The stadium lighting market is estimated to be valued at USD 856.1 million in 2025 and is projected to reach USD 1900.2 million by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period. This growth highlights a strong replacement cycle as older halogen and metal halide systems are being phased out in favor of advanced LED-based lighting that offers superior energy efficiency, longer lifespans, and enhanced illumination quality.

Demand is also rising due to growing sports infrastructure investments, both for professional leagues and community-level arenas, where governments and private entities are investing heavily to modernize facilities. Smart control systems, color-tunable lighting, and integration with IoT platforms are further accelerating adoption, making stadiums more versatile for sports, concerts, and multipurpose events.

Facility managers evaluate stadium lighting specifications based on illumination uniformity, glare control, and broadcast compatibility when planning venue upgrades or new construction projects for professional sports, collegiate athletics, and multi-purpose entertainment facilities.

Equipment selection involves analyzing lumen output, color temperature consistency, and dimming capabilities while considering installation height requirements, maintenance accessibility, and structural load limitations that influence mounting system design. Procurement decisions balance initial capital investment against operational savings including energy consumption reduction, maintenance interval extension, and broadcast quality enhancement that improve facility utilization and revenue generation potential.

Manufacturing processes require precision LED assembly, optical design optimization, and thermal management systems that ensure consistent light output and extended operational lifecycles under demanding outdoor environmental conditions. Production coordination involves managing semiconductor sourcing, lens fabrication, and housing assembly while maintaining photometric performance specifications and environmental protection ratings.

Quality assurance procedures address light distribution testing, thermal cycling validation, and ingress protection verification that confirm fixture performance throughout extended operational periods under varying weather conditions and temperature extremes.

Cross-functional coordination involves lighting designers, structural engineers, and broadcast consultants collaborating to optimize illumination systems that balance player performance visibility with television production requirements while addressing architectural integration and installation complexity.

Installation processes require specialized lifting equipment, electrical infrastructure upgrades, and coordination with sports scheduling that minimizes facility disruption during retrofit projects. Commissioning procedures establish photometric verification, control system programming, and maintenance protocol training that ensure optimal lighting performance throughout venue operational requirements.

Technology advancement prioritizes intelligent lighting controls, wireless communication systems, and predictive maintenance capabilities that optimize energy consumption while providing dynamic lighting scenarios for different event types and broadcast requirements. Manufacturers develop modular fixture designs, integrated sensor systems, and cloud-based monitoring platforms that enable remote facility management while supporting real-time performance optimization and proactive maintenance scheduling.

| Metric | Value |

|---|---|

| Stadium Lighting Market Estimated Value in (2025 E) | USD 856.1 million |

| Stadium Lighting Market Forecast Value in (2035 F) | USD 1900.2 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

The stadium lighting market is expanding steadily due to the global rise in sports events, demand for energy efficient solutions, and growing investment in sports infrastructure modernization. Governments, sports authorities, and private organizations are upgrading lighting systems to meet international standards for broadcasting clarity, athlete performance, and spectator experience.

Advanced lighting technologies are being adopted to enhance uniformity, reduce glare, and support slow motion and high definition broadcasting. Additionally, sustainability targets and cost-saving objectives have accelerated the shift toward long-lasting, low-maintenance lighting systems.

The market outlook remains strong as the demand for reliable and intelligent lighting continues to grow across both new and existing sports venues, driven by the increasing frequency of global tournaments and multiuse arena applications.

The stadium lighting market is segmented by light source, sports type, installation type, distribution channel, and geographic regions. By light source, the stadium lighting market is divided into Light-Emitting Diode (LED), High-Intensity Discharge, High-Pressure Sodium, and Induction Lights. In terms of sports type, the stadium lighting market is classified into Indoor and Outdoor. Based on the installation type, the stadium lighting market is segmented into New installation and Retrofit.

By distribution channel, the stadium lighting market is segmented into Direct sales and Indirect sales. Regionally, the stadium lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The light emitting diode segment is projected to hold 57.20% of total revenue by 2025 within the light source category, positioning it as the dominant segment. The energy efficiency, durability, and superior brightness of LED systems drive this leadership.

LEDs offer longer lifespan, minimal heat emission, and instant illumination, making them ideal for dynamic and high performance sports settings. Their compatibility with smart lighting controls and ability to support advanced broadcasting requirements have reinforced adoption in large stadiums and multifunction arenas.

As venues aim to lower operational costs and meet sustainability goals, the LED segment has emerged as the preferred lighting solution, displacing traditional metal halide and fluorescent systems across both new and retrofit projects.

The indoor sports type segment is expected to account for 53.60% of total market revenue by 2025, making it the leading segment. This dominance is supported by the growing number of indoor arenas being constructed for sports like basketball, badminton, volleyball, and indoor soccer.

Indoor venues demand high precision lighting with consistent intensity and controlled glare to support both player visibility and spectator comfort. Additionally, enclosed environments enable better control over lighting design, uniformity, and energy use.

Increased hosting of tournaments, entertainment events, and multiuse programming within indoor facilities has further elevated the importance of advanced stadium lighting solutions. These factors have collectively contributed to the strong positioning of indoor lighting applications in the overall market.

The new installation segment is anticipated to capture 64.10% of total revenue by 2025 within the installation type category, emerging as the dominant segment. This is driven by global investment in new stadium development across both developed and emerging economies.

New projects prioritize integrated lighting design that aligns with international sports federation guidelines and environmental benchmarks. These installations allow for the deployment of cutting edge technologies without retrofitting constraints, improving design efficiency and future scalability.

As urban centers expand and host cities prepare for major international sporting events, new stadium construction is accelerating. This trend supports the continued leadership of the new installation segment in shaping the future of stadium lighting solutions.

The stadium lighting market is experiencing growth driven by the increasing demand for high-quality, energy-efficient lighting solutions in sports venues, stadiums, and arenas. With the rise of global sporting events and the expansion of sports infrastructure, the need for advanced lighting systems that offer optimal visibility, durability, and energy savings is growing. LED technology, known for its energy efficiency, long lifespan, and low maintenance costs, is increasingly being adopted in stadiums around the world. Additionally, the integration of smart lighting systems that provide greater control and flexibility is also contributing to the market’s expansion.

The growing need for energy-efficient and high-quality lighting is a key driver of the stadium lighting market. With the increasing number of large-scale sporting events and the need for consistent lighting quality for both athletes and spectators, sports venues are seeking advanced lighting solutions that can enhance the viewing experience. LED technology, in particular, is favored due to its lower energy consumption and longer lifespan compared to traditional lighting sources like metal halide or halogen lamps. These benefits help reduce operational costs and maintenance while providing superior brightness and uniformity. As sports venues strive to meet sustainability goals and reduce their energy footprint, the demand for energy-efficient stadium lighting is expected to continue growing.

Despite the market’s growth, the stadium lighting sector faces challenges, primarily due to high initial installation costs and compatibility issues. Although LED lighting and smart solutions offer long-term savings, the upfront costs for upgrading or installing these systems can be significant, especially for smaller venues or organizations with budget constraints. Additionally, integrating new lighting systems with existing infrastructure can present challenges, especially for older venues, requiring extensive modifications. Addressing these challenges involves offering affordable, flexible solutions and financial incentives that can help ease the burden of initial investment for stadium operators.

The stadium lighting market offers numerous growth opportunities with the increasing adoption of smart lighting systems and advanced control features. Smart lighting allows for adaptive lighting, where lighting levels can be adjusted based on specific needs, such as event type, training, or maintenance schedules. These systems also help improve energy efficiency by minimizing unnecessary power use during non-event hours. Additionally, integrating lighting control with other stadium management systems enables better coordination and operation. These advancements provide stadium operators with greater flexibility, efficiency, and control over their lighting systems, contributing to the market’s growth.

A significant trend in the stadium lighting market is the growing integration of LED technology and dynamic lighting control systems. LEDs are becoming the preferred choice for stadium lighting due to their energy efficiency, longevity, and ability to produce bright, uniform illumination. Furthermore, dynamic lighting control systems allow for real-time adjustments to lighting, enhancing both the spectator and athlete experience. These systems enable customization based on event needs, such as light intensity and color adjustments, which adds excitement to live events. As these technologies continue to evolve, they will shape the future of stadium lighting, providing venues with better performance, reduced operational costs, and greater flexibility.

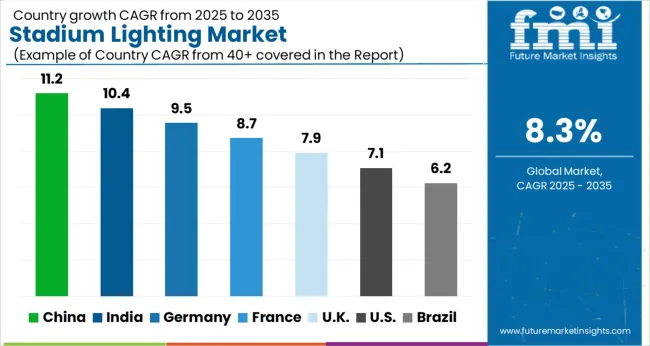

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global stadium lighting market is projected to grow at a global CAGR of 8.3% from 2025 to 2035. China leads the market with a growth rate of 11.2%, followed by India at 10.4%. France records a growth rate of 8.7%, while the UK shows 7.9% and the USA follows at 7.1%. The market is primarily driven by the increasing demand for energy-efficient, high-performance lighting solutions in sports stadiums, entertainment venues, and outdoor arenas. China and India are leading the growth, supported by rapid urbanization, infrastructure development, and increasing investments in sports facilities. Developed economies like France, the UK, and the USA are witnessing steady growth, driven by technological advancements and growing demand for LED and smart lighting systems. The analysis spans over 40+ countries, with the leading markets shown below.

The stadium lighting market in China is expanding at an 11.2% CAGR, driven by the country’s large-scale infrastructure development and increasing investment in sports facilities. As China continues to urbanize, the demand for modern sports stadiums and entertainment venues equipped with energy-efficient lighting solutions is growing rapidly. The Chinese government’s focus on improving public sports infrastructure and hosting major international sporting events is further boosting the adoption of advanced stadium lighting technologies. The shift towards LED and smart lighting systems that reduce energy consumption and enhance the fan experience is contributing to the market’s growth.

The stadium lighting market in India is projected to grow at a 10.4% CAGR, supported by increasing investments in sports infrastructure and modernization of existing stadiums. As India prepares to host more international sporting events, the demand for high-performance, energy-efficient lighting systems in stadiums is rising. The growing focus on improving sports facilities at the grassroots level and urban development is further boosting the adoption of advanced lighting technologies. India’s shift toward LED lighting and eco-friendly solutions is contributing to the market’s growth, as these technologies reduce energy consumption and operational costs.

<

The stadium lighting market in France is expected to grow at an 8.7% CAGR, driven by the country’s focus on modernizing sports facilities and improving the fan experience. With France’s increasing emphasis on energy efficiency and sustainability in public infrastructure, stadiums are increasingly adopting advanced lighting systems like LEDs that offer longer lifespans and reduced energy consumption. The growing popularity of sports events and the demand for enhanced lighting in outdoor arenas are further supporting market growth. France’s strong commitment to environmental regulations and green building standards is also contributing to the rise in demand for energy-efficient lighting systems in sports venues.

The UK stadium lighting market is projected to grow at a 7.9% CAGR, supported by rising demand for high-quality, energy-efficient lighting systems in sports venues. As the UK continues to host major sports events, the need for cutting-edge lighting technologies that enhance the spectator experience and reduce energy consumption is increasing. The growing focus on sustainability and reducing operational costs in stadium management is driving the adoption of LED lighting and smart lighting systems. The UK government’s emphasis on energy-efficient technologies and its commitment to modernizing sports infrastructure further fuel the market’s growth.

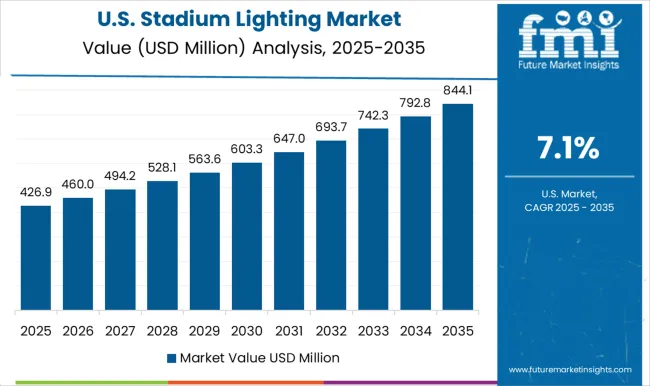

The USA stadium lighting market is expected to grow at a 7.1% CAGR, driven by the demand for advanced lighting systems in sports arenas and large outdoor venues. As the USA continues to invest in the renovation and development of stadiums, the adoption of energy-efficient lighting technologies like LED and smart lighting is rising. The USA sports industry’s focus on providing an enhanced fan experience while reducing operational costs is a key driver of this market. The increasing trend of hosting international sports events in the USA is further contributing to the need for state-of-the-art stadium lighting solutions.

The stadium lighting market is witnessing significant growth, driven by the increasing demand for high-quality, energy-efficient, and durable lighting solutions in sports venues worldwide. Key players in the market include Acuity Brands Inc., AEON LED LLC, Bajaj Electricals Ltd., Cree Lighting (a company of IDEAL INDUSTRIES), Eaton Corporation plc, GE Lighting (a Savant company), LEDiL Oy, Ledworks SRL, LG Electronics Inc., Musco Lighting LLC, OSRAM GmbH, Signify Holding B.V. (Philips Lighting), Schréder Group, SLI Lighting Solutions, Thorn Lighting Ltd. (Zumtobel Group), Transrail Lighting Ltd., and Zumtobel Group AG.

Musco Lighting LLC and Signify (Philips Lighting) are leading innovators in stadium lighting, providing energy-efficient LED solutions that offer high performance and low operational costs. GE Lighting and OSRAM GmbH also offer advanced, high-brightness lighting solutions, focusing on creating a superior viewing experience while ensuring sustainability. Acuity Brands and Eaton Corporation specialize in comprehensive lighting systems for large-scale sports venues, incorporating smart technology for enhanced control and energy savings. LG Electronics and Bajaj Electricals Ltd. deliver high-quality LED lights with long life spans, suitable for both indoor and outdoor stadium applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 856.1 Million |

| Light Source | Light-Emitting Diode (LED), High-Intensity Discharge, High-Pressure Sodium, and Induction Lights |

| Sports Type | Indoor and Outdoor |

| Installation Type | New installation and Retrofit |

| Distribution channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Acuity Brands Inc., AEON LED LLC, Bajaj Electricals Ltd., Cree Lighting (a company of IDEAL INDUSTRIES), Eaton Corporation plc, GE Lighting (a Savant company), LEDiL Oy, Ledworks SRL, LG Electronics Inc., Musco Lighting LLC, OSRAM GmbH, Signify Holding B.V. (Philips Lighting), Schréder Group, SLI Lighting Solutions, Thorn Lighting Ltd. (Zumtobel Group), Transrail Lighting Ltd., Zumtobel Group AG |

| Additional Attributes | Dollar sales by product type (LED stadium lighting, halogen, metal halide lighting) and end-use segments (sports stadiums, arenas, outdoor events, broadcasting). Demand dynamics are driven by increasing investments in sports infrastructure, a shift towards energy-efficient LED lighting, and the growing need for high-performance, durable lighting solutions for live events. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in smart lighting, energy efficiency, and sustainability driving market expansion. |

The global stadium lighting market is estimated to be valued at USD 856.1 million in 2025.

The market size for the stadium lighting market is projected to reach USD 1,900.2 million by 2035.

The stadium lighting market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in stadium lighting market are light-emitting diode (led), high-intensity discharge, high-pressure sodium and induction lights.

In terms of sports type, indoor segment to command 53.6% share in the stadium lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Stadium Security Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Smart Stadium Market Size and Share Forecast Outlook 2025 to 2035

Strobe Lighting Market Size and Share Forecast Outlook 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Marine Lighting Market

Runway Lighting System Market

Plasma Lighting Market

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA