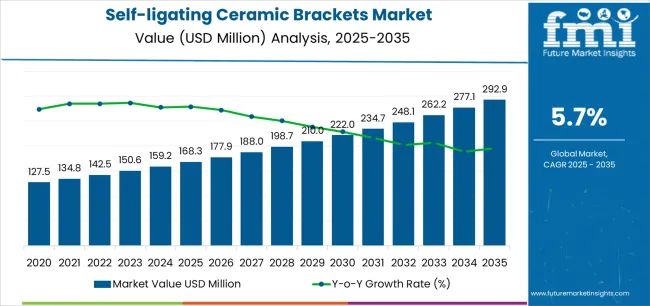

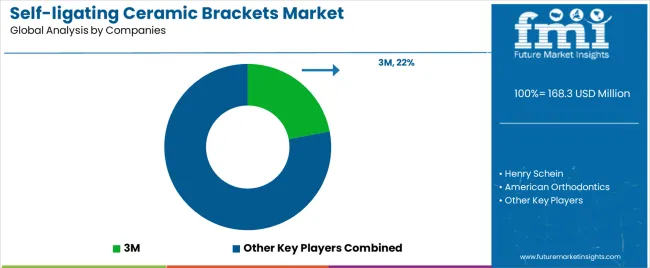

The self-ligating ceramic brackets market is valued at USD 168.3 million in 2025 and is forecasted to reach USD 292.9 million by 2035, growing at a CAGR of 5.7%. Market growth is driven by increasing demand for aesthetic orthodontic solutions, rising disposable incomes, and broader acceptance of advanced dental correction systems among adult and adolescent patients. The shift toward minimally invasive orthodontic procedures and reduced treatment duration further supports the adoption of self-ligating systems over conventional bracket designs.

Passive self-ligating brackets represent the leading product type, offering lower frictional resistance, simplified wire engagement, and enhanced comfort throughout treatment. Their transparent ceramic composition provides aesthetic benefits while maintaining mechanical strength and biocompatibility. Advances in ceramic materials and precision manufacturing techniques continue to improve bracket durability, torque control, and stain resistance, addressing key challenges in orthodontic performance and patient satisfaction.

Asia Pacific leads market expansion due to rising awareness of orthodontic aesthetics and growing investments in dental healthcare infrastructure. Europe and North America maintain steady demand, supported by established orthodontic practices and consistent patient adoption rates. Key market participants include 3M, Henry Schein, American Orthodontics, Ormco, and GC Orthodontics, focusing on product innovation, clinical reliability, and global distribution reach.

The early growth curve, spanning 2025 to 2029, is expected to show steady acceleration as orthodontic clinics adopt self-ligating systems for improved treatment efficiency and patient comfort. During this phase, market expansion will be supported by the increasing shift toward aesthetic dental solutions and the replacement of traditional metal brackets with ceramic variants offering reduced friction and faster alignment outcomes.

The late growth curve, covering 2030 to 2035, will display moderate deceleration as adoption reaches maturity in developed regions and market penetration stabilizes. Continued growth will primarily stem from emerging markets where orthodontic care accessibility and cosmetic awareness are expanding. Product innovation, particularly in bracket design and material transparency, will sustain market momentum during this phase. The comparison between early and late curves highlights a transition from innovation-led adoption to steady replacement and refinement cycles. The trajectory demonstrates stable long-term growth supported by clinical efficiency, aesthetic demand, and continuous material advancements in orthodontic treatment systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 168.3 million |

| Market Forecast Value (2035) | USD 292.9 million |

| Forecast CAGR (2025-2035) | 5.7% |

The self-ligating ceramic brackets market is growing as patients and clinicians demand more aesthetic, efficient orthodontic solutions that combine low-visibility treatment with reliable performance. Improved manufacturing of ceramic materials enables brackets that match tooth colour while incorporating a self-ligating mechanism, thereby offering reduced friction, shorter treatment visits and fewer adjustments compared to conventional ligature systems. Rising awareness of orthodontic care across adult and teenage populations, alongside increased disposable incomes in emerging regions, expands the addressable market for aesthetic braces.

The shift toward digital orthodontics, including scanning, 3D-printed arch-wires and customised bracket systems, further supports adoption of self-ligating ceramic brackets as part of integrated workflows. Adoption faces constraints: ceramic materials can be more brittle than metal alternatives and may require higher cost, clinician training and inventory complexity; competition from clear aligner systems also threatens market share.

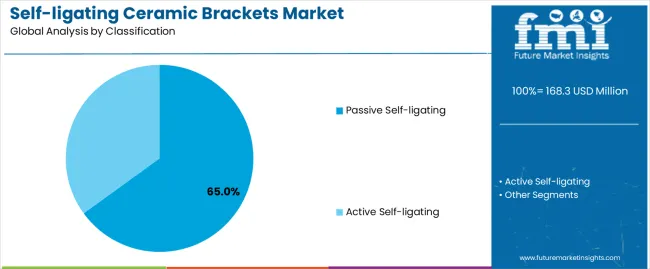

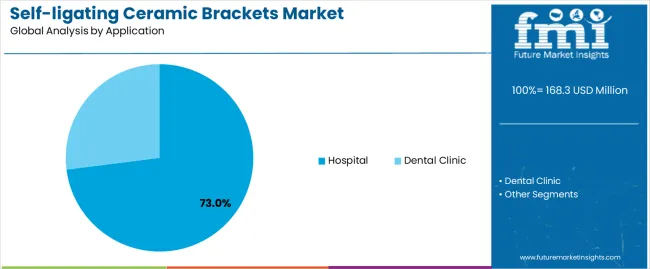

The Self-Ligating Ceramic Brackets Market is segmented by classification and application. By classification, the market is divided into passive self-ligating and active self-ligating ceramic brackets. Based on application, it is categorized into hospitals and dental clinics. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

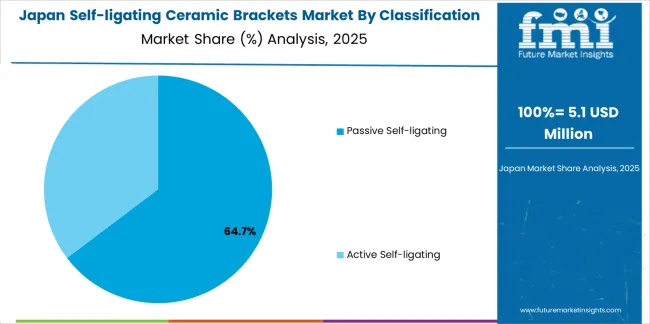

The passive self-ligating segment holds the leading position in the self-ligating ceramic brackets market, representing approximately 65.0% of the total share in 2025. Passive self-ligating brackets utilize a sliding mechanism that reduces friction between the archwire and bracket slot, allowing for more efficient tooth movement with lower applied forces. Their dominance is supported by widespread clinical preference for improved patient comfort, shorter chair time, and enhanced hygiene due to the absence of elastic or metal ligatures.

These systems are particularly favored in orthodontic treatment plans emphasizing aesthetics and minimal discomfort, aligning with the growing use of ceramic materials that match natural tooth color. The segment also benefits from technological advancements in bracket design, including high-strength ceramics and precision slot configurations that maintain durability without compromising translucency. The active self-ligating category remains relevant for specific cases requiring greater torque and control but represents a smaller share due to higher friction and maintenance complexity.

Key factors supporting the passive self-ligating segment include:

The hospital segment accounts for approximately 73.0% of the self-ligating ceramic brackets market in 2025. Hospitals maintain dominance due to the concentration of orthodontic specialists, access to advanced diagnostic tools, and capacity to manage complex dental alignment cases requiring precision treatment systems. Institutional procurement policies and integrated orthodontic departments also contribute to consistent demand for ceramic self-ligating brackets within hospital-based dental practices.

The dental clinic segment follows, supported by expanding private orthodontic practices and rising patient awareness of aesthetic orthodontic options. Clinics increasingly offer ceramic self-ligating systems for cosmetic-driven treatments, though on a smaller operational scale compared to hospitals.

Primary dynamics driving demand from the hospital segment include:

The convergence of rising adult orthodontic demand, aesthetic treatment preference, and efficiency-oriented bracket systems.

The self-ligating ceramic brackets market is driven by growth in adult and teen orthodontic cases worldwide coupled with heightened aesthetic expectations for less visible orthodontic appliances. Self-ligating ceramic systems reduce friction and often allow fewer adjustments, shorter chair-time and improved patient comfort, aligning with practices seeking operational efficiency. The combination of ceramic materials (which blend with tooth colour) and self-ligation mechanisms (which streamline wire changes) has gained traction in private dental clinics, thereby expanding the addressable market. A stronger focus on aesthetic orthodontics coupled with digital workflows and brand differentiation also supports uptake.

Higher cost relative to conventional brackets, material strength limitations, and clinician training requirements.

The premium pricing of self-ligating ceramic brackets compared with standard metal or conventional ceramic brackets restricts adoption in cost-sensitive segments or emerging markets. While ceramic materials offer aesthetic benefits, they remain more brittle than metal counterparts and can be more prone to fracture or edge-chipping during treatment, which can result in additional substitutions and longer overall treatment times. Self-ligation systems may require specific clinician training, adjustment protocols and inventory investment, which may inhibit uptake among general dental practitioners lacking orthodontic specialisation.

Rise of hybrid aesthetic bracket systems, growth in Asia-Pacific, and integration with digital orthodontic planning.

Market dynamics indicate a shift toward hybrid bracket systems combining ceramic visual appeal with metal slot reinforcement or low-friction coatings that improve durability. The Asia-Pacific region is exhibiting strong growth, driven by expanding dental infrastructure, rising disposable income, increasing cosmetic-dentistry awareness and younger populations seeking orthodontic solutions. The integration of digital orthodontic workflows (such as 3D-scanning, customised bracket placement and CAD/CAM manufactured bracket bases) is becoming more prevalent, aligning with self-ligating ceramic bracket systems as part of premium orthodontic offerings.

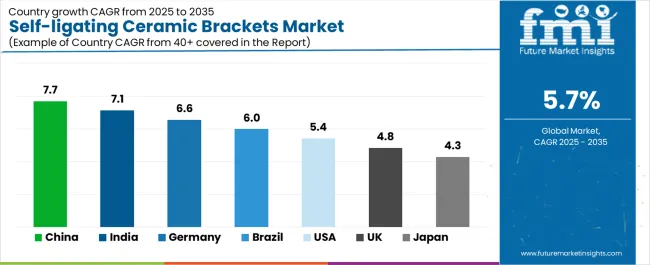

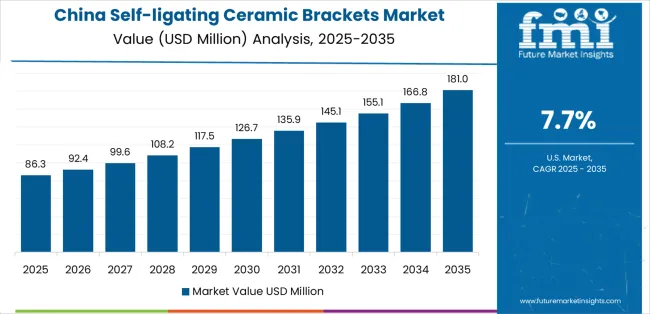

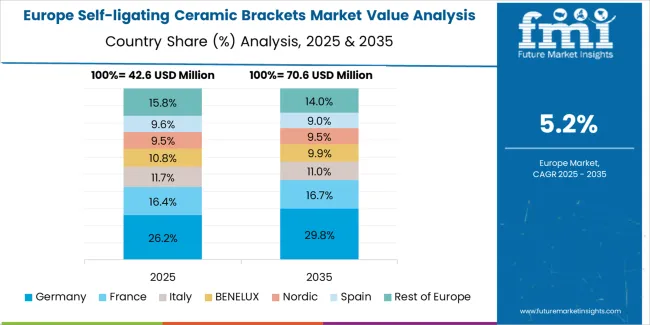

The global self-ligating ceramic brackets market is expanding steadily through 2035, driven by rising orthodontic treatment demand, growing aesthetic preferences, and material advancements in transparent dental systems. China leads with a 7.7% CAGR, followed by India at 7.1%, supported by increasing orthodontic awareness and access to dental care. Germany grows at 6.6%, driven by strong dental innovation and digital orthodontics. Brazil records 6.0%, supported by growing dental tourism and private clinic expansion. The United States posts 5.4%, reflecting sustained demand for premium orthodontic systems. The United Kingdom (4.8%) and Japan (4.3%) maintain stable growth through product innovation, clinical training, and digital dentistry adoption.

| Country | CAGR (%) |

|---|---|

| China | 7.7 |

| India | 7.1 |

| Germany | 6.6 |

| Brazil | 6.0 |

| USA | 5.4 |

| UK | 4.8 |

| Japan | 4.3 |

China’s market grows at 7.7% CAGR, supported by increasing orthodontic treatment uptake, aesthetic awareness, and the availability of affordable ceramic systems. Domestic dental manufacturers are expanding production of transparent and self-ligating bracket systems that minimize friction and treatment time. Integration of CAD/CAM and 3D printing technologies in orthodontic laboratories is enhancing customization accuracy. The government’s Healthy China 2030 initiative encourages oral healthcare modernization, supporting advanced orthodontic product adoption in both urban and regional clinics. Rising disposable income and the expansion of private dental hospitals further strengthen market penetration across major cities.

Key Market Factors:

India’s market grows at 7.1% CAGR, driven by urbanization, increasing dental health awareness, and expansion of orthodontic training programs. Domestic dental laboratories are producing cost-effective self-ligating ceramic brackets suited for both aesthetic and functional correction needs. The National Oral Health Programme supports oral care access in public and private sectors. Collaborations with international orthodontic suppliers are improving access to friction-reducing bracket designs. The demand for minimally invasive orthodontic treatment is growing rapidly, particularly among young adults and working professionals seeking aesthetic alignment solutions. Continuous improvements in materials and distribution networks enhance market competitiveness.

Market Development Factors:

Germany’s market grows at 6.6% CAGR, supported by high orthodontic treatment standards, digital integration, and strong material innovation. German manufacturers are leading in the development of self-ligating ceramic brackets with improved translucency, durability, and biomechanical precision. Integration of intraoral scanning and digital treatment planning enhances clinical efficiency. Strict regulatory standards under the Medical Device Regulation (MDR) ensure consistent product quality. The rising preference for discreet, metal-free orthodontic solutions among adult patients is increasing bracket adoption. Collaboration between universities and dental technology firms supports continuous innovation in self-ligating mechanisms and composite ceramic materials.

Key Market Characteristics:

Brazil’s market grows at 6.0% CAGR, supported by the expansion of private dental care and growth in cosmetic dentistry. Domestic manufacturers and importers are supplying self-ligating ceramic systems designed for tropical climate durability and cost efficiency. Dental tourism contributes significantly, with Brazil serving as a major regional center for orthodontic procedures. Government support for healthcare modernization and increased insurance coverage encourages treatment accessibility. Dental universities and professional associations are promoting training programs that emphasize frictionless bracket systems and digital orthodontic techniques. The expanding middle class and strong aesthetic culture further sustain demand.

Market Development Factors:

The United States grows at 5.4% CAGR, supported by technological innovation and growing acceptance of aesthetic orthodontic systems. Manufacturers are integrating advanced materials such as polycrystalline alumina for strength and translucency. The increasing demand for shorter treatment durations and comfort is driving the popularity of self-ligating systems. Orthodontic clinics are adopting digital treatment workflows combining 3D imaging, AI-based alignment prediction, and customized bracket positioning. The market benefits from continuous clinical validation and FDA-approved product introductions. Growth is also supported by rising adult orthodontic treatment rates and aesthetic-focused dental care trends.

Key Market Factors:

The United Kingdom’s market grows at 4.8% CAGR, supported by adoption of aesthetic orthodontic treatments and integration of digital dental technologies. The NHS and private dental clinics are expanding access to self-ligating ceramic systems for improved patient comfort and appearance. Local distributors collaborate with European manufacturers to ensure compliance with CE and ISO standards. Research initiatives under Innovate UK promote new material development and biomechanical testing of self-ligating mechanisms. The market benefits from the shift toward adult orthodontics, with growing demand for minimally visible correction systems.

Market Development Factors:

Japan’s market grows at 4.3% CAGR, supported by its advanced dental technology base and patient demand for minimally visible orthodontic options. Domestic manufacturers are producing high-precision ceramic brackets using advanced sintering and surface-polishing methods. Orthodontic clinics are incorporating digital imaging and robotic archwire bending technologies to optimize alignment outcomes. The aging population and focus on lifelong oral health sustain steady orthodontic service demand. Collaborations between research institutions and dental product firms continue to enhance biocompatibility and mechanical strength of ceramic materials. Japan’s reputation for precision manufacturing ensures high-quality product availability and export potential.

Key Market Characteristics:

The self-ligating ceramic brackets market is moderately consolidated, with around fifteen major manufacturers active across orthodontic materials and dental device production. 3M leads the market with an estimated 22.0% global share, supported by its advanced orthodontic product lines, material innovation, and long-term relationships with dental professionals worldwide. Its leadership is sustained through continual improvements in bracket design, friction reduction, and aesthetic performance, which have positioned its products as benchmarks in clinical reliability and patient comfort.

Henry Schein, American Orthodontics, and Ormco follow as leading competitors, each offering comprehensive orthodontic portfolios that integrate self-ligating systems into broader treatment solutions. Their competitive strength lies in large-scale distribution, consistent product quality, and training support for dental practitioners. GC Orthodontics, G&H Orthodontics, and Innovative Material and Devices, Inc. operate as mid-tier manufacturers focusing on specialized bracket customization and innovation in translucent ceramic compositions for enhanced aesthetics.

Asian manufacturers such as Shinye Orthodontic Products, Zhejiang Protect Medical Equipment, and Zhejiang Yahong Medical Apparatus compete through cost-effective production and expanding export capabilities, particularly in high-growth markets across Asia and the Middle East. Dentaurum, Tomy, and Dentsply maintain established reputations through precision manufacturing and orthodontic system integration.

Competition in this market is defined by product durability, friction efficiency, and aesthetic transparency. Demand continues to shift toward ceramic systems that balance performance and appearance, driving ongoing innovation in low-friction, stain-resistant, and biocompatible bracket materials across global orthodontic practices.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Classification | Passive Self-ligating, Active Self-ligating |

| Application | Hospital, Dental Clinic |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | 3M, Henry Schein, American Orthodontics, Ormco, GC Orthodontics, G&H Orthodontics, Innovative Material and Devices Inc., Shinye Orthodontic Products, Zhejiang Protect Medical Equipment, 3B Orthodontics, Zhejiang Yahong Medical Apparatus, Creative Dental, Dentaurum, Tomy, Dentsply, JJ Orthodontics |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of orthodontic and dental device manufacturers; advancements in self-ligating bracket materials and designs; integration with aesthetic orthodontics and advanced dental treatment technologies. |

The global self-ligating ceramic brackets market is estimated to be valued at USD 168.3 million in 2025.

The market size for the self-ligating ceramic brackets market is projected to reach USD 292.9 million by 2035.

The self-ligating ceramic brackets market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in self-ligating ceramic brackets market are passive self-ligating and active self-ligating.

In terms of application, hospital segment to command 73.0% share in the self-ligating ceramic brackets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA