The USA automotive engine valve demand is valued at USD 2.2 billion in 2025 and is estimated to reach USD 3.2 billion by 2035, reflecting a CAGR of 3.9%. Demand is shaped by steady production of internal combustion engine vehicles, ongoing replacement needs in the vehicle parc, and sustained use of high-temperature valve materials across light-duty and heavy-duty engine platforms. Engine valves continue to play a central role in airflow control, combustion efficiency, and durability, which keeps procurement stable even as powertrain portfolios diversify.

Mono-metallic valves form the leading product type due to their established performance in medium-temperature operating ranges, predictable machining characteristics, and cost-effective integration into mass-produced engines. These valves remain widely adopted in gasoline engines, commercial fleets, and aftermarket service networks, where reliability and consistent component tolerances are essential.

Regional demand is strongest in the West, South, and Northeast, supported by large concentrations of automotive assembly operations, distribution hubs, and high vehicle ownership levels. These regions also maintain extensive aftermarket supply chains, which contribute to recurring demand for replacement engine components across passenger vehicles and commercial transport fleets. BorgWarner, Delphi Technologies, Eaton Corporation, Mahle GmbH, and Fuji Oozx Inc are the principal suppliers. Their portfolios include intake and exhaust valves engineered for thermal resistance, surface hardening compatibility, and endurance under cyclical loading. Product development across these firms emphasizes improved wear resistance, material refinement, and tighter manufacturing tolerances to support modern combustion requirements.

Peak-to-trough analysis shows a measured cyclical pattern shaped by internal-combustion engine production, aftermarket demand, and vehicle-replacement activity. From 2025 to 2028, the segment is likely to reach an early peak as light-vehicle manufacturing stabilises and repair volumes remain steady. Continued use of combustion engines in trucks, commercial fleets, and rural transport supports this initial rise, along with ongoing demand for heat-resistant and wear-resistant valve materials.

A mild trough may occur between 2029 and 2031 as electrification initiatives advance, moderating valve requirements in new-vehicle output. During this period, procurement will rely more on the aftermarket, where replacement driven by high-mileage vehicles and engine-overhaul cycles maintains a dependable but softer baseline. After 2031, the segment is expected to regain upward momentum as heavy-duty, performance, and specialty-engine applications continue to rely on advanced valve designs. Incremental gains will come from improved alloys, enhanced coating technologies, and extended-life components. The peak-to-trough pattern reflects a durable engine-component segment influenced by powertrain transitions, long service lifecycles, and stable repair activity across the United States.

| Metric | Value |

|---|---|

| USA Automotive Engine Valve Sales Value (2025) | USD 2.2 billion |

| USA Automotive Engine Valve Forecast Value (2035) | USD 3.2 billion |

| USA Automotive Engine Valve Forecast CAGR (2025-2035) | 3.9% |

Demand for automotive engine valves in the USA is rising because vehicle production, especially in large-format trucks and performance cars, remains substantial and components such as intake and exhaust valves continue to be critical parts of internal-combustion engines. Automakers are also investing in more advanced valve technologies that support turbocharging, direct-injection engines and variable valve timing, which drives need for higher-performance materials and precision engineering. The domestic engine component supply chain and aftermarket demand for replacement parts contribute to recurring volume of valve procurement.

Advances in lightweight alloys, bimetallic and hollow-stem valve designs help meet fuel-efficiency and emissions-compliance goals, supporting higher specification valves and increased unit value. The diversification toward hybrid vehicles with internal-combustion backup and performance variants also sustains valve demand. Constraints include the transition toward electric vehicles (EVs) that do not use traditional intake or exhaust valves, which may reduce long-term growth potential. Raw-material price volatility and strict quality-control standards raise manufacturing cost and may delay component upgrades or replacements.

Demand for automotive engine valves in the United States reflects performance, durability, and thermal-resistance requirements across internal-combustion engines used in passenger and commercial vehicles. Product-type distribution is shaped by design complexity, heat management, and material behaviour under high load. Vehicle-type preferences reflect engine configurations, duty cycles, and fleet-service needs. Material selection is driven by resistance to temperature, corrosion, and fatigue, which vary across gasoline, diesel, and high-performance applications.

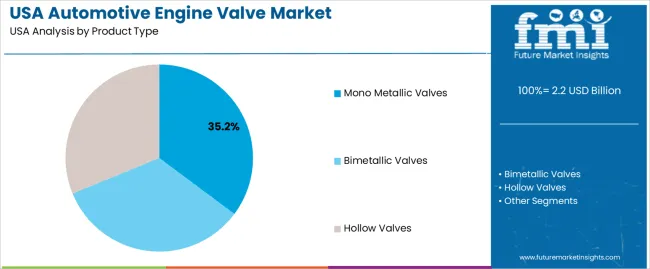

Mono-metallic valves hold 35.2% of national demand and represent the leading product type. Their uniform structure supports predictable expansion, stable thermal behaviour, and cost-efficient production for many passenger and light-commercial engines. Bimetallic valves represent 33.6%, pairing different metals for enhanced heat resistance in exhaust-side operation where thermal stress is highest. Hollow valves account for 31.2%, reducing weight to support improved engine responsiveness and efficiency, especially in higher-performance applications. Product-type distribution reflects trade-offs between structural simplicity, heat-management capacity, and weight reduction across varied engine designs used in USA automotive manufacturing.

Key drivers and attributes:

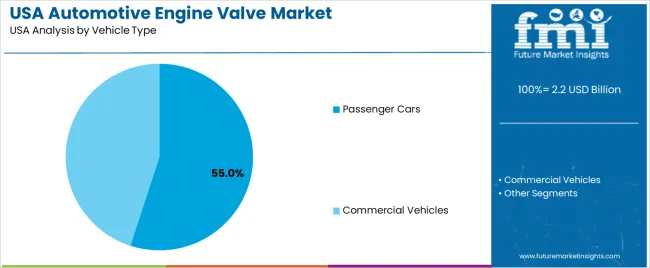

Passenger cars represent 55.0% of national demand and form the leading vehicle category for engine valves. These vehicles rely on durable intake and exhaust valves that accommodate broad engine-size variation across sedans, crossovers, and sport-utility models. Commercial vehicles account for 45.0%, driven by heavy-duty engines requiring valves with enhanced fatigue resistance under prolonged load conditions. Fleet operators depend on robust valve performance to maintain uptime across logistics, construction, and utility services. Vehicle-type distribution reflects operating hours, engine configuration differences, and durability expectations across consumer and commercial fleets in the United States.

Key drivers and attributes:

Steel holds 42.2% of national demand and represents the leading material category for engine-valve production. Steel valves offer consistent durability, corrosion resistance, and cost efficiency across both gasoline and diesel engines. Titanium accounts for 32.4%, providing lightweight, high-strength properties suited to high-performance and efficiency-focused powertrains. Nickel-alloy valves represent 25.4%, supporting engines exposed to elevated temperatures and corrosive exhaust environments. Material distribution reflects thermal stability requirements, weight-reduction priorities, and cost considerations across various engine platforms used by USA manufacturers.

Key drivers and attributes:

In the United States, demand for automotive engine valves is supported by the production of new passenger and light commercial vehicles, which requires replacement at the original equipment manufacturer (OEM) level. Regulatory pressure to improve fuel economy and reduce emissions leads automakers to deploy advanced valve materials, designs (such as bimetallic or hollow valves) and timing systems that enhance combustion efficiency and durability. The rising industry share of turbocharged engines, hybrid powertrains and high output engines increases requirements for high-performance engine valves capable of withstanding greater thermal stress, speed and pressure. These factors combine to support steady growth in engine-valve demand domestically.

The shift toward electric vehicles (EVs), which do not require conventional internal-combustion engine valves, reduces long-term demand potential for this component. Many parts in conventional internal-combustion‐engine (ICE) vehicles are durable and have long service lives, which slows the rate at which replacements or upgrades are required. Materials used for high performance valves, such as titanium, nickel alloys and advanced steels may face cost volatility due to raw-material price changes, which can squeeze margins and lead OEMs or suppliers to delay upgrades or redesigns.

Suppliers are increasingly offering engine valves made from lighter and higher‐strength materials to improve engine response, reduce moving mass and support smaller displacement turbocharged engines. The expansion of hybrid vehicles that still incorporate internal-combustion engines creates a niche demand for advanced valves adapted to intermittent operation and thermal cycling. The aftermarket segment, covering replacement parts, upgrades and performance applications is growing as the vehicle fleet ages and owners seek improved performance or engine rebuilds. These trends support demand for more advanced engine-valve designs and broadened application scope in the USA industry.

Demand for automotive engine valves in the USA is rising through 2035 as vehicle manufacturers, aftermarket suppliers, engine-rebuild shops, and performance-parts distributors expand procurement of intake and exhaust valves for gasoline, diesel, and hybrid powertrains. Growth is linked to replacement cycles in aging vehicle fleets, production of light-duty trucks and SUVs, and continued demand for high-temperature, high-durability valve materials, including stainless steel, titanium, and advanced alloys.

Engine-reconditioning facilities support recurring aftermarket consumption, while hybrid-vehicle platforms maintain steady use of precision-machined components. Regional differences reflect manufacturing concentration, aftermarket density, and fleet composition. The West grows at 4.5%, the South at 4.0%, the Northeast at 3.6%, and the Midwest at 3.1%.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.5% |

| South | 4.0% |

| Northeast | 3.6% |

| Midwest | 3.1% |

The West grows at 4.5% CAGR, supported by high volumes of light-duty trucks, hybrid vehicles, and commuter cars across California, Washington, and Colorado. Independent repair facilities and dealership service networks maintain steady valve-replacement activity due to engine-wear patterns in older vehicles. Performance-parts distributors in automotive hubs supply lightweight and heat-resistant valves for motorsport and enthusiast applications. Hybrid-vehicle adoption contributes to demand for precision-machined components used in smaller displacement engines with frequent thermal-load cycles. Rebuild shops rely on stainless-steel and alloy valves for routine overhaul work. Strong vehicle-usage rates, diverse fleet composition, and a large aftermarket sector sustain consistent procurement.

The South grows at 4.0% CAGR, supported by strong regional automotive activity across Texas, Alabama, Georgia, Tennessee, and the Carolinas. Engine-assembly operations and component suppliers contribute to consistent procurement of intake and exhaust valves for light-duty vehicle production. Aftermarket networks supply valves for common domestic and imported models with high operating hours. Fleet operators in logistics and delivery sectors require ongoing replacement of valvetrain components in high-mileage vehicles. Performance and motorsport communities also support demand for enhanced-strength and heat-resistant valves. Industrial distribution hubs in the South ensure broad availability of aftermarket parts across suburban and rural industries.

The Northeast grows at 3.6% CAGR, supported by dense commuter-vehicle usage, established service networks, and steady aftermarket demand across New York, Massachusetts, Pennsylvania, and nearby states. Cold-weather conditions contribute to engine-stress patterns that increase long-term wear on valvetrain components, maintaining replacement needs. Dealership service centers and independent repair shops source valves for engines used in daily commuting and urban delivery operations. Smaller engine platforms in compact vehicles require precise machining tolerances, reinforcing demand for high-quality replacement parts. Although regional manufacturing is limited, strong service-sector activity ensures stable consumption of intake and exhaust valves.

The Midwest grows at 3.1% CAGR, influenced by automotive manufacturing, engine-assembly facilities, and established aftermarket networks across Michigan, Ohio, Indiana, and Illinois. OEM suppliers procure valves for gasoline and hybrid powertrain production, while engine-rebuild shops support ongoing consumption through refurbishment programs. Agricultural and commercial vehicles operating in rural regions generate steady wear-related replacement demand. Component distributors provide stainless-steel and alloy valves for maintenance of older domestic models. Although some manufacturing activity has shifted to other regions, strong automotive heritage and widespread vehicle usage maintain consistent aftermarket requirements.

Demand for automotive engine valves in the USA is shaped by a concentrated group of powertrain-component manufacturers supplying passenger vehicles, light trucks, and performance engines. BorgWarner holds the leading position with an estimated 43.4% share, supported by controlled metallurgy, consistent heat-resistance performance, and long-standing integration with major USA engine programmes. Its position is reinforced by stable valve-seat durability, predictable flow characteristics, and reliable supply across high-volume platforms.

Delphi Technologies and Eaton Corporation follow as significant participants, offering intake and exhaust valves designed for efficiency-focused engines, turbocharged platforms, and hybrid applications. Their strengths include well-documented material fatigue properties, stable stem-surface finishes, and compatibility with variable-valve-timing systems. Mahle GmbH maintains a notable presence through forged and high-temperature valve solutions used in heavy-duty engines and performance-oriented applications, emphasizing consistent thermal stability and dimensional control. Fuji Oozx Inc contributes additional capability with precision-machined valves adopted in Japanese and USA engine lines, supported by controlled hard-facing processes and reliable wear resistance.

Competition across this segment centers on thermal endurance, material strength, fatigue resistance, flow efficiency, and long-term dimensional stability. Demand remains steady as USA automakers optimize combustion efficiency, extend engine durability, and maintain production of internal-combustion powertrains alongside hybrid systems, relying on reliable, high-performance engine-valve components that perform consistently under variable thermal and mechanical loads.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Mono Metallic Valves, Bimetallic Valves, Hollow Valves |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Material Type | Steel, Titanium, Nickel Alloy |

| Sales Channel | OEM, Aftermarket |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | BorgWarner, Delphi Technologies, Eaton Corporation, Mahle GmbH, Fuji Oozx Inc |

| Additional Attributes | Dollar sales by product type, vehicle type, material composition, and sales channel; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of engine valve manufacturers; advancements in heat-resistant alloys, lightweight titanium valves, hollow stem valve design, and optimized flow performance; integration with internal combustion engine production, aftermarket engine rebuilding, and performance automotive applications in the USA. |

The global demand for automotive engine valve in USA is estimated to be valued at USD 2.2 billion in 2025.

The market size for the demand for automotive engine valve in USA is projected to reach USD 3.2 billion by 2035.

The demand for automotive engine valve in USA is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in demand for automotive engine valve in USA are mono metallic valves, bimetallic valves and hollow valves.

In terms of vehicle type, passenger cars segment to command 55.0% share in the demand for automotive engine valve in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Engine Valve Market Growth – Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Engine Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Management Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valve Spring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Front Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valves Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Automotive Valve Stem Seal Market Growth – Trends & Forecast 2024-2034

Automotive Engine Bearings Market

Automotive Engine Cooling System Market

Automotive Engine Cam Cover Market

Automotive Engine Oil Coolers Market

Automotive Engine Connecting Rods Market

Automotive Engine Hosing Market

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA