The high entropy alloy market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. Expansion in the market is fueled by rising demand for lightweight, durable materials in the aerospace and automotive sectors, particularly as industries push toward fuel efficiency and sustainability.

Additionally, growing interest in HEAs for nuclear and energy storage applications supports long-term adoption. Research and development activities are further driving innovation, with universities and material science companies exploring novel alloy compositions and scalable manufacturing methods. However, high production costs, limited large-scale manufacturing capabilities, and the complexity of alloy design remain significant challenges. Over the forecast period, advancements in additive manufacturing and powder metallurgy are expected to reduce costs and increase accessibility.

| Metric | Value |

|---|---|

| High Entropy Alloy Market Estimated Value in (2025 E) | USD 1.3 billion |

| High Entropy Alloy Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The high entropy alloy market is gaining strong traction due to the growing demand for advanced materials that offer a balance of strength, ductility, corrosion resistance, and thermal stability. These alloys, designed with multiple principal elements, are emerging as next-generation materials across aerospace, defense, energy, and manufacturing sectors. The shift toward lightweight yet high-strength components has positioned high entropy alloys as suitable alternatives to conventional superalloys and stainless steels.

Their adaptability to extreme environments and performance under high stress have made them particularly attractive in high-tech applications. As industrial sectors worldwide prioritize efficiency and durability in component design, the development and commercialization of high entropy alloys are expected to expand.

Further support is coming from increased investment in materials science research, a rising number of pilot production lines, and collaborations between industry and academia to accelerate practical applications of these materials. The market is expected to witness sustained growth driven by performance demands and continuous innovation in alloy design and processing technologies.

The high entropy alloy market is segmented by alloy type, manufacturing method, property, application, end use industry, and geographic regions. By alloy type, the high entropy alloy market is divided into 3D transition metal HEAs, Refractory metal HEAs, Light metal HEAs, Aluminum-containing HEAs, Precious metal HEAs, Rare earth element-containing HEAs, and Others. In terms of manufacturing method, the high entropy alloy market is classified into Casting & solidification, Powder metallurgy, Additive manufacturing, Thin film deposition, and Others.

Based on property, the high entropy alloy market is segmented into Superior mechanical properties, Thermal stability, Corrosion & oxidation resistance, Magnetic properties, Electrical properties, Radiation resistance, and Others. By application, the high entropy alloy market is segmented into Structural applications, Functional applications, Coatings & surface treatments, Extreme environment applications, and Others. By end use industry, the high entropy alloy market is segmented into Aerospace & defense, Automotive, Energy, Industrial equipment, Electronics & semiconductors, Chemical & petrochemical, Medical & healthcare, Research & academia, and Others. Regionally, the high entropy alloy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 3D transition metal HEAs segment is projected to account for 26.7% of the overall High Entropy Alloy market revenue in 2025, making it the leading alloy type. This growth is being driven by the superior structural properties achieved when incorporating transition metals such as chromium, cobalt, iron, nickel, and manganese into multi-principal element systems.

These alloys have demonstrated remarkable stability and strength under high temperature and stress conditions, which are key requirements in aerospace and thermal applications. The ability of these materials to maintain mechanical integrity over prolonged exposure to harsh environments has supported their rising adoption.

Additionally, the high melting point and resistance to oxidation provided by transition metal compositions have made them suitable for use in high-performance sectors that demand reliability and precision. Continued interest from research institutions and industry developers in optimizing these compositions has contributed to their dominant market position.

The casting and solidification manufacturing method segment is expected to hold 31.2% of the High Entropy Alloy market revenue in 2025, making it the leading method in terms of volume and scalability. This leadership is being attributed to the ability of casting techniques to handle a broad range of alloy compositions while maintaining microstructural uniformity.

Solidification processes enable controlled cooling, which results in refined grain structures and improved mechanical behavior of the alloy. The simplicity and adaptability of casting methods have allowed manufacturers to experiment with new HEA formulations without requiring extensive modifications to existing infrastructure.

Moreover, the cost-efficiency of casting has encouraged its widespread adoption in early-stage production and pilot-scale manufacturing. As demand rises for high entropy alloys in larger and more complex components, casting is expected to remain a preferred method due to its compatibility with diverse geometries and scale-up potential.

The superior mechanical properties segment is anticipated to contribute 28.5% of the overall High Entropy Alloy market revenue in 2025, positioning it as the key property driving material selection. This dominance is being supported by the high yield strength, fracture toughness, and fatigue resistance exhibited by HEAs under extreme mechanical stress.

These properties have enabled the alloys to outperform many traditional metals in demanding applications, including turbine engines, structural frames, and ballistic protection systems. The unique atomic configurations of HEAs promote sluggish diffusion and lattice distortion, which contribute to exceptional mechanical stability across a wide temperature range.

As industries increasingly seek materials that can meet both structural and safety requirements, the preference for alloys with proven mechanical superiority has grown. The segment's growth is expected to continue as application areas expand and performance standards tighten in defense, aerospace, and energy infrastructure.

High entropy alloys are expanding due to superior material performance and multi-industry adoption. While cost challenges persist, collaborative research and advanced production methods are driving broader deployment.

High entropy alloys are gaining strong attention across industries such as aerospace, defense, automotive, energy, and biomedical engineering. Their unique capability to combine multiple principal elements results in exceptional mechanical strength, corrosion resistance, and thermal stability. Aerospace and defense rely on them for high-performance turbine blades, structural components, and protective equipment, while automotive producers are exploring lightweight yet durable applications. In biomedical sectors, their wear resistance and biocompatibility make them suitable for implants and surgical devices. Energy operators adopt them in nuclear reactors and gas turbines due to their resilience under extreme temperatures. This widening portfolio of end-use applications demonstrates the versatile positioning of high entropy alloys in addressing multiple performance-driven needs.

The superior properties of high entropy alloys have set them apart from conventional steels and superalloys, making them attractive for industries requiring high efficiency and durability. Their high hardness, tensile strength, and resistance to oxidation allow them to outperform traditional alloys in demanding environments. The alloys are designed to function under extreme temperature cycles, maintaining structural integrity where other materials fail. Their corrosion resistance has made them particularly valuable in marine and chemical environments where long-term reliability is required. These characteristics support extended lifespan of equipment, reduced maintenance costs, and higher overall performance efficiency, creating measurable benefits for industrial adopters.

The progress in high entropy alloy adoption is significantly supported by academic research and collaborative industrial development programs. Universities and research institutes have been actively involved in designing new compositions, supported by computational modeling and experimental validation. Collaborative frameworks between material scientists, defense contractors, and automotive manufacturers have accelerated the transition of lab-scale innovations into industrial-scale applications. Pilot production units are increasingly being tested, validating cost-efficiency and manufacturing feasibility. Industry-academia partnerships ensure faster commercialization pathways, reducing the time required for market adoption. This environment of collaboration has allowed high entropy alloys to become a central theme in advanced material research.

Despite their performance advantages, high entropy alloys face challenges related to cost of production, scalability, and lack of standardized processing methods. Complex manufacturing requirements raise expenses, making commercial adoption slower compared to established alloys. However, opportunities are emerging as industries seek alternatives to scarce or expensive materials like cobalt and nickel. Additive manufacturing and powder metallurgy are opening cost-efficient production routes, improving their industrial viability. Enterprises focusing on long-term durability, reduced downtime, and energy efficiency are showing willingness to invest in advanced alloys. As these production hurdles are gradually addressed, high entropy alloys are expected to capture stronger demand within strategic sectors globally.

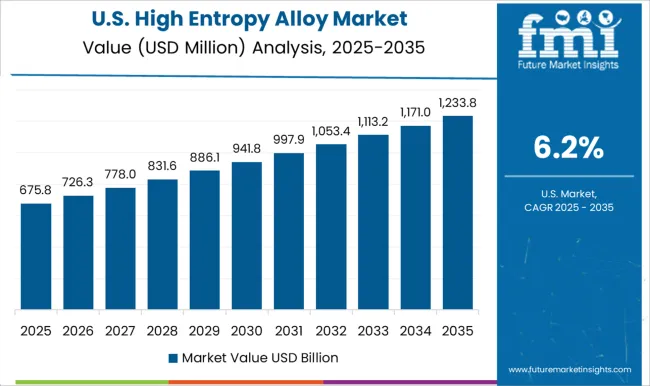

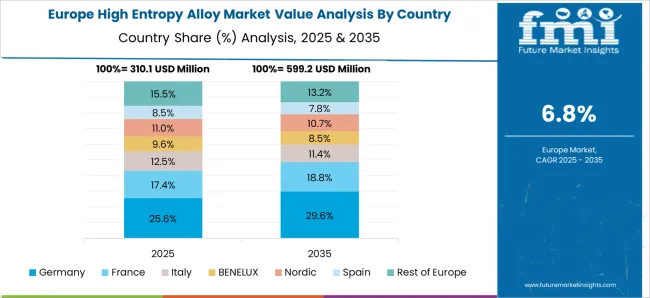

The high entropy alloy market is projected to grow globally at a CAGR of 8.2% from 2025 to 2035, supported by demand across aerospace, defense, automotive, energy, and biomedical sectors. China leads with a CAGR of 9.9%, driven by its large-scale investments in advanced materials research, aerospace projects, and military-grade alloy applications. India follows at 9.1%, supported by its expanding manufacturing ecosystem, government-backed R&D programs, and rising demand from automotive and defense industries. Germany records 8.4%, where growth is fueled by industrial adoption in precision engineering, energy systems, and the automotive supply chain. France posts 7.7%, with emphasis on aerospace and nuclear sectors that increasingly require alloys capable of extreme performance. The United Kingdom achieves 6.9%, reflecting steady adoption in biomedical devices, industrial tooling, and specialized defense applications. The United States records 6.2%, where growth remains modest but significant due to established aerospace and defense programs, combined with incremental adoption in energy and automotive innovation. This divergence in growth rates shows how emerging economies are accelerating alloy adoption through infrastructure and industrial expansion, while developed nations focus on specialized and high-performance deployments.

The CAGR for the high entropy alloy market in the United Kingdom is estimated at 5.5% during 2020–2024, then improves to 6.9% for 2025–2035. The earlier figure was shaped by limited pilot volumes, a narrow supplier base for refractory powders, and long materials certification timelines that slowed purchase decisions. The rise to 6.9 percent has been supported by larger powder metallurgy batches, better print parameter libraries in additive manufacturing, and targeted public R and D that lowered per part costs. Procurement programs in defense turbines and industrial tooling widened addressable demand as lifecycle gains outweighed initial material expense. In-building expertise at research centers and tier suppliers has created a clearer path from prototype to serial production, which strengthens multi industry uptake and moves the market toward steadier growth.

The market is projected at 9.9% CAGR during 2025–2035, supported by scaled powder production, regional clusters for advanced materials, and wider test campaigns in turbine hot sections. Industrial users value wear resistance and oxidation tolerance that lower overhaul frequency and extend service intervals. Universities and state backed labs have diversified alloy chemistries for corrosion prone environments, which improved fit for petrochemical equipment and tooling. Medical implant exploration continues as biocompatibility data expands, creating future channels in orthopedic products. With procurement pipelines spanning aviation primes and heavy industry, high entropy alloys are positioned to convert pilot programs into serial orders, which sustains double digit style growth in installed applications.

India is projected to grow at a CAGR of 9.1% in the high entropy alloy market during 2025–2035, slightly lower than the global growth rate of 7.3%. Between 2020–2024, India experienced a CAGR of 7.4%, with growth driven by advancements in aerospace and automotive applications. The market in India is expanding as manufacturing capabilities improve and more industries seek durable and high-performance materials. The acceleration in growth over the coming years will be fueled by the country's growing focus on aerospace, energy, and defense technologies, with increasing adoption of high entropy alloys for applications that demand superior heat resistance, strength, and corrosion resistance.

The United States is projected to grow at a CAGR of 6.2% for the high entropy alloy market during 2025–2035, slightly below the global rate of 7.3%. Between 2020–2024, the market achieved a CAGR of 5.4%, driven by applications in aerospace, automotive, and defense industries. While the initial phase of growth was slow due to the high cost of production and the niche nature of the material, the market is expected to accelerate in the coming years as industries increasingly recognize the benefits of high entropy alloys. The rise in demand for corrosion-resistant, high-strength materials, particularly in aerospace and military applications, will fuel growth in this segment.

France is projected at 7.7% CAGR during 2025–2035, anchored in aerospace engines, nuclear systems, and precision machining. Engine hot section trials and radiation-tolerant components position these alloys as credible upgrades where lifetime and stability matter. Tooling houses report fewer changeovers, which helps maintain takt time in complex machining. As France pushes for higher energy efficiency and long-term durability in critical infrastructure, high entropy alloys offer solutions that reduce wear and tear in extreme environments. Their superior resistance to corrosion and high-temperature performance aligns with France’s aerospace, automotive, and nuclear energy requirements. Over the forecast period, broader adoption is expected in these industries, as the economic value of longer-lasting components outweighs initial material costs.

The high entropy alloys market is highly competitive, comprising both global players and regional specialists. Companies such as Carpenter Technology Corporation, Alcoa Corporation, and AMETEK Specialty Metal Products are at the forefront, known for their extensive product portfolios and innovations in advanced material technologies. Carpenter Technology Corporation stands out with its expertise in producing high-performance alloys for aerospace, defense, and energy applications.

Alcoa Corporation focuses on manufacturing lightweight high entropy alloys for aerospace and automotive sectors, while AMETEK Specialty Metal Products provides critical materials for industrial and medical applications. Key players such as Aperam S.A., ATI Metals, and Haynes International are key contributors in the production of high entropy alloys for specialized sectors like defense, energy, and manufacturing. Aubert & Duval and Daido Steel focus on producing alloys for high-stress applications such as turbines and heat exchangers. Hitachi Metals, Höganäs AB, and IHI Corporation specialize in high-entropy powder metallurgy and alloy production for industrial and energy systems.

Other companies like Metalysis, Nippon Yakin Kogyo, and Oerlikon Metco are increasingly investing in research and development to improve the performance and cost-effectiveness of high entropy alloys. Players such as Praxair Surface Technologies, Questek Innovations, and VDM Metals GmbH are innovating in the field of additive manufacturing and advanced coatings for alloys, providing a competitive edge in industries like aerospace and biomedical engineering. Differentiation strategies in this market are centered around improving the alloy compositions for enhanced strength, durability, and resistance to extreme conditions. Companies are increasingly focusing on partnerships and joint ventures to diversify their product offerings, explore new application areas, and expand their footprint in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Alloy Type | 3D transition metal HEAs, Refractory metal HEAs, Light metal HEAs, Aluminum-containing HEAs, Precious metal HEAs, Rare earth element-containing HEAs, and Others |

| Manufacturing Method | Casting & solidification, Powder metallurgy, Additive manufacturing, Thin film deposition, and Others |

| Property | Superior mechanical properties, Thermal stability, Corrosion & oxidation resistance, Magnetic properties, Electrical properties, Radiation resistance, and Others |

| Application | Structural applications, Functional applications, Coatings & surface treatments, Extreme environment applications, and Others |

| End Use Industry | Aerospace & defense, Automotive, Energy, Industrial equipment, Electronics & semiconductors, Chemical & petrochemical, Medical & healthcare, Research & academia, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carpenter Technology Corporation, Alcoa Corporation, AMETEK Specialty Metal Products, Aperam S.A., ATI Metals, Aubert & Duval, Daido Steel, Eramet Group, H.C. Starck GmbH, Haynes International, High Entropy Alloys Inc., Hitachi Metals, Höganäs AB, IHI Corporation, Kennametal, Materion Corporation, Metalysis, Nippon Yakin Kogyo, Oerlikon Metco, Plansee SE, Praxair Surface Technologies, Questek Innovations, Sandvik AB, Special Metals Corporation, and VDM Metals GmbH |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive landscape, alloy performance in key industries, growth in aerospace, defense, automotive, and biomedical sectors, and material cost forecasts. |

The global high entropy alloy market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the high entropy alloy market is projected to reach USD 2.6 billion by 2035.

The high entropy alloy market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in high entropy alloy market are 3d transition metal heas, _cocrfemnni (cantor alloy), _cocrfeni, _cocrfenimn, _others, refractory metal heas, _nbmotaw, _vnbmotaw, _hfnbtatizr, _others, light metal heas, _almglicazn, _allimgscti, _others, aluminum-containing heas, _alcocrfeni, _alcocrcufeni, _others, precious metal heas, rare earth element-containing heas and others.

In terms of manufacturing method, casting & solidification segment to command 31.2% share in the high entropy alloy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA