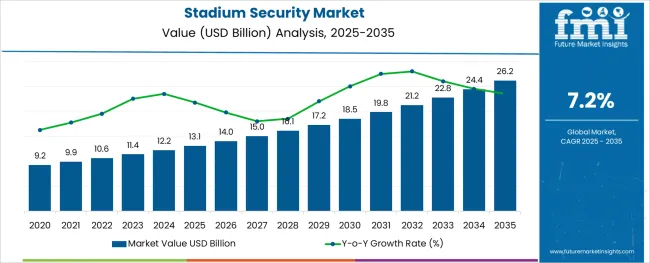

The Stadium Security Market is estimated to be valued at USD 13.1 billion in 2025 and is projected to reach USD 26.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The stadium security market is witnessing substantial growth fueled by increasing investments in public safety, rising attendance at live events, and the growing complexity of crowd management. Stadium operators and event organizers are prioritizing advanced security technologies to mitigate threats, ensure operational continuity, and enhance visitor experience. This includes the integration of high-definition surveillance, facial recognition, access control, and real-time incident response platforms.

Government regulations and sports league mandates are also influencing the adoption of standardized security frameworks and interoperable systems. Additionally, threats related to terrorism, hooliganism, and cyber vulnerabilities in connected venues have elevated the importance of comprehensive security strategies.

Stakeholders are increasingly adopting a layered security approach that combines physical infrastructure with analytics-driven monitoring systems. With smart stadium initiatives gaining traction, future growth is expected to be shaped by scalable, cloud-compatible platforms supported by data analytics and partner-driven deployment models that align with both legacy systems and modern digital infrastructure.

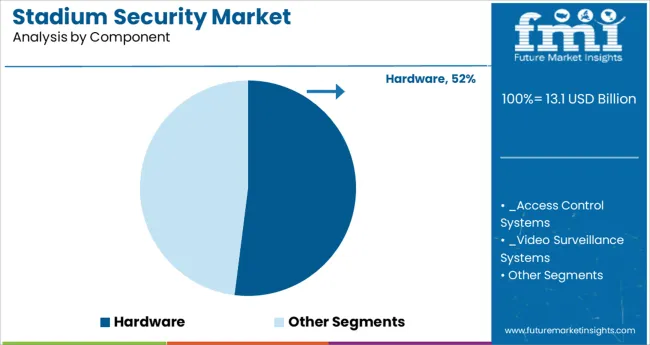

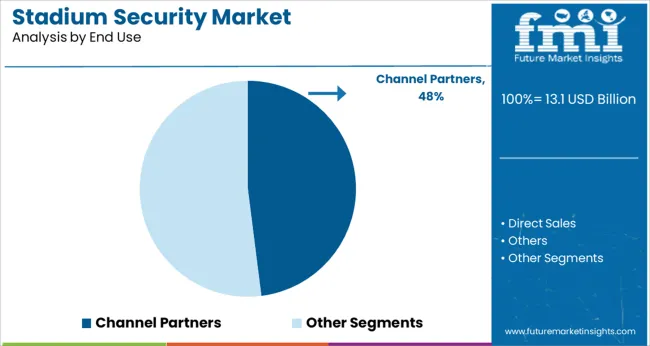

The market is segmented by Component and End Use and region. By Component, the market is divided into Hardware, Software, Services, and Direct Sales. In terms of End Use, the market is classified into Channel Partners, Direct Sales, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Component and End Use and region. By Component, the market is divided into Hardware, Software, Services, and Direct Sales. In terms of End Use, the market is classified into Channel Partners, Direct Sales, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is anticipated to hold 52.0% of the total revenue share in 2025, establishing itself as the dominant contributor within the stadium security market. This leadership is supported by the foundational role hardware plays in surveillance and access management systems.

Demand has remained strong for physical infrastructure including CCTV cameras, perimeter sensors, biometric scanners, metal detectors, and turnstile access points. The ongoing modernization of stadiums and the push for end-to-end security coverage have led to increased investments in hardware-intensive upgrades.

Integration with command and control systems and compatibility with emerging technologies such as artificial intelligence and machine learning have enhanced the value proposition of security hardware. The need for high-speed data capture, low-latency video processing, and weather-resistant equipment in outdoor environments has further driven hardware adoption across new stadium builds and retrofits.

Channel partners are projected to account for 48.0% of total market revenue in 2025 under the end use segment, making them a leading deployment and distribution group. This dominance is being driven by the critical role partners play in delivering end-to-end security solutions including consultation, system integration, technical support, and post-deployment service.

Channel partners have enabled scalable implementations of hardware and software across diverse stadium environments, ensuring compliance with local safety regulations and technical standards. Their ability to provide bundled offerings with installation, maintenance, and staff training has increased adoption among stadium operators seeking turnkey solutions.

Additionally, global technology vendors continue to rely on partner networks for market penetration, local expertise, and customization based on stadium size, capacity, and threat profile. As smart stadium models evolve, the relevance of channel partners in ensuring seamless upgrades, interoperability, and ongoing support is expected to grow, reinforcing their significant role in the value chain.

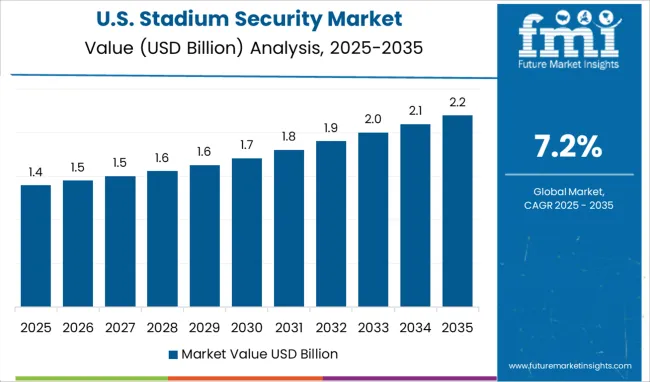

As per the Stadium Security Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2025, the market value of the Stadium Security Market increased at around 12.6% CAGR. In the forthcoming years, with a projected CAGR of 7.2%, the market is expected to gross an absolute dollar opportunity of USD 13.1 Billion from 2025 to 2035.

The growing number of sporting events and concerts held in stadiums is assisting the growth of the global Stadium Security Market. The importance of public security at stadiums is growing across the world. This compels stadium owners to build robust security systems such as intrusion alarm systems, metal detectors, CCTV cameras, access control systems, and fire alarm systems. Owing to some disastrous incidences in the past, stadium management has also been deploying facial recognition technology to restrict the troublemakers' access.

Terrorist attacks at an occasion or event at a stadium have been the key element driving the expansion of the stadium security industry in the coming years. The safety and security of the venues are critical for big events, such as shows, games, and other open social gatherings that take place in the arenas. Managing a large group of people is not an easy task, since group upheavals, misbehavior by some bystanders, and infractions are all too often.

Similarly, there is a strong risk of militant attacks at prime locations. In the past, the attacks including the 2020 Manchester attack and the 2020 Paris attack, posed a serious threat to human life. Numerous prominent players are implementing stadium surveillance systems at several large stadiums to get an advantage against tough competitors. Vodafone, for example, is expected to create a smart stadium safety and security system for the FIFA World Cup 2025 in Qatar.

The security of the stadium is a critical component in ensuring the safety of the spectators and providing a better observer experience. Each arena deployed with stadium security systems has a robust security framework that includes, but is not limited to, access CCTV Stadium Security Cameras, control frameworks, metal indications, interruption caution frameworks, and alarm frameworks, among others.

The growing occurrence of games organized in various parts of the world, as well as hordes of fans attending them, may continue to drive interest in arena security at an alarming rate. Short response times assured by security organizations during crises or unexpected events have been necessary to quickly flood the interest. According to arena experts, providing a unique experience and ensuring the security of attendees are of primary importance.

The growing use of Internet of Things (IoT) technology for efficient stadium infrastructure management, as well as a greater emphasis on engaging and pleasing people on the premises, are some of the reasons expected to drive the market for stadium security using technologies throughout the projected period. Several security standards for stadium construction have been enforced by sports governing organizations across the world.

For example, the Union of European Football Associations (UEFA) partnered with the UEFA Stadium and Security Council to develop the UEFA Stadium Facilities and Security and Safety Regulations. Its objective is to provide higher safety requirements for the seamless operation of events.

Intellect-based stadium security solutions provide efficient incident investigation and aid in the prevention of issues before they occur. These advantages are likely to enhance businesses to make an investment in stadium security management systems.

Anti-drone technology is also driving the market. Drones are increasingly being employed for business and recreational purposes. However, many individuals are apprehensive about the use of drones, not only for privacy, but also for safety.

Unauthorized drone usage near or within a stadium may not only be irritating or bothersome, but it may also endanger public safety if the drone crashes. Anti-drone technology is specialized by several businesses, including DroneShield in Australia and Anti-Drone in Denmark.

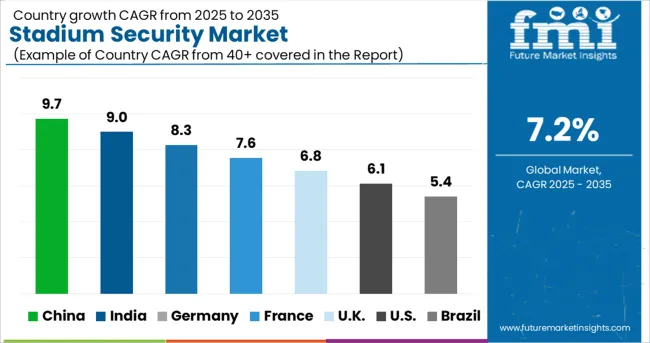

During the projected period, North America is expected to continue dominating the global Stadium Security Market with a market size of nearly USD 9.2 Billion. The Carolina Panthers confirmed spending more than USD 3 Million to enhance the security system at Bank of America (BOA) Stadium in September 2020.

Bomb-sniffing dogs and above 100 new metal detectors are part of the security system. Furthermore, in April 2020, Major League Soccer (MLS) committed to the deployment of improved security for all North American athletic league games. Innovative screening measures upon stadium admission at all matches are part of the new increased security.

The United States is expected to account for the largest market share of USD 26.2 Billion by the end of 2035 with a projected CAGR of 6.6% from 2025 to 2035.

Stadium management is implementing stadium security technology to engage its stadium attendees. With the advancement of technology, the region is witnessing the creation of smart stadiums. This is projected to increase the need for public address systems for enhanced crowd management.

The hardware segment is forecasted to grow at the highest CAGR of around 11.7% from 2025 to 2035. During the projected period, the hardware sector is likely to dominate the worldwide stadium security market. In terms of security and safety, the digital transformation would provide substantial advantages to all stadium administrators and visitors.

An example can be stated with the use of Radio-frequency identification (RFID) tagged cards invented by Zebra Technologies, which allows a user to enter the stadium but will restrict the user to go into the locker room. These ID cards with ultrahigh-frequency RFID may be read from a wider distance, but a security guard is typically required to ensure that unauthorized individuals do not try to slip through a doorway when it allows for an approaching user or cardholder.

Also, the smart stadium idea might incorporate a variety of technologies, beginning with the accessibility of parking space. The increased usage of IoT technology for effective stadium infrastructure management has also benefited the stadium security industry.

The Channel Partner segment is forecasted to grow at the highest CAGR of around 12% from 2025 to 2035. Choosing the right sales channel may not only impact the company's marketing strategy but also its prospective income. During the projected period, the channel partner sector is predicted to have a considerable revenue share. Distributors and system integrators are among the players in the channel partner category.

Channel partners assist stadium security makers in a variety of ways, including maintenance services and installation, brand, sales, and marketing assistance. Furthermore, it aids in increasing income from existing clients by satisfying more of their security demands.

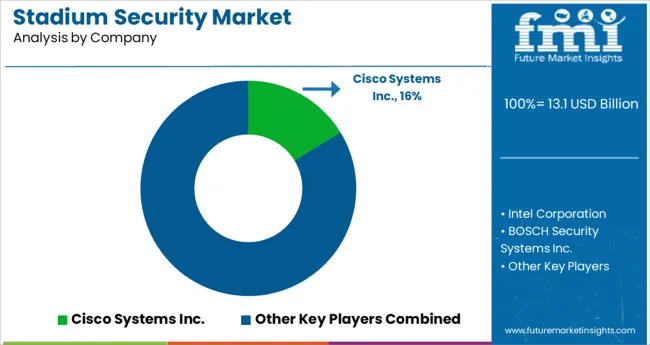

The Stadium Security Market is highly concentrated, with a few competitors accounting for the vast majority of the market share. The established firms are attempting to obtain supremacy in this sector. These firms are increasing their profits and market shares through smart joint projects. The key stadium security companies include Cisco Systems Inc., Intel Corporation, BOSCH Security Systems Inc., Avigilon Corporation, Honeywell International Inc., Axxonsoft, Genetec Inc., Rapiscan Systems, NEC Corporation, and Dallmeier.

Some of the recent developments in the Stadium Security market include:

Being a part of the SecureX system, Cisco Security will combine risk-based and threat vulnerability management, broadening the experience of the platform and offering full scorecards for security measures and threat response capabilities.

The purchase will be incorporated into Honeywell's Fire and Connected Life Safety systems division, expanding Honeywell's range of public safety communication services, and offering first responders increased situational awareness of building crises and improved life safety. USA Digital Designs' services, when integrated with Honeywell's solutions, will securely communicate precise data about the incident, such as the type of danger, severity, and position within the impacted structure, before when first responders arrive.

Similarly, recent developments related to companies in Stadium Security Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global stadium security market is estimated to be valued at USD 13.1 billion in 2025.

It is projected to reach USD 26.2 billion by 2035.

The market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types are hardware, _access control systems, _video surveillance systems, _others, software, _on-premise based, _cloud based, services, _installation and maintenance, direct sales and _others.

channel partners segment is expected to dominate with a 48.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Smart Stadium Market Size and Share Forecast Outlook 2025 to 2035

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA