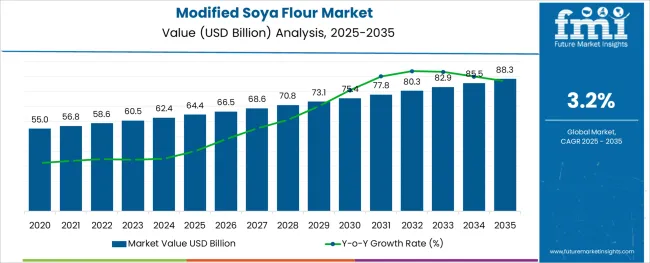

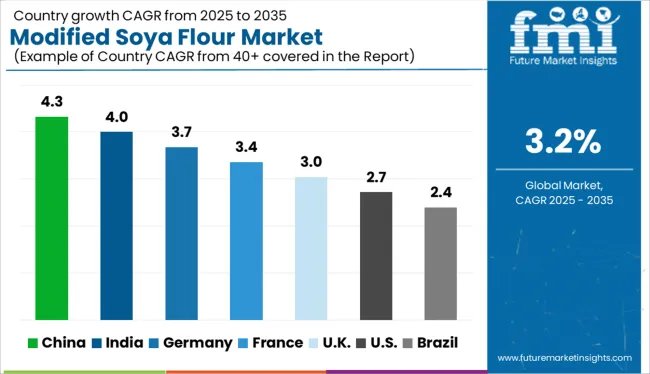

The Modified Soya Flour Market is estimated to be valued at USD 64.4 billion in 2025 and is projected to reach USD 88.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The modified soya flour market is expanding steadily, driven by the increasing demand for functional ingredients that enhance nutritional profiles and improve food texture. Recent trends in clean-label and plant-based food products have pushed manufacturers to incorporate soy derivatives as versatile additives. Industry updates highlight growing use of modified soya flour in bakery and confectionery products due to its ability to improve moisture retention, texture, and shelf life.

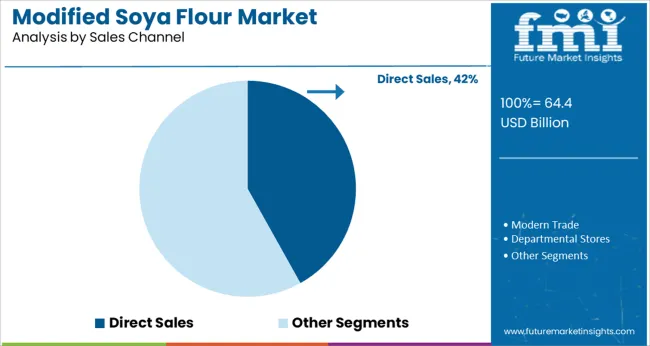

Additionally, rising consumer awareness about protein-rich diets and gluten-free alternatives is encouraging the adoption of soya-based ingredients. Food producers are focusing on ingredient innovation to meet the needs of health-conscious consumers and evolving taste preferences. Distribution channels are shifting towards direct sales models that allow manufacturers to build stronger relationships with customers and offer customized solutions.

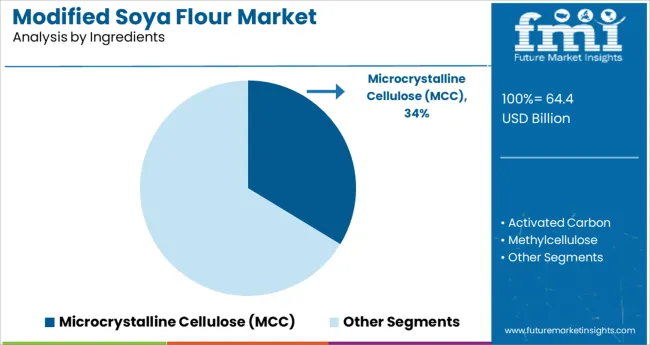

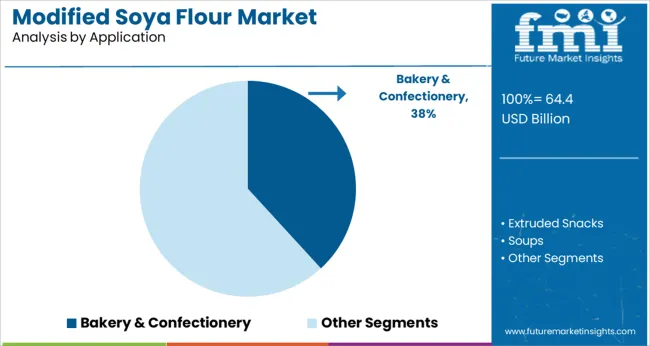

Looking ahead, the market is expected to benefit from ongoing research into ingredient functionality and expanding applications in processed foods. Growth will likely be led by Microcrystalline Cellulose (MCC) as the key ingredient, the Bakery & Confectionery sector as the main application, and Direct Sales as the preferred sales channel.

The market is segmented by Ingredients, Application, and Sales Channel and region. By Ingredients, the market is divided into Microcrystalline Cellulose (MCC), Activated Carbon, Methylcellulose, Carboxymethyl cellulose (CMC), Ethylcellulose, Phosphorus Chemicals, and Succinic Acid. In terms of Application, the market is classified into Bakery & Confectionery, Extruded Snacks, Soups, Packaged Food, and Other Application.

Based on Sales Channel, the market is segmented into Direct Sales, Modern Trade, Departmental Stores, Convenience Stores, Online Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Microcrystalline Cellulose (MCC) segment is projected to hold 33.7% of the modified soya flour market revenue in 2025, establishing itself as the leading ingredient category. This segment has grown due to MCC’s excellent functional properties including water-binding, bulking, and improving texture in bakery and confectionery products. Food manufacturers have favored MCC for its ability to enhance dough handling and improve product consistency.

It is also valued for being a natural, non-toxic additive compatible with clean-label trends. The stability and versatility of MCC have led to its broad acceptance as a preferred ingredient in modified soya flour formulations.

As the demand for healthier and texture-optimized food products increases, the MCC segment is expected to sustain its strong market position.

The Bakery & Confectionery segment is anticipated to contribute 38.2% of the modified soya flour market revenue in 2025, maintaining its dominance as the primary application area. Growth in this segment is driven by the increasing use of modified soya flour to improve the nutritional value and sensory characteristics of baked goods and sweets.

Producers have utilized modified soya flour to extend shelf life, enhance moisture retention, and improve the mouthfeel of products such as bread, cakes, and cookies. Rising consumer demand for protein-enriched and gluten-free bakery items has further supported segment expansion. Innovation in product formulations to meet dietary preferences and food safety standards has attracted both manufacturers and consumers.

The Bakery & Confectionery segment is expected to remain a critical driver of market growth due to ongoing consumer interest and product innovation.

The Direct Sales segment is projected to account for 41.9% of the modified soya flour market revenue in 2025, securing its position as the leading sales channel. Growth in this segment has been supported by manufacturers' efforts to establish direct relationships with food producers and large-scale customers.

Direct sales facilitate customization of product offerings and allow quicker response to client needs and market trends. This approach also reduces reliance on intermediaries, which can enhance pricing competitiveness and supply chain efficiency. Many suppliers have adopted direct sales strategies to provide technical support and foster long-term partnerships with clients.

As the demand for specialized and high-quality modified soya flour grows, the Direct Sales segment is expected to maintain its importance in the distribution landscape.

| Particulars | Details |

|---|---|

| H1 2024 | 3.2% |

| H1 2025 Projected | 3.2% |

| H1 2025 Expected | 3.5% |

| BPS Change | - 35.2 ↓ |

FMI presents a half-yearly comparison analysis and review of the market growth rates and further development prospects in the global market. The market is predominantly influenced by certain demographic and innovation factors under the subjective impact of macro and industry factors.

Some new developments that have taken place in these markets include:

The global market for Modified Soya Flour has witnessed H1 2024 growth at the magnitude of 3.2%. However, this growth is not evenly spread across all regions, with the developing markets recording higher growth rates of 3.5%. Thus, leaving the gap of -35.2 BPS points between expected and projected growth during H1 2025.

Key reasons for this change in growth rate are attributed to slow/rapid uptake of the market during the first half of the forecast period owing to improving end-user demand in key economies and their booming populations.

In particular, China and India are both seeing an increase in their consumption pattern, resulting in increased demand for the Modified Soya Flour market. Additionally, many other market segments are expected to perform fairly and attain promising growth prospects in the next half of the projection period.

Despite these positive prospects, there are some likely challenges that stay ahead for the industry including a shift in consumer preferences, stringent trade barriers, and a low degree of security in raw material supply, and other manufacturing inputs.

Because of its nutritional advantages, such as gluten-free, trans-fat-free, and whole-grain food products, the Modified Soya Flour market driver can be ascribed to rising adoption of soy-derived flour in processed meals among consumers.

Furthermore, throughout the projected period 2025 to 2035, the increase in sales of modified soya flour would be notably witnessed in rising economies, owing to increasing consumption of modified soya flour, namely in Russia and Germany.

In the next years, regional markets for modified soya flour in Asia Pacific except Japan (Asia Pacific except Japan-APEJ) are likely to present chances for expansion. In the Asia Pacific excluding Japan area, the modified soya flour market is predicted to generate substantial sales volumes in rising nations like China and India.

The modified soya flour market in Asia Pacific Except Japan-APEJ had a large - volume production in 2020 and is expected to maintain this trend throughout the forecast period, reaching a significant volume estimation by the end of the assessment year (2035), making Asia Pacific excluding Japan the most lucrative region for the global market for modified soya flour growth.

Furthermore, the worldwide modified soya flour market is predicted to expand at a rapid pace in Asia Pacific except Japan-APEJ, owing to the region's growing use of the product in a variety of food applications.

In 2024, North America dominated the Modified Soya Flour Market, with a 45% share. This is due to an increase in the preference for modified soya flour due to increased consumption of healthy food products. Furthermore, rising advancements in the food and beverage sector, as well as expanding veganism popularity among the populace, are propelling the Modified Soya Flour Market forward.

In the next years, Europe is predicted to become the second biggest market for modified soya flour. Because of the large use of modified soya flour in Russia, followed by Germany, the region is experiencing significant volume generation. Throughout the assessment period, the modified soya flour market in North America is expected to grow at a slower pace than in other regions.

In 2024, the Activated Carbon category stood as the largest revenue generator. This is due to the fact that activated carbon aids in the purification of various food and beverage procedures, which has resulted in an increase in the use of activated carbon in the food and beverage sector. Furthermore, activated carbon aids in the removal of odor from food, increasing the need for activated carbon ingredients and therefore the market's growth.

For the period 2025-2035, the Methylcellulose category is expected to grow at the fastest rate of 4.5 percent. This is due to its numerous health benefits, such as the reduction of constipation. Furthermore, methylcellulose is employed in a variety of baked goods, which is increasing the use of methylcellulose in food and, as a result, the Modified Soya Flour Market.

Based on application, the Modified Soya Flour Market can be divided into Packaged Bakery, Food, Soups and Confectionery, and Others. In 2024, the Packaged Food category will account for the largest proportion of the Modified Soya Flour Market. This is mostly due to increased consumer adoption of packaged food as a result of higher consumption of ready-to-eat items.

Furthermore, packaged food has a longer shelf life, which increases consumer preference for packaged food due to their busy schedules. Over the period 2025 to 2035, the Bakery and Confectionery segment is expected to grow at the fastest rate of 5.2%. This is primarily due to rising consumer demand for baked goods, which drives up bakery and confectionery demand.

Furthermore, producers are concentrating on developing a variety of baked goods that would increase customer demand, hence moving the Modified Soya Flour Market forward.

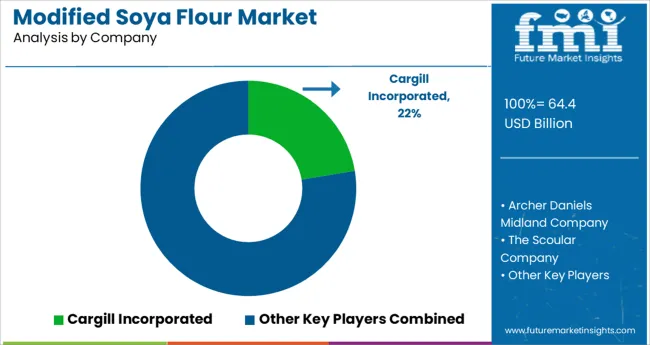

According to the market research analysis Cargill Incorporated, The Scoular Company, Associated British Foods Plc., The Hain Celestial Group, Inc., General Mills Inc., Parrish and Heimbecker Ltd., ITC Limited, SunOpta Limited, The Caremoli Group, Ingredion Inc., Unicorn Grain Specialties, ConAgra Foods, Inc., Bunge Limited, Archer Daniels Midland Company, and Buhler are identified as key players in the Modified Soya Flour Market.

| Attribute | Details |

|---|---|

| Market Size Value in 2024 | USD 64.4 billion |

| Market Forecast Value in 2035 | USD 88.3 billion |

| Global Growth Rate | 3.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | MT for Volume and USD Mn for Value |

| Key Regions Covered | North America; Latin America; Europe; Japan; Asia Pacific Except Japan-APEJ and Middle East and Africa -MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, EU5, Russia, Poland, China, ASEAN, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, others. |

| Key Market Segments Covered | Ingredients, Application, Sales Channel and Regions |

| Key Companies Profiled | Cargill Incorporated; The Scoular Company; Associated British Foods Plc.; The Hain Celestial Group, Inc.; General Mills Inc., Parrish and Heimbecker Ltd.; ITC Limited, SunOpta Limited; The Caremoli Group; Ingredion Inc.; Unicorn Grain Specialties; ConAgra Foods, Inc.; Bunge Limited; Archer Daniels Midland Company; Buhler; Others |

| Pricing | Available upon Request |

The global modified soya flour market is estimated to be valued at USD 64.4 billion in 2025.

It is projected to reach USD 88.3 billion by 2035.

The market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types are microcrystalline cellulose (mcc), activated carbon, methylcellulose, carboxymethyl cellulose (cmc), ethylcellulose, phosphorus chemicals and succinic acid.

bakery & confectionery segment is expected to dominate with a 38.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modified Milk Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Modified Atmosphere Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Modified Starch Market Analysis - Size, Share, and Forecast 2024 to 2034

Modified lecithin Market

Modified Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Non-GMO Soya Market

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA