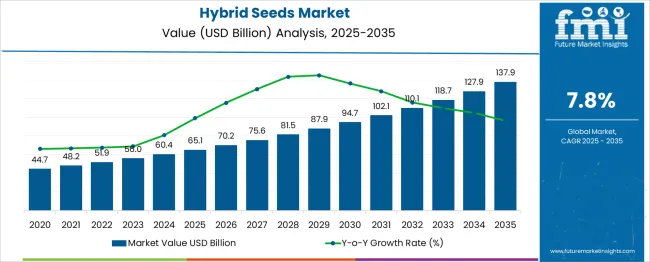

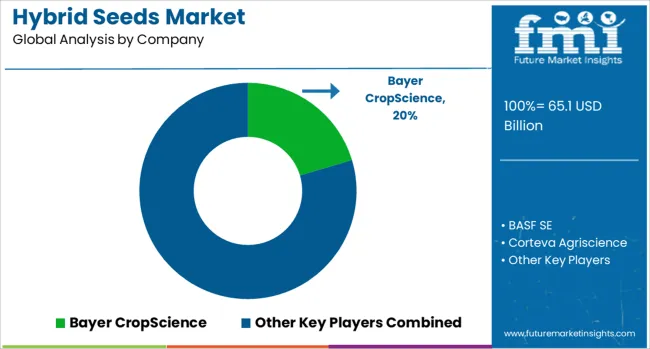

The Hybrid Seeds Market is estimated to be valued at USD 65.1 billion in 2025 and is projected to reach USD 137.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Hybrid Seeds Market Estimated Value in (2025 E) | USD 65.1 billion |

| Hybrid Seeds Market Forecast Value in (2035 F) | USD 137.9 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The expanding adoption of modern agricultural practices and government support for food security initiatives have accelerated the integration of hybrid seeds, particularly in emerging economies. Technological advancements in seed breeding and biotechnology continue to enhance seed quality, contributing to higher productivity and sustainability. The market outlook remains positive as farmers seek to optimize input costs and output quality in response to growing global food demand.

Growing awareness of hybrid seeds’ benefits and expansion of seed distribution networks are expected to reinforce market growth, especially in the context of evolving environmental challenges and the need for efficient resource use.

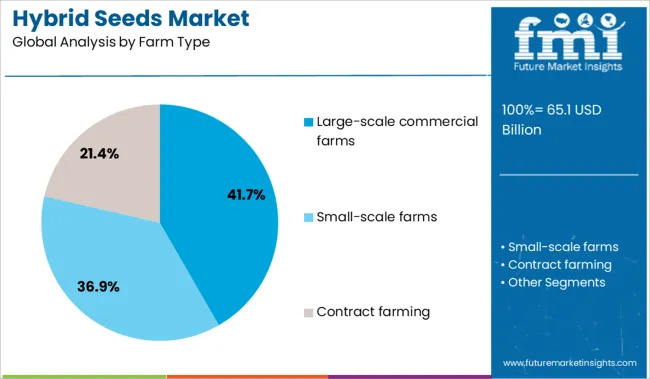

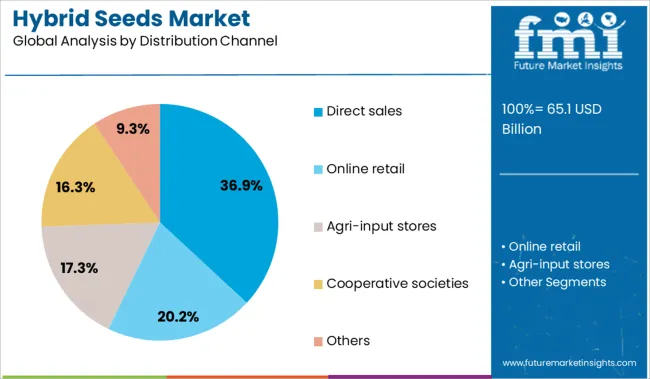

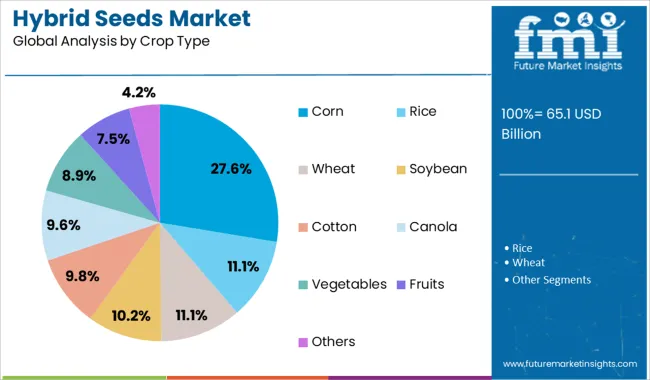

The hybrid seeds market is segmented by farm type, distribution channel, crop type, and trait and geographic regions. By farm type of the hybrid seeds market is divided into Large-scale commercial farms, Small-scale farms, and Contract farming. In terms of distribution channel of the hybrid seeds market is classified into Direct sales, Online retail, Agri-input stores, Cooperative societies, and Others. Based on crop type of the hybrid seeds market is segmented into Corn, Rice, Wheat, Soybean, Cotton, Canola, Vegetables, Fruits, and Others. By trait of the hybrid seeds market is segmented into Insect resistance, Disease resistance, Herbicide tolerance, Abiotic stress tolerance, Yield enhancement, Quality improvement, and Others. Regionally, the hybrid seeds industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The large-scale commercial farms segment accounts for 41.7% of the hybrid seeds market share, reflecting its pivotal role in driving demand for high-quality, high-yield seed varieties. These farms prioritize hybrid seeds for their superior performance, consistency, and adaptability to mechanized and large-area cultivation.

Investments in precision agriculture and data-driven farming techniques have increased the reliance on hybrid seeds to maximize output and ensure profitability. Large-scale operations benefit from economies of scale and streamlined supply chains, facilitating the bulk procurement of hybrid seeds.

This segment is expected to maintain robust growth as commercial farming continues to expand in key agricultural regions, supported by favorable policies and increasing export opportunities.

Direct sales represent 36.9% of the hybrid seeds market, emphasizing the importance of direct relationships between seed producers and farmers. This distribution channel allows for personalized customer service, technical support, and tailored product offerings, which are critical for addressing specific crop and regional needs.

The direct sales approach facilitates knowledge transfer regarding seed handling, crop management, and agronomic practices, enhancing overall seed adoption and satisfaction. It also enables faster feedback loops for product improvement and innovation.

The growth of direct sales is supported by digital platforms and farm extension services that improve accessibility and trust. This segment is projected to expand further as producers leverage direct engagement to strengthen market presence and foster loyalty among large and small-scale farmers alike.

Corn dominates the hybrid seeds market with a 27.6% share, driven by its status as one of the most widely cultivated and economically important crops globally. The high demand for corn in food, feed, and biofuel applications underscores the emphasis on hybrid varieties that offer enhanced yield potential, drought tolerance, and pest resistance.

Hybrid corn seeds contribute to consistent production levels and improved crop quality, essential for meeting growing industrial and consumer needs. Innovations in corn seed genetics have also led to better nutrient use efficiency and adaptability to diverse climatic conditions.

The corn segment’s growth is bolstered by expanding cultivation areas and adoption of modern farming technologies. It is anticipated to remain a key driver of the hybrid seeds market due to ongoing investments in crop improvement and market expansion.

Hybrid seed varieties are being planted across staple and vegetable crops to meet needs for higher yield, climate adaptation, and disease resistance. Farmers are purchasing seeds with traits tailored to local agro-ecologies, such as drought tolerance, pest resistance, and rapid maturation. Breeding programs, public-private partnerships, and regional seed certification authorities have supported trait commercialization. Adoption has been observed among smallholder and commercial farmers seeking risk mitigation and productivity improvement through genetically selected hybrids.

Hybrid seed adoption has been driven by the availability of varieties with resistance to local pest and disease pressures, improving crop survival and yield stability. Traits such as drought and heat tolerance have been incorporated to align with weather variability, reducing risk for farmers. High-yield potential characteristics have been bred into hybrid varieties targeting cereals, oilseeds and horticultural crops. Seed companies have invested in on-farm performance trials and farmer training to demonstrate yield gains and trait benefits. Hybrid bundles that include complementary crop management guidelines have further encouraged adoption. Government-led initiatives supporting seed certification and quality assurance have built confidence in hybrid performance and strengthened farmer purchasing decisions.

Hybrid seed technologies have been constrained by intellectual property protection and royalty enforcement, increasing costs for smallholder farmers. Licensing and trait licensing frameworks have limited availability of open-source or local breeder varieties, which has restricted choice in certain regions. Affordability remains an issue where seed prices are elevated relative to traditional open-pollinated varieties. Distribution networks beyond flagship corridors may face logistics bottlenecks, reducing access in remote areas. Seed preservation practices carried out by farmers can conflict with hybrid intellectual property rights, complicating adoption. Public sector breeding alternatives have been limited due to underfunding and scaling challenges. As hybrid performance depends on seed quality and local adaptation, continuous agronomic support has remained essential to ensure consistent results.

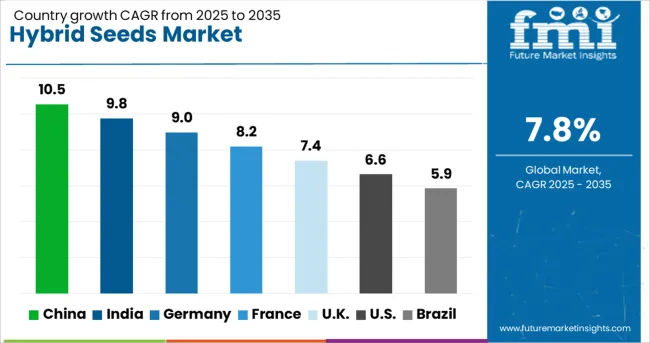

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global hybrid seeds market is projected to grow at a 7.8% CAGR from 2025 to 2035. Of the 40 countries analyzed, China leads at 10.5%, followed by India at 9.8% and Germany at 9.0%, while France posts 8.2% and the United Kingdom records 7.4%. These rates represent growth premiums of +34% for China, +26% for India, and +15% for Germany above the global average, while France and the UK maintain modest expansion near baseline. Divergence reflects local catalysts: hybrid rice and corn penetration in China, oilseed and vegetable seed innovation in India, high-yield cereal adoption in Germany, specialty crop hybrids in France, and protected agriculture growth in the UK. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 10.5% CAGR, driven by strong demand for hybrid rice, corn, and vegetable seeds to enhance agricultural productivity. Government programs promoting high-yield crop varieties and subsidies for advanced seed technology support this expansion. Domestic companies are investing in biotech innovations for stress-resistant hybrids to address climatic variability. Integration of precision farming tools with hybrid seeds is improving adoption in large-scale farming clusters. Rising mechanization and commercialization of agriculture further reinforce the demand for hybrids with uniform growth cycles and high germination rates.

India is expected to grow at a 9.8% CAGR, supported by increasing hybridization in maize, cotton, and horticultural crops. Expansion of protected cultivation systems in vegetables and floriculture drives hybrid seed demand. Government initiatives under seed replacement programs and farmer subsidies for improved varieties further accelerate adoption. Domestic and global seed companies are collaborating to introduce pest-resistant and climate-resilient hybrids tailored to regional needs. Digital platforms for agri-input sales are improving last-mile access to hybrid seeds in Tier II and rural markets.

Germany is forecast to grow at a 9.0% CAGR, supported by the high adoption of hybrid varieties in cereals, oilseeds, and fodder crops. Breeding programs emphasize hybrids with improved disease resistance and higher nutrient efficiency. Rising demand for energy crops, including hybrid maize for biogas production, adds momentum to the sector. Integration of precision farming and variable rate technology enhances hybrid seed performance in large-scale farms. Seed companies are focusing on hybrid lines adapted for shorter growing seasons and sustainable input management, aligning with EU agricultural standards.

France is projected to grow at an 8.2% CAGR, driven by demand for hybrids in oilseed rape, sunflower, and maize crops. Seed companies emphasize traits like drought tolerance and early maturity to suit regional farming systems. Expansion of organic and low-input agriculture influences hybrid development for better resilience and yield stability. Investments in research for hybrid vegetables catering to greenhouse farming enhance diversification opportunities. Cooperative networks are facilitating hybrid seed adoption through advisory services and bulk procurement models for farmers.

The United Kingdom is expected to grow at a 7.4% CAGR, supported by hybrid demand in cereals, forage crops, and specialty vegetables. Breeding innovations focus on disease-resistant wheat and barley hybrids to improve food security. Protected agriculture and controlled-environment farming accelerate hybrid use in leafy greens and salad crops. Partnerships between seed firms and agri-tech companies aim to deliver data-driven hybrid solutions for optimized productivity. Post-Brexit regulatory frameworks emphasize improved seed traceability, creating opportunities for certified hybrid seed systems.

The construction equipment finance market is anchored by global OEMs such as AB Volvo, Caterpillar Inc., Deere & Company, Komatsu, and CNH Industrial, which provide integrated financing solutions to support equipment sales. Major financial institutions, including Bank of America, JPMorgan Chase, Wells Fargo, and GE Capital, strengthen market depth through leasing programs, equipment loans, and working-capital financing. OEM financing divisions enhance competitiveness with tailored packages that include maintenance services and flexible repayment plans. Digital credit platforms and automated loan processing tools are gaining traction, enabling faster approvals and improving accessibility for contractors. Competition focuses on interest rates, repayment flexibility, and partnerships with rental companies, particularly in high-growth regions such as Asia-Pacific and North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.1 Billion |

| Farm Type | Large-scale commercial farms, Small-scale farms, and Contract farming |

| Distribution Channel | Direct sales, Online retail, Agri-input stores, Cooperative societies, and Others |

| Crop Type | Corn, Rice, Wheat, Soybean, Cotton, Canola, Vegetables, Fruits, and Others |

| Trait | Insect resistance, Disease resistance, Herbicide tolerance, Abiotic stress tolerance, Yield enhancement, Quality improvement, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bayer CropScience, BASF SE, Corteva Agriscience, DowDuPont Inc., East-West Seed, Groupe Limagrain, Groupe Roullier, KWS SAAT SE, Land O'Lakes, and Monsanto Company |

| Additional Attributes | Dollar sales by crop category (cereals, oilseeds, vegetables) and trait segment (high yield, pest resistance, drought tolerance), with hybrid seeds preferred for superior productivity over conventional varieties. Regional trends are led by North America, while Asia-Pacific demonstrates significant growth potential. Key players emphasize genetic advancements, trait diversification, and product portfolio expansion to cater to evolving agricultural needs. |

The global hybrid seeds market is estimated to be valued at USD 65.1 billion in 2025.

The market size for the hybrid seeds market is projected to reach USD 137.9 billion by 2035.

The hybrid seeds market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in hybrid seeds market are large-scale commercial farms, small-scale farms and contract farming.

In terms of distribution channel, direct sales segment to command 36.9% share in the hybrid seeds market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA