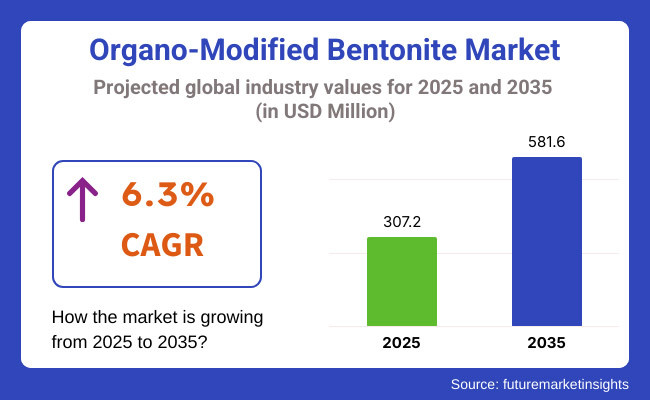

The global organo-modified bentonite market is estimated at USD 307.2 million in 2025. By 2035, the market is expected to reach USD 581.6 million, expanding at a CAGR of 6.3% during this period. Demand is being driven by its high efficacy in rheological control across oil drilling, adhesives, and coatings applications.

In 2025, enhanced oil-based drilling activities significantly influenced the market performance. Saudi Aramco, in its 2025 quarterly report, confirmed increased use of organophilic clays to optimize wellbore stability in offshore fields. Similar trends were noted in USA shale formations, where Chevron adopted modified bentonite for better emulsion stability under high-pressure conditions. According to the company’s statement released in January 2025, organo-modified clays allowed for greater thermal resistance in extreme reservoirs.

The coatings industry has emerged as a strong end-use segment in organo-modified bentonite market. In February 2025, BASF’s performance chemicals division highlighted a surge in demand for bentonite-based rheology modifiers in protective coatings. A company spokesperson noted that “our customers in marine and industrial segments seek consistency, anti-sag properties, and sedimentation control-bentonite delivers that reliably.”

Adhesives and sealants incorporating organo-modified bentonite have also gained traction. In a 2025 press release, Sika AG emphasized the compound’s ability to maintain viscosity across temperature shifts, essential for infrastructure sealants in hot and humid climates. This trend has remained especially strong across Southeast Asia, where tropical conditions affect formulation stability.

Technological developments have played a critical role in maintaining quality and performance. A 2024 publication from the Swiss Federal Institute of Technology detailed innovations in alkyl quaternary ammonium surface treatments, improving dispersion in non-aqueous media. These enhancements have helped producers meet compliance targets set by European REACH directives and new U.S. EPA guidelines introduced in late 2024.

In terms of capacity expansion, Asia Pacific has remained a focal point. Indian company Ashapura Group disclosed a USD 21 million investment in Gujarat for expanding bentonite refinement capacity by mid-2025. A company executive remarked that “this initiative ensures material availability for clients in Asia and the Middle East while reducing reliance on volatile import routes.”

However, challenges persist in the industry. Inconsistencies in raw bentonite quality and concerns over organoclay disposal continue to hinder adoption in some regions. Nonetheless, active R&D is being conducted in Germany and Japan, focusing on low-toxicity modifiers and biodegradable surfactants.

Organo-modified bentonite is increasingly demanded across diverse sectors such as drilling fluid, clarification agent, and oil and gas, among others. The fabricated divisions cover a crucial aspect of their processes to guarantee operational efficiency.

Among the most well-known applications of organo-modified bentonite, in particular in the oil and gas sector, is drilling fluid. An additive made of clay that helps increase the viscosity, suspension, and lubrication of drilling mud common components that help stabilize wellbores and reduce formation damage. Growing worldwide requirement for crude oil and natural gas has propelled the growth of organo-modified bentonite in drilling.

Its better rheological properties is the key reason for choosing this product in both onshore and offshore projects. Moreover, the gradual transition into the deep-water and ultra-deep-water allows for the strong reliance of advanced drilling fluids, which aids in further props up the market share of organo-modified bentonite.

Clarification agents also command a significant share in the market owing to their effectiveness in treatment of industrial fluids and water purification. Because bentonite modified with organics displays excellent adsorption properties, it is widely applied in the treatment of wastewater, clarification of beverages, and refining of edible oil. In food and beverage, it helps to eliminate haze and improve clarity and stability of the end product.

With growing international emphasis on sustainable water management systems and increasingly rigorous waste control measures, there is a burgeoning demand for clarification agents that have made organo-modified bentonite a key player in the realms of filtration and water purification.

As industrial operations such as oil drilling continue to grow worldwide, applications of drilling fluids and clarification agents are expected to maintain dominance, fuelled by high demand for oilfield services and environmental treatment solutions.

Organo-modified bentonite finds immense application in a number of end-user industries, out of which the oil and gas and paints and coatings industries promote the highest demand for organo-modified bentonite, as these end-user segments extensively use organo-modified bentonite for its outstanding properties relating to binding, thickening and rheological control properties.

Contribution of the oil and gas industry to the global organo-modified bentonite market remains high as it is the most important application owing to their importance in drilling operations. It is commonly used in drilling fluids to facilitate drilling operations and maintain wellbore stability, as it minimizes fluid loss and enhances whole cleaning.

As appetite for both exploration and production activities in the global energy sector continues to increase, with particular focus on unconventional reservoirs, high performance drilling additives have seen increased demand. Additionally, the growing adoption of organo-modified bentonite, driven by the industry's focus on eco-friendly and low consumption drilling solutions, is expected to boost market growth.

From the above end-use segments, paints and coat industry is another prominent end-use sector of organo-modified bentonite. This compound is commonly used as rheological modifier, stabilizing thickener and anti-settling agent in paint, varnish and coatings. It is an ideal additive because it provides viscosity improvement, settling resistance, and high film performance for both industrial and decorative coatings.

The automotive, construction, and furniture industries for high-performance coatings have fuelled the demand for advanced-performance rheological additives, ensuring the role of organo-modified bentonite in this segment. In addition to it, the stringent environmental regulations encouraging the adoption of low-VOC (volatile organic compound) coatings are leading the formulators to use organo-modified bentonite to attain the best consistency of the product while being regulatory compliant.

The organo-modified bentonite market is also likely to witness robust growth across multiple domains, with oil and gas and paints and coatings industries paving the long-term growth of the organo-modified bentonite market as these end-use industries demand advanced functional materials in order to improve performance and sustainability.

Based on region, North America is a leading market for organo-modified bentonite, owing to its wide applications in oil drilling, paints & coatings and cosmetics industries. The USA. and Canada are top contributors owing to the high demand from the energy sector for drilling fluid additives and the personal care industry for rheology modifiers.

With the higher penetration of green drilling technologies and high-performance coatings, the demand for organo-modified bentonite has also increased. Nevertheless, the regulatory environment regarding mining activities and environmental issues associated with waste disposal will limit production. To tackle this challenge and meet industry needs, manufacturers are emphasizing sustainable extraction practices and improved formulation techniques.

The organic modified bentonite request in Europe is one of the immense requests supported by tight earth confirmations, and the general industrialized base of the district. In Germany, France, the UK, and Italy, demand for the material in adhesives, sealants, and lubricants grows.

Innovation within the coatings and industrial sector is driven by the demand for sustainable formulations and reduction of VOC emissions. Nevertheless, constraints in the regulatory environment governing mineral extraction and chemical processing may contribute to higher production costs. Industry investments in R&D are geared towards finding bio-based alternatives and greener components that comply with EU standards but exhibit the same product functionality.

The Asia-Pacific organo-modified bentonite market is booming due to increase industrialization, infrastructure expansion, and the rising usage of performance lubricants and coatings. Growing manufacturing activities and construction projects, particularly in leading markets - China, India, Japan and South Korea, have propelled expansion.

While domestic production and advancements in materials science have certainly influenced market trends in this space, government policies play a role as well. The challenges of price volatility in raw materials and environmental threats of mining remain, however. Manufacturers are addressing these risks by diversifying supply chains and adopting sustainable production techniques to meet regional demands.

Challenges - Raw Material Price Volatility and Supply Chain Constraints

Stringent government regulations for raw material extraction, fluctuating prices, and the impact of COVID-19 on LPOC are the key. Bentonite mining is restricted to few areas of world hence the market is susceptible to political disturbance, trade ban and environmental regulations.

And then, there are additional costs for processing and modification that go into the production chain to affect manufacturers' profits. Mitigating these risks requires companies to implement strategic sourcing, diversify their sources of supply locally, and engage in sustainable practices of mining.

Opportunities - Growing Demand in Paints, Coatings, and Oil & Gas Applications

Opportunities in industries such as paints & coatings, lubricants, and oil & gas drilling have increased organo-modified bentonite adoption. Its properties that enhance rheological, thixotropic, and suspension stability have made the compound a popular additive for high-performance coatings and drilling fluids. Market demand is being propelled by the construction and energy sectors and the progress of Nano clay based organo-modified bentonite. Investment in customized formulations and eco-friendly alterations will contribute to a competitive advantage for manufacturers.

Over the period from 2020 through 2024, the market experienced moderate growth, fuelled by growing applications in industrial coatings, as well as adhesives and sealants. The supply side faced hurdles in the form of volatility of crude oil prices and public perception on bentonite mining from environmental aspects.

The organo-modified bentonite market is anticipated to focus on eco-safe or bio-based solutions in the coming years 2025 to 2035, as well as better availability for applications in automotive coatings, 3D printing materials, and high-performance lubricants. Market dynamics will also be influenced by the development of advanced dispersion technologies and compatibility with innovative green chemistry formulations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter mining and environmental regulations |

| Technological Advancements | Development of high-dispersion organo-bentonite |

| Industry Adoption | Used in coatings, lubricants, and drilling fluids |

| Supply Chain and Sourcing | Price fluctuations and dependency on key suppliers |

| Market Competition | Established chemical companies and specialty material firms |

| Market Growth Drivers | Growth in construction, automotive, and oil & gas industries |

| Sustainability and Energy Efficiency | Initial phase of eco-friendly modifications |

| Consumer Preferences | Demand for high-performance and easy-to-disperse bentonite |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of sustainable sourcing and bio-based modifications |

| Technological Advancements | Integration of nanotechnology and smart functional additives |

| Industry Adoption | Expansion into advanced composites and next-gen coatings |

| Supply Chain and Sourcing | Localized and diversified supply chains for risk mitigation |

| Market Competition | Emergence of eco-friendly additive manufacturers |

| Market Growth Drivers | Rise of sustainable coatings, renewable energy, and specialty lubricants |

| Sustainability and Energy Efficiency | Widespread adoption of low-impact, bio-based alternatives |

| Consumer Preferences | Preference for green, non-toxic, and high-efficiency formulations |

The United States accounts for a considerable portion of the organo modified bentonite market owing to high demand in coatings, paints, and lubricants industries. The growth of high-performance drilling fluids in the oil and gas industry also benefits the market. Moreover, the growth of leading manufacturers and research institutes pursuing innovative bentonite formulations supports market growth. The country's robust regulatory environment further fuels the demand for green and sustainable additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

The organo-modified bentonite market in the UK is growing due to increasing application in the construction, automotive, and personal care sectors. The increasing trend for green and eco-friendly and non-toxic formulations in the industrial applications is expected to act as a continuous demand driving factor. Furthermore, government regulations in favour of sustainable manufacturing practices, along with a rising demand for effective rheological additives in paints and coatings, are further expected to drive the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

The demand for organo-modified bentonite in cosmetics, pharmaceuticals, and industrial sectors is strengthening the organo-modified bentonite market in Europe. Germany, France, and Italy major contributors to stratospheric ozone depletion owing to their involvement in the automotive or chemical industries. Growing adoption across several verticals is further catalysed by the regulatory policies promoting adoption of eco-friendly additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

Organo-modified bentonite applications such as automotive coatings and adhesives, and electronics are contributing to the growth of the Japan market. The interplay of the country’s well-developed technology ecosystem and investment in research and development leads to innovative applications of bentonite in high-performance materials. As a result, the growing popularity of specialty lubricants and greases in the manufacturing industry is relevant to the growth of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

Organo-Modified Bentonite by Region South Korea is anticipated to be a significant market for organo-modified bentonite owing to its increasing demand in consumer products, rubber and plastic production. This is driving market growth due to the country’s emphasis on high-quality industrial additives and government efforts encouraging the development of advanced material. Additionally, growing electronics sector and the demand for performance-enhancing additives increases adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The organo-modified bentonite market is expected to grow at a healthy pace during the forecast period owing to its increasing application in industries such as oil & gas, paints & coatings, personal care, and construction. Organo-modified bentonite, where the clay is modified with an organic surfactant is commonly used in various industrial applications for controlling rheology properties (thickening, suspensions). Manufacturers adopt sustainable production, advanced modification techniques, and enhanced dispersion properties to meet the evolving market demands.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BYK Additives | 22-26% |

| Elementis Specialties | 18-22% |

| BASF SE | 14-18% |

| Zhejiang Huate Industry | 10-14% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| BYK Additives | Specializes in high-performance organo-modified bentonite for coatings, lubricants, and oil drilling. |

| Elementis Specialties | Develops advanced bentonite-based rheology modifiers with a focus on paints, coatings, and personal care. |

| BASF SE | Provides sustainable and highly dispersible organo-clay additives for multiple industrial applications. |

| Zhejiang Huate Industry | Offers cost-effective and high-efficiency organo-modified bentonite for construction and adhesive applications. |

Key Company Insights

BYK Additives (22-26%)

BYK Additives is a leading player in the organo-modified bentonite market that provides high-performance rheological additives. With its emphasis on high-tech modification techniques, environmentally acceptable formulations, and stability enhancement properties, the company has strengthened its position in the market.

Elementis Specialties (18-22%)

Major organoclay additives providers include Elementis Specialties, which serves in the paints, coatings, and personal care products segments. Its focus on shear-thinning properties, flow behavior, and long-term stability makes it stand out.

BASF SE (14-18%)

A producer of ingredients focused on innovation-driven solutions, BASF SE supplies sustainable and readily dispersible bentonite additives, not only enhancing thickening/anti-settling properties but also addressing other functionalities. ECO-CHEM is dedicated to green chemistry & performance which helps it to hold the market.

Zhejiang Huate Industry (10-14%)

Zhejiang Huate Industry Co., Ltd. is a global leader in high-tech and economical bentonite products, making it an excellent option in construction, adhesives, and sealants. By fine tuning of particle size to make it more compatible the efficiency of the product is increased.

Other Key Player (25-35% Combined)

The organo-modified bentonite market appears to be fragmented in nature, with several small and medium scale ventures emphasizing cost-effective production, advanced dispersion technology, and eco-friendly formulations. Key players include:

The overall market size for the organo-modified bentonite market was USD 307.2 million in 2025.

The organo-modified bentonite market is expected to reach USD 581.6 million in 2035.

The demand for organo-modified bentonite is expected to rise due to its increasing application in paints & coatings, oil & gas, and personal care industries, along with growing advancements in nanotechnology and enhanced rheological properties.

The top five countries driving the development of the organo-modified bentonite market are the USA, China, Germany, India, and Japan.

Solvent-based organo-modified bentonite and water-based organo-modified bentonite are expected to command a significant share over the assessment period.

Table 01: GlobalMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 02: GlobalMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Table 03: GlobalMarket Value (US$ Million) and Volume (Tons) Forecast by Region, 2018 to 2033

Table 04: North AmericaMarket Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 05: North AmericaMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 06: North AmericaMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Table 07: Latin AmericaMarket Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 08: Latin AmericaMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 09: Latin AmericaMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Table 10: EuropeMarket Size (US$ Million) and Volume (Tons) Forecast by

Table 11: EuropeMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 12: EuropeMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Table 13: South Asia and PacificMarket Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 14: South Asia and PacificMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: South Asia and PacificMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Table 16: East AsiaMarket Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 17: East AsiaMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 18: East AsiaMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Table 19: Middle East and AfricaMarket Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 20: Middle East and AfricaMarket Size (US$ Million) and Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: Middle East and AfricaMarket Size (US$ Million) and Volume (Tons) Forecast by End User, 2018 to 2033

Figure 01: GlobalHistorical Market Volume (Tons) Analysis, 2018 to 2022

Figure 02: GlobalCurrent and Future Market Volume (Tons) Analysis, 2023 to 2033

Figure 03: GlobalMarket Value (US$ Million), 2018 to 2022

Figure 04: GlobalMarket Value (US$ Million) Forecast, 2023 to 2033

Figure 05: GlobalMarket Absolute $ Opportunity, 2018 to 2022 and 2023 to 2033

Figure 06: GlobalMarket Share and BPS Analysis by Application – 2023 and 2033

Figure 07: GlobalMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 08: GlobalMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 09: GlobalMarket Absolute $ Opportunity by Drilling Fluid Segment

Figure 10: GlobalMarket Absolute $ Opportunity by Clarification Agent Segment

Figure 11: GlobalMarket Absolute $ Opportunity by Nucleating Agent Segment

Figure 12: GlobalMarket Absolute $ Opportunity by Binder Segment

Figure 13: GlobalMarket Absolute $ Opportunity by Absorbent or Adsorbent Segment

Figure 14: GlobalMarket Absolute $ Opportunity by Others Segment

Figure 15: GlobalMarket Share and BPS Analysis by End User – 2023 and 2033

Figure 16: GlobalMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 17: GlobalMarket Attractiveness Analysis by End User, 2023 to 2033

Figure 18: GlobalMarket Absolute $ Opportunity by Oil and Gas Segment

Figure 19: GlobalMarket Absolute $ Opportunity by Foundry Segment

Figure 20: GlobalMarket Absolute $ Opportunity by Paints and Coatings Segment

Figure 21: GlobalMarket Absolute $ Opportunity by Textile Segment

Figure 22: GlobalMarket Absolute $ Opportunity by Water Treatment Segment

Figure 23: GlobalMarket Absolute $ Opportunity by Cement Segment

Figure 24: GlobalMarket Absolute $ Opportunity by Cosmetics Segment

Figure 25: GlobalMarket Absolute $ Opportunity by Lubricants and Greases Segment

Figure 26: GlobalMarket Absolute $ Opportunity by Coal Briquette Segment

Figure 27: GlobalMarket Share and BPS Analysis by Region– 2023 and 2033

Figure 28: GlobalMarket Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 29: GlobalMarket Attractiveness Analysis by Region, 2023 to 2033

Figure 30: GlobalMarket Absolute $ Opportunity by North America Segment

Figure 31: GlobalMarket Absolute $ Opportunity by Latin America Segment

Figure 32: GlobalMarket Absolute $ Opportunity by Europe Segment

Figure 33: GlobalMarket Absolute $ Opportunity by East Asia Segment

Figure 34: GlobalMarket Absolute $ Opportunity by South Asia Pacific Segment

Figure 35: GlobalMarket Absolute $ Opportunity by Middle East & Africa Segment

Figure 36: North AmericaMarket Share and BPS Analysis by Country– 2023 and 2033

Figure 37: North AmericaMarket Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 38: North AmericaMarket Attractiveness Analysis by Country, 2023 to 2033

Figure 39: North AmericaMarket Share and BPS Analysis by Technology– 2023 and 2033

Figure 40: North AmericaMarket Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 41: North AmericaMarket Attractiveness Analysis by Technology, 2023 to 2033

Figure 42: North AmericaMarket Share and BPS Analysis by Application– 2023 and 2033

Figure 43: North AmericaMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 44: North AmericaMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 45: North AmericaMarket Share and BPS Analysis by End User– 2023 and 2033

Figure 46: North AmericaMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 47: North AmericaMarket Attractiveness Analysis by End User, 2023 to 2033

Figure 48: Latin AmericaMarket Share and BPS Analysis by Country– 2023 and 2033

Figure 49: Latin AmericaMarket Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 50: Latin AmericaMarket Attractiveness Analysis by Country, 2023 to 2033

Figure 51: Latin AmericaMarket Share and BPS Analysis by Technology– 2023 and 2033

Figure 52: Latin AmericaMarket Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 53: Latin AmericaMarket Attractiveness Analysis by Technology, 2023 to 2033

Figure 54: Latin AmericaMarket Share and BPS Analysis by Application– 2023 and 2033

Figure 55: Latin AmericaMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 56: Latin AmericaMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 57: Latin AmericaMarket Share and BPS Analysis by End User– 2023 and 2033

Figure 58: Latin AmericaMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 59: Latin AmericaMarket Attractiveness Analysis by End User, 2023 to 2033

Figure 60: EuropeMarket Share and BPS Analysis by Country– 2023 and 2033

Figure 61: EuropeMarket Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 62: EuropeMarket Attractiveness Analysis by Country, 2023 to 2033

Figure 63: EuropeMarket Share and BPS Analysis by Technology– 2023 and 2033

Figure 64: EuropeMarket Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 65: EuropeMarket Attractiveness Analysis by Technology, 2023 to 2033

Figure 66: EuropeMarket Share and BPS Analysis by Application– 2023 and 2033

Figure 67: EuropeMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 68: EuropeMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 69: EuropeMarket Share and BPS Analysis by End User– 2023 and 2033

Figure 70: EuropeMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 71: EuropeMarket Attractiveness Analysis by End User, 2023 to 2033

Figure 72: South Asia and PacificMarket Share and BPS Analysis by Country– 2023 and 2033

Figure 73: South Asia and PacificMarket Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 74: South Asia and PacificMarket Attractiveness Analysis by Country, 2023 to 2033

Figure 75: South Asia and PacificMarket Share and BPS Analysis by Technology– 2023 and 2033

Figure 76: South Asia and PacificMarket Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 77: South Asia and PacificMarket Attractiveness Analysis by Technology, 2023 to 2033

Figure 78: South Asia and PacificMarket Share and BPS Analysis by Application– 2023 and 2033

Figure 79: South Asia and PacificMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 80: South Asia and PacificMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 81: South Asia and PacificMarket Share and BPS Analysis by End User– 2023 and 2033

Figure 82: South Asia and PacificMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 83: South Asia and PacificMarket Attractiveness Analysis by End User, 2023 to 2033

Figure 84: East AsiaMarket Share and BPS Analysis by Country– 2023 and 2033

Figure 85: East AsiaMarket Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 86: East AsiaMarket Attractiveness Analysis by Country, 2023 to 2033

Figure 87: East AsiaMarket Share and BPS Analysis by Technology– 2023 and 2033

Figure 88: East AsiaMarket Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 89: East AsiaMarket Attractiveness Analysis by Technology, 2023 to 2033

Figure 90: East AsiaMarket Share and BPS Analysis by Application, 2023 and 2033

Figure 91: East AsiaMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 92: East AsiaMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 93: East AsiaMarket Share and BPS Analysis by End User, 2023 and 2033

Figure 94: East AsiaMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 95: East AsiaMarket Attractiveness Analysis by End User, 2023 to 2033

Figure 96: Middle East and AfricaMarket Share and BPS Analysis by Country– 2023 and 2033

Figure 97: Middle East and AfricaMarket Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 98: Middle East and Africa aMarket Attractiveness Analysis by Country, 2023 to 2033

Figure 99: Middle East and AfricaMarket Share and BPS Analysis by Technology, 2023 and 2033

Figure 100: Middle East and AfricaMarket Y-o-Y Growth Projections by Technology, 2023 to 2033

Figure 101: Middle East and AfricaMarket Attractiveness Analysis by Technology, 2023 to 2033

Figure 102: Middle East and AfricaMarket Share and BPS Analysis by Application– 2023 and 2033

Figure 103: Middle East and AfricaMarket Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 104: Middle East and AfricaMarket Attractiveness Analysis by Application, 2023 to 2033

Figure 105: Middle East and AfricaMarket Share and BPS Analysis by End User– 2023 and 2033

Figure 106: Middle East and AfricaMarket Y-o-Y Growth Projections by End User, 2023 to 2033

Figure 107: Middle East and AfricaMarket Attractiveness Analysis by End User, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bentonite Clay Market Forecast Outlook 2025 to 2035

Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Bentonite Cat Litter Market Analysis by Type, Composition, Distribution Channel and Region Through 2025 to 2035

Sulphur Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bentonite in EU Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA