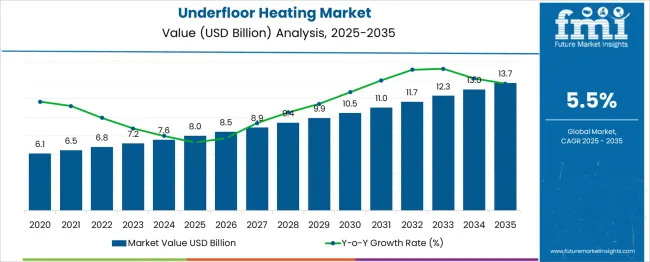

The Underfloor Heating Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

A rolling CAGR analysis, examining compounded annual growth over sequential multi-year periods, reveals a stable yet slightly strengthening growth profile. From 2025 to 2028, the rolling CAGR averages around 3.6–4.2%, reflecting gradual adoption in both residential retrofits and select new-build projects. Installation cost barriers and the cyclical nature of construction activity influence this slower initial pace. However, the technology’s energy efficiency appeal and alignment with low-carbon building codes steadily build momentum. The mid-period (2028–2031) sees rolling CAGR climbing toward 5.0–5.4%, as hydronic and electric systems gain traction in commercial developments and multi-family housing. Accelerated uptake is also supported by advancements in quick-install panel systems, making retrofitting more cost-effective. In the final stretch (2031–2035), rolling CAGR sustains between 5.6–5.9%, indicating a mature yet robust expansion phase. By this stage, market growth is driven more by policy-driven energy transition goals, heightened renovation activity, and integration with smart home energy management systems. This rolling CAGR profile highlights a market shifting from moderate early adoption to consistent, policy-backed expansion, suggesting long-term resilience and scope for sustained revenue scaling beyond 2035.

| Metric | Value |

|---|---|

| Underfloor Heating Market Estimated Value in (2025 E) | USD 8.0 billion |

| Underfloor Heating Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The underfloor heating market is regarded as a steadily growing segment within its broader parent industries. It is estimated to represent about 2.1% of the global heating, ventilation and air conditioning industry indicating increasing preference for energy efficient systems. Within the residential heating solutions market a share of approximately 3.4% is assessed driven by new build and retrofit installations in homes. In the commercial and institutional building systems sector around 2.7% is calculated supported by use in hotels, offices and schools.

Within the smart home and building automation market about 1.9% is observed reflecting integration with thermostats and control platforms. In the renewable and low‑carbon heating equipment market a share of roughly 2.5% is evaluated as hydronic and electric underfloor systems gain traction. Trends in this market have been shaped by increasing adoption of systems offering uniform heat distribution and reduced energy waste. Innovations have been focused on hydronic solutions with thin‑profile pipes and faster heat‑up times. Interest has increased in electric underfloor designs compatible with smart thermostats and zoned control for improved comfort. The Europe region has been observed to lead demand while North America is showing growing uptake, especially in new construction driven by building code incentives. Strategic initiatives have included partnerships between underfloor heating suppliers and home automation companies to deliver modular systems with predictive temperature control, remote monitoring and installation support services.

The underfloor heating market is growing steadily, fueled by rising demand for energy-efficient, space-saving heating solutions in modern infrastructure. With increasing awareness of sustainable construction practices and stricter energy codes across developed and emerging economies, underfloor systems have gained traction for both comfort and performance.

These systems offer uniform heat distribution, lower operational costs, and enhanced design flexibility compared to conventional radiators. Technological advancements in thermostat integration, smart controls, and heat retention materials have improved efficiency and user control.

Supportive government incentives and building mandates are further propelling adoption, particularly in colder climates and high-end residential developments. The growing appeal of radiant heating in eco-certified projects is expected to sustain long-term demand across segments.

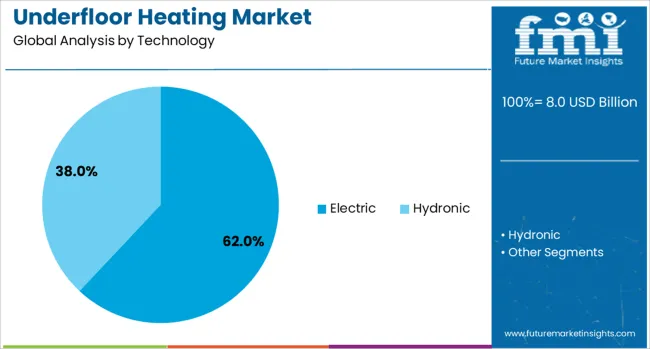

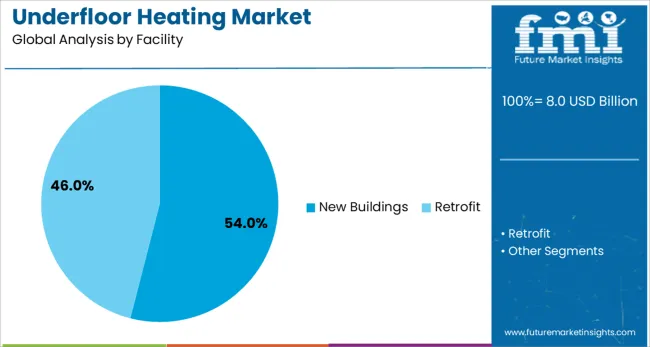

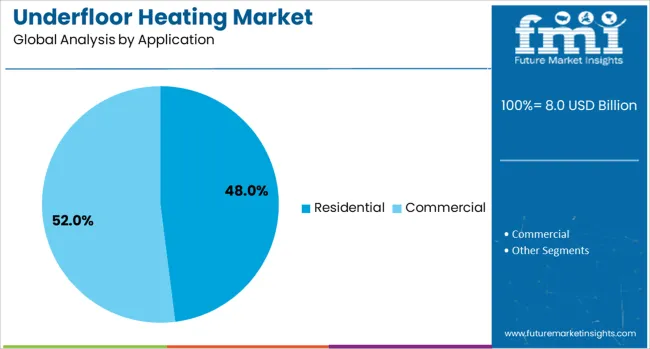

The underfloor heating market is segmented by technology, facility, and application and geographic regions. By technology of the underfloor heating market is divided into Electric and Hydronic. In terms of facility of the underfloor heating market is classified into New Buildings and Retrofit. Based on application of the underfloor heating market is segmented into Residential and Commercial. Regionally, the underfloor heating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electric underfloor heating is expected to dominate the market with a 62.00% share in 2025. Its growth is driven by ease of installation, lower upfront costs, and suitability for retrofit projects and small-area applications such as bathrooms and kitchens.

Unlike hydronic systems, electric variants do not require boilers or pumps, making them ideal for residential renovations and localized heating needs. Integration with smart home systems has further improved usability, while innovations in heating mats and carbon film technology have enhanced energy efficiency.

The minimal maintenance and faster heat-up times offered by electric systems are particularly appealing in urban apartments and high-efficiency housing models.

New buildings are projected to account for 54.00% of the total underfloor heating market revenue by 2025, making them the leading facility type. This growth is supported by design-stage integration, which allows for optimized floor layouts and cost-effective system planning.

In newly constructed residential and commercial buildings, developers are increasingly choosing underfloor heating to meet regulatory thermal performance requirements and boost property value. Enhanced energy modeling and building information modeling (BIM) integration are streamlining system specification in new projects.

With green building certifications such as LEED and BREEAM becoming mainstream, new developments are favoring embedded radiant heating to align with energy-efficient design principles.

Residential usage is forecast to hold a 48.00% market share in 2025, leading the application segment. Homeowners are increasingly adopting underfloor heating for its aesthetic benefits, space efficiency, and comfort.

The technology eliminates the need for wall-mounted units, enabling flexible interior design and cleaner room layouts. It is particularly in demand in luxury housing, multi-family units, and smart homes where climate zoning and energy optimization are priorities.

The rise of home automation and personalized comfort controls has also accelerated demand in residential retrofits. As awareness of low-emission heating alternatives increases, the residential segment is poised for further expansion, especially in energy-conscious urban markets.

Underfloor heating systems have been increasingly installed in residential, commercial, and industrial buildings for their ability to provide uniform warmth and improved space utilization. Both hydronic and electric variants have been adopted based on project scale and energy availability. Growth has been notable in colder climates and in renovation projects where enhanced comfort and energy efficiency are prioritized. Advances in installation techniques, insulation materials, and smart thermostatic controls have influenced adoption trends. The integration of underfloor heating with renewable energy sources has also gained market attention.

Underfloor heating systems have been valued for delivering even heat distribution and eliminating cold spots common with traditional radiators. By operating at lower temperatures, these systems can achieve notable energy savings while maintaining comfortable indoor conditions. Hydronic systems have been preferred in large-scale installations due to their compatibility with boilers and heat pumps, while electric variants have been widely used in smaller residential projects and bathroom retrofits. The absence of visible heating units has allowed more flexible interior layouts. Property developers in Northern Europe, Canada, and parts of Asia have increasingly specified underfloor heating in new construction to enhance property value. Reduced dust circulation compared to forced-air systems have been recognized as an additional health benefit, supporting adoption among allergy-sensitive occupants. The combination of comfort and operational efficiency has positioned underfloor heating as a desirable long-term investment in multiple building types.

The integration of underfloor heating systems with smart thermostats and home automation platforms has improved temperature control, scheduling, and energy management. Users have been able to adjust heating remotely via mobile applications, enabling greater operational flexibility. Adaptive control algorithms have been implemented to learn usage patterns and optimize energy consumption. Builders in technologically advanced markets such as Germany, Japan, and the United States have adopted these integrated systems in premium housing projects. Connectivity with renewable energy systems, such as solar thermal and geothermal heat pumps, has further enhanced efficiency. Voice-control compatibility and room-by-room zoning have increased user convenience, allowing targeted heating for occupied spaces only. These technological improvements have been viewed as a major contributor to user satisfaction, while also aligning with growing interest in connected living environments that balance comfort and efficiency.

Adoption of underfloor heating has been supported by both new construction and retrofitting activities. In new builds, the installation is more cost-effective due to integration during the design phase, while in renovations, thin electric mats and low-profile hydronic systems have been developed to minimize floor height impact. Builders and contractors in Europe and New Zealand have reported increased requests for underfloor heating in high-end homes, hotels, and office spaces. Demand in the renovation sector has been strengthened by property owners seeking to upgrade heating performance without extensive structural modifications. The ability to install underfloor heating under a wide range of flooring materials, including tile, laminate, and engineered wood, has contributed to its versatility. The dual applicability in new and existing buildings has allowed market expansion across diverse construction cycles.

Despite comfort and efficiency benefits, adoption of underfloor heating systems has been limited by high installation costs and compatibility challenges in certain buildings. Hydronic systems require substantial initial investment and are more complex to install, particularly in retrofit scenarios. In older buildings, structural floor height constraints and insufficient insulation have restricted installation feasibility. Electric systems, while simpler to install, can lead to higher operating costs in regions with expensive electricity. Long warm-up times compared to forced-air heating have been cited as a disadvantage in some climates. Maintenance requirements for hydronic systems, including pump and valve servicing, have added to ownership costs. Without reductions in material and installation expenses, or more adaptable system designs, the technology may remain concentrated in premium residential and commercial segments rather than achieving broad market penetration.

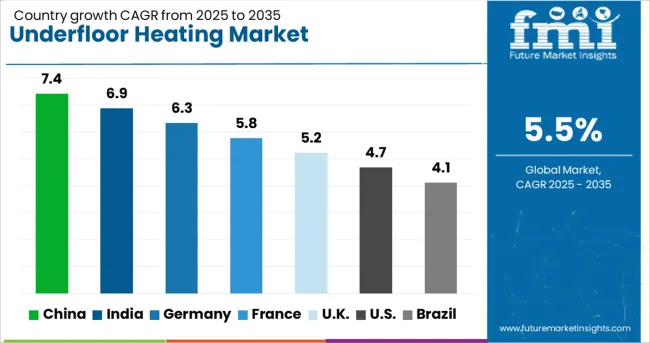

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

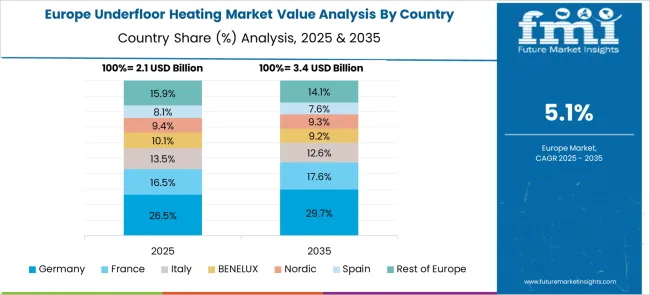

The market is expected to grow at a global CAGR of 5.5% between 2025 and 2035, driven by demand for energy-efficient heating solutions, improved indoor comfort, and integration with renewable energy systems. China leads with a 7.4% CAGR, supported by rapid residential and commercial construction and increased adoption of modern heating technologies. India follows at 6.9%, fueled by growth in premium housing projects and hospitality infrastructure. Germany, at 6.3%, benefits from strong green building standards and advanced heating system engineering. The UK, projected at 5.2%, sees growth from retrofitting projects and luxury housing demand. The USA, at 4.7%, reflects gradual adoption in colder regions and high-end residential developments. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 7.4% from 2025 to 2035 in the underfloor heating market, supported by large-scale residential and commercial construction projects in colder regions such as Heilongjiang, Inner Mongolia, and Xinjiang. Domestic manufacturers like Jiangsu Aolan Heating and Qingdao Yushen are expanding product portfolios to include hydronic and electric underfloor heating systems with advanced digital thermostats. Increasing adoption in premium housing developments is driving demand for energy-efficient heating solutions. Government emphasis on building energy standards is also pushing developers to incorporate modern underfloor heating during initial construction phases.

India is expected to achieve a CAGR of 6.9% from 2025 to 2035, driven by growth in luxury residential construction, commercial office spaces, and hospitality infrastructure in cooler regions such as Himachal Pradesh, Uttarakhand, and Kashmir. Companies like Warmup India and Devi Electric are focusing on thin-mat electric heating systems that are easy to retrofit. Demand from high-end hotels and wellness resorts is increasing as underfloor heating becomes a preferred solution for guest comfort. Rising awareness of indoor air quality benefits compared to traditional heating methods is also influencing adoption.

Germany is projected to post a CAGR of 6.3% from 2025 to 2035, driven by high energy efficiency standards and strong demand for hydronic systems in both residential and commercial segments. Leading suppliers such as Uponor GmbH and Rehau AG are integrating renewable energy compatibility, enabling systems to work with solar thermal and heat pumps. Demand is particularly strong in new-build housing projects and energy-efficient renovations. The integration of zoning controls for optimized room-by-room heating is becoming a standard feature.

The United Kingdom is forecasted to record a CAGR of 5.2% from 2025 to 2035, driven by demand in housing renovations, office refurbishments, and new residential developments. Suppliers such as Polypipe, Warmup UK, and Nu-Heat are expanding their electric underfloor heating ranges for retrofit-friendly applications. Increasing uptake in bathroom and kitchen renovations is contributing to market growth. Government incentives for energy-efficient home upgrades are also encouraging adoption, particularly in combination with improved insulation systems.

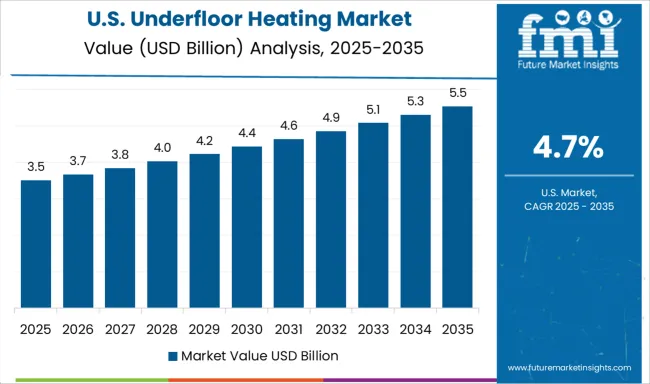

The United States is expected to grow at a CAGR of 4.7% from 2025 to 2035, supported by residential upgrades in colder states and expanding use in commercial facilities. Brands such as Warmboard, Schluter Systems, and SunTouch are focusing on systems with rapid heat-up times and integration with smart home automation platforms. Demand is particularly strong in custom-built homes and luxury condominiums. The healthcare sector is also adopting underfloor heating for patient comfort in cold-climate hospitals and clinics.

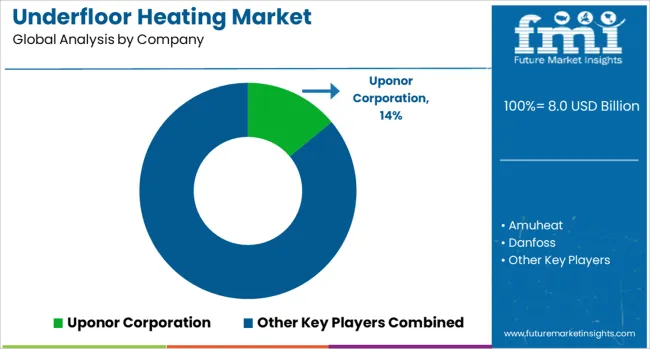

Uponor Corporation, REHAU, and Polypipe lead with comprehensive water-based and electric underfloor heating systems, supported by extensive installer networks and turnkey project capabilities. Danfoss and Siemens integrate advanced controls and energy management features into their systems, enhancing operational efficiency and comfort. Warmup, Thermogroup Ltd., and Thermo-Floor UK Limited have strong positions in the UK and European markets, focusing on retrofit-friendly electric mat systems and quick-install heating cables.

Gaia Climate Solutions, HEATCOM CORPORATION A/S, and Hemstedt GmbH target both bespoke and large-scale developments with custom heating layouts and automation-ready solutions. Daikin and Resideo Technologies Inc. leverage their broader HVAC portfolios to provide integrated underfloor heating within complete climate control packages, while Watts combines hydronic system expertise with robust distribution channels.

ThermaRay and H2O Heating Pty Ltd. emphasize radiant comfort solutions for niche architectural and high-performance building markets. Hunt Commercial and Amuheat cater to regional requirements with tailored designs and specialist installation support. Manufacturers compete through innovation in heating controls, energy-efficient operation, and compatibility with renewable energy sources. Strategies include partnerships with builders and architects, expansion of training programs for certified installers, and localized distribution hubs for faster project support. Entry into this market is limited by technical installation expertise, compliance with building regulations, and the need for proven product reliability in long-term applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.0 Billion |

| Technology | Electric and Hydronic |

| Facility | New Buildings and Retrofit |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Uponor Corporation, Amuheat, Danfoss, Daikin, Gaia Climate Solutions, HEATCOM CORPORATION A/S, H2O Heating Pty Ltd., Hemstedt GmbH, Hunt Commercial, nVent, Polypipe, REHAU, Resideo Technologies Inc., Siemens, ThermaRay, Thermo-Floor UK Limited, Thermogroup Ltd., Warmup, and Watts |

The global underfloor heating market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the underfloor heating market is projected to reach USD 13.7 billion by 2035.

The underfloor heating market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in underfloor heating market are electric and hydronic.

In terms of facility, new buildings segment to command 54.0% share in the underfloor heating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Commercial Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Examining Europe Hydronic Underfloor Heating Market Share & Trends

Europe Hydronic Underfloor Heating Market Insights – Trends, Demand & Growth 2025-2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Air Distribution Systems Market

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Heating Pad Market

Preheating Tunnel Furnace for Lithium Battery Market Size and Share Forecast Outlook 2025 to 2035

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Radiant Heating And Cooling Systems Market

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

District Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

District Heating Market Size and Share Forecast Outlook 2025 to 2035

District Heating Pipeline Network Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA