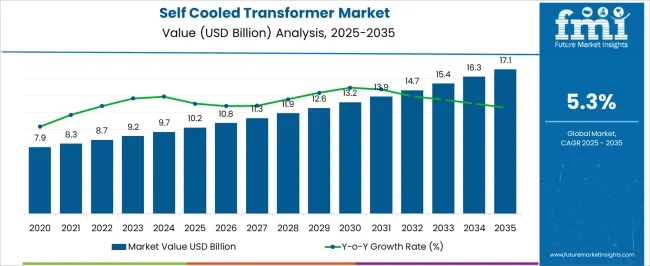

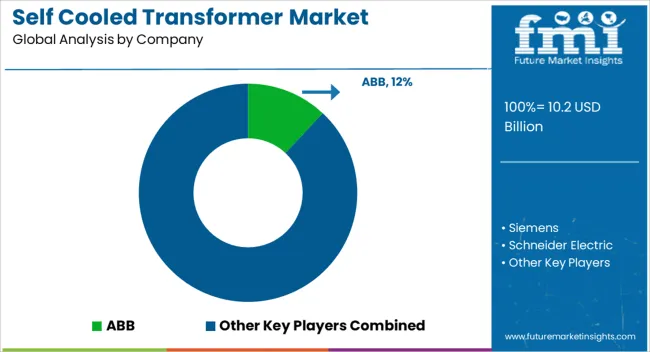

The self cooled transformer market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 17.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

Between 2020 and 2025, the market expanded from USD 7.9 billion to USD 10.2 billion, marking the steady adoption phase where rising electricity demand, urbanization, and grid modernization initiatives fueled installations, particularly in developing regions. During this stage, utilities prioritized cost-effective, low-maintenance transformers for distribution networks, benefiting from reduced operational complexity compared to forced-cooled systems. \

From 2026 to 2030, the market grows from USD 10.8 billion to USD 13.2 billion, contributing nearly 43% of the absolute dollar opportunity. This acceleration is underpinned by the proliferation of renewable energy projects, rural electrification programs, and replacement demand for aging infrastructure, with governments emphasizing energy efficiency and grid stability. By 2031–2035, the market further expands from USD 13.9 billion to USD 17.1 billion, contributing the remaining 57% of growth, as digital grid integration, industrial automation, and higher load-handling capacities boost adoption of advanced self-cooled transformers equipped with smart monitoring systems.

| Metric | Value |

|---|---|

| Self Cooled Transformer Market Estimated Value in (2025 E) | USD 10.2 billion |

| Self Cooled Transformer Market Forecast Value in (2035 F) | USD 17.1 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The self cooled transformer market represents a specialized segment within the global power transformer industry, contributing an estimated 7–9% share of total transformer installations, where oil-immersed and dry-type units dominate. Within the broader electrical distribution equipment sector, self cooled transformers hold around 5–6%, primarily driven by demand in medium-voltage networks and industrial operations. In renewable energy integration, especially in solar and wind farms, their share is close to 8–10%, as utilities increasingly deploy compact, low-maintenance transformers for decentralized generation. Across urban distribution grids and commercial complexes, their share stands at 6–7%, supported by lower installation costs and reliability under varying load conditions. In the overall energy infrastructure market, the share is more modest at 2–3%, as switchgear, cables, and substations account for larger proportions of spending.

Growth is being reinforced by rising electricity consumption, grid modernization programs, and expansion of industrial facilities in emerging economies. Manufacturers are focusing on improving thermal efficiency, insulation systems, and compact designs to meet safety and performance requirements. Strategic partnerships with utilities and renewable developers are also shaping competitive positioning. Although smaller compared to oil-immersed transformers, the self cooled transformer market is consolidating its importance as a reliable and cost-effective solution within medium-voltage distribution and renewable integration projects.

The market is experiencing strong momentum as industries and utilities prioritize energy efficiency, operational reliability, and cost-effective grid infrastructure. Increasing electricity demand in both developed and emerging economies has driven the deployment of transformers capable of reliable performance without additional cooling systems. This technology is being adopted due to its low maintenance requirements, reduced operational costs, and environmental benefits, as it eliminates the need for auxiliary cooling equipment.

Urbanization, industrial expansion, and the modernization of power distribution networks are further propelling market growth. Regulatory emphasis on reducing carbon emissions and enhancing energy efficiency has encouraged utilities to upgrade existing transformer fleets with self cooled models.

The integration of advanced insulation materials, high-quality core designs, and improved winding configurations is improving performance, while digital monitoring systems are enhancing operational safety As renewable energy integration continues to expand, self cooled transformers are anticipated to play an increasingly important role in decentralized and distributed energy systems.

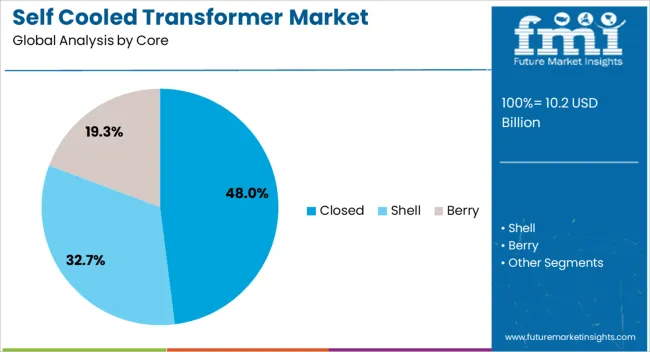

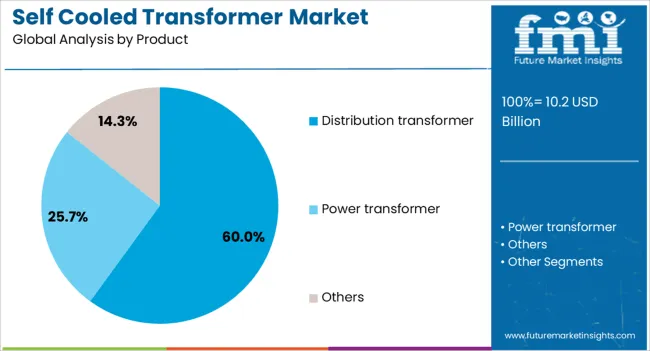

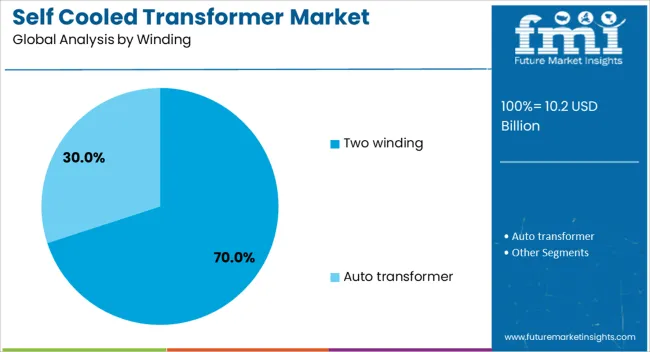

The self cooled transformer market is segmented by core, product, winding, insulation, rating, application, and geographic regions. By core, self cooled transformer market is divided into closed, shell, and berry. In terms of product, self cooled transformer market is classified into distribution transformer, power transformer, and others. Based on winding, self cooled transformer market is segmented into two winding and auto transformer. By insulation, self cooled transformer market is segmented into oil, solid, and others. By rating, self cooled transformer market is segmented into ≤ 10 MVA and > 10 MVA to ≤ 100 MVA. By application, self cooled transformer market is segmented into utility, residential, and commercial & industrial. Regionally, the self cooled transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The closed core segment is expected to hold 48% of the self cooled transformer market revenue share in 2025, making it the leading core type. Growth in this segment has been supported by its proven efficiency in minimizing core losses and improving transformer performance under continuous load conditions. Closed core designs provide a robust magnetic path that enhances power transfer and reduces energy dissipation. The structural strength of this configuration supports long service life, reducing the frequency of replacements and maintenance. It has been widely adopted in both industrial and utility applications due to its ability to handle varying load demands efficiently. Compatibility with advanced conductor materials and optimized lamination techniques has further boosted its performance As utilities focus on lowering total operating costs and ensuring high operational reliability, the closed core configuration continues to be favored for self cooled transformer designs, reinforcing its dominant market position.

The distribution transformer segment is projected to account for 60% of the market revenue share in 2025, establishing it as the leading product type. This growth has been driven by the widespread need to efficiently deliver electricity from substations to end-users in residential, commercial, and light industrial settings. Self cooled designs have been increasingly implemented in distribution transformers due to their lower maintenance needs, operational simplicity, and enhanced reliability in diverse environmental conditions. The absence of external cooling systems reduces both capital expenditure and operating costs, which is appealing to utilities and infrastructure developers. As smart grids expand and rural electrification initiatives accelerate, distribution transformers with self cooled features are being deployed to support dependable, low-loss energy delivery The ability to integrate advanced monitoring systems for real-time performance analysis further enhances their operational appeal, sustaining their leading role in the market.

The two winding segment is projected to hold 70% of the market revenue share in 2025, marking it as the dominant winding configuration. This design has been preferred for its cost-effectiveness, simplicity, and reliability in a wide range of voltage transformation applications. Two winding configurations allow efficient electrical isolation between primary and secondary windings, enhancing safety and performance stability. The design’s straightforward construction reduces complexity in manufacturing, leading to lower costs and faster production cycles. Its compatibility with various voltage classes and adaptability to multiple installation environments has contributed to broad adoption. Utilities and industrial operators value the proven durability and operational resilience of two winding self cooled transformers, particularly in regions where stable performance is essential under fluctuating load conditions The combination of economic efficiency and robust performance continues to reinforce the leadership of this configuration in the overall market.

Self cooled transformers are gaining demand from distribution grids and renewable projects, driven by reliability and efficiency. High upfront costs and raw material issues remain key challenges to faster adoption.

The self cooled transformer market is expanding due to growing requirements in power distribution networks across industrial, commercial, and residential sectors. Utilities are prioritizing transformers with reliable performance and lower maintenance costs to ensure uninterrupted electricity supply. Self cooled units are being deployed in medium-voltage applications where compact size and efficient cooling systems provide operational benefits. Their use in substation upgrades and distribution grid expansions is increasing steadily as energy consumption patterns diversify across regions. Countries investing in modern grid infrastructure and rural electrification are further supporting adoption. This rising demand positions self cooled transformers as a dependable choice for applications that require consistent performance and low operating costs in everyday power distribution.

Opportunities for self cooled transformers are emerging strongly within renewable energy projects such as wind farms, solar power plants, and decentralized generation systems. These transformers are valued for their capacity to handle fluctuating loads while maintaining safety and reliability in harsh operating environments. Developers of renewable infrastructure are adopting self cooled units to reduce dependency on high-maintenance cooling systems and to ensure long service life. Their compatibility with compact, modular substations makes them suitable for expanding renewable integration. As governments and private firms continue to invest heavily in clean power expansion, the market outlook for self cooled transformers within renewable projects is set to strengthen further, driving wider adoption and consistent long-term demand.

Competition in the self cooled transformer market revolves around efficiency, insulation technology, and compliance with international safety standards. Established manufacturers focus on developing transformers with longer service lifespans and enhanced cooling systems that reduce operational failures. Regional suppliers differentiate by providing cost-effective and customized designs tailored to local power distribution needs. Partnerships with utilities, renewable developers, and industrial plants form an essential strategy for expanding market presence. Competitive advantage is often tied to the ability to offer reliable performance under varying load conditions. This dynamic competitive environment ensures continuous improvements in transformer design and delivery, positioning established and emerging players to capture expanding opportunities worldwide.

The self cooled transformer market faces challenges linked to cost pressures, raw material availability, and installation constraints. The upfront investment remains high compared to conventional oil-immersed units, limiting adoption in cost-sensitive regions. Limited awareness among smaller utilities and industrial operators about long-term benefits also slows wider implementation. Raw material volatility in copper, steel, and insulation components impacts pricing and supply consistency. Space restrictions in dense industrial zones sometimes discourage installation, as more compact solutions are preferred. These barriers reduce faster adoption rates but do not diminish the importance of self cooled transformers as reliable and low-maintenance equipment for power distribution and renewable integration projects.

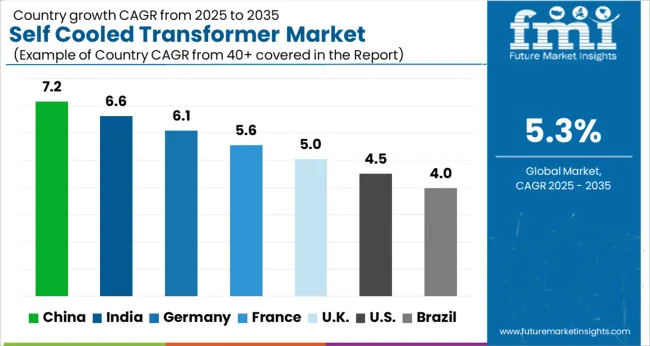

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The self cooled transformer market is projected to grow globally at a CAGR of 5.3% from 2025 to 2035, driven by rising electricity demand, grid modernization, and renewable energy integration. China leads with a CAGR of 7.2%, supported by rapid industrialization, urban grid expansion, and large-scale renewable power projects. India follows at 6.6%, benefitting from government-backed electrification programs, smart grid initiatives, and growing demand in industrial corridors. France posts 5.6%, with growth tied to modernization of aging power networks and industrial load centers. The United Kingdom achieves 5.0%, where demand is guided by infrastructure upgrades and renewable adoption. The United States records 4.5%, with moderate growth driven by selective investments in distribution efficiency and industrial power requirements. This outlook highlights Asia as the strongest growth hub, Europe sustaining steady expansion through energy transition programs, and North America progressing with moderate but stable adoption trends.

China is projected to expand at a CAGR of 7.2% during 2025–2035, which is significantly higher than the global average of 5.3%. During 2020–2024, the CAGR was closer to 6.1%, supported by steady adoption across industrial zones and distribution networks. The noticeable rise in the next phase is anchored by large-scale renewable energy integration, expansion of manufacturing hubs, and state-backed grid modernization projects. Investments in solar and wind corridors have created greater demand for reliable medium-voltage transformers, and self cooled variants have proven suitable for long-term operation. This positions China as the global leader in scaling adoption across both utilities and industrial clusters.

India’s CAGR for the self cooled transformer market is estimated at 6.6% during 2025–2035, compared to 5.5% in 2020–2024, highlighting strong momentum. Earlier growth was driven by electrification in rural areas, industrial corridor expansion, and smart city projects. The later decade sees accelerated deployment due to renewable energy parks, digital grid initiatives, and strengthening of industrial supply chains. Government policies promoting energy efficiency and private investments in high-demand sectors such as steel and cement further encourage adoption. These factors collectively place India among the fastest-growing countries in this segment, with self cooled transformers serving as cost-effective and durable solutions for medium-voltage requirements.

France is expected to grow at a CAGR of 5.6% during 2025–2035, compared to 4.6% in 2020–2024, signaling an improvement in adoption. In the earlier phase, growth was moderate as demand was tied to selective utility upgrades and limited industrial expansion. The stronger outlook in the following next few years is backed by EU-driven energy transition programs, investment in renewable integration, and replacement of aging transformers across industrial plants. French utilities and private grid operators are expected to favor self cooled designs due to their lower maintenance costs and operational reliability. This evolution highlights France’s steady role in the European distribution network transformation.

The CAGR for the self cooled transformer market in the United Kingdom is projected at 5.0% during 2025–2035, up from 4.2% in 2020–2024, showing gradual strengthening. The earlier period was marked by modest adoption due to high upfront costs and cautious replacement of legacy systems. In the following phase, greater momentum is expected from renewable integration, grid reinforcement, and industrial modernization projects. The pharmaceutical and food industries are also expanding their demand for reliable medium-voltage distribution, further strengthening adoption. This shift underscores a progressive rise, with the UK aligning itself with the broader European transformation in energy distribution systems.

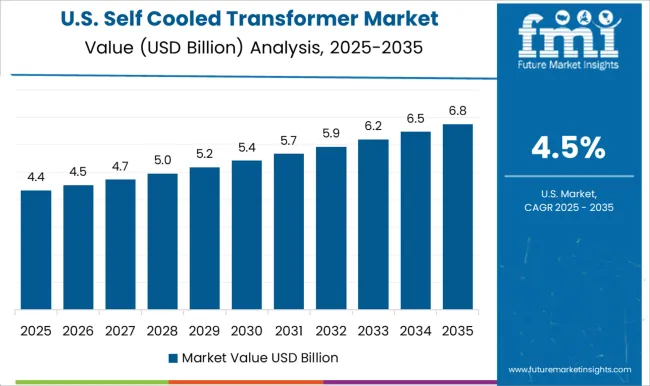

The United States is forecast to grow at a CAGR of 4.5% during 2025–2035, compared to 3.9% in 2020–2024, showing a modest yet steady increase. Earlier growth was restricted by high reliance on oil-immersed transformers and limited replacement of older units. In the following decade, demand gains are supported by selective modernization of distribution networks, growth in renewable integration, and investment in grid resilience projects. Industrial sectors such as chemicals, steel, and automotive are expected to add incremental demand. While the growth pace remains below Asian and European markets, the USA continues to display a stable adoption curve reinforced by high-value applications.

The self cooled transformer market is highly competitive, with leading multinational corporations and specialized regional manufacturers addressing both utility-scale and industrial requirements. ABB holds a strong leadership position, leveraging its advanced engineering expertise, wide distribution footprint, and emphasis on grid modernization to deliver reliable transformer solutions. Siemens plays a pivotal role in Europe and global markets, focusing on high-efficiency self cooled transformers integrated with digital monitoring systems for improved operational reliability. Schneider Electric strengthens its share through compact designs and energy-efficient models tailored for medium-voltage applications across commercial and industrial sectors. General Electric (GE) contributes with its diversified transformer portfolio, emphasizing durability and integration within USA and global distribution networks.

Mitsubishi Electric is recognized for its high-quality self cooled transformers that cater to large-scale utilities and industrial facilities, particularly in Asia and the Middle East. Eaton expands its presence by offering customizable transformer solutions for power distribution and industrial users, focusing on cost efficiency and compliance with international safety standards. Competitive differentiation in this market is shaped by efficiency, lifecycle performance, cost optimization, and ability to meet stringent grid reliability requirements. Key strategies include strengthening R&D for improved thermal design, building partnerships with utilities and renewable developers, and expanding global service networks. The competition remains intense as companies invest in product upgrades, supply chain efficiency, and customer-focused solutions to capture emerging opportunities in distribution and renewable energy integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.2 billion |

| Core | Closed, Shell, and Berry |

| Product | Distribution transformer, Power transformer, and Others |

| Winding | Two winding and Auto transformer |

| Insulation | Oil, Solid, and Others |

| Rating | ≤ 10 MVA and > 10 MVA to ≤ 100 MVA |

| Application | Utility, Residential, and Commercial & industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, Schneider Electric, General Electric (GE), Mitsubishi Electric, and Eaton |

| Additional Attributes | Dollar sales, share, regional adoption trends, utility procurement pipelines, competitive benchmarking, pricing analysis, raw material cost impact, regulatory standards, and future growth opportunities. |

The global self cooled transformer market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the self cooled transformer market is projected to reach USD 17.1 billion by 2035.

The self cooled transformer market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in self cooled transformer market are closed, shell and berry.

In terms of product, distribution transformer segment to command 60.0% share in the self cooled transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-propelled Orchard Top-cutting Machines Market Forecast and Outlook 2025 to 2035

Self-healing Network Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Biologics Market Size and Share Forecast Outlook 2025 to 2035

Self-fusing Silicone Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Parenteral Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-service Analytics Market Size and Share Forecast Outlook 2025 to 2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Self-adhesive Tear Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Labels Market Size and Share Forecast Outlook 2025 to 2035

Self-Healing Concrete Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Self Sensing Nanocomposites Market Size and Share Forecast Outlook 2025 to 2035

Self-Lubricating Bearings Market Size and Share Forecast Outlook 2025 to 2035

Self - Locking Trays Market Size and Share Forecast Outlook 2025 to 2035

Self-urinary Infection Testing Market Size and Share Forecast Outlook 2025 to 2035

Self-chilling Cans Market Size and Share Forecast Outlook 2025 to 2035

Self-Service BI Market Size and Share Forecast Outlook 2025 to 2035

Self-checkout Systems Market Analysis by Portable Self-Checkout Devices and Stationary Self-Checkout Kiosks Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA