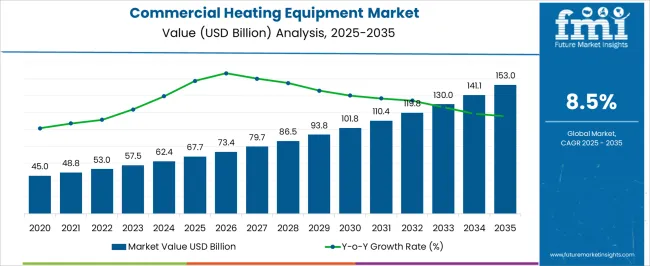

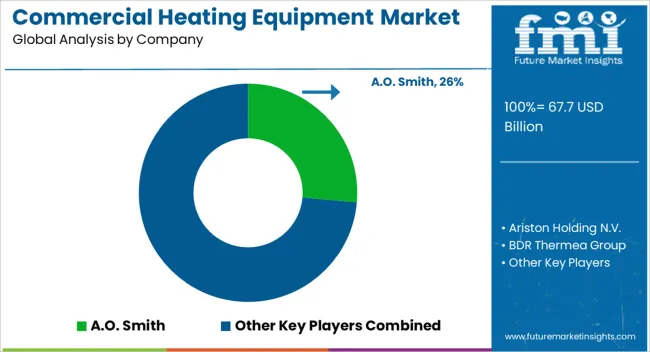

The Commercial Heating Equipment Market is estimated to be valued at USD 67.7 billion in 2025 and is projected to reach USD 153.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

This substantial growth highlights the rising replacement cycle of aging heating systems, stricter building efficiency codes, and expanding demand across offices, retail complexes, healthcare facilities, and educational institutions. In the early phase from 2025 to 2030, the market will likely benefit from infrastructure modernization programs and heightened investment in energy-efficient boilers, heat pumps, and radiant heating solutions.

From 2030 to 2035, the pace of expansion is projected to intensify as climate-focused regulations and indoor comfort standards reshape purchasing decisions. The incremental opportunity of USD 85.3 billion over ten years indicates a sizable revenue pool for manufacturers, contractors, and service providers.

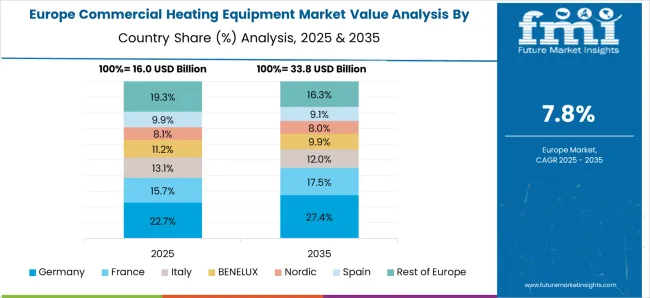

Market players are expected to differentiate through advanced control systems, hybrid units, and integration with building management software, ensuring both performance and compliance. Regional adoption will be most dynamic in Asia and Europe, where new commercial construction activity and retrofitting initiatives remain strong.

| Metric | Value |

|---|---|

| Commercial Heating Equipment Market Estimated Value in (2025 E) | USD 67.7 billion |

| Commercial Heating Equipment Market Forecast Value in (2035 F) | USD 153.0 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The commercial heating equipment market is expanding steadily due to increasing energy efficiency regulations, technological advancements, and a growing demand for sustainable heating solutions across commercial infrastructure. Businesses are prioritizing systems that reduce operational costs while minimizing environmental impact, prompting accelerated adoption of low emission and high performance technologies.

Modernization of old infrastructure and replacement of traditional boilers with energy efficient alternatives are also contributing to growth. The integration of smart thermostats, automation features, and hybrid systems is enabling better energy management in commercial settings.

Government incentives and green building certifications are further pushing stakeholders toward innovative heating solutions. With the focus on operational efficiency and climate resilience, the market is expected to maintain consistent demand across sectors such as corporate offices, hospitality, education, and retail.

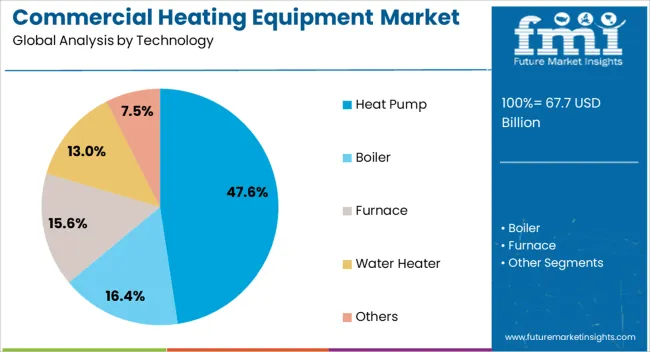

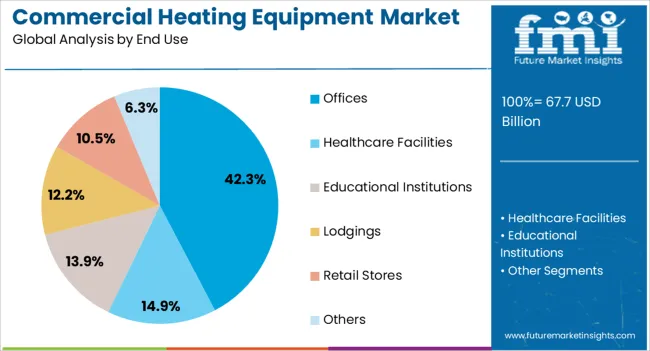

The commercial heating equipment market is segmented by technology, end use, channel, and geographic regions. By technology, the commercial heating equipment market is segmented into Heat Pumps, Boilers, Furnaces, Water Heaters, and Others. In terms of end use, the commercial heating equipment market is classified into Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others.

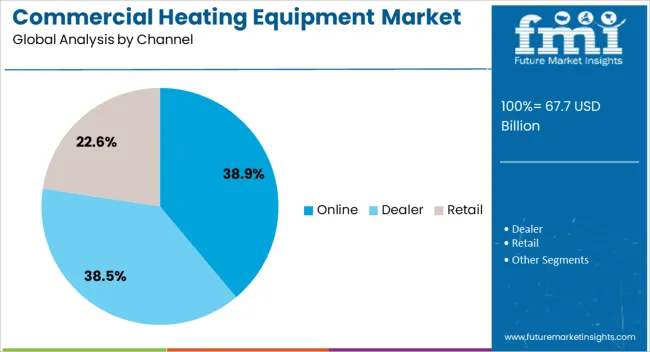

Based on channel, the commercial heating equipment market is segmented into Online, Dealer, and Retail. Regionally, the commercial heating equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The heat pump segment is anticipated to hold 47.60% of the total market revenue by 2025, emerging as the leading technology within the commercial heating equipment space. This dominance is driven by the rising shift toward energy-efficient and environmentally friendly heating systems.

Heat pumps are recognized for their ability to provide both heating and cooling, reducing the need for separate systems and lowering energy consumption. Their compatibility with renewable energy sources and lower greenhouse gas emissions has made them increasingly favorable under evolving building codes and sustainability mandates.

As commercial buildings aim for net zero energy consumption and carbon neutrality, heat pump adoption continues to increase, positioning this segment at the forefront of market growth.

The offices segment is projected to account for 42.30% of market revenue by 2025 under the end use category, securing its status as the leading segment. This is primarily due to the high concentration of commercial heating demand in corporate buildings, coworking spaces, and administrative facilities.

As companies focus on enhancing workplace comfort, indoor air quality, and energy savings, there is a strong emphasis on modern heating system upgrades. Retrofit programs, smart heating controls, and climate conscious building designs are further accelerating adoption within this segment.

Additionally, the post pandemic shift toward healthier and more energy responsive workspaces has reinforced the demand for efficient commercial heating solutions in office environments.

The online channel is expected to contribute 38.90% of total revenue by 2025 in the distribution category, making it the dominant sales channel. The segment's growth is attributed to the convenience, transparency, and wide product availability offered by digital platforms.

Commercial buyers and contractors are increasingly relying on online portals for comparing specifications, accessing technical support, and securing competitive pricing. E-commerce platforms have expanded their product ranges and logistics capabilities to accommodate larger orders and faster fulfillment for commercial heating systems.

The shift toward digital procurement processes, especially in regions with strong internet infrastructure and commercial development, continues to drive online channel growth within the market.

Energy efficiency regulations and smart building integration are driving the growth of the commercial heating equipment market. Increased demand for cost-effective, energy-efficient solutions and competition from key players are fueling this expansion.

The demand for energy-efficient commercial heating equipment is rising, driven by stricter energy regulations and the need for cost-effective solutions. As businesses focus on reducing operational costs, energy-efficient heating systems, such as heat pumps and hybrid systems, are gaining popularity. Commercial buildings are increasingly adopting these solutions to meet government energy targets and achieve long-term savings. This shift is particularly visible in office buildings, hotels, and retail establishments where large energy consumption is a concern. The need for reduced energy consumption across commercial spaces, coupled with the rising cost of energy, is expected to drive the continued growth of this market.

Government regulations are a critical factor driving the commercial heating equipment market. Many countries have implemented stringent building codes and energy efficiency standards that require commercial properties to use more efficient heating systems. These regulations often include incentives, rebates, and tax credits to promote the adoption of high-performance heating systems. Compliance with environmental standards and building codes is pushing businesses to upgrade their heating systems. As these regulations tighten globally, manufacturers are responding by offering products that meet these evolving standards. This trend will accelerate the adoption of energy-efficient heating equipment in the commercial sector.

The competitive landscape in the commercial heating equipment market is highly dynamic, with key players such as Carrier, Daikin, and Trane competing to capture market share. Companies are differentiating themselves by offering high-efficiency systems and focusing on customer service. Leading manufacturers are investing in research and development to create heating systems that offer both energy savings and improved comfort for commercial spaces. Smaller players are focusing on niche applications and specialized systems for specific sectors such as hospitality, retail, and healthcare. Market competition is intensifying as companies look to capitalize on growing demand for advanced, cost-effective heating solutions.

The integration of smart building systems is becoming increasingly important in the commercial heating market. More commercial properties are adopting smart HVAC solutions that allow for better control of heating, ventilation, and air conditioning. These smart systems enable businesses to optimize energy usage, reduce costs, and ensure better comfort levels for occupants. Through real-time monitoring and automation, commercial heating equipment can respond to changes in building occupancy, weather conditions, and other variables. This trend is boosting the demand for advanced commercial heating systems that integrate seamlessly with building management systems, making it a key factor for growth in the sector.

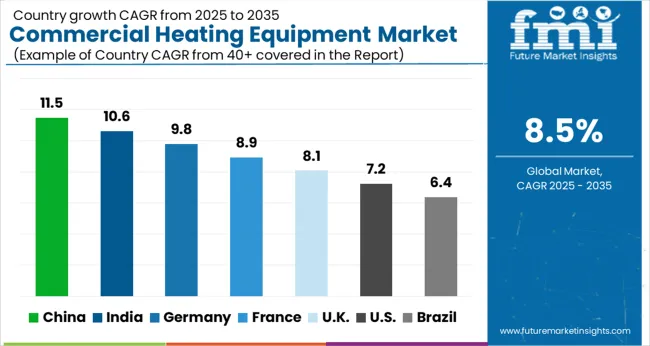

| Countries | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The commercial heating equipment market is projected to grow globally at a CAGR of 8.5% from 2025 to 2035, driven by increasing demand for energy-efficient and reliable heating systems in commercial buildings. China leads with a CAGR of 11.5%, supported by large-scale infrastructure projects, growing urban populations, and government initiatives to enhance building efficiency. India follows with a 10.6% CAGR, benefiting from rapid industrialization, infrastructure development, and the rising need for energy-efficient heating solutions. France achieves 8.9%, driven by demand for commercial heating systems in response to stricter environmental standards. The UK grows at 8.1%, backed by increasing investments in commercial building upgrades and the rise in energy-efficient heating solutions. The USA maintains a 7.2% CAGR, driven by continued demand for replacement heating systems and new commercial installations. This growth outlook emphasizes the role of Asia-Pacific and Europe in driving the commercial heating equipment market, with North America following suit due to regulatory push and modernization efforts in commercial buildings.

The UK is expected to achieve a CAGR of 8.1% during 2025–2035, slightly below the global CAGR of 8.5%. Between 2020–2024, the CAGR was around 6.5%, driven by moderate demand for energy-efficient heating solutions in commercial buildings, influenced by economic constraints and slow adoption of renewable energy solutions. However, the market is expected to experience stronger growth in the coming decade due to government incentives, a rise in commercial building upgrades, and stricter energy efficiency regulations. The increase in the demand for green heating solutions, fuel-efficient systems, and the modernization of older buildings will contribute to this market's acceleration. This rise in CAGR is attributed to the increased focus on reducing operational costs in commercial properties, alongside the growing adoption of smart heating technologies.

China is expected to achieve a CAGR of 11.5% during 2025–2035, significantly higher than the global CAGR of 8.5%. The CAGR for the 2020–2024 period was around 9.0%, driven by the country’s large-scale infrastructure and industrialization projects. As China continues to urbanize, the demand for commercial heating systems in large buildings, shopping centers, and industrial complexes has been on the rise. The projected increase in CAGR is attributed to government policies promoting energy efficiency and green building certifications. Investments in energy-efficient systems, especially in commercial properties, are expected to increase during the 2025–2035 period as the country looks to reduce emissions and improve air quality. The adoption of hybrid and renewable heating systems will also play a significant role in this growth.

India is projected to achieve a CAGR of 10.6% during 2025–2035, driven by rapid industrialization and increasing commercial construction. The CAGR from 2020–2024 was around 8.5%, reflecting the country's early-stage adoption of energy-efficient heating systems in commercial spaces. The projected rise in CAGR is due to a growing emphasis on green energy solutions and energy efficiency, particularly in newly built commercial complexes and urban areas. The shift towards more sustainable, cost-effective heating systems will be supported by government incentives and rising awareness of energy savings. As businesses in India continue to expand and upgrade their facilities, the demand for advanced, efficient, and low-emission heating systems will continue to grow.

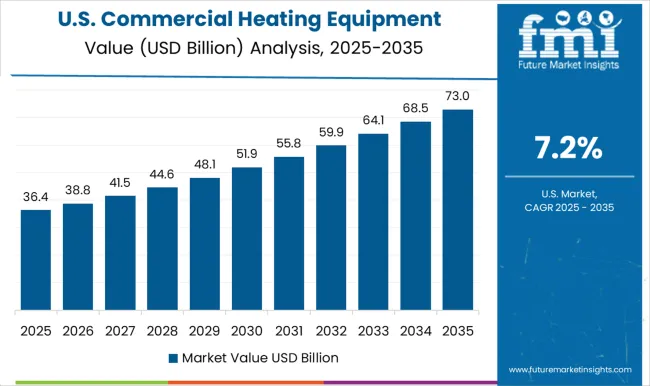

The USA is projected to grow at a CAGR of 7.2% during 2025–2035, slightly lower than the global CAGR of 8.5%. Between 2020–2024, the CAGR was about 6.0%, as energy-efficient commercial heating systems gradually gained popularity. The projected rise in CAGR is driven by the need to meet stricter building codes and environmental goals, coupled with the increasing demand for efficient heating solutions in commercial buildings. The USA commercial heating market will see growth in response to incentives for low-emission systems, as well as a growing shift toward hybrid and electric heating technologies.

France is expected to achieve a CAGR of 8.9% during 2025–2035, driven by rising demand for energy-efficient heating solutions in commercial buildings. The CAGR from 2020–2024 was approximately 7.0%, as the market gradually adopted more advanced systems in response to government regulations and building code requirements. The increase in the growth rate from 2025 to 2035 is attributed to the French government's strong commitment to reducing emissions and increasing the use of renewable energy sources in commercial buildings. In particular, the market for hybrid heating solutions, including solar and heat pump systems, is projected to rise significantly. France's focus on achieving carbon neutrality and its commitment to green building standards will continue to drive demand for energy-efficient commercial heating systems.

The commercial heating equipment market is highly competitive, with major manufacturers offering a variety of solutions tailored to the needs of residential and commercial spaces. A.O. Smith leads in providing water heating systems with energy-efficient technologies and a focus on sustainability. Carrier Corporation is recognized for its innovative HVAC solutions, providing highly efficient heating systems and integrated technologies for commercial buildings.

DAIKIN INDUSTRIES, Ltd. specializes in high-performance air conditioning and heating systems, catering to the growing demand for energy-efficient solutions. Honeywell International Inc. offers cutting-edge heating solutions, including smart thermostats and control systems, with a focus on building management and system integration.

Mitsubishi Electric Corporation is a significant player, offering hybrid heating solutions with advanced inverter technologies. Siemens is a key player, providing smart heating control systems for commercial buildings to improve energy efficiency.

Trane Technologies stands out with its sustainable heating solutions designed for commercial HVAC systems, while Rheem Manufacturing Company delivers energy-efficient water heating systems. Other significant competitors like Bosch GmbH, LG Electronics, and Vaillant Group are also enhancing their product offerings with high-performance, low-energy heating systems suitable for large-scale commercial buildings.

Key strategies in this market include technological advancements for energy efficiency, a focus on integrating smart systems for improved control, and the development of tailored solutions for industrial and commercial applications. Manufacturers are also expanding their product ranges to meet the growing demand for cost-effective and sustainable heating systems in the commercial sector. As energy regulations become tighter, the market is expected to continue innovating and growing.

| Item | Value |

|---|---|

| Quantitative Units | USD 67.7 Billion |

| Technology | Heat Pump, Boiler, Furnace, Water Heater, and Others |

| End Use | Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others |

| Channel | Online, Dealer, and Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | A.O. Smith, Ariston Holding N.V., BDR Thermea Group, Carrier Corporation, Cleaver-Brooks, DAIKIN INDUSTRIES, Ltd., Danfoss, Emerson Electric Co., Fulton Boiler Works, Goodman Manufacturing Company, Honeywell International Inc., Johnson Controls International, Lennox International, LG Electronics, Mitsubishi Electric Corporation, Miura America, NIBE Industrier AB, Panasonic Corporation, Rheem Manufacturing Company, Robert Bosch GmbH, SAMSUNG, Siemens, Thermax Limited, Trane Technologies, Vaillant Group, Viessmann Group, and WOLF GmbH |

| Additional Attributes | Dollar sales projections, market share by region, key growth drivers such as energy efficiency regulations and government incentives, and demand trends for energy-efficient solutions. |

The global commercial heating equipment market is estimated to be valued at USD 67.7 billion in 2025.

The market size for the commercial heating equipment market is projected to reach USD 153.0 billion by 2035.

The commercial heating equipment market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in commercial heating equipment market are heat pump, boiler, furnace, water heater and others.

In terms of end use, offices segment to command 42.3% share in the commercial heating equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA