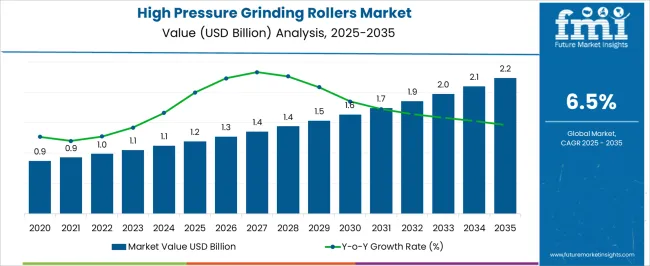

The high pressure grinding rollers market is projected to grow from USD 1.2 billion in 2025 to USD 2.2 billion by 2035, with a compound annual growth rate (CAGR) of 6.5%. A compound absolute growth analysis reveals consistent market expansion over time. Starting at USD 0.9 billion in 2024, the market experiences gradual growth, reaching USD 0.9 billion in 2025 and USD 1.0 billion in 2026, driven by the increasing demand for energy-efficient grinding solutions in mining and cement industries. From 2027 onwards, the market begins to pick up pace, with the value rising to USD 1.1 billion in 2027 and USD 1.2 billion in 2028.

The market shows steady, incremental increases through 2029 and 2030, reaching USD 1.3 billion in 2029 and USD 1.4 billion in 2030, reflecting the adoption of high pressure grinding rollers for improving operational efficiency and reducing energy consumption. As the market matures, growth accelerates further, reaching USD 1.7 billion in 2032 and USD 2.1 billion by 2034. The market reaches its peak at USD 2.2 billion in 2035, with increasing industry reliance on high pressure grinding technology for resource optimization and reduced operational costs. This growth reflects the ongoing demand for more efficient processing systems in mining and other industrial sectors.

| Metric | Value |

|---|---|

| High Pressure Grinding Rollers Market Estimated Value in (2025 E) | USD 1.2 billion |

| High Pressure Grinding Rollers Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

As global mining and cement industries shift toward sustainable practices, HPGR systems are being increasingly integrated into grinding circuits to lower energy consumption and environmental impact.

The future growth of this market is also being shaped by the rising demand for finely ground materials in emerging economies and the growing need to process complex ores with lower grades. Industry stakeholders are investing in R&D for wear-resistant materials, smart control systems, and process optimization technologies to extend the lifecycle of HPGR components and minimize maintenance downtime.

Moreover, the ability of HPGRs to improve metal liberation and downstream recovery rates has further positioned them as a preferred alternative to conventional milling techniques.

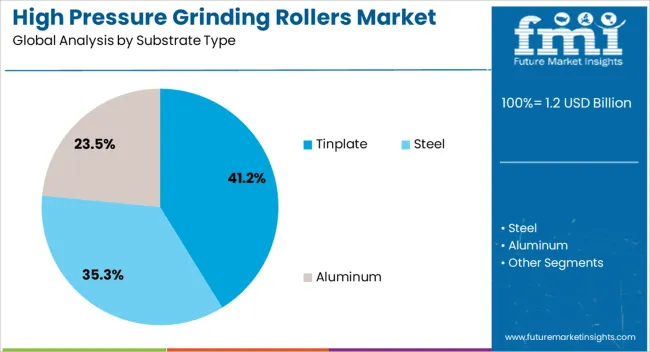

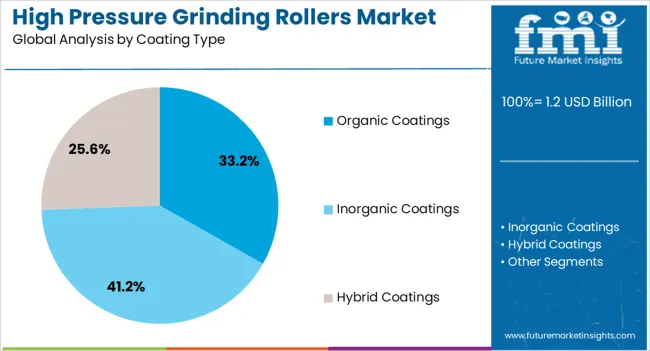

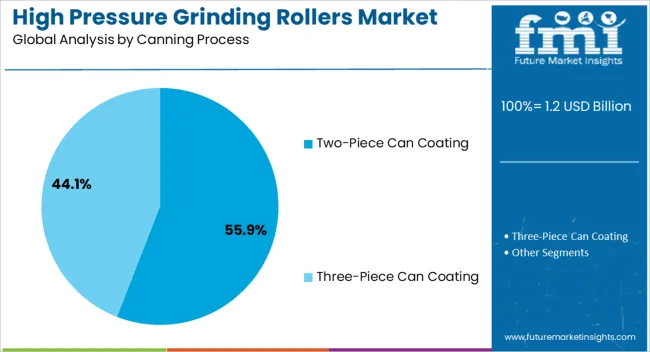

The high pressure grinding rollers market is segmented by substrate type, coating type, canning process, application, end user, and geographic regions. By substrate type, high pressure grinding rollers market is divided into Tinplate, Steel, and Aluminum. In terms of coating type, high pressure grinding rollers market is classified into Organic Coatings, Inorganic Coatings, and Hybrid Coatings. Based on canning process, high pressure grinding rollers market is segmented into Two-Piece Can Coating and Three-Piece Can Coating. By application, high pressure grinding rollers market is segmented into Food Cans, Beverage Cans, Aerosol Cans, and General Line Cans. By end user, high pressure grinding rollers market is segmented into Food and Beverage Processors and Pharmaceutical and Healthcare. Regionally, the high pressure grinding rollers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tinplate substrate type segment is projected to account for 41.2% of the revenue share in the High Pressure Grinding Rollers market in 2025. This leading position can be attributed to tinplate’s high strength-to-weight ratio, corrosion resistance, and compatibility with extreme mechanical pressures generated during grinding operations. Tinplate has been favored in HPGR applications due to its ability to maintain structural integrity under cyclic stress, enhancing roller performance and extending equipment longevity.

The segment’s growth is further supported by the material’s recyclability and alignment with sustainability initiatives in industrial manufacturing. Manufacturing consistency and formability have enabled precise fabrication of tinplate-coated components, ensuring minimal performance variability in high-stress environments.

The integration of tinplate substrates within HPGR systems has also contributed to improved efficiency and cost-effectiveness across ore processing plants Its broad acceptance in operational settings has reinforced its position as a trusted substrate material for long-term use in high-load grinding systems.

The organic coatings segment is expected to capture 33.2% of the revenue share in the High Pressure Grinding Rollers market by 2025. The segment’s growth is being influenced by the increasing need for wear and corrosion protection across roller surfaces exposed to abrasive and chemically aggressive environments. Organic coatings have demonstrated effectiveness in enhancing surface durability, reducing maintenance cycles, and improving operational uptime in HPGR equipment.

Their adaptability to various substrate types and environmental conditions has allowed manufacturers to tailor coating formulations to site-specific operational challenges. Enhanced thermal stability, chemical resistance, and adhesion properties have made organic coatings a reliable solution for protecting critical components.

Additionally, advancements in polymer chemistry and application techniques have led to the development of high-performance coating systems with improved longevity These benefits have supported the widespread adoption of organic coatings as a cost-effective solution for increasing the lifecycle of HPGR rollers in both mining and cement applications.

The two piece can coating segment is forecast to represent 55.9% of the revenue share in the High Pressure Grinding Rollers market in 2025. The dominance of this segment is being driven by its structural efficiency, material integrity, and high adaptability in automated production lines. Two piece can coatings have gained traction due to their uniformity and reduced seam-related vulnerabilities, which contribute to improved durability in high-pressure applications.

The segment’s growth is also influenced by the reduced material usage and streamlined production offered by the two piece format, aligning with cost optimization goals of manufacturers. In HPGR operations, the consistency of these coatings has enabled enhanced resistance to mechanical stress and surface degradation, particularly under high-load conditions.

Technological advancements in coating formulation have further optimized surface hardness, thermal endurance, and chemical resilience, making them highly suitable for prolonged exposure to grinding forces As industry standards evolve toward performance-driven solutions, the two piece can coating approach remains a strategic choice for efficiency-focused operations.

The high pressure grinding rollers (HPGR) market is experiencing steady growth, driven by the increasing demand for energy-efficient comminution technologies in industries such as mining, cement, and minerals processing. HPGRs offer advantages over traditional grinding methods, including reduced energy consumption, improved throughput, and enhanced mineral liberation. As a result, HPGRs are being increasingly adopted for processing low-grade ores and producing fine particles in various applications. The market is expected to continue expanding as industries seek more cost-effective grinding solutions, particularly in regions with high energy costs and resource constraints.

The wireless power bank market is primarily driven by the increasing adoption of wireless charging technology in smartphones, tablets, and other electronic devices. As more devices are integrated with wireless charging capabilities, the demand for wireless power banks is growing. Consumers appreciate the convenience of charging their devices without the need for physical connectors, making wireless power banks an attractive option. The expansion of wireless charging standards, such as Qi, and the growing compatibility of devices with wireless charging further support market growth. As more consumers seek convenient, hassle-free charging solutions, the demand for wireless power banks is expected to continue rising.

One significant barrier is the high initial capital investment required for the adoption of HPGR systems, which may be prohibitive, especially for small and medium-sized enterprises. Operational challenges include the need for specialized maintenance due to the complex components of HPGRs, which may wear down faster under heavy usage, leading to increased downtime. Integrating HPGRs into existing processing lines may require significant modifications, which increases implementation costs and leads to operational disruptions. Overcoming these challenges will require continuous innovation in design to improve durability, reduce costs, and enhance the compatibility of HPGR systems with existing infrastructure, making them more accessible for diverse industrial applications.

Advancements in materials science are contributing to the development of more durable, wear-resistant components that can extend the lifespan of HPGRs and reduce the frequency of maintenance. The integration of digital technologies, such as sensors and automation systems, is enhancing the monitoring and control of HPGR operations, improving operational efficiency, and enabling predictive maintenance. These innovations can reduce costs and improve reliability. Emerging applications, including the processing of unconventional ores and fine particle production, are opening new markets for HPGR technology. Moreover, with the increasing focus on energy-efficient solutions, HPGRs are being adopted in mining operations to enhance energy usage efficiency, positioning the market for future growth in sectors that prioritize cost-effective and sustainable processing solutions.

The HPGR market is being shaped by several trends aimed at improving performance and efficiency. Larger and more efficient units are being developed to handle higher throughput, meeting the needs of large-scale mining operations. The use of wear-resistant materials, such as tungsten carbide studs, enhances the durability of HPGRs, enabling them to withstand more intense operational conditions. Integration of artificial intelligence (AI) and machine learning (ML) technologies is revolutionizing maintenance by enabling predictive capabilities, which optimize HPGR operations and minimize downtime. The trend towards modular and flexible HPGR designs is gaining traction. These designs make it easier to integrate HPGRs into existing processing lines, offering scalability and adaptability to diverse production requirements. This ongoing evolution is driving the widespread adoption of HPGR technology across various industries.

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

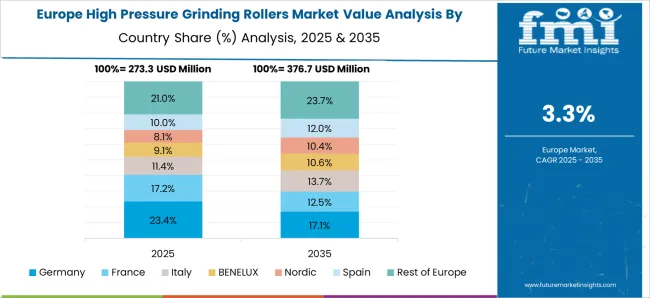

The global high pressure grinding rollers (HPGR) market is projected to grow at a CAGR of 6.5% from 2025 to 2035. Among the key markets, China leads with a growth rate of 8.8%, followed by India at 8.1%, and France at 6.8%. The United Kingdom and the United States show more moderate growth rates of 6.2% and 5.5%, respectively. This growth is driven by the increasing demand for energy-efficient and high-performance grinding solutions in industries like cement, mining, and mineral processing. Emerging markets such as China and India are expanding rapidly, while developed markets focus on process optimization and operational efficiency. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global high pressure grinding rollers (HPGR) market, growing at a projected CAGR of 8.8% from 2025 to 2035. The country’s expanding mining and mineral processing industries, particularly in sectors like cement, coal, and non-ferrous metals, are key drivers of market growth. China’s increasing demand for energy-efficient and cost-effective grinding solutions is contributing to the rising adoption of HPGR technology. As the country continues to modernize its mining processes and focus on optimizing production efficiency, the demand for high pressure grinding rollers is expected to grow significantly.

The HPGR market in India is projected to expand at a CAGR of 8.1% from 2025 to 2035. The country’s increasing industrialization, particularly in sectors like cement, mining, and mineral processing, is driving the demand for high pressure grinding solutions. India’s growing need for energy-efficient and high-performance grinding technologies in mineral extraction and cement manufacturing is expected to fuel market growth. With India’s ongoing investments in modernizing mining processes and improving production efficiency, the demand for HPGR technology is anticipated to rise significantly, positioning India as a key market in the global HPGR industry.

Demand for HPGR in France is expected to grow at a steady pace, with a anticipated CAGR of 6.8% from 2025 to 2035. The country’s mining and cement industries continue to drive demand for energy-efficient and high-performance grinding solutions. France’s focus on optimizing industrial processes and reducing operational costs is contributing to the growing adoption of HPGR technology. Additionally, the increasing emphasis on eco-friendly and cost-effective solutions in mineral processing is expected to further boost the demand for HPGR systems. As France continues to innovate in mining and cement production technologies, the market for HPGR is set to expand.

The HPGR market in the United Kingdom is projected to grow at a CAGR of 6.2% from 2025 to 2035. The UK’s demand for HPGR technology is primarily driven by the increasing need for energy-efficient grinding solutions in mineral processing and cement production. The growing focus on optimizing production processes and improving grinding efficiency is further contributing to market growth. The adoption of HPGR systems is expected to rise in the UK, supported by advancements in the mining and cement industries and government initiatives promoting sustainable manufacturing practices. The market is set for steady growth in the coming years.

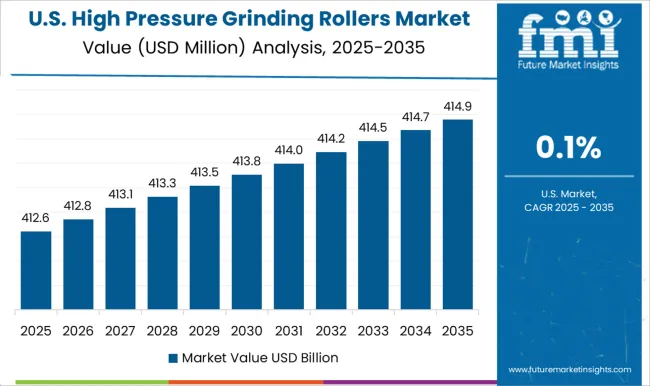

The high pressure grinding rollers market in the United States is projected to grow at a CAGR of 5.5% from 2025 to 2035. The USA mining and cement industries are key drivers of demand for HPGR technology, as companies seek to optimize grinding processes and reduce energy consumption. The country’s focus on improving production efficiency and reducing operational costs in mineral extraction is contributing to market growth. As the USA continues to invest in advanced grinding technologies and innovations in cement manufacturing, the demand for HPGR systems is expected to rise steadily in the coming years.

The high pressure grinding rollers (HPGR) market is driven by the increasing demand for energy-efficient grinding solutions in the mining, cement, and minerals processing industries. Leading players in the market include CITIC Heavy Industries Co. Ltd., FLSmidth, KHD Humboldt Wedag International AG, Cast Steel Products, The Weir Group PLC, Thyssenkrupp Koppern Group, Outotec Oyj (Metso Outotec), and TAKRAF GmbH (Tenova Core Inc.).

CITIC Heavy Industries Co. Ltd. is a key player in the HPGR market, offering advanced, high-quality solutions for grinding. FLSmidth is recognized for its innovations in HPGR technology, focusing on energy efficiency and high throughput. KHD Humboldt Wedag International AG provides state-of-the-art HPGR systems used in cement and mineral processing. Cast Steel Products specializes in the production of durable wear parts for HPGRs, enhancing the efficiency of grinding operations.

The Weir Group PLC is a notable provider of HPGRs, catering to mining and cement industries globally. Thyssenkrupp Koppern Group focuses on high-performance HPGR systems that offer lower energy consumption and higher productivity. Outotec Oyj (Metso Outotec) delivers advanced HPGR solutions for ore processing. TAKRAF GmbH (Tenova Core Inc.) provides customized HPGR technology for various industrial applications.

These companies differentiate themselves through technological advancements, innovation, and high-quality customer service, meeting the growing demand for energy-efficient and sustainable grinding solutions in mining, cement, and minerals processing sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Substrate Type | Tinplate, Steel, and Aluminum |

| Coating Type | Organic Coatings, Inorganic Coatings, and Hybrid Coatings |

| Canning Process | Two-Piece Can Coating and Three-Piece Can Coating |

| Application | Food Cans, Beverage Cans, Aerosol Cans, and General Line Cans |

| End User | Food and Beverage Processors and Pharmaceutical and Healthcare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CITICHeavyIndustriesCo.Ltd., FLSmidth, KHDHumboldtWedagInternationalAG, CastSteelProducts, TheWeirGroupPLC, ThyssenkruppKoppernGroup, OutotecOyj(MetsoOutotec), and TAKRAFGmbH(TenovaCoreInc.) |

| Additional Attributes | Dollar sales by product type (2 x 100 kW - 2 x 650 kW, 2 x 650 kW - 2 x 1,900 kW, 2 x 1,900 kW - 2 x 3,700 kW, 2 x 3,700 kW and above) and end-use segments (mining, cement, minerals processing). Demand dynamics are driven by energy efficiency, cost-effective processing solutions, and the rise in mining and cement industries. Regional trends show strong growth in Asia-Pacific, North America, and Europe. |

The global high pressure grinding rollers market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the high pressure grinding rollers market is projected to reach USD 2.2 billion by 2035.

The high pressure grinding rollers market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in high pressure grinding rollers market are tinplate, steel and aluminum.

In terms of coating type, organic coatings segment to command 33.2% share in the high pressure grinding rollers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA