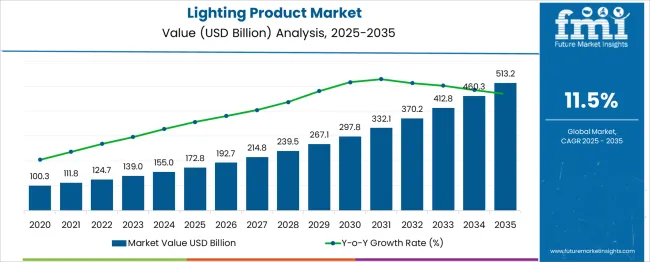

The Lighting Product Market is estimated to be valued at USD 172.8 billion in 2025 and is projected to reach USD 513.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

| Metric | Value |

|---|---|

| Lighting Product Market Estimated Value in (2025 E) | USD 172.8 billion |

| Lighting Product Market Forecast Value in (2035 F) | USD 513.2 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

As governments and regulatory bodies across major economies push for net-zero emissions and energy conservation, the demand for lighting products incorporating advanced control features and low-energy consumption continues to accelerate. A surge in urbanization, infrastructure modernization, and the digitization of buildings has further encouraged investment in smart lighting technologies.

The transition from conventional lighting to programmable, software-integrated solutions is reshaping the competitive landscape. Developments in light quality, lifespan enhancement, and thermal management have improved the reliability of modern lighting solutions, making them ideal for large-scale deployments.

Sustainability goals and building automation requirements are paving the way for widespread adoption of sensor-based, adaptive lighting systems. With continued support from policy frameworks, rising construction activity, and a growing preference for long-term energy savings, the Lighting Product market is expected to maintain a strong trajectory across both developed and emerging regions.

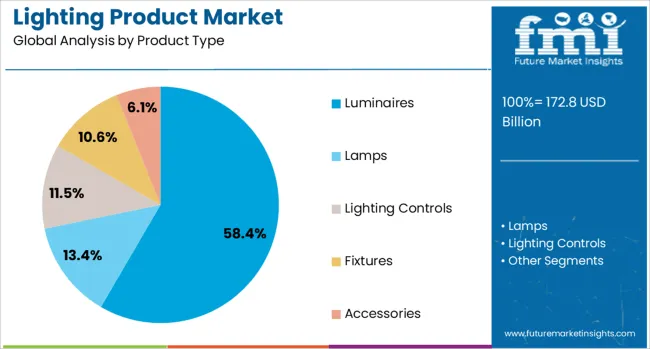

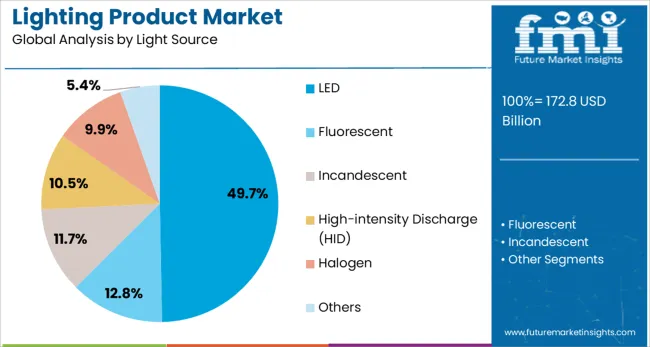

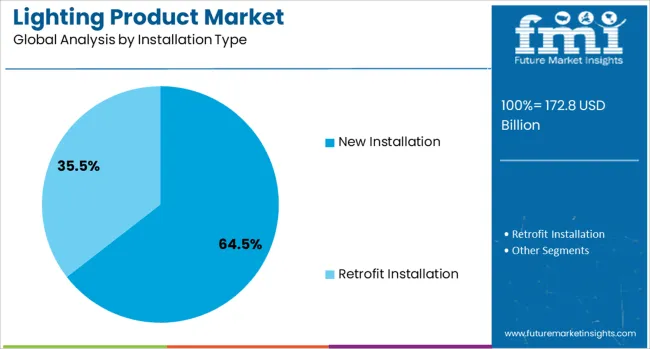

The lighting product market is segmented by product type, light source, installation type, application, distribution channel, end-use industry, and geographic regions. By product type, the lighting product market is divided into Luminaires, Lamps, Lighting Controls, Fixtures, and Accessories. In terms of light source, the lighting product market is classified into LED, Fluorescent, Incandescent, High-intensity Discharge (HID), Halogen, and Others. Based on the installation type of the lighting product, the market is segmented into New Installation and Retrofit Installation.

The lighting product market is segmented into Indoor and Outdoor. The distribution channel of the lighting product market is segmented into Retail, Direct Sales, and Wholesale. The end-use industry of the lighting product market is segmented into Commercial, Residential, Industrial, Automotive, Aerospace & Defense, Healthcare, Entertainment, and Others. Regionally, the lighting product industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The luminaires segment is expected to account for 58.4% of the total revenue share in the Lighting Product market in 2025, establishing it as the leading product category. The growth of this segment is being driven by the increasing demand for integrated lighting systems that offer both functional and aesthetic value across residential, commercial, and industrial settings.

Luminaires have become central to energy-efficient building design due to their adaptability with modern lighting controls and compatibility with energy-saving light sources. Their design flexibility and ability to support intelligent features such as dimming, occupancy sensing, and daylight harvesting have enhanced their relevance in contemporary architectural applications.

Moreover, innovations in material design, thermal management, and optics have allowed manufacturers to deliver high-performance luminaires with longer service life and improved light distribution. As sustainability-focused construction projects continue to gain momentum, luminaires are being increasingly specified in both retrofit and new installation projects, reinforcing their market dominance.

The LED light source segment is projected to capture 49.7% of the total Lighting Product market revenue in 2025, reflecting its pivotal role in the shift toward energy-efficient lighting solutions. This growth is being driven by the superior energy performance, extended lifespan, and declining cost of LED technology, which has made it the preferred light source across all major applications.

LEDs are being widely adopted in both indoor and outdoor lighting environments due to their low power consumption and ability to deliver uniform illumination with minimal heat generation. Advancements in LED chip design and optical engineering have further improved luminous efficacy, color rendering, and durability.

The compatibility of LEDs with smart lighting platforms and control systems has reinforced their integration into intelligent lighting infrastructures. Additionally, environmental considerations and regulatory incentives aimed at phasing out incandescent and fluorescent lamps are accelerating the adoption of LEDs in commercial, industrial, and public sector lighting deployments.

The new installation segment is forecast to contribute 64.5% of the total revenue share in the Lighting Product market in 2025, reflecting the dominance of greenfield infrastructure development and urban modernization initiatives. The segment’s growth is being supported by increasing construction activity across residential complexes, commercial buildings, industrial zones, and public infrastructure.

Governments and private developers are prioritizing energy-efficient lighting in new projects to align with sustainability mandates and building certification requirements. The integration of lighting with smart building systems, occupancy sensors, and daylight-responsive technologies has positioned new installations as a key driver for market expansion.

Furthermore, new installation environments offer the advantage of seamless planning for optimal lighting layouts, wiring infrastructure, and automation compatibility. As cities expand and smart infrastructure gains global traction, the demand for modern lighting systems designed from the ground up is set to remain strong, establishing new installation projects as a strategic contributor to the market’s overall growth.

Lighting products are evolving to serve diverse functional, aesthetic, and energy efficiency needs. Smart controls, design integration, and efficiency standards are shaping demand, while construction and renovation remain core growth engines for the industry.

Growing residential, commercial, and industrial construction has been a major driver for lighting products, with emphasis on energy efficiency, design versatility, and compliance with evolving building codes. Renovation projects, particularly in retail and hospitality spaces, are incorporating modern LED and decorative lighting to enhance ambiance and customer experience. Government initiatives promoting efficient lighting retrofits in public infrastructure and housing are adding to the momentum. The growing preference for modular, easy-to-install fixtures supports adoption in both new builds and refurbishments. Manufacturers are expanding portfolios to cater to mixed-use developments that require diverse lighting types for functional, decorative, and safety purposes, ensuring consistent market demand across varied applications and regions.

The adoption of intelligent control systems is reshaping the lighting product landscape, driven by demand for automation, remote monitoring, and energy optimization. IoT-based lighting enables features such as daylight harvesting, occupancy sensing, and programmable lighting schedules. Commercial and municipal projects increasingly integrate centralized control platforms to manage large-scale installations, improving efficiency and reducing operational costs. In residential applications, voice-activated and app-controlled lighting systems are gaining traction, supported by growing smart home adoption. The combination of aesthetic appeal, convenience, and measurable cost savings is compelling property owners to invest in advanced lighting solutions. This trend is creating opportunities for both established brands and specialized technology providers.

Energy-efficient lighting continues to dominate market preferences, with LEDs at the forefront due to their lower energy consumption, long lifespan, and reduced maintenance costs. Regulatory frameworks in multiple regions mandate minimum efficiency standards, prompting accelerated replacement of incandescent and fluorescent lighting. Industrial facilities and warehouses are transitioning to high-efficiency luminaires to cut electricity expenses and meet environmental compliance requirements. The expansion of green building certifications has indirectly bolstered the adoption of efficient lighting designs. Manufacturers are also focusing on integrating dimmable and tunable white lighting to support energy management while offering flexible lighting experiences for end-users, especially in multipurpose spaces.

Lighting has evolved from a purely functional element to a critical component of architectural design, influencing atmosphere, mood, and brand perception. In hospitality, retail, and luxury residential segments, customized lighting designs are used to create signature looks and enhance customer engagement. Advancements in fixture materials, finishes, and form factors allow designers greater freedom in integrating lighting seamlessly into interiors and exteriors. Decorative pendants, recessed lighting, and linear LED systems are in high demand for their ability to blend performance with visual appeal. The emphasis on aesthetics also drives premiumization, with buyers willing to invest in high-quality fixtures that elevate space value.

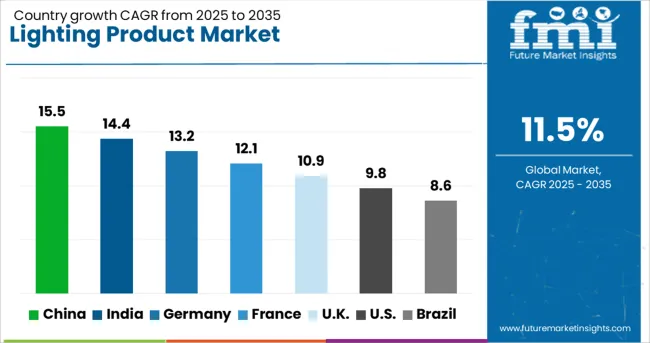

| Country | CAGR |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| France | 12.1% |

| UK | 10.9% |

| USA | 9.8% |

| Brazil | 8.6% |

The lighting product sector is projected to expand globally at a CAGR of 11.5% from 2025 to 2035, driven by the transition to energy-efficient solutions, integration of smart lighting systems, and demand from infrastructure development. China leads with a CAGR of 15.5%, supported by extensive urban infrastructure projects, aggressive LED adoption, and large-scale smart city programs. India follows at 14.4%, fueled by commercial real estate growth, government-backed street lighting upgrades, and rising residential installations. Germany records 13.2%, benefitting from industrial retrofits, advanced architectural lighting demand, and strong compliance with energy directives. The United Kingdom grows at 10.9%, supported by smart home adoption and energy efficiency mandates. The United States registers 9.8%, influenced by retrofitting of public buildings, commercial projects, and expansion in decorative lighting applications. The analysis indicates Asia-Pacific’s leadership in scale and technology adoption, while Europe and North America emphasize design innovation, efficiency compliance, and retrofit opportunities.

China is anticipated to record a CAGR of 15.5% between 2025 and 2035, up from nearly 13.8% in 2020–2024, positioning it far ahead of the global 11.5% average. The improvement is attributed to aggressive government-led LED deployment, widespread adoption of smart lighting systems, and integration of IoT-based controls in public and commercial infrastructure. Expanding smart city projects and rising demand for connected street lighting solutions continue to drive higher unit volumes and value-added product sales. Domestic manufacturers benefit from economies of scale and increasing exports to developing economies, further amplifying growth. The focus on high-efficiency luminaires in industrial and large-scale residential projects supports consistent momentum across sectors.

India is projected to post a CAGR of 14.4% in 2025–2035, rising from around 12.5% in 2020–2024, surpassing the global 11.5% average. This acceleration is linked to extensive public lighting modernization, commercial real estate expansion, and rising middle-class demand for decorative and functional lighting solutions. Government programs such as UJALA and smart pole initiatives are boosting mass adoption of energy-efficient lighting. Domestic production capacity for LED modules, fixtures, and drivers is expanding, reducing reliance on imports and improving cost competitiveness. Growing penetration of connected lighting in office spaces and high-end residential projects adds to premium segment growth, enhancing revenue opportunities for both domestic and global players.

Germany is forecasted to achieve a CAGR of 13.2% during 2025–2035, rising from about 11.6% in 2020–2024, above the global 11.5% rate. The improvement reflects strong adoption in architectural lighting, commercial retrofits, and industrial modernization programs. Compliance with stringent EU energy directives is pushing large-scale upgrades across municipal infrastructure and public buildings. The automotive and manufacturing sectors are also increasing their use of advanced lighting for precision tasks and safety enhancement. Germany’s well-established export base for high-quality luminaires and lighting controls further contributes to growth momentum. Demand for human-centric lighting solutions in offices and healthcare facilities adds a premium edge to the market.

The United Kingdom is projected to post a CAGR of 10.9% between 2025 and 2035, compared with approximately 9.2% during 2020–2024, close to the global 11.5% rate. This growth improvement comes from increased smart home adoption, expansion in commercial refurbishment projects, and retrofitting initiatives for public infrastructure. Demand for connected lighting systems integrated with home automation platforms has risen sharply, particularly in residential upgrades. Government-backed energy efficiency mandates are creating additional impetus for replacing legacy lighting in schools, hospitals, and offices. The hospitality sector’s focus on ambience-driven lighting in renovation projects is also aiding volume growth in decorative and functional segments.

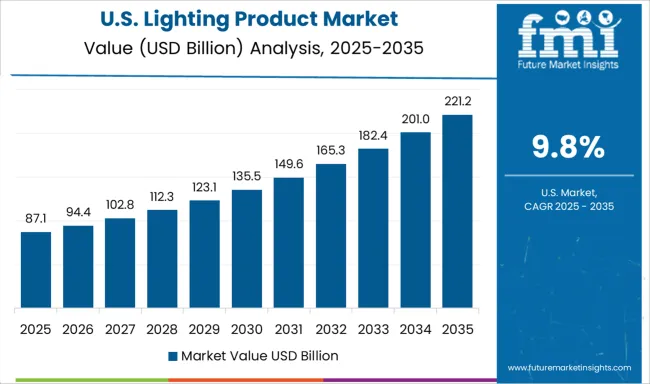

The United States is expected to register a CAGR of 9.8% during 2025–2035, up from about 8.4% in 2020–2024, slightly trailing the global 11.5% average. This upward shift is due to widespread retrofitting of municipal and commercial buildings, growing e-commerce sales channels for lighting products, and surging demand in decorative and specialty lighting categories. Federal and state programs supporting energy-efficient infrastructure are reinforcing market penetration in both public and private projects. The industrial sector is increasingly using LED and adaptive lighting for cost reduction and improved work safety. Premium consumer segments are investing in connected lighting systems with voice and app-based controls, driving higher per-unit revenues.

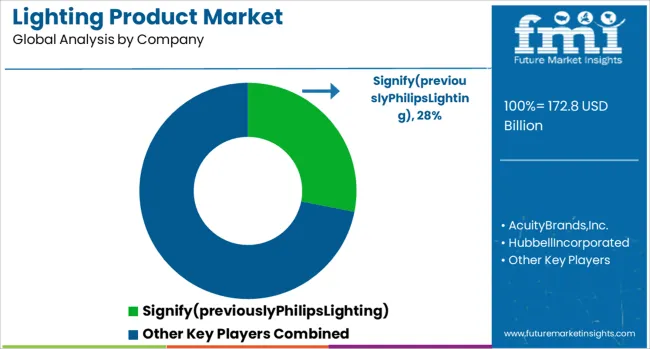

The lighting products market is shaped by prominent global and regional manufacturers such as Signify (previously Philips Lighting), Acuity Brands, Inc., Hubbell Incorporated, LSI Industries Inc., and Bajaj Electricals Limited. These players compete through product efficiency, design versatility, advanced control systems, and cost-effective manufacturing to cater to diverse consumer and commercial needs. Signify focuses on connected lighting solutions, LED innovations, and large-scale smart city projects. Acuity Brands, Inc. emphasizes integrated lighting and building management systems, targeting both indoor and outdoor applications. Hubbell Incorporated delivers a broad portfolio of residential, industrial, and utility lighting, with a strong presence in retrofit and infrastructure projects.

LSI Industries Inc. specializes in lighting solutions for retail, petroleum, and commercial sectors, offering customized design and installation services. Bajaj Electricals Limited leads in the Indian market with an extensive range of consumer and professional lighting products, supported by strong distribution and brand recognition. Competitive strategies center on IoT-enabled product lines, regional manufacturing expansion, and strengthening energy-efficient portfolios. These companies are scaling R&D in connected and adaptive lighting systems, focusing on integration with smart infrastructure. Future competitiveness will depend on balancing technological innovation with affordability, expanding into emerging markets, and meeting evolving regulatory standards for energy efficiency.

In April 2024, LSI Industries Inc. announced the acquisition of EMI Industries for USD 50 million to expand its store fixtures and display equipment portfolio.

| Item | Value |

|---|---|

| Quantitative Units | USD 172.8 Billion |

| Product Type | Luminaires, Lamps, Lighting Controls, Fixtures, and Accessories |

| Light Source | LED, Fluorescent, Incandescent, High-intensity Discharge (HID), Halogen, and Others |

| Installation Type | New Installation and Retrofit Installation |

| Application | Indoor and Outdoor |

| Distribution Channel | Retail, Direct Sales, and Wholesale |

| End-Use Industry | Commercial, Residential, Industrial, Automotive, Aerospace & Defense, Healthcare, Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Signify(previouslyPhilipsLighting), AcuityBrands,Inc., HubbellIncorporated, LSIIndustriesInc., and BajajElectricalsLimited |

| Additional Attributes | Dollar sales, share, growth by product category, competitive positioning, pricing trends, regional demand shifts, regulatory changes, technology adoption rates, and key customer segments. |

The global lighting product market is estimated to be valued at USD 172.8 billion in 2025.

The market size for the lighting product market is projected to reach USD 513.2 billion by 2035.

The lighting product market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in lighting product market are luminaires, lamps, lighting controls, fixtures and accessories.

In terms of light source, led segment to command 49.7% share in the lighting product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Product Cost Management Market

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA