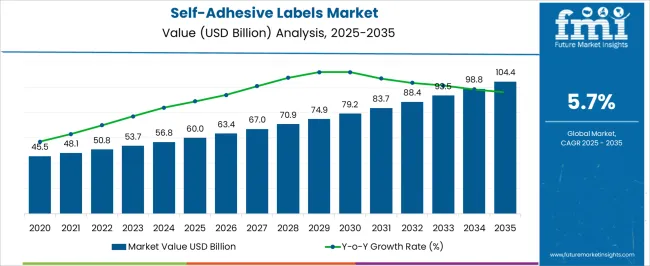

The self adhesive labels sector is projected to expand from USD 60.0 billion in 2025 to USD 104.4 billion in 2035, at a 5.7 percent CAGR. The ten-year growth comparison presents a compounding curve, moving through 63.4, 67.0, and 70.9 before reaching 79.2 by 2030. Demand is being anchored by packaging, FMCG, pharmaceuticals, and logistics, where pressure-sensitive labels, linerless formats, and thermal transfer media are relied upon for high uptime and application. The curve should be read as durable and volume-led, with barcode, batch coding, and variable information printing embedded in workflows that reward consistency and clarity.

From 2031, the path advances to 83.7, 88.4, 93.5, 98.8, and closes at 104.4, indicating persistent adoption across retail, cold chain, and e-commerce shipping. In this reading, share gains versus wet glue in many categories appear likely, driven by faster applicators, adhesive performance across temperatures, and reliable dispensability on high speed lines. Procurement emphasis is placed on label durability, tamper-evident features, RFID-enabled traceability, and compliant inks for food and pharma contact. Suppliers with dependable liners, release coatings, and service programs are expected to capture outsize value as converters and brand owners prioritize operational throughput and defect reduction.

| Metric | Value |

|---|---|

| Self-Adhesive Labels Market Estimated Value in (2025 E) | USD 60.0 billion |

| Self-Adhesive Labels Market Forecast Value in (2035 F) | USD 104.4 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The self adhesive labels segment is estimated to account for about 46% of the labels and labeling market, roughly 8% of the packaging materials market, close to 17% of the packaging printing market, nearly 12% of the pressure sensitive adhesives market, and around 10% of the product identification and tracking solutions market, yielding an aggregated share of approximately 93% across these parent categories. Self adhesive labels enable variable data printing, barcode and QR workflows, and compliant product identification across food and beverage, pharmaceuticals, personal care, and logistics. Category strength has been supported by versatile facestocks in paper and film, clean die cutting, and dependable release liners that maintain uptime on high speed applicators. Procurement tends to be guided by print method fit, adhesive tack and shear balance, liner choice, and durability under moisture, abrasion, and temperature cycling. Converters and brands favor formats that integrate tamper evidence, brand protection, and serialized tracking to improve supply chain visibility. Growth has been reinforced by digital press adoption for short runs, private label expansion, and linerless rollouts that reduce changeovers while improving throughput. In operational terms, self adhesive labels function as a control point linking packaging, warehousing, and retail checkout, which elevates their strategic weight within parent markets. Continued advances in low migration inks, recyclable constructions, and RFID enabled labels are expected to secure deeper specification in regulated and time sensitive categories where accuracy, traceability, and shelf impact guide buying decisions.

The self-adhesive labels market is experiencing steady expansion, supported by the increasing demand for efficient product identification, branding, and compliance labeling across multiple industries. Growth is being driven by rising adoption in food and beverages, pharmaceuticals, logistics, and personal care sectors, where durability, ease of application, and high-quality printing are critical. Advancements in adhesive formulations and printing technologies are improving label performance on diverse surfaces and in varying environmental conditions.

E-commerce growth is further amplifying demand, with self-adhesive labels playing a pivotal role in packaging and shipping efficiency. Sustainability trends are encouraging the development of recyclable materials and linerless label formats, expanding the market’s innovation potential.

Regulatory requirements for traceability and safety labeling in various sectors are also reinforcing adoption The market’s future outlook is being shaped by increasing automation in label application processes, integration with smart technologies such as RFID, and the growing preference for visually appealing and functional labeling solutions that enhance both brand identity and operational efficiency.

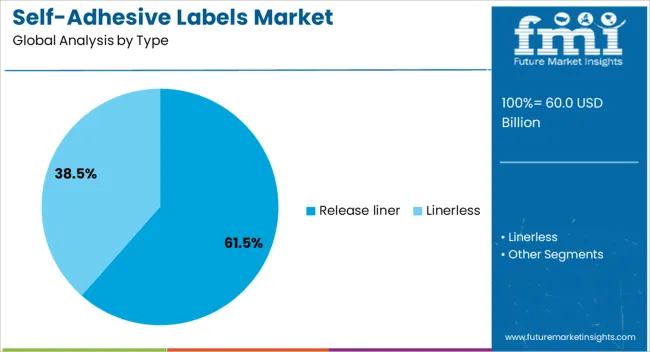

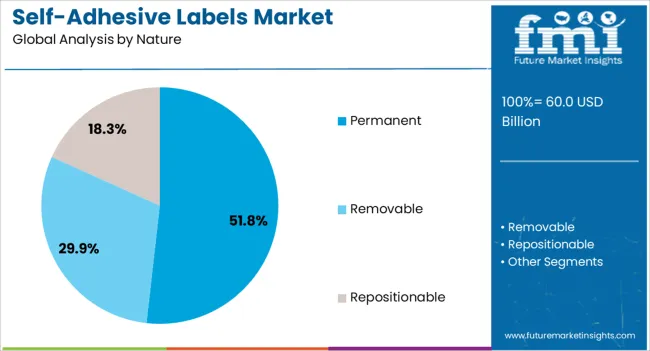

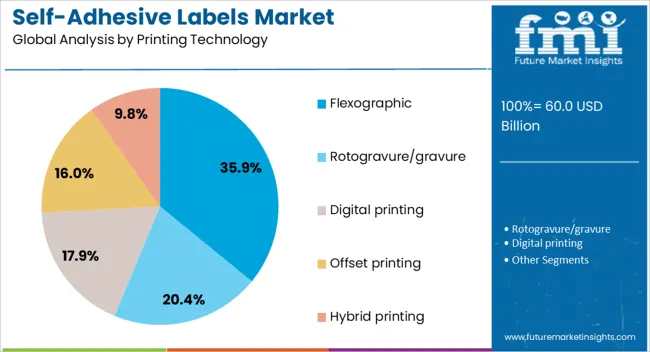

The self-adhesive labels market is segmented by type, nature, printing technology, end use industry, and geographic regions. By type, self-adhesive labels market is divided into Release liner and Linerless. In terms of nature, self-adhesive labels market is classified into Permanent, Removable, and Repositionable. Based on printing technology, self-adhesive labels market is segmented into Flexographic, Rotogravure/gravure, Digital printing, Offset printing, and Hybrid printing. By end use industry, self-adhesive labels market is segmented into Consumer goods, Electronics, Food & beverages, Logistics and transportation, Pharmaceuticals, Retail and e-commerce, and Others. Regionally, the self-adhesive labels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The release liner segment is projected to account for 61.5% of the self-adhesive labels market revenue share in 2025, making it the dominant type. This leadership is being driven by the segment’s versatility, durability, and compatibility with a wide range of printing technologies and adhesives. Release liners protect the adhesive until the label is applied, ensuring consistent quality and easy handling during production and application processes.

Their widespread adoption is supported by their ability to work with high-speed labeling equipment, which improves operational efficiency in large-scale manufacturing. Availability in multiple material types, including paper and film-based liners, allows customization for diverse end-use applications.

The segment also benefits from its compatibility with premium graphics and variable data printing, enhancing both branding and product traceability As industries increasingly prioritize reliability and speed in labeling processes, release liners are expected to maintain their leading position, supported by ongoing improvements in liner materials that reduce waste and improve recyclability without compromising performance.

The permanent segment is anticipated to hold 51.8% of the self-adhesive labels market revenue share in 2025, establishing itself as the leading nature category. This dominance is attributed to its strong adhesive properties, which ensure long-lasting label attachment on a variety of surfaces, even in challenging environmental conditions. Permanent labels are widely used in applications where label removal is not desired, such as product identification, branding, and compliance labeling in food, beverage, pharmaceutical, and industrial sectors.

Their resistance to moisture, abrasion, and temperature variations enhances their suitability for demanding operational environments. The segment’s growth is also being reinforced by the ability to combine permanent adhesives with diverse facestock materials, enabling flexibility in design and performance.

Advancements in adhesive chemistry are further improving bond strength while maintaining compatibility with high-speed application processes As industries seek labeling solutions that provide durability, security, and brand consistency, permanent labels are expected to retain their leadership in the market, supported by continued innovation in adhesive performance and sustainability.

The flexographic printing technology segment is expected to capture 35.9% of the self-adhesive labels market revenue share in 2025, making it the leading printing technology. Its dominance is being supported by its ability to deliver high-quality printing at high speeds, making it ideal for large production runs in industries such as food and beverages, personal care, and logistics.

Flexographic printing offers versatility in working with various label materials, including paper, film, and metallic substrates, enabling brands to achieve distinctive visual appeal while maintaining cost efficiency. The technology’s compatibility with a wide range of inks, including water-based and UV-curable options, is aligning with sustainability goals and regulatory compliance in multiple markets.

Continuous advancements in plate-making techniques and press automation are enhancing print accuracy, reducing setup times, and minimizing waste As demand grows for visually appealing, durable, and cost-effective labeling solutions, flexographic printing is expected to maintain its leadership, supported by its adaptability to both short and long production runs without compromising on quality or efficiency.

The self-adhesive labels market is projected to expand as consumer goods, healthcare, and logistics continue relying on pressure sensitive formats for branding, compliance, and traceability. Demand is being reinforced by e-commerce shipping, pharma serialization, and food information rules. Opportunities are expected in linerless systems, RFID and NFC smart labels, and premium embellishments that lift shelf impact. Trends point to filmic facestocks, water based and hot melt adhesives, and digital print for variable data runs. Challenges remain around paper and resin volatility, liner waste handling, regulatory differences, and price pressure from commoditized SKUs.

Demand has been reinforced by fast-moving consumer goods, healthcare, and third-party logistics where pressure sensitive labels support barcodes, QR codes, and batch traceability. Shipping and returns in e-commerce have been fueled by direct thermal and thermal transfer formats that print cleanly on demand. In regulated segments, dosage labeling, tamper-evident seals, and cold-chain indicators have been specified, while GHS and hazard icons in chemicals have required durable filmic facestocks. Retailers have insisted on GS1 standards, clear UPCs, and scannability across automated fulfillment lines. Private label growth has been matched by short runs and frequent artwork refreshes that are well served by digital presses. It is believed that reliable adhesion across corrugate, HDPE, PET, and glass, combined with smear-resistant inks and topcoats, is now viewed as non-negotiable. As shelf competition intensifies, pressure sensitive labels are being preferred for fast application, consistent branding, and cost-effective variable data.

Opportunities are being unlocked by RFID and NFC conversions that enable item-level tracking, anti-counterfeit features, and automated inventory reconciliation. Linerless labels are being positioned to raise print yield per roll, cut changeovers, and simplify applicators in quick-service food, parcel hubs, and grocery logistics. Premiumization is being pursued through tactile varnish, cold foil, high-build spot coatings, and metallized papers that elevate brand presence without changing primary packaging. Strongest wins will be realized where converters bundle compliance expertise with materials selection, offering face-stock and adhesive families tuned for low-temperature, oily, or textured surfaces. Growth is also expected from healthcare unit-dose, clinical trial kits, and sample vials that demand small-format legibility. Co-development programs with applicator OEMs, plus subscription replenishment for ribbons and printheads, are being used to create stickier accounts. Export opportunities are being supported by multilingual templates and variable data workflows.

Trends have centered on migration toward BOPP and PET films for durability, thinner carriers to increase roll length, and wash-off or residue-low adhesives where packaging recovery is targeted. Hybrid print lines that combine UV flexo, inkjet, and finishing in one pass are being adopted to meet short lead times with versioned art. Variable data printing for serialized pharma, track-and-trace in beverages, and dynamic pricing in retail have been normalized. Liner optimization with PET and glassine choices is being pursued to balance speed, caliper, and die-cut performance, while liner take-back programs are gaining interest among high-volume shippers. Opaque whites, extended gamut CMYK-OGV, and durable topcoats are being specified for high-saturation designs. Material science plus press flexibility is being treated as the real differentiator, since consistent adhesion, clean matrix stripping, and tight color tolerance translate directly into lower waste and faster approvals.

Challenges have been presented by volatility in pulp, acrylic monomers, hot-melt resins, and silicone coatings that move input costs faster than contracts allow. Food-contact and pharma migration limits have required rigorous testing, slowing approvals when facestock, adhesive, or inksets change. Liner waste handling has remained uneven across regions, creating disposal fees for high-throughput users. Fragmented buyer specifications around peel strength, shear, mandrel performance, and service temperature have complicated standardization, while private label tenders force price compression. Print quality risks arise when humidity, press speed, or corona treatment drift impacts ink anchorage. Counterfeit-resistant features and tamper evidence add cost and require staff training. It is believed that vendors who publish robust technical data sheets, offer cross-validated material stacks, and support applicator setup on site will defend margin. Without disciplined QA and documented performance, commoditized bids and rework will continue to erode profitability.

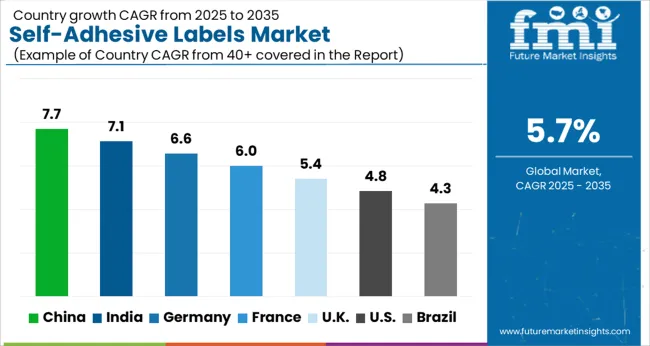

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

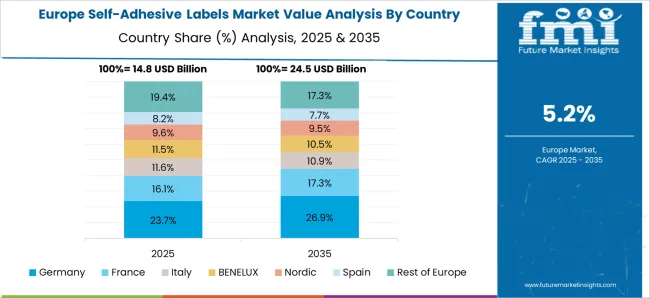

The global self-adhesive labels market is projected to grow at 5.7% from 2025 to 2035. China leads at 7.7%, followed by India 7.1% and Germany 6.0%, with the United Kingdom 5.4% and United States 4.8% trailing. Growth is being pulled by FMCG shrink-wrapped launches, e-commerce logistics, pharma serialization, and variable-data applications in food and beverage. Pressure-sensitive formats with acrylic and hot-melt adhesives are favored for quick changeovers, while filmic face stocks support moisture and scuff resistance. Digital and flexo hybrids are being adopted to compress lead times and reduce makeready waste. Liner optimization, wash-off systems, and monomaterial constructions are gaining attention as brands target cleaner recycling streams. Converters that master short-run economics and label-to-pack compatibility will capture outsized share. This report includes insights on 40+ countries; the top markets are shown here for reference.

The self-adhesive labels market in China is expected to expand at 7.7%. Demand has been driven by high-velocity FMCG launches, beverage multipacks, and fast-growing OTC pharma where compliant print and traceability are required. Large converters have scaled UV-flexo and digital fleets, enabling quick artwork cycles, SKU proliferation, and regional variants. Filmic face stocks (PP, PE) are widely specified for moisture resistance, while paper is retained for cost-sensitive grocery lines. Heat- and cold-chain logistics have reinforced interest in specialty adhesives with low-temperature tack and shear stability. Private-label programs at national retailers have amplified short runs with frequent refreshes. It is believed that China will keep setting the cadence on price, speed, and breadth of constructions, supported by domestic resin supply, release-liner capacity, and a dense ecosystem of finishing equipment and inspection.

The self-adhesive labels market in India is forecast to grow at 7.1%. Expansion has been underpinned by personal care, beverages, and organized retail where shelf appeal and rapid SKU refresh are prioritized. Pharma serialization and excise requirements have accelerated variable-data adoption, pushing hybrid workflows that combine digital personalization with flexo whites and varnishes. Regional languages, small batch sizes, and frequent artwork changes have favored agile converters with automated prepress and MIS integrations. Adhesive choices are tilting toward balanced tack/peel systems to suit PET, HDPE, and glass. E-commerce and quick-commerce have lifted demand for logistics labels, return labels, and tamper-evident seals. India’s converters will gain share as inline finishing, color control, and slit-to-pack services are scaled for national brands and fast-growing D2C players.

The self-adhesive labels market in Germany is projected to rise at 6.0%. Adoption has been shaped by premium beverages, specialty foods, chemicals, and automotive fluids where abrasion resistance, barcode fidelity, and chemical durability are scrutinized. Converters emphasize color management, low-migration inks, and audit-ready traceability. Paper/film laminates and top-coated PP are widely used for resistance to condensation and scuffing, while wash-off label systems are preferred on returnable glass. Compliance with packaging and food-contact rules has guided material selection and curing regimes. Advanced inspection, inline viscosity control, and spectrophotometry have been normalized to protect brand integrity. Germany will maintain a premium position as tactility, embossing, and specialty varnishes are combined with precise converting to serve brand owners demanding high shelf impact and consistent machineability.

The self-adhesive labels market in the UK is anticipated to expand at 5.4%. Growth has been supported by private-label retail, craft drinks, health and beauty, and chilled foods. Brands are leaning on rapid changeovers, short-run seasonal work, and late-stage customization to manage demand swings. Paper remains common for cost-control and print warmth, while filmic stocks address moisture and chill. Brewers and distillers favor premium textures, foils, and spot varnish, paired with reliable application on curved glass. Procurement frameworks emphasize supply assurance, artwork governance, and consistent applicator performance. With a mature converting base and strong design agencies, the UK is expected to sustain steady progress built on service levels, color fidelity, and disciplined lead-time management across retail calendars.

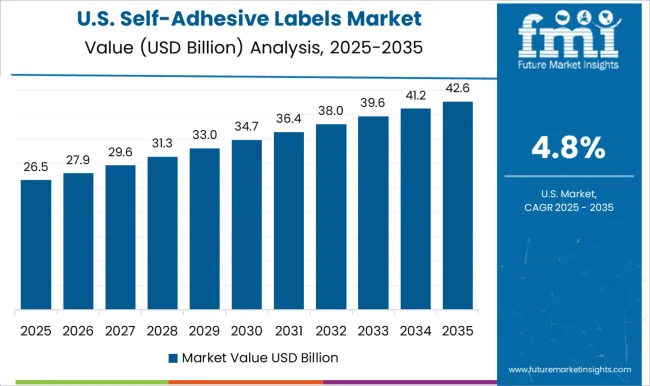

The self-adhesive labels market in the United States is projected to grow at 4.8%. Progress has been anchored by food and beverage, pharma, home care, and parcel logistics. Large brand portfolios require consistent color across sites, pushing adoption of spectro-driven standards and certified workflows. Cold-chain and RTD beverages have favored filmic face stocks, while paper remains prevalent in center-store categories. Variable-data labels for promotions, track-and-trace, and returns continue to scale with e-commerce volume. Converters are investing in hybrid presses, turret rewind, and automated inspection to lift throughput and cut waste.

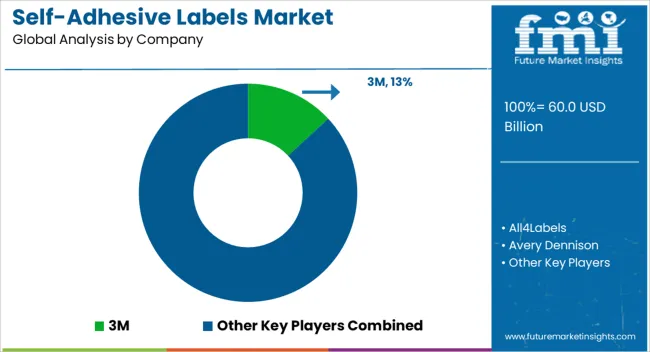

Competition in self adhesive labels has been defined by brochures that translate materials science into clear purchase logic. Avery Dennison, UPM Raflatac, 3M, and CCL Industries present wide catalogues that map facestocks to adhesives and liners for FMCG, pharma, logistics, and durables. Technical sheets list paper, PP, PE, PET, and specialty films, with peel, tack, and shear shown in N per 25 mm, plus stated application and service temperatures. BS 5609 and GHS drums are covered through chemical resistant constructions, while UL 969 and FDA or EU food contact notes are printed for compliance driven buyers. Lintec, Herma, Fuji Seal International, and Huhtamaki emphasize premium print surfaces for flexo, UV inkjet, and HP Indigo, with layflat liners and low migration ink systems for sensitive packs. Sato Holdings layers barcoding and RFID inlays into labels for item level tracking. All4Labels, Coveris, Optimum Group, CS Labels, Multipack, Skanem India, Rebsons Labels, Sticky Line, and regional converters compete on speed, short runs, and kitting. Brochures make comparison easy through caliper, grammage, opacity, mandrel performance, wet strength, and ice bucket test notes. Strategy has been executed through documentation that removes risk for specifiers and co packers. Selector guides group permanent, removable, freezer, and wash off adhesives, with glassine or PET liners matched to line speed and die cutting stability. Printability is shown via dot gain, scuff resistance, and varnish or lamination options, then tied to digital press profiles for color control. Logistics labels are positioned with high contrast topcoats for thermal transfer and direct thermal, alongside abrasion tests and rub ratings. Beverage and home care lines are presented with no label look films, tight shrinkage control, and moisture holdout. Warranty language, roll geometry, core sizes, and MOQ ladders are stated up front, which shortens trials. Advantage is won by brochures that read like process recipes and test logs. When the sheet proves adhesion in cold, heat, and chemical splash, and shows print fit across press types, the order follows.

| Item | Value |

|---|---|

| Quantitative Units | USD 60.0 Billion |

| Type | Release liner and Linerless |

| Nature | Permanent, Removable, and Repositionable |

| Printing Technology | Flexographic, Rotogravure/gravure, Digital printing, Offset printing, and Hybrid printing |

| End Use Industry | Consumer goods, Electronics, Food & beverages, Logistics and transportation, Pharmaceuticals, Retail and e-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, All4Labels, Avery Dennison, CCL Industries, Coveris, CS Labels, Fuji Seal International, Herma, Huhtamaki, Lintec, Multipack, Optimum Group, Rebsons Labels, Sato Holdings, Skanem India, Sticky Line, and UPM Raflatac |

| Additional Attributes | Dollar sales by material (paper, film facestocks), Dollar sales by adhesive (acrylic, hot melt, rubber), Dollar sales by end use (food and beverage, pharma, logistics, industrial), Trends in linerless, RFID/NFC, and variable data printing, Role in track and trace and brand security, Regional demand across Asia Pacific, Europe, North America. |

The global self-adhesive labels market is estimated to be valued at USD 60.0 billion in 2025.

The market size for the self-adhesive labels market is projected to reach USD 104.4 billion by 2035.

The self-adhesive labels market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in self-adhesive labels market are release liner and linerless.

In terms of nature, permanent segment to command 51.8% share in the self-adhesive labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labels Market Forecast and Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Labels Companies

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

HAZMAT Labels Market Growth and Forecast 2025 to 2035

In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

QR Code Labels Market Size and Share Forecast Outlook 2025 to 2035

Braille Labels Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Thermal Labels Market Analysis - Size, Growth & Outlook 2025 to 2035

Competitive Landscape of In-Mold Labels Providers

Competitive Breakdown of Braille Labels Manufacturers

Canning Labels Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA