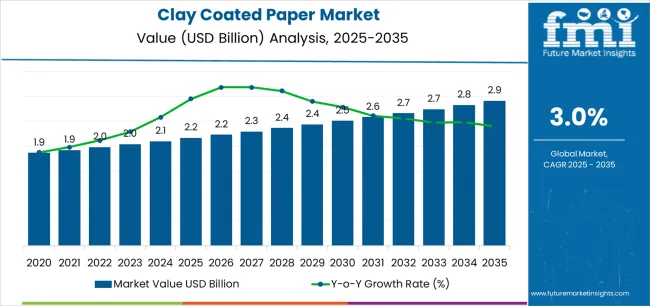

The global clay coated paper market is valued at USD 2.2 billion in 2025 and is projected to reach USD 2.9 billion by 2035, representing an absolute increase of USD 0.7 billion over the assessment period. The overall market size is expected to expand to nearly 1.32 times its current value, supported by rising demand for high-quality packaging substrates and visually distinctive labeling materials across consumer goods, food and beverage, and print media industries.

Growth momentum is shaped by the increasing preference for coated surfaces that deliver high print clarity, smooth texture, and enhanced ink retention, improving product presentation and brand differentiation. Regulatory emphasis on recyclable and fiber-based packaging is prompting innovation in clay coating formulations, particularly those that balance brightness, durability, and cost efficiency while enabling greater use of recycled fibers. Continued improvements in coating machinery and lightweight paperboard production are further strengthening performance consistency.

| Metric | Value |

|---|---|

| Clay Coated Paper Market Estimated Value in (2025 E) | USD 2.2 billion |

| Clay Coated Paper Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

As brand owners prioritize packaging aesthetics alongside environmental compliance, clay coated paper producers positioned with high-brightness, low-weight, and cost-competitive solutions are expected to maintain a steady expansion trajectory. Key trends in the clay coated paper market indicate a move toward lightweight, high-brightness grades that maintain print sharpness without increasing material usage. Brand owners are prioritizing substrates that support premium surface aesthetics, especially for folding cartons, product sleeves, and branded labels in cosmetics, personal care, and specialty food applications.

At the same time, converters and printers are showing increased interest in coating uniformity and gloss control to ensure consistent color reproduction across multiple press runs. Another trend is the development of functional coatings that improve grease resistance, moisture barrier performance, and surface hardness without relying heavily on plastic laminates. This supports recyclability goals while allowing coated papers to replace film-based packaging formats in selected use cases. Additionally, supply chain optimization is encouraging regional paperboard sourcing and local coating lines to reduce freight costs, shorten delivery lead times, and improve responsiveness to seasonal packaging cycles.

The clay coated paper market is witnessing steady expansion driven by increasing demand for high-quality packaging and labeling materials across diverse industries. Current market conditions reflect growing adoption of coated substrates due to their superior printability, smooth surface finish, and enhanced visual appeal. Manufacturers are focusing on cost optimization through the use of recycled materials while maintaining performance standards suitable for both industrial and consumer applications.

The future outlook remains positive as sustainability trends and regulatory emphasis on recyclable and eco-friendly packaging are prompting innovation in clay coating formulations and paperboard manufacturing. Growth rationale is centered on the balance between aesthetic performance, durability, and environmental compliance.

Advancements in coating technologies, combined with increasing demand from the food and beverage and consumer goods sectors, are expected to sustain market momentum The ability of producers to deliver lightweight, high-brightness paper solutions with improved ink retention is further strengthening market competitiveness and ensuring consistent long-term expansion.

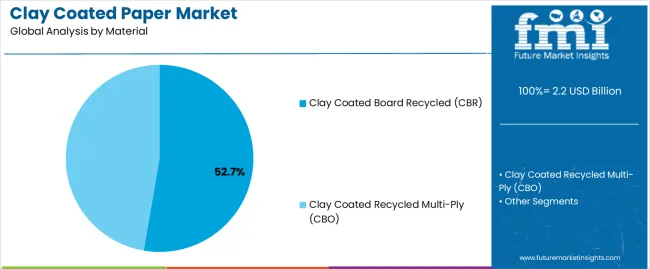

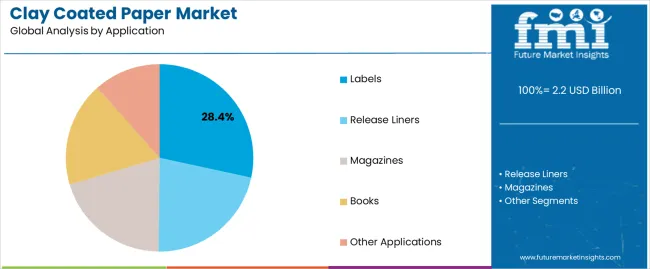

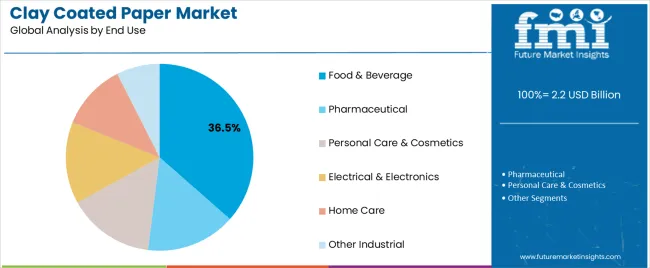

The market is segmented by Material, Application, and End Use and region. By Material, the market is divided into Clay Coated Board Recycled (CBR) and Clay Coated Recycled Multi-Ply (CBO). In terms of Application, the market is classified into Labels, Release Liners, Magazines, Books, and Other Applications. Based on End Use, the market is segmented into Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Electrical & Electronics, Home Care, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clay coated board recycled (CBR) segment, holding 52.7% of the material category, has emerged as the dominant material type due to its cost-effectiveness and environmental advantages. Its widespread adoption is being driven by the growing emphasis on circular economy practices and the need for sustainable packaging alternatives.

The segment benefits from advancements in recycling technologies that improve fiber strength, coating uniformity, and print quality. Consistent demand from packaging converters and printing houses has reinforced its market share.

The combination of lower production costs and compliance with environmental regulations has enhanced its competitiveness against virgin fiber options Manufacturers are increasingly investing in upgrading coating lines and quality control systems to meet global standards, which is expected to sustain CBR’s leading position and support its continued expansion across commercial and industrial packaging applications.

The labels segment, accounting for 28.4% of the application category, has been leading the market owing to its integral role in brand identification and product differentiation. Demand has been supported by the growing need for high-resolution printing and superior surface aesthetics in consumer packaging.

Clay coated paper provides the required smoothness, gloss, and ink absorption for premium label finishes, making it a preferred substrate among converters. Expanding applications across beverages, cosmetics, and personal care products are further enhancing demand.

Continuous advancements in printing technology, particularly in digital and flexographic processes, have improved efficiency and reduced waste These developments, combined with the rising trend toward sustainable labeling materials, are expected to reinforce the segment’s growth trajectory and sustain its strong market share over the forecast period.

The food and beverage segment, representing 36.5% of the end use category, has maintained dominance due to the sector’s extensive reliance on coated paper for packaging, labeling, and promotional materials. Growth has been fueled by increasing consumption of packaged and ready-to-eat foods, as well as rising demand for visually appealing and sustainable packaging formats.

The segment benefits from the moisture resistance and print quality offered by clay coated paper, which ensures durability and shelf appeal. Compliance with food safety and packaging regulations has further encouraged its use among major brands.

Ongoing investments in coating formulations designed for recyclability and compostability are aligning with global sustainability initiatives As consumer preferences continue to shift toward eco-friendly packaging, the food and beverage sector is expected to remain a key driver of demand, ensuring consistent market growth for clay coated paper products.

Rising digitization will negatively impact the clay coated paper market, limiting the product’s scope in the printing industry. The presence of alternatives such as polyethylene coated papers also constrains the market's growth.

Clay coated board recycled (CBR) is the material that is majorly preferred in clay coated paper. The paper is predominately used in the making of release liners.

For 2025, clay coated board recycled (CBR) is expected to account for 76.1% of the market share by material. Some of the key drivers for the increasing use of clay coated board recycled (CBR) are:

| Attributes | Details |

|---|---|

| Top Material | Clay Coated Board Recycled (CBR) |

| Market Share (2025) | 76.1% |

Release liner use of clay coated paper is anticipated to account for 33.1% of the market share in 2025. Some of the key drivers for the progress of clay coated papers in release liners include:

| Attributes | Details |

|---|---|

| Top Application | Release Liners |

| Market Share (2025) | 33.1% |

Increasing uses being found for coated paper are helping the market’s prospects in the Asia Pacific. The booming e-commerce sector is also playing its part in the market’s ascension in the region.

Printing still being popular in Europe, where it has its origins, is aiding the demand for clay coated paper in the region. Rapidly developing manufacturing facilities are also positively impacting the market in Europe.

| Countries | CAGR |

|---|---|

| Spain | 2.1% |

| South Korea | 2.4% |

| Thailand | 4.1% |

| China | 4.7% |

| India | 6.4% |

The market is set to register a CAGR of 2.1% in Spain for the forecast period. The key drivers for growth are:

The CAGR for the clay coated paper market in South Korea is tipped to be 2.4% over the forecast period. Some of the key factors driving the growth are:

The CAGR for the clay coated paper market in Thailand is tipped to be 4.1% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 4.7% in China for the forecast period. Some of the key trends include:

The market is expected to register a CAGR of 6.4% in India over the forecast period. Some of the key trends include:

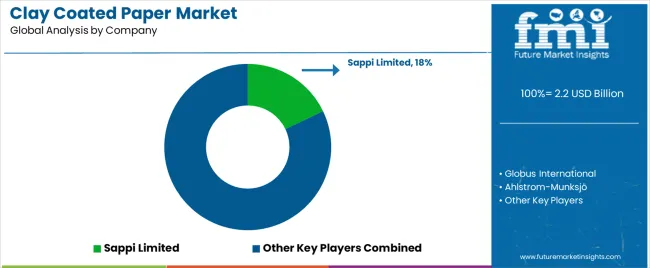

The clay coated paper market is competitive, with the presence of numerous players of varying sizes. Small-scale companies are focused on improving demand locally and giving a fight to their bigger rivals.

Globus International’s focus on food and medical packaging is seeing their clay coated paper production rise. Other market players are collaborating with end-use industries to expand the demand.

Recent Developments in the Clay Coated Paper Market

The global clay coated paper market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the clay coated paper market is projected to reach USD 2.9 billion by 2035.

The clay coated paper market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in clay coated paper market are clay coated board recycled (cbr) and clay coated recycled multi-ply (cbo).

In terms of application, labels segment to command 28.4% share in the clay coated paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clay Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

Polycoated Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Polycoated Paper Packaging Market Share

Wax-coated Paper Market

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Coated Recycled Paperboard Providers

Poly Coated Paperboard Market

Coated Sack Kraft Paper Market

Coated White Board Paper Market

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Key Players & Market Share in the Barrier Coated Paper Industry

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Poly coated Kraft Paper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA