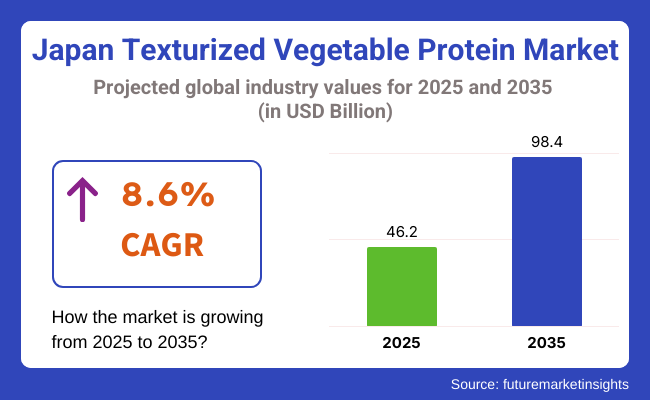

The Japan texturized vegetable protein market is poised to register a valuation of USD 46.2 million in 2025. The industry is slated to grow at 8.6% CAGR from 2025 to 2035, witnessing USD 98.4 million by 2035.

The expansion of market is being fueled by a mix of evolving consumer behavior, public awareness of health issues, and the cultural shift toward trends in global cuisine. Among the main causes of this growth is Japan's growing adoption of plant-based diets due to environmental as well as health concerns.

Although Japan normally possesses a fish-, soy-, and vegetable-based diet, the current global trend of cutting down on meat intake and using sustainable protein sources has caught up with Japanese consumers-specifically the younger population and urban dwellers.

This has created an opportunity for TVP to be a leading meat substitute in daily meals, particularly as heart health, cholesterol, and lifestyle-related disease issues become increasingly prevalent. Moreover, Japan's aging population is also an influencing factor in dietary patterns.

Older consumers require protein-rich but low-fat and easily digestible food, and TVP accommodates these demands. With increasing awareness of the health benefits of high-protein, low-saturated-fat diets, people increasingly turn to plant-based sources such as TVP for their nutritional quality and usability.

Japanese food, already utilizing soy-based foods like miso and tofu, has not found it too difficult to blend TVP into common fare like curries, stir-fries, and donburi bowls. Sustainable living and increased eco-awareness have also boosted the market.

As Japan begins to make a push toward reaching its climate goals, there is increasing social and governmental pressure to embrace sustainable food systems. TVP, which carries a smaller carbon footprint than meat, is in line with these objectives. The growth in plant-based space in grocery stores, along with education around alternate proteins, is also pushing forward consumer adoption faster.

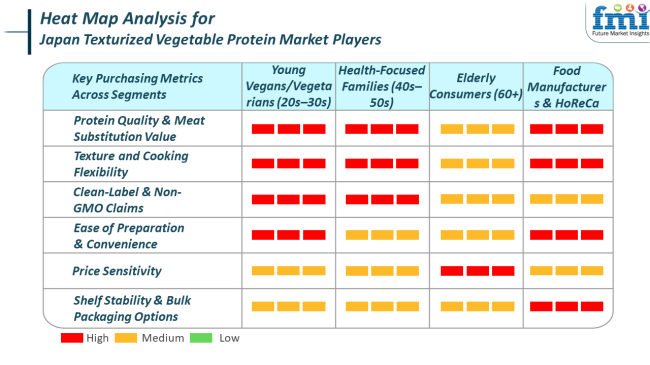

In Japan's texturized vegetable protein (TVP) market, purchasing behaviors and trends differ significantly across end-use segments like food manufacturers, foodservice operators, and household consumers. Food manufacturers are emphasizing TVP as a central ingredient in creating meat-alternative products that meet increasing health and sustainability needs.

Their requirements revolve around cost-effectiveness, texture compatibility, and clean-label ingredients that can resonate with increasingly health-aware consumers. There is also an effort to localize flavors and product forms to suit traditional Japanese cuisine such as soboro, curry rice, and gyoza.

Foodservice operators, especially in city restaurants, convenience stores, and cafes, are looking for convenient and easy-to-prepare TVP solutions that can be integrated into known menu items. In contrast, retail consumers and families are adopting TVP for its healthfulness, lower price, and simplicity of preparation.

Active lifestyles, particularly in cities, have generated demand for fast-cooking, protein-containing food, making TVP a convenient option for everyday meals. Packaging that directly communicates health benefits-high protein, low fat, and cholesterol-free-has been successful at driving retail purchases.

There's also an increase in environmentally responsible consumer behavior with consumers opting for plant-based proteins to advance environmental objectives, particularly among younger and female consumers. Consumers are impacted by cooking programs, social media, and social influencers who recommend plant-based cuisine, further motivating experimentation with TVP in meal preparation at home.

Between 2020 and 2024, Japan's texturized vegetable protein (TVP) market went through a slow but significant evolution. Plant-based consumption was initially a small niche, with soy-based traditional foods such as tofu and natto holding center stage. As the world's plant-based phenomenon started affecting Japanese consumer preferences, especially among young, urban consumers, this began to shift.

During the COVID-19 pandemic, the focus of consumers further turned towards health-oriented and shelf-stable foods, opening up new avenues for TVP. Throughout this timeframe, food producers started testing TVP in popular forms such as bento meal, frozen dumplings, and convenience foods.

While still developing, knowledge regarding sustainable food increased, and therefore some supermarkets and food chains added more plant-based foods. Between 2025 and 2035, the TVP market in Japan is predicted to gain strong momentum due to health trends, environmental policy, and food trends.

With the aging population, there will be greater demand for high-protein, low-fat, and digestible food, making TVP a favored protein source among older consumers. Furthermore, Japan's focus on curbing carbon emissions and sustainable living is likely to lead to government-sponsored programs in favor of plant-based food production.

On the consumer side, increased variety in TVP sources, including pea, faba bean, and lentil proteins, will arise to address allergen issues and create more differentiated flavor profiles. Food processing innovation will also be important, improving texture and flavor to match the preferences of the Japanese consumer.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 (Projected) |

|---|---|

| TVP remained relatively unknown to the typical Japanese consumer, with plant-based diets being perceived as trendy or niche instead of mainstream. Interest was primarily generated in urban settings and among health-conscious or environmentally aware consumers. | TVP will become increasingly widely accepted across all demographics as plant-based eating becomes part of daily life, backed by health, sustainability, and institutional food policy. |

| TVP products predominantly contained soy because of Japan's cultural adaptation to soy foods such as tofu and miso. Alternatives were scarce in terms of variety and not very aggressively marketed. | A broader variety of ingredients such as pea, faba bean, and lentil protein will be added, appealing to allergen-concerned consumers and variety-conscious consumers for flavor and nutrition. |

| TVP products surfaced occasionally in specialty stores and health-oriented restaurants but with limited penetration in mainstream foodservice or supermarket channels. | Convenience stores, supermarkets, and quick-service restaurants will carry more TVP-based ready meals and snacks, further increasing the convenience and accessibility of plant-based eating. |

| TVP was promoted based on its protein value and longevity, particularly during the pandemic when food security and home cooking were given priority. | Food manufacturers will invest in flavor enhancement, texture, and culinary functionality, developing TVP products to match Japanese cuisine and appealing to discerning food consumers. |

Although Japan's texturized vegetable protein (TVP) market is picking up speed, it is also confronted with various risks and challenges that may affect its stability and future growth in the long term. One major issue is the low domestic production capacity for alternative proteins.

Japan is very dependent on overseas raw materials such as soy and pea protein, and this makes the market susceptible to global supply chain interruptions, trade disputes, and volatility in prices. This dependence also increases the environmental and economic costs tied to transportation and import duties, which could limit competitive pricing within the domestic market.

The second major risk is consumer distrust and cultural taste. TVP products that do not meet local taste and texture preferences can have a hard time finding broad acceptance, particularly among the older generations.

Furthermore, with increased awareness about sustainability, there is still great price sensitivity, and consumers are likely to resist selecting TVP over traditional protein sources if perceived as too costly or of low quality.

In Japan, conventional texturized vegetable protein (TVP) is now more commonly sold and used compared to its organic equivalent. It is largely because it is cost-effective, available on a wider scale, and has well-established supply chains, making it a more practical choice for food producers, restaurants, and mass retailers.

This TVP is also widely utilized in convenience store foods, ready-to-consume goods, and processed foodstuffs-segments that dominate the Japanese market. Considering Japan's emphasis on food quality consistency, safety, and affordability, conventional TVP complies with standard scale requirements for which it is best suited in high-volume production.

Moreover, Japan's TVP market continues to be at a growth and awareness stage where customers are learning more about plant-based meat alternatives but might not necessarily rank organic certification as the foremost buying consideration.

Whereas organic food fashions continue to expand in Japan-particularly among younger, health-conscious shoppers-the market for organic TVP is niche given its premium pricing and restricted shelf life. Japan's stringent organic certification regulatory climate also translates to fewer domestic players entering organic TVP production, further restricting supply and increasing cost.

The most commonly retailed form of TVP in Japan are granules because they are versatile, convenient to use, and well-suited to Japanese cuisine. Granular TVP resembles ground meat in texture as well as usage, and it is an excellent vegan alternative for foods like soboro (seasoned ground meat), curry rice, gyoza filling, stuffed peppers, and miso stews.

This type of form pairs well with seasonings and sauces, which it can soak up well-a significant feature in Japanese cooking, which focuses on balance and umami. Its small size and fast rehydration are also a boon to both foodservice operators and home preparers seeking convenient, protein-based ingredients.

Additionally, granule use reflects Japan's keen demand for convenience foods, particularly in ready-made meals and bento boxes stocked in supermarkets and convenience stores. Food processors prefer granules as they are easy to process, portion, and store, so they are compatible with mass production and shelf-stable packaging. They have a mild and malleable texture that facilitates forming a neutral foundation that does not overwhelm traditional Japanese flavor profiles.

The Japanese texturized vegetable protein (TVP) industry is changing rapidly, with domestic and foreign firms competing in multiple types of protein, certifications, and end-use applications. As consumers become more interested in plant-based eating, clean-labeling, and sustainable food systems, firms are utilizing innovation, alliances, and retail strategy to capture market share.

The industry is marked by a mix of traditional food manufacturers, organic experts, and global ingredient giants, each serving various segments of the plant-based value chain. Kurakon, a domestic brand, takes consumer awareness with its established presence in soy-based foods and expansion into retail-friendly TVP varieties.

Cargill Inc. maintains its dominance by large-volume B2B supply of soy and pea-based proteins to food makers and institutional foodservice customers. Alishan Organic Textured Soy Protein has niched out as the supplier of organic, non-GMO soy TVP, reaching health-focused and ethical customers, especially online and specialty food stores.

Fuji Oil Company Limited, the soy-based food innovation leader in Japan, incorporates TVP into both consumer and industrial use, capitalizing on its R&D expertise in plant emulsifiers and textures. Startups such as Miracle Meats are targeting the flexitarian and gourmet market by combining local ingredients with cutting-edge plant-based processing, frequently replicating traditional Japanese meat dishes.

Puris Proteins, LLC., although USA-based, is growing its presence in Japan through pea protein TVP, which is perfect for allergen-free product lines. Rice protein-based meat alternatives are becoming a culturally appealing substitute, providing gluten- and soy-free alternatives that appeal to dietary sensitivities. At the same time, multinational giants such as Archer Daniels Midland (ADM) and CHS Inc. keep pushing global-scale ingredient availability and technical expertise into the Japanese market.

Roquette Frères and Beneo GmbH are investing in texture upgrading and functional nutrition, providing high-end TVP solutions to meet Japan's demand for clean taste and low additives. These companies are also investing in local alliances and adaptation, understanding the need to integrate plant-based innovations into locally accepted dishes such as curry, soboro, and stir-fry bowls.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kurakon | 16-20% |

| Cargill Inc. | 14-18% |

| Fuji Oil Company Limited | 12-15% |

| Roquette Frères | 10-13% |

| Archer Daniels Midland Company (ADM) | 8-11% |

| Alishan Organic Textured Soy Protein | 6-9% |

| Miracle Meats | 4-7% |

| Beneo GmbH | 4-6% |

| Puris Proteins, LLC. | 3-5% |

| CHS Inc. | 3-5% |

| Rice protein-based meat analogues | 2-4% |

| Other Key Players (Combined) | 10-15% |

Kurakon is market leader in Japan's TVP market with an estimated 16-20% share. It enjoys advantages from its local heritage, established consumer loyalty, and concentrations on soy format that resonate well with Japanese popular tastes. Kurakon's success in embedding TVP within popular retail fare such as miso-simmered foods and bento lunches has sustained its dominance in the category.

Cargill Inc., at 14-18%, provides large-scale soy and pea-based TVP for industrial uses and processed food. Its focus is scalability, global sourcing, and compliance with Japan's strict food safety regulations, and hence it is an ideal partner for manufacturers that procure in high volumes. Fuji Oil Company Limited, at 12-15%, utilizes its R&D excellence and history of soy innovation, providing textured soy solutions that meet both traditional and Westernized plant-based menus.

Roquette Frères, holding a 10-13% market share, is establishing its position in Japan through its pea protein capabilities and continuous product development focusing on clean-label, allergen-free nutrition. ADM and CHS Inc. are dominant in providing raw TVP materials and technical solutions to manufacturers. They specialize in cost-efficient supply, protein diversification, and processing flexibility to meet a wide range of applications.

Alishan Organic Textured Soy Protein, with a 6-9% share, is on the rise among organic and health food consumers, particularly among e-commerce shoppers and younger consumers. Miracle Meats and Puris Proteins are contributing to the diversification of the protein base away from soy, with attention to texture, allergen-free status, and culinary appeal. Rice protein-based analogues are a developing category with potential based on Japan's strong cultural link to rice, although their share remains tiny.

Beneo GmbH, active in the functional and nutritional TVP segment, is focusing investments on clean, fortified, and high-protein formats that address health-conscious segments. Collectively, these players are a market fueled by innovation, cultural insight, health positioning, and responsive protein sourcing, all key to realizing future growth in Japan's changing plant-based arena.

Based on nature, the industry is classified into organic and conventional.

In terms of product type, the market is divided into soy protein, wheat protein, pea protein, rice protein, faba bean protein, lentil protein, flax protein, chia protein,andcorn protein.

Based on form, the industry is divided into chunks, slices, flakes, and granules.

Based on end-use, the market is classified into household, industrial, and commercial.

By process type, the industry is classified into dry TVP and wet TVP.

In terms of distribution channel, the industry is divided into direct and indirect.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 46.2 million in 2025.

The industry is projected to witness USD 98.4 million by 2035.

The industry is projected to witness 8.6% CAGR during the study period.

Conventional products are widely sold.

Leading companies include Kurakon, Cargill Inc., Alishan Organic Textured Soy Protein, Fuji Oil Company Limited, Miracle Meats, Puris Proteins, LLC., Rice protein-based meat analogues, Archer Daniels Midland Company, CHS Inc., Roquette Frères, and Beneo GmbH.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 13: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: Kanto Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: Kanto Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 19: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: Kanto Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 22: Kanto Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 23: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 24: Kanto Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 25: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: Kanto Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 27: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Chubu Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Chubu Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 31: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 32: Chubu Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 33: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 34: Chubu Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 35: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 36: Chubu Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 37: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Chubu Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 39: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 40: Kinki Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 41: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 42: Kinki Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 43: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Kinki Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 45: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 46: Kinki Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 47: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 48: Kinki Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 49: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Kinki Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 57: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 58: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 59: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 60: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 61: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 62: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 63: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: Tohoku Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: Tohoku Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 67: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: Tohoku Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 69: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 70: Tohoku Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 71: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 72: Tohoku Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 73: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 74: Tohoku Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 75: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 79: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 80: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Form, 2018 to 2033

Table 81: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 82: Rest of Industry Analysis and Outlook Volume (MT) Forecast by End-Use, 2018 to 2033

Table 83: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Process Type, 2018 to 2033

Table 84: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Process Type, 2018 to 2033

Table 85: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 86: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (MT) Analysis by Region, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 16: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 17: Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 18: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 19: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 20: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 21: Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 22: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 23: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 24: Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 25: Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 26: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 27: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 28: Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 29: Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 30: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 31: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 32: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 33: Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 34: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 35: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 37: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 38: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 39: Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 40: Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 41: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 42: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 44: Kanto Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 45: Kanto Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 46: Kanto Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 48: Kanto Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 49: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 50: Kanto Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 51: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 52: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 53: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 54: Kanto Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 55: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 56: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 57: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Kanto Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 62: Kanto Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 63: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 64: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 65: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 66: Kanto Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 67: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 68: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 69: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 70: Kanto Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 71: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 72: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 73: Kanto Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 74: Kanto Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 75: Kanto Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 76: Kanto Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 77: Kanto Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 78: Kanto Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 79: Chubu Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 80: Chubu Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 81: Chubu Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 82: Chubu Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 83: Chubu Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 84: Chubu Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 85: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 86: Chubu Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 87: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 88: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 89: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 90: Chubu Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 91: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 92: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 93: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 94: Chubu Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 95: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 96: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 97: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 98: Chubu Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 99: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 100: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 101: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 102: Chubu Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 103: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 104: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 105: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 106: Chubu Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 107: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 108: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 109: Chubu Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 110: Chubu Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 111: Chubu Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 112: Chubu Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 113: Chubu Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 114: Chubu Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 115: Kinki Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 116: Kinki Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 117: Kinki Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 118: Kinki Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 119: Kinki Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 120: Kinki Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 121: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 122: Kinki Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 123: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 124: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 125: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 126: Kinki Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 127: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 128: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 129: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 130: Kinki Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 134: Kinki Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 135: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 136: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 137: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 138: Kinki Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 139: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 140: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 141: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 142: Kinki Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 144: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 145: Kinki Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 146: Kinki Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 147: Kinki Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 148: Kinki Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 149: Kinki Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 150: Kinki Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 151: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 152: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 154: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 155: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 156: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 157: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 158: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 159: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 160: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 161: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 162: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 163: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 164: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 165: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 166: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 167: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 168: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 169: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 170: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 171: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 172: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 173: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 174: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 175: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 176: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 177: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 178: Kyushu & Okinawa Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 179: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 180: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 181: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 182: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 183: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 184: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 185: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 186: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 187: Tohoku Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 188: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 189: Tohoku Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 190: Tohoku Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 191: Tohoku Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 192: Tohoku Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 193: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 194: Tohoku Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 195: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 196: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 197: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 198: Tohoku Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 199: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 200: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 201: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 202: Tohoku Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 203: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 204: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 205: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 206: Tohoku Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 207: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 208: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 209: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 210: Tohoku Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 211: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 212: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 213: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 214: Tohoku Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 215: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 216: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 217: Tohoku Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 218: Tohoku Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 219: Tohoku Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 220: Tohoku Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 221: Tohoku Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 222: Tohoku Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 223: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 224: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 225: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 226: Rest of Industry Analysis and Outlook Value (US$ Million) by End-Use, 2023 to 2033

Figure 227: Rest of Industry Analysis and Outlook Value (US$ Million) by Process Type, 2023 to 2033

Figure 228: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 229: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 230: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Nature, 2018 to 2033

Figure 231: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 232: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 233: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 234: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 235: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 236: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 237: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 238: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Form, 2018 to 2033

Figure 239: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 240: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 241: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 242: Rest of Industry Analysis and Outlook Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 243: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 244: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 245: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Process Type, 2018 to 2033

Figure 246: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Process Type, 2018 to 2033

Figure 247: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Process Type, 2023 to 2033

Figure 248: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Process Type, 2023 to 2033

Figure 249: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 250: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 251: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 252: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 253: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 254: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 255: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 256: Rest of Industry Analysis and Outlook Attractiveness by End-Use, 2023 to 2033

Figure 257: Rest of Industry Analysis and Outlook Attractiveness by Process Type, 2023 to 2033

Figure 258: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA