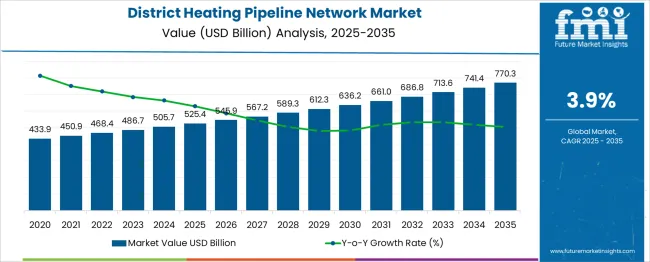

The District Heating Pipeline Network Market is estimated to be valued at USD 525.4 billion in 2025 and is projected to reach USD 770.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. The acceleration and deceleration pattern of the market reveals a steady, yet moderate, increase in value over the forecast period. In the early years (2024–2029), the market experiences a gradual acceleration, with an average annual increase of approximately USD 21.6 million, moving from USD 525.4 million to USD 589.3 million.

This phase demonstrates consistent growth as infrastructure investment in district heating expands, especially in regions seeking energy-efficient heating solutions. The growth rate in this period is relatively stable, with a slight acceleration towards the later years, reflecting increasing adoption in urban areas and newer projects. From 2029 to 2035, the growth rate slows down, with the market adding USD 180.9 million, from USD 589.3 million to USD 770.3 million.

This deceleration suggests a maturing market as the adoption rate stabilizes, and existing infrastructure becomes more widespread. The USD 180.9 million increase in the latter phase of the forecast represents around 23.5% of the total market growth, indicating a slower but steady progression, characteristic of a well-established market that is gradually reaching its capacity for expansion.

| Metric | Value |

|---|---|

| District Heating Pipeline Network Market Estimated Value in (2025 E) | USD 525.4 billion |

| District Heating Pipeline Network Market Forecast Value in (2035 F) | USD 770.3 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The district heating pipeline network market is expanding steadily due to increasing investments in clean energy infrastructure, urbanization, and the transition toward energy-efficient heating solutions. Emphasis on reducing carbon emissions and reliance on fossil fuels has led to broader adoption of centralized heating systems, especially in colder climates across urban and industrial regions.

Government-backed modernization of aging pipeline infrastructure and mandates on thermal efficiency have further accelerated pipeline upgrades. Technological improvements in insulation, corrosion resistance, and leak detection systems are enhancing operational reliability and lifespan of pipeline networks.

Additionally, increasing integration of renewable energy sources such as biomass and geothermal with district heating systems is creating future-ready pipeline requirements. The market is expected to see continued growth as cities adopt decarbonized heating strategies aligned with net-zero targets.

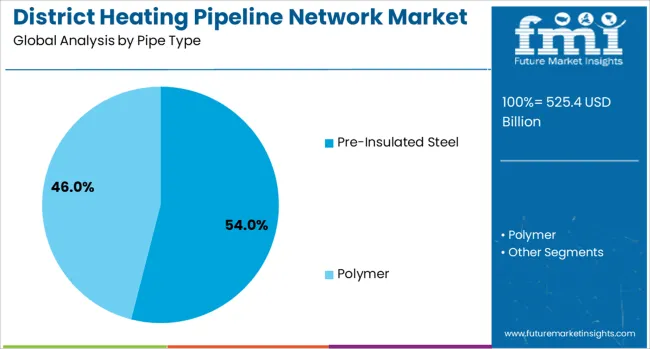

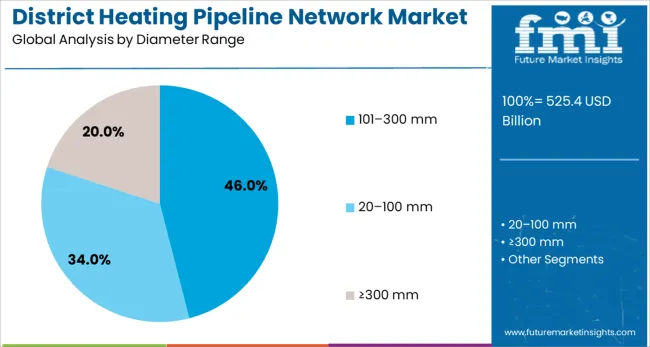

The district heating pipeline network market is segmented by pipe type, diameter range, application, and geographic regions. By pipe type, the district heating pipeline network market is divided into Pre-Insulated Steel and Polymer. In terms of diameter range of the district heating pipeline network market is classified into 101-300 mm, 20-100 mm≥300 mm.

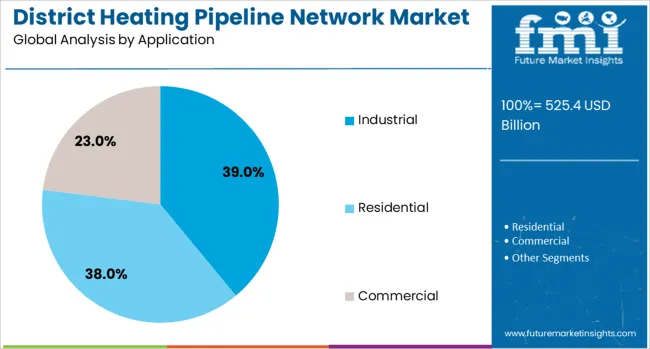

Based on the application of the district heating pipeline network, the market is segmented into Industrial, Residential, and Commercial. Regionally, the district heating pipeline network industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Pre-insulated steel pipes are expected to lead the market with 54.0% of the total revenue share in 2025. Their dominance is being driven by superior thermal conductivity control, high mechanical strength, and long-term durability under high-pressure, high-temperature conditions typical of district heating applications.

These pipes are widely adopted in both retrofitting older networks and installing new lines due to their compatibility with advanced insulation technologies. Resistance to corrosion, ease of underground installation, and the ability to maintain consistent heat delivery over long distances have reinforced their preference in both urban and industrial deployments.

Manufacturers are also offering smart monitoring layers integrated within the insulation, which further strengthens operational control and minimizes downtime.

Pipelines within the 101-300 mm diameter range are anticipated to account for 46.0% of the market share by 2025, emerging as the most utilized segment. This range strikes an optimal balance between thermal efficiency and installation flexibility, making it suitable for medium-scale networks spanning residential blocks, commercial zones, and institutional facilities.

Their adaptability in densely populated areas allows for minimal trenching and reduced installation disruption. The segment’s growth is supported by ongoing infrastructure projects aimed at upgrading municipal heating systems, especially in cities transitioning toward low-emission zones.

Increased focus on energy efficiency and cost-effective thermal delivery across short to mid-range distances has further amplified the preference for this diameter category.

Industrial applications are projected to generate 39.0% of the revenue in the district heating pipeline network market in 2025, making it the largest end-use segment. This lead is being driven by the consistent thermal demand in processing industries, chemical plants, and large manufacturing complexes, where district heating offers reliable and centralized energy delivery.

The industrial sector’s focus on decarbonizing thermal energy sources and reducing operational costs has contributed to increased investments in dedicated pipeline networks. Integration with combined heat and power (CHP) plants and renewable thermal sources is further enhancing energy efficiency and regulatory compliance.

The durability and high performance of modern pipelines are enabling industrial users to scale up heat distribution networks with lower maintenance requirements.

The demand for district heating pipeline networks is increasing as more cities and regions seek energy-efficient heating solutions. These systems provide centralized heat generation that is distributed to residential, commercial, and industrial users. The need to reduce carbon emissions and improve energy efficiency, along with the integration of renewable energy, is driving market growth. However, challenges such as high installation costs and regulatory hurdles remain. Opportunities for growth lie in the development of smarter grids, advanced technologies, and the renovation of aging infrastructure, leading to improved system performance and accessibility.

The demand for district heating systems is growing due to the increasing need for energy-efficient and effective heating solutions in urban areas. Centralized heating networks reduce operational costs, conserve energy, and lower emissions, making them highly appealing for municipalities and industries aiming to meet environmental targets. The adoption of renewable energy sources, including solar, biomass, and geothermal, is accelerating the use of district heating as these systems offer a more efficient way of distributing energy. Government policies that incentivize energy-efficient technologies further enhance the growth potential of this market. As cities face rising energy demands, district heating provides an effective method to meet energy needs while reducing reliance on conventional heating methods.

A significant challenge facing the district heating market is the high initial cost required to develop new networks. The expense of installing pipelines, building heat generation plants, and integrating renewable energy sources can be prohibitive, particularly for smaller municipalities or regions with limited financial resources. Retrofitting existing infrastructure to accommodate district heating adds additional costs. Regulatory issues, including lengthy approval processes, zoning restrictions, and complex compliance requirements, create obstacles to fast-tracking projects. Delays in regulatory approval can hinder progress, creating uncertainty for investors and reducing the appeal of committing to large-scale projects. In areas without existing district heating systems, these financial and regulatory challenges slow the adoption of more efficient heating solutions.

The district heating pipeline network sector offers numerous growth opportunities through technological advancements. The integration of smart grids, energy storage systems, and improved thermal management solutions can enhance the efficiency and reliability of heating networks. As demand for energy-efficient solutions grows, opportunities arise for expanding district heating into new regions, especially in areas with increasing energy needs. Updating older district heating infrastructure also presents a significant opportunity to improve energy distribution and reduce operational costs. The application of IoT and AI-driven technologies for system optimization, predictive maintenance, and real-time monitoring enhances overall performance. These developments contribute to the broader adoption of district heating networks across urban and rural communities.

A key trend in district heating is the shift toward more decentralized systems, where smaller, localized networks reduce dependence on large central plants. This approach provides greater flexibility and efficiency in meeting local heating demands. The growing use of renewable energy sources, such as biomass, geothermal, and solar thermal, is also driving the adoption of district heating systems. Digital technologies, such as real-time monitoring and smart sensors, are increasingly being integrated into these systems to improve performance and reduce maintenance costs. These innovations help optimize energy distribution, making district heating systems more efficient and adaptable to the evolving needs of consumers and industries.

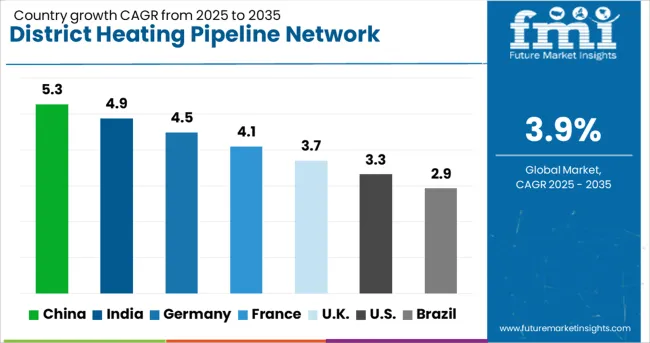

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The district heating pipeline network market is projected to grow globally at a CAGR of 3.9% from 2025 to 2035. Among the top five markets, China leads at 5.3%, followed by India at 4.9%, while Germany posts 4.5%, the United Kingdom records 3.7%, and the United States stands at 3.3%. The rapid urbanization and infrastructure development in BRICS nations like China and India are driving higher demand for efficient heating systems, especially in metropolitan areas. In contrast, OECD countries such as Germany, the UK, and the USA experience steady growth as they invest in system modernization, retrofitting, and energy efficiency. The analysis spans over 40 countries, with the leading markets detailed below.

India is projected to grow at a CAGR of 4.9% through 2035, fueled by rapid urbanization and increased demand for efficient heating systems in both residential and industrial applications. As the country continues to expand its infrastructure in cities, demand for district heating networks is rising, particularly in cold regions that need centralized heating solutions. India is investing heavily in energy-efficient technologies to address growing energy consumption while minimizing carbon emissions. The government's focus on renewable energy and sustainable heating systems is pushing the growth of district heating networks across the country. Additionally, the increasing awareness of energy conservation and environmental sustainability is also influencing market demand for district heating pipeline systems.

China is expected to grow at a CAGR of 5.3% through 2035, driven by the country’s ongoing urban development and rapid industrialization. As China faces growing concerns over energy consumption and environmental sustainability, the demand for district heating systems is rising, especially in northern and cold regions. Government-led initiatives and regulations aimed at improving energy efficiency and reducing carbon emissions are promoting the adoption of district heating solutions in cities. Additionally, China’s commitment to the development of eco-friendly technologies and renewable energy sources is accelerating the deployment of modern district heating networks. These networks, often powered by clean energy sources like solar, geothermal, and waste heat recovery, are key to supporting the country’s ambitious goals.

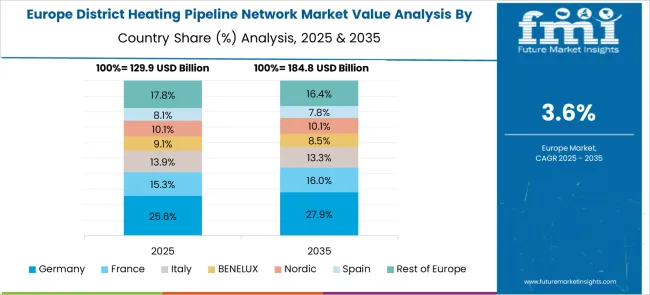

Germany is projected to grow at a CAGR of 4.5% through 2035, supported by a strong focus on energy efficiency and sustainable infrastructure. As part of its energy transition policy, Germany is increasingly investing in renewable energy and modernizing its district heating systems. The country has been a leader in adopting green technologies, and district heating plays a crucial role in meeting the country’s climate and energy goals. Many cities are upgrading their existing district heating networks to integrate renewable sources such as biomass, geothermal energy, and solar power, reducing the reliance on fossil fuels. This transition is expected to continue driving market growth as demand for low-carbon and energy-efficient heating solutions increases.

The United Kingdom is expected to grow at a CAGR of 3.7% through 2035, with demand for district heating networks driven by government policies aimed at reducing carbon emissions and improving energy efficiency. The UK has committed to ambitious climate goals, and district heating is seen as a key solution for reducing carbon footprints in urban areas, particularly in cities that are already adopting renewable energy technologies. The market for district heating pipelines in the UK is expanding as cities work to modernize their heating infrastructure and replace aging systems. Furthermore, demand is being driven by the increasing interest in renewable district heating solutions, such as heat pumps, biomass, and waste heat recovery systems.

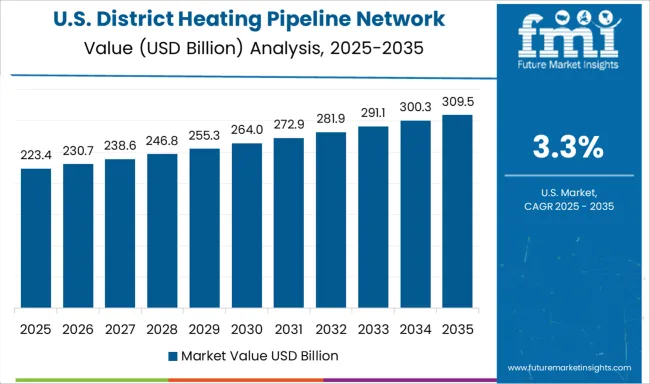

The United States is projected to grow at a CAGR of 3.3% through 2035, with demand for district heating pipelines largely driven by the need for more energy-efficient heating solutions in colder regions and large urban centers. As energy costs continue to rise and environmental concerns grow, the USA market is gradually shifting toward adopting renewable energy-based district heating systems. The growth of district heating in the USA is being further supported by government incentives for green infrastructure projects and energy conservation. Additionally, there is growing interest in integrating district heating networks with other energy-saving technologies such as smart grids and cogeneration plants to improve efficiency.

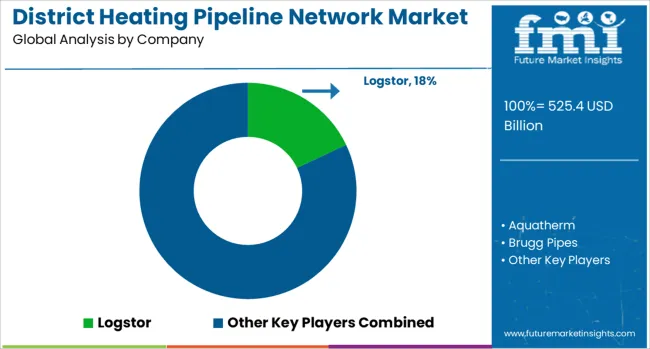

The district heating pipeline network market is dominated by leading manufacturers of insulated pipe systems, providing energy-efficient and durable solutions for heating infrastructure in residential, commercial, and industrial sectors. Logstor is a prominent player, offering high-performance pre-insulated pipes and network solutions for district heating systems globally.

Aquatherm and Brugg Pipes focus on high-quality, long-lasting piping solutions designed for the transport of hot water and steam, emphasizing system reliability and thermal efficiency. CPV and Golan Plastic Products cater to niche segments with advanced plastic-based piping systems offering corrosion resistance and ease of installation.

Isoplus, Ke Kelit, and Mannesmann Line Pipe provide customized pipe solutions with strong insulation capabilities, meeting growing demand in Europe and North America for energy-efficient district heating networks. Microflex and Perma-Pipe focus on innovative solutions in the field of insulated piping, offering sustainable alternatives with enhanced thermal performance for both urban and industrial applications.

Pipelife and Rehau offer versatile pre-insulated pipe systems that are increasingly being adopted in renewable energy projects, enhancing their appeal in modern heating networks. Thermaflex and Uponor leverage advanced materials and digital monitoring technologies to improve system efficiency, durability, and reduce operational costs for district heating infrastructure.

Competitive differentiation in this market is driven by material quality, insulation technology, ease of installation, and compliance with energy efficiency and sustainability standards. Barriers to entry include high manufacturing costs, stringent regulatory requirements, and the need for specialized installation techniques. Strategic priorities include developing flexible, environmentally friendly pipe systems, enhancing digitalization for real-time monitoring of network efficiency, and expanding partnerships for integrated heating solutions across urban infrastructures.

| Item | Value |

|---|---|

| Quantitative Units | USD 525.4 Billion |

| Pipe Type | Pre-Insulated Steel and Polymer |

| Diameter Range | 101-300 mm, 20-100 mm, and ≥300 mm |

| Application | Industrial, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Logstor, Aquatherm, Brugg Pipes, CPV, Golan Plastic Products, Isoplus, Ke Kelit, Mannesmann Line Pipe, Microflex, Perma-Pipe, Pipelife, Rehau, Thermaflex, and Uponor |

| Additional Attributes | Dollar sales by pipe type (pre-insulated, insulated) and end-use segments (residential, commercial, industrial, renewable energy). Demand dynamics are driven by urbanization, growing emphasis on energy-efficient heating, and increased adoption of renewable district heating solutions. Regional trends indicate strong growth in Europe, driven by established district heating networks, and emerging markets in Asia-Pacific due to increasing urbanization and energy initiatives. |

The global district heating pipeline network market is estimated to be valued at USD 525.4 billion in 2025.

The market size for the district heating pipeline network market is projected to reach USD 770.3 billion by 2035.

The district heating pipeline network market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in district heating pipeline network market are pre-insulated steel and polymer.

In terms of diameter range, 101–300 mm segment to command 46.0% share in the district heating pipeline network market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA