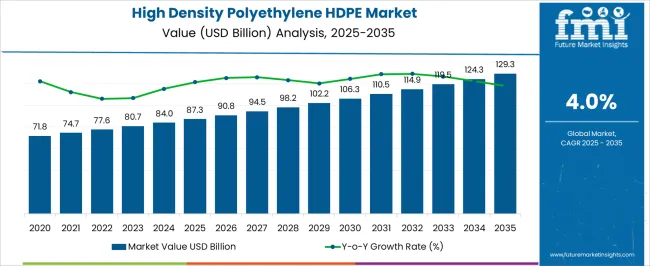

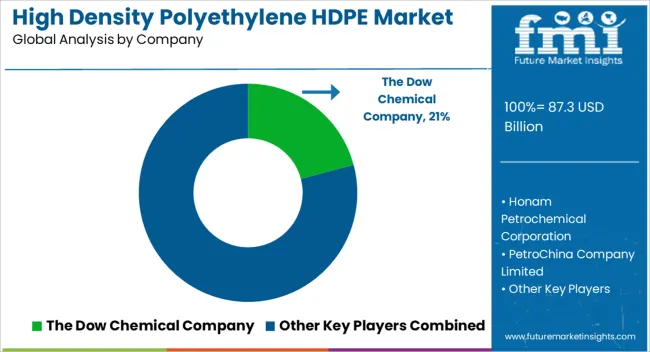

The high density polyethylene (HDPE) market is valued at USD 87.3 billion in 2025 and is likely to reach USD 129.3 billion by 2035, growing at a CAGR of 4.0%, with a multiplying factor of about 1.48x. A rolling CAGR analysis provides a closer view of how growth momentum shifts across overlapping periods rather than remaining uniform over the decade.

In the initial phase, from 2025 to 2028, rolling CAGR values are slightly above the long-term average as demand rises from applications in packaging, piping, and consumer goods. Growth during this stage is supported by expanding infrastructure, urban development, and increasing adoption in emerging regions.

From 2028 to 2032, rolling CAGR indicates moderate acceleration as specialized HDPE grades for industrial, automotive, and renewable energy sectors gain traction. Increasing deployment in water management, solar, and wind energy infrastructure contributes to stronger incremental growth during this phase.

In the final phase, from 2032 to 2035, rolling CAGR shows slight moderation as mature markets approach higher penetration levels, and incremental expansion depends on product performance improvements, recycling initiatives, and compliance with evolving environmental standards. The rolling analysis demonstrates that while the overall CAGR is 4.0%, periods of faster and slower growth occur, providing stakeholders with guidance for strategic capacity planning, technology investment, and regional market focus in the HDPE sector.

| Metric | Value |

|---|---|

| High Density Polyethylene HDPE Market Estimated Value in (2025 E) | USD 87.3 billion |

| High Density Polyethylene HDPE Market Forecast Value in (2035 F) | USD 129.3 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The HDPE market is expanding steadily due to increasing demand for versatile and durable plastic materials across various industries. Growing consumer preference for lightweight, recyclable, and cost-effective packaging solutions has significantly influenced HDPE consumption.

Advancements in polymer processing technologies and the development of specialized HDPE grades have improved material performance, allowing wider applications. The surge in packaging demand driven by the food and beverage, personal care, and household products sectors has boosted HDPE market growth.

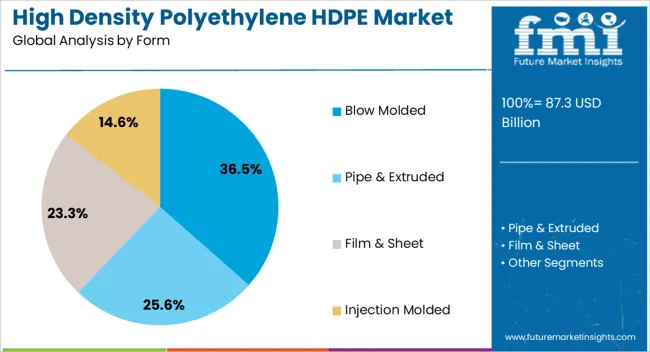

Additionally, regulatory emphasis on sustainable packaging and recycling initiatives has promoted HDPE use due to its recyclability and environmental benefits. Urbanization and e-commerce expansion have further stimulated the need for efficient packaging materials. Moving forward, the market is expected to benefit from innovations in blow molding processes and expanding applications in packaging and other end-user industries. Segmental growth is forecasted to be driven by the blow-molded form segment and the Packaging end-user segment due to their large-scale adoption and evolving consumer trends.

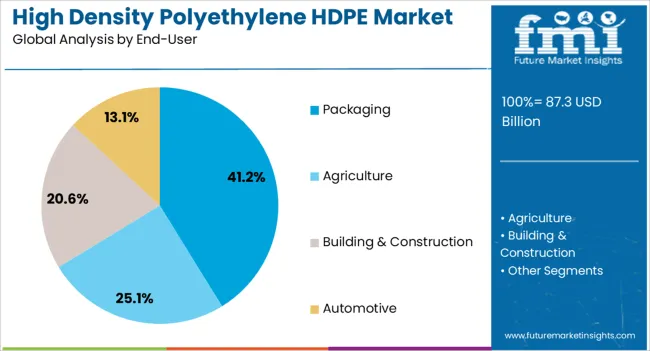

The high density polyethylene HDPE market is segmented by form, end-user, and geographic regions. By form, the high-density polyethylene HDPE market is divided into blow-molded, Pipe & Extruded, Film & Sheet, and injection-molded. In terms of end-user, the high density polyethylene HDPE market is classified into Packaging, Agriculture, Building & Construction, and Automotive. Regionally, the high density polyethylene HDPE industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Blow Molded segment is anticipated to account for 36.5% of the HDPE market revenue in 2025, retaining its lead among processing forms. This growth is supported by blow molding’s ability to produce hollow and complex-shaped containers efficiently and economically.

Blow molded HDPE products, such as bottles and drums, are widely used in packaging due to their strength and lightweight nature. The manufacturing process offers high production rates and design flexibility, meeting the increasing demand for customized packaging solutions.

Furthermore, blow molding supports the use of recycled HDPE, aligning with sustainability goals. Industries requiring durable and safe containers have driven the adoption of blow-molded HDPE products, making this segment critical to market growth.

The Packaging segment is projected to hold 41.2% of the HDPE market revenue in 2025, leading the end-user categories. The dominance of packaging is attributed to HDPE’s excellent barrier properties, chemical resistance, and ability to preserve product freshness.

The food and beverage sector has been a major contributor to packaging demand, requiring reliable containers and films that comply with safety standards. Additionally, personal care and household product industries have increasingly used HDPE packaging to enhance product protection and shelf appeal.

Consumer preference for recyclable and lightweight packaging has further boosted HDPE adoption. As environmental regulations tighten and sustainability becomes a key focus, the packaging segment is expected to sustain strong growth supported by ongoing innovations and market expansion.

The high density polyethylene (HDPE) market is growing due to increasing demand for versatile and durable plastic products. HDPE is widely used in packaging, construction, and consumer goods due to its strength, chemical resistance, and low moisture absorption. The rising focus on sustainability, alongside the increasing adoption of HDPE in industries like packaging and automotive, is driving market expansion. Despite challenges like fluctuating raw material prices and competition from other plastics, HDPE remains a leading choice for cost-effective and high-performance plastic solutions in numerous applications.

The high density polyethylene market is primarily driven by the increasing demand for durable, versatile plastic products across various industries. HDPE’s superior chemical resistance, strength, and low moisture absorption make it an ideal material for packaging, construction, and consumer goods. In the packaging industry, HDPE is commonly used for bottles, containers, and plastic bags due to its ability to withstand harsh environments and provide long-lasting protection. Additionally, the automotive and construction industries are increasingly adopting HDPE for manufacturing pipes, containers, and insulation materials. The growing preference for durable, cost-effective, and high-performance plastics is fueling HDPE adoption, further driving market growth. As industries focus on efficiency and material longevity, HDPE continues to be a popular choice for a wide range of applications.

A significant challenge in the high-density polyethylene market is the volatility in raw material prices, particularly due to the fluctuation in crude oil prices. HDPE is produced from petroleum-based feedstocks, and any price increases in crude oil or other related materials directly impact production costs, making it difficult for manufacturers to maintain stable pricing. HDPE faces competition from alternative materials, such as polypropylene and PET, which can sometimes offer better performance or lower cost in specific applications. The growing focus on recyclable and biodegradable materials also presents a challenge, as HDPE is often criticized for its environmental impact. Companies need to adapt to these pressures by improving HDPE recycling processes or exploring more sustainable alternatives, while still maintaining cost-effectiveness and quality.

The HDPE market presents significant opportunities, particularly driven by advancements in recycling technologies and growing applications across emerging markets. The development of more efficient recycling processes has made it easier to reuse HDPE products, which is contributing to sustainability goals and reducing waste. With increasing awareness of the need for a circular economy, HDPE recycling rates are improving, which enhances the demand for recycled HDPE in various industries. As emerging markets, particularly in Asia-Pacific and Latin America, experience rapid industrialization and urbanization, the demand for HDPE products in packaging, construction, and infrastructure is set to increase significantly. Manufacturers can capitalize on these trends by expanding into these regions and offering products made from recycled or recyclable HDPE materials, helping to address environmental concerns while tapping into new growth areas.

A key trend in the HDPE market is the increasing use of recycled HDPE in packaging and manufacturing processes. With growing environmental concerns, many companies are adopting recycled HDPE to meet consumer demand for eco-friendly products. This trend is particularly evident in the packaging industry, where brands are focusing on reducing plastic waste and offering recyclable or recycled content packaging. As sustainability becomes a central focus, manufacturers are investing in improving HDPE recyclability and developing eco-friendly alternatives. Innovations in processing technologies are also enabling the production of higher-quality recycled HDPE, which can be used in a wider variety of applications.

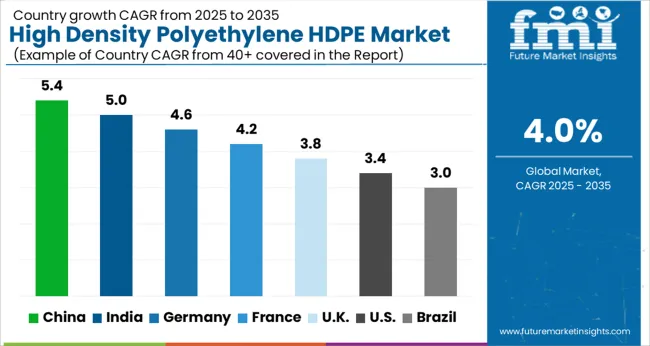

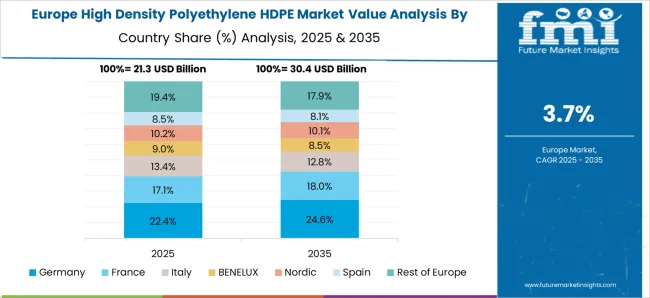

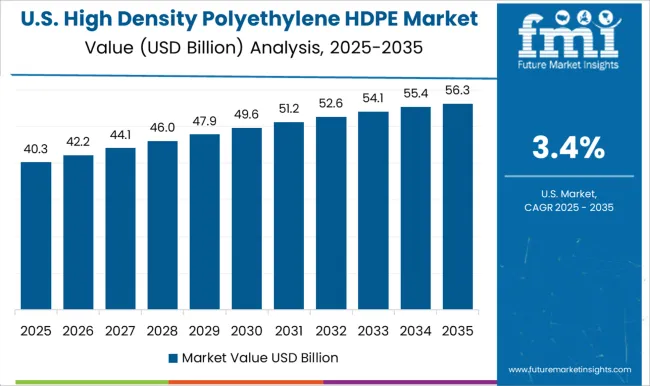

The global High Density Polyethylene (HDPE) market is projected to grow at a CAGR of 4.0% from 2025 to 2035. China leads at 5.4%, followed by India at 5.0%, and France at 4.2%, while the United Kingdom records 3.8% and the United States posts 3.4%.

These rates translate to a growth premium for China, India, and France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing adoption of HDPE products in packaging, construction, and consumer goods industries in China and India. The analysis includes over 40+ countries, with the leading markets detailed below.

India is projected to grow at a CAGR of 5.0% through 2035, driven by increasing demand from the packaging, automotive, and construction sectors. As industrialization accelerates, India’s demand for HDPE in both consumer and industrial applications is expected to rise. The country’s growing urbanization and rising disposable incomes are contributing to an increase in packaging demand, particularly in the food and beverage sector, where HDPE is commonly used. Additionally, the construction sector’s rapid expansion and demand for durable materials will boost HDPE consumption.

China is projected to grow at a CAGR of 5.4% through 2035, leading the global HDPE market. The country’s rapid industrialization, urbanization, and expansion in the construction and packaging sectors are driving demand for HDPE. As one of the largest consumers of plastic materials, China is expected to continue relying on HDPE for its durable, versatile, and cost-effective properties in a variety of applications, including packaging, textiles, and construction. Government policies favoring sustainable materials will further increase the demand for HDPE in China.

France is projected to grow at a CAGR of 4.2% through 2035, supported by increasing demand for HDPE in packaging and construction applications. The country’s push for sustainable packaging solutions and the increased demand for lightweight, durable materials in construction are key drivers for HDPE adoption. The packaging sector in France, particularly for food and beverage products, is increasingly relying on HDPE due to its durability, recyclability, and cost-effectiveness. The growing focus on green building materials is contributing to the market growth.

The UK HDPE market is expected to grow at a 3.8% CAGR through 2035. The demand for HDPE products is being driven by the increasing need for efficient packaging solutions in food, beverage, and pharmaceutical sectors. As manufacturers continue to adopt automation to improve packaging productivity and reduce labor costs, the demand for HDPE-based solutions rises. The UK market is benefiting from growing retail and e-commerce sectors that require fast, reliable, and scalable packaging solutions. The market is also seeing increasing demand for HDPE products in the automotive sector.

The United States is projected to grow at a CAGR of 3.4% through 2035, with significant demand for HDPE in the packaging, automotive, and construction industries. The shift towards more sustainable packaging and the growing construction sector will continue to boost HDPE demand. HDPE’s versatility in manufacturing, its ability to be recycled, and its performance in heavy-duty applications make it a preferred material in a variety of industries. The increasing use of HDPE in consumer goods packaging, particularly in the food and beverage sector, is also driving market growth in the USA

The high-density polyethylene (HDPE) market is driven by major chemical companies offering a wide range of HDPE products used in applications such as packaging, construction, automotive, and consumer goods. The Dow Chemical Company is a market leader, providing high-performance HDPE resins known for their strength, durability, and versatility across various applications, including containers, pipes, and films.

Honam Petrochemical Corporation offers a broad portfolio of HDPE solutions, focusing on enhancing product performance and sustainability while meeting industry-specific demands. PetroChina Company Limited is a significant player in the market, leveraging its vast petrochemical production capabilities to offer HDPE products used in applications like packaging, pipes, and automotive parts. Borealis AG specializes in providing high-quality HDPE materials used in packaging, construction, and automotive sectors, emphasizing product consistency and cost-effectiveness. Abu Dhabi Polymers Company Ltd (Borouge) focuses on providing HDPE solutions for both industrial and consumer markets, with an emphasis on improving product performance and energy efficiency.

LyondellBasell Industries NV offers a wide range of HDPE products, focusing on sustainability and high performance for applications such as blow molding, injection molding, and films. Formosa Plastics Corp provides HDPE resins with exceptional tensile strength and durability, widely used in the production of containers, piping systems, and films. Exxon Mobil Corp is a key player, offering HDPE products known for their high impact resistance, used in a variety of industrial applications. Chevron Phillips Chemical Co specializes in producing high-quality HDPE resins used in packaging and pipes, emphasizing their high chemical resistance and strength. Braskem S.A. provides innovative HDPE solutions with a focus on sustainable production methods and high-performance characteristics.

| Item | Value |

|---|---|

| Quantitative Units | USD 87.3 Billion |

| Form | Blow Molded, Pipe & Extruded, Film & Sheet, and Injection Molded |

| End-User | Packaging, Agriculture, Building & Construction, and Automotive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Dow Chemical Company, Honam Petrochemical Corporation, PetroChina Company Limited, Borealis AG, Abu Dhabi Polymers Company Ltd, LyondellBasell industries NV, Formosa Plastics Corp, Exxon Mobil Corp, Chevron Phillips Chemical Co, and Braskem S.A. |

| Additional Attributes | Dollar sales by product type (HDPE resins, HDPE sheets, HDPE films) and end-use segments (packaging, construction, automotive, consumer goods, textiles). Demand dynamics are influenced by the growing need for lightweight and durable materials in packaging, the expanding construction industry, and the increasing use of HDPE in eco-friendly products. Regional trends show strong growth in North America and Europe due to regulations promoting eco-frienfly packaging and construction materials, while Asia-Pacific is expanding rapidly due to high industrialization, urbanization, and the growing demand for HDPE in emerging markets. |

The global high density polyethylene HDPE market is estimated to be valued at USD 87.3 billion in 2025.

The market size for the high density polyethylene HDPE market is projected to reach USD 129.3 billion by 2035.

The high density polyethylene HDPE market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in high density polyethylene HDPE market are blow molded, pipe & extruded, film & sheet and injection molded.

In terms of end-user, packaging segment to command 41.2% share in the high density polyethylene HDPE market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Density Polyethylene (HDPE) Bottle Market Analysis - Size, Share, and Forecast 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA