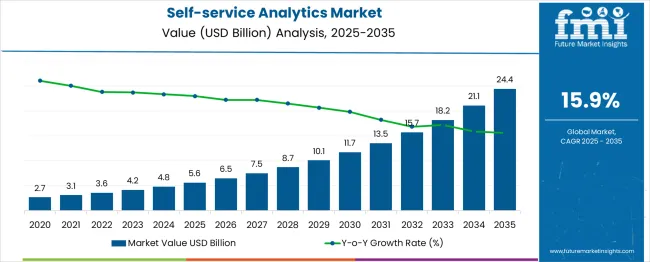

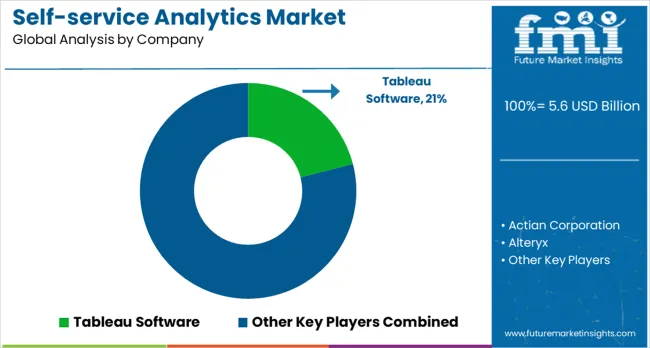

The global self-service analytics market is expected to expand from USD 5.6 billion in 2025 to USD 24.4 billion by 2035, reflecting a 16% CAGR and creating an absolute dollar opportunity of USD 18.8 billion. Growth is driven by increasing adoption of cloud-based analytics platforms, demand for real-time decision-making, and the ability of business users to generate insights independently. Advanced features such as intuitive dashboards, machine learning integration, and automated reporting enhance operational efficiency and support adoption across industries including retail, finance, healthcare, and manufacturing.

Quick Stats for Self-Service Analytics Market

Seasonality and cyclicality patterns reveal how demand varies throughout the year. The market tends to peak during the final quarters of fiscal years when organizations implement new analytics projects, finalize budgets, and prepare strategic plans. Early-year activity often shows slower adoption as companies assess requirements and plan deployments. Sector-specific cycles further influence demand: retail and e-commerce see higher activity during seasonal campaigns, while manufacturing and logistics align adoption with production planning and performance reviews. Regional differences also affect patterns, with North America and Europe exhibiting predictable fiscal-year-driven peaks, and Asia Pacific showing adoption cycles tied to infrastructure development and digital transformation initiatives. Despite these seasonal fluctuations, the market growth remains consistently upward, driven by technology integration and enterprise investment, ensuring steady expansion and a significant increase in market value from 2025 to 2035.

| Metric | Value |

| Estimated Value in (2025E) | USD 5.6 billion |

| Forecast Value in (2035F) | USD 24.4 billion |

| Forecast CAGR (2025 to 2035) | 16% |

Recent developments in the self-service analytics market focus on AI integration, cloud deployment, and user-friendly design. Vendors are introducing machine learning algorithms, natural language query tools, and automated dashboards to deliver actionable insights with minimal IT support. Cloud-based solutions enhance scalability, flexibility, and data accessibility, while interactive visualizations improve user experience. Mobile-enabled analytics and real-time reporting are expanding adoption across industries. Increasing need for rapid decision-making, operational efficiency, and democratized access to data is driving growth. These trends are fostering innovation, wider adoption, and enhanced functionality in self-service analytics solutions worldwide.

The market is driven by five primary parent markets with specific shares. Enterprise IT and business intelligence lead with 40%, enabling organizations to perform data analysis independently and speed decision-making. Healthcare and life sciences contribute 22%, applying analytics to patient outcomes, research data, and operational efficiency. Retail and e-commerce account for 15%, using platforms to monitor sales trends, optimize inventory, and understand consumer behavior. Financial services represent 13%, leveraging analytics for risk management, regulatory compliance, and portfolio assessment. Government and public sector applications hold 10%, supporting data-driven policy making and performance evaluation. These segments collectively shape global market demand.

Market expansion is being supported by the increasing volume of business data and the corresponding demand for analytical tools that can enable non-technical users to derive insights and make data-driven decisions without relying on IT departments or data science teams. Modern organizations are increasingly focused on achieving analytical agility and reducing time-to-insight by distributing analytical capabilities across business functions and organizational levels. Self-service analytics' proven ability to democratize data access while maintaining governance and security makes it an essential technology for data-driven transformation and competitive advantage.

The growing focus on citizen data science and business user empowerment is driving demand for self-service analytics platforms that combine powerful analytical capabilities with intuitive user interfaces and guided analytics workflows. Organizational preference for solutions that can reduce analytical bottlenecks while improving business user productivity is creating opportunities for innovative self-service analytics implementations. The rising influence of cloud computing and software-as-a-service delivery models is also contributing to increased adoption of self-service analytics solutions that can scale rapidly and integrate with existing business applications.

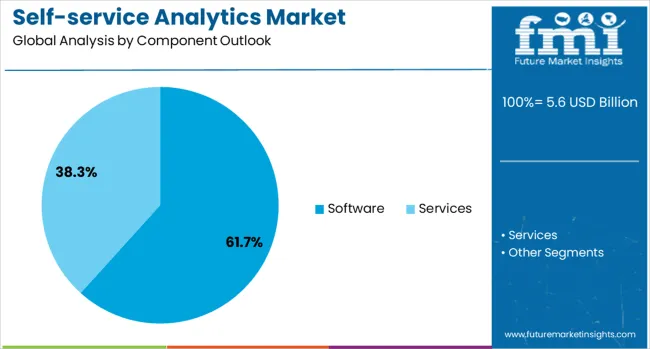

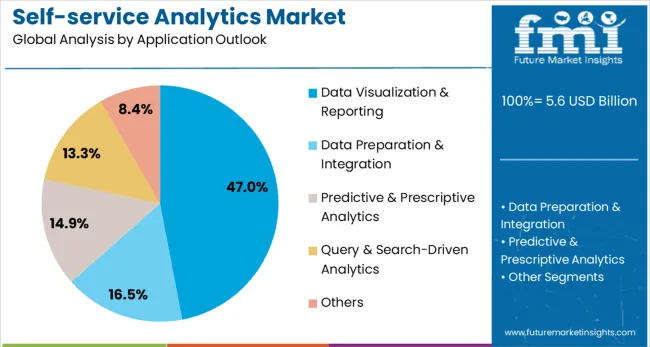

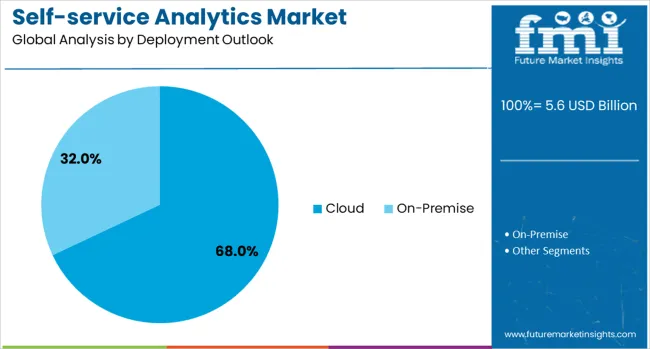

The market is segmented by component, application, deployment, enterprise size, end use, and region. By component, the market is divided into software and services. Based on application, the market is categorized into data visualization & reporting, data preparation & integration, predictive & prescriptive analytics, query & search-driven analytics, and others. In terms of deployment, the market is segmented into cloud and on-premise. By enterprise size, the market is classified into large enterprises and small & medium enterprises. By end use, the market is divided into BFSI, retail & e-commerce, healthcare, IT & telecommunication, manufacturing, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The software component segment is projected to account for 62.0% of the self-service analytics market in 2025, reaffirming its position as the dominant component category. Organizations increasingly invest in self-service analytics software platforms for their comprehensive analytical capabilities, user-friendly interfaces, and ability to enable business users to perform complex data analysis independently. Software platforms' essential role in providing the core analytical functionality and user experience directly addresses organizational needs for democratized data analytics and reduced dependence on technical resources.

This component category represents the primary technology investment required for self-service analytics deployment, including analytics platforms, visualization tools, and data preparation capabilities that enable business user empowerment. Vendor investments in intuitive user interface design and advanced analytical algorithms continue to strengthen software platform adoption.

Data visualization & reporting applications are projected to represent 47.0% of self-service analytics demand in 2025, underscoring their critical role as the primary interface between users and analytical insights. Business users prefer data visualization and reporting capabilities for their ability to transform complex data into understandable visual formats and communicate insights effectively across organizations. Positioned as essential functionality for analytical communication and decision support, data visualization & reporting offers both insight discovery benefits and stakeholder communication advantages.

The segment is supported by increasing focus on data storytelling and visual communication that enables business users to present analytical findings in compelling and actionable formats. Additionally, modern visualization tools provide interactive capabilities that will allow users to explore data dynamically and discover insights through visual analysis.

The cloud deployment segment is forecasted to contribute 68.0% of the self-service analytics market in 2025, reflecting the growing preference for scalable and accessible analytics solutions. Organizations increasingly prefer cloud-based self-service analytics platforms for their rapid deployment capabilities, automatic updates, and ability to scale resources dynamically based on user demand and analytical workloads.

The segment benefits from continuous cloud platform advancement and growing organizational confidence in cloud security and performance for analytical applications. With established cloud service ecosystems and flexible subscription models, cloud-based self-service analytics serves as the preferred deployment approach for organizations seeking agile and cost-effective analytical capabilities, making it a critical foundation for market accessibility and widespread adoption.

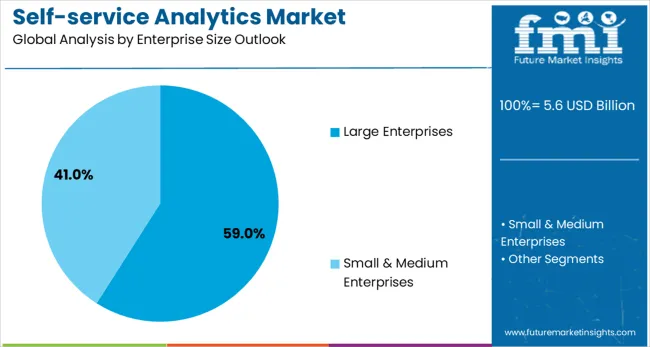

The large enterprises segment is forecasted to contribute 59.0% of the self-service analytics market in 2025, reflecting the primary adoption of self-service analytics solutions in organizations with substantial data volumes and complex analytical requirements. Large enterprises increasingly invest in self-service analytics to address the analytical needs of diverse business functions while reducing the burden on centralized IT and analytics teams. This aligns with enterprise digital transformation strategies that prioritize distributed capabilities and business user empowerment.

The segment benefits from large enterprises' substantial technology budgets and established data management infrastructure that can support comprehensive self-service analytics deployments. With significant analytical requirements and resources to implement advanced solutions, large enterprises serve as the primary market for self-service analytics platforms, making them a critical foundation for vendor business models and technology advancement.

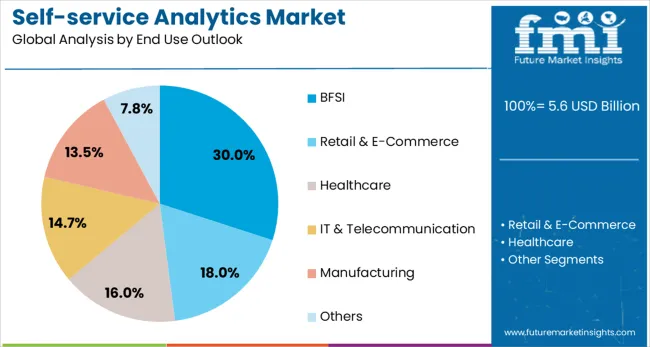

The BFSI (Banking, Financial Services, and Insurance) end-use segment is forecasted to contribute 30.0% of the self-service analytics market in 2025, reflecting the critical importance of data analytics in financial services operations and decision-making. Financial institutions increasingly utilize self-service analytics for risk management, customer analytics, regulatory reporting, and business performance monitoring that require rapid insight generation and flexible analytical capabilities. This aligns with financial services trends that focus in data-driven operations and regulatory compliance through analytical transparency.

The segment benefits from a financial services data-rich environment and established analytical requirements that demand sophisticated self-service capabilities for various business functions, including credit analysis, fraud detection, and customer relationship management. With significant regulatory and competitive pressures requiring analytical agility, BFSI serves as the primary industry driver of self-service analytics adoption, making it a critical foundation for market growth and solution development.

The self-service analytics market is advancing rapidly due to increasing data volumes and growing demand for analytical democratization that enables business users to derive insights independently. The market faces challenges including data governance and security concerns, user training and adoption barriers, and integration complexity with existing enterprise systems. Innovation in augmented analytics and natural language interfaces continues to influence product development and market expansion patterns.

The growing adoption of augmented analytics capabilities is enabling self-service analytics platforms to provide automated insights, smart recommendations, and intelligent data preparation that reduces the analytical skills required for effective use. AI-powered features enhance user productivity while democratizing advanced analytical capabilities, including machine learning and predictive analytics. Organizations are increasingly recognizing the value of augmented analytics for expanding self-service capabilities to broader user populations.

Modern self-service analytics providers are incorporating natural language processing capabilities that enable users to query data and generate insights using conversational interfaces and plain-language questions. These technologies reduce barriers to analytics adoption while providing more intuitive user experiences that can accommodate users with varying technical skills. Advanced NLP integration also enables voice-activated analytics and automated report generation that improves user accessibility and productivity.

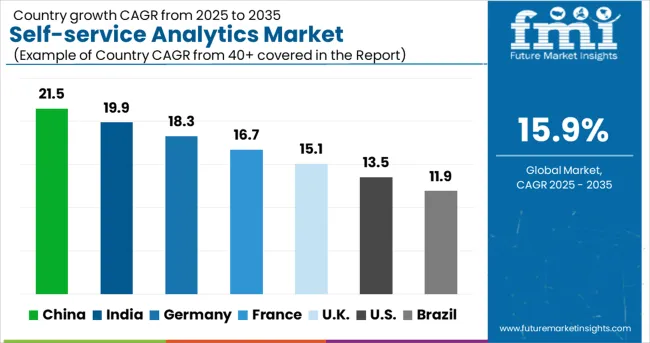

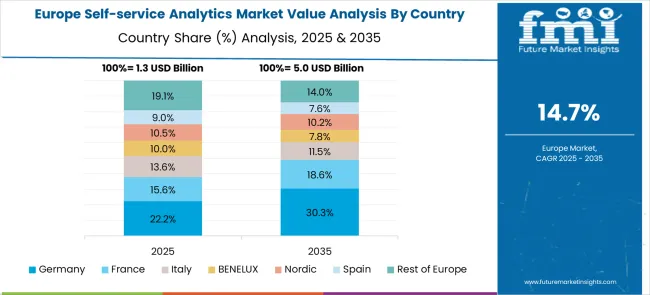

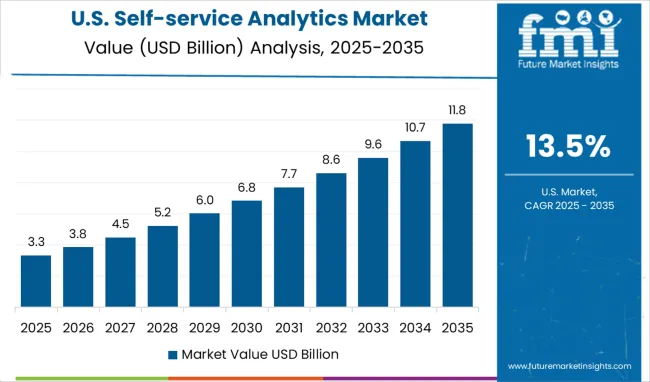

In 2025, the self-service analytics market is projected to grow at a global CAGR of 16% through 2035, supported by increasing enterprise demand for actionable insights, automated reporting, and cloud-based analytics platforms. China leads at 21.5%, 1.35× the global rate, driven by BRICS-related digital transformation programs, adoption of AI-powered analytics, and rapid enterprise integration. India follows at 19.9%, 1.24× the global benchmark, reflecting growing adoption in IT, retail, and financial services. Germany records 18.3%, 1.14× the global CAGR, shaped by OECD-led technological adoption, regulatory data initiatives, and industrial analytics use. France posts 16.7%, slightly above the global rate, supported by enterprise uptake of advanced analytics solutions. The United Kingdom stands at 15.1%, slightly below the global benchmark, driven by commercial and medium-scale enterprise deployment. The United States grows at 13.5%, 0.84× the global rate, with expansion concentrated in large corporations and tech sectors. Brazil records 11.9%, 0.75× the global CAGR, reflecting early-stage enterprise adoption and regional digital initiatives.

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

| China | 21.5% |

| India | 19.9% |

| Germany | 18.3% |

| France | 16.7% |

| UK | 15.1% |

| U.S. | 13.5% |

| Brazil | 11.9% |

China is growing at a CAGR of 21.5%, outpacing the global average due to rapid digital transformation in enterprise operations. Businesses in finance, retail, and manufacturing are adopting self-service analytics platforms to enable faster insights and enhance operational efficiency. Domestic technology providers are developing AI-powered and cloud-integrated solutions to improve real-time reporting and decision-making capabilities. Investment in big data infrastructure, predictive analytics, and data governance is accelerating adoption. Government-backed initiatives to digitize commercial and public sector operations further drive market growth. Organizations increasingly leverage analytics to optimize supply chains, improve customer engagement, and enhance financial performance, strengthening China's position in the global market.

India is growing at a CAGR of 19.9%, driven by expanding IT services, digital transformation initiatives, and SME adoption of analytics solutions. Enterprises are increasingly using self-service platforms to democratize data access and reduce dependency on centralized IT teams. AI-enabled features, cloud deployment, and interactive visualization tools are facilitating faster decision-making. Government programs supporting digital adoption and data-driven infrastructure in finance, healthcare, and logistics are further encouraging uptake. Domestic vendors are introducing low-code and scalable analytics platforms suitable for large and mid-sized organizations, supporting adoption across multiple sectors.

Germany is advancing at a CAGR of 18.3%, supported by strong industrial and commercial adoption. Enterprises increasingly utilize self-service analytics to improve operational efficiency, forecast trends, and optimize resource allocation. Focused adoption occurs in manufacturing, logistics, and automotive sectors, leveraging AI-assisted dashboards and real-time reporting. Market growth is fueled by automation in analytics workflows, predictive modeling, and visualization tools for rapid insight generation. Collaboration with technology providers and consulting firms accelerates deployment across mid-sized and large organizations. Industrial operators rely on self-service analytics to improve supply chain efficiency, reduce operational costs, and strengthen decision-making in high-volume production environments.

France is growing at a CAGR of 16.7%, driven by adoption across commercial, public sector, and industrial enterprises. Self-service analytics solutions enable data-driven decision-making in finance, retail, and energy sectors. Vendors focus on interactive visualization, automated reporting, and AI integration to improve insight generation. Growth is further supported by government-backed digitization programs and enterprise adoption of cloud-based solutions. Enterprises leverage analytics for operational efficiency, market intelligence, and predictive trend analysis.

The UK is growing at a CAGR of 15.1%, with adoption across commercial, healthcare, and financial sectors. Self-service analytics platforms empower business units to independently analyze data, reducing dependency on IT teams. Vendors provide interactive dashboards, predictive analytics, and cloud-based solutions to enhance decision-making. Increasing focus on operational efficiency, supply chain optimization, and customer experience drives adoption. Enterprises increasingly integrate self-service analytics with ERP, CRM, and marketing platforms.

The US is growing at a CAGR of 13.5%, driven by enterprise adoption in technology, healthcare, finance, and retail sectors. Self-service analytics platforms reduce dependency on centralized IT, enabling real-time decision-making and faster insights. Vendors focus on AI integration, predictive modeling, and interactive dashboards for mid-sized and large enterprises. Adoption in logistics, supply chain, and customer experience management is increasing. Companies leverage analytics to optimize operations, enhance market responsiveness, and reduce costs, strengthening the market landscape.

Brazil is expanding at a CAGR of 11.9%, supported by adoption in commercial, industrial, and public sector enterprises. Self-service analytics platforms are gaining popularity for operational efficiency, real-time insights, and cost-effective decision-making. Vendors focus on cloud-based solutions, interactive dashboards, and visualization tools to simplify adoption. Growth is accelerated by investment in digital infrastructure, industrial modernization, and data-driven initiatives. Enterprises are leveraging analytics to optimize supply chains, improve productivity, and enhance customer experience, contributing to steady market expansion.

The self-service analytics market is shaped by technology providers delivering advanced tools for data visualization, reporting, and business intelligence. Tableau Software, U.S.-based, is recognized for user-friendly dashboards and data integration capabilities that allow organizations to analyze complex datasets without requiring advanced coding knowledge. Actian Corporation focuses on hybrid data management and analytics solutions that simplify insights across cloud and on-premise environments. Alteryx prioritize data preparation and workflow automation, enabling business users to generate insights efficiently. Athena Solutions provides platforms that support strategic decision-making with strong reporting and analytic functionalities. Board International delivers integrated business intelligence and performance management tools tailored for corporate environments.

Cerexio offers AI-powered self-service analytics systems designed for predictive maintenance and industrial applications. Dremio focuses on data lakehouse platforms, enhancing accessibility and scalability for enterprise analytics. IBM Corporation provides a suite of business intelligence solutions, integrating self-service analytics with AI-driven features. LANSA INC. delivers low-code and analytics platforms to streamline business operations. Luzmo NV specializes in embedded analytics solutions, enabling companies to integrate customizable dashboards within business applications. Metric Insights offers data governance and dashboard intelligence to help enterprises improve analytics adoption. PYRAMID ANALYTICS provides decision intelligence platforms that combine self-service analytics with machine learning capabilities.

QlikTech International AB focuses on associative data models that allow interactive exploration across multiple data sources. Sisense Ltd. delivers analytics platforms designed for embedded business applications and real-time insights. ThoughtSpot Inc. enables search-driven analytics with natural language processing for enterprise decision-making. Zoho Corporation Pvt. Ltd. provides a comprehensive self-service analytics suite integrated within its business software ecosystem. Collectively, these organizations empower enterprises to democratize data usage, reduce dependency on IT teams, and drive faster, data-driven decision-making across industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.6 billion |

| Component | Software, Services |

| Application | Data Visualization & Reporting, Data Preparation & Integration, Predictive & Prescriptive Analytics, Query & Search-Driven Analytics, Others |

| Deployment | Cloud, On-Premise |

| Enterprise Size | Large Enterprises, Small & Medium Enterprises |

| End Use | BFSI, Retail & E-Commerce, Healthcare, IT & Telecommunication, Manufacturing, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Tableau Software, Actian Corporation, Alteryx, Athena Solutions, Board International, Cerexio, Dremio, IBM Corporation, LANSA INC, Luzmo NV, Metric Insights, PYRAMID ANALYTICS, QlikTech International AB, Sisense Ltd, ThoughtSpot Inc, Zoho Corporation Pvt Ltd |

| Additional Attributes | Dollar sales by component and end-use category, regional demand trends, competitive landscape, buyer preferences for cloud versus on-premise deployment, integration with business applications, innovations in augmented analytics, natural language processing, and citizen data science platform development |

Component:

Application:

Deployment:

Enterprise Size:

End Use:

Region:

The global self-service analytics market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the self-service analytics market is projected to reach USD 24.4 billion by 2035.

The self-service analytics market is expected to grow at a 15.9% CAGR between 2025 and 2035.

The key product types in self-service analytics market are software and services.

In terms of application outlook, data visualization & reporting segment to command 47.0% share in the self-service analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Visual Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Patent Analytics Market Trends – Growth & Industry Outlook 2024-2034

Speech Analytics Market

Payment Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA