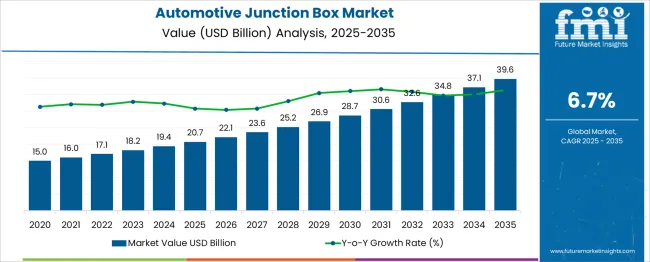

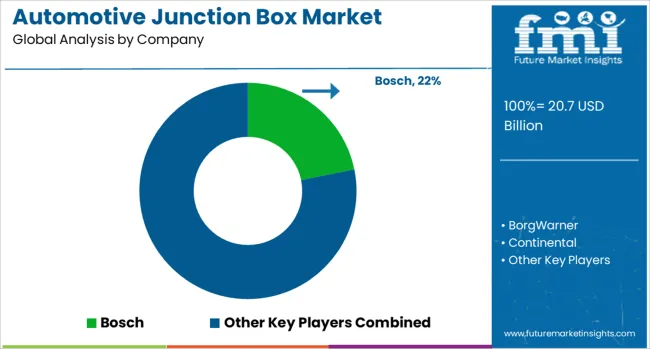

The Automotive Junction Box Market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 39.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Junction Box Market Estimated Value in (2025 E) | USD 20.7 billion |

| Automotive Junction Box Market Forecast Value in (2035 F) | USD 39.6 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The automotive junction box market is expanding steadily with the increasing integration of smart technologies in vehicles. The shift towards electric and hybrid vehicles has increased the demand for advanced electrical distribution systems. These systems require smart junction boxes that can manage complex power loads efficiently.

Industry advancements have improved the functionality and reliability of junction boxes, supporting enhanced vehicle safety and performance. Growing consumer demand for connected and automated vehicle features is driving the adoption of intelligent power management solutions.

Additionally, original equipment manufacturers (OEMs) are emphasizing quality and integration capabilities to meet stringent automotive standards. Infrastructure developments and investments in automotive electronics continue to support market growth. Segment growth is projected to be driven by the smart type segment, automotive power switching function, and OEM sales channels.

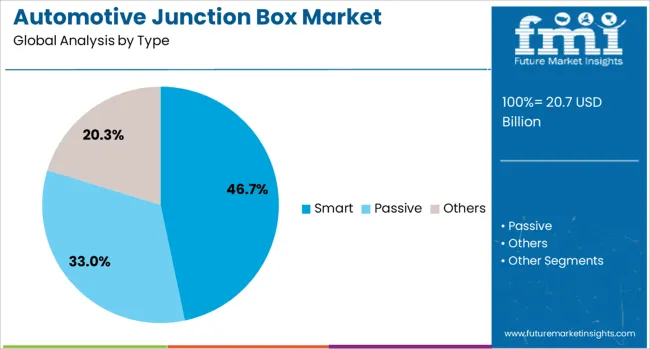

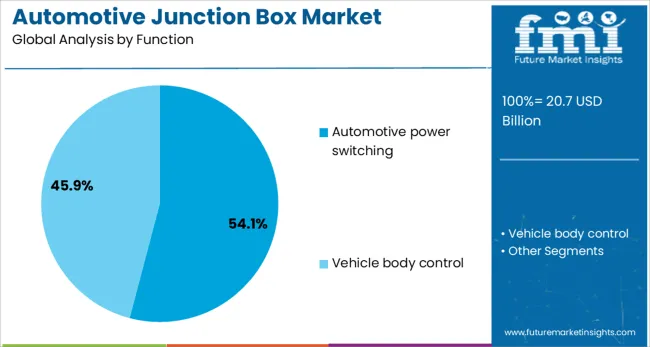

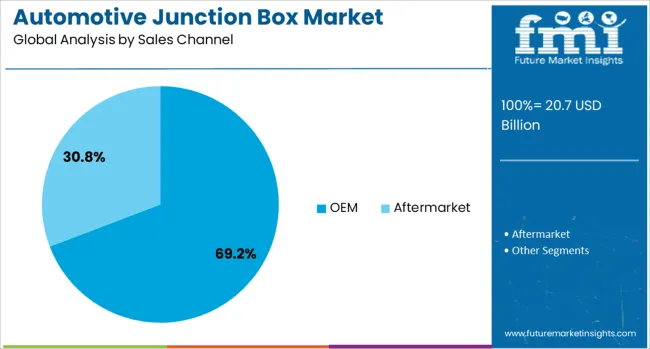

The automotive junction box market is segmented by type, function, sales channel, vehicle type, and geographic region. The automotive junction box market is divided by type into Smart, Passive, and Others. The automotive junction box market is classified into Automotive power switching and Vehicle body control. The sales channel of the automotive junction box market is segmented into OEM and Aftermarket. The automotive junction box market is segmented by vehicle type into Passenger cars and Commercial vehicles. Regionally, the automotive junction box industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The smart segment is projected to account for 46.7% of the automotive junction box market revenue in 2025, maintaining its lead among types. This growth is attributed to the increasing complexity of vehicle electrical systems, which require intelligent components capable of real-time monitoring and control. Smart junction boxes enable efficient management of power distribution and fault detection, enhancing vehicle safety and performance.

The rise in electric vehicles and advanced driver-assistance systems (ADAS) has further boosted demand for smart junction boxes. Their ability to integrate with vehicle networks and support remote diagnostics has made them essential components in modern automotive design. The ongoing trend towards vehicle electrification is expected to sustain the smart segment’s dominance.

The automotive power switching function segment is expected to represent 54.1% of the market revenue in 2025, leading the functional categories. This function is critical for managing the distribution and control of electrical power within the vehicle. Power switching junction boxes regulate current flow to various subsystems, ensuring safety and operational efficiency.

With the increasing number of electrical loads in modern vehicles, including infotainment, lighting, and safety systems, the demand for reliable power switching solutions has grown. Enhanced power switching also supports energy management in electric and hybrid vehicles, contributing to battery life optimization.

As vehicles become more electrified and connected, the importance of robust power switching functions will continue to drive growth in this segment.

The OEM sales channel segment is projected to contribute 69.2% of the automotive junction box market revenue in 2025, dominating the market. Growth in this segment is driven by direct partnerships between junction box manufacturers and vehicle manufacturers. OEMs prioritize integrated solutions that meet strict quality and performance standards.

The requirement for seamless compatibility with vehicle electrical architectures has encouraged OEMs to source junction boxes from trusted suppliers. The trend towards modular vehicle design and platform sharing has also supported increased demand through OEM channels.

Additionally, OEMs' focus on innovation and cost optimization has fostered close collaboration with component manufacturers. The segment is expected to maintain its leading position as vehicle manufacturers continue to incorporate advanced electrical systems in their designs.

Automotive junction boxes are being used to centralize electrical distribution and fuse protection controls within vehicle architectures. Compact modules accommodating fuses, relays, and electronic control units are being deployed to support advanced driver assistance systems, infotainment configurations, and lighting circuits. Demand has been observed in both internal combustion and electric vehicle platforms as production complexity increases and safety standards evolve. Modular designs, connector integrations, and IP-rated enclosures have reinforced reliability across harsh automotive environments.

Junction boxes integrating fused circuits, relays, and sensor interfaces have been selected to manage growing electrical loads in modern vehicles. High-density PCB layouts and plug-and-play connector systems have minimized assembly time and vehicle weight. Modules featuring over-current detection, temperature sensors, and onboard diagnostics are being used to protect complex electrical systems and simplify fault tracing during service procedures. Production of hybrid and electric models has involved creation of high-voltage junction units with insulation coordination and IP67 sealing for safety under voltage stress. Wiring harness complexity has been reduced through consolidation of relay and fuse locations into central modules. As multifunction lighting systems and body electronics have expanded, junction box designs have been iterated to support flexibility across global vehicle variants and trim levels.

Design of automotive junction boxes has been constrained by global regulatory requirements related to electrical safety, EMC emissions, and crash performance. High current paths have required thermal simulations and heat sink integrations to prevent overheating in compact enclosures. Compatibility with fast-charging EV systems has demanded precise insulation coordination and connector gas sealing to meet high-voltage safety standards. Supply chain interruption in electronic components such as microrelays and ASIC controllers has delayed production ramp-ups. Miniaturized layouts have increased difficulty in rework and on-board repairability. Cost trade-offs between advanced features and material certifications have created challenges in balancing price pressure and performance. Manual testing remains necessary to verify connector function and fuse behavior, limiting full automation in junction box assembly.

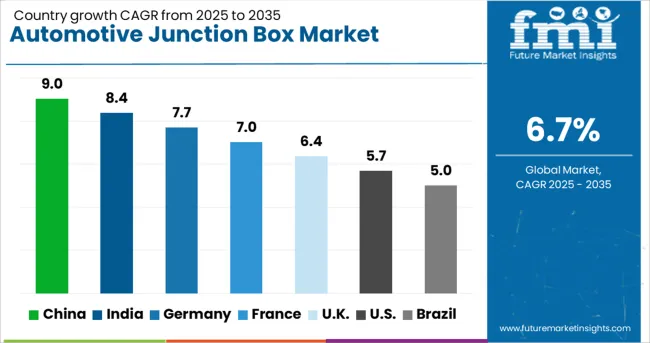

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global automotive junction box market is projected to grow at a 6.7% CAGR from 2025 to 2035. Of the 40 countries analyzed, China leads at 9.0%, followed by India at 8.4% and Germany at 7.7%, while France posts 7.0% and the United Kingdom records 6.4%. Growth premiums stand at +34% for China, +25% for India, and +15% for Germany, while France and the UK maintain growth close to the global average. Key drivers include China’s surge in EV production and wiring harness integration, India’s focus on compact car manufacturing, Germany’s high-end vehicle electrification, and connected car adoption in France and the UK. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 9.0% CAGR, driven by rapid EV penetration and favorable electrification policies. High-voltage junction boxes with advanced thermal management dominate EV and hybrid platforms to ensure safe power distribution. Leading OEMs and Tier-1 suppliers are introducing modular designs with smart monitoring for voltage, current, and fault diagnostics. Growing adoption of CAN and LIN protocols supports intelligent junction systems for connected vehicles. Expansion in autonomous vehicle development and large-scale smart manufacturing hubs accelerates local production. Rising investment in silicon-based solutions further enhances performance and energy efficiency across advanced automotive architectures, making China a global leader in next-generation power distribution technologies.

India is expected to grow at an 8.4% CAGR, supported by rapid expansion in compact car manufacturing and emerging EV clusters. OEMs prioritize lightweight materials for junction boxes to meet stringent fuel-efficiency and weight-reduction targets. Local suppliers are forming alliances with global Tier-1 players to develop cost-optimized designs featuring integrated fuses and relays. Government initiatives such as FAME-II and PLI schemes encourage adoption of EV-ready power distribution units. Increasing demand for connected and telematics-equipped vehicles accelerates the shift toward smart junction boxes, particularly in passenger and light commercial segments. Advancements in thermal safety and modularity strengthen the adoption of intelligent systems in cost-sensitive vehicle categories.

France is projected to achieve a 7.0% CAGR, supported by growth in EV and hybrid vehicle registrations incentivized by national subsidies. Automotive suppliers prioritize compact junction box designs to maximize space in smaller electric vehicles. Advanced sealing and insulation technologies are developed to improve safety under wet and humid operating conditions. Digital twin simulations are increasingly utilized to design efficient and durable power distribution units. Rising integration of in-vehicle connectivity accelerates demand for smart junction boxes equipped with real-time monitoring features. Focus on modular, energy-efficient designs supports compliance with evolving regulatory standards and consumer demand for reliability in compact and urban mobility platforms.

The United Kingdom is forecast to grow at a 6.4% CAGR, driven by zero-emission vehicle mandates and electrification of automotive platforms. Smart junction boxes with predictive diagnostics are increasingly deployed to support proactive maintenance strategies. Luxury EV segment investments are boosting demand for high-voltage units featuring advanced thermal protection. Local suppliers are introducing modular junction systems compatible with battery-swapping and fast-charging architectures. Integration of AI-driven control algorithms enhances energy distribution efficiency and system reliability in connected vehicles. Growing emphasis on cybersecurity and compliance standards strengthens adoption of intelligent junction systems across premium and mid-segment electric vehicles.

France is projected to achieve a 7.0% CAGR, supported by growth in EV and hybrid vehicle registrations incentivized by national subsidies. Automotive suppliers prioritize compact junction box designs to maximize space in smaller electric vehicles. Advanced sealing and insulation technologies are developed to improve safety under wet and humid operating conditions. Digital twin simulations are increasingly utilized to design efficient and durable power distribution units. Rising integration of in-vehicle connectivity accelerates demand for smart junction boxes equipped with real-time monitoring features. Focus on modular, energy-efficient designs supports compliance with evolving regulatory standards and consumer demand for reliability in compact and urban mobility platforms.

The automotive junction box market is dominated by Bosch, which holds a significant market share due to its extensive product integration, high-density packaging, and strong OEM relationships across global vehicle platforms. BorgWarner, Continental, and Valeo follow closely, delivering advanced junction box systems with enhanced diagnostics and thermal management capabilities. Denso and Yazaki leverage their expertise in electrical architecture components to offer smart power distribution modules. Eaton, Johnson Controls, and Lear Corporation provide custom-designed junction boxes tailored for hybrid, electric, and start-stop systems. ON Semiconductor supplies sensor-integrated junction elements that support safety and autonomy features. Competition in this market centers on miniaturization, thermal efficiency, electronic integration, and adaptability to next-gen powertrain architectures.

In April 2024, Enact Systems integrated Oracle Blockchain into its award-winning solar software, enabling tokenized issuance of Renewable Energy Certificates and carbon credits tied to verified solar system performance and output.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.7 Billion |

| Type | Smart, Passive, and Others |

| Function | Automotive power switching and Vehicle body control |

| Sales Channel | OEM and Aftermarket |

| Vehicle | Passenger cars and Commercial vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, BorgWarner, Continental, Denso, Eaton, Johnson Control, Lear Corporation, ON Semiconductor, Valeo, and Yazaki |

| Additional Attributes | Dollar sales by junction box type (standard and smart) and vehicle category (passenger and commercial), driven by EV growth, advanced safety compliance, and increasing electrical complexity in modern vehicles. Regional trends led by North America and Asia-Pacific, supported by strong automotive manufacturing bases. Key players focus on innovations in diagnostics, thermal management, and integration for optimized power distribution in next-generation architectures. |

The global automotive junction box market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the automotive junction box market is projected to reach USD 39.6 billion by 2035.

The automotive junction box market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in automotive junction box market are smart, passive and others.

In terms of function, automotive power switching segment to command 54.1% share in the automotive junction box market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA