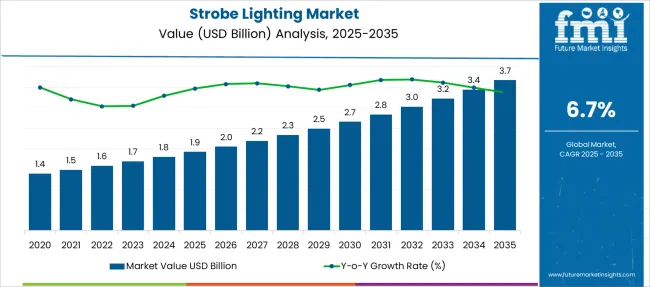

The Strobe Lighting Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Strobe Lighting Market Estimated Value in (2025 E) | USD 1.9 billion |

| Strobe Lighting Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The strobe lighting market is expanding steadily due to rising adoption across entertainment, industrial, and commercial environments where high-intensity, pulsating light is required for visibility, signaling, or visual effects. Increasing demand from sectors such as stage production, emergency services, and security systems has created sustained opportunities for manufacturers.

Technological innovation, particularly the shift toward LED-based systems, has improved energy efficiency, longevity, and customization, making strobe lights more versatile and cost-effective. Market momentum is further supported by regulatory emphasis on workplace safety and public infrastructure enhancements, where strobe lighting serves as an alert or warning mechanism.

As urbanization and commercial construction continue globally, the need for functional and durable lighting solutions is projected to drive future demand. The market is likely to benefit from increased investments in smart lighting systems and advanced lighting controls tailored for dynamic environments.

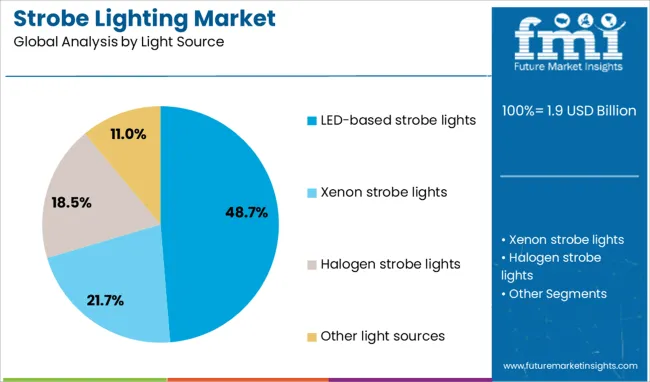

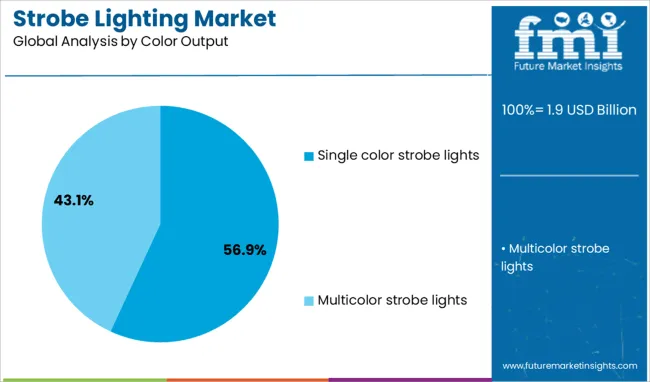

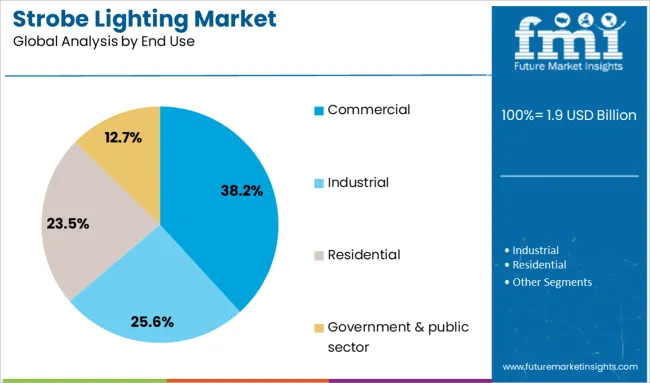

The strobe lighting market is segmented by light source, color output, and end use and geographic regions. The strobe lighting market is divided into LED-based strobe lights, Xenon strobe lights, Halogen strobe lights, and Other light sources. In terms of color output, the strobe lighting market is classified into single-color strobe lights and Multicolor strobe lights. Based on end use, the strobe lighting market is segmented into Commercial, Industrial, Residential, and Government & public sector. Regionally, the strobe lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED-based strobe lights segment dominates the light source category with a 48.7% market share, reflecting the widespread industry shift toward energy-efficient and low-maintenance lighting solutions. LED technology offers significant advantages including longer lifespan, reduced heat emission, and better control over brightness and frequency modulation.

These attributes have positioned LED strobe lights as the preferred choice across entertainment venues, emergency vehicles, and industrial signaling systems. Manufacturers are focusing on integrating smart control features such as remote operation, wireless synchronization, and programmable light patterns, enhancing user experience and functional reliability.

The segment's growth is further bolstered by regulatory push for energy conservation and the phasing out of older incandescent or xenon-based systems. Continued advancements in miniaturization, durability, and optical performance are expected to reinforce the dominance of LED-based strobe lights in the market landscape.

Single color strobe lights lead the color output category with a commanding 56.9% market share, driven by their simplicity, cost-effectiveness, and high applicability in standardized signaling and visual warning systems. These lights are commonly used in safety applications, security systems, and commercial signage where uniformity and clarity are essential.

Their popularity is sustained by ease of installation, minimal power consumption, and consistent output, making them suitable for both indoor and outdoor environments. Industries such as construction, transportation, and event management prefer single color variants for effective visibility and compliance with safety codes.

The segment benefits from standardization and mass production, allowing for reduced manufacturing costs and greater availability. With steady demand from institutional buyers and expanding use in utility and infrastructure projects, single color strobe lights are expected to retain their market dominance over the forecast period.

The commercial segment accounts for 38.2% of the strobe lighting market by end use, indicating its critical role in driving consistent demand across applications such as retail spaces, hospitality, signage, and public infrastructure. In commercial settings, strobe lighting is deployed to enhance visibility, attract attention, or provide emergency signaling, often integrated with broader building management or security systems.

The segment is gaining traction due to increasing investment in commercial real estate, smart city projects, and upgraded lighting systems in public facilities. Additionally, the growth of entertainment venues and night-time businesses is fueling adoption of dynamic lighting setups, including programmable strobe units.

Advancements in low-voltage and modular lighting systems have further simplified integration in complex commercial environments. As businesses continue to prioritize energy-efficient and reliable lighting solutions, the commercial segment is expected to remain a key contributor to overall market growth.

The strobe lighting market is expanding steadily, driven by applications in entertainment, industrial safety, and aviation signaling. Growth is supported by rising demand for high-intensity lighting in stage productions, emergency services, and warning systems. Opportunities are being generated through integration with smart control systems and LED-based energy-efficient designs.

Notable trends include wireless synchronization, ruggedized builds for outdoor events, and compact modular units for automotive and aerospace sectors. Restraints include high initial costs and fluctuations in component prices. The market outlook signals sustained demand from event production and safety-focused industries, with rapid penetration in smart lighting ecosystems.

Strong demand has emerged from the entertainment and event management sector, where strobe lights are essential for creating dynamic lighting effects. In 2024 and 2025, the adoption of LED-based strobes increased significantly in large-scale concerts and festivals due to their low power consumption and superior brightness.

Manufacturers have developed weather-resistant designs for outdoor installations, further fueling demand. The automotive sector also adopted strobe systems for emergency and signaling functions. This momentum indicates that performance-focused lighting solutions will remain central to market expansion across entertainment and safety-critical applications.

Significant opportunities exist in industrial safety and the adoption of smart control. In 2025, strobe lighting systems integrated with IoT-enabled controllers gained traction in manufacturing and warehouse environments for hazard signaling and emergency alerts. Aviation and marine sectors have shown rising interest in LED-based strobes for compliance with updated safety standards. These developments highlight a shift toward multifunctional systems offering connectivity and automation features. Suppliers focusing on intelligent strobe systems that integrate seamlessly with control software and energy management systems are expected to capture a competitive advantage in both developed and emerging markets.

Emerging trends in the strobe lighting market include wireless synchronization technology and miniaturized designs for diverse applications. In 2025, portable strobe systems for stage performances gained popularity due to easier setup and enhanced durability. Wireless control through mobile applications and DMX systems has transformed event lighting by reducing cabling requirements. Compact strobe units have also gained traction in automotive and drone-based signaling applications. Manufacturers are prioritizing energy-efficient LED solutions coupled with modularity, enabling flexible installation. These changes are expected to redefine user experience and operational efficiency in both commercial and industrial environments.

Key restraints affecting the market include high initial investment for advanced strobe lighting systems and fluctuating prices of LEDs and electronic components. In 2024, event organizers reported budget constraints for premium strobe installations despite rising demand for high-quality lighting experiences.

Additionally, cost-sensitive sectors in developing economies have opted for low-end alternatives, limiting the penetration of advanced products. Regulatory compliance for safety-critical applications has further increased certification costs, impacting profitability for smaller manufacturers.

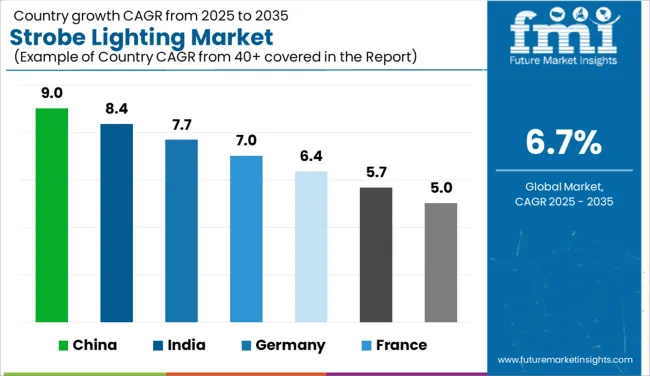

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global strobe lighting market is expected to grow at a 6.7% CAGR between 2025 and 2035. China leads with 9.0% CAGR, driven by strong demand from entertainment venues, event production, and architectural lighting projects. India follows at 8.4%, supported by growth in stage lighting solutions for cultural events and rising use in automotive signaling systems.

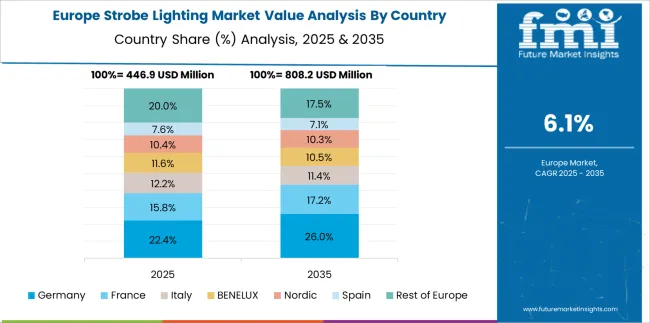

France posts 7.0%, backed by adoption in industrial safety lighting and creative lighting for entertainment. The UK records 6.4% CAGR, while the United States grows at 5.7%, showing stable demand but mature infrastructure in stage and concert production. Asia-Pacific dominates the global market, driven by rapid urbanization, entertainment industry investments, and automotive sector upgrades, while Europe and North America emphasize efficiency and smart strobe control systems.

China leads the global strobe lighting market with a projected 9.0% CAGR through 2035. Market expansion is fueled by large-scale investment in entertainment infrastructure, such as theaters, concert venues, and theme parks. The country’s booming events industry drives the adoption of advanced strobe lighting solutions with DMX control for stage performances and live shows. Automotive manufacturers are incorporating high-intensity strobes in signaling and hazard systems, contributing to segment growth. Domestic manufacturers dominate the market with cost-efficient LED-based strobe solutions, while global brands target premium segments with high-performance lighting technologies.

India’s strobe lighting market is expected to achieve 8.4% CAGR, supported by rapid growth in stage lighting for weddings, concerts, and cultural events. Increasing popularity of large-scale entertainment shows and live music festivals drives adoption of strobe systems with synchronized lighting effects. Automotive OEMs utilize strobe lights for advanced hazard signaling in premium and commercial vehicles. Domestic manufacturers are improving LED-based solutions to meet demand for energy efficiency and long service life. Imports of high-end strobe lighting systems from global brands remain strong for large venues and premium event applications.

France registers a 7.0% CAGR, with rising adoption of strobe lighting in industrial safety systems and entertainment venues. The country’s cultural events and music festivals maintain consistent demand for professional strobe lighting solutions with programmable features. Compliance with EU safety regulations fuels usage of strobe lighting in factories, warehouses, and emergency alert systems. French manufacturers and European suppliers focus on high-performance LED strobes with integrated smart controls for energy optimization and remote operation. Urban lighting projects also integrate strobes for architectural aesthetics.

The United Kingdom is projected to grow at 6.4% CAGR, driven by entertainment lighting upgrades and increased deployment in event management sectors. Rising demand from theme parks, exhibitions, and corporate event spaces supports market momentum. Automotive strobe lighting adoption is gradually increasing for safety signaling, especially in commercial fleets. Suppliers are introducing energy-efficient, dimmable LED strobe lights compatible with IoT-based lighting systems. UK event companies prioritize durable, weather-resistant strobe units for outdoor applications, driving innovation in product design and material resilience.

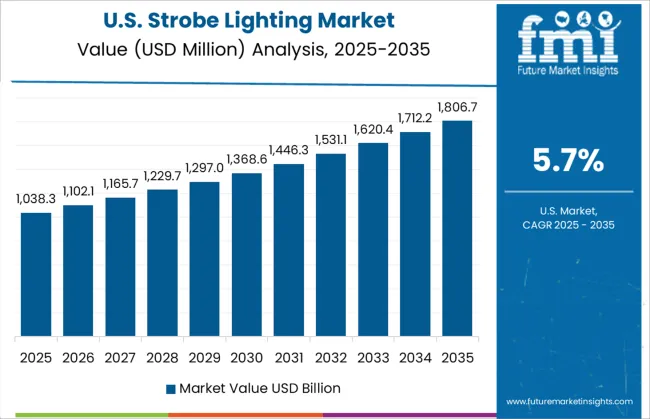

The United States strobe lighting market is forecasted to expand at 5.7% CAGR, indicating moderate growth driven by replacement demand in mature entertainment and industrial markets. Investments in theme parks, sports arenas, and stage production sustain steady adoption. Strobe lights for emergency warning systems and hazard signaling in industrial sites remain an important application segment. Premium strobe lighting solutions integrated with DMX and wireless control technologies dominate large-scale event installations. Sustainability considerations drive the shift toward energy-efficient LED strobes with longer operational lifespans.

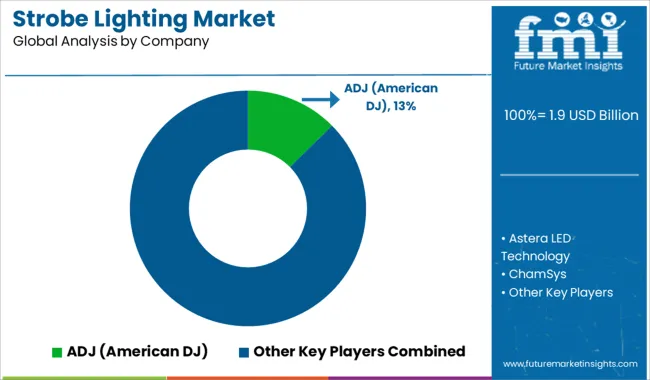

The strobe lighting market is moderately fragmented, with ADJ (American DJ) recognized as a leading player due to its comprehensive range of professional strobe lighting solutions for entertainment, stage, and event applications. The company’s focus on energy-efficient LED technology, durability, and dynamic lighting effects strengthens its position in the global market. Key players include Astera LED Technology, ChamSys, Chauvet Professional, Claypaky, Eternal Lighting, Elation Professional, GLP (German Light Products), Jands, Klarna, Lightbar UK, Martin, PR Lighting, Prolights, ROBE Lighting, and SpeedTechLight. These companies provide high-performance strobe lights for live concerts, clubs, theatres, and outdoor events, offering features such as DMX control, wireless connectivity, variable flash rates, and RGB color mixing for creative lighting designs. Market growth is driven by increasing demand for advanced stage lighting in live entertainment, music festivals, and corporate events, along with the growing adoption of LED-based strobe systems that deliver high output with lower energy consumption.

Leading manufacturers are focusing on product innovations such as IP-rated fixtures for outdoor use, smart lighting integration, and lightweight modular designs for easy installation and transport. Emerging trends include the integration of strobe lighting into synchronized lighting systems with automation and software-based programming for immersive experiences. North America and Europe dominate the market due to strong event and entertainment industries, while Asia-Pacific shows rapid growth with expanding concert and live performance markets.

LED-based strobe lighting is rapidly displacing xenon systems, driven by superior energy efficiency, extended operational life, and reduced maintenance costs. This technological shift enhances reliability for entertainment, industrial, and safety applications, making LED the preferred choice for both cost-effectiveness and performance across multiple sectors worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Light Source | LED-based strobe lights, Xenon strobe lights, Halogen strobe lights, and Other light sources |

| Color Output | Single color strobe lights and Multicolor strobe lights |

| End Use | Commercial, Industrial, Residential, and Government & public sector |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADJ (American DJ), Astera LED Technology, ChamSys, Chauvet Professional, Claypaky, Eternal Lighting, Elation Professional, GLP (German Light Products), Jands, Klarna, Lightbar UK, Martin, PR Lighting, Prolights, ROBE Lighting, and SpeedTechLight |

| Additional Attributes | Dollar sales by light source (LED vs xenon) and end-use (entertainment, industrial, emergency, aerospace). Market size was \~USD 1.8 billion in 2024, with LEDs rapidly gaining share. Asia-Pacific drives expansion, while North America adoption is fueled by safety regulations. Key innovations include ultra-fast LED strobes, color-tunable intensity, and programmable multi-pattern flash systems. |

The global strobe lighting market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the strobe lighting market is projected to reach USD 3.7 billion by 2035.

The strobe lighting market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in strobe lighting market are led-based strobe lights, xenon strobe lights, halogen strobe lights and other light sources.

In terms of color output, single color strobe lights segment to command 56.9% share in the strobe lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Marine Lighting Market

Runway Lighting System Market

Plasma Lighting Market

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Wireless Lighting Market Size and Share Forecast Outlook 2025 to 2035

Flexible Lighting Foils Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA