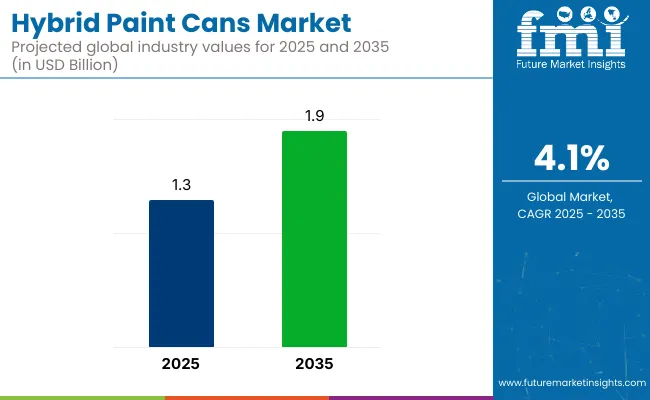

The hybrid paint cans market is valued at USD 1.3 billion in 2025 and is slated to reach USD 1.9 billion by 2035, at a CAGR of 4.1%. Hybrid paint cans are used due to their combination of metal and plastic benefits, offering durability, recyclability, and reduced weight.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 1.3 Billion |

| Projected Market Size (2035) | USD 1.9 Billion |

| CAGR (2025 to 2035) | 4.1% |

Demand has been increasing as regulatory standards shift toward sustainable packaging, encouraging innovations in tamper-proof, corrosion-resistant, and smart packaging solutions.

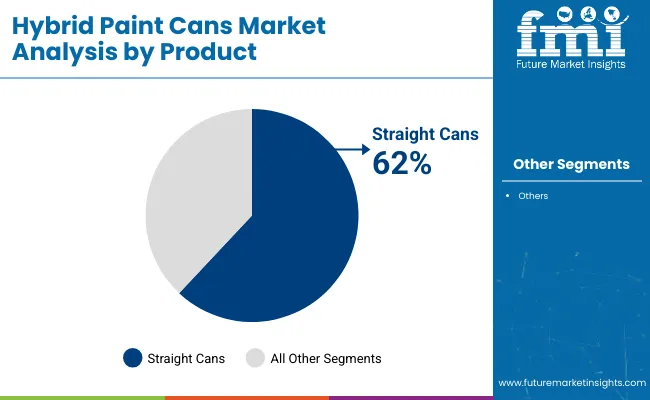

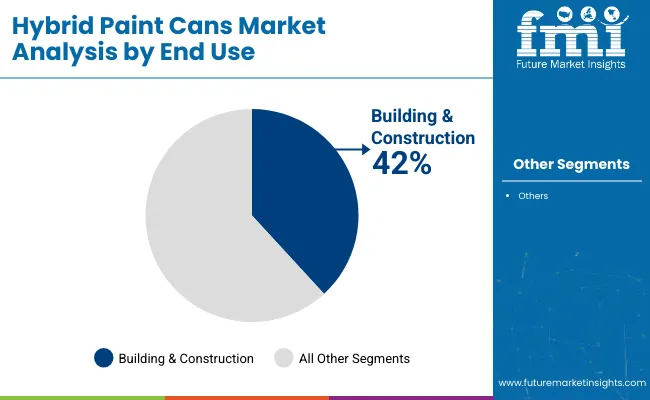

Straight cans have been holding the highest market share across the product segment with over 62% contribution in 2025. The building & construction segment is expected to dominate end-use demand with around 42% of the market share. The USA is anticipated to record the highest CAGR of 5.9% during the forecast period, driven by regulatory mandates on sustainable materials and rising construction activities.

Hybrid paint cans hold an estimated 22% share in the global paint cans market, driven by their lightweight, durable, and sustainable design that combines plastic and metal. Within the broader paint and coatings packaging market, hybrid cans account for approximately 9% to 12%, primarily used for water-based and premium paint products. In the industrial packaging segment, their share is relatively niche at around 4% to 6%, due to dominance by metal drums and rigid containers. Within the hybrid packaging solutions category, hybrid paint cans represent 18% to 20%, reflecting growing adoption across retail paints and DIY consumer markets.

Innovations in hybrid paint cans have been driven by the integration of AI-based defect detection systems, allowing manufacturers to maintain consistent product quality while minimizing wastage during production. Smart labeling technologies have been incorporated to enhance product traceability and consumer engagement through QR codes and interactive packaging features. Additionally, solvent-resistant coatings have been developed to extend the shelf life and maintain the integrity of various paint formulations.

Furthermore, advancements in automated production lines, modular design configurations, and high-resolution digital printing technologies have been shaping market trends. These developments have been ensuring that hybrid paint cans remain viable and competitive across industrial, residential, and commercial applications globally.

The market is segmented into product type, capacity, end use, and region. By product type, the market is divided into straight cans and beaded cans. Based on capacity, the market is categorized into below 1000 ml, 1001-2000 ml, 2001-3000 ml, 3001-4000 ml, and above 4000 ml.

In terms of end use, the market is segmented into building & construction, automobile, textile, and others (marine, aerospace, electrical & electronics). Regionally, the market is classified into North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and Middle East & Africa.

Straight cans are expected to lead the product segment, accounting for around 62% of the global market share by 2025. These cans have been widely adopted for their strong structural integrity, cost efficiency, and ease of manufacturing, meeting diverse paint packaging needs.

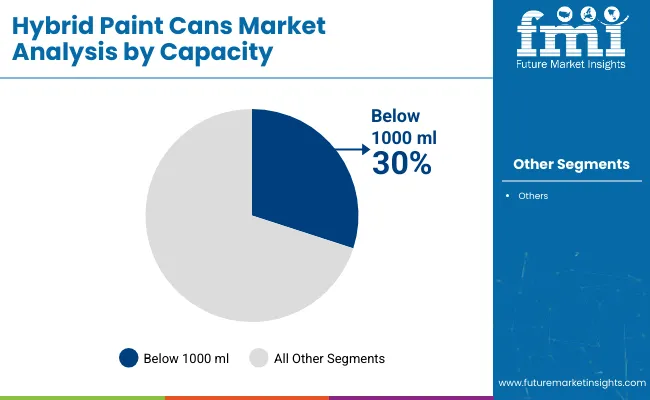

Below 1000 ml cans are projected to hold around 30% market share by 2025. These cans have been widely used for consumer paints, sample packs, and specialty coatings requiring easy handling.

The building & construction segment is anticipated to lead end-use demand, capturing approximately 42% market share in 2025. Hybrid paint cans have been favored for their durability and compatibility with a variety of construction coatings.

The hybrid paint cans market is experiencing steady growth, driven by rising demand for durable, recyclable packaging solutions, innovations in hybrid material technologies, and increasing adoption of smart packaging features for enhanced consumer convenience.

Recent Trends in the Hybrid Paint Cans Market

Challenges in the Hybrid Paint Cans Market

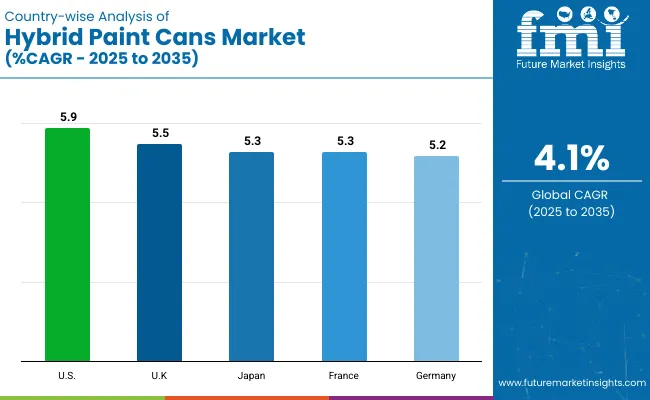

The hybrid paint cans market is witnessing steady growth across key developed regions, led by the USA at a CAGR of 5.9% (2025 to 2035), driven by sustainability regulations, home renovation trends, and smart packaging innovations. The UK market is expanding at 5.5% CAGR, supported by eco-friendly initiatives and demand for lightweight, refillable containers.

Japan and France follow with 5.3% CAGR each, emphasizing compact, corrosion-resistant designs, AI-driven quality control, and QR-coded smart packaging. Germany’s market is projected to grow at 5.2%, fueled by demand in industrial and automotive sectors, supported by automation and smart dispensing features. Across all regions, regulatory pressure, material innovation, and consumer demand for sustainable and intelligent packaging are key growth drivers.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Thehybrid paint cans demand in the USA is projected to grow at a CAGR of 5.9% from 2025 to 2035. Growth is supported by regulatory mandates for recyclable packaging, rising construction activities, and technological innovations in smart and ergonomic paint can designs.

The UK hybrid paint cans market is expected to expand at a CAGR of 5.5% during the forecast period. Growth is being driven by the country’s emphasis on sustainable packaging solutions and lightweight recyclable containers for decorative and industrial paints.

Hybrid paint cans sales in Japan are forecast to grow at a CAGR of 5.3% through 2035. Increased demand for high-performance, compact, and eco-friendly paint packaging solutions has been driving market expansion.

France’s hybrid paint cans market is anticipated to grow at a CAGR of 5.3% during the forecast period. Market growth is being driven by strong environmental regulations, consumer preference for eco-friendly packaging, and investments in smart packaging solutions.

Hybrid paint can demand in Germany is projected to grow at a CAGR of 5.2% between 2025 and 2035. Growth is supported by demand for durable and recyclable paint packaging in automotive and construction sectors.

The hybrid paint cans market is moderately consolidated, with global leaders holding significant shares while regional players innovate in smart, eco-friendly, and lightweight designs. Competitive strategies include technological advancements, plant expansions, and strategic collaborations to enhance market presence.

Tier-one firms such as Sherwin-Williams, PPG Industries, Behr Paint Company, AkzoNobel, and Rust-Oleum are investing in recyclable and lightweight hybrid can technologies, ergonomic designs, and smart packaging features to strengthen market positioning. Partnerships with retailers and construction firms have been formed to secure long-term demand.

Recent Hybrid Paint Cans Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 1.9 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in million units |

| By Product Type | Straight Cans, Beaded Cans |

| By Capacity | Below 1000 ml, 1001-2000 ml, 2001-3000 ml, 3001-4000 ml, Above 4000 ml |

| By End Use | Building & Construction, Automobile, Textile, Others (Marine, Aerospace, Electrical & Electronics) |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Brazil, India, Italy |

| Key Players | Sherwin-Williams, PPG Industries, Behr Paint Company, AkzoNobel , Rust-Oleum, Benjamin Moore, Valspar, Krylon , Dunn-Edwards, Farrow & Ball |

| Additional Attributes | Market share analysis by region and country-wise analysis. |

The market is expected to reach USD 1.9 billion by 2035.

The global market is projected to grow at a CAGR of 4.1% during this period.

Straight cans are expected to lead with over 62% market share in 2025.

Below 1000 ml cans are expected to hold around 30% of the market share by 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 5.9% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA