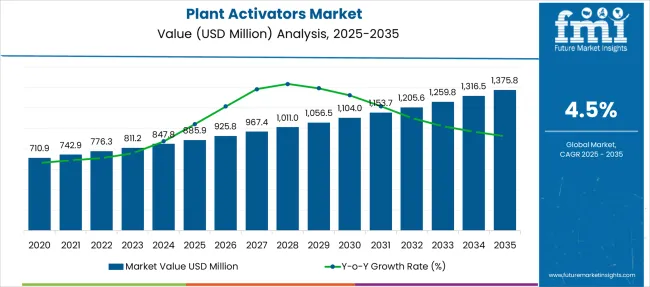

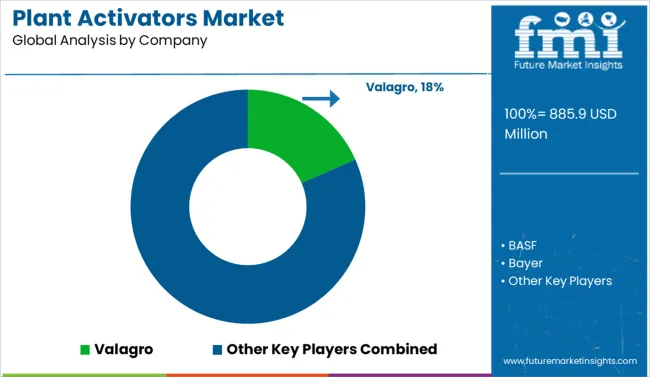

The Plant Activators Market is estimated to be valued at USD 885.9 million in 2025 and is projected to reach USD 1375.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Plant Activators Market Estimated Value in (2025 E) | USD 885.9 million |

| Plant Activators Market Forecast Value in (2035 F) | USD 1375.8 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The plant activators market is expanding steadily as agricultural systems worldwide prioritize crop resilience, yield enhancement, and sustainable farming practices. Increased pressure from climate variability, soil degradation, and pest outbreaks has driven demand for solutions that stimulate plant defense mechanisms without causing genetic modification.

Plant activators work by triggering innate immune responses, thereby supporting crop health against a wide range of stressors. Growing consumer demand for residue free produce and regulatory shifts favoring environmentally safe inputs are further accelerating adoption.

Investments in research on plant physiology and biostimulants have led to the development of more targeted and crop specific formulations. The future trajectory of the market is supported by a combination of precision agriculture practices, increased emphasis on organic farming, and government initiatives encouraging biological input adoption across global agricultural regions.

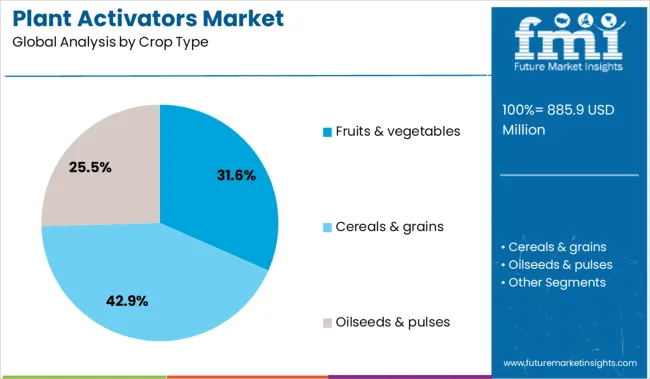

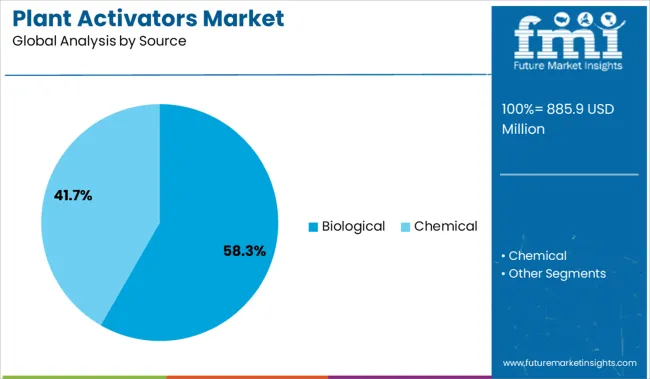

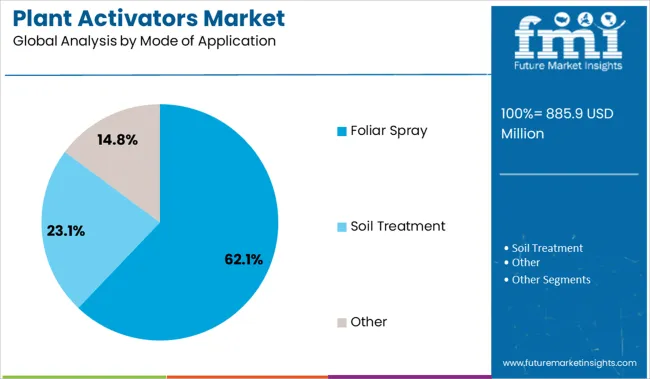

The plant activators market is segmented by crop type, source, and mode of application and geographic regions. By crop type of the plant activators market is divided into Fruits & vegetables, Cereals & grains, Oilseeds & pulses, Turf & ornamentals, and Others. In terms of source of the plant activators market is classified into Biological and Chemical. Based on mode of application of the plant activators market is segmented into Foliar Spray, Soil Treatment, and Other. Regionally, the plant activators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fruits and vegetables segment is expected to represent 31.60 percent of market revenue by 2025 within the crop type category, emerging as the leading segment. This is due to the high economic value of these crops and their sensitivity to environmental and biotic stress.

The need for consistent quality, extended shelf life, and resistance to post harvest diseases has led to increased integration of plant activators in horticulture. Growers are adopting these products to improve color, size, and taste without compromising residue standards.

As the fruits and vegetables segment faces growing scrutiny over chemical use, plant activators offer a sustainable and market compliant alternative, strengthening their role in value driven crop categories.

The biological segment is projected to account for 58.30 percent of market revenue by 2025 under the source category, positioning it as the most dominant. This is driven by the global transition toward organic and low residue agricultural inputs.

Farmers and agribusinesses are increasingly opting for biologically derived solutions that are environmentally friendly and compliant with international export standards. Biological sources offer enhanced compatibility with integrated pest and nutrient management systems while reducing dependence on synthetic agrochemicals.

Rising awareness about soil microbiome health and the regulatory push toward green chemistry have further reinforced the preference for biologically sourced plant activators in modern agriculture.

The foliar spray method is projected to hold 62.10 percent of the market by 2025 in the mode of application category, establishing it as the leading method. This dominance is due to its effectiveness in delivering active ingredients directly to the site of action, ensuring rapid uptake and visible results.

Foliar sprays offer flexibility in application timing, making them especially useful during critical crop growth stages. Additionally, they provide consistent coverage, require lower dosages compared to soil applications, and minimize leaching or environmental runoff.

The ease of integration into existing farm practices and compatibility with a wide range of crops have made foliar spraying the preferred mode for applying plant activators across diverse farming systems.

Demand for plant activators is rising in precision agriculture and residue-free crop production. Sales of SAR-inducing products and microbial-based formulas are growing as farmers seek alternatives to chemical pesticides and enhance crop resilience under climate pressure.

Demand for plant activators surged 21% in 2025 as precision agriculture systems scaled across high-value crops. Systemic Acquired Resistance (SAR) inducers with jasmonic acid and salicylic acid pathways were applied in over 1.7 million hectares globally, particularly in vineyards and citrus orchards. Farmers using real-time disease detection paired with drone-based delivery of SAR sprays saw fungal infection rates drop by 18%. In the USA Midwest and parts of Spain, variable-rate application enabled 13% lower dosage rates with no yield penalty. Companies offering field-specific activator blends linked to weather forecasting apps experienced 24% higher subscription renewals for their advisory platforms.

Sales of plant activators based on microbial extracts and fermented bioactives grew 28% as regulatory frameworks tightened around synthetic pesticides in the EU, Japan, and California. Export-oriented growers of leafy greens and berries pivoted to zero-residue plant activators to meet MRL thresholds in overseas markets. Chilean producers using Bacillus-based formulations reduced quarantine rejections by 14%, while greenhouse tomato operations in the Netherlands achieved 11% yield gains without fungicides. Distributors in Southeast Asia reported higher reorder volumes for activators combining PGPRs with amino acids. Companies offering QR-code traceability for residue-free certification improved B2B sales close rates by 31%, especially in premium retail supply chains.

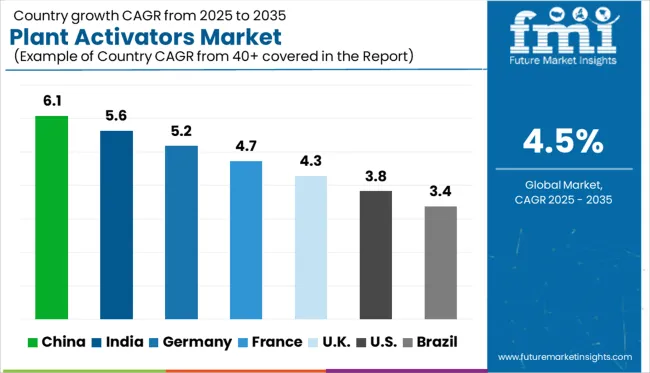

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global plant activators market is projected to expand at a CAGR of 4.5% between 2025 and 2035. China (BRICS) leads with a CAGR of 6.1%, outpacing the global average by 1.6 percentage points, propelled by large-scale adoption of crop immunity boosters in rice, maize, and horticultural sectors. India (BRICS) follows at 5.6% (+1.1 pp), supported by increasing organic farming practices, rising pest pressure, and demand for biostimulant-based crop protection. Among OECD countries, Germany records 5.2% (+0.7 pp), reflecting heightened regulatory approval for eco-friendly inputs and greater integration in greenhouse agriculture. The UK sees moderate growth at 4.3% (-0.2 pp), while the United States trails at 3.8% (-0.7 pp), affected by slower registration timelines and limited awareness among smallholder farmers. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The China market is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by government support for sustainable crop production and precision farming initiatives. Between 2020 and 2024, adoption was primarily led by large-scale grain producers. From 2025 onward, broader usage is expected in fruit and vegetable cultivation due to regulatory encouragement and environmental compliance pressures.

India is anticipated to expand at a CAGR of 5.6% through 2035, bolstered by the need to improve crop yields without relying heavily on synthetic agrochemicals. From 2020 to 2024, growth was centered around sugarcane and rice belts. Moving into the next decade, rising awareness among horticultural farmers and micro-irrigation users will drive greater market penetration.

Germany is expected to post a CAGR of 5.2% between 2025 and 2035, propelled by strict environmental laws and demand for residue-free produce. During 2020–2024, organic farms were the primary adopters of activators. From 2025 forward, the mainstream vegetable and viticulture sectors are likely to integrate them into disease prevention regimes.

The UK market is forecast to grow at a CAGR of 4.3% during the 2025–2035 period, supported by initiatives aimed at reducing chemical pesticide dependency post-Brexit. In 2020–2024, market demand was driven by greenhouse tomato and soft fruit growers. The next decade will witness broader usage in outdoor cereals and oilseeds due to evolving regulatory policies.

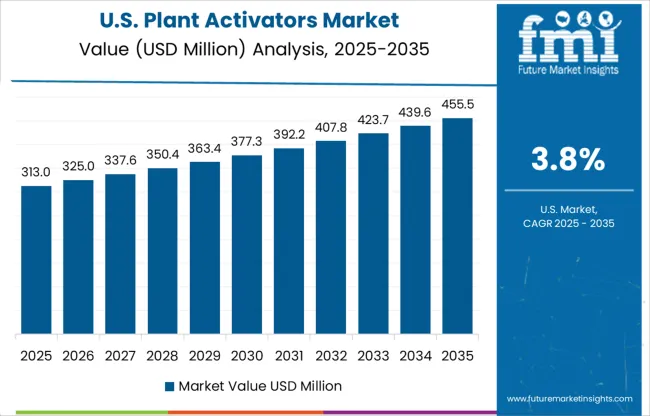

The USA market is set to register a CAGR of 3.8% from 2025 to 2035, reflecting a gradual shift from traditional chemical treatments toward biological inputs. Between 2020 and 2024, most demand came from high-value specialty crops like almonds and grapes. Looking ahead, regulatory support for residue reduction will enhance demand across large-scale farms.

Demand for plant activators is accelerating in 2025 due to stricter residue regulations and the shift toward regenerative agriculture. Valagro leads with a significant market share, driven by proprietary biostimulant technologies and strong penetration in high-value horticulture. Sales of plant activators by BASF and Bayer remain strong across Europe and Latin America, especially in row crop applications. Syngenta and UPL are expanding rapidly in Asia with foliar immunity enhancers tailored for rice and wheat. Novozymes and Yara International are leveraging microbial-based innovations and nitrate efficiency activators. Growth from Sumitomo Chemical and DuPont is attributed to pipeline expansion in abiotic stress solutions. Meanwhile, Greenlight Biosciences and Biostadt Humus GmbH are gaining traction with RNA-based and humic compound activators tailored for organic and hybrid systems.

In October 2024, BASF partnered with Acadian Plant Health to integrate seaweed-based biostimulants into its BioSolutions portfolio, enhancing resilience and stress tolerance in crops, while expanding global availability of climate-smart activators.

| Item | Value |

|---|---|

| Quantitative Units | USD 885.9 Million |

| Crop Type | Fruits & vegetables, Cereals & grains, Oilseeds & pulses, Turf & ornamentals, and Others |

| Source | Biological and Chemical |

| Mode of Application | Foliar Spray, Soil Treatment, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Valagro, BASF, Bayer, Syngenta, UPL, DuPont, Sumitomo Chemical, Novozymes, Yara International, Stimulus, Plant Health Australia, Biostadt Humus GmbH, Greenlight Biosciences, Agralan Group, and Kellogg Company |

| Additional Attributes | Dollar sales by activator source (biological vs chemical) and crop type, demand dynamics across small‑holder and commercial farming, regional trends in APAC versus Europe and Americas, innovation in microbial, nano‑formulated, and smart IoT‑enabled activators, environmental impact on soil and carbon footprint, and emerging integration in precision AgTech systems. |

The global plant activators market is estimated to be valued at USD 885.9 million in 2025.

The market size for the plant activators market is projected to reach USD 1,375.8 million by 2035.

The plant activators market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in plant activators market are fruits & vegetables, _berries, _citrus fruits, _tropical fruits, _others, cereals & grains, _corn, _wheat, _rice, _barley, _others, oilseeds & pulses, _soybeans, _canola, _peanuts, _others, turf & ornamentals, _grasses, _shrubs, _flowering plants, _others and others.

In terms of source, biological segment to command 58.3% share in the plant activators market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA