The bentonite clay market is experiencing steady expansion, fueled by increased demand across oil and gas, construction, and environmental sectors. Industry publications and mineral exploration updates have noted a rise in drilling activity globally, which has directly supported the consumption of bentonite clay, particularly in fluid management and borehole stabilization.

In addition, government investments in infrastructure and tunneling projects have sustained demand for bentonite-based slurry systems in geotechnical engineering. Environmental applications such as landfill liners, wastewater treatment, and soil sealing have also contributed to the market’s growth due to bentonite’s absorptive and sealing properties.

On the supply side, improvements in mining and processing methods have enhanced the quality and consistency of bentonite products, meeting stricter industry specifications. Furthermore, market participants have expanded logistics and supply networks to serve energy and civil engineering markets in developing economies. Looking forward, the market is expected to remain driven by the dominant use of sodium bentonite and its essential role in drilling mud applications for upstream energy operations.

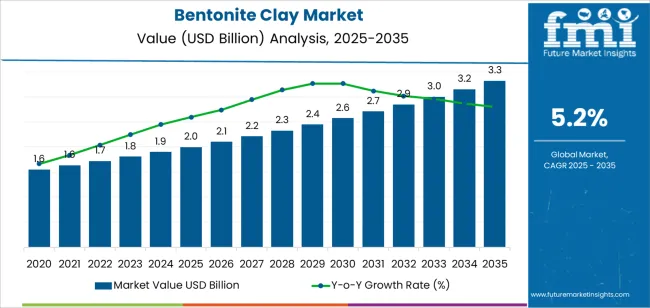

| Metric | Value |

|---|---|

| Bentonite Clay Market Estimated Value in (2025 E) | USD 2.0 billion |

| Bentonite Clay Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

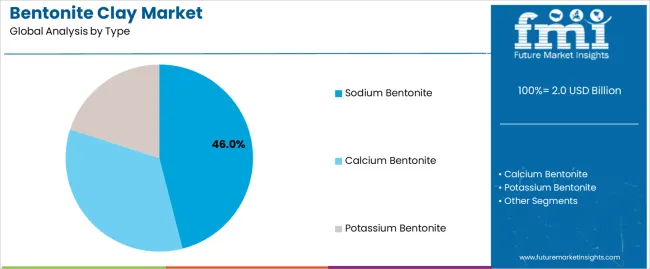

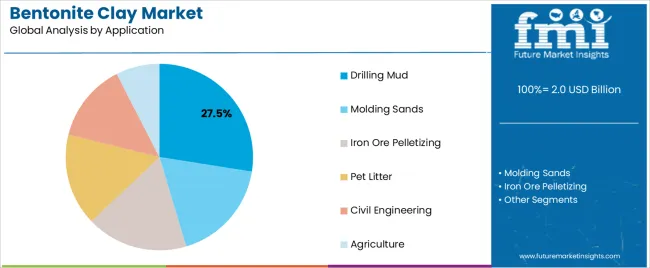

The market is segmented by Type and Application and region. By Type, the market is divided into Sodium Bentonite, Calcium Bentonite, and Potassium Bentonite. In terms of Application, the market is classified into Drilling Mud, Molding Sands, Iron Ore Pelletizing, Pet Litter, Civil Engineering, and Agriculture. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Sodium Bentonite segment is projected to capture 46.00% of the bentonite clay market revenue in 2025, making it the leading type category. Growth in this segment has been influenced by the superior swelling capacity and bonding properties of sodium bentonite, which make it highly suitable for a wide range of industrial applications.

Sodium bentonite has been preferred in drilling, binder formulations, and sealing systems due to its ability to form stable gels when hydrated. Mining and construction industries have consistently relied on sodium bentonite for borehole stability and trenchless excavation, where its rheological behavior under pressure is critical.

Technical papers and production data have emphasized sodium bentonite’s efficiency in slurry formulations used in foundation and tunneling works. Furthermore, the segment has benefited from high-volume usage in steel pelletizing and environmental containment projects. With stable supply chains and favorable performance characteristics, sodium bentonite is expected to remain the preferred variant across major end-use industries.

The Drilling Mud segment is projected to account for 27.5% of the bentonite clay market revenue in 2025, positioning it as the leading application segment. Growth of this segment has been driven by the rising number of oil and gas exploration projects, particularly in offshore and unconventional fields.

Bentonite clay has been widely adopted in drilling mud systems due to its capacity to lubricate drill bits, control borehole pressure, and remove cuttings efficiently. Energy sector reviews and upstream operational reports have confirmed that sodium-based bentonite is integral to maintaining borehole integrity, especially under high-pressure conditions.

Additionally, increased drilling activity in shale formations and deepwater basins has elevated the demand for high-performance drilling fluids, where bentonite serves as a critical component. The segment has also gained traction in geothermal drilling and horizontal directional drilling for utilities. With exploration investments continuing in both developed and emerging energy markets, the Drilling Mud segment is expected to sustain its lead through stable demand and performance-driven usage.

Rising Focus on Sustainability to Surge Sales

Bentonite clay is gaining popularity in various industries due to its high swelling capacity, viscosity, and absorption capabilities. The industry is prioritizing environmental sustainability, with manufacturers adopting sustainable mining practices and investing in eco-friendly technologies. Consumers are also seeking eco-friendly bentonite products, indicating a growing commitment to sustainability.

Untapped Potential of Bentonite Clay in New Applications

Advancements in mining, processing, and refinement techniques are improving bentonite clay production efficiency. Research and development focuses on enhancing properties and functionalities through innovations like nano-bentonite materials.

Bentonite clay is becoming popular in the cosmetics and personal care sectors due to its natural absorbent and cleansing properties. Consumers are seeking organic skin care products, fueling demand for clay-based formulations like facial masks, scrubs, and cleansers.

Impact of Government Regulations on Bentonite Clay Mining and Use in Specific Industries

Emerging economies, particularly in Asia-Pacific and Latin America, are experiencing a surge in clay consumption due to rapid industrialization, urbanization, and infrastructure development. However, regulatory frameworks, including mining practices, product quality standards, and environmental protection, continue to impact the business.

Fluctuations in Oil Prices Impacting Bentonite Clay Demand in the Foundry Industry

Bentonite clay faces competition from alternative materials and synthetic substitutes in various applications, such as drilling fluids. The availability and cost-effectiveness of these alternatives are set to limit the growth in specific segments.

Fluctuations in raw material prices, such as sodium and calcium bentonite ores, are set to affect production costs and profit margins. Factors like mining regulations, geopolitical tensions, and currency fluctuations also contribute to raw material price volatility, posing challenges for companies.

The sector grew at a CAGR of 6.9% from 2020 and 2025. The market reached USD 2 billion in 2025. Bentonite clay, dating back to ancient civilizations, has been used in various industries for centuries.

The substance's exceptional properties, including high swelling capacity and viscosity, have made this a vital component in various industries, including construction, cosmetics, pharmaceuticals, and wastewater treatment.

Industrialization has increased demand for bentonite due to its high swelling capacity and viscosity. Technological advancements in mining, processing, and refining techniques have enabled efficient extraction of high-quality clay, leading to increased production capacities and improved product quality.

Environmental concerns and waste disposal regulations have influenced the market, with manufacturers focusing on sustainable practices and recycling to minimize environmental impact. Bentonite has prolonged applications beyond traditional use, now used in various industries such as cosmetics, pharmaceuticals, agriculture, and environmental remediation.

The sector is influenced by economic trends, trade policies, and geopolitical factors, with fluctuations in commodity prices and trade tariffs impacting supply and demand dynamics. Consumer preferences, such as a growing demand for natural and organic products, have also influenced sales. This demand drives clay-based formulations in cosmetics and personal care products.

Research and development have led to new applications and formulations for bentonite clay, with nanotechnology innovations enhancing properties for specialized applications. Over the forecast period, the sector is poised to exhibit healthy growth, reaching USD 3.3 billion by 2035.

Key tier 1 companies are experiencing significant growth due to factors such as increasing industrialization, infrastructure development, and construction activities.

Demand for environmentally sustainable solutions and high-quality raw materials also drives innovation and product development. Trends like sustainable mining practices, technological advancements, and growing consumer product applications contribute to growth.

Emerging markets, particularly Asia-Pacific and Latin America, offer future opportunities due to rapid urbanization and infrastructure investments.

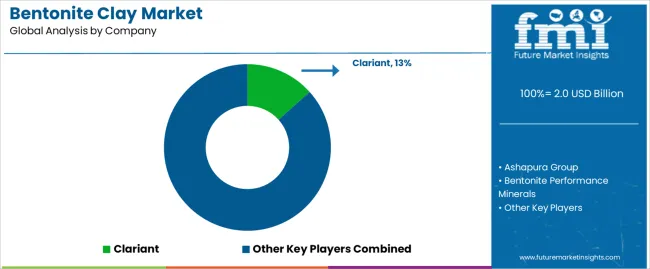

Partnerships, acquisitions, and strategic alliances enable these companies to develop reach and enhance competitive edge in the evolving landscape. Prominent companies within Tier 1 include Clariant, Imerys, Minerals Technologies Inc., and Ashapura Group. The companies hold around 45% share.

Leading Tier 2 companies are experiencing growth due to niche expertise, specialized product offerings, and agility in responding to demands. These focus on specific applications or regional markets, gaining a competitive advantage. Key trends fueling growth include sustainable solutions, technological innovations, and diversification in industries like cosmetics and pharmaceuticals.

Despite challenges such as limited financial resources, intense competition, and regulatory compliance, these companies capitalize on growth opportunities in targeted segments of the business. Prominent companies in Tier 2 include American Colloid Company, Bentonite Performance Minerals LLC, Wyo-Ben Inc., and Black Hills Bentonite LLC. These players hold around 30% of the share.

Tier 3 companies are growing due to specialization in niche sectors, agility, and cost-effective solutions. However, these players need more resources, saturation, and regulatory compliance.

Nevertheless, upcoming growth opportunities lie in niche applications, regional development, and strategic partnerships. Tier 3 companies, including Kunimine Industries Co. Ltd., LKAB Minerals, Kutch Minerals, and Star Bentonite Group, hold 25% of the share.

The following table shows the estimated growth rates of the leading markets and regional opportunities. The United States is anticipated to remain at the forefront in North America, with a CAGR of 5.5% through 2035. In East Asia, Japan is projected to witness a CAGR of 6.8% by 2035, followed by China at 5.9%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 5.5% |

| United Kingdom | 6.4% |

| China | 5.9% |

| Japan | 6.8% |

| South Korea | 7.3% |

Over the assessment period, demand in the United States is set to rise at 5.5% CAGR. The bentonite clay industry is promoting sustainable practices, such as reclamation and restoration, to minimize environmental impact and meet regulatory requirements.

The oil and gas industry remains a key consumer of clay, with ongoing exploration and production activities requiring clay-based drilling fluids and additives. The United States bentonite clay sector requires strict adherence to regulations on mining permits, environmental protection, and product quality to ensure consumer safety.

By 2035, the United Kingdom is projected to rise at a CAGR of 6.4%. Use of bentonite clay in environmental remediation projects in the country is on the rise due to increased awareness of environmental issues and regulatory requirements. The clay is also being used in consumer products like cosmetics, personal care items, and pharmaceuticals by companies.

Consumers are drawn to natural and organic products, leading to the adoption of clay-based formulations in skincare products. Technological innovations in clay processing and applications are improving the performance and versatility of these clay-based products for various industrial and consumer applications.

The United Kingdom’s rapid industrialization and urbanization have led to a significantly increasing demand for bentonite clay in several industries. The country's key sectors consuming bentonite include construction, oil and gas drilling, foundry, environmental remediation, and agriculture.

The country is anticipated to reach USD 3.3 million by 2035. Over the forecast period, demand in China is set to increase at a steady CAGR of 5.9%. Booming construction sector in the country is a significant consumer of bentonite clay, used in waterproofing, tunneling, and soil stabilization.

The sector is competitive, with key companies vying for product quality, price, and innovation. Leading companies are consolidating through mergers, acquisitions, and strategic partnerships to grow presence and enhance product portfolios in China.

The section below analyzes the leading segment of the market. In terms of type, the sodium bentonite segment accounted for a share of 46% in 2025. Further, the molding sands segment based on application category held a share of 27% in 2025.

| Segment | Sodium Bentonite (Type) |

|---|---|

| Value Share (2025) | 46% |

Sodium bentonite's swelling capacity when hydrated with water is a key growth factor in the bentonite clay landscape. Its high water absorption and swelling properties make it valuable in sealing, waterproofing, and liquid containment applications.

Industries such as construction, environmental remediation, and oil and gas drilling rely on sodium bentonite for creating impermeable barriers. Demand for sodium bentonite is driven by infrastructure development projects, environmental regulations, and the need for effective solutions in various sectors, fueling industry growth.

| Segment | Molding Sands (Application) |

|---|---|

| Value Share (2025) | 27% |

Rising focus on lightweight and efficiency in automotive and aerospace applications is spurring demand for molding sands that offer dimensional accuracy, surface finish, and mechanical properties. Bentonite clay-based molding sands play a vital role in achieving lightweight and complex castings with high precision and integrity.

Environmental regulations and sustainability concerns further drive the adoption of eco-friendly molding sand formulations in the foundry industry. Bentonite, as a natural and abundant material, offers ecological benefits compared to synthetic binders and additives.

Research and development efforts drive innovation in molding sand technology, adopting collaboration between foundries, material suppliers, and research institutions.

Clariant, Ashapura Group, Bentonite Performance Minerals, Bento Group Minerals, Ningcheng Tianyu, and Xinjiang Nonmetallic Minerals are the key players in the bentonite clay market. The report provides a comprehensive analysis of the bentonite clay market competitive landscape, evaluating product offerings, business strategies, share, and SWOT analysis.

The study also highlights recent developments, such as product development, innovations, joint ventures, partnerships, mergers and acquisitions, and strategic alliances.

Leading participants are taking strategic initiatives to grow global presence, such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaborations. To survive in this competitive environment, competitors are offering cost-effective products.

Manufacturers in the bentonite sector are adopting local manufacturing to reduce operating costs and benefit clients. Furthermore, key firms are investing in research and development activities to produce new products and increase manufacturing capacity.

Leading players are implementing strategies for new entrants to gain bentonite clay market share such as collaborations, acquisitions, mergers, and facility developments to grow presence.

Industry Updates

As per type, the industry has been categorized into sodium bentonite, calcium bentonite, and potassium bentonite.

The industry is segmented into molding sands, iron ore pelletizing, pet litter, drilling mud, civil engineering, and agriculture.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The global bentonite clay market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the bentonite clay market is projected to reach USD 3.3 billion by 2035.

The bentonite clay market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in bentonite clay market are sodium bentonite, calcium bentonite and potassium bentonite.

In terms of application, drilling mud segment to command 27.5% share in the bentonite clay market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Bentonite Cat Litter Market Analysis by Type, Composition, Distribution Channel and Region Through 2025 to 2035

Sulphur Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bentonite in EU Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Clay Based Construction Products Market Size and Share Forecast Outlook 2025 to 2035

Clay Coated Recycled Boxboard Market Growth - Demand & Forecast 2024 to 2034

Clay Coated Paper Market Growth & Demand 2024-2034

Clay Desiccant Bag Market

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

China Clay Market Size, Growth, and Forecast for 2025-2035

Automatic Clay Brick Making Machine Market

TerraCotta Clay for Detoxification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA