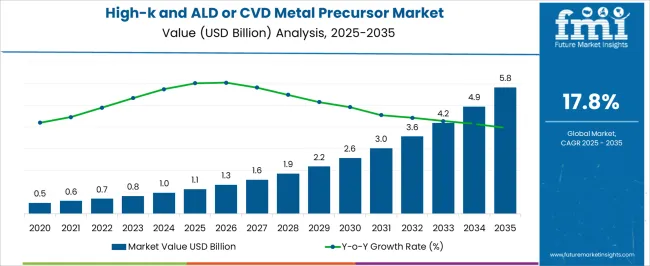

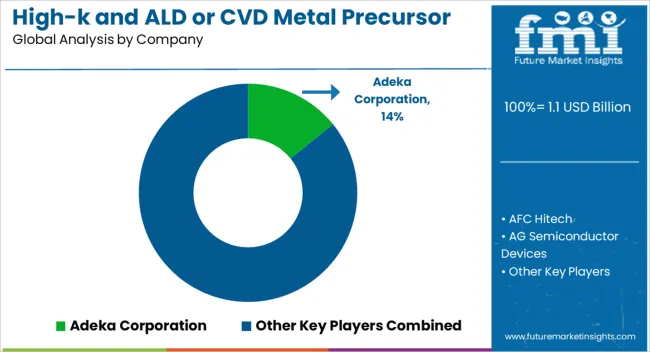

The high-k and ALD or CVD metal precursor market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 17.8% over the forecast period.

The growth is being driven by increased demand in semiconductor manufacturing, advanced electronics, and thin-film deposition processes. Market expansion is being supported as manufacturers prioritize high-purity precursors, consistent deposition quality, and compatibility with next-generation fabrication processes. Over the forecast period, supply chain optimization and strategic partnerships are being emphasized to maintain uninterrupted precursor availability and meet the growing requirements of global electronics manufacturers. Throughout the 2025–2035 period, the high-k and ALD or CVD metal precursor market is being influenced by increasing adoption of miniaturized devices, high-performance integrated circuits, and precision coating applications.

The market is being shaped by the focus on reducing defects, improving uniformity, and achieving higher yield rates in semiconductor production. In opinion, the market is being positioned as an indispensable element in advanced electronics manufacturing, with growth supported by targeted product development, quality assurance practices, and expanding fabrication capacities. Demand for specialized precursors is being reinforced by their critical role in maintaining reliability, efficiency, and performance standards across multiple electronic applications.

| Metric | Value |

|---|---|

| High-k and ALD or CVD Metal Precursor Market Estimated Value in (2025 E) | USD 1.1 billion |

| High-k and ALD or CVD Metal Precursor Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 17.8% |

The high-k and ALD or CVD metal precursor market has established a strong position across its parent industries, driven by its critical role in producing next-generation semiconductors, memory devices, and high-performance electronic components. Within the semiconductor materials market, high-k and ALD/CVD metal precursors account for approximately 18–20% share, reflecting their extensive use in gate dielectrics and advanced transistor architectures. In the advanced electronics manufacturing market, they represent around 12–15%, as they are integral to ensuring precise thin-film deposition and material uniformity in microchips and integrated circuits. Within the chemical vapor deposition (CVD) materials market, these precursors contribute nearly 25–28%, given their pivotal function in forming conformal films on complex substrate geometries. In the atomic layer deposition (ALD) materials market, the segment holds about 30–32% share, since the controlled, layer-by-layer deposition process relies on high-purity precursors to achieve nanoscale thickness and performance consistency.

In the microelectronics and memory devices market, high-k and ALD/CVD precursors account for roughly 10–12%, supporting high-density memory, DRAM, and logic devices. While challenges such as precursor cost and process integration persist, their indispensable role in achieving high-efficiency, miniaturized electronic components ensures sustained adoption. From my perspective, the market’s growth is reinforced by the increasing demand for smaller, faster, and more energy-efficient devices, positioning high-k and ALD or CVD metal precursors as foundational materials in modern semiconductor manufacturing and advanced electronics.

The high-k and ALD or CVD metal precursor market is advancing due to the increasing complexity of semiconductor manufacturing and the need for high-performance materials in next-generation devices. Developments in microelectronics have heightened demand for high-k dielectrics and advanced metal precursors, as these materials enable improved gate capacitance, reduced leakage current, and enhanced device scaling.

Industry announcements have highlighted investments in 3D architectures and advanced logic designs, which require precise thin-film deposition through atomic layer deposition (ALD) and chemical vapor deposition (CVD) techniques. The market has also benefited from expanded foundry capacities and the integration of these materials into memory, logic, and display applications.

Environmental compliance regulations and the push for improved process yields have further driven innovation in precursor chemistry. Going forward, increasing adoption of artificial intelligence hardware, electric vehicles, and IoT devices is expected to sustain strong demand for high-k and metal precursor technologies across global semiconductor ecosystems.

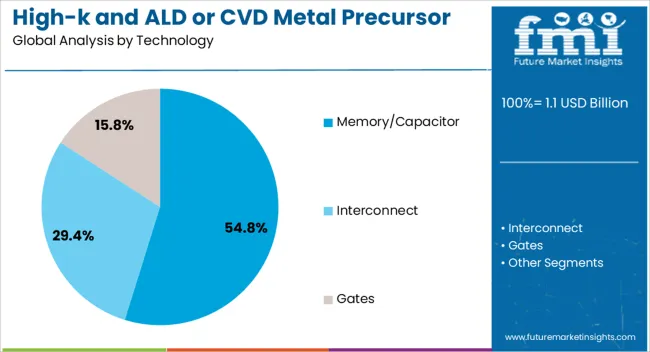

The high-k and ALD or CVD metal precursor market is segmented by technology, and geographic regions. By technology, high-k and ALD or CVD metal precursor market is divided into memory/capacitor, interconnect, and gates. Regionally, the high-k and ALD or CVD metal precursor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The memory/capacitor segment is projected to account for 54.8% of the high-k and ALD or CVD metal precursor market revenue in 2025, maintaining its dominance among application categories. Growth in this segment has been supported by the widespread use of high-k materials to improve capacitance density and performance in DRAM, NAND, and emerging non-volatile memory technologies. ALD and CVD processes have enabled uniform and conformal deposition of thin films, meeting the stringent requirements for high-aspect-ratio structures in advanced memory nodes. Semiconductor manufacturers have prioritized high-k and metal precursor integration to achieve low leakage currents and improved retention characteristics, particularly in high-speed and low-power memory applications. Industry collaborations between material suppliers and device manufacturers have accelerated the adoption of these solutions in leading-edge fabrication facilities. As data center expansion, AI workloads, and 5G infrastructure drive higher memory demand, the Memory/Capacitor segment is expected to remain the largest and fastest-growing area for high-k and ALD or CVD metal precursor utilization.

The high-k and ALD or CVD metal precursor market is expanding due to rising demand from semiconductor, memory, and electronics sectors. Opportunities exist in advanced logic and memory devices, while trends emphasize high-purity, low-contamination, and environmentally compliant precursors. Challenges stem from high costs, complex manufacturing, and regulatory compliance. Overall, the market outlook is positive as manufacturers focus on reliable, scalable, and high-performance precursor solutions to meet the growing demands of next-generation semiconductor devices and emerging electronics applications.

The high-k and ALD (Atomic Layer Deposition) or CVD (Chemical Vapor Deposition) metal precursor market is witnessing strong demand due to rapid growth in semiconductor manufacturing and advanced electronics. These precursors are essential for producing thin, high-performance dielectric layers in transistors, memory devices, and integrated circuits. The expanding adoption of 5G, AI-enabled devices, and IoT applications is driving the need for highly reliable, uniform, and scalable deposition materials. Manufacturers are increasingly prioritizing high-quality precursors to ensure device miniaturization, energy efficiency, and superior electrical performance, making them critical in modern semiconductor fabrication.

Significant opportunities exist in advanced logic and memory applications, including DRAM, NAND, and emerging non-volatile memory devices. As semiconductor nodes shrink and multi-layer architectures become standard, demand for high-k metal precursors with precise composition control and excellent thermal stability is growing. Emerging semiconductor hubs in Asia-Pacific and investments in R&D for next-generation chip architectures present additional market potential. Companies providing application-specific solutions and scalable precursor production capabilities can leverage these opportunities to strengthen partnerships with leading foundries and memory manufacturers.

A prominent trend is the development of high-purity, low-contamination, and environmentally compliant metal precursors to meet the stringent requirements of advanced semiconductor processes. Manufacturers are adopting novel synthesis techniques to enhance uniformity, volatility, and thermal stability. Digital monitoring and in-situ process integration are increasingly used to optimize deposition and reduce waste. These trends reflect the growing focus on efficiency, process control, and regulatory adherence, enabling semiconductor manufacturers to achieve higher yield, performance, and reliability in logic, memory, and emerging device applications.

The market faces challenges due to the high cost of raw materials, complex synthesis processes, and stringent purity requirements. Producing high-k and ALD/CVD precursors requires specialized infrastructure and quality assurance, which can limit accessibility for smaller manufacturers. Additionally, maintaining batch consistency and addressing environmental and safety regulations adds operational complexity. Fluctuating precursor availability or delays in supply chains can impact semiconductor production timelines. To overcome these hurdles, companies are investing in advanced manufacturing technologies, quality control measures, and strategic supplier partnerships to ensure reliable, scalable, and cost-effective precursor supply.

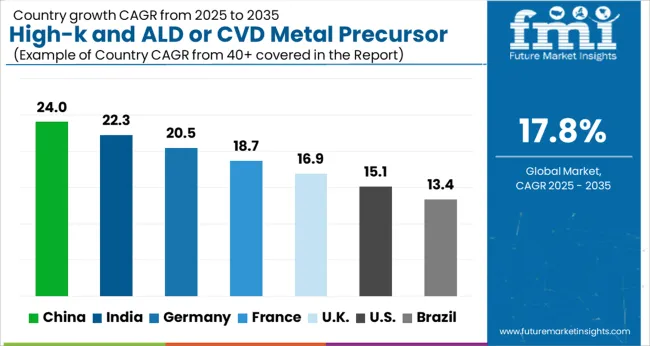

| Country | CAGR |

|---|---|

| China | 24.0% |

| India | 22.3% |

| Germany | 20.5% |

| France | 18.7% |

| UK | 16.9% |

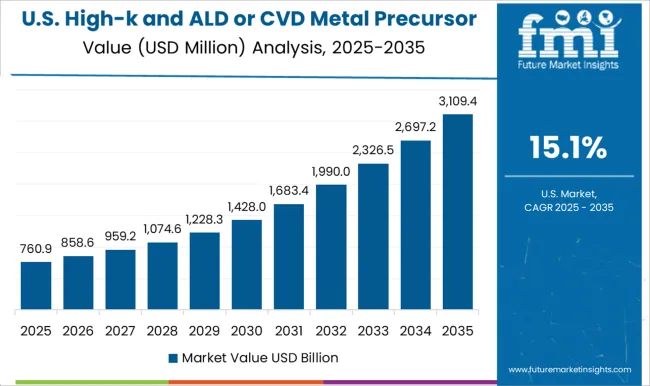

| USA | 15.1% |

| Brazil | 13.4% |

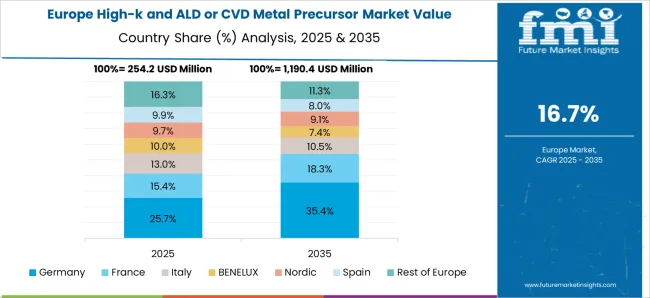

The global high-k and ALD or CVD metal precursor market is projected to grow at a CAGR of 17.8% from 2025 to 2035. China leads with a growth rate of 24%, followed by India at 22.3% and France at 18.7%. The United Kingdom records a growth rate of 16.9%, while the United States shows the slowest growth at 15.1%. Expansion is driven by rising semiconductor fabrication, increasing adoption of advanced microelectronics, and growing demand for miniaturized electronic devices. Emerging markets such as China and India experience higher growth due to expanding semiconductor production, investment in wafer fabrication facilities, and increasing R&D in high-performance materials. Developed markets like France, the UK, and the USA maintain steady growth supported by established semiconductor industries, high-quality manufacturing standards, and precision material adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

The high-k and ALD or CVD metal precursor market in China is projected to grow at a CAGR of 24%. Rising semiconductor fabrication and increasing production of advanced microelectronics are driving the market. Domestic manufacturers are focusing on high-purity precursors and optimized deposition processes to meet performance requirements. Expanding wafer fabrication facilities and government support for electronics manufacturing contribute to strong market growth. Additionally, investment in research for advanced materials and integration with high-performance chips enhances adoption across consumer electronics, automotive electronics, and memory devices.

The high-k and ALD or CVD metal precursor market in India is expected to grow at a CAGR of 22.3%. Increasing semiconductor manufacturing, including chip design and fabrication, fuels market expansion. Domestic production of advanced electronics and growing demand for memory and logic devices enhance adoption of high-performance precursors. Government initiatives promoting electronics manufacturing and R&D investments in advanced materials indirectly support market growth. Companies are also focusing on process optimization and precision deposition technologies to improve product efficiency and yield, strengthening the market outlook.

The high-k and ALD or CVD metal precursor market in France is projected to grow at a CAGR of 18.7%. Demand is driven by the country’s established semiconductor industry and electronics manufacturing sector. High-purity metal precursors are adopted for advanced deposition processes, including ALD and CVD, in logic and memory device production. Research initiatives and collaborations with global semiconductor companies ensure access to cutting-edge materials. Adoption is further supported by regulatory compliance, precision manufacturing standards, and integration into high-performance microelectronics applications.

The high-k and ALD or CVD metal precursor market in the United Kingdom is expected to grow at a CAGR of 16.9%. Adoption is supported by electronics manufacturing, semiconductor fabrication, and research-driven innovation in microelectronics. High-purity precursors and precise deposition technologies are increasingly implemented in advanced semiconductor devices. Companies focus on compliance with international manufacturing standards while enhancing product performance. Collaboration with research institutions and global suppliers ensures availability of optimized precursors, supporting steady growth in the UK market.

The high-k and ALD or CVD metal precursor market in the United States is projected to grow at a CAGR of 15.1%. Demand is driven by the established semiconductor and electronics manufacturing sectors. High-purity precursors are used in ALD and CVD deposition for logic, memory, and advanced integrated circuits. Companies focus on innovation in material chemistry and process optimization to meet high-performance requirements. Access to global suppliers and adherence to international quality standards support consistent adoption. Additionally, USA-based semiconductor R&D and manufacturing facilities contribute to steady market expansion.

The high-k and ALD/CVD metal precursor market is driven by chemical suppliers and semiconductor material innovators competing on purity, deposition efficiency, and process compatibility. Air Liquide, Air Products and Chemicals, and Dow Chemical lead with brochures highlighting ultra-high purity precursors, consistent thin-film deposition, and integration with advanced semiconductor nodes. JSR Corporation, Samsung Electronics, and Soulbrain emphasize tailored precursor chemistries for specific ALD and CVD applications, showcasing marketing materials that stress reproducibility, thermal stability, and low defect density. AFC Hitech, Colnatec, and Praxair differentiate through specialized delivery systems and scalable production capabilities, promoting brochures that highlight reliability under high-throughput manufacturing conditions. Mid-sized players such as Adeka Corporation, Dynamic Network Factory Inc. (DNF), and Strem Chemicals Inc. target niche segments, focusing on custom formulations and rapid technical support to address evolving process requirements.

Brochures serve as a critical tool to communicate technical performance, regulatory compliance, and integration readiness. Other competitors, including Linde, NANMAT, OCI Materials, REC, Tri Chemical Laboratories, and Union Pacific Chemicals, leverage regional manufacturing presence and material expertise to capture emerging markets. Brochures emphasize precursor stability, high step coverage, and compatibility with next-generation lithography processes. Marketing strategies focus on delivering a balance between performance, reliability, and cost-effectiveness, enabling buyers to optimize deposition processes while minimizing defects. Across the market, brochure-driven narratives are central to differentiating suppliers through technical credibility, product innovation, and operational support, reinforcing trust among semiconductor manufacturers pushing the boundaries of device scaling and material engineering.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 billion |

| Technology | Memory/Capacitor, Interconnect, and Gates |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adeka Corporation, AFC Hitech, AG Semiconductor Devices, Air Liquide, Air Products and Chemicals, Colnatec, Praxair, Dynamic Network Factory Inc., DNF, Dow Chemical, JSR Corporation, Linde, NANMAT, OCI Materials, REC, Samsung Electronics, Soulbrain, Strem Chemicals Inc., Tri Chemical Laboratories Inc., and Union Pacific Chemicals |

| Additional Attributes | Dollar sales by precursor type (high-k, ALD, CVD) and application (semiconductors, memory devices, logic chips) are key metrics. Trends include rising demand for advanced node semiconductor manufacturing, growth in miniaturized electronic components, and adoption in next-generation memory and logic technologies. Regional adoption, technological advancements, and industry-specific requirements are driving market growth. |

The global high-k and ALD or CVD metal precursor market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the high-k and ALD or CVD metal precursor market is projected to reach USD 5.8 billion by 2035.

The high-k and ALD or CVD metal precursor market is expected to grow at a 17.8% CAGR between 2025 and 2035.

The key product types in high-k and ALD or CVD metal precursor market are memory/capacitor, interconnect and gates.

In terms of technology, the memory/capacitor segment is set to command 54.8% share in the high-k and ALD or CVD metal precursor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA