staple food crops such as wheat, rice, and maize, which form the basis of food security in many regions.

Breeding efforts in cereals and grains focus on improving yield potential, stress tolerance, and nutritional quality to meet the needs of a growing population. The extensive cultivation area and the economic importance of these crops further support the segment’s growth.

Additionally, breeding programs targeting cereals and grains benefit from well-developed research networks and germplasm repositories, enabling continuous improvement. As climate variability intensifies, the development of resilient cereal and grain varieties is becoming increasingly critical, sustaining the segment’s leading market position.

The plant breeding market is expanding as biotechnology, genomics, and molecular breeding techniques enable the development of high-yield, disease-resistant, and climate-resilient crops. Advanced methods such as CRISPR gene editing, marker-assisted selection, and genomic selection accelerate breeding cycles and improve precision. Rising demand for sustainable agriculture, improved food security, and crop diversification support market growth.

Seed companies and agricultural research institutions offering high-performance hybrid and genetically enhanced varieties gain a competitive edge. Integration of bioinformatics, phenotyping platforms, and AI-driven predictive modeling enhances breeding efficiency. These technological trends allow breeders to respond to changing environmental conditions, pest pressures, and consumer preferences while supporting global initiatives for agricultural sustainability and productivity.

Market growth is restrained by high R&D costs and complex regulatory frameworks. Developing new crop varieties requires significant investment in laboratory research, field trials, and multi-year evaluation programs. Regulatory approvals for genetically modified organisms (GMOs) and new cultivars involve rigorous safety assessments, environmental impact studies, and compliance with regional agricultural policies. Intellectual property protection, seed licensing, and patent disputes further complicate market entry for smaller firms.

Additionally, field testing is subject to climatic variability and soil conditions, adding risk to breeding programs. Until cost-effective breeding strategies and streamlined regulatory pathways are widely available, adoption of advanced plant breeding solutions may remain concentrated among large seed producers, agricultural biotechnology companies, and well-funded research institutions.

Technological innovations are shaping trends in the plant breeding market. Gene editing tools, high-throughput phenotyping, and genomic selection enable precise development of crop traits such as drought tolerance, nutrient efficiency, and pest resistance. Integration of digital agriculture platforms, remote sensing, and AI-driven predictive analytics allows breeders to monitor crop performance, environmental responses, and genetic potential in real-time.

Hybrid breeding, speed breeding, and polyploidy techniques further accelerate variety development. These advancements increase efficiency, reduce time to market, and optimize resource utilization. The convergence of genomics, automation, and digital analytics is creating a more agile and data-driven plant breeding ecosystem that meets the growing demand for sustainable and resilient crop production.

Opportunities in the plant breeding market are fueled by increasing global population, changing dietary preferences, and climate change. Higher demand for staple crops, fruits, vegetables, and biofuel feedstocks requires varieties with improved yield, quality, and resilience. Extreme weather, shifting rainfall patterns, and evolving pest pressures drive the need for stress-tolerant crops.

Emerging markets with growing agricultural sectors and governments supporting food security initiatives present significant growth potential. Breeding companies offering locally adapted, high-performance varieties and collaborative programs with research institutions and farmers can capture market share. Additionally, demand for functional foods, organic crops, and specialty cultivars creates niche opportunities for innovative plant breeding solutions.

Fragmented competition, complex intellectual property landscapes, and adoption challenges restrain market growth. Global and regional seed companies compete on traits, yield, and technological integration, affecting pricing and margins. Patent disputes, licensing restrictions, and proprietary technologies can limit access for smaller breeders. Farmers may be hesitant to adopt genetically improved or hybrid seeds due to cost, traditional practices, or lack of awareness. Additionally, regulatory variability across countries increases compliance complexity. Until plant breeding solutions become more accessible, affordable, and standardized, market adoption may remain concentrated in large-scale commercial agriculture, agribusiness-driven research programs, and regions with supportive regulatory and financial environments.

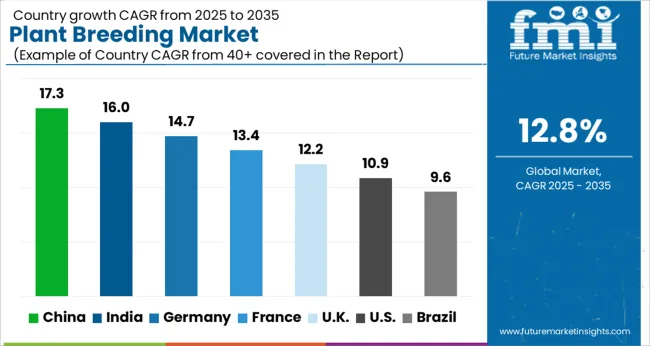

| Country | CAGR |

|---|---|

| China | 17.3% |

| India | 16.0% |

| Germany | 14.7% |

| France | 13.4% |

| UK | 12.2% |

| USA | 10.9% |

| Brazil | 9.6% |

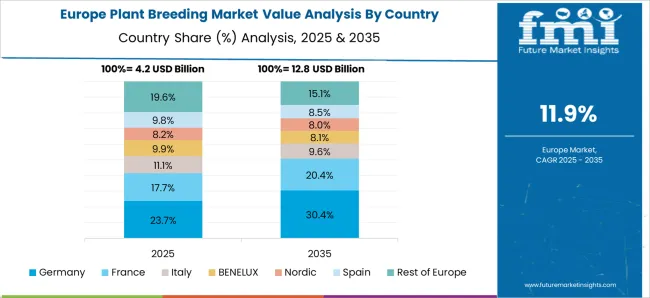

The global plant breeding market was projected to grow at a 12.8% CAGR through 2035, driven by demand in crop improvement, hybrid seed production, and agricultural biotechnology applications. Among BRICS nations, China recorded 17.3% growth as large-scale research and breeding facilities were commissioned and compliance with agricultural and safety standards was enforced, while India at 16.0% growth saw expansion of production and research units to meet rising regional agricultural demand. In the OECD region, Germany at 14.7% maintained substantial output under strict industrial and regulatory guidelines, while the United Kingdom at 12.2% relied on moderate-scale operations for crop breeding and seed development applications. The USA, expanding at 10.9%, remained a mature market with steady demand across commercial and research-driven plant breeding segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The plant breeding market in China is growing at a CAGR of 17.3% due to increasing demand for high yield, disease resistant, and climate resilient crop varieties. Agricultural organizations, seed companies, and research institutes are adopting modern plant breeding techniques including hybridization, molecular breeding, and genomic selection. Growth is supported by rising food demand, agricultural modernization, and government programs promoting improved crop productivity. Suppliers provide seeds, breeding technologies, and biotechnological tools to enhance crop performance and yield. Distribution through seed companies, agricultural cooperatives, and research institutes ensures wide accessibility. Adoption is further driven by the need for sustainable production, quality improvement, and competitive agricultural practices. China remains a leading market due to its large agricultural sector, investment in modern plant breeding technologies, and focus on food security and productivity improvement initiatives.

India is witnessing growth at a CAGR of 16.0% in the plant breeding market due to increasing demand for high yield, pest resistant, and climate tolerant crop varieties. Farmers, seed companies, and agricultural research institutes are adopting hybridization, molecular breeding, and genomic selection techniques to improve crop performance. Growth is supported by government initiatives promoting modern agriculture, rising food demand, and agricultural infrastructure development. Suppliers provide seeds, breeding technologies, and biotechnology tools tailored for various crops and climatic conditions. Distribution through seed companies, agricultural cooperatives, and research institutes ensures market accessibility. Adoption is further driven by the need for improved productivity, resilience against climate challenges, and food security. India continues to see strong growth as agricultural modernization and research investments accelerate plant breeding adoption across the country.

Germany is growing at a CAGR of 14.7% in the plant breeding market due to rising demand for high quality, disease resistant, and climate adapted crop varieties. Seed companies, agricultural research institutes, and farming organizations are adopting modern plant breeding techniques including hybridization, molecular breeding, and genomic selection. Growth is supported by increasing investment in agricultural research, demand for sustainable production, and focus on food security. Suppliers provide high performance seeds, breeding technologies, and biotechnology solutions to improve yield and quality. Distribution through seed distributors, cooperatives, and research centers ensures accessibility. Adoption is further driven by regulatory support, agricultural modernization, and emphasis on crop resilience and quality improvement. Germany remains a key European market due to its strong agricultural research ecosystem and focus on innovation in plant breeding.

The United Kingdom market is expanding at a CAGR of 12.2% due to rising adoption of modern plant breeding techniques for high yield, disease resistant, and climate tolerant crop varieties. Seed companies, research institutes, and farmers are implementing hybridization, molecular breeding, and genomic selection to improve productivity and crop resilience. Suppliers provide advanced seeds, breeding technologies, and biotechnological tools suitable for various crops and climatic conditions. Growth is supported by government programs promoting modern agriculture, rising food demand, and investment in agricultural research. Distribution through seed distributors, cooperatives, and research centers ensures widespread accessibility. Adoption is further driven by the need for sustainable production, quality improvement, and food security initiatives. The United Kingdom continues to see steady growth as modern plant breeding becomes critical for competitive agriculture.

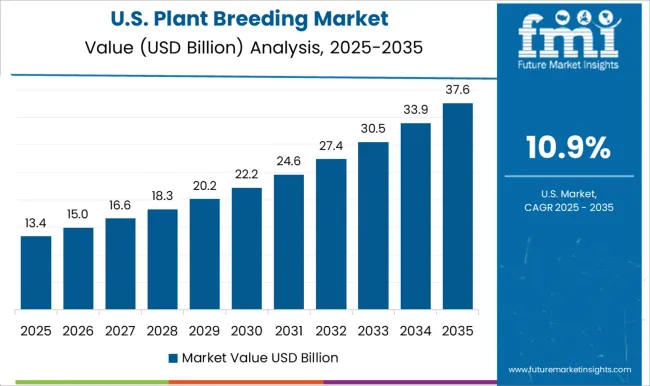

The United States market is growing at a CAGR of 10.9% due to increasing adoption of modern plant breeding techniques for high yield, pest resistant, and climate resilient crop varieties. Farmers, seed companies, and agricultural research institutions are utilizing hybridization, molecular breeding, and genomic selection to enhance productivity and crop quality. Growth is supported by investment in agricultural research, demand for sustainable and resilient crops, and government programs promoting improved seed varieties. Suppliers provide advanced seeds, breeding technologies, and biotechnology solutions for diverse crops and climatic conditions. Distribution through seed companies, agricultural cooperatives, and research institutes ensures market accessibility. Adoption is further driven by the need for food security, crop resilience, and efficiency improvements in agriculture. The United States remains a key market due to its large agricultural sector and investment in innovative plant breeding technologies.

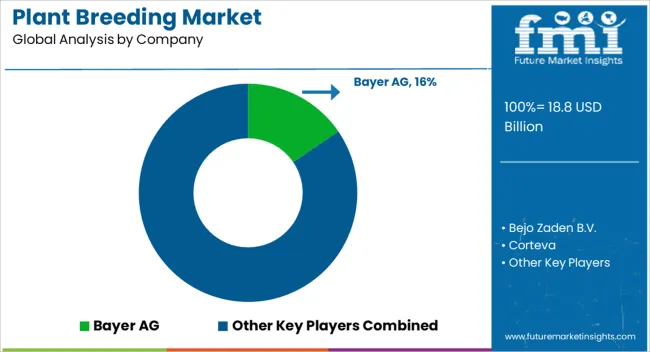

The plant breeding market is primarily served by companies such as Bayer AG, Bejo Zaden B.V., Corteva, Enza Zaden, KWS SAAT SE & Co. KGaA, Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel B.V, Sakata, Syngenta, and Takii Europe B.V. These suppliers focus on developing high-yielding and disease-resistant crop varieties across cereals, vegetables, fruits, and oilseeds. Technical literature highlights the use of advanced breeding techniques, including marker-assisted selection, hybridization, and genome editing, to improve crop quality, nutritional content, and environmental adaptability. Competition in the market is driven by genetic innovation, seed quality, and adaptability to local climates.

Bayer, Corteva, and Syngenta invest heavily in R&D to develop hybrid and genetically improved seeds that address farmer-specific needs. Companies like Bejo Zaden, Enza Zaden, and Rijk Zwaan specialize in vegetable breeding, offering varieties with enhanced shelf life and uniformity. Limagrain and KWS SAAT provide broad-spectrum cereal and maize seeds, often targeting large-scale agricultural operations. Market strategies emphasize regional adaptation, regulatory compliance, and farmer support services. Firms provide detailed planting guides, cultivation manuals, and agronomic support to maximize crop performance. Trends observed in the market include the integration of precision agriculture techniques with breeding programs, the development of climate-resilient varieties, and the expansion into emerging agricultural regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.8 Billion |

| Type | Traditional Breeding and Biotechnological Breeding |

| Trait | Herbicide Tolerance, Disease Resistance, Insect Resistance, Yield Improvement, and Others |

| Application | Cereals & Grains, Maize (Corn), Wheat, Rice, Barley, and Others |

| Cereals & Grains Sub | Maize (Corn), Wheat, Rice, Barley, Others, Oilseeds & Pulses, Fruits & Vegetables, and Others |

| Oilseeds & Pulses Sub | Soybean, Canola, Sunflower, Peas, Lentils, and Others |

| Fruits & Vegetables Sub | Tomato, Potato, Lettuce, Cabbage, Strawberry, and Others |

| Others | Turf & Ornamentals and Forage Crops |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bayer AG, Bejo Zaden B.V., Corteva, Enza Zaden, KWS SAAT SE & Co. KGaA, Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel B.V, Sakata, Syngenta, and Takii Europe B.V. |

| Additional Attributes | Dollar sales vary by technique, including conventional breeding, molecular breeding, and genome editing; by crop type, such as cereals & grains, fruits & vegetables, oilseeds, and pulses; by end-use industry, spanning agriculture, horticulture, and seed companies; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising food demand, climate-resilient crop development, and advancements in biotechnology. |

The global plant breeding market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the plant breeding market is projected to reach USD 62.8 billion by 2035.

The plant breeding market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in plant breeding market are traditional breeding, biotechnological breeding, _genetic engineering, _genome editing, _hybrid breeding and _others.

In terms of trait, herbicide tolerance segment to command 34.5% share in the plant breeding market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA