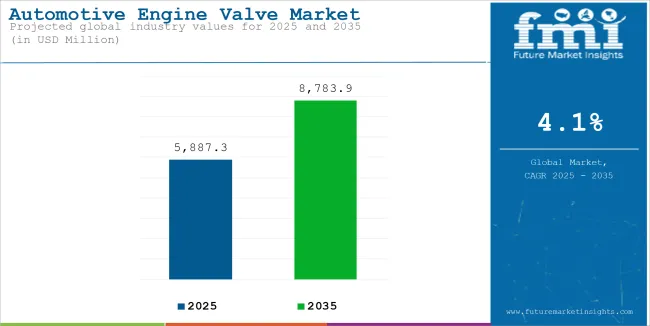

The global demand for Automotive Engine Valve is estimated to be worth USD 5,887.3 million in 2025 and is anticipated to reach a value of USD 8,783.9 million by 2035. Demand for automotive engine valve is projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035.

The revenue generated by implementation of automotive engine valve in 2024 was USD 5,645.5 million. The industry is predicted to exhibit a Y-o-Y growth of 4.0% in 2025. This projected growth indicates a value growth of nearly 1.4X from the current value over the study period.

Automotive engine valves play a crucial role in controlling the flow of air, fuel, and exhaust gases within engines. Their efficiency is essential for ensuring smooth engine performance, fuel efficiency, and reduced emissions. The demand for advanced valves is driven by the need to withstand extreme temperatures and pressures, making them indispensable for modern passenger and commercial vehicles.

With a growing focus on lightweight and durable components, the development of innovative valve technologies is shaping the automotive industry.

Mono-metallic valves are widely preferred due to their cost-effectiveness and ability to withstand high heat. These valves are especially suitable for standard applications where durability and reliability are essential.

Bimetallic valves, known for their superior strength and heat dissipation, are becoming a preferred choice in high-performance vehicles. Similarly, hollow valves, designed for reduced weight and better thermal management, are gaining popularity in premium vehicles, reflecting the emphasis on efficiency and innovation in automotive components.

Passenger cars remain the dominant segment, driven by increasing production of compact, mid-sized, and luxury vehicles.

These vehicles demand high-quality valves to support fuel-efficient engines and enhance overall performance. Light commercial vehicles also contribute significantly, particularly for urban transportation, while heavy commercial vehicles rely on robust valve designs to handle challenging operating conditions.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 5,887.3 million |

| Projected Size (2035) | USD 8,783.9 million |

| Value-based CAGR (2025 to 2035) | 4.1% |

Steel valves continue to be extensively used for their strength and affordability, making them suitable for various engine types. Lightweight titanium valves are increasingly adopted in high-performance vehicles for better efficiency and reduced emissions.

Nickel alloy valves, with their exceptional resistance to extreme temperatures, are commonly used in heavy-duty applications, catering to vehicles operating under demanding conditions.

Original equipment manufacturers dominate the distribution channel by integrating high-quality valves into newly manufactured vehicles. These manufacturers prioritize precise standards and innovative designs for optimal performance.

At the same time, the aftermarket channel serves vehicle owners seeking reliable and cost-effective replacement valves, particularly in regions with older vehicle fleets. This balance ensures a steady supply of engine valves for diverse customer needs.

The table below presents the annual growth rates of the global engine valves market from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth evolves from the first half of the year (January to June, H1) to the second half (July to December, H2).

This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 3.8% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.8% (2024 to 2034) |

| H2 2024 | 4.0% (2024 to 2034) |

| H1 2025 | 4.0% (2025 to 2035) |

| H2 2025 | 4.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly increase to 4.0% in the first half and relatively increase to 4.2% in the second half. In the first half (H1) and second half (H2), the sector saw a similar increase of 20 BPS.

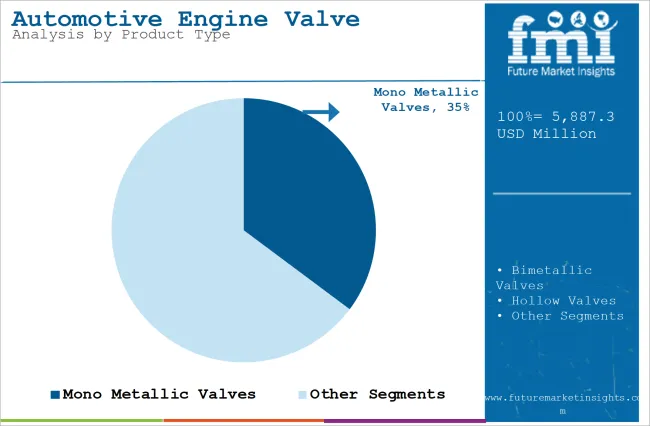

The section explains the market value share of the leading segments in the industry. In terms of product type, the Mono Metallic Valves will likely dominate and generate a share of around 35.2% in 2025.

Based material, the Steel type is projected to hold a prominent share of 39.4% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value Share (2025) |

|---|---|

| Mono Metallic Valves (Product Type) | 35.2% |

Mono metallic valves have become the preferred choice in the automotive engine valve sector due to their durability, high performance, and efficiency. These valves, typically made from a single metal alloy, are widely used in modern engine designs, especially in high-performance and heavy-duty applications.

Mono metallic valves are designed to withstand high temperatures and pressure variations, offering superior resistance to wear and corrosion. A key example is Ford’s use of mono metallic valves in its EcoBoost engines, where the valves are engineered to handle the thermal stress generated in turbocharged engine systems.

This helps to optimize fuel efficiency and ensure the engine’s long-term reliability. Mono metallic valves’ ability to perform under extreme conditions while maintaining precise control over airflow and exhaust gases is essential to meeting increasingly stringent emission standards.

This superior performance has solidified their dominance in automotive engine applications, where efficiency and durability are top priorities.

| Segment | Value Share (2025) |

|---|---|

| Steel (Material Type) | 39.4% |

Steel’s inherent high-temperature resistance makes it an ideal choice for automotive engine valves, particularly in high-performance and heavy-duty applications. Steel valves are able to withstand extreme heat generated in combustion chambers, which is crucial for maintaining the operational integrity of the engine.

For instance, engine valves operate in environments where temperatures can exceed 800°C, particularly in turbocharged and high-output engines. The strength and stability of steel under such conditions prevent valve deformation and failure, ensuring smooth operation over extended periods.

Steel's resistance to thermal fatigue and its ability to retain structural integrity at elevated temperatures make it a preferred material in engines subjected to continuous heat cycles.

This characteristic is especially beneficial in applications where precise timing and consistent valve operation are critical, such as in performance vehicles and industrial machinery. The use of steel in engine valves enables these systems to handle extreme temperatures without compromising the overall functionality, contributing to better longevity and reliability in high-demand environments.

Increasing focus on high-performance engines boosts demand for advanced engine valve technology

The growing production of fuel-efficient and high-performance vehicles is driving the need for advanced engine valves. Modern engines demand valves that can withstand higher temperatures and pressures while ensuring optimal fuel combustion.

For example, Honda’s Earth Dreams technology uses bimetallic valves to balance durability and heat resistance. The global shift towards stringent emission regulations, such as Euro 7 and Bharat Stage VI, further pushes manufacturers to innovate with materials like titanium and nickel alloys.

These materials offer better thermal stability and extended lifespan compared to traditional steel. Companies like Eaton are developing lightweight hollow valves to improve vehicle efficiency and reduce emissions. The increasing adoption of such advanced technologies reflects the industry’s commitment to enhancing engine performance while meeting environmental standards.

Growing hybrid vehicle adoption creates demand for heat-resistant and efficient engine valves

The rapid adoption of hybrid vehicles has created a demand for engine valves designed for both durability and fuel efficiency. Hybrid engines, which combine internal combustion with electric power, operate under unique conditions requiring specialized valve technology.

Toyota’s latest hybrid models integrate advanced hollow valves to minimize weight and maximize heat resistance, improving engine efficiency. This trend is particularly evident in regions such as Asia-Pacific, where hybrid adoption is rising due to stricter emission norms and government incentives.

Hybrid vehicles, requiring both traditional and new engine valve designs, offer significant opportunities for manufacturers to innovate and expand their portfolios.

Transition to hydrogen engines offers new opportunities for specialized engine valve development

The global shift towards hydrogen-powered vehicles has created opportunities for specialized engine valve innovations. Hydrogen combustion engines operate at higher pressures and temperatures than conventional engines, demanding robust valve materials and designs.

BMW and Hyundai are actively developing hydrogen engines, spurring demand for valves capable of enduring such challenging conditions. Valves made from nickel-based alloys or advanced ceramics are emerging as ideal solutions, offering enhanced durability and resistance to hydrogen embrittlement.

Manufacturers investing in these technologies are aligning with the push for alternative fuels and decarbonization. The rise of hydrogen vehicles could redefine valve requirements, paving the way for advanced innovations in the field.

Emphasis on lightweight valve materials aligns with growing focus on emission reduction

Reducing vehicle weight has become essential to improving fuel efficiency and meeting stricter emission standards. Lightweight materials like titanium and aluminum alloys are increasingly being used to manufacture engine valves.

For example, Ferrari and Porsche utilize titanium valves in their high-performance engines, leveraging their strength-to-weight advantages. Hollow valves are also gaining popularity, as they reduce overall engine weight without compromising durability.

This trend is not limited to high-end vehicles; as mid-range cars also adopt lightweight valves to comply with evolving regulations. The push for emission reduction continues to drive innovation in lightweight valve design, offering significant advantages in performance and efficiency.

Increasing electric vehicle sales present challenges to traditional engine valve demand

The growing shift towards electric vehicles is reducing the reliance on internal combustion engines, impacting the demand for engine valves. EVs, which do not require conventional combustion components, are gaining traction as global sales grow.

For instance, Tesla and BYD have seen significant increases in EV adoption, driven by government subsidies and consumer preferences for sustainable transport. In 2023, EV sales surged by 40%, reflecting the rapid pace of this transition.

As automakers invest more in electrification, traditional engine valve manufacturers face challenges to maintain their relevance. This shift highlights the importance of diversification and exploring components compatible with emerging propulsion technologies.

The Automotive Engine Valve recorded a CAGR of 3.5% during the historical period between 2020 and 2024. The growth of Automotive Engine Valve was positive as it reached a value of USD 5,645.5 million in 2024 from USD 4,893.8 million in 2020.

From 2020 to 2024, the demand for automotive engine valves grew steadily due to rising vehicle production and the need for efficient engines. The adoption of lightweight materials like titanium and nickel alloys gained momentum to meet stricter emission standards and improve engine performance.

For example, Honda introduced hollow sodium-filled valves in its turbocharged engines to enhance heat resistance and efficiency. In regions such as Europe and North America, the shift toward hybrid vehicles drove the integration of advanced valve technologies, including variable valve timing systems, to optimize fuel combustion and emissions.

Meanwhile, in Asia-Pacific, economies like India and China saw increased adoption of bimetallic valves in entry-level and mid-range vehicles, reflecting growth in automotive manufacturing.

Between 2025 and 2035, rising electrification trends and the transition toward hydrogen engines are expected to reshape valve technologies. Hydrogen-powered engines, such as those under development by Toyota and BMW, will require robust valve materials capable of withstanding high pressures and temperatures.

In addition, hybrid vehicles will continue driving innovation in lightweight and heat-resistant valve designs. The increasing integration of artificial intelligence in engine design is expected to improve valve performance and optimize combustion processes.

Industries such as automotive, commercial vehicles, and motorsports are projected to adopt advanced engine valves to enhance durability, reduce emissions, and improve fuel efficiency. With a growing focus on sustainability and technological advancement, the demand for innovative engine valve solutions is set to evolve significantly over the next decade.

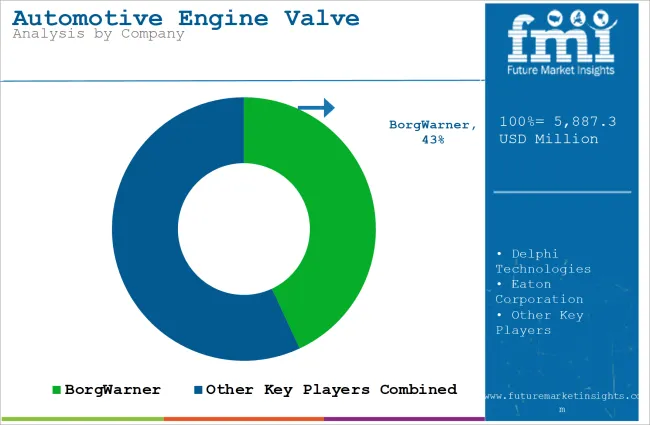

Tier-1 companies account for around 50-55% of the overall market with a product revenue from the Automotive Engine Valve market of more than USD 500 million. The Tier-1 manufacturers like BorgWarner, Delphi Technologies and other players would have prominent share in the market.

Tier-2 and other companies such Renex Valves, Eminent Engitech and other players are projected to account for 45-50% of the overall market with the estimated revenue under the range of USD 500 million through the sales of Automotive Engine Valve.

The section below covers the industry analysis for automotive engine valve in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

| Australia | 4.6% |

| Germany | 4.2% |

| The USA | 3.8% |

| China | 3.5% |

The sale of Automotive Engine Valve in China is projected to reach USD 1,690.9 million and is estimated to grow at a 3.5% CAGR by 2035.

China’s robust automotive industry significantly fuels the demand for advanced engine valves, driven by its large-scale vehicle production and export dominance. In 2023, China produced over 30 million passenger vehicles and exported more than 4.4 million units, solidifying its position as the world’s largest car exporter.

The rapid adoption of hybrid and electric vehicles in the domestic market is pushing automakers to integrate advanced valve technologies to meet stricter emission standards and efficiency goals.

Companies like BYD and Geely are incorporating variable valve timing and sodium-filled valves to enhance combustion efficiency and engine performance. For example, BYD’s advancements in its hybrid engine technology rely on durable, lightweight valves that minimize wear and heat distortion.

These innovations address both global and domestic emission regulations, ensuring sustained growth in demand for sophisticated engine components. China’s continued focus on automotive innovation positions it as a leader in advancing next-generation engine valve solutions.

The demand in the USA for automotive engine valve is projected to reach USD 1,515.2 million by 2035 and is predicted to grow at an 3.8% CAGR.

The rising demand for fuel-efficient and high-performance vehicles in the USA is a key factor driving advancements in engine valve technologies. Automakers are focused on integrating innovative designs that optimize engine efficiency, reduce weight, and lower emissions to meet stringent EPA standards.

Ford, for instance, uses sodium-filled hollow valves in its EcoBoost engines to achieve better heat resistance and lighter weight, which improves overall combustion performance. Similarly, General Motors employs titanium alloy valves in its high-performance vehicles to enhance durability and reduce friction, aligning with consumer expectations for long-lasting, efficient engines.

The growing focus on hybrid and electric vehicle integration has also prompted the use of advanced valve designs in hybrid systems. This innovation caters to the country’s goals of reducing reliance on fossil fuels and adopting sustainable mobility solutions. The USA ’s emphasis on emission compliance and energy efficiency ensures continued demand for cutting-edge engine valve technologies.

The automotive engine valve in the Japan is projected to reach USD 1,106.8 million and grow at a CAGR of 4.2% by 2035.

Japan’s commitment to hybrid and hydrogen-powered vehicles is driving significant advancements in durable and high-performance engine valve technologies. Automakers like Toyota and Honda are at the forefront, leveraging innovations to create valves capable of withstanding extreme conditions in advanced engine systems.

Toyota’s hydrogen combustion engines, for instance, employ heat-resistant alloy valves that ensure reliability and efficiency in high-temperature operations, contributing to the company’s ambition of achieving carbon neutrality by 2050.

Honda, on the other hand, focuses on lightweight materials such as titanium for valves in its hybrid powertrains, improving fuel efficiency and reducing emissions. Japan’s stringent regulatory environment and its leadership in green automotive technologies create a fertile ground for the development of cutting-edge valve systems.

As the country continues to lead in vehicle innovation, manufacturers of automotive engine valves are well-positioned to benefit from opportunities to cater to these advanced and evolving demands.

Technological innovations in automotive engine valves are driving improvements in engine efficiency, performance, and emissions reduction. Manufacturers are focusing on lightweight materials like titanium and advanced alloys to reduce valve weight, enhancing fuel economy.

Variable valve timing (VVT) technology is gaining popularity, optimizing engine power across driving conditions. The use of advanced coatings, such as diamond-like carbon (DLC), is becoming common to improve wear resistance and reduce friction. As stricter emission standards emerge, automakers are investing in valve technologies that help meet regulatory requirements. These advancements are enabling greater engine efficiency and sustainability, positioning the segment for future growth.

Recent Industry Developments

The segment is further categorized into Mono Metallic Valves, Bimetallic Valves, and Hollow Valves.

The segment is further categorized into Passenger Cars and Commercial Vehicles.

The segment is further categorized into Mono Steel, Titanium and Nickel Alloys.

The segment is further categorized into OEM and Aftermarket.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The Automotive Engine Valve was valued at USD 5,645.5 million in 2024.

The demand for Automotive Engine Valve is set to reach USD 5,887.3 million in 2025.

Rising automotive production, advancements in engine technologies, consumer preference for high-performance engines, and the shift towards hybrid vehicles will drive demand.

The Automotive Engine Valve demand is projected to reach USD 8,783.9 million by 2035.

Mono Metallic Valves in Automotive Engine Valve is expected to lead during the forecast period.

Table 01: Global Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 02: Global Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 03: Global Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 04: Global Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Sales Channel

Table 05: Global Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Region

Table 06: North America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Country

Table 07: North America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 08: North America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 09: North America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 10: North America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Sales Channel

Table 11: Latin America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Country

Table 12: Latin America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 13: Latin America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 14: Latin America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 15: Latin America Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Sales Channel

Table 16: Europe Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Country

Table 17: Europe Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 18: Europe Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 19: Europe Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 20: Europe Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Sales Channel

Table 21: East Asia Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Country

Table 22: East Asia Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 23: East Asia Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 24: East Asia Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 25: East Asia Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Sales Channel

Table 26: South Asia Pacific Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Country

Table 27: South Asia Pacific Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 28: South Asia Pacific Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 29: South Asia Pacific Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 30: South Asia Pacific Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Sales Channel

Table 31: Middle East Africa Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Country

Table 32: Middle East Africa Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Product Type

Table 33: Middle East Africa Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Vehicle Type

Table 34: Middle East Africa Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By Material Type

Table 35: Middle East Africa Market Value (US$ Million) Volume (units) Historical Data 2016 to 2020 and Forecast 2021 to 2031 By End Use

Figure 01: Global Market Volume (units) and Y-o-Y Growth Rate From 2022 to 2032

Figure 02: Global Market Value (US$ Million) and Y-o-Y Growth Rate From 2022 to 2032

Figure 03: Global Market Absolute $ Opportunity Analysis, 2022 to 2032

Figure 04: Global Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 05: Global Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 06: Global Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 07: Global Market Incremental $ Opportunity By Product Type,

Figure 08: Global Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 09: Global Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 10: Global Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 11: Global Market Incremental $ Opportunity By Vehicle Type,

Figure 12: Global Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 13: Global Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 14: Global Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 15: Global Market Incremental $ Opportunity By Material Type,

Figure 16: Global Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 17: Global Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 18: Global Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Figure19: Global Market Incremental $ Opportunity By Sales Channel, 2022 to 2032

Figure 20: Global Market Share and BPS Analysis By Region - 2022 to 2032

Figure 21: Global Market Y-o-Y Growth By Region, 2022 to 2032

Figure 22: Global Market Attractiveness Analysis By Region, 2022 to 2032

Figure 23: Global Market Incremental $ Opportunity By Region,

Figure 24: North America Market Share and BPS Analysis By Country - 2022 to 2032

Figure 25: North America Market Y-o-Y Growth By Country, 2022 to 2032

Figure 26: North America Market Attractiveness Analysis By Country, 2022 to 2032

Figure 27: North America Market Incremental $ Opportunity By Country,

Figure 28: North America Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 29: North America Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 30: North America Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 31: North America Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 32: North America Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 33: North America Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 34: North America Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 35: North America Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 36: North America Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 37: North America Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 38: North America Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 39: North America Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Figure 40: Latin America Market Share and BPS Analysis By Country - 2022 to 2032

Figure 41: Latin America Market Y-o-Y Growth By Country, 2022 to 2032

Figure 42: Latin America Market Attractiveness Analysis By Country, 2022 to 2032

Figure 43: Latin America Market Incremental $ Opportunity By Country

Figure 44: Latin America Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 45: Latin America Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 46: Latin America Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 47: Latin America Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 48: Latin America Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 49: Latin America Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 50: Latin America Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 52: Latin America Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 53: Latin America Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 54: Latin America Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 55: Latin America Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Figure 56: Europe Market Share and BPS Analysis By Country - 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth By Country, 2022 to 2032

Figure 58: Europe Market Attractiveness Analysis By Country, 2022 to 2032

Figure 59: Europe Market Incremental $ Opportunity By Country, 2022 to 2032

Figure 60: Europe Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 62: Europe Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 63: Europe Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 64: Europe Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 65: Europe Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 66: Europe Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 67: Europe Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 68: Europe Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 69: Europe Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 70: Europe Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 71: Europe Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Figure 72: East Asia Market Share and BPS Analysis By Country 2022 to 2032

Figure 73: East Asia Market Y-o-Y Growth By Country, 2022 to 2032

Figure 74: East Asia Market Attractiveness Analysis By Country, 2022 to 2032

Figure 75: East Asia Market Incremental $ Opportunity By Country

Figure 76: East Asia Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 77: East Asia Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 78: East Asia Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 79: East Asia Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 80: East Asia Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 81: East Asia Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 82: East Asia Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 83: East Asia Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 84: East Asia Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 85: East Asia Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 86: East Asia Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 87: East Asia Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Figure 88: South Asia & Pacific Market Share and BPS Analysis By Country - 2022 to 2032

Figure 89: South Asia & Pacific Market Y-o-Y Growth By Country, 2022 to 2032

Figure 90: South Asia & Pacific Market Attractiveness Analysis By Country, 2022 to 2032

Figure 91: South Asia & Pacific Market Incremental $ Opportunity By Country

Figure 92: South Asia & Pacific Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 93: South Asia & Pacific Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 94: South Asia & Pacific Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 95: South Asia & Pacific Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 96: South Asia & Pacific Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 97: South Asia & Pacific Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 98: South Asia & Pacific Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 99: South Asia & Pacific Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 100: South Asia & Pacific Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 101: South Asia & Pacific Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 102: South Asia & Pacific Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 103: South Asia & Pacific Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Figure 104: Middle East & Africa Market Share and BPS Analysis By Country - 2022 to 2032

Figure 105: Middle East & Africa Market Y-o-Y Growth By Country, 2022 to 2032

Figure 106: Middle East & Africa Market Attractiveness Analysis By Country, 2022 to 2032

Figure 107: Middle East & Africa Market Incremental $ Opportunity By Country

Figure 108: Middle East & Africa Market Share and BPS Analysis By Product Type 2022 to 2032

Figure 109: Middle East & Africa Market Y-o-Y Growth By Product Type, 2022 to 2032

Figure 110: Middle East & Africa Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 111: Middle East & Africa Market Share and BPS Analysis By Vehicle Type 2022 to 2032

Figure 112: Middle East & Africa Market Y-o-Y Growth By Vehicle Type, 2022 to 2032

Figure 113: Middle East & Africa Market Attractiveness Analysis By Vehicle Type, 2022 to 2032

Figure 114: Middle East & Africa Market Share and BPS Analysis By Material Type 2022 to 2032

Figure 115: Middle East & Africa Market Y-o-Y Growth By Material Type, 2022 to 2032

Figure 116: Middle East & Africa Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 117: Middle East & Africa Market Share and BPS Analysis By Sales Channel- 2022 to 2032

Figure 118: Middle East & Africa Market Y-o-Y Growth By Sales Channel, 2022 to 2032

Figure 119: Middle East & Africa Market Attractiveness Analysis By Sales Channel, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Engine Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Management Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valve Spring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Front Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valves Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Automotive Valve Stem Seal Market Growth – Trends & Forecast 2024-2034

Automotive Engine Bearings Market

Automotive Engine Cooling System Market

Automotive Engine Cam Cover Market

Automotive Engine Oil Coolers Market

Automotive Engine Connecting Rods Market

Automotive Engine Hosing Market

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Automotive Proportioning Valve Market Growth – Trends & Forecast 2024-2034

Automotive Electric Coolant Valve Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA