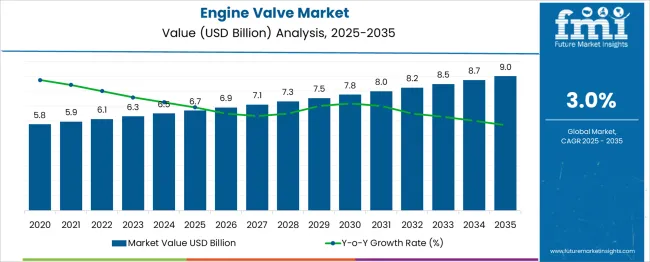

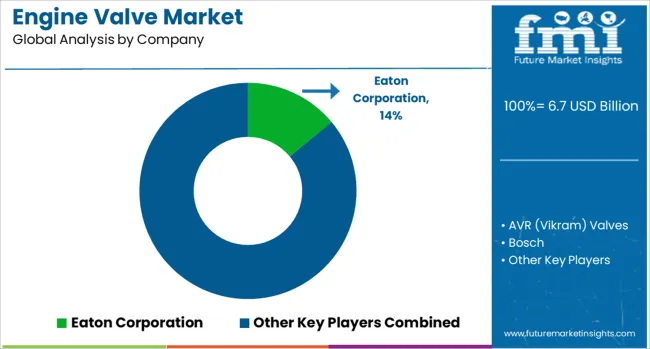

The Engine Valve Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period. A Saturation Point Analysis evaluates when the market approaches a state of slowed incremental growth, often due to maturity, technological stability, or limited demand expansion.

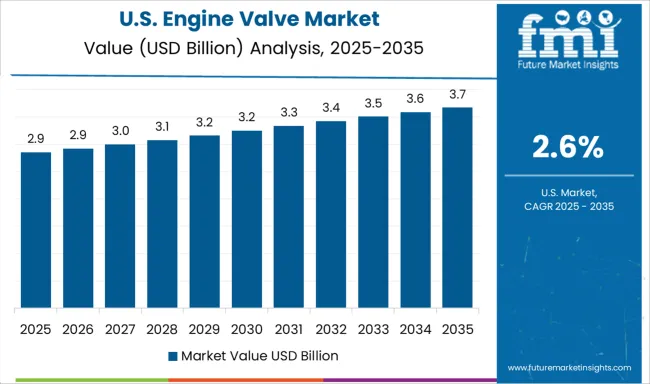

The annual increments in value remain modest throughout the forecast period, ranging between USD 0.2 and USD 0.3 billion. Early years, such as 2025 to 2027, see growth of USD 0.2 billion annually, while later years, such as 2033 to 2035, also reflect similarly small increments, indicating a relatively flat acceleration curve. This steady yet subdued growth pattern signals that the market is already operating near a mature phase with limited disruptive innovation or significant demand surges.

The data suggests that saturation effects are likely to appear earlier in the forecast horizon, potentially between 2029 and 2031, as incremental gains remain small and consistent, lacking steep upward shifts. Market expansion appears primarily driven by replacement demand, gradual production increases, and marginal efficiency improvements rather than transformative technological change.

The market’s trajectory points toward a slow-moving approach to saturation, with growth maintained by steady replacement cycles and marginal volume increases, rather than significant new demand generation.

| Metric | Value |

|---|---|

| Engine Valve Market Estimated Value in (2025 E) | USD 6.7 billion |

| Engine Valve Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The Engine Valve market is experiencing steady growth fueled by the ongoing advancements in internal combustion engine technologies and the rising demand for fuel-efficient vehicles. Increased production of passenger and commercial vehicles across emerging economies has been contributing to the market expansion. Industry news and corporate presentations have highlighted the role of lightweight and durable valve materials in enhancing engine performance and reducing emissions, aligning with stringent environmental regulations.

Investments by manufacturers in research and development to optimize valve designs and improve thermal resistance have further supported growth. In addition, the market is benefiting from the sustained use of internal combustion engines in hybrid powertrains even as electric vehicles gain traction.

As per investor announcements and industry articles, aftermarket demand for engine components, especially in regions with aging vehicle fleets, continues to strengthen the outlook. These drivers are expected to maintain a positive trajectory for the market over the coming years.

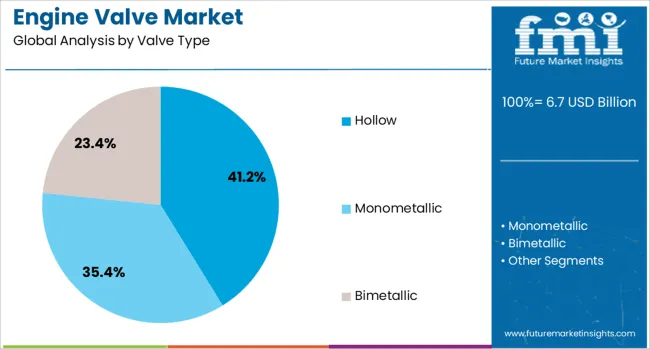

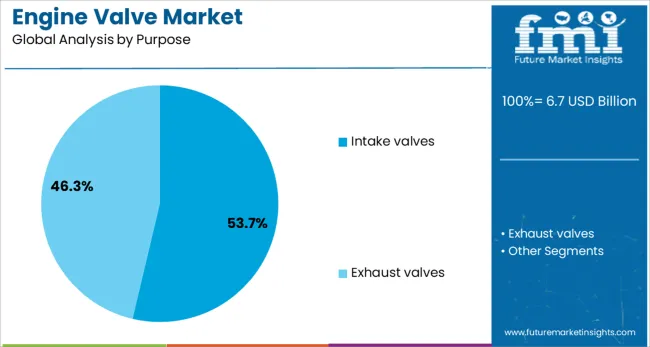

The engine valve market is segmented by valve type, purpose, engine type, technology, material, application, distribution channel, and geographic regions. By valve type, the engine valve market is divided into Hollow, Monometallic, and Bimetallic. In terms of the purpose, the engine valve market is classified into Intake valves and Exhaust valves.

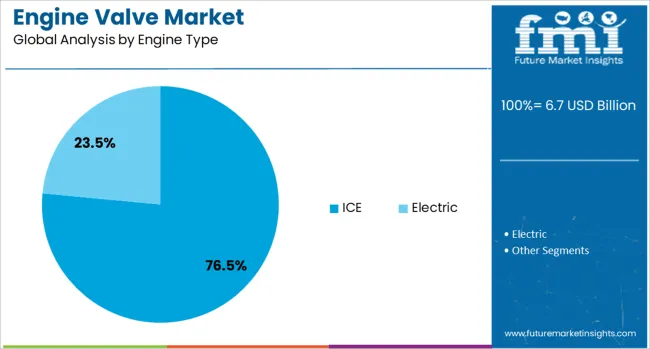

Based on engine type, the engine valve market is segmented into ICE and Electric. The engine valve market is segmented into Hydraulic, Pneumatic, and Electric. The engine valve market is segmented by material into Stainless Steel, Nickel Alloy, Chrome Plated, and others (Nitrate, Stellite Alloy, etc.).

By application, the engine valve market is segmented into Automotive, Marine Applications, Natural Gas Engines, Military & Defense Applications, Agricultural & Earth Moving Machinery, Railway & Locomotive Applications, Generators & Industrial Engines, and others.

The distribution channel of the engine valve market is segmented into OEM and Aftermarket. Regionally, the engine valve industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hollow valve type segment is projected to account for 41.2% of the Engine Valve market revenue share in 2025, making it the leading valve type. This leadership has been supported by the superior thermal performance and reduced weight of hollow valves, which improve engine efficiency and meet evolving emission standards, as noted in technical bulletins and product updates.

Adoption by automotive manufacturers has been facilitated by the ability of hollow valves to withstand higher operating temperatures and reduce overall engine weight, contributing to fuel economy. Corporate statements have emphasized the cost-effectiveness of producing hollow valves at scale while maintaining durability.

These advantages have enabled widespread use in both passenger and commercial vehicles, reinforcing their position as the preferred choice. Moreover, the compatibility of hollow valves with advanced engine technologies and their role in reducing maintenance requirements have further contributed to their dominance in the market.

The intake valves segment is expected to command 53.7% of the Engine Valve market revenue share in 2025, establishing it as the leading purpose segment. This prominence has been attributed to the critical role of intake valves in optimizing air-fuel mixture flow and ensuring efficient combustion, as detailed in engineering journals and manufacturer press releases.

Automotive suppliers have focused on enhancing intake valve materials and coatings to resist wear and improve sealing, enabling better engine performance and reduced emissions. Product announcements have underscored that intake valves are subjected to high operating frequencies and thermal stresses, making innovations in this segment essential.

The increasing demand for vehicles with improved fuel efficiency and stricter emissions compliance has driven the development and adoption of high-performance intake valves. These factors, combined with their necessity in both gasoline and diesel engines, have secured their leading position in the market.

The internal combustion engine (ICE) segment is anticipated to represent 76.5% of the Engine Valve market revenue share in 2025, maintaining its dominance in engine type. This dominance has been reinforced by the continued global reliance on ICE-powered vehicles, particularly in markets where electric vehicle adoption remains limited, as highlighted in automotive industry reports and annual statements. The enduring demand for ICE engines in hybrid configurations has also sustained market growth.

Investments in advanced ICE technologies aimed at enhancing fuel economy and reducing emissions have increased the need for durable and efficient engine valves. Corporate strategies have focused on extending the operational life of ICE vehicles, supporting robust aftermarket demand for engine components.

Furthermore, the widespread availability of refueling infrastructure and lower upfront costs of ICE vehicles have maintained their relevance. These factors collectively have underpinned the segment’s leading share in the engine valve market in 2025.

The market has been expanding steadily as automotive, marine, and industrial engine manufacturers continue to prioritize efficiency, emissions compliance, and durability in engine performance. Engine valves, which control the intake of air-fuel mixtures and the expulsion of exhaust gases, are fundamental to internal combustion engine functionality. The market has been influenced by a surge in global vehicle production, growth in heavy machinery applications, and the adoption of advanced manufacturing technologies such as precision forging and high-temperature casting. Increasing investments in research and development have been directed toward lighter, heat-resistant, and corrosion-proof materials to meet performance and regulatory demands.

A substantial portion of the engine valve market’s growth is linked to the consistent increase in automotive manufacturing volumes worldwide, particularly in emerging economies with expanding transportation networks and rising consumer demand for personal vehicles. Demand is not limited to new production, as the aftermarket for replacement valves remains vital in regions with aging vehicle fleets, where regular maintenance cycles drive component turnover. Heavy-duty trucks, agricultural machinery, and construction equipment also contribute significantly to demand, given their reliance on high-durability valves capable of operating under extreme thermal and mechanical stress. Furthermore, OEMs and aftermarket suppliers have been leveraging digital platforms to streamline parts distribution, ensuring availability across diverse markets.

Material innovation has been a defining factor in the evolution of engine valves, with manufacturers adopting titanium alloys, high-nickel steels, and advanced ceramics to improve temperature tolerance and reduce overall weight without compromising strength. The incorporation of specialized coatings such as chromium nitride, molybdenum disulfide, and diamond-like carbon has been instrumental in reducing friction, minimizing wear, and extending service life under high-load conditions. These technological improvements directly contribute to enhanced fuel efficiency, reduced oil consumption, and improved thermal stability. Research collaborations between automotive OEMs, metallurgical specialists, and valve producers are accelerating the development of cost-effective material blends that can be implemented across different vehicle classes, from economy passenger cars to high-performance sports models.

The tightening of global emission standards has placed significant emphasis on optimizing engine combustion processes, making valve design a critical area of focus for compliance. Regulations such as Euro 7 in Europe, EPA Tier standards in the United States, and similar mandates in Asia have necessitated the use of variable valve timing, multi-valve configurations, and precision-machined components that enable optimal air-fuel mixing and complete combustion. Enhanced valve actuation systems are being developed to reduce pumping losses and improve thermal efficiency, thereby lowering carbon dioxide and nitrogen oxide emissions. As hybrid and alternative fuel systems grow, engine valves are being engineered to handle variable operating temperatures and fluctuating load cycles.

The gradual transition toward alternative fuel technologies have opened new pathways for the engine valve market. Vehicles powered by compressed natural gas, hydrogen, biofuels, and synthetic fuels require valves capable of withstanding different combustion pressures and chemical compositions compared to traditional gasoline or diesel systems. Hybrid vehicles, which operate under variable engine cycles, place unique demands on valve responsiveness and sealing integrity. Beyond automotive applications, specialized engines in marine propulsion, aerospace auxiliary systems, and high-performance motorsports are adopting advanced valve architectures tailored to niche operating conditions. Manufacturers are capitalizing on this diversification by offering modular valve solutions that can be adapted across multiple engine types, ensuring relevance in evolving powertrain ecosystems.

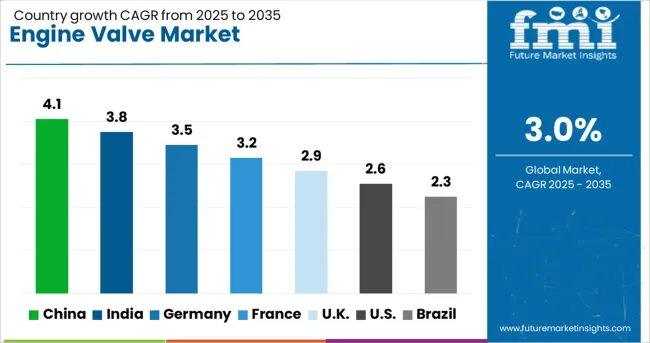

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The market is projected to grow at a CAGR of 3.0% from 2025 to 2035, supported by advancements in automotive manufacturing, rising demand for fuel-efficient engines, and adoption of advanced materials for performance enhancement. China is anticipated to lead with a 4.1% CAGR, driven by its expanding automotive production base and continuous technological upgrades. India follows at 3.8%, benefiting from rising vehicle manufacturing and increasing demand for passenger and commercial vehicles. Germany, at 3.5%, gains from its strong automotive engineering capabilities and emphasis on precision manufacturing. The UK, with a 2.9% CAGR, maintains demand through niche performance vehicle manufacturing. The USA, at 2.6%, experiences steady growth linked to replacement demand and aftermarket services. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by rising production volumes in the automotive and heavy machinery sectors. Manufacturers are increasingly adopting advanced alloy materials and precision machining technologies to improve durability and performance. The shift toward hybrid and fuel-efficient vehicles is encouraging the development of lightweight valves with enhanced thermal resistance. Domestic suppliers are expanding exports to meet demand from global automakers, while collaborations with research institutes are helping accelerate innovations in valve coating and surface treatment.

India is forecast to register a CAGR of 3.8%, supported by growing domestic vehicle manufacturing and aftermarket demand. OEMs are increasingly sourcing valves with high wear resistance to meet the needs of commercial and passenger vehicles operating in diverse conditions. The government’s push for Bharat Stage VI emission compliance is influencing the adoption of advanced valve designs that improve combustion efficiency. Local manufacturers are expanding production capacities, while partnerships with global technology providers are enhancing product quality and competitiveness.

Germany’s market is expected to grow at a CAGR of 3.5%, underpinned by strong demand from premium automotive and industrial equipment manufacturers. Producers are leveraging high-precision CNC machining and heat treatment processes to deliver valves that meet stringent performance and durability standards. The move toward turbocharged and downsized engines is creating demand for high-temperature-resistant valves. Close integration with OEM design teams is enabling faster development cycles and customization for specific engine models, especially in high-performance segments.

The United Kingdom engine valve market is anticipated to grow at a CAGR of 2.9%, with demand driven by both the domestic automotive industry and exports to European markets. Manufacturers are upgrading facilities to incorporate automation, robotic handling, and improved quality control systems. The performance vehicle segment is influencing the design of valves with higher flow efficiency and reduced weight. In addition, aftermarket demand is being supported by a rising number of engine rebuilds and upgrades across passenger and commercial vehicle fleets.

The United States market is set to expand at a CAGR of 2.6%, driven by the need for improved fuel efficiency, durability, and emission control in modern engines. Manufacturers are focusing on titanium and nickel-based alloys for high-performance applications, particularly in sports cars, heavy trucks, and industrial engines. The trend toward downsized turbocharged engines is pushing innovation in thermal-resistant coatings. Additionally, the growth of remanufacturing activities is fueling demand in the aftermarket, with suppliers offering cost-effective yet high-specification replacements.

The market is defined by the presence of global automotive component manufacturers and specialized engineering firms that deliver critical intake and exhaust valve solutions for internal combustion engines. Eaton Corporation holds a leading position through its extensive range of valves designed for enhanced performance and fuel efficiency across passenger cars, trucks, and industrial engines.

AVR (Vikram) Valves and Rane address OEM and aftermarket requirements, supplying reliable and cost-effective products, particularly in high-growth emerging markets. Bosch, Continental AG, and Denso emphasize innovation by integrating advanced materials, precision machining, and specialized coatings that improve durability while meeting stringent emission regulations.

Federal-Mogul, recognized for its strong aftermarket presence, and Fuji Oozx, with expertise in high-precision Japanese manufacturing, both focus on long-lasting, high-performance components. Grindtech provides specialized performance valves for niche applications, while Hitachi Ltd leverages its broad manufacturing capabilities to serve multiple engine platforms globally.

The competitive landscape is shaped by evolving emission standards, demand for lightweight components, and increasing production of commercial vehicles. Companies are investing in lightweight alloys, surface treatment innovations, and automated production technologies to improve efficiency and performance.

As electrification advances, the market is expected to see strategic diversification, with leading manufacturers expanding into hybrid and alternative powertrain components to maintain long-term relevance.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.7 Billion |

| Valve Type | Hollow, Monometallic, and Bimetallic |

| Purpose | Intake valves and Exhaust valves |

| Engine Type | ICE and Electric |

| Technology | Hydraulic, Pneumatic, and Electric |

| Material | Stainless Steel, Nickel Alloy, Chrome Plated, and Others (Nitrate, Stellite Alloy, etc.) |

| Application | Automotive, Marine Applications, Natural Gas Engines, Military & Defense Applications, Agricultural & Earth Moving Machinery, Railway & Locomotive Applications, Generators & Industrial Engines, and Others |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eaton Corporation, AVR (Vikram) Valves, Bosch, Continental AG, Denso, Federal-Mogul, Fuji Oozx, Grindtech, Hitachi Ltd, and Rane |

| Additional Attributes | Dollar sales by valve type and engine configuration, demand dynamics across passenger cars, commercial vehicles, and off-highway machinery, regional trends in production and aftermarket replacement across Asia-Pacific, Europe, and North America, innovation in lightweight materials, heat-resistant alloys, and variable valve timing technologies, environmental impact of improved fuel efficiency and emission reduction, and emerging use cases in hybrid powertrains, alternative fuel engines, and high-performance motorsport applications. |

The global engine valve market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the engine valve market is projected to reach USD 9.0 billion by 2035.

The engine valve market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in engine valve market are hollow, monometallic and bimetallic.

In terms of purpose, intake valves segment to command 53.7% share in the engine valve market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Engine Valve Market Growth – Trends & Forecast 2025 to 2035

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

Engine-Driven Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Engine Fixture Market Size and Share Forecast Outlook 2025 to 2035

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Engine Cylinder Liners Market Size and Share Forecast Outlook 2025 to 2035

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engine Fogging Oil Market Size and Share Forecast Outlook 2025 to 2035

Valve Driver Market Size and Share Forecast Outlook 2025 to 2035

Engine Starter Fluid Market Growth - Demand, Trends & Forecast 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Engineered Cell Therapy - Market Trends & Forecast 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA