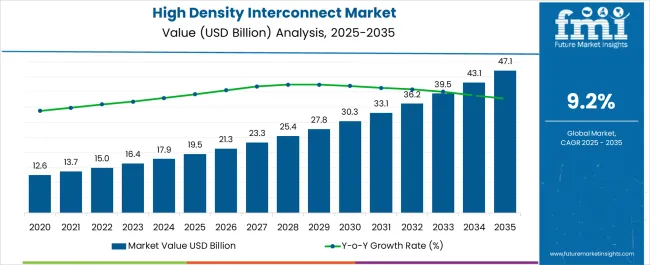

The High Density Interconnect Market is estimated to be valued at USD 19.5 billion in 2025 and is projected to reach USD 47.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| High Density Interconnect Market Estimated Value in (2025 E) | USD 19.5 billion |

| High Density Interconnect Market Forecast Value in (2035 F) | USD 47.1 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The high density interconnect market is witnessing notable expansion driven by rising demand for miniaturized electronics, faster signal transmission, and advanced packaging technologies. Increasing adoption of 5G infrastructure, IoT devices, and high performance consumer electronics is creating strong momentum for high density interconnect printed circuit boards.

Continuous advancements in semiconductor technology, along with the need for compact multilayer designs in smartphones, wearables, and automotive systems, are reinforcing growth. Moreover, regulatory focus on energy efficiency and lightweight materials in electronics manufacturing is supporting adoption.

With industries prioritizing enhanced reliability, higher circuit density, and improved thermal performance, the market outlook remains promising, especially across automotive, telecommunications, and consumer electronics domains.

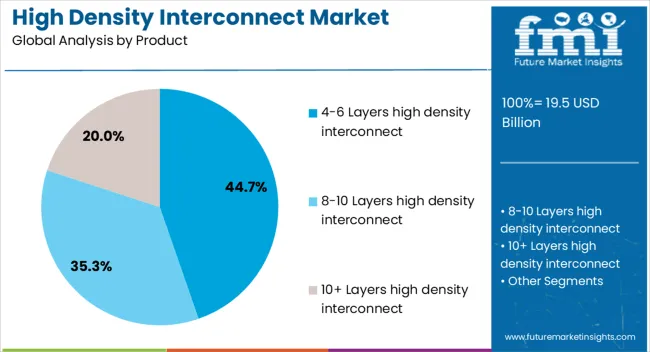

The 4 to 6 layers segment is projected to account for 44.70% of market revenue by 2025 within the product category, making it the leading product type. This dominance is attributed to its balance of cost effectiveness, functionality, and scalability for mass production of electronic devices.

Its capability to support higher wiring density while maintaining performance reliability has made it essential for consumer devices, communication systems, and industrial electronics.

The segment’s adaptability to multiple end use requirements and compatibility with advanced fabrication processes have further reinforced its strong market presence.

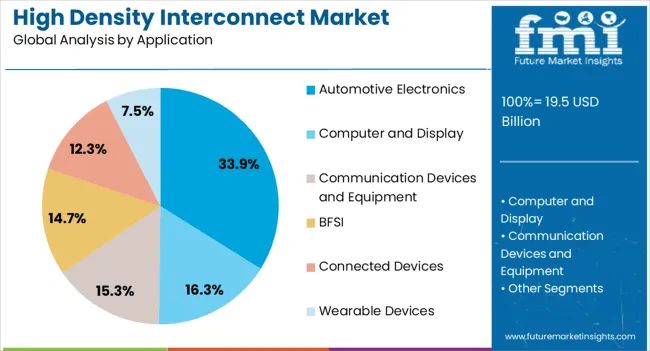

The automotive electronics segment is expected to capture 33.90% of market revenue by 2025 under the application category, positioning it as the dominant industry user. Growth in this segment is being fueled by the increasing integration of advanced driver assistance systems, electric vehicle platforms, and in vehicle infotainment technologies.

The need for high performance circuit boards to handle complex power management, connectivity, and safety functions has accelerated the adoption of high density interconnect solutions. Rising demand for lightweight and compact electronic assemblies in vehicles, coupled with regulatory focus on energy efficiency and safety, is driving consistent adoption.

As automotive design continues to evolve toward connected and autonomous systems, the automotive electronics application segment is set to retain its leadership.

As per Future Market Insights (FMI), historically, from 2020 to 2047.1, the value of the high density interconnect market increased at around 12.0% CAGR. With an absolute USD opportunity of USD 47.1 Billion, the market is projected to reach a valuation of USD 36.0 billion by 2035.

The automotive sector has been at the forefront of incorporating high density interconnect market technology in recent years. The demand for high density interconnect in this industry vertical is expected to grow significantly between 2025 and 2035.

High power boards, high-density connection boards, flex PCBs, PTFE materials for high-frequency PCBs, miniaturization of PCBs, and green PCBs have recently marked an uptick in demand. They are expected to continue trending in the PCB business.

The PCB sector is primarily pushed by increased demand for PCBs in the communication industry, advancements in connected devices, and in automotive electronics.

The factors restraining the growth of the high density interconnect market are the high cost and limited application areas. High production expenses are experienced due to this technology's need for sophisticated manufacturing processes and expensive materials. Traditional PCBs are less sophisticated than high density interconnect technology, necessitating specialist design, and manufacturing knowledge. Its acceptance in quick-paced sectors is constrained by its complexity. This can also lead to lengthier development durations and thus restrain market growth.

The designs and production methods used by several firms to create high density interconnect technology are exclusive.

Due to this, competition is restricted, and it is challenging for new competitors to enter the market which restrains the market growth. Often exclusive, high-end applications like smartphones, tablets, and other portable electronic devices typically utilize high density interconnect technology.

Asia Pacific to Exhibit Significant Demand for High Density Interconnect Products by 2035

Asia Pacific is considered to have the predominant high density interconnect market throughout the projection period. The growing need for high density interconnect market products in the consumer electronics and automotive electronics sector has LED to the expansion of this market in Asia Pacific.

This region is a hub for consumer electronics and is poised to grow with a high demand over the forecast years. This can be attributed to the rising demographic contribution towards digitalization and the entertainment sector.

Prominent players, like China, India, Japan, South Korea are keen on manufacturing and innovation in the sector to attract the global market. This has LED to multiple opportunities for businesses willing to utilize the South Asian markets.

Wide Proliferation of Performance-Intensive Electronic Devices to Push Voluminous Growth of the High Density Interconnect Market

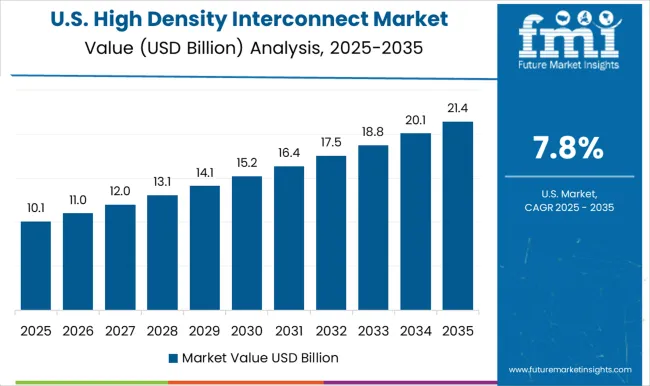

As per the recent Future Market Insights (FMI) report, the United States market will have continued growth in technological advancements and will witness increased competition.

With a projected CAGR of 8% from 2025 to 2035, the high density interconnect industry in the United States is expected to continue its growth trajectory. This is likely to be driven by increasing demand for miniaturization and high-performance electronic devices in various industries. For instance, consumer electronics, automotive, and healthcare.

Industry growth will likely push for technological advancements in high density interconnects, including new materials and manufacturing techniques. This could lead to improved performance, increased reliability, and reduced costs, further driving demand for high density interconnect solutions.

With the industry expected to reach USD 5.2 billion by the end of the forecast period, several companies are likely to enter the market. An absolute USD growth opportunity of USD 2.8 billion is further likely to increase competition. This could drive down prices and increase innovation as companies try to differentiate themselves and gain market share.

In March 2024, Sanmina Corporation, a United States company, expanded its Thailand facility. The facility now offers sophisticated bespoke packaging and assembly capabilities. It is utilized in the production of advanced optical, high-speed, and radio frequency (RF) microelectronic assemblies and products, enhancing its existing mission-critical products.

With this increase, the networking, 5G, data center, automotive/LIDAR, aerospace, and military industries will all experience significant growth for new technological items.

Presence of Well-Established Electronic Device Manufacturers Will Fuel Market Expansion

The high density interconnect market in the United Kingdom is projected to continue its steady growth trajectory, with a CAGR of 7.6% from 2025 to 2035. This is slightly more than the growth rate from 2020 to 2024, indicating a positive trend for the industry.

The absolute USD growth of the United Kingdom high density interconnect market is expected to be USD 117.9 million from 2025 to 2035. This indicates a strong potential for market expansion and development.

By 2035, the market is projected to be worth USD 933.8 million, indicating a significant growth potential for the industry in the region.

In June 2025, Kestrel International Circuits Ltd was acquired by NCAB Group. Kestrel will be integrated into NCAB Group UK, which, in turn, is a part of the Europe segment within the NCAB Group. Synergies are expected in the areas of factory management, suppliers, payment terms as well as in logistics.

The Versatile Production Systems and High Capacity to Boost Sales for China Manufacturers

The market is expected to continue growing, with a projected absolute USD growth of USD 6.1 billion and a CAGR of 10.6% from 2025 to 2035. By 2035, the market is projected to be worth USD 17.9 billion, which represents significant growth from its value in 2024.

The high CAGR 14.2% from 2020 to 2024 indicates that there is strong demand for high density interconnect solutions in China. This is a key factor likely to continue driving market growth ovr the forecast period.

In September 2025, Unimicron, a Chinese company, invested heavily in the manufacturing of the latest PCB technology. Copper plating technology enables the use of a wide range of materials for multilayers, as well as high density interconnect PCBs and integrated circuit (IC) substrates.

The new 48-meter-long line is outfitted with a completely automated loading and unloading mechanism as well as RFID recognition for internal traceability. It provides great versatility in terms of production capacity, copper layer thicknesses, circuit board technologies, and dimensions.

Technology Innovation in 10+ Layers HDIs to Pave Way for Enhanced Demand in the Market Segment

10+ Layers high density interconnect is projected to witness significant growth. The application of 10+ Layers HDIs is found in a variety of devices, including high-reliability automotive goods. High-density mobile devices, and Internet of Things (IoT) modules are also found to be responsible for this rise.

Benefits of 10+ Layers high density interconnect include its compact size, lightweight design, and increased flexibility. This kind of PCB is utilized in high density applications where greater performance and reliability are needed. It is constructed out of several smaller boards that are bonded together.

While expensive, it provides a higher level of security and dependability. It works well for applications that need a lot of power and rapid processing. The CAGR for 10+ Layers high density interconnect was around 11.8% from 2020 to 2024, and is forecasted to grow at around 9.1% through the end of 2035.

The Pressing Need by Industry 4.0 Opens Up Opportunity for Wearable Device Manufacturers

A widely used application of the high density interconnect market is wearable devices. The CAGR for wearable devices was around 11.6% from 2020 to 2024 and is forecasted to grow by 9% by the end of 2035.

The increased component density is made feasible by high density interconnect PCBs, which have extraordinary technical properties. The lightweight design and great performance of high density interconnect boards make them perfect for supplying power to wearable technology.

Additionally, the development of the high density interconnect market is anticipated to present further profitable prospects. Technical improvements, the rise in demand for industry 4.0 standards, and the emergence of industry 5.0 will be significantly responsible for this.

The global demand for smartphones and other mobile devices is increasing, which is boosting the requirement for high density interconnect technology. Innovative solutions, patents and acquisitions are frequently employed by manufacturers to gain a competitive edge.

The players, who currently hold a small market share, are constantly aiming to grow their revenues in the high density interconnect market.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 15.0 billion |

| Projected Market Valuation (2035) | USD 36.0 billion |

| Value-based CAGR (2025 to 2035) | 9.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD billion) |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Covered | The United States, United Kingdom, Germany, France, Spain, Italy, Japan, China, Singapore, Malaysia, Sri Lanka, Kingdom of Saudi Arabia, United Arab Emirates, South Korea, Finland, Hungary, Rest of the World |

| Key Segments Covered | Product, Application, Region, Technology |

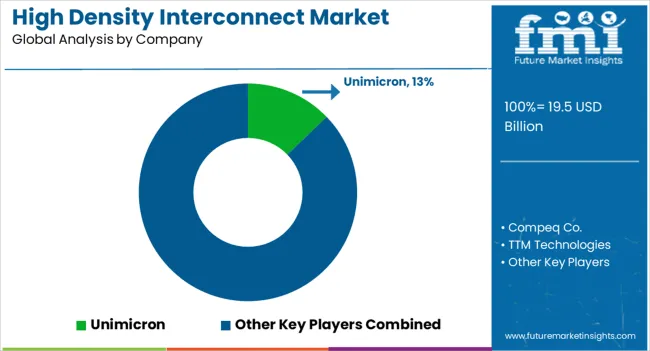

| Key Companies Profiled | Unimicron; Compeq Co.; TTM Technologies; Austria Technologies and Systemtechnik ; Zhen Ding Tech.; IBIDEN; MEIKO ELECTRONICS; FUJITSU INTERCONNECT TECHNOLOGIE; Tripod Technology Corp.; SAMSUNG ELECTRO-MECHANICS; Daeduck GDS Co; DAP Corp.; Korea Circuit |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global high density interconnect market is estimated to be valued at USD 19.5 billion in 2025.

The market size for the high density interconnect market is projected to reach USD 47.1 billion by 2035.

The high density interconnect market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in high density interconnect market are 4-6 layers high density interconnect, 8-10 layers high density interconnect and 10+ layers high density interconnect.

In terms of application, automotive electronics segment to command 33.9% share in the high density interconnect market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Density Polyethylene HDPE Market Size and Share Forecast Outlook 2025 to 2035

High density Fiberboard (HDF) Market Size and Share Forecast Outlook 2025 to 2035

High Density (HD) Cell Banking Market Size and Share Forecast Outlook 2025 to 2035

High Density Polyethylene (HDPE) Bottle Market Analysis - Size, Share, and Forecast 2025 to 2035

High-Density Racks (>100Kw) Market Growth - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in High-Density Polyethylene Bottle Market

High Density Polyethylene Film Market

High-Speed Interconnects Market by Type by Application & Region Forecast till 2035

Demand for High-Density Racks (100Kw) in Japan Size and Share Forecast Outlook 2025 to 2035

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA