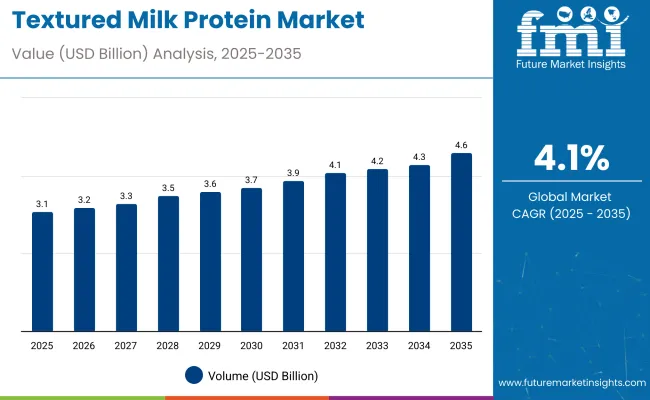

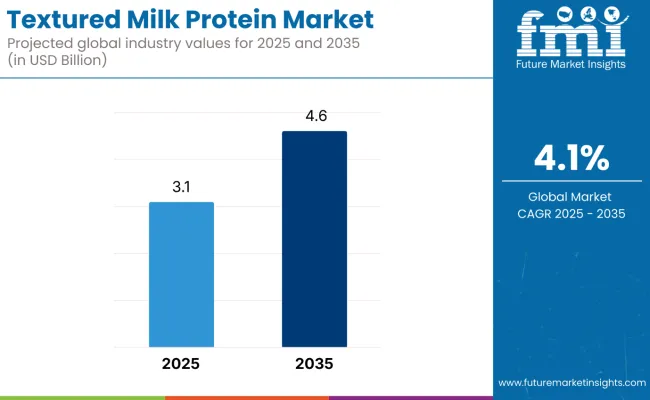

The textured milk protein market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 3.1 billion |

| Forecast Value in 2035 (F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The market is expected to add an absolute dollar opportunity of USD 1.5 billion during this period. This reflects a 1.48 times growth at a compound annual growth rate of 4.1%. The market evolution is expected to be shaped by increasing demand for high-quality protein ingredients in food and beverage formulations, rising health awareness, and expanding applications in dairy and meat analog products. The market demonstrates a consistent upward trend, supported by innovations in processing technologies and product texture enhancement that appeal to health-conscious consumers and clean-label preferences.

By 2030, the market is forecast to reach USD 3.9 billion, showing steady growth through the first half of the forecast period. Growth is anticipated to accelerate toward the latter half of the timeline owing to broader adoption in functional foods, nutritional supplements, and plant-based dairy alternatives.

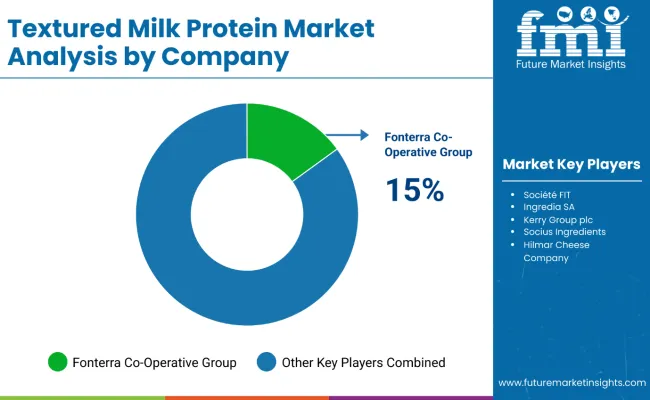

Companies such as Fonterra Co-Operative Group, Société FIT, Ingredia SA, Kerry Group plc, and Socius Ingredients are strengthening their market presence by scaling production capacity and investing in advanced milk protein technologies. Their focus on clean-label solutions, textured protein variants, and value-added formulations positions them well for tapping niche and mainstream segments. Market performance will be strongly influenced by quality standards, responsible sourcing practices, and regulatory compliance, shaping competitive dynamics across key geographic regions including the USA, Japan, and South Korea.

The market holds a strong position across its parent industries, reflecting its rising adoption in dairy alternatives, sports nutrition, and functional food applications. Within the meat analog and alternative protein market, textured milk proteins account for 35%, driven by their functional role in enhancing texture and nutritional value. In the dairy ingredient market, textured milk proteins contribute about 30%, supported by rising demand for protein-enriched and clean-label products. In nutritional supplements, textured milk proteins represent nearly 25% of ingredient usage, owing to their high protein content and versatile formulation benefits. In the bakery and confectionery ingredients segment, they hold around 20%, enhancing texture, moisture retention, and overall product quality.

The market is being driven by advancements in processing technologies that enhance protein functionality and sensory attributes. Manufacturers are expanding applications into plant-based meat alternatives, functional snacks, and fortified dairy products, supported by innovations in clean-label and organic protein ingredients. Strategic partnerships with food manufacturers and retailers, alongside growing consumer preference for high-protein and healthier foods, are broadening distribution channels and fueling market expansion, positioning textured milk protein as a key player disrupting traditional protein sources.

The market is expanding due to increasing consumer demand for high-quality, functional protein ingredients in food and beverage products. Rising awareness of health and wellness, alongside growing preference for clean-label and protein-enriched foods, is fueling market growth. Advances in processing technologies have improved the texture, solubility, and nutritional profile of milk proteins, making them more versatile and appealing across diverse applications such as meat analogs, dairy alternatives, and nutritional supplements.

Furthermore, strategic collaborations between ingredient manufacturers, foodservice operators, and retail channels are broadening market reach and strengthening distribution networks. With continuous focus on product quality, responsible sourcing, and nutritional enhancement, the textured milk protein market is positioned for sustained growth across global regions.

The market is segmented by form, type, end use, and region. By form, the market is bifurcated into powder and liquid. By type, the market is divided into whey protein concentrate and milk protein concentrate. Based on end use, the market is categorized into bars, smoothies & milkshakes, dairy, yogurt, cheese, cream, ice creams, functional food, sports nutrition, breakfast cereals, and bakery. Regionally, the market spans across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

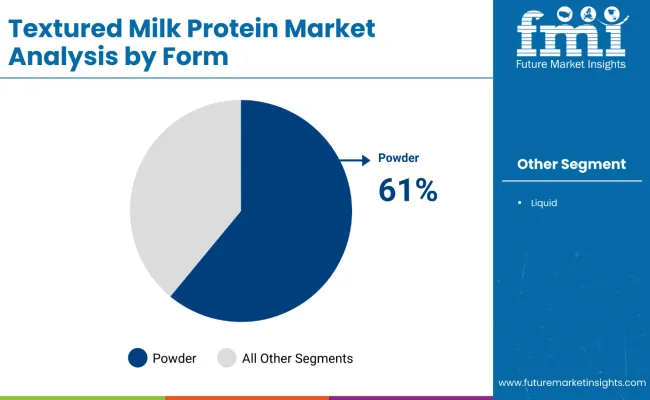

The powder segment dominates the textured milk protein market, accounting for 61% of the market share in 2025. This segment’s prominence is largely due to its versatility, longer shelf life, and ease of integration into various food and beverage products. Powdered textured milk protein is widely used in nutritional supplements, sports nutrition, bakery, dairy, and functional foods to enhance texture, protein content, and overall product quality.

The ability to customize the powder’s properties, such as solubility, texture, and flavor, makes it highly attractive to manufacturers aiming to meet evolving consumer demands for clean-label and high-protein products. Additionally, powdered proteins offer logistical advantages such as easier storage and transportation compared to liquid forms, contributing to cost-efficiency in production. While the liquid form is growing, especially in ready-to-drink formulations, the powder segment’s well-established presence and broad application base solidify its position as the most lucrative form in the textured milk protein market, driving steady growth globally from 2025 to 2035.

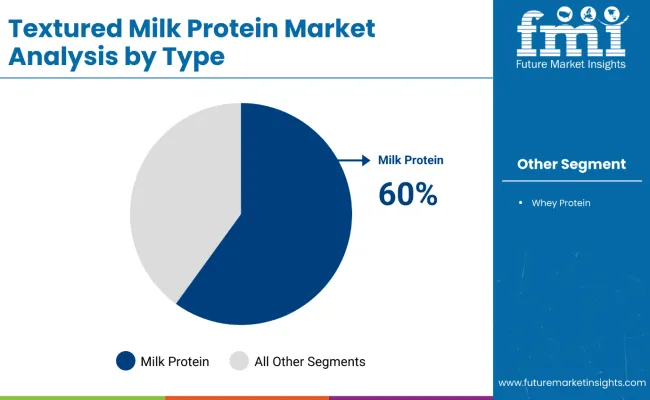

The milk protein concentrate (MPC) segment holds a commanding 60% share of the textured milk protein market in 2025, making it the leading type within this sector. MPC is prized for its balanced composition of both casein and whey proteins, which imparts excellent functional properties such as improved texture, moisture retention, and gelation in food products. These characteristics make MPC highly suitable for diverse applications, including bakery, dairy, meat analogs, and nutritional supplements.

The ability of milk protein concentrate to enhance mouthfeel and stability, while providing a high protein content, drives its widespread use among manufacturers seeking to develop clean-label, high-protein foods. Additionally, MPC’s nutritional benefits and versatility in formulation contribute to its dominant market position. As consumer demand for protein-enriched and functional foods continues to rise globally, the milk protein concentrate segment is expected to sustain robust growth, supported by technological advancements and expanding applications across the food and beverage industry. This strong presence underscores MPC’s critical role in the textured milk protein market’s outlook.

From 2025 to 2035, the textured milk protein market is expected to witness significant growth driven by increasing consumer demand for high-quality, functional protein ingredients. Consumers are becoming more health-conscious and focusing on protein-enriched foods to support active lifestyles and wellness goals. This rising preference for clean-label, nutrient-rich, and protein-fortified products is encouraging manufacturers to invest heavily in advanced processing technologies. Companies are expanding their product portfolios to include innovative textured milk protein variants that cater to evolving dietary trends like plant-based diets, muscle recovery, and weight management, thus broadening market opportunities.

Growing Consumer Health Awareness Drives Market Growth

The growing emphasis on health and wellness among consumers is a primary factor propelling the textured milk protein market’s expansion. There is a substantial increase in demand for protein-fortified products across several categories, including sports nutrition, bakery, dairy alternatives, and functional foods. Consumers are seeking products that not only provide nutrition but also improve product quality through enhanced texture and taste. Manufacturers are responding by improving processing methods to optimize protein functionality, texture, and nutritional value, aiming to meet rising expectations for natural, clean-label, and effective protein sources within diverse food applications.

Innovation in Product Development Expands Market Opportunities

Innovation remains central to the textured milk protein market’s growth story as manufacturers focus on developing advanced protein formulations and processing techniques. These innovations include organic, specialty, and responsibly sourced protein variants that deliver better solubility, improved texture, and enhanced nutritional profiles. By leveraging these advances, companies are extending the market reach beyond traditional applications to emerging sectors such as meat analogs, functional foods, bakery, and nutritional supplements. Additionally, companies emphasizing responsible sourcing and obtaining quality certifications strengthen their market position by appealing to environmentally conscious and health-driven consumers, ensuring long-term growth and competitive advantage.

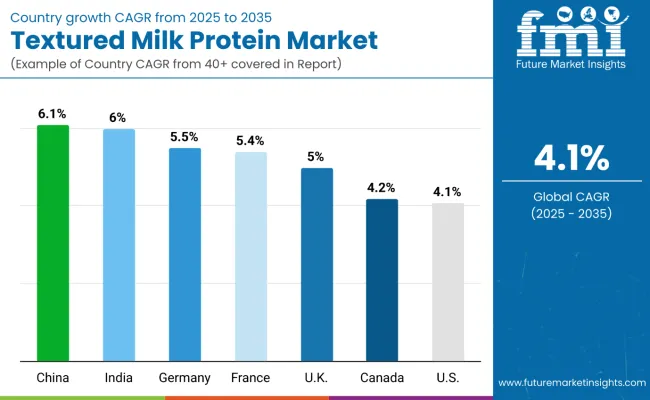

| Countries | CAGR (%) |

|---|---|

| China | 6.1 |

| India | 6.0 |

| Germany | 5.5 |

| France | 5.4 |

| UK | 5.0 |

| Canada | 4.2 |

| USA | 4.1 |

The market shows diverse growth rates across key countries. India leads with a 6% CAGR, driven by rising health awareness and urbanization. China closely follows at 6.1%, supported by increasing incomes and government initiatives. Germany and France exhibit stable growth of 5.5% and 5.4%, focusing on responsible sourcing and functional foods. The UK and Canada grow at 5% and 4.2%, benefiting from health-conscious consumers and retail expansion. The USA market, growing at 4.1%, is fueled by demand for clean-label, high-protein products and processing innovations.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Sales of textured milk protein in China are expected to grow at a CAGR of 6.1% from 2025 to 2035, driven by rising disposable incomes and urbanization. Production capacity is expanding rapidly to meet growing consumer demand for dairy and functional foods enriched with high-quality protein. There is considerable investment in modern processing technologies and innovations tailored to local tastes.

Government initiatives to improve nutrition further stimulate market growth. E-commerce platforms and modern retail distribution channels provide broad access to textured milk protein products. Manufacturers are increasingly focusing on clean-label and organic options to satisfy health-conscious consumers. The convergence of technological advancements and consumer trends supports sustained output expansion and innovation in the textured milk protein industry in China.

Revenue from textured milk protein in India is projected to grow at a CAGR of 6% from 2025 to 2035, driven by rising health awareness and rapid urbanization. The expanding middle class and increasing disposable income are shifting consumer preferences toward protein-rich diets and functional foods. Production capacity expansion is underway as local and multinational companies invest in modern processing facilities.

Growth in the dairy sector, coupled with innovations in textured milk protein applications, supports increased output. Affordability and accessibility remain key drivers, with companies tailoring products to suit regional tastes. The government’s initiatives promoting nutrition and food safety enhance industry confidence. The market is expected to benefit from rising demand in sports nutrition, bakery, and dairy alternatives, facilitating sustained capacity growth in the coming years.

Demand for textured milk protein in Germany is expected to grow at a CAGR of 5.5% from 2025 to 2035, driven by rising demand for functional and health-oriented foods. Manufacturers are adopting new production structures focusing on responsible sourcing and organic protein variants to align with consumer preferences. This shift includes upgrading processing lines to improve product texture, solubility, and nutritional efficacy. The market in Germany benefits from strong food safety regulations and emphasis on high-quality standards.

Demand for protein-enriched bakery, dairy, and sports nutrition products supports structural investment in manufacturing facilities. Companies are also forging collaborations for responsible sourcing, driving competitive advantage. The integration of advanced automation and quality control systems enhances production efficiency, positioning Germany as a key player in the European textured milk protein market.

Demand for textured milk protein in France is expected to grow at a CAGR of 5.4% from 2025 to 2035, driven by regulatory frameworks strongly influencing production and market growth. Manufacturers are adapting by enhancing product quality and ensuring compliance with stringent food safety standards. Investment in research and development supports product innovation, including organic and fortified protein ingredients.

Demand for high-protein dairy alternatives and functional foods is rising, encouraging expansion of production capacities. The growing preference among French consumers for natural and clean-label products drives market trends. Companies are incorporating responsible sourcing and traceability practices to maintain competitive advantage while meeting regulatory requirements.

The textured milk protein market in the UK is expected to expand at a CAGR of 5% from 2025 to 2035, supported by rising consumer interest in high-protein foods and supplements. Producers are expanding manufacturing capabilities to meet growing demand, with increased focus on innovative formulations and clean-label protein solutions. Retail expansion, including health-focused stores and e-commerce, enhances product accessibility.

The market benefits from strong partnerships between ingredient suppliers and food manufacturers to accelerate new product development. Emphasis on organic and responsibly sourced protein ingredients aligns with evolving consumer preferences. The integration of manufacturing advancements and retail distribution ensures effective market penetration and sustained growth in the UK

Revenue from textured milk protein in Canada is anticipated to grow at a CAGR of 4.2% from 2025 to 2035, driven by expanding health awareness and robust dairy and bakery industries. Market players are strategically increasing production capacities and adopting innovation-driven growth approaches. Technological advancements in protein extraction and formulation are central to enhancing product appeal. The demand for clean-label and fortified protein ingredients encourages investment in scalable manufacturing solutions.

Canadian companies emphasize responsible sourcing and traceability, meeting evolving consumer expectations. The expansion of retail and online distribution channels facilitates wider market penetration. Collaboration between ingredient suppliers and food manufacturers is fostering new product development, supporting the country’s role as a growing producer and consumer of textured milk protein.

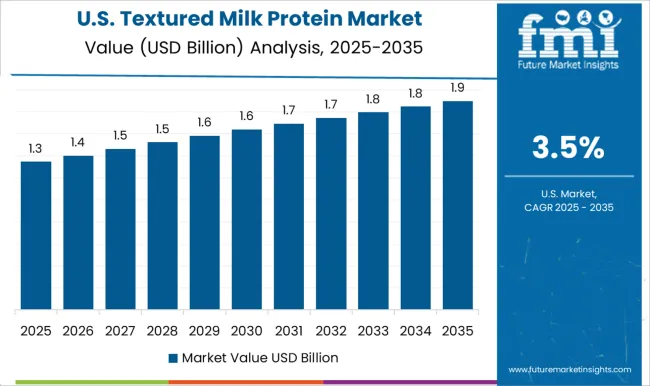

Demand for textured milk protein in the USA is expected to grow at a CAGR of 4.1%from 2025 to 2035, driven by strong consumer preference for high-protein and clean-label food products. Innovation in protein formulations and expanded applications in sports nutrition and functional foods propel this growth. Manufacturers are increasing production capacities to meet the surging demand, investing in advanced technologies for enhanced texture and nutritional quality.

The rising health-conscious population, combined with expanding e-commerce and retail channels, further supports market penetration. Additionally, partnerships between ingredient suppliers and food manufacturers are fostering new product development. The clean-label trend and emphasis on responsible sourcing are also key factors shaping production strategies. With continuous R&D and government support, the USA remains a leading hub for textured milk protein innovation and output expansion.

The market is moderately consolidated, with key players distinguishing themselves through advanced processing capabilities, product innovation, and strong regional market penetration. Leading companies such as Fonterra Co-Operative Group, Société FIT, Ingredia SA, Kerry Group plc, and Socius Ingredients maintain their competitive edge by leveraging large-scale production facilities and diverse product portfolios focused on clean-label, high-protein textured milk ingredients for various food applications. Their strengths include technological expertise in protein texturization, quality assurance, and robust distribution networks.

Companies like these emphasize cost-efficient production methods and supply chain optimization to meet the increasing global demand for functional, organic, and responsibly sourced protein ingredients. Regional players prioritize local sourcing, authentic ingredient quality, and tailored product formulations to serve niche markets, especially in North America, Europe, and Asia-Pacific.

Barriers to entry remain moderate due to the need for sophisticated processing technology, strict compliance with food safety and nutritional standards, and the challenge to innovate continuously. Market competitiveness is driven by advancements in processing, responsible sourcing commitments, and responsiveness to evolving consumer preferences and regulatory landscapes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.1 billion |

| Form | Powder and Liquid |

| Type | Whey Protein Concentrate and Milk Protein Concentrate |

| End Use | Bars, Smoothies & Milkshakes, Dairy, Yogurt, Cheese, Cream, Ice Creams, Functional Food, Sports Nutrition, and Breakfast Cereals, Bakery |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Fonterra Co-Operative Group, Société FIT, Ingredia SA, Kerry Group plc, Socius Ingredients, and Hilmar Cheese Company. |

| Additional Attributes | Dollar sales by form, type, and end use; rising demand for clean-label and high-protein products; expansion in sports nutrition and functional food sectors; innovations in protein texturization and formulation; focus on responsible sourcing and nutritional quality |

The global textured milk protein market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the textured milk protein market is projected to reach USD 4.6 billion by 2035.

The textured milk protein market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in textured milk protein market are powder and liquid.

In terms of type, whey protein concentrate segment to command 63.2% share in the textured milk protein market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Protein Hydrolysate Market Growth - Infant Nutrition & Functional Use 2024 to 2034

Textured Vegetable Protein Market Size and Share Forecast Outlook 2025 to 2035

Soluble Milk Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Protein Milk Market

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA