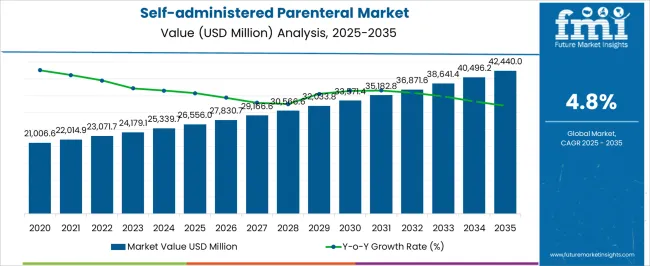

The Self-administered Parenteral Market is estimated to be valued at USD 26556.0 million in 2025 and is projected to reach USD 42440.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Self-administered Parenteral Market Estimated Value in (2025 E) | USD 26556.0 million |

| Self-administered Parenteral Market Forecast Value in (2035 F) | USD 42440.0 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The self-administered parenteral market is advancing steadily, supported by the growing prevalence of chronic conditions requiring regular injections and the increasing emphasis on patient-centric healthcare solutions. Demand is fueled by the convenience of home-based administration, reducing dependence on hospital visits and lowering overall treatment costs. Technological advancements in device design, including improved safety mechanisms and ergonomic formats, have further accelerated adoption.

Rising awareness of self-care, along with healthcare system pressures to optimize resources, has reinforced the shift toward self-administered therapies. The market is also benefiting from greater access to biologics and biosimilars that require injectable delivery.

With expanding usage across therapeutic areas and ongoing innovation in pre-filled formats, the outlook remains robust. The market is expected to achieve consistent growth, underpinned by expanding healthcare accessibility and patient empowerment trends.

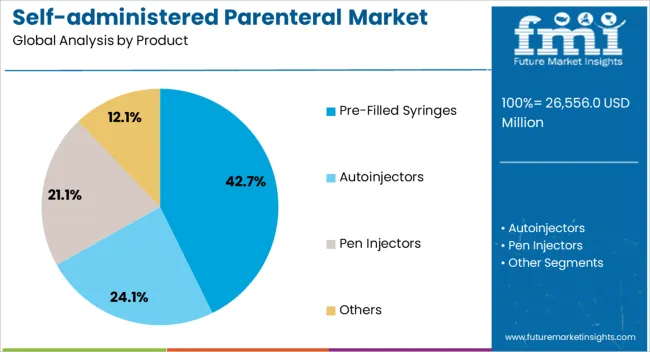

The pre-filled syringes segment dominates the product category, accounting for approximately 42.70% share. This leadership is attributed to the convenience, precision, and reduced risk of contamination offered by pre-filled delivery systems.

These syringes eliminate the need for manual dose preparation, ensuring greater accuracy and safety for patients self-administering treatments. Pharmaceutical companies favor this format for biologics and vaccines, as it enhances stability and compliance.

The segment’s growth is also supported by favorable regulatory acceptance and increasing investments in advanced packaging technologies. With patient preference shifting toward devices that simplify administration, pre-filled syringes are projected to remain the leading format in the self-administered parenteral market.

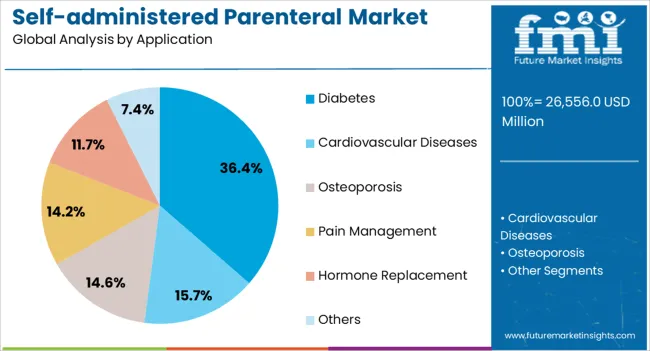

The diabetes segment leads the application category with approximately 36.40% share, reflecting the high demand for insulin and other injectable therapies in diabetes management. The global rise in diabetes prevalence has made self-administered injectables a cornerstone of treatment, enabling patients to manage their condition more effectively at home.

Devices tailored to insulin delivery, including pre-filled syringes and auto-injectors, have driven adoption. Healthcare systems encourage self-care for diabetes patients to reduce hospital burden, further supporting demand.

With continuous advancements in delivery technologies and expanding patient education programs, the diabetes segment is expected to maintain its dominant share across the application landscape.

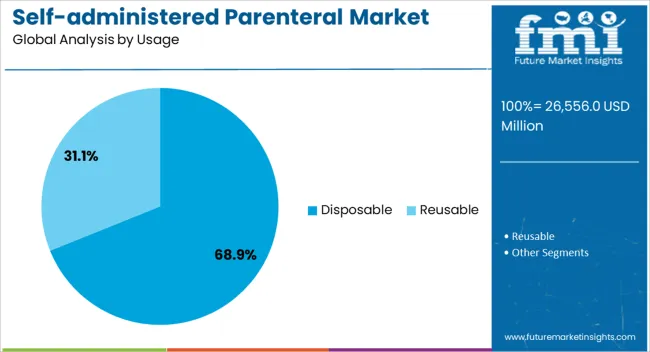

The disposable segment dominates the usage category with approximately 68.90% share. Single-use delivery systems have gained preference due to their safety, hygiene, and compliance benefits.

Disposable devices minimize the risk of infection and cross-contamination, making them suitable for widespread home use. Manufacturers continue to innovate with lightweight, cost-effective materials, further driving adoption.

The segment’s growth is reinforced by increasing reliance on injectables in chronic disease management and rising global demand for sterile, convenient formats. As healthcare systems emphasize infection control and patients prioritize ease of use, disposable formats are projected to sustain their leadership in the forecast period.

Global sales of self-administered parenteral products recorded a CAGR of 5.7% from 2020 to 2025. Total market valuation at the end of 2025 reached around USD 24,000.2 million. Over the assessment period, the global self-administered parenteral industry is projected to expand at a 4.8% CAGR.

| Historical CAGR (2020 to 2025) | 5.7% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.8% |

The rising prevalence of chronic illnesses significantly influences the market for self-administered parenteral products. Chronic disorders like diabetes, cardiovascular diseases, and other autoimmune diseases are frequently treated with this technique.

Self-administered parenteral products give patients the autonomy to manage their own care by enabling them to provide themselves with medication in the convenience of their own homes. For those who need continuous therapy due to chronic diseases, this convenience is incredibly crucial.

Self-administration convenience frequently results in increased patient adherence to recommended treatment plans. As a result, there may be an improvement in health outcomes and a decrease in the cost of healthcare due to non-compliance.

The self-administered parenteral technique is frequently applied to drugs that need to be taken regularly, like some kinds of therapies or prescriptions for long-term illnesses. Patient convenience and flexibility are two benefits of self-administered parenteral therapies since the patient may be able to administer the medication at home.

Self-administered parenteral is gaining immense traction due to its convenience and high effectiveness. It involves the injection of medications or therapeutic agents using wearable infusion pumps, autoinjectors, and other products.

More intuitive and effective self-administration devices may result from technological advancements, such as miniaturization, connectivity, and usability. This can improve parenteral medicine administration overall and increase patient compliance.

Patients and healthcare professionals can benefit from the integration of smart technology, such as sensors and networking elements, which can give useful data. Better disease management and individualized treatment plans are made possible by the inclusion of data on dosage, adherence, and patient health indicators.

The need for enhanced delivery systems is being driven by the rising incidence of parenterally administered specialty medicines and biologics. Hence, the self-administered parenteral industry is set to witness steady growth through 2035.

The growth and market dynamics of the self-administered parenteral industry are impacted by pricing constraints and competition from alternative products. If oral medications are readily available and efficacious, patients may favor them over self-administered parenteral drugs in certain instances. This desire may restrict the market potential for parenteral products that are self-administered.

Self-administered parenteral medications are facing competition from advances in drug delivery methods, such as transdermal patches, inhalers, or oral formulations with increased bioavailability. This also negatively impacts the target advanced parenteral drug delivery device market.

Parenteral medications that are self-administered and have generic counterparts on the market may cause price erosion and lower profit margins for the original manufacturers. In some areas, the market for self-administered parenteral products can be saturated, which would limit the potential for rapid expansion. It could be difficult to demand higher costs for new self-administered parenteral products if they lack uniqueness or innovation.

The section highlights growth projections across prominent countries. India and China are predicted to register higher CAGRs of 9.4% and 8.3%, respectively, through 2035. This is due to the growing prevalence of chronic diseases and rising health awareness in these nations.

Market Growth Outlook by Key Countries

| Countries | Value CAGR |

|---|---|

| United States | 3.7% |

| Germany | 4.5% |

| United Kingdom | 4.0% |

| Japan | 5.8% |

| China | 8.3% |

| India | 9.4% |

The United States self-administered parenteral market value totaled USD 5,470.1 million in 2025 and is projected to rise at a 3.7% CAGR throughout the forecast period. This is attributable to the rising prevalence of diabetes and the growing popularity of pen injectors and autoinjectors.

Parenteral medications that are self-administered allow patients to administer their medication conveniently at home without having to make frequent trips to the clinic or hospital. Better patient adherence to treatment plans may result from this. As a result, demand for self-administered parenteral products is set to rise steadily in the United States.

In the United States, chronic conditions that need lifelong care, like diabetes, rheumatoid arthritis, and some types of cancer, are becoming more common. Patients can take more independent care of their conditions when they self-administer. Growing usage of products like insulin pens is expected to improve the United States' self-administered parenteral market share.

The development of wearable technology and auto-injectors, among other medication delivery systems, has made self-administration safer and easier. These developments could lead to a rise in the use of self-administered parenteral medications.

Another key factor boosting the United States market is the growing demand for home-based parenteral therapy solutions. Similarly, a rise in patient-centric parenteral administration will foster market growth.

In China, the market for self-administered parenteral products is expanding as a result of greater knowledge and understanding of healthcare and self-administration techniques. People are becoming increasingly interested in self-administration choices as they become more health-concerned.

China's population is aging, and as self-administered parenteral solutions offer greater independence and convenience, older people may prefer them for the management of chronic illnesses. Growing adoption of advanced drug delivery systems like autoinjectors is expected to boost China market.

The rise in cases of cardiovascular diseases and osteoporosis is another prominent factor expected to drive demand for self-administered parenteral products. Similarly, the flourishing injection pen sector will likely create growth opportunities for manufacturers.

As per the latest analysis, India is set to emerge as the most lucrative market for self-administered parenteral products. In 2025, the total market value in India reached USD 2,522.0 million. Over the forecast period, sales of self-administered parenteral products in India are expected to soar at 9.4% CAGR.

The rising incidence of chronic diseases like diabetes, rheumatoid arthritis, and numerous autoimmune disorders drives the need for self-administered parenteral drugs in India. Self-administered choices and increased healthcare understanding may encourage patients to choose these solutions, particularly if they provide greater comfort and flexibility.

Innovations in this field may be pushed by pharmaceutical companies competing to create and sell novel self-administered medications. Enhancements to the healthcare infrastructure in India, such as improved logistics and distribution networks, can help make self-administered parenteral medications more accessible and available. This will further boost the market.

The section below highlights key segments' estimated market shares and CAGRs, including product, application, usage, and distribution channel. This information can be vital for companies to invest in demanding products and find the most profitable distribution channels for their business and maximum sales.

Market Growth Outlook by Key Products

| Products | Value CAGR |

|---|---|

| Pre-filled Syringes | 3.2% |

| Autoinjectors | 6.3% |

| Pen Injectors | 4.7% |

| Others | 7.7% |

Pre-filled syringes remain the most sought-after products in the market, holding a dominant value share of 38.8% in 2025. In the assessment period, demand for pre-filled syringes is projected to rise at 3.2% CAGR.

The self-administered parenteral market has seen a rise in the use of pre-filled syringes as a result of several reasons that cater to the increasing need for safe and convenient medication delivery methods. These syringes are especially useful for self-administration because they are pre-loaded with a precise medication dosage, saving patients from having to measure or draw the right amount.

The invention of pre-filled syringes has greatly improved patient compliance and usability, especially when it comes to long-term ailments that call for frequent injections. They have become a convenient and efficient way to administer medication, offering multiple advantages over traditional ampoules and vials.

Pre-filled syringes have the potential to lower dosage errors, which is a significant benefit. Pre-measured doses reduce the possibility of overdosing or neglecting while also streamlining the delivery process, which enhances therapeutic results. This is particularly important when patients are self-administering because they might not have access to medical guidance or support.

Market Growth Outlook by Key Application

| Application | Value CAGR |

|---|---|

| Cardiovascular Diseases | 3.7% |

| Diabetes | 3.8% |

| Osteoporosis | 6.0% |

| Pain Management | 4.2% |

| Hormone Replacement | 7.5% |

| Others | 7.0% |

As per the latest analysis, pain management remains the most remunerative application for self-administered parenteral products. In 2025, the pain management segment contributed a value share of 27.3%. Over the assessment period, the same segment is projected to record a CAGR of 4.2%.

Pain management is a notable application because of a number of elements that emphasize the need for this specific therapeutic area. Self-administered parenteral therapy, which involves the patient administering medication via injection, has become increasingly popular in the treatment of pain for a variety of reasons.

First, there has been a global increase in the prevalence of chronic pain problems. A sizable fraction of people suffer from ailments like neuropathic pain, back pain, and arthritis. Self-administered parenteral medication is a practical and handy option for addressing these illnesses, as it is often provided through injections.

By administering the necessary medication at home, patients can improve their overall quality of life and avoid frequent medical facility trips. Growing adoption of self-administered parenteral as a valuable tool in pain management is expected to boost the segment.

Parenteral medications, such as infusions and injections, provide faster and more effective pain relief compared to oral medications. Similarly, products like patient-controlled analgesia pumps offer improved control for patients.

Market Growth Outlook by Key Usage

| Usage | Value CAGR |

|---|---|

| Disposable | 4.3% |

| Reusable | 5.6% |

The disposable segment dominated the global market with a 46.2% market share in 2025. Over the forecast period, it is projected to advance at a CAGR of 4.3%. This is attributable to rising patient preference for disposable self-administered parenteral products due to their convenience and reduced risk of infection.

The increased focus on hygiene and safety in healthcare procedures is playing a key role in driving demand for disposable solutions. Similarly, the growing prevalence of infectious diseases is expected to boost the target segment.

Disposable devices provide a one-time solution, removing the possibility of infection and contamination that comes with reusable options. This is especially important for parenteral administration, where sterility is of utmost importance because drugs are injected straight into the circulation, bypassing the body's natural defenses.

Time-consuming sterilizing procedures between patients are avoided by using disposable devices. These devices reduce the possibility of cross-contamination between patients, which aids in maintaining a high level of infection control. Because single-use devices are disposed of after each use, sterilization is not required, and there is less chance of infectious organisms spreading.

Market Growth Outlook by Key Distribution Channel

| Distribution Channel | Value CAGR |

|---|---|

| Hospital Pharmacies | 3.9% |

| Online Pharmacies | 4.7% |

| Home Healthcare Providers | 4.2% |

| Specialty Clinics | 6.0% |

| Others | 7.4% |

Based on distribution channel, the hospital pharmacies segment will continue to dominate the global self-administered parenteral market. It held a market share of 38.9% in 2025 and is projected to register a CAGR of 3.9% throughout the forecast period.

Hospital pharmacies dominate this industry primarily because of their well-established infrastructure and proficiency in parenteral medicine administration. In most cases, hospitals have well-stocked pharmacies staffed by trained pharmacists who know how to prepare and administer injectable drugs.

Innovation has become a key success tool for manufacturers of self-administered parenteral products manufacturers. Similarly, the United States Food and Drug Administration (FDA) approval and expansion are a priority for leading self-administered parenteral product companies as they work to create new product lines and expand their global consumer base. Several companies also look to establish new facilities as well as adopt mergers and acquisitions to expand their presence.

Recent Developments in the Self-administered Parenteral Market

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 26556.0 million |

| Projected Value (2035) | USD 42440.0 million |

| Expected Growth Rate (2025 to 2035) | 4.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia; Oceania; Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Chile, China, Japan, South Korea, India, ASEAN Countries, Australia & New Zealand, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic Countries, Russia, Hungary, Poland, Saudi Arabia, Türkiye, South Africa, Other African Union. |

| Key Market Segments Covered | Product, Application, Usage, Distribution Channel, and Region |

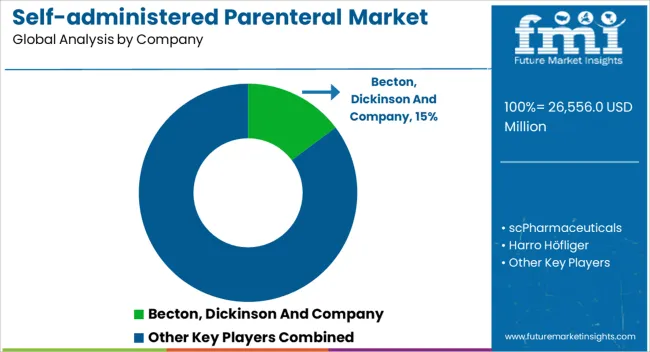

| Key Companies Profiled | Becton; Dickinson and Company; scPharmaceuticals; Harro Höfliger; Owen Mumford; Haselmeier; Stevanato Group; Ypsomed AG; Solteam Group; AstraZeneca; Enable Injections; CCBio; Phillips-Medisize Corporation; Sorrel Medical; Krontec Healthcare; Subcuject Aps; Ascendia Pharmaceuticals; West Pharmaceutical Services, Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, Drivers, Restraints, Opportunities, Trend Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global self-administered parenteral market is estimated to be valued at USD 26,556.0 million in 2025.

The market size for the self-administered parenteral market is projected to reach USD 42,440.0 million by 2035.

The self-administered parenteral market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in self-administered parenteral market are pre-filled syringes, autoinjectors, pen injectors and others.

In terms of application, diabetes segment to command 36.4% share in the self-administered parenteral market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Parenteral Nutrition Market Forecast and Outlook 2025 to 2035

Parenteral Packaging Market Size and Share Forecast Outlook 2025 to 2035

Parenteral Formula Market Analysis by Type of Nutrient, Indications and Sale Channels Through 2035

Parenteral Compounding Market Analysis - Share, Size, and Forecast 2025 to 2035

Market Share Breakdown of Parenteral Packaging Industry

Parenteral Drugs Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA