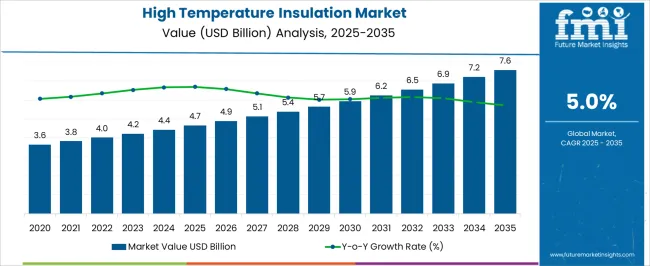

The high temperature insulation market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The growth contribution index shows that the market's expansion is driven by both volume and price growth, with incremental growth across each period of the forecast. From 2021 to 2025, the market grows from USD 3.6 billion to 4.7 billion, with intermediate values of USD 3.8 billion, 4.0 billion, 4.2 billion, and 4.4 billion. In this phase, volume growth dominates as the market benefits from the growing demand for high-temperature insulation in industries such as automotive, construction, and power generation. This phase is characterized by steady adoption in key sectors focusing on energy efficiency and heat resistance, particularly in high-performance industrial applications.

Between 2026 and 2030, the market accelerates, growing from USD 4.7 billion to 6.2 billion. This period shows a stronger contribution from price growth as innovations in insulation materials and manufacturing processes lead to more advanced and cost-effective products. Rising demand for industrial applications and stringent regulatory standards around energy efficiency drive this phase of growth. From 2031 to 2035, the market expands from USD 6.5 billion to 7.6 billion, with the growth driven by both volume and price contributions.

The high-temperature insulation market is shaped by five key parent markets that collectively drive its growth, applications, and technological advancements. The thermal insulation materials market contributes the largest share, about 30-35%, as high-temperature insulation is essential in protecting equipment, machinery, and infrastructure from excessive heat in industries such as metal processing, power generation, and chemical manufacturing.

The industrial manufacturing market adds approximately 20-24%, as high-temperature insulation is used to maintain the thermal integrity of kilns, furnaces, boilers, and reactors, helping to improve energy efficiency and reduce operational costs. The energy and power generation market contributes around 15-18%, as power plants and refineries require high-temperature insulation for turbines, pipes, and combustion chambers to ensure safety, prevent heat loss, and improve energy output.

The automotive and transportation market accounts for roughly 12-15%, where high-temperature insulation is crucial for protecting components in engines, exhaust systems, and catalytic converters, helping to improve fuel efficiency and emissions control in vehicles. Finally, the construction and building materials market represents about 8-10%, with high-temperature insulation being used in industrial buildings, warehouses, and processing facilities to reduce energy consumption, enhance fire safety, and protect against extreme temperature fluctuations.

| Metric | Value |

|---|---|

| High Temperature Insulation Market Estimated Value in (2025 E) | USD 4.7 billion |

| High Temperature Insulation Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The high temperature insulation market is experiencing steady expansion, driven by the increasing need for energy efficiency, thermal management, and process reliability in high-heat industrial environments. Industry publications and manufacturing sector reports have highlighted growing adoption of advanced insulation materials to reduce heat loss, lower operational costs, and meet stringent environmental regulations.

Technological advancements in refractory products and ceramic-based insulations have improved thermal resistance, mechanical strength, and service life, enabling their use in extreme conditions. Additionally, the global emphasis on reducing greenhouse gas emissions has encouraged industrial operators to invest in insulation solutions that enhance furnace, kiln, and reactor performance.

The petrochemical, metal processing, and power generation industries have remained key demand drivers, supported by infrastructure modernization and capacity expansions in emerging economies. Future growth is expected to be fueled by innovations in lightweight, low-density materials, and by increasing retrofitting activities in older facilities seeking to improve thermal efficiency and regulatory compliance.

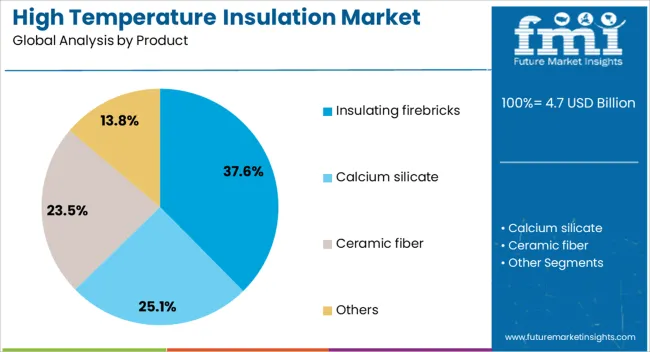

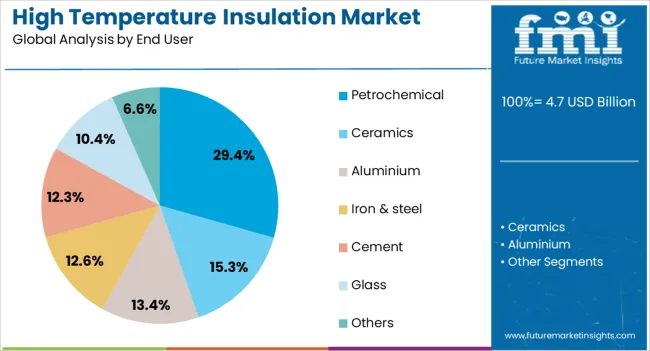

The high temperature insulation market is segmented by product, end user, and geographic regions. By product, high temperature insulation market is divided into insulating firebricks, calcium silicate, ceramic fiber, and others. In terms of end user, high temperature insulation market is classified into petrochemical, ceramics, aluminium, iron & steel, cement, glass, and others. Regionally, the high temperature insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The insulating firebricks segment is projected to account for 37.6% of the high temperature insulation market revenue in 2025, maintaining its leadership due to its superior thermal resistance and low thermal conductivity. This segment’s growth has been supported by its widespread application in furnaces, kilns, and reactors where maintaining high operational temperatures while minimizing heat loss is critical.

Industry reports have noted that insulating firebricks provide excellent structural strength at elevated temperatures and are lighter in weight compared to dense refractories, reducing structural load. Additionally, their ease of installation and ability to be machined into custom shapes have enhanced their suitability across multiple high-temperature processes.

The segment has also benefited from ongoing improvements in raw material quality and manufacturing processes, resulting in bricks with enhanced durability and energy efficiency. With industries increasingly prioritizing operational cost savings and energy conservation, insulating firebricks are expected to remain the preferred choice for high-temperature insulation applications.

The petrochemical segment is projected to contribute 29.4% of the high temperature insulation market revenue in 2025, securing its position as the leading end-use category. Growth in this segment has been driven by the sector’s extensive use of furnaces, reformers, and reactors that operate under extreme heat conditions for chemical processing.

Petrochemical plants have prioritized high-performance insulation to reduce heat loss, improve process efficiency, and comply with environmental emission standards. Industry analyses have indicated that insulation materials in this sector must withstand thermal cycling, chemical exposure, and mechanical stress, making advanced refractory products particularly critical.

Capital investments in petrochemical capacity expansions, particularly in Asia-Pacific and the Middle East, have further fueled demand for high temperature insulation. Moreover, ongoing plant maintenance and retrofitting activities to meet energy efficiency targets have contributed to steady consumption. As global petrochemical production continues to rise to meet demand for plastics, synthetic materials, and specialty chemicals, the sector is expected to sustain its leading role in high temperature insulation adoption.

The high temperature insulation market is growing due to increasing demand in industries like steel, cement, and power generation, where energy efficiency and emissions reduction are key priorities. Challenges include raw material costs, performance consistency, and environmental concerns regarding traditional materials. Opportunities lie in the adoption of energy-efficient solutions and regulatory compliance for emission reduction. Trends in advanced materials, customization, nanotechnology, and smart insulation are driving market growth. Manufacturers offering high-performance, eco-friendly, and customized insulation solutions are well-positioned to capitalize on these emerging trends in industrial applications.

The high temperature insulation market is experiencing growth due to increasing demand in industrial applications such as steel, cement, petrochemical, and power generation. These industries require materials that can withstand extremely high temperatures while providing thermal efficiency. High temperature insulation materials, such as ceramic fibers, mineral wool, and calcium silicate, are used to insulate furnaces, kilns, boilers, and pipes to prevent heat loss and improve energy efficiency. The market is driven by the push to optimize energy consumption and meet regulatory requirements for emissions reduction. Key players like Owens Corning, Saint-Gobain, and Isolite Insulation are providing high-performance insulation solutions that cater to the needs of high-temperature industrial processes.

The high temperature insulation market faces challenges related to the cost of raw materials, performance consistency, and environmental concerns. Many high-performance insulation materials, such as ceramic fibers, are expensive, which can limit their widespread adoption in price-sensitive markets. Additionally, achieving consistent insulation performance in extreme conditions, such as high heat, pressure, and chemical exposure, can be challenging. There are also growing concerns about the environmental impact of some high temperature insulation materials, particularly those that contain asbestos or require energy-intensive manufacturing processes. Manufacturers are investing in research to develop more cost-effective, durable, and eco-friendly alternatives to meet industry demands.

With global industries focusing on reducing their carbon footprint, high temperature insulation helps minimize heat loss, reducing energy consumption and lowering greenhouse gas emissions. Industrial facilities, such as power plants and manufacturing plants, are under pressure to adopt energy-efficient solutions to comply with environmental regulations and reduce operational costs. Insulation materials that provide better thermal resistance and lower heat loss are particularly valuable in this context. Companies offering advanced, high-performance, and energy-efficient insulation solutions are likely to benefit from these market opportunities.

The high temperature insulation market is witnessing trends in the development of advanced materials and customized solutions. Manufacturers are increasingly focusing on producing advanced insulation materials that offer higher thermal resistance, durability, and resistance to chemical exposure. There is also a growing trend toward customization, with suppliers providing tailored insulation solutions to meet the specific needs of industrial processes. These innovations allow industries to choose materials that optimize performance, reduce costs, and enhance the overall efficiency of their operations. High-temperature insulation materials with improved properties, such as lightweight designs and high thermal conductivity, are becoming more common in demanding industrial applications.

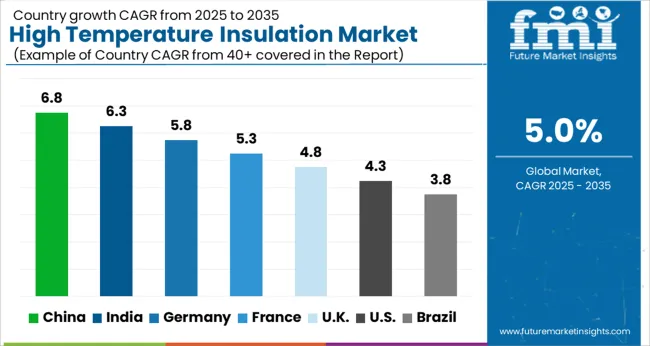

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

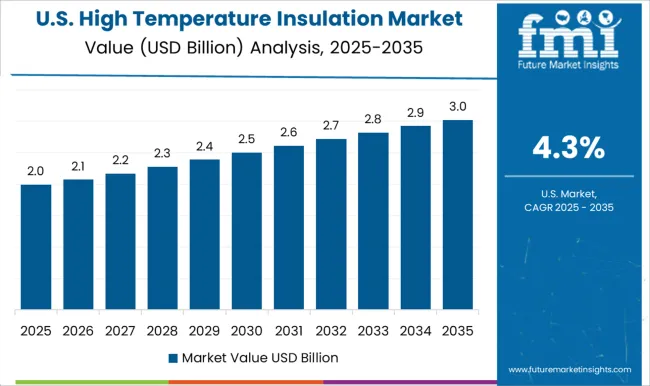

| USA | 4.3% |

| Brazil | 3.8% |

The global high-temperature insulation market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and Germany at 5.3%. The UK and USA show moderate growth at 4.8% and 4.3%, respectively. China and India’s industrial expansions, especially in sectors like manufacturing, power, and chemicals, contribute significantly to market growth. Meanwhile, Europe and the USA are driven by regulatory initiatives aimed at improving energy efficiency and reducing environmental impacts. Regional trends highlight a strong demand for energy-efficient solutions in industrial applications, positioning high-temperature insulation as a critical component in operational performance and cost savings. The analysis spans over 40+ countries, with the leading markets shown below.

The high-temperature insulation market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035. The country’s increasing industrial activity, particularly in sectors like manufacturing, power generation, and chemical processing, is driving the demand for high-temperature insulation products. These materials are essential in maintaining thermal efficiency in high-heat environments, such as furnaces, boilers, and kilns. China’s rapid industrialization and infrastructural development, along with government initiatives focused on energy efficiency, contribute significantly to market growth. As the demand for energy conservation in industrial operations rises, the adoption of high-temperature insulation solutions is set to increase. China’s well-established manufacturing capabilities further ensure a steady supply of affordable and high-quality insulation products, boosting the overall market potential.

The high-temperature insulation market in India is expected to grow at a CAGR of 6.3% from 2025 to 2035. The expansion of industries such as steel, cement, petrochemicals, and power generation in India is driving the demand for high-temperature insulation materials. These products are vital for maintaining thermal efficiency in high-heat environments, preventing energy losses, and ensuring equipment longevity. The growing industrial sector, coupled with increased awareness of energy conservation, is a key factor propelling the adoption of high-temperature insulation solutions. The country’s focus on enhancing manufacturing capabilities and improving infrastructure contributes to market growth. The rise in industrial output and the government’s push for modernization further elevate the demand for high-performance insulation materials.

The high-temperature insulation market in France is projected to grow at a CAGR of 5.3% from 2025 to 2035. The demand for high-temperature insulation in France is primarily driven by the country’s industrial sectors, including manufacturing, energy, and chemical processing. These industries require insulation materials to maintain efficient operations in high-temperature environments. France’s focus on reducing energy consumption and improving industrial efficiency has led to a rise in demand for such insulation solutions. The country’s strict energy efficiency regulations and standards, particularly in the industrial and construction sectors, are encouraging the adoption of high-temperature insulation products. France's emphasis on green building practices and reducing environmental impact further supports market growth.

The high-temperature insulation market in the UK is expected to grow at a CAGR of 4.8% from 2025 to 2035. The demand for high-temperature insulation products in the UK is fueled by the increasing need for energy-efficient solutions in the manufacturing, power, and chemical industries. These sectors require insulation to minimize heat loss and improve operational efficiency in high-heat environments. The country’s commitment to achieving carbon reduction goals and improving industrial energy efficiency is driving the market for high-temperature insulation materials. The rise in renewable energy and the continued focus on reducing industrial carbon footprints contribute to the growing demand for these products. Government policies aimed at enhancing industrial sustainability and energy conservation also play a crucial role in shaping market trends.

The USA high-temperature insulation market is projected to grow at a CAGR of 4.3% from 2025 to 2035. The demand for high-temperature insulation in the USA is primarily driven by the manufacturing, energy, and chemical sectors, where efficient thermal insulation is crucial for maintaining operational performance. With increasing regulations surrounding energy efficiency and a growing focus on sustainability, high-temperature insulation products are becoming more prevalent. The USA market is also influenced by innovations in insulation materials that offer improved thermal resistance and durability. As industries focus on reducing operational costs and improving energy efficiency, high-temperature insulation products are expected to play a significant role. The USA also benefits from a well-established manufacturing base, providing easy access to a variety of insulation solutions.

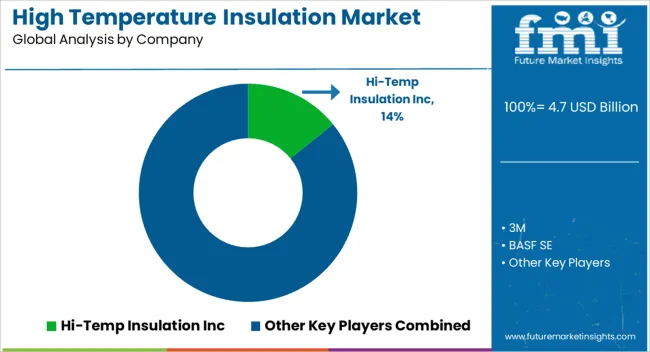

Competition in the high-temperature insulation market is driven by product durability, heat resistance, and the ability to meet the demanding requirements of industries such as aerospace, automotive, and industrial manufacturing. Hi-Temp Insulation Inc. leads with specialized solutions that cater to extreme temperature conditions. Their product brochures emphasize superior thermal resistance and long-term performance, making their insulation ideal for high-heat applications like furnaces, boilers, and kilns. The company differentiates itself by offering customizable insulation materials tailored to specific industry needs, ensuring maximum efficiency and reliability.

3M competes by offering advanced high-temperature insulation materials that incorporate cutting-edge technology and innovation. Their brochures highlight a range of solutions, including high-performance ceramic and silica-based products, designed for industries requiring precise temperature control. 3M’s product portfolio focuses on minimizing heat loss, improving energy efficiency, and ensuring safety in environments exposed to extreme temperatures. The company’s deep expertise in materials science and manufacturing excellence positions it as a leader in the high-temperature insulation market. BASF SE provides high-quality insulation materials for industrial applications, with a focus on heat protection, fire resistance, and energy efficiency.

Their product brochures emphasize the ability of their insulation solutions to withstand continuous high temperatures while maintaining structural integrity. BASF differentiates itself by integrating sustainable manufacturing practices, using environmentally friendly materials without compromising on performance. Their advanced thermal insulation products cater to industries such as automotive and construction, where high heat resistance is critical. Cabot Corporation focuses on advanced carbon-based insulation materials designed for extreme heat applications. Their brochures highlight the superior performance of their high-temperature insulation in protecting critical components from thermal damage, with a focus on lightweight, flexible, and easy-to-install products. Cabot’s emphasis on innovation and high-performance solutions makes it a key player in markets requiring insulation in extreme conditions, such as aerospace and industrial processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 billion |

| Product | Insulating firebricks, Calcium silicate, Ceramic fiber, and Others |

| End User | Petrochemical, Ceramics, Aluminium, Iron & steel, Cement, Glass, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hi-Temp Insulation Inc, 3M, BASF SE, and Cabot Corporation |

| Additional Attributes | Dollar sales by product type (ceramic fiber, aerogel, refractory insulation, high-temperature coatings), application (automotive, aerospace, energy, industrial manufacturing), and temperature resistance (up to 1,000°C, 1,500°C, 2,000°C). Demand in this market is driven by the increasing need for energy-efficient insulation materials in high-heat applications, regulatory requirements for improved thermal performance, and the growing adoption of advanced materials for sustainability and safety. Regional trends show a strong growth in North America, Europe, and Asia-Pacific, with industries such as energy and automotive pushing for innovations in high-temperature insulation to improve performance and reduce environmental impact. |

The global high temperature insulation market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the high temperature insulation market is projected to reach USD 7.6 billion by 2035.

The high temperature insulation market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in high temperature insulation market are insulating firebricks, calcium silicate, ceramic fiber and others.

In terms of end user, petrochemical segment to command 29.4% share in the high temperature insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA