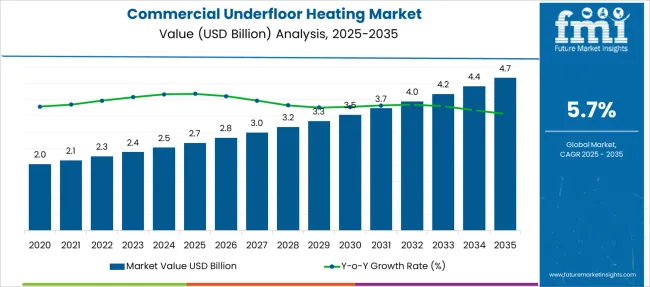

The Commercial Underfloor Heating Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Underfloor Heating Market Estimated Value in (2025 E) | USD 2.7 billion |

| Commercial Underfloor Heating Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The commercial underfloor heating market is exhibiting steady growth as energy efficiency regulations, rising construction of green buildings, and the demand for enhanced occupant comfort influence adoption patterns. The shift toward low-carbon heating solutions has encouraged stakeholders to consider underfloor heating as a viable alternative to conventional systems.

Advancements in installation techniques and the integration of smart controls have improved the value proposition, enabling faster deployment and improved operational performance. The market outlook remains positive with increasing investments in sustainable infrastructure, stringent building codes, and heightened awareness about lifecycle cost benefits contributing to long-term growth.

Opportunities are emerging from innovations in thermal insulation materials and the push for electrification of heating in urban environments which are paving the way for broader adoption and scalable solutions..

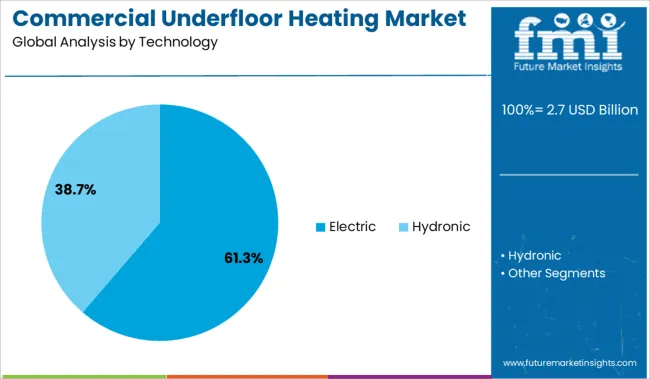

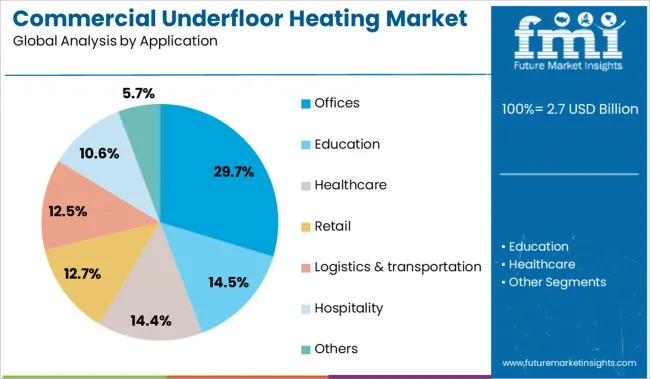

The market is segmented by technology, application, and region. By Technology, the market is divided into Electric and Hydronic. In terms of Application, the market is classified into Offices, Education, Healthcare, Retail, Logistics & transportation, Hospitality, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by technology, the electric segment is expected to command 61.30% of the total market revenue in 2025 making it the leading technology segment. This dominance has been driven by the ease of installation, lower upfront costs for smaller areas, and compatibility with retrofit projects.

The simplicity of electric systems compared to hydronic alternatives has facilitated their preference in projects with tight timelines or design constraints. Enhanced efficiency through advanced thermostats and zoning capabilities has improved operational control making electric systems attractive for commercial spaces with varying occupancy levels.

The reduced maintenance requirements and ability to integrate with renewable energy sources have further supported their leadership position. Growing demand for flexible and modular heating solutions in office renovations and high-rise buildings has reinforced the prominence of the electric segment..

Segmented by application the offices segment is forecast to hold 29.70% of the market revenue in 2025 establishing itself as the top application area. This leadership has been influenced by the increasing emphasis on employee wellness energy savings and aesthetics in office design.

The ability of underfloor heating to provide uniform warmth without occupying visible space has made it particularly suitable for open-plan and modern office layouts. Enhanced thermal comfort has been shown to support productivity and reduce complaints about inconsistent temperatures driving adoption in new and refurbished office projects.

Compliance with sustainable building certifications and the desire to achieve low operational carbon footprints have also motivated developers and facility managers to implement these systems. The flexibility to integrate with smart building management systems has further strengthened the appeal of underfloor heating in office environments consolidating its leading share in the market..

Demand for commercial underfloor heating systems is rising due to reduced operating costs, cleaner indoor air, and better space utilization. Sales of hydronic and electric variants are accelerating across healthcare, hospitality, and office projects. Smart zoning and modular installation continue to drive specifications in both new construction and retrofit markets.

Demand for hydronic underfloor heating systems grew 24% YoY across commercial complexes over 1,000 m², led by airports, hospitals, and academic campuses. Sales of PEX-a and PE-RT tubing systems rose in Germany and the Netherlands due to enhanced BREEAM and LEED compliance. Builders selected water-based radiant heating to reduce HVAC lifecycle costs by up to 22%. Integrated with condensing boilers and air-source heat pumps, these systems enabled multi-zone temperature control with IoT-linked actuators. Installers reported 33% savings in ducting labor. In the UK, local councils mandated hydronic systems for energy-labeled public buildings, positioning the technology as a core component of decarbonization retrofits.

Sales of electric underfloor heating systems climbed 29% in 2025, driven by fast-track commercial renovations and modular office builds. Thin-film heating mats gained traction in floor areas under 150 m², offering 45% faster heat-up times and simplified dry-installation. Demand for electric heating rose sharply in Nordic hotels and clinics, where tiled bathroom zones favored underfloor layouts over radiators. Programmable dual-sensor thermostats enabled precise thermal regulation, cutting power draw during peak hours. Installers in Canada and Sweden adopted 150 W/m² grids for higher-efficiency coverage. Developers now favor electric underfloor systems in projects constrained by slab depth or requiring quick mechanical turnaround.

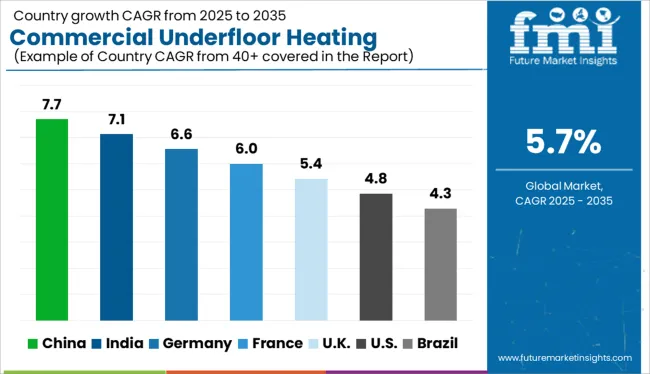

| Country | CAGR |

|---|---|

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

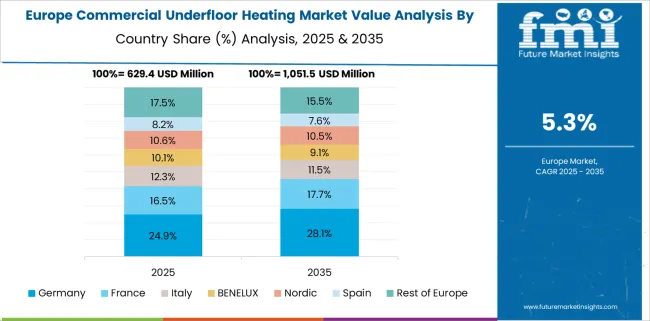

The global commercial underfloor heating market is forecast to grow at a CAGR of 5.7% between 2025 and 2035. BRICS countries are showing faster expansion, with China growing at 7.7% and India at 7.1%, supported by large-scale commercial real estate developments and increased demand for energy-efficient buildings. Within the OECD, Germany is advancing at 6.6%, benefiting from sustainability targets and high adoption in modern office spaces. The UK follows closely at 5.4%, aligned with infrastructure upgrades across commercial zones. The USA trails slightly at 4.8%, where regional climatic variation and cost sensitivity in retrofits weigh on adoption. ASEAN nations, though not detailed here, are expected to contribute steadily due to construction sector growth. This performance contrast underscores strong momentum in emerging economies and regulatory-led gains in developed nations. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in China is projected to witness a CAGR of 7.7% from 2025 to 2035. Between 2020 and 2024, adoption was mostly driven by luxury commercial construction in major cities. Looking ahead, large-scale installations are expected across eco-parks, tech campuses, and public sector buildings in line with China’s dual-carbon goals. Demand for commercial underfloor heating is further stimulated by subsidies for energy-efficient infrastructure in northern provinces.

India is anticipated to grow at a 7.1% CAGR in the industry during 2025–2035. From 2020 to 2024, usage was minimal, limited to upscale projects in Delhi and Bengaluru. The demand for commercial underfloor heating will surge due to Smart Cities programs, rising income levels, and evolving urban infrastructure. Sales of modular electric radiant systems are growing in Tier-2 business centers.

Germany is forecast to post a CAGR of 6.6% in the market from 2025 to 2035. Between 2020 and 2024, demand rose from retrofits in government and educational buildings. Going forward, adoption will be driven by energy regulations, carbon neutrality goals, and heat pump-compatible systems. Demand for commercial underfloor heating will center on commercial buildings meeting KfW efficiency standards.

The UK market is expected to expand at a 5.4% CAGR through 2035. Between 2020 and 2024, the market was fueled by retrofits in schools and civic centers. In the next decade, demand for commercial underfloor heating will grow due to net-zero construction mandates and the decline of gas-based systems. Sales of electric underfloor solutions are set to increase, especially in the public sector.

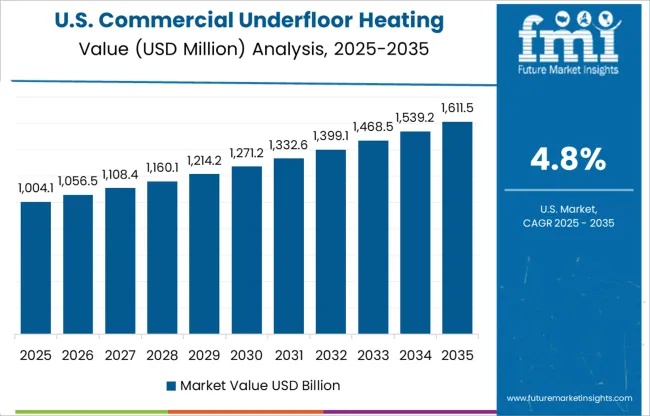

The US is expected to register a 4.8% CAGR in the market during 2025–2035. From 2020 to 2024, market growth was concentrated in eco-certified buildings in states like California and Oregon. Moving forward, demand for commercial underfloor heating will expand due to stricter energy codes and the rise of wellness-oriented workspaces. Sales of underfloor heating are also expected to increase in healthcare and university campuses.

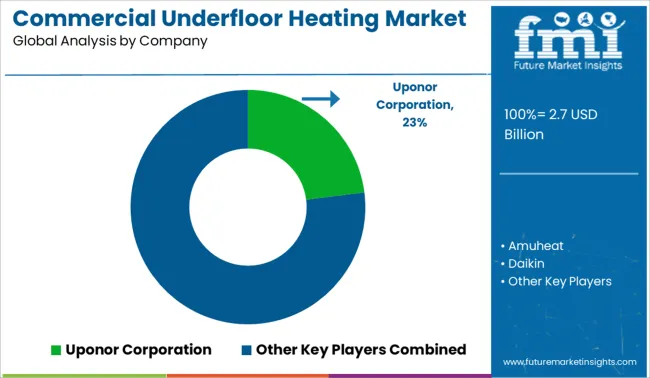

The demand for commercial underfloor heating is expanding rapidly due to energy-efficiency mandates and rising retrofitting activity in non-residential spaces in 2025. Uponor Corporation leads the global market with a prominent share, supported by robust sales of hydronic systems across Europe’s institutional and healthcare sectors. REHAU and Danfoss collectively account for 19% of global revenue, fueled by demand for PEX-based radiant systems in large-scale commercial developments. Sales of electric underfloor heating are rising in North America and Asia, especially for quick-install solutions in modular office projects. Siemens, nVent, and Resideo Technologies are gaining traction in the controls and automation segment, while Warmup and Thermogroup are expanding their footprint through flexible mat systems tailored for high-traffic zones.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Technology | Electric and Hydronic |

| Application | Offices, Education, Healthcare, Retail, Logistics & transportation, Hospitality, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Uponor Corporation, Amuheat, Daikin, Danfoss, Gaia Climate Solutions, H2O Heating Pty td., Hunt Commercial, nVent, REHAU, Resideo Technologies Inc., Siemens, ThermaRay, Thermogroup Ltd., Thermo-Floor UK Limited, Warmup, and Watts |

| Additional Attributes | Dollar sales by heating system type and commercial building segment, demand dynamics across hospitality and healthcare facilities, regional trends in retrofitting versus new installations, innovation in smart thermostat integration and zoning controls, environmental impact of energy efficiency regulations, and emerging use cases in modular construction and green-certified buildings. |

The global commercial underfloor heating market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the commercial underfloor heating market is projected to reach USD 4.7 billion by 2035.

The commercial underfloor heating market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in commercial underfloor heating market are electric and hydronic.

In terms of application, offices segment to command 29.7% share in the commercial underfloor heating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA