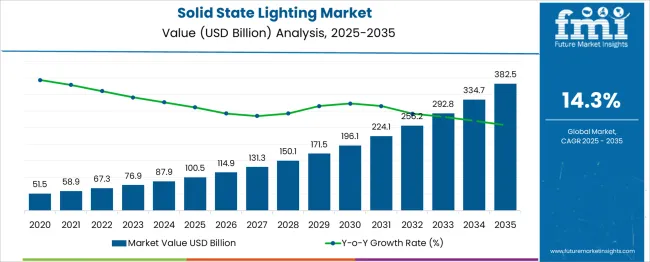

The Solid-State Lighting Market is estimated to be valued at USD 100.5 billion in 2025 and is projected to reach USD 382.5 billion by 2035, registering a compound annual growth rate (CAGR) of 14.3% over the forecast period. This growth, supported by a strong CAGR of 14.3%, is driven by increased adoption of energy-efficient lighting solutions, government regulations promoting sustainability, and the widespread transition from traditional lighting to LED technology.

During the first five years (2025–2030), the market will expand from USD 100.5 billion to USD 196.1 billion, adding USD 95.6 billion, which accounts for 33.9% of the total incremental growth, with a 5-year multiplier of 1.95x. The second phase (2030-2035) contributes USD 186.4 billion, representing 66.1% of incremental growth, reflecting accelerated demand for smart lighting, advanced controls, and integration with IoT applications in both residential and commercial sectors. Annual increments increase from USD 15.3 billion in early years to USD 25.2 billion by 2035, driven by the growing importance of lighting in smart city infrastructure, energy-saving initiatives, and automotive applications. Manufacturers focusing on IoT-enabled systems, tunable white lighting, and sustainable LED production will capture significant value in this USD 282 billion growth opportunity as global lighting markets continue to transition to solid-state technologies.

| Metric | Value |

|---|---|

| Solid-State Lighting Market Estimated Value in (2025 E) | USD 100.5 billion |

| Solid-State Lighting Market Forecast Value in (2035 F) | USD 382.5 billion |

| Forecast CAGR (2025 to 2035) | 14.3% |

The solid state lighting market is experiencing accelerated growth, driven by widespread policy mandates, energy conservation goals, and declining costs of high-performance lighting solutions. Technological advancements in semiconductors and thermal management have improved lifespan, lumen output, and color quality across applications.

Government-led bans on incandescent and fluorescent bulbs, alongside regulatory subsidies for energy-efficient upgrades, are pushing rapid adoption in both residential and commercial sectors. Industry stakeholders are focusing on smart integration and IoT-based lighting systems, creating additional demand for retrofitting legacy infrastructure.

Growing awareness around carbon footprint reduction, combined with corporate ESG strategies, is expected to further drive preference toward durable, low-maintenance lighting products. Long-term growth will be supported by advancements in materials science, miniaturization of drivers, and scalable manufacturing processes.

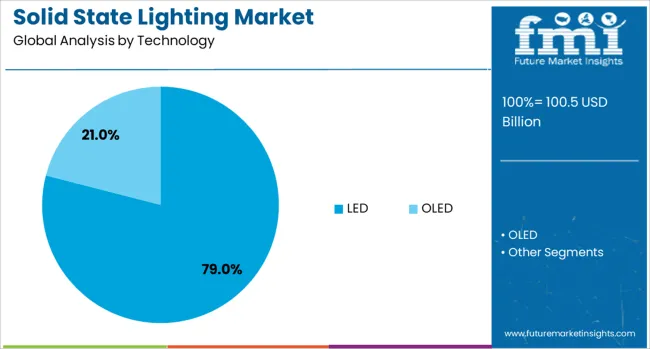

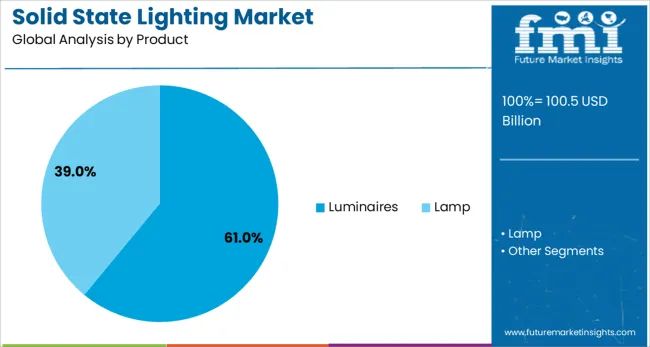

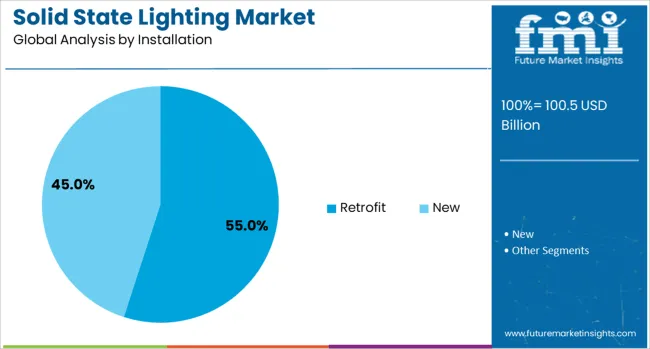

The solid-state lighting market is segmented by technology, product installation, and geographic regions. The technology of the solid-state lighting market is divided into LED and OLED. In terms of the product, the solid-state lighting market is classified into Luminaires and lamps. The solid-state lighting market is segmented into Retrofit and New Installations. Regionally, the solid-state lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

LED technology is projected to account for 79.0% of the overall revenue in the solid state lighting market by 2025, maintaining its leadership position. This dominance has been sustained due to superior energy efficiency, extended operational life, and significant reductions in heat emissions compared to traditional lighting technologies.

Improved cost-to-performance ratios and flexible form factors have enabled wider adoption in diverse applications, from architectural to industrial lighting. LEDs also support tunable color temperatures and dynamic dimming, aligning with evolving user preferences in commercial, residential, and outdoor settings.

The transition toward sustainable urban infrastructure, coupled with smart building trends, has reinforced LED adoption globally.

Luminaires are expected to represent 61.0% of the total market revenue in 2025, positioning them as the leading product segment. Their prominence is attributed to integrated fixture designs that simplify installation, enhance design aesthetics, and deliver uniform lighting performance.

Demand has been fueled by architectural lighting upgrades, especially in commercial and retail environments, where energy code compliance and user comfort are key. The adoption of IoT-enabled luminaires capable of supporting daylight harvesting and occupancy sensing has further enhanced their value proposition.

Manufacturers are prioritizing modularity, longer lifecycle components, and recyclable materials to align with green building standards and circular economy goals.

Retrofit installations are projected to account for 55.0% of the revenue share in 2025, making them the top installation type in the solid state lighting market. The retrofit segment is being driven by the need to modernize outdated lighting systems without overhauling existing electrical infrastructure.

It enables cost-effective upgrades while delivering immediate energy savings and regulatory compliance, especially in older commercial buildings and public institutions. Utility rebate programs, shorter payback periods, and minimal downtime during installation have supported the retrofit trend.

As global building stock ages and efficiency mandates tighten, retrofitting is expected to remain the most pragmatic and scalable solution for lighting upgrades.

The solid state lighting market is growing due to increased demand for energy-efficient lighting solutions and advancements in LED technology. Growth in 2024 and 2025 was driven by the rising adoption of LEDs in both residential and commercial sectors. Opportunities lie in the development of smart lighting systems and the integration of LEDs in automotive and outdoor applications. Key trends include the increasing use of OLEDs and the shift toward tunable lighting solutions. However, high initial costs, competition from traditional lighting solutions, and technological challenges remain significant market restraints.

The primary growth driver is the rising demand for energy-efficient lighting solutions that comply with government regulations. In 2024 and 2025, the shift toward solid state lighting, especially LEDs, accelerated due to their low energy consumption and longer lifespan. Government regulations in various regions mandated the use of energy-efficient lighting in commercial, industrial, and residential buildings. As energy conservation efforts intensify, the transition to solid state lighting solutions, including LEDs and OLEDs, continues to fuel market growth globally.

Significant opportunities are emerging with the development of smart lighting systems and integration with the Internet of Things (IoT). In 2025, IoT-enabled lighting solutions became increasingly popular in commercial spaces, offering real-time control, energy management, and automation. The demand for smart bulbs and connected lighting systems, which allow users to control brightness, color, and scheduling through mobile apps, created new market segments. These advancements highlight the growing demand for lighting systems that offer enhanced user experience and improved energy efficiency in both residential and commercial spaces.

Emerging trends include the use of organic light-emitting diodes (OLEDs) and adaptive lighting systems. In 2024, OLEDs gained attention for their potential to deliver flexible, energy-efficient, and aesthetically pleasing lighting solutions, particularly in display applications. The adoption of adaptive lighting solutions, which adjust based on ambient light or occupancy, became more common in commercial and residential applications. These trends indicate that the market is evolving toward more customizable, flexible, and intelligent lighting solutions to meet diverse consumer needs and improve environmental impact.

Market restraints include high initial investment costs and limited consumer awareness of solid state lighting benefits. In 2024 and 2025, although LED and OLED technologies offered long-term savings, the upfront cost of these products remained a significant barrier for many residential and commercial consumers. Additionally, a lack of awareness regarding the advantages of solid state lighting over traditional incandescent bulbs continued to limit broader adoption. Overcoming these challenges requires educating consumers and businesses about the long-term cost benefits and environmental advantages of transitioning to solid state lighting.

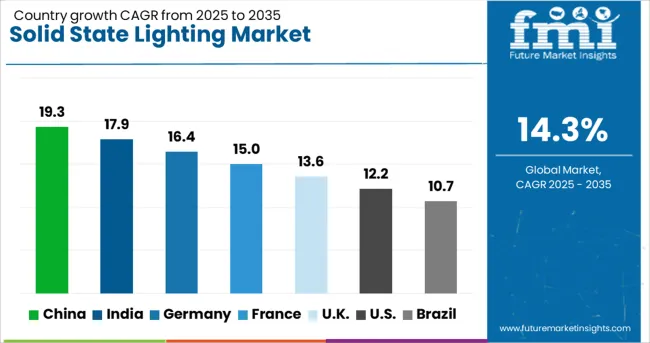

| Country | CAGR |

|---|---|

| China | 19.3% |

| India | 17.9% |

| Germany | 16.4% |

| France | 15.0% |

| UK | 13.6% |

| USA | 12.2% |

| Brazil | 10.7% |

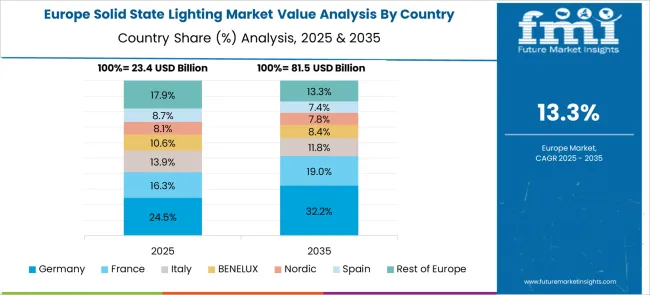

The global solid-state lighting (SSL) market is projected to grow at 14.3% CAGR during 2025–2035. China leads with 19.3% CAGR, driven by massive government initiatives, increased industrial demand, and the rapid adoption of LED technologies in both urban and rural infrastructure. India follows at 17.9%, fueled by growth in commercial and residential sectors, coupled with government support for energy-efficient solutions. France records 15% CAGR, supported by strong sustainability goals and adoption of eco-friendly lighting solutions. The United Kingdom grows at 13.6%, while the United States posts 12.2%, reflecting steady demand for energy-efficient lighting solutions and smart city integrations. Asia-Pacific dominates growth due to cost advantages and infrastructure demand, while Europe and North America emphasize high-performance and smart lighting technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The solid-state lighting market in China is forecasted to grow at 19.3% CAGR, driven by substantial investments in LED technology and national energy efficiency programs. Demand for energy-saving lighting solutions in commercial, residential, and industrial sectors is growing rapidly, with a shift towards smart lighting systems and connected lighting in urban developments. Government incentives, such as subsidies for energy-efficient lighting, further boost market penetration. China’s leadership in manufacturing LED components strengthens its position in the global SSL market.

The solid-state lighting market in India is projected to grow at 17.9% CAGR, driven by rapid urbanization, rising demand for energy-efficient lighting, and the government’s push for LED adoption. The adoption of smart city initiatives across major cities increases the demand for connected lighting systems, offering energy savings and remote monitoring capabilities. The commercial and residential sectors, backed by growing disposable incomes and changing consumer preferences, also contribute to the expansion of the SSL market in India.

The solid-state lighting market in France is expected to grow at 15% CAGR, supported by the country’s green building regulations and demand for energy-efficient lighting solutions. France’s focus on reducing carbon emissions and improving energy efficiency in public infrastructure leads to widespread adoption of LED and smart lighting technologies. Additionally, the growing popularity of energy-efficient lighting in the commercial sector contributes to market growth. Sustainability-driven consumer preferences further accelerate the demand for eco-friendly lighting solutions.

The solid-state lighting market in the United Kingdom is projected to grow at 13.6% CAGR, driven by the government’s emphasis on sustainability and energy efficiency. The UK’s adoption of energy-efficient lighting solutions in both residential and commercial sectors continues to rise. Government initiatives supporting low-carbon technologies and the increasing trend of smart city developments push the demand for connected and intelligent lighting systems. As part of the UK’s green initiatives, retrofitting existing infrastructure with LED lighting further boosts the market.

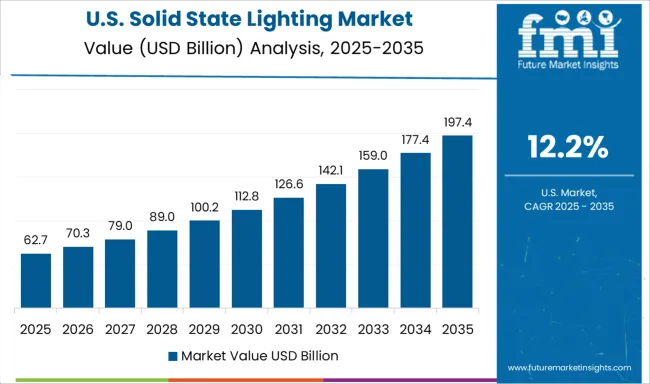

The solid-state lighting market in the United States is projected to grow at 12.2% CAGR, driven by demand for energy-efficient lighting in commercial, industrial, and residential applications. The USA focus on smart cities and advanced lighting technologies supports the adoption of connected SSL systems, integrating IoT and automation for energy management. Increasing awareness of environmental sustainability and the shift towards green building certifications also encourage demand for LED and smart lighting solutions. Federal and state government programs incentivize the use of energy-efficient lighting in public infrastructure and private enterprises.

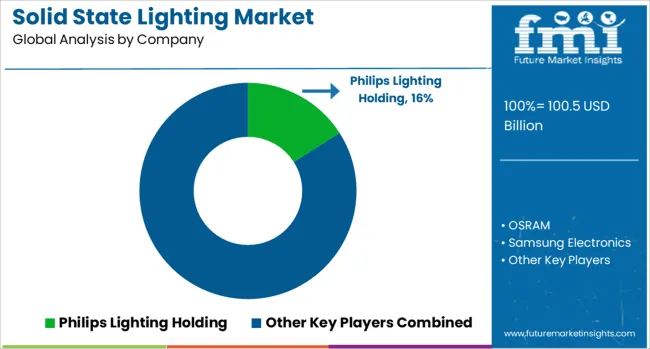

The solid-state lighting (SSL) market is dominated by Philips Lighting Holding, which secures its leadership through a wide range of energy-efficient LED solutions for residential, commercial, and industrial applications. Philips strengthens its dominant position by leveraging its expertise in connected lighting systems and smart home integrations. Key players such as OSRAM, Samsung Electronics, General Electric, and Mitsubishi Electric maintain significant market shares by providing innovative SSL technologies, including LEDs, OLEDs, and advanced lighting controls designed to reduce energy consumption and improve lighting quality. These companies focus on enhancing product performance, longevity, and adaptability to diverse environmental conditions across various applications.

Emerging players like Eaton and Bridgelux are expanding their presence by offering high-performance SSL solutions tailored to specific market needs, such as horticultural lighting, automotive applications, and architectural designs. Their strategies include developing next-generation LEDs with improved light output, color rendering, and energy efficiency. Market growth is driven by the increasing adoption of energy-efficient lighting systems, stringent energy regulations, and growing demand for smart lighting solutions. Continuous advancements in LED technology, integration with IoT platforms, and the development of tunable white and human-centric lighting solutions are expected to influence competitive dynamics, creating opportunities for both established players and emerging innovators globally.

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD 100.5 Billion |

| Technology | LED and OLED |

| Product | Luminaires and Lamp |

| Installation | Retrofit and New |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Philips Lighting Holding, OSRAM, Samsung Electronics, General Electric, Mitsubishi Electric, Eaton, and Bridgelux |

| Additional Attributes | Dollar sales by lighting type (LED, OLED, PLED) and application segment (indoor, outdoor, specialty lighting); segmentation by installation type (new installations vs. retrofits); end-use sector breakdown (residential, commercial, industrial, automotive, healthcare). Regional market share: North America leading with 34.7% in 2023, followed by Asia-Pacific and Europe. Innovation in smart lighting integration (IoT-enabled, tunable white, circadian lighting). Environmental impact considerations (energy savings, CO₂ reduction, recyclability). Emerging applications in horticultural lighting, UV disinfection, and automotive lighting systems. |

The global solid-state lighting market is estimated to be valued at USD 100.5 billion in 2025.

The market size for the solid-state lighting market is projected to reach USD 382.5 billion by 2035.

The solid-state lighting market is expected to grow at a 14.3% CAGR between 2025 and 2035.

The key product types in solid-state lighting market are led and oled.

In terms of product, luminaires segment to command 61.0% share in the solid-state lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Strobe Lighting Market Size and Share Forecast Outlook 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Marine Lighting Market

Runway Lighting System Market

Plasma Lighting Market

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Wireless Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA