The high-end lighting market is anticipated to expand from USD 21.8 billion in 2025 to USD 45.8 billion by 2035, growing at a CAGR of 7.7%. The market demonstrates steady year-on-year growth, beginning with USD 15.1 billion in 2020 and reaching USD 21.8 billion in 2025. Early growth is driven by rising consumer demand for luxury and designer lighting solutions, coupled with increasing investments in smart and energy-efficient lighting technologies. From 2025 to 2030, the market scales significantly, increasing from USD 21.8 billion to around USD 29.4 billion.

This phase reflects wider adoption of connected and customizable lighting solutions in commercial and residential projects, along with heightened awareness of sustainability and energy savings. Manufacturers are increasingly focusing on premium finishes, smart integrations, and IoT-enabled lighting products, which accelerate revenue growth. Between 2030 and 2035, the market progresses from USD 29.4 billion to USD 45.8 billion, entering a consolidation stage. Growth during this period is supported by global expansion, mergers, and acquisitions, as well as diversification into niche luxury segments such as designer-led architectural lighting. Overall, the high-end lighting market’s year-on-year trajectory highlights a transition from early adoption to rapid scaling and eventual market stabilization, reflecting evolving consumer preferences, technological innovation, and premiumization trends.

| Metric | Value |

|---|---|

| High End Lighting Market Estimated Value in (2025 E) | USD 21.8 billion |

| High End Lighting Market Forecast Value in (2035 F) | USD 45.8 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The high end lighting market is experiencing robust expansion fueled by increasing demand for energy efficient, design driven, and smart lighting solutions in residential, commercial, and hospitality environments. Rising consumer preference for sustainable technologies combined with evolving aesthetics and wellness oriented interior design trends is accelerating adoption of high performance lighting systems.

Technological innovations in digital controls, tunable white lighting, and human centric lighting are enhancing both functionality and ambience, making lighting a key element in spatial design. High end consumers are increasingly seeking customizable lighting experiences that support automation, mood adaptability, and minimal energy consumption.

As regulations tighten on energy usage and sustainability benchmarks, lighting solutions offering long term value and enhanced user control are gaining prominence. The future of the market is being shaped by the intersection of design, technology, and efficiency where integrated systems offer both operational performance and elevated visual appeal.

The high-end lighting market is segmented by technology, product, connectivity, distribution channel, end use, and geographic regions. By technology, the high end lighting market is divided into LED lighting, Halogen lighting, CFL lighting, and Incandescent lighting. In terms of the high-end lighting market, it is classified into Luminaires, Lamps, and Architectural lighting. The high-end lighting market is segmented into Wired and Wireless. The distribution channel of the high-end lighting market is segmented into Online and Offline.

The end use of the high-end lighting market is segmented into Indoor, Industrial, Others, and Outdoor. Regionally, the high end lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED lighting segment is projected to account for 54.60% of total revenue by 2025 within the technology category, positioning it as the dominant choice in high end lighting. This is driven by its superior energy efficiency, extended product lifespan, and ability to deliver consistent lighting quality with minimal heat generation.

LED technology supports advanced dimming features and color tuning capabilities, which align with the demand for dynamic and mood based lighting environments. Its integration with smart controls and low maintenance requirements makes it ideal for luxury residential and commercial applications.

As environmental consciousness and energy performance become central to purchasing decisions, the LED segment continues to lead due to its ability to combine design flexibility with functional excellence.

The luminaires segment is anticipated to capture 41.30% of the total market revenue by 2025 in the product category, establishing it as the leading product type. Luminaires are preferred for their aesthetic impact, fixture variety, and design centered customization which appeal to premium buyers.

They offer a complete lighting solution that blends seamlessly with interior architecture while delivering optimal illumination and visual comfort. With demand rising for sculptural, statement lighting pieces and modular configurations, manufacturers are prioritizing form and function in equal measure.

Innovations in fixture design and materials have further elevated their appeal in high end residential, retail, and hospitality spaces, driving sustained dominance in the product category.

The wired connectivity segment is expected to contribute 62.40% of overall market revenue by 2025 under the connectivity category, making it the most utilized integration method. This is attributed to its reliability, security, and consistent performance, particularly in large scale architectural and commercial installations where stable and uninterrupted operation is essential.

Wired systems provide robust support for centralized control, complex lighting scenes, and precise dimming functionalities which are crucial for luxury lighting applications. Additionally, concerns over wireless interference, signal strength, and integration challenges in metal structured environments have maintained the preference for wired infrastructure.

As high end lighting becomes increasingly digital and programmable, wired connectivity remains the standard for seamless and scalable lighting networks.

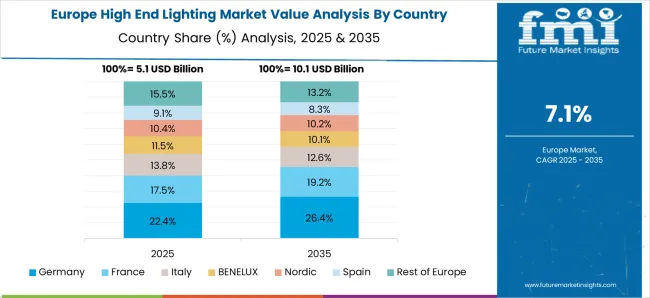

The high-end lighting market is experiencing steady growth as consumers and businesses increasingly prioritize aesthetic appeal, energy efficiency, and smart lighting solutions. Premium lighting products, including designer fixtures, LED systems, and smart-integrated luminaires, are widely adopted in luxury residences, commercial spaces, hotels, and architectural projects. North America and Europe lead due to higher disposable incomes and design-focused construction trends, while Asia-Pacific shows rising demand in urban development and luxury infrastructure. Market growth is driven by innovation in smart lighting, energy-efficient LEDs, customizable designs, and sustainable materials, along with multi-channel retailing including e-commerce and professional lighting distributors.

High-end lighting products often involve premium materials, intricate designs, and advanced technologies, resulting in higher production and installation costs. Customization requirements and integration with smart home systems further increase complexity. For small-scale manufacturers or cost-sensitive projects, these expenses can limit adoption. Until cost-effective design and manufacturing solutions become widespread, the market may face barriers in expanding to mid-tier residential and commercial segments despite strong demand for premium aesthetics.

Innovation in LED technology, IoT-enabled controls, and energy-efficient lighting systems is shaping the market. Smart lighting features such as remote control, voice activation, scene customization, and adaptive lighting enhance user experience and energy savings. Integration with building management systems and IoT ecosystems allows for automated and intelligent lighting solutions in commercial and residential settings. Manufacturers investing in R&D for innovative, energy-efficient, and connected lighting systems gain competitive advantage and cater to design-conscious, tech-savvy consumers.

High-end lighting products must adhere to energy efficiency, safety, and environmental standards. Regional regulations dictate energy ratings, RoHS compliance, and certifications for electrical safety. Non-compliance can lead to market access restrictions, fines, or reputational damage. Companies aligning products with global energy efficiency standards and sustainability certifications enhance market credibility and appeal, particularly in Europe and North America, where regulations and green building certifications strongly influence purchase decisions.

The high-end lighting market is competitive, with established brands offering premium designs and cutting-edge technology, while emerging players focus on niche designs and smart integrations. Distribution spans specialty lighting showrooms, e-commerce platforms, interior design collaborations, and luxury construction projects. Supply chain reliability, including sourcing high-quality components and skilled artisans, impacts production timelines and product quality. Competitive differentiation relies on design innovation, energy efficiency, customization, and brand reputation to capture affluent consumers and high-profile commercial projects globally.

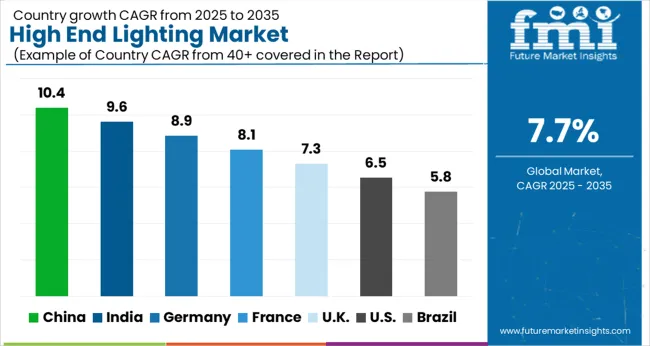

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The global High End Lighting Market is projected to grow at a CAGR of 7.7% through 2035, supported by increasing demand across architectural, commercial, and residential applications. Among BRICS nations, China has been recorded with 10.4% growth, driven by large-scale production and deployment in premium lighting solutions, while India has been observed at 9.6%, supported by rising utilization in commercial and luxury residential projects. In the OECD region, Germany has been measured at 8.9%, where production and adoption for architectural, commercial, and residential lighting have been steadily maintained. The United Kingdom has been noted at 7.3%, reflecting consistent use in high-end residential and commercial applications, while the USA has been recorded at 6.5%, with production and utilization across luxury, commercial, and architectural sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The high-end lighting market in China is growing at a CAGR of 10.4%, driven by increasing urbanization, rising disposable incomes, and a focus on luxury and smart home solutions. Demand is particularly strong in premium residential, commercial, and hospitality projects, where aesthetic appeal, energy efficiency, and advanced functionality are key factors. Technological innovations, including LED systems, smart lighting controls, and IoT integration, are accelerating market adoption. Government incentives for energy-efficient building solutions and growing awareness of sustainable lighting further support expansion. Additionally, retail and online channels are providing access to premium lighting products for both residential and commercial customers. The integration of design, performance, and energy efficiency ensures that high-end lighting continues to attract consumer and business investment across China.

The high-end lighting market in India is expanding at a CAGR of 9.6%, fueled by growing premium residential and commercial infrastructure development. Rising disposable incomes, increasing lifestyle-focused consumption, and the adoption of smart home technologies contribute to market growth. LED lighting, intelligent control systems, and energy-efficient solutions are becoming standard in luxury homes, hotels, and corporate offices. Government incentives promoting energy conservation and green building initiatives further encourage adoption of high-end lighting solutions. Online and offline retail channels are providing easy access to premium lighting products, while interior designers and architects are driving demand through customized solutions. As the Indian market shifts toward aesthetics, efficiency, and technology-enabled lighting, high-end lighting is poised for strong growth.

Germany’s high-end lighting market is growing at a CAGR of 8.9%, driven by sustainable architecture, smart lighting adoption, and a focus on premium design aesthetics. Commercial, hospitality, and luxury residential segments are leading demand, supported by LED innovations, energy-efficient systems, and intelligent controls. Environmental awareness and strict energy efficiency regulations encourage the adoption of advanced lighting solutions. Retailers, specialized distributors, and design professionals provide accessibility to high-quality lighting products. Integration with smart building systems and IoT platforms enhances user experience, while government incentives and certifications for sustainable building projects further boost market adoption. Overall, Germany’s emphasis on sustainability, design, and technological innovation ensures steady growth for the high-end lighting sector.

The high-end lighting market in the United Kingdom is expanding at a CAGR of 7.3%, supported by luxury residential, corporate, and hospitality demand. Consumers increasingly prefer smart, energy-efficient, and aesthetically pleasing lighting solutions. LED innovations, intelligent controls, and IoT integration enhance convenience and functionality. Retail, online, and interior design channels facilitate access to premium lighting products, while awareness of sustainability and energy efficiency drives adoption. Architectural projects, high-end hotels, and residential developments are major contributors to market growth. As lifestyle-focused lighting becomes standard in luxury and commercial settings, the UK high-end lighting market is expected to experience steady expansion.

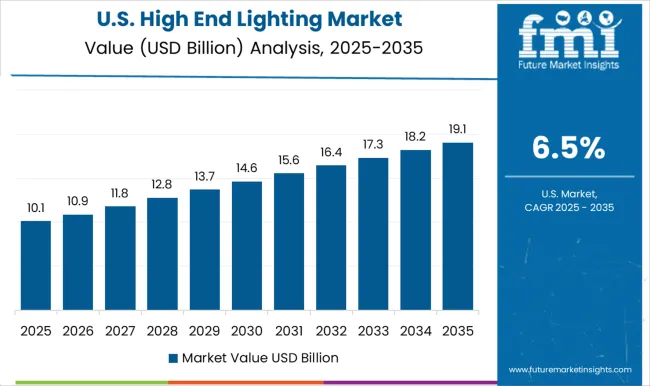

The high-end lighting market in the United States is growing at a CAGR of 6.5%, fueled by demand for luxury residential, commercial, and hospitality lighting solutions. Advanced LED technologies, smart controls, and energy-efficient systems are widely adopted. Consumers prioritize aesthetics, performance, and sustainability when selecting lighting solutions. Distribution through specialized retailers, online platforms, and interior designers supports accessibility and adoption. Government programs and incentives promoting energy-efficient buildings further encourage the use of high-end lighting. As technology-enabled, smart, and sustainable lighting becomes standard in premium projects, the USA high-end lighting market is poised for steady growth.

The high-end lighting market is driven by demand for premium, energy-efficient, and technologically advanced lighting solutions across residential, commercial, and industrial sectors. These products often combine aesthetics with functionality, incorporating smart controls, superior color rendering, and innovative designs. The trend toward sustainable and energy-saving solutions has further fueled growth, with smart lighting systems gaining popularity in luxury homes, corporate offices, and high-end retail environments.

Signify Holding, formerly Philips Lighting, is a global leader in advanced lighting solutions, offering connected lighting systems, professional luminaires, and innovative LED technology. Savant Technologies LLC focuses on integrated smart home lighting, combining automation, voice control, and customizable ambiance for luxury residential and commercial spaces. OSRAM GmbH is renowned for high-performance lighting products, including LEDs and smart lighting systems for architectural, automotive, and industrial applications. Wolfspeed, Inc. provides advanced semiconductor solutions enabling energy-efficient, high-performance lighting systems, particularly in LEDs and solid-state lighting.

Digital Lumens specializes in intelligent LED lighting solutions with networked controls, emphasizing energy efficiency, operational savings, and real-time monitoring for commercial and industrial applications. These companies lead the high-end lighting market by blending cutting-edge technology with design excellence. They address the growing consumer preference for sustainable, customizable, and connected lighting solutions, supporting both functional and aesthetic requirements in modern living and working environments. Innovation, energy efficiency, and integration with smart systems remain the core drivers for market leadership in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.8 Billion |

| Technology | LED lighting, Halogen lighting, CFL lighting, and Incandescent lighting |

| Product | Luminaires, Lamps, and Architectural lighting |

| Connectivity | Wired and Wireless |

| Distribution Channel | Online and Offline |

| End Use | Indoor, Industrial, Others, and Outdoor |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Signify Holding, Savant Technologies LLC, OSRAM GmbH, Wolfspeed, Inc, and Digital Lumens |

| Additional Attributes | Dollar sales vary by product type, including chandeliers, pendant lights, wall sconces, floor lamps, and outdoor luxury lighting; by technology, spanning LED, halogen, and smart/connected lighting systems; by application, such as residential, commercial, hospitality, and architectural projects; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for luxury and designer interiors, adoption of smart and energy-efficient lighting solutions, increasing urbanization, premiumization in commercial and residential spaces, and sustainability and regulatory initiatives. |

The global high end lighting market is estimated to be valued at USD 21.8 billion in 2025.

The market size for the high end lighting market is projected to reach USD 45.8 billion by 2035.

The high end lighting market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in high end lighting market are led lighting, halogen lighting, cfl lighting and incandescent lighting.

In terms of product, luminaires segment to command 41.3% share in the high end lighting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA