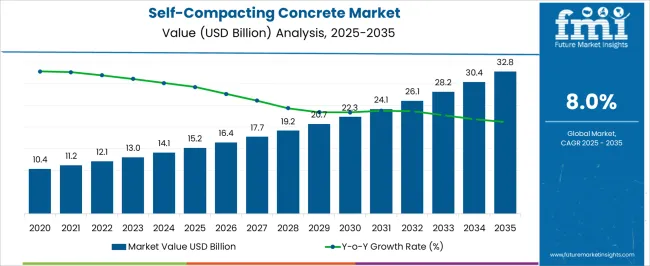

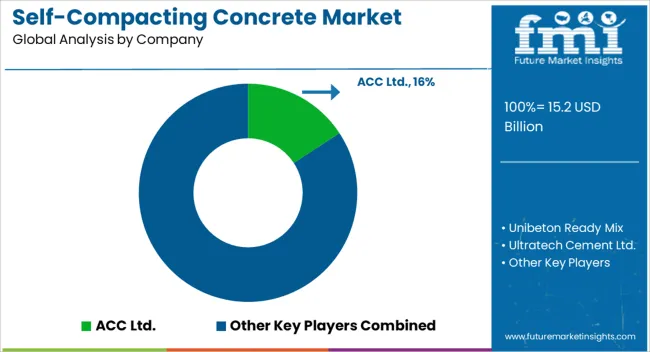

The self-compacting concrete market is estimated to be valued at USD 15.2 billion in 2025 and is projected to reach USD 32.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The global semiconductor foundry market is anticipated to rise from 148.7 USD billion in 2025 to 355.3 USD billion by 2035, achieving a CAGR of 9.1%. Analysis of the peak-to-trough dynamics highlights periods of accelerated expansion followed by relative stabilization, reflecting the cyclical nature of semiconductor demand and capital-intensive manufacturing investments. In the early forecast years, from 2025 to 2028, the market experiences steady growth with minor troughs caused by temporary capacity constraints and fluctuations in chip demand across consumer electronics and automotive sectors.

Between 2029 and 2032, accelerated peaks are observed as technology nodes advance, driving higher wafer starts and increased adoption of leading-edge processes in artificial intelligence, 5G infrastructure, and high-performance computing applications. Slight dips in growth occur in transitional years due to inventory corrections, geopolitical supply chain disruptions, and adjustments in capital expenditure, yet these troughs are followed by renewed momentum.

By the latter part of the decade, 2033 to 2035, the market achieves sustained peaks supported by demand from electric vehicles, IoT devices, and data center expansions, ensuring robust utilization of foundry capacities. The yearly progression from 148.7 USD billion to 355.3 USD billion demonstrates that while the market exhibits short-term oscillations between peaks and troughs, the long-term trajectory remains strongly upward, driven by technological adoption, global electronics demand, and strategic capacity expansions.

| Metric | Value |

|---|---|

| Self-Compacting Concrete Market Estimated Value in (2025 E) | USD 15.2 billion |

| Self-Compacting Concrete Market Forecast Value in (2035 F) | USD 32.8 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The self-compacting concrete (SCC) market is strongly influenced by interconnected parent segments, each contributing uniquely to overall demand and growth. The building and construction sector holds the largest share at 45.8%, driven by the increasing adoption of SCC for its superior workability and ability to flow into intricate molds without mechanical vibration, making it ideal for complex structural applications. The infrastructure segment contributes 25%, with SCC being extensively used in the construction of bridges, tunnels, and high-rise buildings, where its durability and ease of placement are highly valued. The oil and gas sector accounts for 15%, as SCC is utilized in the construction of offshore platforms and pipelines, where its resistance to harsh environmental conditions is crucial.

The precast concrete segment holds 10%, with SCC enabling the production of high-quality precast elements with enhanced surface finishes and reduced labor costs. Finally, the industrial applications segment represents 4.2%, encompassing the use of SCC in industrial flooring and other specialized applications. Collectively, the building and construction, infrastructure, and oil and gas sectors account for 85% of overall demand, highlighting that urban development, infrastructure expansion, and energy sector requirements remain the primary growth drivers, while precast and industrial applications provide steady, complementary demand across regions globally.

The self-compacting concrete market is witnessing strong growth, driven by the increasing demand for high-performance, labor-efficient, and durable concrete solutions in construction projects worldwide. Adoption is being accelerated by the need to reduce construction time, minimize labor dependency, and ensure consistent quality in complex structural applications.

Advancements in mix design technology, material optimization, and chemical admixtures are enhancing workability, flowability, and stability, making self-compacting concrete suitable for densely reinforced structures. The market is also benefiting from the growing emphasis on sustainable and environmentally friendly construction practices, as the material reduces waste, energy consumption, and the carbon footprint associated with traditional concrete placement methods.

Rising infrastructure investments, particularly in high-rise buildings, bridges, and industrial facilities, are further stimulating demand As contractors and engineers prioritize efficiency, reliability, and long-term durability, self-compacting concrete is being increasingly adopted, and the market is expected to sustain growth, supported by continuous innovation in raw materials, powder formulations, and application techniques.

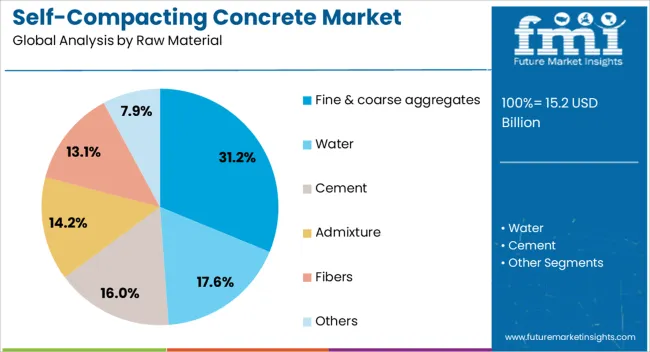

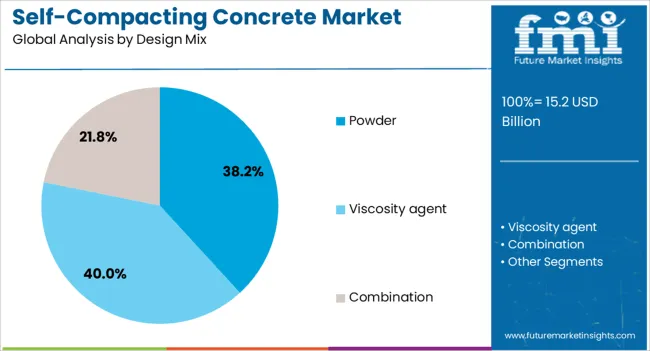

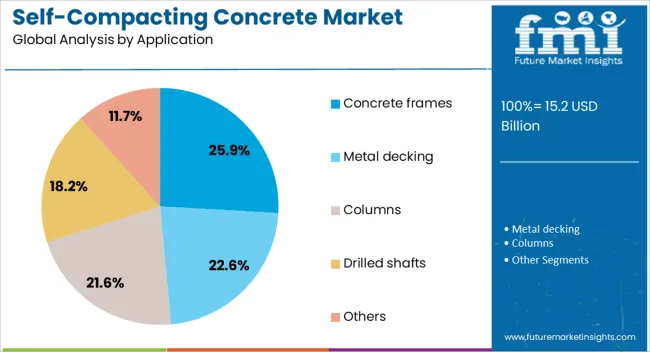

The self-compacting concrete market is segmented by raw material, design mix, application, end-user, and geographic regions. By raw material, self-compacting concrete market is divided into fine & coarse aggregates, water, cement, admixture, fibers, and others. In terms of design mix, self-compacting concrete market is classified into powder, viscosity agent, and combination. Based on application, self-compacting concrete market is segmented into concrete frames, metal decking, columns, drilled shafts, and others. By end-user, self-compacting concrete market is segmented into building & construction, infrastructure, oil & gas, and others. Regionally, the self-compacting concrete industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fine and coarse aggregates segment is projected to hold 31.2% of the self-compacting concrete market revenue share in 2025, making it the leading raw material category. Its dominance is being driven by the essential role aggregates play in determining concrete strength, workability, and durability.

Proper grading and selection of fine and coarse aggregates enable optimal particle packing, which enhances flowability and minimizes segregation in self-compacting concrete mixes. The segment benefits from advancements in aggregate processing and quality control techniques, which ensure consistent performance and reduce variability in concrete characteristics.

Increasing adoption of self-compacting concrete in high-rise, commercial, and industrial construction projects, where structural integrity and efficiency are critical, is further supporting growth Cost-effectiveness, wide availability, and compatibility with diverse powder and admixture combinations are reinforcing the preference for fine and coarse aggregates as the primary raw material in the global market.

The viscosity agent segment of the design mix is expected to account for 40.0% of the self-compacting concrete market revenue share in 2025, establishing it as the leading design mix category. This prominence is being supported by the critical role viscosity-modifying agents play in stabilizing flow characteristics, preventing segregation, and enhancing the homogeneity of the concrete mix.

Use of optimized viscosity agents, including cellulose derivatives, polysaccharides, and synthetic polymers, improves the resistance to bleeding and ensures consistent distribution of aggregates, even in heavily reinforced sections. The segment is being driven by the rising demand for highly flowable concrete in complex architectural forms and congested reinforcement structures, where stability and performance are paramount.

Technological advancements in polymer chemistry and admixture formulation have enabled better control of rheology, contributing to increased adoption across infrastructure, high-rise, and precast applications. The ability of viscosity-agent-based design mixes to deliver long-term durability, reduced permeability, and superior structural integrity is reinforcing their leading position in the market.

The concrete frames application segment is projected to hold 25.9% of the self-compacting concrete market revenue share in 2025, making it the leading application segment. Its growth is being driven by the demand for high-quality structural frames in high-rise buildings, commercial complexes, and infrastructure projects, where self-compacting concrete offers superior flowability and uniform filling of intricate formworks.

The material enables the reduction of vibration efforts, labor dependency, and construction time while ensuring uniform surface finishes and structural integrity. Increasing urbanization and the construction of multi-story buildings in emerging economies are reinforcing adoption in concrete frame applications.

Enhanced durability, high early and long-term strength, and the ability to meet demanding structural requirements are also contributing to the segment’s leadership Contractors and engineers are favoring self-compacting concrete for frame applications due to its ability to simplify construction processes and deliver consistent quality, solidifying its position as the largest revenue-generating application in the market.

The self-compacting concrete market is witnessing steady growth due to its superior workability, high performance, and ability to reduce labor and construction time. Regulatory standards and quality compliance ensure consistent performance, durability, and safety, encouraging adoption across commercial and infrastructure projects. Technological improvements in mix design, admixtures, and batching methods enhance SCC’s properties, enabling its use in complex formworks and high-rise structures. Expansion in urban development, large-scale infrastructure, and industrial projects drives consistent demand.

The self-compacting concrete market is growing steadily due to increased adoption in residential, commercial, and infrastructure projects. SCC provides superior flowability and uniformity without the need for mechanical vibration, improving construction speed and reducing labor requirements. High-performance properties such as enhanced durability, reduced segregation, and improved surface finish are driving preference among contractors and engineers. Large-scale projects like bridges, high-rise buildings, and tunnels benefit from SCC’s ability to fill complex formworks. Growing focus on faster project completion, better quality, and reduced rework is supporting market expansion globally.

Regulatory frameworks and quality standards significantly shape the SCC market. Compliance with local and international construction codes, material safety standards, and durability requirements ensures reliability and long-term performance. Standardized guidelines for mix design, workability, and strength are enforced in infrastructure and commercial projects. Contractors and engineers prefer certified suppliers to reduce risk and ensure consistent concrete performance. Regulatory compliance also includes environmental considerations such as limiting waste and controlling raw material sourcing. Adhering to these standards builds credibility, enhances project acceptance, and drives adoption in both public and private sector developments.

Advancements in concrete mix design, admixtures, and chemical additives are driving the SCC market. The use of superplasticizers, viscosity-modifying agents, and supplementary cementitious materials improves flowability, segregation resistance, and strength. Customized formulations cater to specific project requirements such as high-strength, lightweight, or rapid-setting SCC. Innovations in batching, quality control, and on-site mixing technology ensure consistent performance and reduced errors. Performance optimization allows SCC to meet aesthetic, structural, and durability needs for complex architectural designs, reinforcing its adoption across diverse construction projects and challenging environments.

The SCC market is expanding with large-scale infrastructure, industrial, and urban development projects. Bridges, high-rise buildings, tunnels, and metro construction require high-quality concrete that can be placed efficiently and provide structural integrity. Urban expansion, government-funded infrastructure initiatives, and private sector developments are driving adoption in emerging and developed economies. Contractors are increasingly selecting SCC to reduce construction time, labor dependency, and maintenance requirements. Demand is further supported by sustainable construction practices emphasizing longer-lasting structures and minimized defects, positioning SCC as a preferred material for modern, high-performance projects.

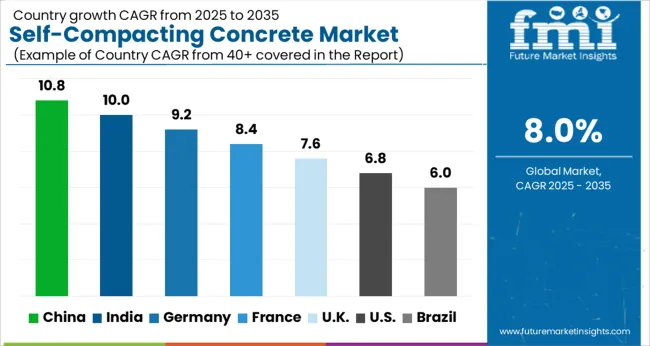

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| U.K. | 7.6% |

| U.S. | 6.8% |

| Brazil | 6.0% |

The global self-compacting concrete market is projected to grow at a CAGR of 8.0% from 2025 to 2035. China leads expansion at 10.8%, followed by India at 10.0%, Germany at 9.2%, the U.K. at 7.6%, and the U.S. at 6.8%. Growth is driven by increasing demand for high-performance concrete solutions, large-scale infrastructure projects, and efficiency-focused construction methods. China and India are spearheading adoption due to rapid urban development and industrial expansion, while Germany, the U.K., and the U.S. emphasize advanced mix designs, automation in concrete placement, and sustainable material practices to meet complex construction requirements. The analysis covers over 40 countries, with the leading markets detailed below.

The self-compacting concrete (SCC) market in China is projected to grow at a CAGR of 10.8% from 2025 to 2035, driven by rapid urban infrastructure development, high-rise construction, and large-scale industrial projects. Adoption of SCC is increasing due to its ability to flow under its own weight, reduce labor dependency, and ensure superior surface finish, especially in complex formwork and congested reinforcement areas. Government initiatives for smart city projects, metro construction, and sustainable building practices are boosting demand. Manufacturers are focusing on innovations in mix design, admixtures, and additives to improve workability, durability, and early strength. Collaborative projects with construction technology providers enhance efficiency and quality control across commercial, residential, and industrial segments.

The SCC market in India is expected to grow at a CAGR of 10.0% from 2025 to 2035, fueled by rapid urbanization, increasing construction of residential and commercial complexes, and rising public infrastructure investment. SCC adoption is driven by its labor-saving properties, enhanced flowability, and ability to achieve uniform compaction in complex structural elements. The growth of metro rail projects, highways, and industrial parks is creating strong demand for high-performance concrete solutions. Local manufacturers are investing in R&D for optimized mix designs, admixtures, and additives that improve durability and reduce curing time. The government’s push for modern, efficient, and sustainable building practices is further enhancing SCC deployment.

Germany’s SCC market is projected to grow at a CAGR of 9.2% from 2025 to 2035, supported by stringent construction standards, industrialization, and demand for high-quality precast concrete components. Adoption is driven by the need for superior surface finish, faster construction cycles, and reduced dependency on skilled labor. Manufacturers are investing in advanced admixtures, viscosity-modifying agents, and fiber-reinforced SCC to meet industrial and infrastructure requirements. Large-scale projects such as bridges, commercial complexes, and industrial facilities are increasing demand for durable and self-compacting solutions. Collaborations between local suppliers and international technology providers enhance innovation, quality control, and efficiency. Sustainable construction initiatives and emphasis on high-strength concrete further boost SCC adoption.

The UK SCC market is expected to grow at a CAGR of 7.6% from 2025 to 2035, driven by residential, commercial, and public infrastructure projects requiring labor-efficient and high-quality concrete. SCC adoption is encouraged by its ability to flow without segregation, reduce vibration requirements, and provide superior surface finish in precast and complex structural elements. Manufacturers are introducing customized mix designs with admixtures for workability, strength, and durability optimization. Large-scale projects such as airports, hospitals, and urban housing developments are contributing to growth. Collaborations between construction companies and technology providers enhance adoption of automated pouring and quality control practices, ensuring compliance with local building codes and sustainability goals.

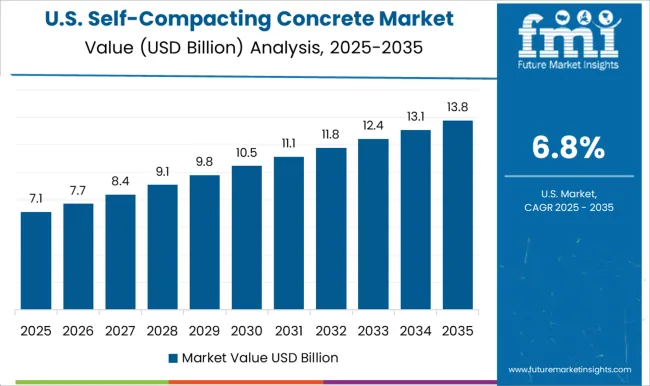

The U.S. SCC market is projected to grow at a CAGR of 6.8% from 2025 to 2035, influenced by increasing adoption in commercial, residential, and infrastructure projects. The market benefits from labor cost savings, faster construction cycles, and superior flowability in complex formwork and precast concrete applications. Manufacturers are focusing on advanced mix designs, polymer-based admixtures, and fiber reinforcement to improve workability, durability, and strength. High-rise residential towers, bridges, and industrial facilities are driving demand. Partnerships with construction technology providers facilitate quality monitoring, automated pouring, and sustainable concrete practices. Regulatory emphasis on green construction and high-performance building materials further strengthens SCC adoption across the U.S. construction sector.

Competition in the self-compacting concrete (SCC) market is shaped by mix design innovation, workability, and strength performance. ACC Ltd. leads with high-performance SCC solutions optimized for large-scale infrastructure and high-rise construction projects, emphasizing flowability, segregation resistance, and durability. Ultratech Cement Ltd. and Unibeton Ready Mix compete with tailored SCC formulations for residential, commercial, and industrial applications, focusing on rapid placement, reduced vibration needs, and consistent quality. Sika AG differentiates with advanced admixtures and chemical solutions that enhance SCC rheology, strength development, and setting times.

Tarmac Trading Ltd. and CEMEX provide customized SCC offerings for regional construction demands, emphasizing eco-friendly mixes and adherence to local standards. LafargeHolcim leverages global reach to supply SCC solutions with performance guarantees for infrastructure, commercial, and transport projects. BASF SE focuses on specialty admixtures that optimize SCC flow, durability, and shrinkage control. Gilson Company and Breedon Group offer complementary equipment, testing, and mix services to ensure consistent performance and quality control.

Mid-sized and regional players differentiate through localized production, flexible supply chains, and custom mix designs catering to niche applications such as bridges, tunnels, and industrial flooring. Strategies emphasize high workability, reduced labor costs, and enhanced durability, while reducing the need for vibration and formwork adjustments. Research and development focus on admixture optimization, sustainable materials integration, and improved performance under varying environmental conditions. Partnerships with construction contractors, architects, and engineering firms support adoption and project-specific solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD 15.2 billion |

| Raw Material | Fine & coarse aggregates, Water, Cement, Admixture, Fibers, and Others |

| Design Mix | Powder, Viscosity agent, and Combination |

| Application | Concrete frames, Metal decking, Columns, Drilled shafts, and Others |

| End-User | Building & construction, Infrastructure, Oil & gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ACC Ltd., Unibeton Ready Mix, Ultratech Cement Ltd., Sika AG, Tarmac Trading Ltd., CEMEX, LafargeHolcim, BASF SE, Gilson Company, and Breedon Group |

| Additional Attributes | Dollar sales by mix type and application (residential, commercial, infrastructure), share by region and project segment, growth trends, performance characteristics, raw material availability, construction standards, and competitive positioning. |

The global self-compacting concrete market is estimated to be valued at USD 15.2 billion in 2025.

The market size for the self-compacting concrete market is projected to reach USD 32.8 billion by 2035.

The self-compacting concrete market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in self-compacting concrete market are fine & coarse aggregates, water, cement, admixture, fibers and others.

In terms of design mix, viscosity agent segment to command 40.0% share in the self-compacting concrete market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Market Share Insights for Hollow Concrete Blocks Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA