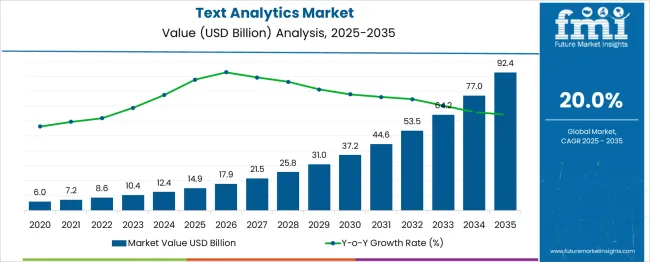

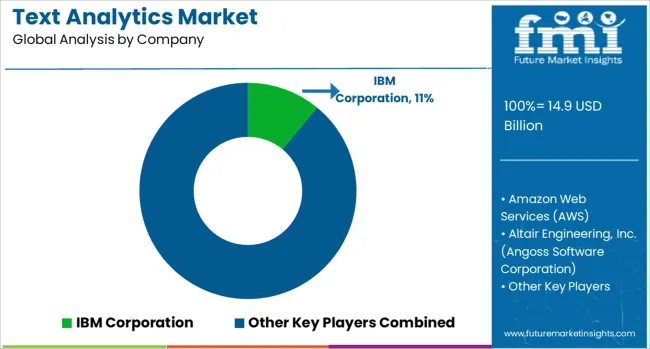

The Text Analytics Market is estimated to be valued at USD 14.9 billion in 2025 and is projected to reach USD 92.4 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period. During the first ten years, from 2020 to 2030, the market is projected to grow from USD 6.0 billion to around USD 31.0 billion, driven by the rapid adoption of artificial intelligence, machine learning, and natural language processing technologies across a wide range of industries. The rising need for advanced data analytics solutions that can extract actionable insights from unstructured text data is a key driver of this expansion.

Industries such as healthcare, finance, retail, and telecommunications are fueling demand, supported by the surge in digital content creation and the growing importance of customer sentiment analysis. Continuous technological improvements in computing power and algorithm efficiency enable more accurate and scalable text analytics tools, fostering wider integration across enterprise systems. From 2030 to 2035, the market growth accelerates further, rising from USD 37.2 billion to USD 92.4 billion. This phase is propelled by increased integration with big data platforms, cloud computing infrastructure, and real-time analytics capabilities, allowing organizations to enhance decision-making and operational efficiency. Emerging economies show rapid adoption due to ongoing digital transformation initiatives and expanding IT infrastructure. Innovations such as conversational AI, chatbots, and voice recognition systems drive further demand for sophisticated text analytics solutions. Businesses increasingly rely on these technologies for personalized customer experiences, risk mitigation, and regulatory compliance. The Text Analytics Market is positioned for sustained, robust growth through 2035, supported by continuous technological innovation, expanding applications, and an increasing focus on data-driven strategies across diverse sectors.

| Metric | Value |

|---|---|

| Text Analytics Market Estimated Value in (2025 E) | USD 14.9 billion |

| Text Analytics Market Forecast Value in (2035 F) | USD 92.4 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The text analytics market is witnessing accelerated adoption due to the exponential rise in unstructured data generation across digital platforms and the growing emphasis on extracting actionable insights for business decision-making. Enterprises are increasingly leveraging natural language processing (NLP) and machine learning (ML) to analyze customer feedback, social media sentiment, and internal communication data.

As organizations prioritize automation and data-driven strategies, text analytics is emerging as a critical tool for enhancing customer experience, detecting fraud, and improving operational efficiency. The shift toward real-time analytics and multilingual processing capabilities is driving platform innovation, while integration with business intelligence tools is expanding the scope of usage across industries such as BFSI, retail, healthcare, and government.

Regulatory requirements for data privacy and compliance are also prompting businesses to adopt secure, scalable text analytics solutions.

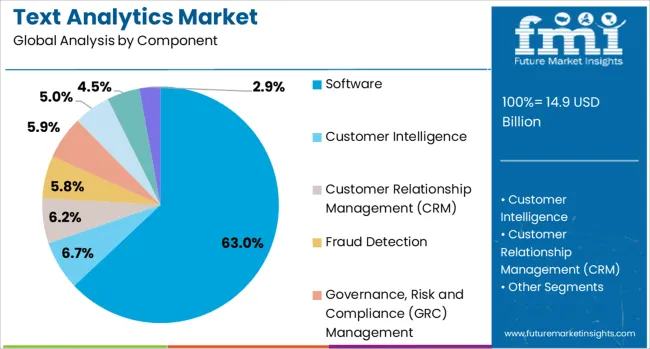

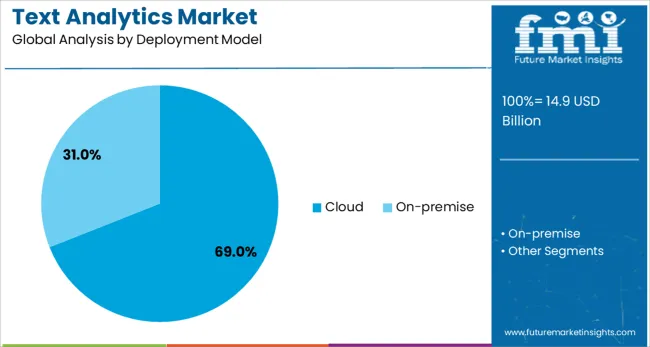

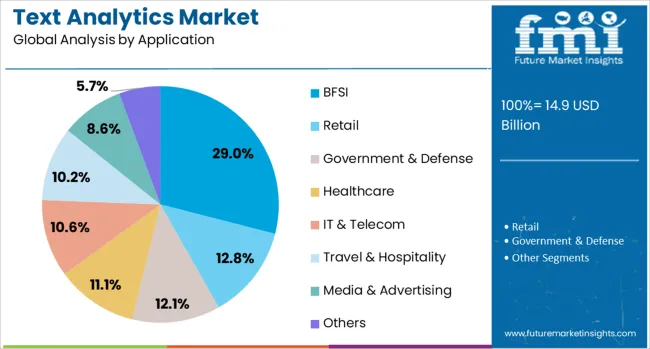

The text analytics market is segmented by component, deployment model, application, and geographic regions. The component of the text analytics market is divided into Software, Customer Intelligence, Customer Relationship Management (CRM), Fraud Detection, Governance, Risk and Compliance (GRC) Management, Service, Professional Services, and Managed Services. In terms of the deployment model, the text analytics market is classified into Cloud and on-premise. Based on the application, the text analytics market is segmented into BFSI, Retail, Government & Defense, Healthcare, IT & Telecom, Travel & Hospitality, Media & Advertising, and others. Regionally, the text analytics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Software is expected to dominate the component category with a 63.00% market share in 2025, driven by rising demand for advanced analytics engines and easy-to-integrate NLP platforms. The growth of this segment is supported by increasing enterprise investment in SaaS-based analytics tools that offer real-time text classification, sentiment analysis, and entity recognition.

Vendors are focusing on AI-enhanced software that delivers predictive and prescriptive capabilities, enabling businesses to optimize customer engagement, detect anomalies, and streamline document processing.

The scalability, interoperability, and customizability of software platforms are making them the preferred choice across both SMEs and large enterprises.

Cloud deployment is projected to account for 69.00% of the overall text analytics market in 2025, making it the dominant deployment model. This leadership is being driven by the advantages of lower upfront costs, ease of integration, and elastic scalability offered by cloud-based solutions.

Organizations adopting remote work models and decentralized data architectures are increasingly turning to cloud analytics platforms for unified access and management. Enhanced security features, continuous updates, and faster time-to-value further support cloud’s growing adoption.

As digital transformation accelerates, cloud deployment is expected to remain the foundation of modern text analytics implementation.

The BFSI sector is forecast to lead the text analytics market by application, contributing 29.00% of the total revenue in 2025. This prominence stems from the sector’s focus on customer sentiment analysis, risk mitigation, fraud detection, and regulatory compliance.

Financial institutions are leveraging text analytics to monitor client communications, extract insights from customer service transcripts, and identify emerging patterns in transaction narratives.

With increasing regulatory scrutiny and demand for personalized services, the BFSI segment is prioritizing AI-powered text analysis tools that enhance transparency, speed, and accuracy in decision-making.

The text analytics market is advancing through customer experience optimization, enterprise integration, compliance-driven applications, and multilingual processing. These trends underscore its pivotal role in data-driven business strategies across sectors.

Text analytics has become a core enabler for businesses aiming to improve customer engagement and satisfaction. Organizations are using advanced text mining to analyze feedback across multiple channels, including social media, emails, and chat logs. This capability helps businesses identify pain points, emerging trends, and opportunities for product improvement in real time. By leveraging sentiment analysis and contextual insights, companies can tailor personalized experiences, enhance loyalty programs, and mitigate churn. The shift from reactive to proactive customer service strategies is significantly influenced by text analytics, which provides actionable intelligence for refining marketing campaigns and customer interaction models across various industries.

The integration of text analytics into enterprise-level intelligence platforms is reshaping business decision-making processes. Organizations are embedding these tools within CRM, ERP, and knowledge management systems to derive structured meaning from massive volumes of unstructured text. This convergence supports predictive analytics, compliance tracking, and operational efficiency initiatives. Industries such as finance and insurance rely heavily on text analytics for fraud detection, risk assessment, and regulatory reporting. The trend is particularly strong in enterprises adopting cloud-based analytics ecosystems, as text data becomes a critical input for real-time dashboards and AI-driven forecasting models aimed at optimizing organizational workflows.

Highly regulated sectors such as healthcare, BFSI, and government are experiencing rapid adoption of text analytics solutions. These tools assist in ensuring compliance, detecting anomalies, and automating reporting processes that involve large textual datasets. For healthcare, the ability to extract valuable insights from clinical notes and research articles supports evidence-based care models and pharmacovigilance activities. In financial institutions, text analytics enables early detection of fraudulent activities through advanced linguistic pattern recognition. Government agencies employ it for policy impact analysis and intelligence gathering. Increased compliance requirements and the need for risk mitigation make text analytics indispensable for regulated industries globally.

The demand for multilingual processing capabilities in text analytics is growing as businesses expand globally and interact with diverse customer bases. Companies require systems that go beyond basic translation to capture nuances, sentiment, and intent in multiple languages. Modern solutions incorporate machine learning models trained on regional datasets to improve accuracy in context-specific interpretations. This capability is crucial for international brands conducting social listening, reputation management, and market expansion strategies. Contextual understanding aids in refining content moderation systems and enhancing targeted marketing, making multilingual and contextual analytics a critical factor for success in the competitive global marketplace.

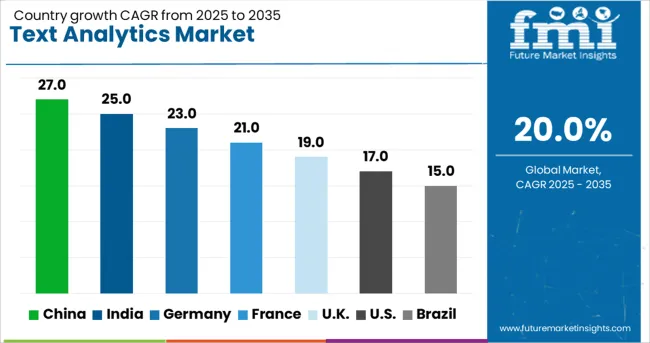

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The text analytics market is projected to expand globally at a CAGR of 20.0% from 2025 to 2035, fueled by the surge in unstructured data generation, increasing reliance on AI-driven analytics, and the growing need for real-time insights across industries. China leads with a CAGR of 27.0%, supported by rapid enterprise digitization, e-commerce dominance, and heavy investments in natural language processing and AI technologies. India follows at 25.0%, driven by large-scale digital adoption, social media analytics demand, and the expansion of IT and BFSI sectors leveraging text-based data solutions. Germany posts 23.0%, underpinned by strong enterprise analytics adoption and compliance-driven deployments in financial services and manufacturing sectors. The United Kingdom grows at 19.0%, shaped by rising adoption of advanced analytics in retail, healthcare, and e-governance projects, while the United States records 17.0%, reflecting steady uptake in mature markets with increased focus on predictive analytics and integrated sentiment analysis platforms. The report covers in-depth insights for more than 40 countries, with these markets setting critical benchmarks for future investments, innovation strategies, and enterprise AI adoption trends in the global text analytics industry.

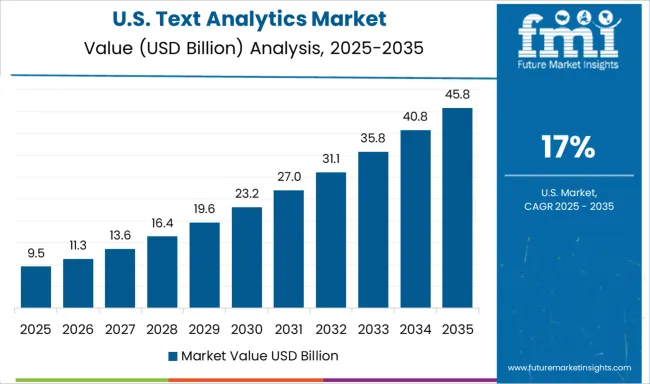

The CAGR of the USA text analytics market was approximately 12.5% during 2020–2024 and is projected to rise to 17.0% between 2025 and 2035, signaling accelerated adoption of AI-driven analytics. The initial phase experienced steady progress as organizations integrated basic sentiment analysis and keyword extraction tools for customer engagement. In the following next few years, growth surged due to the rising demand for predictive analytics, automated compliance monitoring, and large-scale digital transformation projects across enterprises. Investments in real-time language processing for customer service and e-commerce platforms further propelled uptake. The market is now shaped by cloud-based deployments and sector-specific solutions offering scalability and advanced contextual interpretation.

The CAGR for the UK text analytics market averaged 13.8% during 2020–2024 and is expected to advance to 19.0% in 2025–2035, reflecting strong enterprise adoption. The earlier phase was driven by modest integration of text mining tools within CRM platforms and social media listening initiatives. In the next decade, demand intensified due to large-scale digitization, government-backed AI programs, and higher investments in predictive modeling for business intelligence. Retail, healthcare, and financial services emerged as leading adopters, leveraging contextual analytics to improve decision-making and compliance frameworks. Increased reliance on multi-language processing further strengthened adoption in global-facing businesses.

China’s CAGR for text analytics stood at 18.4% between 2020–2024 and escalated to 27.0% during 2025–2035, making it the fastest-growing market globally. The earlier growth was supported by e-commerce expansion and social media monitoring applications across leading platforms. The sharp increase in the following decade is attributed to advanced NLP adoption in AI-driven governance programs, smart city initiatives, and real-time business intelligence applications. Localization strategies and government investment in language processing technology enhanced penetration across sectors. Enterprises now focus on contextual AI and predictive analytics for both operational and strategic decisions, reinforcing China’s dominance in this segment.

The CAGR for India’s text analytics market transitioned from 17.2% during 2020–2024 to 25.0% in 2025–2035, highlighting a significant acceleration in adoption. Initial demand was primarily from IT and telecom sectors implementing basic text mining for operational insights. Post-2024, rapid digitalization in BFSI, retail, and public governance fueled advanced deployments, including real-time analytics and compliance monitoring. Multilingual capabilities became critical as businesses expanded into Tier-2 and Tier-3 markets. Managed service providers played a crucial role in improving accessibility for small and medium enterprises through cost-effective cloud-based models.

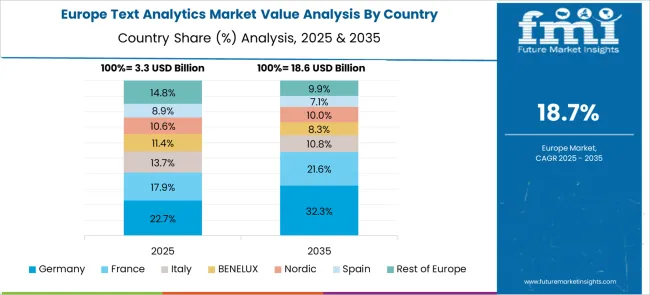

Germany’s CAGR in text analytics averaged 15.5% from 2020-2024, rising to 23.0% between 2025 and 2035, reflecting strong enterprise digitization and compliance-driven initiatives. The early phase relied on basic sentiment and market intelligence tools adopted by automotive and manufacturing firms. In the next few years, emphasis on AI-driven predictive analytics, automated documentation, and multilingual processing in industrial operations boosted adoption. Financial institutions and healthcare providers implemented advanced text mining for fraud detection and patient record analysis, further propelling growth. Strategic collaborations with AI vendors and cloud solution providers reinforced market penetration in Germany’s technology-driven business environment.

The text analytics market features a highly competitive landscape comprising global technology leaders and specialized solution providers focused on delivering advanced natural language processing (NLP) and AI-driven analytics platforms. IBM Corporation is a dominant player with its Watson platform, offering deep learning capabilities and enterprise-grade solutions for sentiment analysis and business intelligence. Amazon Web Services (AWS) leverages its cloud infrastructure to deliver scalable text analytics services integrated with machine learning models for multilingual data processing. Microsoft Corporation drives adoption through Azure Cognitive Services, providing comprehensive AI-powered text mining for businesses seeking real-time insights.

SAP SE and SAS Institute Inc. bring advanced analytics and integration capabilities, targeting large-scale enterprises with compliance-driven applications. Specialized vendors such as Clarabridge, Brandwatch, and Netbase Solutions focus on social listening and customer experience analytics, enabling businesses to derive actionable insights from digital engagement channels. Luminoso Technologies Inc and Lexalytics Inc excel in contextual text analysis using AI and linguistics-based approaches, supporting enterprise needs for granular insights. Emerging players like Bitext Innovations SL and Basis Technology differentiate through multilingual processing and advanced semantic interpretation. Competitive strategies revolve around cloud-based deployments, API-driven integration for enterprise systems, and enhancements in real-time analytics. Leading companies prioritize building domain-specific language models, expanding AI-driven automation, and forging partnerships with CRM and marketing automation vendors. Future opportunities lie in predictive modeling, voice-to-text analytics, and integration with advanced data visualization platforms, positioning text analytics as a cornerstone for data-driven enterprise strategies.

Organizations prioritized AI and machine learning integration to enhance sentiment analysis, contextual interpretation, and predictive modeling. Cloud-based deployments gained momentum due to scalability and cost benefits, while real-time analytics became essential for decision-making in retail, BFSI, and healthcare. Compliance with data privacy regulations and multilingual capabilities also influenced solution design. Strategic partnerships between analytics providers and CRM platforms, combined with the integration of generative AI, positioned text analytics as a critical tool for digital transformation initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.9 Billion |

| Component | Software, Customer Intelligence, Customer Relationship Management (CRM), Fraud Detection, Governance, Risk and Compliance (GRC) Management, Service, Professional Services, and Managed Services |

| Deployment Model | Cloud and On-premise |

| Application | BFSI, Retail, Government & Defense, Healthcare, IT & Telecom, Travel & Hospitality, Media & Advertising, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM Corporation, Amazon Web Services (AWS), Altair Engineering, Inc. (Angoss Software Corporation), Basis Technology, Bitext Innovations SL, Brandwatch, Clarabridge, Interactions LLC, Jive Software (Aurea, Inc.), Khoros, LLC, Lexalytics Inc, Luminoso Technologies Inc, Medallia Inc, Megaputer Intelligence, Inc, Micro Focus LLC, Microsoft Corporation, Netbase Solutions, OpenText Corporation, RapidMiner Inc, SAP SE, SAS Institute Inc, Unimetric, and Verint Systems, Inc |

| Additional Attributes | Dollar sales by deployment type, share by industry vertical, regional adoption trends, competitive positioning, pricing analysis, cloud vs on-premise adoption patterns, integration with AI models, regulatory impact, and growth forecasts across enterprise segments. |

The global text analytics market is estimated to be valued at USD 14.9 billion in 2025.

The market size for the text analytics market is projected to reach USD 92.4 billion by 2035.

The text analytics market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in text analytics market are software, customer intelligence, customer relationship management (crm), fraud detection, governance, risk and compliance (grc) management, service, professional services and managed services.

In terms of deployment model, cloud segment to command 69.0% share in the text analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Scientific Text Analytics And Annotators Market Size and Share Forecast Outlook 2025 to 2035

Textured Vegetable Protein Market Size and Share Forecast Outlook 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Textured Milk Protein Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Texturized Vegetable Protein Market Size, Growth, and Forecast for 2025 to 2035

Textile Colorant Market – Trends & Forecast 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Colors Market Growth - Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Texture Modifying Agents Market – Growth, Innovations & Food Applications

Textile Auxiliaries Market Trends 2024-2034

Textured Variegates Market

Textile Printing Ink Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA