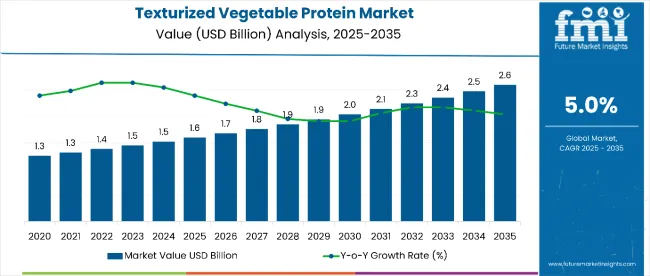

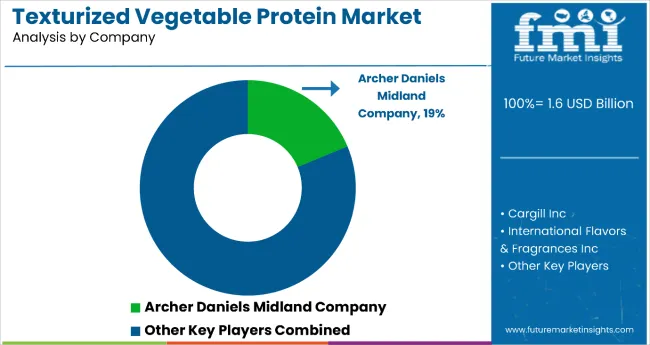

The texturized vegetable protein (TVP) market is estimated to be worth USD 1.6 billion in 2025 and is forecasted to grow to USD 2.6 billion by 2035, expanding at a 5.0% CAGR. This robust growth trajectory is underpinned by increasing consumer demand for allergen-free, sustainable, and plant-based protein alternatives.

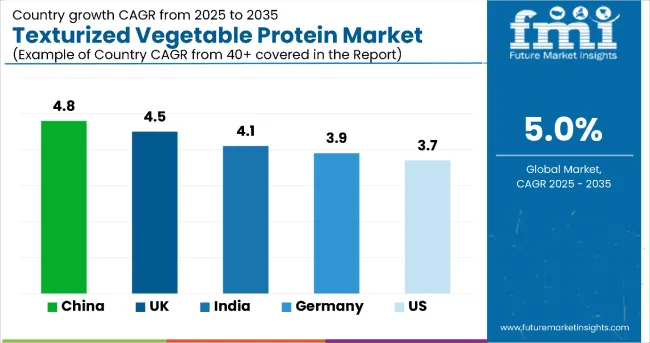

While the United States leads the market due to its established plant-based food ecosystem, India and China are poised for significant growth. India’s CAGR of 4.1% is driven by affordability and cultural reliance on vegetarian diets, whereas China, projected to grow at 4.8%, benefits from industrial capacity and rising flexitarian trends.

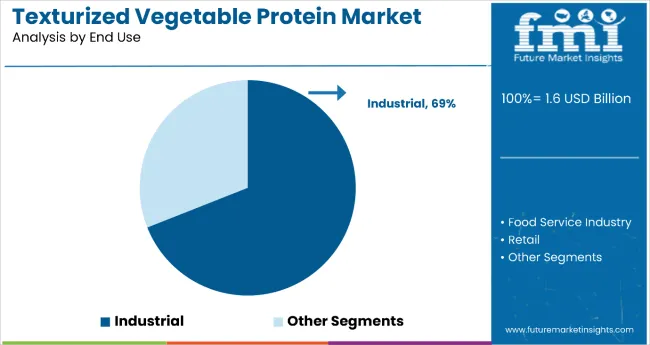

Key market drivers include a surge in health-conscious eating and rising awareness of food allergies, prompting consumers to shift from common allergens such as dairy and gluten to plant-based proteins. TVP, particularly soy and pea-based variants, offers a clean-label, cholesterol-free, and fiber-rich alternative for those seeking nutrition without animal products. This demand is echoed in the food processing industry, which accounts for nearly 69% of the end-use segment, leveraging TVP’s texture and flavor adaptability in meat substitutes, ready meals, and functional snacks.

Despite its advantages, the TVP industry faces challenges, including supply chain disruptions, the high cost of non-soy protein sources, and regulatory hurdles for novel ingredients in emerging economies. However, ongoing R&D in alternative protein sources like lentils, chickpeas, and faba beans, combined with product innovations from Tier 1 players like ADM and Cargill, are expected to expand the market’s reach and consumer base.

Furthermore, the rising popularity of hybrid diets where plant proteins are blended with small amounts of animal-based ingredients is opening up new opportunities for TVP-based formulations. These flexitarian innovations appeal to mainstream consumers seeking taste and texture familiarity while moving toward healthier, sustainable food choices. As food manufacturers strive to balance nutrition, cost, and taste, TVP stands out as a versatile building block for the evolving global protein paradigm.

As sustainability becomes central to food systems, TVP’s low environmental footprint, long shelf life, and compatibility with global cuisines position it as a cornerstone of the future protein economy.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5.0% |

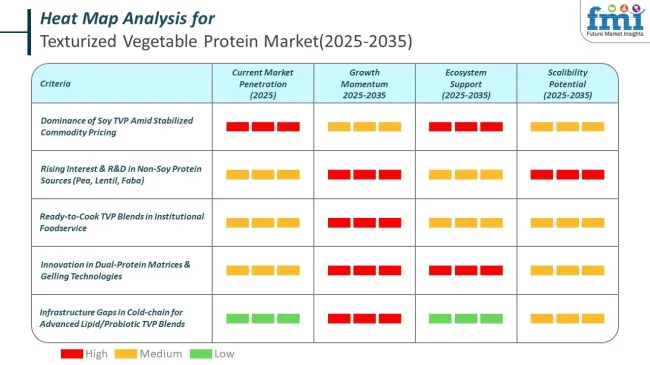

In 2025, the texturized vegetable protein (TVP) market finds itself in a transitional phase defined by stabilized soy commodity prices, mounting interest in non-soy variants, and uneven infrastructure across value chains.

Per capita consumption of TVP remains highest in the United States and German industry, both exceeding 1.8 kg per annum. Data from USDA’s Economic Research Service confirms continued displacement of animal protein in meal kits and fast casual formats.

In India, consumption hovers near 0.7 kg, but is rising 6.1% YoY due to school meal programs and soy fortification mandates. China's blended use in plant-meat hybrids continues to grow as domestic startups pivot away from pure isolates to textured forms in the texturized vegetable protein market.

Modern trade networks increasingly favor ready-to-cook TVP blends. Foodservice penetration is steeper in institutional catering than in fine dining in the texturized vegetable protein market. National Restaurant Association reports confirm bulk adoption of TVP across universities, hospitals, and defense kitchens, with standard portion-control packs designed for high-volume use.

Innovation in formulations is shifting toward dual-protein matrices and extrusion conditioning in the texturized vegetable protein market. Patent filings in WIPO and Espacenet databases in 2024 to 2025 rose 19% YoY. Key themes include enzymatic pre-treatment of lentil flours, thermal structuring of faba matrix, and non-GMO gelling agents.

Cold-chain reliance remains limited for conventional TVP, which typically carries ambient shelf stability of 12-18 months. However, emerging formulations with lipid inclusions or probiotic layering require sub-ambient transport. Southeast Asia and Central Africa still lack warehouse infrastructure to prevent protein degradation in high-humidity zones.

Top players are opting for differentiated strategies to outshine the competition in the texturized vegetable protein market. ADM has launched hybrid soy-faba textured inputs targeted at mid-tier European processors.

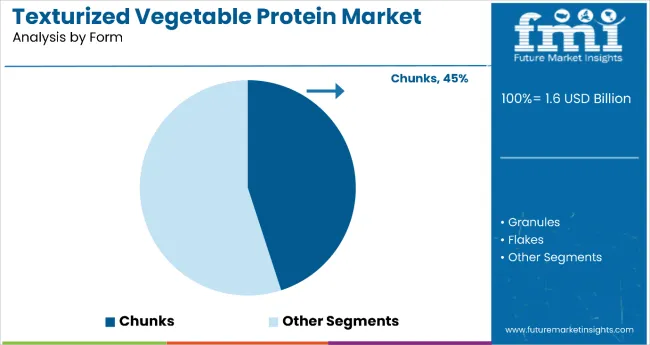

The chunks segment holds the dominant position with 45% of the market share in the form category within the texturized vegetable protein market. This leadership is driven by the versatility and meat-like texture that TVP chunks provide in food applications, making them the preferred choice for meat alternatives, ready-to-eat meals, and processed foods.

Chunks offer superior rehydration properties and maintain structural integrity during cooking processes, closely mimicking the texture and mouthfeel of traditional meat products.Food manufacturers value TVP chunks for their ability to absorb flavors effectively while providing substantial protein content and satisfying bite experience that appeals to both vegetarian and flexitarian consumers.

The segment's growth is supported by increasing demand for plant-based protein sources and the rising popularity of meat substitutes in mainstream food markets. As consumer preference for sustainable, high-protein alternatives continues to expand, the chunks segment is positioned to maintain its market leadership through continued innovation in texture enhancement and flavor compatibility.

Industrial applications dominate the texturized vegetable protein market with 69% of the market share, reflecting the extensive use of TVP in large-scale food manufacturing and processing operations.

This segment's leadership is driven by the growing demand from processed food manufacturers, meat processors, and foodservice companies that utilize TVP as a cost-effective protein extender and meat substitute ingredient. Industrial end users benefit from TVP's consistent quality, extended shelf life, and ability to enhance nutritional profiles while reducing overall product costs.

The segment encompasses applications in frozen foods, canned products, snack foods, and institutional foodservice preparations where TVP serves as both a functional ingredient and protein source. Major food companies are increasingly incorporating TVP into their product portfolios to meet consumer demand for plant-based options and address sustainability goals.

As industrial food production scales globally and plant-based protein adoption accelerates across commercial foodservice and retail channels, the industrial segment is expected to sustain its dominant market position through continued investment in TVP processing technologies and product development initiatives.

A nutrient-rich protein alternative promoting better health and wellness

Textured vegetable protein (TVP) has become a go-to option for consumers prioritizing health and wellness in their dietary choices. TVP is a key source of high-quality protein, offering all the essential amino acids necessary for muscle growth, repair, and overall body function.

Unlike animal-based proteins, TVP is low in fat and completely free from cholesterol, making it a heart-friendly option for those aiming to maintain cardiovascular health. Furthermore, its high fiber content promotes better digestion, supports gut health, and helps regulate blood sugar levels, making it a suitable choice for individuals managing conditions like diabetes or seeking to improve digestive wellness.

The growing awareness around the adverse health effects of excessive meat consumption, such as an increased risk of heart disease and certain cancers, has driven consumers to explore healthier alternatives like TVP. This trend is especially prominent among fitness enthusiasts, athletes, and the general health-conscious population looking for protein-packed foods without the drawbacks of saturated fats or added hormones commonly found in meat products.

A versatile ingredient enhancing meals across cuisines and food categories

Textured vegetable protein’s versatility has positioned it as a vital ingredient in a wide array of culinary applications. Its ability to mimic the texture of meat while readily absorbing flavors makes it an ideal substitute in numerous recipes, from traditional dishes to modern fusion cuisine.

Whether incorporated into vegan burgers, tacos, lasagna, or stir-fries, TVP seamlessly adapts to diverse cooking styles and preferences, appealing to a global audience with varied tastes.

One of TVP’s most significant advantages is its compatibility with different flavor profiles and cuisines. From Asian-inspired dishes like dumplings and stir-fried noodles to Mediterranean classics like kebabs and pasta sauces, TVP offers chefs and home cooks alike the flexibility to create diverse meals. Its shelf-stable nature and ease of preparation make it a convenient choice for busy consumers, foodservice providers, and manufacturers of ready-to-eat meals.

Rising demand for plant-based options among health-conscious consumers

The global shift toward plant-based diets has fuelled the rising demand for textured vegetable protein. As consumers become more aware of the environmental and ethical implications of meat production, many are turning to plant-based alternatives like TVP as a sustainable and cruelty-free source of protein.

This trend is not limited to vegans and vegetarians; flexitarians, who reduce but do not eliminate meat from their diets, represent a significant portion of this growing business ecosystem.

Health-conscious consumers are particularly drawn to TVP for its clean label and natural origin. It aligns with the preferences of those seeking minimally processed, wholesome foods free from artificial additives or preservatives.

The growing focus on sustainable food systems and ethical eating practices has also boosted TVP’s appeal, as it requires fewer resources like water and land compared to animal agriculture. For individuals striving to lower their carbon footprint, TVP offers an eco-friendly protein option that meets their dietary goals without compromising the environment.

The following table shows the estimated growth rate of the key territories. United States, China, & India are expected to exhibit a significant CAGR recording a CAGR of 3.7%, 4.1% and 4.8% respectively through 2035

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 3.7% |

| India | 4.1% |

| China | 4.8% |

The United States dominates the global textured vegetable protein (TVP) industry due to its robust food processing infrastructure, high consumer awareness, and innovation-driven industry. With the growing trend of plant-based eating, the USA has seen a surge in demand for TVP as a key ingredient in meat alternatives like burgers, sausages, and nuggets.

Leading plant-based food companies such as Beyond Meat, Impossible Foods, and MorningStar Farms extensively utilize TVP to meet the expectations of health-conscious and environmentally aware consumers.

The USA sector benefits significantly from its advanced agricultural practices, ensuring a steady supply of high-quality soybeans, a primary source of TVP. This strong supply chain supports the large-scale production of TVP, making it a cost-effective and accessible protein alternative.

Furthermore, government initiatives promoting plant-based diets and sustainability have created a favorable environment for industry growth. The country’s R&D capabilities also enable the development of innovative TVP-based products, enhancing its appeal to diverse consumer groups.

India’s dominance in the TVP sector stems from its dual strengths as a leading soybean producer and a nation with deep-rooted vegetarian dietary traditions. TVP, primarily derived from soy, has found significant demand in Indian households due to its affordability, high protein content, and compatibility with various local dishes.

Indian consumers, particularly in rural and semi-urban areas, rely on TVP as a cost-effective protein source, making it a staple in many diets.

India's large-scale soybean cultivation and processing capabilities ensure a consistent supply of raw materials for TVP production. The country’s low manufacturing costs and strong export network position it as a major supplier of TVP globally.

Domestic demand is further fueled by increasing health awareness and the government’s initiatives to promote nutrition-rich diets. The growing popularity of packaged plant-based foods in urban areas has also created new opportunities for TVP manufacturers.

China’s dominance in the textured vegetable protein (TVP) sector is driven by its massive pet food processing industry and the nation’s growing focus on plant-based diets. As one of the largest producers of soybeans and soy-based products, China ensures a reliable supply of raw materials for TVP manufacturing. The country’s extensive production capabilities allow for large-scale, cost-effective output, meeting both domestic and global demands.

Domestically, China has a long history of consuming plant-based proteins, such as tofu and soy milk, which aligns with the growing preference for TVP among health-conscious consumers.

The middle-class population, which is increasingly adopting flexitarian diets, drives demand for innovative TVP-based products. Furthermore, concerns about environmental sustainability and food security have prompted the government and consumers to embrace plant-based alternatives like TVP.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| Product Types Analyzed | Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Faba Bean Protein, Lentil Protein, Flax, Chia |

| Form Segments Analyzed | Chunks, Slice, Flakes, Granules |

| End Use Industries Analyzed | Food Processing (Bakery, Snacks, Ready Meals, Sports Nutrition, Clinical Nutrition, Baby Food, Meat Analogues), Animal Feed, Foodservice, Retail (Hypermarkets, Convenience Stores, Online) |

| Nature Segments Analyzed | Organic, Conventional |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa, Russia & CIS, Central Asia, Balkans & Baltic |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia |

| Key Players | Archer Daniels Midland, Cargill, Roquette, Fuji Oil, MGP Ingredients, Wilmar, IFF, Crown Soya Protein, A&B Ingredients, Granea sp zoo |

| Additional Attributes | Tier-wise breakdown, country-wise CAGR, sales split by type/form/end use/nature |

| Customization & Pricing | Available on request |

As per product type, the global industry has been categorized into Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Faba Bean Protein, Lentil Protein, Flax Protein, and Chia Protein.

As per Nature, the global texturized vegetable protein industry has been categorized into Organic, Conventional.

By Form, the global texturized vegetable protein industry has been categorized into Chunks, Slice, Flakes, and Granules.

As per End Use, the global texturized vegetable protein industry has been categorized into Industrial, Food Service Industry, and Retail.

Industry analysis has been carried out in key countries of North America, Western Europe, Eastern, Europe, Russia & Belarus, Balkan & Baltic Countries, Latin America, Central Asia, East Asia, Middle East & Africa and South Asia & Pacific.

As of 2025, the texturized vegetable protein market is valued at approximately USD 1.6 billion, with projections indicating a rise to USD 2.6 billion by 2035, driven by growing demand for plant-based and allergen-free protein alternatives.

Key drivers of the texturized vegetable protein market include increasing health awareness, rising adoption of plant-based diets, demand for allergen-free products, and the sustainability benefits of meat substitutes.

South Asia & Pacific is anticipated to witness the fastest growth in the texturized vegetable protein market due to vegetarian dietary patterns, affordability, and expanding food processing capabilities.

The texturized vegetable protein market includes soy protein, wheat protein, pea protein, rice protein, faba bean protein, lentil protein, flax protein, and chia protein, with pea protein showing the highest CAGR.

The food processing industry dominates the texturized vegetable protein market, leveraging TVP for meat analogues, ready meals, and sports nutrition products due to its functionality and high protein content.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Vegetable Glycerin Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Seed Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Sugar Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Parchment Paper Market Size, Share & Forecast 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Vegetable Dicing Machines Market Growth – Food Processing Efficiency 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Vegetable Powders Market Insights - Growth & Functional Benefits 2025 to 2035

Vegetable Concentrates Market Growth - Nutrient-Dense Foods & Industry Demand 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Vegetable Waste Products Market

IQF Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Savory Vegetable Flavours Market Insights - Applications & Industry Growth 2025 to 2035

Canned Vegetable Market Growth – Preservation & Industry Demand 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA