The Fruit and Vegetable Ingredient Market is estimated to be valued at USD 11.9 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Fruit and Vegetable Ingredient Market Estimated Value in (2025 E) | USD 11.9 billion |

| Fruit and Vegetable Ingredient Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The fruit and vegetable ingredient market is experiencing steady growth, driven by increasing consumer demand for natural, healthy, and functional food products. Rising awareness of health and wellness trends, coupled with a shift toward plant-based diets, is supporting the adoption of fruit and vegetable-derived ingredients across diverse food and beverage applications. Manufacturers are focusing on product innovation, including concentrates, purees, powders, and extracts, to cater to changing consumer preferences for convenience and clean-label products.

Investments in research and development, coupled with advancements in extraction and preservation technologies, are enhancing ingredient quality, stability, and flavor retention. Additionally, the growing demand for fortified beverages, functional foods, and natural additives is driving uptake in key end-use segments.

Regulatory support for natural ingredients and increasing supply chain efficiencies further bolster market expansion As global consumption of fruit and vegetable-based products continues to rise, the market is expected to maintain robust growth, with opportunities emerging across processed foods, beverages, and nutraceutical applications.

The fruit and vegetable ingredient market is segmented by product type, form, end use, and geographic regions. By product type, fruit and vegetable ingredient market is divided into Concentrates, Pastes and Purees, Pieces and Powders, and NFC Juices. In terms of form, fruit and vegetable ingredient market is classified into Fruit and Vegetable. Based on end use, fruit and vegetable ingredient market is segmented into Beverages, Confectionery Products, Bakery Products, Soups and Sauces, Dairy Products, and RTE Products. Regionally, the fruit and vegetable ingredient industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The concentrates product type is projected to hold 29.3% of the fruit and vegetable ingredient market revenue share in 2025, establishing it as the leading product type. This dominance is being driven by the high potency, extended shelf life, and ease of handling offered by concentrates, which allow manufacturers to maintain consistent flavor and nutritional profiles across diverse applications. Concentrates are being increasingly preferred for their ability to deliver concentrated fruit and vegetable flavors, colors, and nutrients while reducing transportation and storage costs.

The segment benefits from growing adoption in beverages, sauces, and bakery products where consistency and quality are critical. Advances in concentration technologies and process optimization have improved yield and nutrient retention, reinforcing the segment’s leadership.

Additionally, concentrates allow for efficient blending and formulation flexibility, enabling food and beverage producers to meet evolving consumer demands for natural and minimally processed products This combination of functional benefits, cost efficiency, and product adaptability is sustaining the growth of the concentrates segment.

The fruit form segment is expected to account for 62.8% of the fruit and vegetable ingredient market revenue share in 2025, making it the dominant form. This leadership is being supported by widespread use in beverages, dairy products, and bakery applications, where fruit-based ingredients deliver natural sweetness, flavor, and nutritional benefits. Fruits are highly valued for their antioxidant content, vitamins, and sensory appeal, which enhances product acceptability among health-conscious consumers.

The segment is being further reinforced by consumer trends favoring clean-label, minimally processed products and plant-based nutrition. Increasing demand for fruit-based flavoring, coloring, and fortification in beverages and functional foods is accelerating adoption.

Supply chain improvements, cold chain logistics, and processing innovations have enhanced the availability and quality of fruit ingredients globally, supporting broader market penetration The combination of nutritional benefits, sensory appeal, and versatility in application ensures that the fruit form segment maintains its leading position in the market.

The beverages end-use segment is projected to hold 26.2% of the fruit and vegetable ingredient market revenue share in 2025, making it the leading end-use category. Growth in this segment is being driven by rising consumer preference for natural, functional, and plant-based beverages, including juices, smoothies, and fortified drinks. Fruit and vegetable ingredients enhance flavor, color, and nutritional content, which improves product appeal and marketability.

The segment benefits from strong demand for convenient, ready-to-drink products that offer health benefits, including vitamins, antioxidants, and fiber. Increasing investment by beverage manufacturers in product innovation, clean-label formulations, and fortified beverages is expanding ingredient consumption.

Additionally, the ability of fruit and vegetable ingredients to improve shelf stability and maintain sensory characteristics during processing makes them highly suitable for beverage applications As consumer awareness of health and wellness continues to rise, beverages are expected to remain the dominant end-use segment, driving ongoing growth and adoption of fruit and vegetable ingredients globally.

In 2025, the global fruit and vegetable ingredient market revenue is expected to total USD 11,383.4 million. Over the forecast period, the industry is projected to register a CAGR of 4.4%. By 2035, the sector is estimated to be valued at USD 17,479.6 million.

The food and beverage industry is witnessing a revolution driven by a simple ingredient - fruits and vegetables. But these aren't average apples and oranges. These are a dynamic market of fruit and vegetable ingredients, where the freshest produce is transformed into versatile components for an array of products.

The target industry is booming, fueled by a confluence of factors. At the forefront is the health-conscious consumer. The demand for nutritious and minimally processed foods is pushing manufacturers to incorporate fruits and vegetables in innovative ways. Powders, concentrates, purees, and even extracts - these ingredients offer a concentrated dose of flavor, color, and essential nutrients, allowing for delicious and healthy product development.

| Attributes | Description |

|---|---|

| Estimated Global Fruit and Vegetable Ingredient Market Size (2025E) | USD 11,383.4 million |

| Projected Global Fruit and Vegetable Ingredient Market Value (2035F) | USD 17,479.6 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

Beyond health trends, the fruit and vegetable ingredient market thrives on convenience. These prepped ingredients save manufacturers time and resources during production. Imagine creating a vibrant smoothie or a perfectly flavored bakery filling - all with the ease of using concentrated fruit purees. This efficiency translates to cost savings for manufacturers and, ultimately, more affordable products for consumers.

The industry caters to a diverse range of applications. From the vibrant colors of beet powder in yogurt to the subtle sweetness of apple concentrate in popular granola bars, fruit and vegetable ingredients are silently playing a starring role.

Fruit and vegetable ingredients are not just limited to sweet treats. For instance, they are widely used for making soups and stews. Even the pharmaceutical and nutraceutical industries are using the power of these ingredients to create functional foods and supplements.

Geographically, the industry shows a dynamic landscape. Europe has traditionally held the dominant position, but regions like North America and Asia are experiencing significant growth. This can be attributed to factors like rising disposable incomes, increasing urbanization, and growing awareness about healthy eating habits.

The market, however, faces some challenges. Seasonality of certain fruits and vegetables can pose hurdles for consistent supply. Additionally, ensuring sustainability throughout the supply chain, from farm to factory, is crucial for responsible sourcing and maintaining consumer trust.

Despite these challenges, the future of the fruit and vegetable ingredient industry is bright. With continuous innovation in processing techniques, a focus on sustainable practices, and a growing demand for healthy and convenient food options, this market is poised to continue its fruitful journey.

Clean Label Drives Fruit and Veggie Power from Farm to Factory

The rise of clean label trends is a major force positively impacting the fruit and vegetable ingredient market. Consumers are demanding minimally processed, recognizable ingredients. This translates to a surge in demand for fruit and vegetable concentrates, purees, and powders made using gentle processing techniques. These ingredients allow manufacturers to deliver the taste, color, and nutrients of real fruits and vegetables without resorting to artificial additives or hidden sugars, perfectly aligning with the clean label philosophy.

Organic Fruits and Veggies Gain Market Power

The health food sector is witnessing a surge in the market penetration of organic fruit and vegetable ingredients. Consumers are increasingly seeking out products free from synthetic pesticides and fertilizers, aligning with the core values of the health food industry. This trend is fueled by a growing belief in the potential health benefits of organic produce and a desire for a more sustainable food system.

Manufacturers in the health food sector are responding by incorporating organic fruit and vegetable concentrates, powders, and extracts into their products. They are offering consumers a convenient way to access the goodness of organic produce in various forms like protein bars, healthy snacks, and functional beverages.

The Bumpy Road of Fresh Fruits and Veg Ingredients

The sunshine side of fruits and vegetables hides a few shadows. Short seasons cause price swings and limited options outside peak times. Keeping them fresh throughout processing is a delicate dance.

Transportation adds cost and environmental concerns. While the variety of ingredients is growing, some unique options lack efficient processing methods. Despite these hurdles, innovation in storage, sustainable farming, and wider processing techniques can pave the way for a truly fruitful future for this industry.

The United States fruit and vegetable ingredient market is experiencing significant growth. This is due to a confluence of factors that align perfectly with consumer preferences and broader industry trends.

American consumers are increasingly health-conscious, seeking out nutritious and minimally processed foods. Fruit and vegetable ingredients offer a concentrated dose of vitamins, minerals, and antioxidants, allowing manufacturers to create delicious and healthy products that cater to this demand.

The fast-paced American lifestyle fuels the desire for convenient food options. Fruit and vegetable ingredients are pre-processed and ready to use, saving manufacturers time and resources during production. This translates to a wider variety of healthy and convenient options for busy consumers.

The Indian fruit and vegetable ingredient market is growing rapidly due to several converging factors. India has a diverse climate and rich agricultural heritage, allowing for the cultivation of a wide variety of fruits and vegetables. This presents an opportunity for manufacturers to source ingredients locally, potentially reducing costs and promoting sustainability.

The Indian government is actively promoting the processing of fruits and vegetables to reduce spoilage and waste. This can incentivize the growth of the fruit and vegetable ingredient industry by creating a more robust infrastructure and supply chain.

Similar to other countries, Chinese consumers are becoming increasingly health-conscious. Fruit and vegetable ingredients offer a concentrated dose of vitamins, minerals, and antioxidants, allowing manufacturers to create products that cater to this growing demand for healthy eating.

With a growing global integration of the Chinese food market, there's a rising interest in exotic fruits. Fruit and vegetable ingredients can be used to incorporate unique flavors into various food products, appealing to adventurous palates and driving industry growth.

Fruit and vegetable concentrates are heavily used in various sectors due to a combination of factors that offer significant advantages over using whole fruits and vegetables. Concentrates save manufacturers time and resources during production. They eliminate the need for washing, peeling, chopping, and discarding waste, streamlining the process and reducing waste.

Fruit and vegetable concentrates undergo controlled processing techniques, resulting in a consistent product with reliable flavor, color, and nutritional value. This simplifies recipe development and ensures consistent quality in the final product.

Fruits and vegetables play distinct roles in the food and beverage sector. Fruits, with their sweetness and diverse flavors, reign supreme in desserts, yogurts, and beverages. Their higher sugar content makes them ideal natural sweeteners. Vegetables, on the other hand, offer a world of savory options for soups, sauces, and snacks. They also bring natural coloring options and unique health benefits to the table.

While fruits might seem to have the upper hand in sweetness, there's a rising trend of incorporating vegetables in new ways, like hidden veggie powders and healthy vegetable-based juices. Ultimately, both fruits and vegetables hold a strong position in the food and beverage industry, each with its unique strengths catering to specific needs and market trends.

The battle for industry share in the fruit and vegetable ingredient market is heating up, and key players are wielding innovation as their weapon of choice. Expanding their ingredient variety allows them to cater to the ever-evolving demands for unique flavors and functionalities in food and beverages. But innovation goes beyond just variety.

Companies are focusing on clean label options, aligning with consumer preferences for minimally processed ingredients free from artificial additives. Additionally, the rise of functional foods has spurred the development of fruit and vegetable ingredients with targeted health benefits. These innovations wouldn't be possible without a strong foundation.

Key players in the fruit and vegetable ingredient market are establishing strategic partnerships with farmers to ensure a consistent supply of high-quality produce. Mergers and acquisitions are also on the rise, allowing companies to expand their product portfolios and reach new markets.

Building strong relationships with food and beverage manufacturers is another key strategy. Collaboration allows for the joint development of innovative products that leverage the power of fruit and vegetable ingredients.

Successful players understand the importance of effective communication. They educate consumers about the health benefits of incorporating these ingredients into their diets while highlighting the versatility they offer across food and beverage categories. Investing in research and development ensures continuous improvement in processing techniques, product quality, and functionality.

Players are also emphasizing a commitment to sustainable practices throughout the supply chain resonates with environmentally conscious consumers and manufacturers alike. By excelling in all these areas, key players in the fruit and vegetable ingredient market are well-positioned to not just compete but thrive.

Industry Updates

The fruit and vegetable ingredient market segmentation, based on the product type, is categorized into concentrates, pastes and purees, pieces and powders, and NFC juices.

Based on form, the industry is bifurcated into fruit and vegetable.

Prominent end use segments include beverages, confectionery products, bakery products, soups and sauces, dairy products, and RTE products.

Analysis of the fruits and vegetables market has been carried out in key nations of North America, Latin America, Europe, East Asia, South Asia, Pacific, and the Middle East and Africa.

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

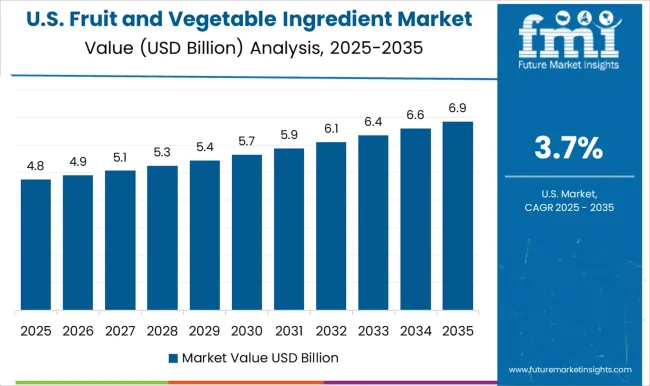

| USA | 3.7% |

| Brazil | 3.3% |

The Fruit and Vegetable Ingredient Market is expected to register a CAGR of 4.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.9%, followed by India at 5.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.3%, yet still underscores a broadly positive trajectory for the global Fruit and Vegetable Ingredient Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.1%. The USA Fruit and Vegetable Ingredient Market is estimated to be valued at USD 4.2 billion in 2025 and is anticipated to reach a valuation of USD 6.1 billion by 2035. Sales are projected to rise at a CAGR of 3.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 535.5 million and USD 384.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 Billion |

| Product Type | Concentrates, Pastes and Purees, Pieces and Powders, and NFC Juices |

| Form | Fruit and Vegetable |

| End Use | Beverages, Confectionery Products, Bakery Products, Soups and Sauces, Dairy Products, and RTE Products |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGRANA Beteiligungs-AG, ADM, Tate & Lyle, Olam International, Ingredion, Döhler, SunOpta Inc., Balchem ingredient solutions, Cargill, Kerry Group, Sensient Technologies Corporation, and Symrise |

The global fruit and vegetable ingredient market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the fruit and vegetable ingredient market is projected to reach USD 18.3 billion by 2035.

The fruit and vegetable ingredient market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in fruit and vegetable ingredient market are concentrates, pastes and purees, pieces and powders and nfc juices.

In terms of form, fruit segment to command 62.8% share in the fruit and vegetable ingredient market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Monk Fruit Ingredient Market Size and Share Forecast Outlook 2025 to 2035

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Fresh Fruits & Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Processed Fruit and Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Vegetable Glycerin Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Seed Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Sugar Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Parchment Paper Market Size, Share & Forecast 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA